A look at what has gone wrong at AGFX, including management’s voluntary disclosure around liquidity risk versus the reality of zero-zero margins. Other companies covered MERC and ELIX.

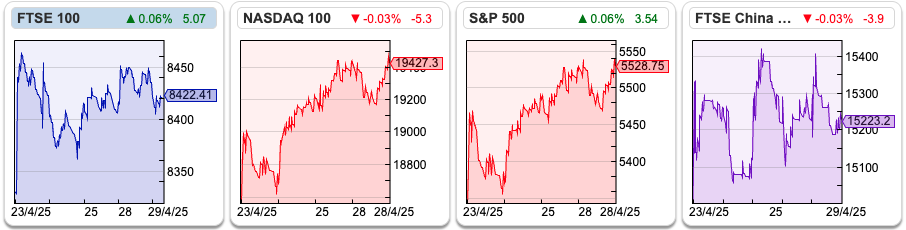

The FTSE 100 was up +1% to 8,422 in the last 5 days. US markets rallied much more strongly, with the Nasdaq100 up +9% and the S&P500 up +7%, driven by tariff-related newsflow from the Trump administration. The only indices in negative territory were the CSI 300 (Shanghai) and the SSE Composite (Shanghai).

Last Thursday alone, we saw profit warnings from i) RWS, the patent translation group at risk of being disrupted by AI, ii) Somero, the US concrete screed company which blamed high interest rates and uncertainty around Trump’s policies delaying construction projects iii) GB Group, the identity verification company, blaming uncertainty around Trump’s policies iv) Tracis, the transport technology provider, blaming uncertainties around Trump’s policies on US procurement v) ECO Animal Health, the pig and poultry antibiotic group, blaming US administration’s trade policies. I could go on, but I am beginning to see a theme developing.

Mello Events is still happening, on Tuesday 3rd and Wed 4th June, at the Clayton Hotel, in Chiswick, W London. It was great to meet so many readers face-to-face last year. Unfortunately, I have a diary clash, and won’t be able to make it, but it looks like David has got some interesting companies presenting.

This is a good opportunity to mix with other investors, I chatted with Richard Stavely at Rockwood about Argentex at Mello last year. I look at what has gone wrong at AGFX below. Bloomberg says management were offering clients high-risk forward trades but with zero initial margins and zero variation margin: so-called “zero zero margins”. Below, I also look at management consultancy Elixirr FY Dec results and alternative asset manager Mercia’s trading update.

Finally, the MoneyWeek survey of financial services providers is now open. If you enjoy using Sharescope, please consider voting for us under the Investment Data Providers category.

Elixirr International FY Dec Results

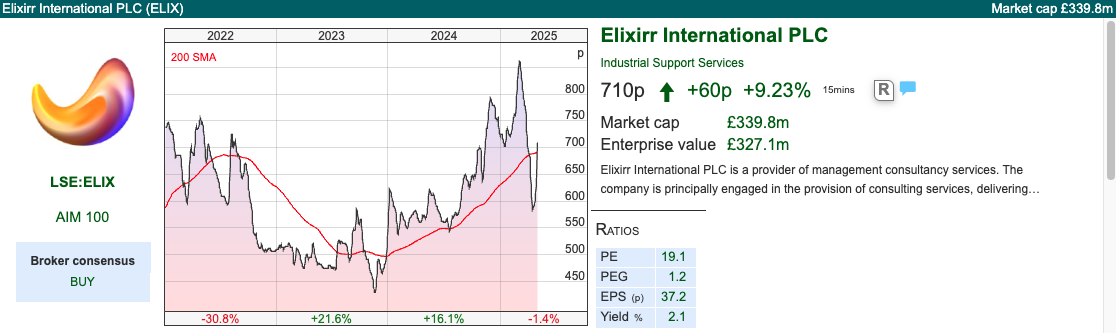

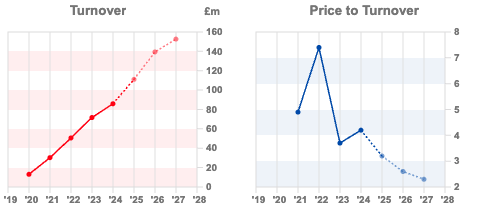

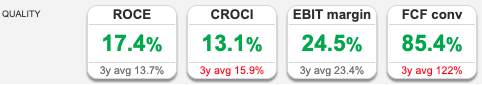

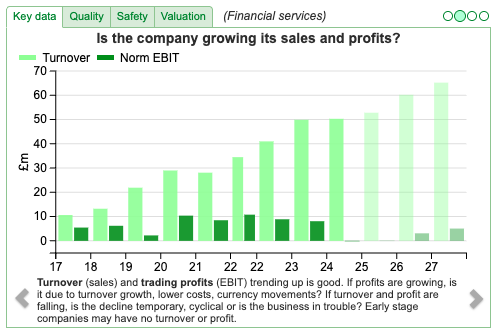

This management consultancy put out an ahead-of-expectations trading statement in mid-February, but despite that has fallen by a third peak to trough, before recently recovering. They have now announced their FY Dec results, with revenue up +30% to £111.3m (guidance in February was greater than £111m) and adj EBITDA margin of 28.0% (guidance in February was approximately 28%). Statutory PBT was up a more pedestrian +4% to £22.9m, as share-based payments, contingent consideration, plus a £3m swing in M&A-related items (also contingent consideration) held back statutory PBT. Organic revenue growth was +13%, so more than half of the top-line growth is coming from acquisitions.

Outlook: The new financial year has started strongly, with Q1 and April hitting records for revenue. Management remain confident of achieving FY Dec 2025F expectations, however, they are not providing guidance directly. Instead, Cavendish, their broker, has published a 13-page research note, suggesting revenue growing +25% this year, before falling back to +8.5% in FY Dec 2026F. EPS growth is forecast to grow +12%, before falling back to 9% FY Dec 2026F. There’s no mention of tariffs in their RNS, suggesting tariffs are less relevant to the professional services industry.

Balance sheet: There’s £130m of intangible assets on the face of the balance sheet, versus £132m of net assets. Inevitably, in the most recent presentation, management claim to have a “strong balance sheet”. I sometimes wonder if that phrase is code for “we may dilute equity shareholders in future”.

ELIX is a people business, so I wouldn’t expect to see a balance sheet backed by tangible assets, but neither would I describe £2m of tangible book v £ 176m total assets as “strong”. Unlike SFOR (net debt £143m) or NFG (net debt £38m), ELIX has £7.5m of net cash. There is a £45m RCF with NatWest, so it’s possible that ELIX could fund future acquisitions with debt. The liabilities from contingent consideration are not recorded on the face of the balance sheet, but looking at note 20 of the accounts seem to be £8.5m (it’s not clear, there are two items both labelled contingent consideration, which I’ve added together). Also, the company has lent £7m to senior employees, who are also shareholders. I’m assuming that this is similar to a partnership structure, where a company lends money at a below-market rate to the partners in order to buy into the partnership, and is used to lock in employees.

Valuation: Using Cavendish’s numbers the shares are trading on a PER of 13.4x FY Dec 2026F, dropping to 12.5x the following year. The shares are on around 8x EV/EBITDA. Seems like GaaRP, if performance can be sustained, but worth noting that if management become reliant on acquisitions to drive growth, then that could result in a de-rating (as we saw with SDI a couple of years ago).

Opinion: This looks to have performed well since I last covered it 18 months ago. Management consultancy services, along with marketing budgets, can often be cut in a downturn – but so far momentum has continued well into 2025. One thing I’ve noted in the past though, is that with a retail brand like FeverTree or Wise, it’s relatively easy for investors to figure out how differentiated the product is. With a management consultancy offering B2B services, it’s harder to work out what they are doing differently and if there’s a genuine “moat”.

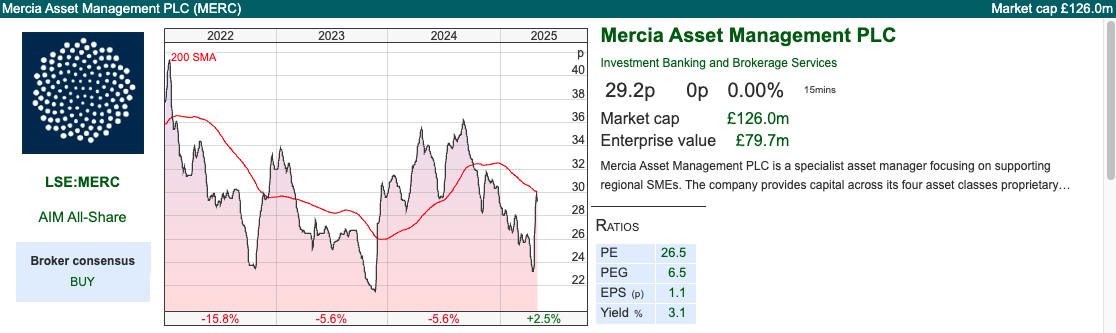

Mercia AM FY Mar Trading Update

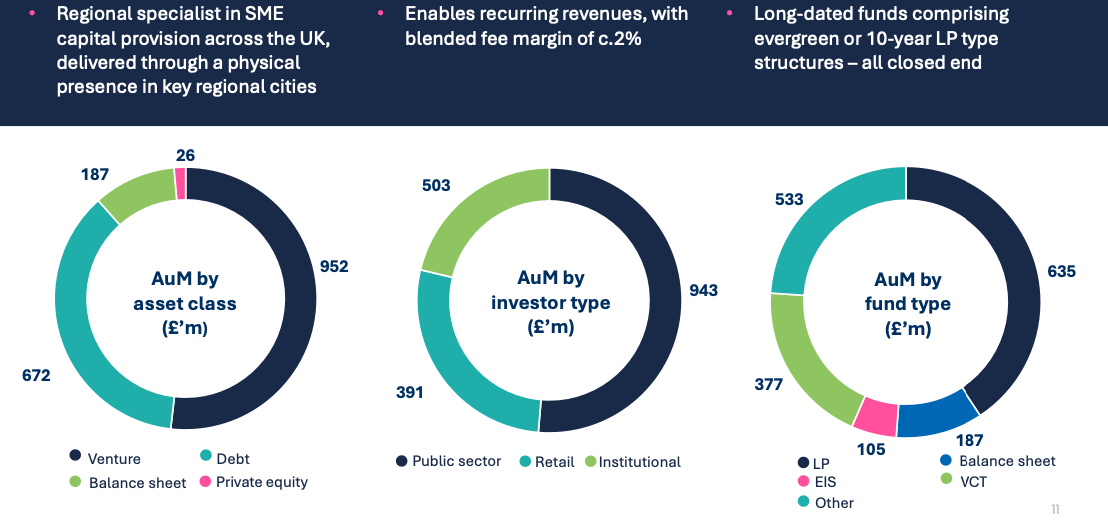

This alternative asset manager, with just £1.8bn of AuM announced EBITDA FY 2025 would be “materially ahead of current market expectations”. Sharescope says that EBITDA was previously forecast to be £6.2m, which would have implied a +13% increase on the previous year. Unlike many public market fund managers (Liontrust, Impax AM) MERC haven’t seen any redemptions and reported £250m of inflows in the final quarter of the year. That looks to be a remarkably strong performance in Q4, for comparison in H1 they only saw £57m of inflows. If inflows are accelerating, that suggests that management are doing something well. The group also had £40m of net cash, which represents a third of the market cap.

Mercia specialises in tax-efficient wrappers like Venture Capital Trusts (VCTs) and Enterprise Investment Schemes (EIS) funds. The strategy is to focus on providing regional UK SMEs with growth capital, across four asset classes: venture, debt, private equity and proprietary capital. Equity funds typically deploy between £100k & £10m per investment, and debt funds between £250k & £20m. To my mind these are hazy distinctions, if there’s a UK recession then the four asset classes will be highly correlated.

Mercia invests directly with its own balance sheet but management are now growing 3rd party fund management, on which they charge fees of c. 2% AuM. As of H1 direct on balance sheet investments were valued at £121m (or 28p per share), which management hope to realise up to 70% of that by Mar 2027. They are hoping to grow third-party AuM, from £1.6bn as of Sept 2024 to £3bn in AuM by Mar 2027, with an EBITDA margin of 26% (versus 21% H1 Sept 2024).

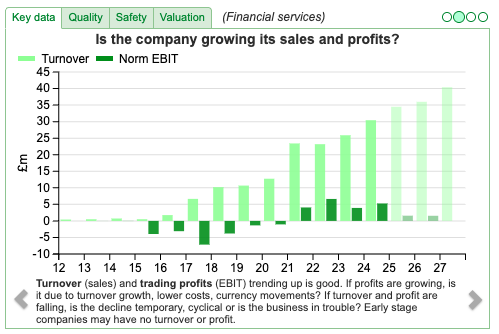

History: The history goes back to 1982 when WME, a precursor to Mercia, was established as a venture capital provider. The current CEO, Mark Payton, joined WME in 2005 and then led a management buyout in 2010 to establish Mercia. They came to market in 2014, raising £70m at 50p per share, giving the company a market cap of £106m. Since then the share count has roughly doubled to 436m. Revenue was less than £1m at the time of the IPO, compared to the £34.5m forecast by Equity Development FY Mar 2025F. There was a large, £18m loss reported in Mar 2020 at the beginning of the pandemic, driven by a fair value write down which equated to 15% of the direct portfolio. This gives some indication of how much “book value” might evaporate if there’s another recession. Current performance has improved and management have continued to attract third-party funds.

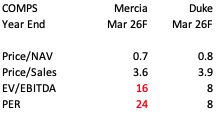

Valuation: MERC trades on 0.7x NAV and 3.6x sales. It’s interesting to compare the valuation with Duke Capital, which started out as a royalty finance company, but now makes direct equity investments. That has a similar Price/NAV and Price/Sales, but as Duke is more profitable, the earnings multiple ratings EV/EBITDA and PER look much more attractive than for Mercia.

Implicitly, investors believe that as MERC grows AuM, profitability will improve. But you are paying for that operational gearing upfront, and there’s no evidence of that in Sharecope’s FY Mar 2026F forecasts, with profits forecast to drop 8%.

Opinion: When this came to market at 50p per share in 2014, it was obviously overvalued and too small. 11 years later, looking at the investment case, I think it could be very interesting. The downside risk is that a portfolio of illiquid SME’s is unlikely to do well during a recession. The upside is management can continue to attract funds into what seems to be an attractive niche, with less downward pressure on fees for private markets than mainstream active fund managers, who invest in the stock market, competing against BlackRock and passive index trackers. No position at the moment, but will watch with interest.

Argentex suspension

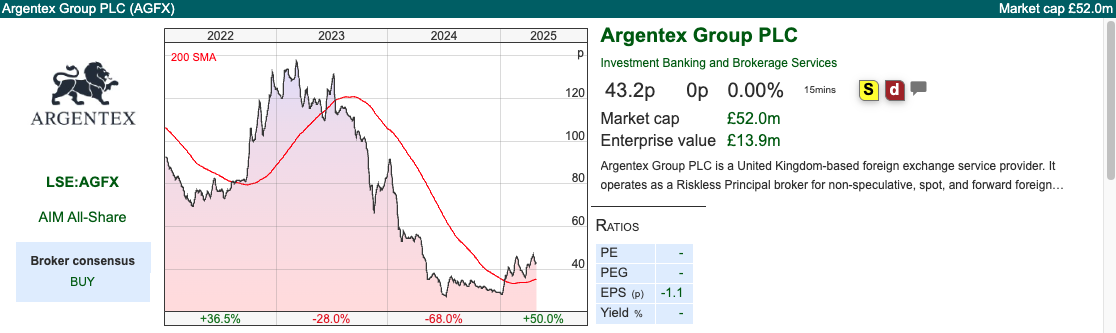

A disastrous RNS from this ‘global specialist in currency risk management’ last week. Following the decline in the US dollar, the group is in trouble and warned about its liquidity, driven by margin calls on the FX forward and options book.

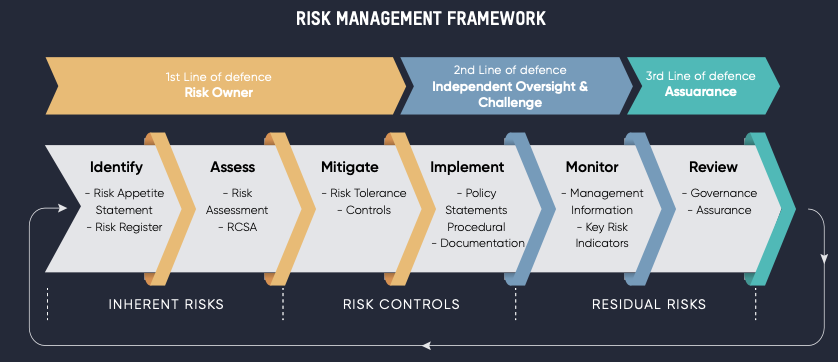

This is bizarre. At the beginning of April, FY Dec results were ahead of expectations, on the call management were specifically asked about the impact of Trump’s tariffs and US dollar weakness and they claimed that volatility is good for their business model because their clients, who are corporate treasurers and CFOs, look to lock in currency rates at times of uncertainty. Currencies have been volatile, but not especially so compared to the beginning of the pandemic, the day of Brexit or the Truss/Kwarteng-related sterling sell-off. So much for their “3 lines of defence” in their risk management framework.

Other recent encouraging signs released on 2nd April were i) Singer’s, their broker, increasing FY Dec 2025F adj EBITDA by 2.6x from £1.7m to £4.5m ii) £18m of cash on the balance sheet iii) director buying, and iv) turnaround specialist Rockwood Strategic increased its position to above 5%.

They’ve now received an offer, valuing the shares at just 2.49p from a competitor, IFX Payments. That’s a 94% reduction from the price before the shares were suspended and equates to £3m. They’ve also received £6.5m, structured as a bridging loan paying 15% per annum. In a separate announcement, Jim Ormonde, the CEO, left the group with immediate effect. He was not thanked.

This article from Bloomberg suggests that management were required to post collateral — or margin — for their forward FX trades, with counterparty banks (Barclays and Citi), as a buffer against potential losses if hedges begin to sour. Typically, an FX brokerage like AGFX would then demand similar levels of margin from its clients. Indeed, this is what the “liquidity risk” section on p43 of the Admission Document says: “robust margin call terms are maintained with clients.”

Instead, Argentex offered trades with zero initial margin and zero variation margin; so-called “zero-zero lines” to its corporate customers, according to this Bloomberg article. The “liquidity risk” section of their FY Dec 2024 has changed the wording from the Admission Document, now saying: “to mitigate margin calls from banking counterparties, the Group’s portfolio facilitates a blend of terms that enable client margin calls.”

Opinion: I don’t think management can hide behind that subtle change of wording, hopefully, there are serious consequences. I’ve lost a significant amount of money on this, though not nearly as much as Paul Hill, who owned 2.9% of the company. I am planning to publish an in-depth “post mortem” on Izzy Kaminska’ The Blind Spot, with open access (ie available to everyone, not behind the paywall). Using Sharescope’s chat function, it’s possible to go back and look at the discussion in November 2022. One comment, from kst200 Sat Nov 12 2022, stands out:

You have to ask yourself if it takes a lot of brain power to understand what’s going on, why bother? This business model is beyond most investors understanding. Including me. Be careful.

Notes

Bruce owns shares in Argentex

Got some thoughts on this week’s commentary from Bruce? Share these in the ShareScope “Weekly Market Commentary” chat. Login to ShareScope – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Bi-Weekly Market Commentary | 30/4/2025 | AGFX, MERC, ELIX | Zero Zero Margins

A look at what has gone wrong at AGFX, including management’s voluntary disclosure around liquidity risk versus the reality of zero-zero margins. Other companies covered MERC and ELIX.

The FTSE 100 was up +1% to 8,422 in the last 5 days. US markets rallied much more strongly, with the Nasdaq100 up +9% and the S&P500 up +7%, driven by tariff-related newsflow from the Trump administration. The only indices in negative territory were the CSI 300 (Shanghai) and the SSE Composite (Shanghai).

Last Thursday alone, we saw profit warnings from i) RWS, the patent translation group at risk of being disrupted by AI, ii) Somero, the US concrete screed company which blamed high interest rates and uncertainty around Trump’s policies delaying construction projects iii) GB Group, the identity verification company, blaming uncertainty around Trump’s policies iv) Tracis, the transport technology provider, blaming uncertainties around Trump’s policies on US procurement v) ECO Animal Health, the pig and poultry antibiotic group, blaming US administration’s trade policies. I could go on, but I am beginning to see a theme developing.

Mello Events is still happening, on Tuesday 3rd and Wed 4th June, at the Clayton Hotel, in Chiswick, W London. It was great to meet so many readers face-to-face last year. Unfortunately, I have a diary clash, and won’t be able to make it, but it looks like David has got some interesting companies presenting.

This is a good opportunity to mix with other investors, I chatted with Richard Stavely at Rockwood about Argentex at Mello last year. I look at what has gone wrong at AGFX below. Bloomberg says management were offering clients high-risk forward trades but with zero initial margins and zero variation margin: so-called “zero zero margins”. Below, I also look at management consultancy Elixirr FY Dec results and alternative asset manager Mercia’s trading update.

Finally, the MoneyWeek survey of financial services providers is now open. If you enjoy using Sharescope, please consider voting for us under the Investment Data Providers category.

Elixirr International FY Dec Results

This management consultancy put out an ahead-of-expectations trading statement in mid-February, but despite that has fallen by a third peak to trough, before recently recovering. They have now announced their FY Dec results, with revenue up +30% to £111.3m (guidance in February was greater than £111m) and adj EBITDA margin of 28.0% (guidance in February was approximately 28%). Statutory PBT was up a more pedestrian +4% to £22.9m, as share-based payments, contingent consideration, plus a £3m swing in M&A-related items (also contingent consideration) held back statutory PBT. Organic revenue growth was +13%, so more than half of the top-line growth is coming from acquisitions.

Outlook: The new financial year has started strongly, with Q1 and April hitting records for revenue. Management remain confident of achieving FY Dec 2025F expectations, however, they are not providing guidance directly. Instead, Cavendish, their broker, has published a 13-page research note, suggesting revenue growing +25% this year, before falling back to +8.5% in FY Dec 2026F. EPS growth is forecast to grow +12%, before falling back to 9% FY Dec 2026F. There’s no mention of tariffs in their RNS, suggesting tariffs are less relevant to the professional services industry.

Balance sheet: There’s £130m of intangible assets on the face of the balance sheet, versus £132m of net assets. Inevitably, in the most recent presentation, management claim to have a “strong balance sheet”. I sometimes wonder if that phrase is code for “we may dilute equity shareholders in future”.

ELIX is a people business, so I wouldn’t expect to see a balance sheet backed by tangible assets, but neither would I describe £2m of tangible book v £ 176m total assets as “strong”. Unlike SFOR (net debt £143m) or NFG (net debt £38m), ELIX has £7.5m of net cash. There is a £45m RCF with NatWest, so it’s possible that ELIX could fund future acquisitions with debt. The liabilities from contingent consideration are not recorded on the face of the balance sheet, but looking at note 20 of the accounts seem to be £8.5m (it’s not clear, there are two items both labelled contingent consideration, which I’ve added together). Also, the company has lent £7m to senior employees, who are also shareholders. I’m assuming that this is similar to a partnership structure, where a company lends money at a below-market rate to the partners in order to buy into the partnership, and is used to lock in employees.

Valuation: Using Cavendish’s numbers the shares are trading on a PER of 13.4x FY Dec 2026F, dropping to 12.5x the following year. The shares are on around 8x EV/EBITDA. Seems like GaaRP, if performance can be sustained, but worth noting that if management become reliant on acquisitions to drive growth, then that could result in a de-rating (as we saw with SDI a couple of years ago).

Opinion: This looks to have performed well since I last covered it 18 months ago. Management consultancy services, along with marketing budgets, can often be cut in a downturn – but so far momentum has continued well into 2025. One thing I’ve noted in the past though, is that with a retail brand like FeverTree or Wise, it’s relatively easy for investors to figure out how differentiated the product is. With a management consultancy offering B2B services, it’s harder to work out what they are doing differently and if there’s a genuine “moat”.

Mercia AM FY Mar Trading Update

This alternative asset manager, with just £1.8bn of AuM announced EBITDA FY 2025 would be “materially ahead of current market expectations”. Sharescope says that EBITDA was previously forecast to be £6.2m, which would have implied a +13% increase on the previous year. Unlike many public market fund managers (Liontrust, Impax AM) MERC haven’t seen any redemptions and reported £250m of inflows in the final quarter of the year. That looks to be a remarkably strong performance in Q4, for comparison in H1 they only saw £57m of inflows. If inflows are accelerating, that suggests that management are doing something well. The group also had £40m of net cash, which represents a third of the market cap.

Mercia specialises in tax-efficient wrappers like Venture Capital Trusts (VCTs) and Enterprise Investment Schemes (EIS) funds. The strategy is to focus on providing regional UK SMEs with growth capital, across four asset classes: venture, debt, private equity and proprietary capital. Equity funds typically deploy between £100k & £10m per investment, and debt funds between £250k & £20m. To my mind these are hazy distinctions, if there’s a UK recession then the four asset classes will be highly correlated.

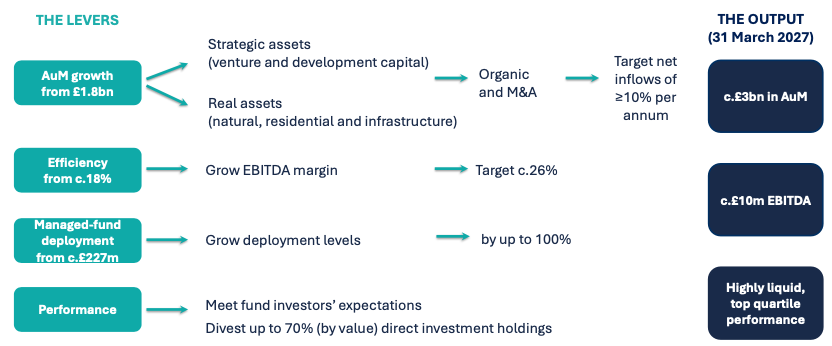

Mercia invests directly with its own balance sheet but management are now growing 3rd party fund management, on which they charge fees of c. 2% AuM. As of H1 direct on balance sheet investments were valued at £121m (or 28p per share), which management hope to realise up to 70% of that by Mar 2027. They are hoping to grow third-party AuM, from £1.6bn as of Sept 2024 to £3bn in AuM by Mar 2027, with an EBITDA margin of 26% (versus 21% H1 Sept 2024).

History: The history goes back to 1982 when WME, a precursor to Mercia, was established as a venture capital provider. The current CEO, Mark Payton, joined WME in 2005 and then led a management buyout in 2010 to establish Mercia. They came to market in 2014, raising £70m at 50p per share, giving the company a market cap of £106m. Since then the share count has roughly doubled to 436m. Revenue was less than £1m at the time of the IPO, compared to the £34.5m forecast by Equity Development FY Mar 2025F. There was a large, £18m loss reported in Mar 2020 at the beginning of the pandemic, driven by a fair value write down which equated to 15% of the direct portfolio. This gives some indication of how much “book value” might evaporate if there’s another recession. Current performance has improved and management have continued to attract third-party funds.

Valuation: MERC trades on 0.7x NAV and 3.6x sales. It’s interesting to compare the valuation with Duke Capital, which started out as a royalty finance company, but now makes direct equity investments. That has a similar Price/NAV and Price/Sales, but as Duke is more profitable, the earnings multiple ratings EV/EBITDA and PER look much more attractive than for Mercia.

Implicitly, investors believe that as MERC grows AuM, profitability will improve. But you are paying for that operational gearing upfront, and there’s no evidence of that in Sharecope’s FY Mar 2026F forecasts, with profits forecast to drop 8%.

Opinion: When this came to market at 50p per share in 2014, it was obviously overvalued and too small. 11 years later, looking at the investment case, I think it could be very interesting. The downside risk is that a portfolio of illiquid SME’s is unlikely to do well during a recession. The upside is management can continue to attract funds into what seems to be an attractive niche, with less downward pressure on fees for private markets than mainstream active fund managers, who invest in the stock market, competing against BlackRock and passive index trackers. No position at the moment, but will watch with interest.

Argentex suspension

A disastrous RNS from this ‘global specialist in currency risk management’ last week. Following the decline in the US dollar, the group is in trouble and warned about its liquidity, driven by margin calls on the FX forward and options book.

This is bizarre. At the beginning of April, FY Dec results were ahead of expectations, on the call management were specifically asked about the impact of Trump’s tariffs and US dollar weakness and they claimed that volatility is good for their business model because their clients, who are corporate treasurers and CFOs, look to lock in currency rates at times of uncertainty. Currencies have been volatile, but not especially so compared to the beginning of the pandemic, the day of Brexit or the Truss/Kwarteng-related sterling sell-off. So much for their “3 lines of defence” in their risk management framework.

Other recent encouraging signs released on 2nd April were i) Singer’s, their broker, increasing FY Dec 2025F adj EBITDA by 2.6x from £1.7m to £4.5m ii) £18m of cash on the balance sheet iii) director buying, and iv) turnaround specialist Rockwood Strategic increased its position to above 5%.

They’ve now received an offer, valuing the shares at just 2.49p from a competitor, IFX Payments. That’s a 94% reduction from the price before the shares were suspended and equates to £3m. They’ve also received £6.5m, structured as a bridging loan paying 15% per annum. In a separate announcement, Jim Ormonde, the CEO, left the group with immediate effect. He was not thanked.

This article from Bloomberg suggests that management were required to post collateral — or margin — for their forward FX trades, with counterparty banks (Barclays and Citi), as a buffer against potential losses if hedges begin to sour. Typically, an FX brokerage like AGFX would then demand similar levels of margin from its clients. Indeed, this is what the “liquidity risk” section on p43 of the Admission Document says: “robust margin call terms are maintained with clients.”

Instead, Argentex offered trades with zero initial margin and zero variation margin; so-called “zero-zero lines” to its corporate customers, according to this Bloomberg article. The “liquidity risk” section of their FY Dec 2024 has changed the wording from the Admission Document, now saying: “to mitigate margin calls from banking counterparties, the Group’s portfolio facilitates a blend of terms that enable client margin calls.”

Opinion: I don’t think management can hide behind that subtle change of wording, hopefully, there are serious consequences. I’ve lost a significant amount of money on this, though not nearly as much as Paul Hill, who owned 2.9% of the company. I am planning to publish an in-depth “post mortem” on Izzy Kaminska’ The Blind Spot, with open access (ie available to everyone, not behind the paywall). Using Sharescope’s chat function, it’s possible to go back and look at the discussion in November 2022. One comment, from kst200 Sat Nov 12 2022, stands out:

You have to ask yourself if it takes a lot of brain power to understand what’s going on, why bother? This business model is beyond most investors understanding. Including me. Be careful.

Notes

Bruce owns shares in Argentex

Got some thoughts on this week’s commentary from Bruce? Share these in the ShareScope “Weekly Market Commentary” chat. Login to ShareScope – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.