A look at how the Nasdaq’s 2021 vintage of IPOs has compared to the same vintage on AIM. Companies covered: FTC, IPX, GDWN.

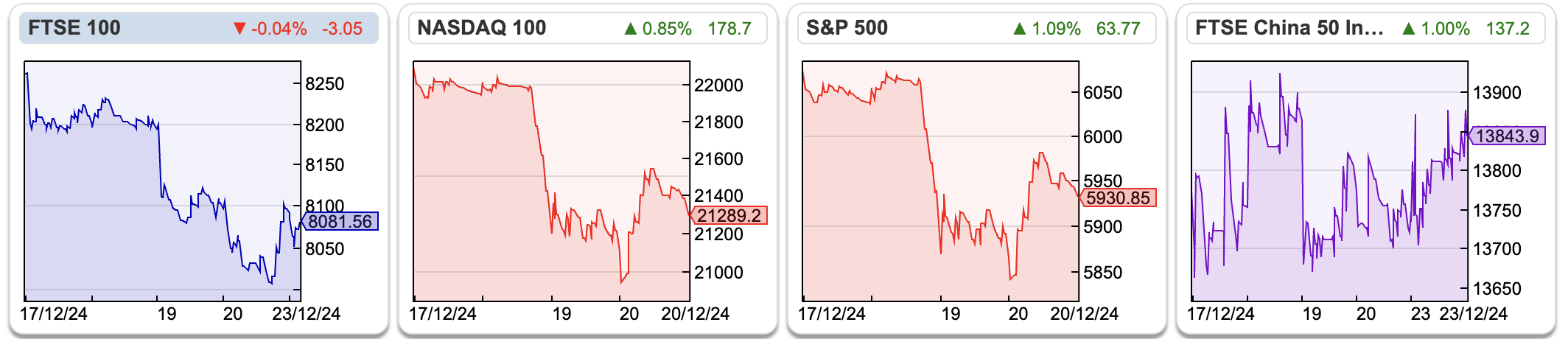

The FTSE 100 fell -2% to 8081 last week. The S&P500 and Nasdaq hit all-time highs, but then sold off -2% following a “hawkish rate cut” from the Fed. That is, the Fed delivered the anticipated 25bp rate cut, but forecasted only two 25bp rate cuts next year, which was more hawkish than market expectations. S&P and Nasdaq fell 3% and 3.6%, with high growth winners off more.

The FTSE 100 fell -2% to 8081 last week. The S&P500 and Nasdaq hit all-time highs, but then sold off -2% following a “hawkish rate cut” from the Fed. That is, the Fed delivered the anticipated 25bp rate cut, but forecasted only two 25bp rate cuts next year, which was more hawkish than market expectations. S&P and Nasdaq fell 3% and 3.6%, with high growth winners off more.

The Bank of England left interest rates unchanged at 4.75% but is clearly more dovish than the Fed; more members of the Monetary Policy Committee dissented in favour of cuts than markets had expected. The UK stockmarket, particularly AIM looks much better value than the US.

Out of curiosity, I looked at how the performance of Nasdaq 2021 vintage of IPO’s and SPACs, using my Sharepad IPO filter. On the Nasdaq, there were 575 IPOs and SPACs that year, the best performing DJT, Trump Media & Technology (the investment vehicle behind “Truth Social”), up +4400%. The company generated $1m of revenue in Q3 this year, versus a market cap of $7.7bn. Matt Levine at Bloomberg has suggested perhaps DJT could merge with Elon Musk’s X. Of the 575 IPOs in the US, just 77 are in positive territory (or 13%). 325 (or 56%) of the recent listings are down more than -80% or more.

The 2021 vintage on AIM was 59 companies, with 7 in positive territory (or 12%). 25 (or 42%) of the recent listings are down -80% or more. So that looks to be a similar probability distribution of investing in a winning 2021 IPO, it’s just the winners in the US markets can turn into very big winners.

4Basebio (congratulations to Leon Boros who tipped it in April 2020, ahead of the spin-out from Expedeon) was the best performer on AIM, up +794%. Interestingly the second best performer was also a corporate spinout from Ashstead, (AT. Ashtead Technology Hldngs) up +215%. This suggests to me a couple of rules of thumb 1) avoid whatever Private Equity is selling, but 2) be open to whatever publicly listed corporate management teams are spinning out. Still, a hit rate of 7 out of 59 supports the idea that IPO stands for “It’s Probably Overpriced”.

Below I look at Filtronic’s H1 Nov positive trading update, environmental asset manager Impax loss of a big mandate and Goodwin’s encouraging H1 October results.

FTC H1 Nov Trading Update

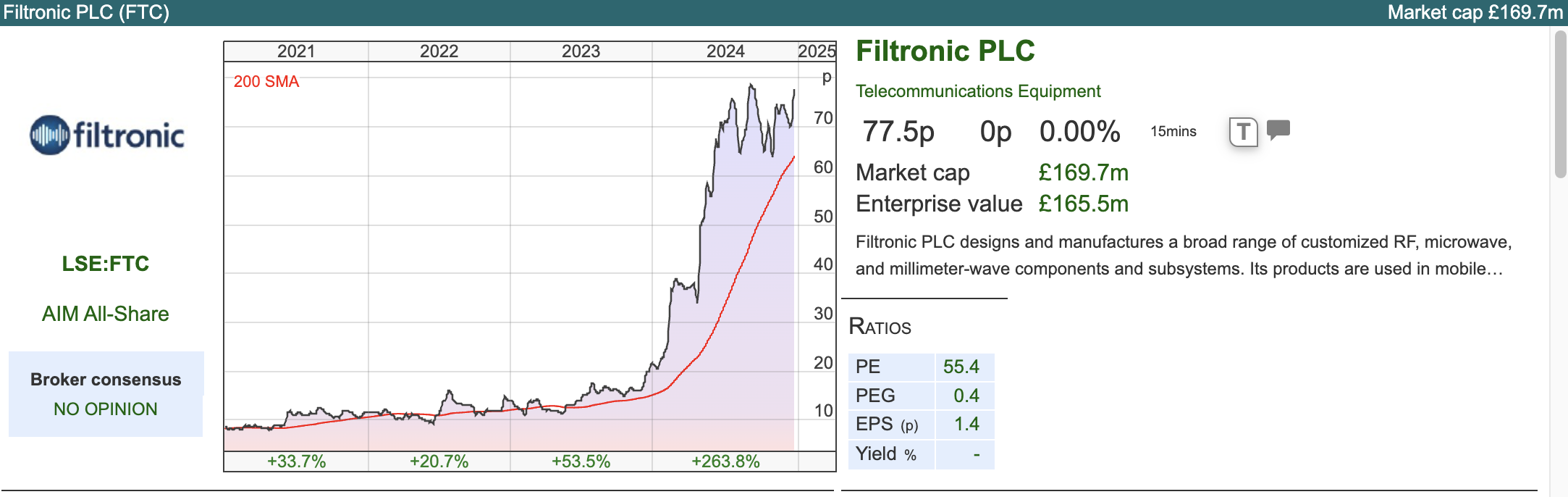

This aerospace, defence and space company with a partnership with Elon Musk’s SpaceX has a May year end. They announced last week “significant growth in revenue and profits” and “stronger results for the Full Year than current market expectations.” Management haven’t been any more specific, but Cavendish are their broker, and have raised FY May 2025F revenue forecasts by +7% to £43.4m and EPS by +25% to 4.0p.

This aerospace, defence and space company with a partnership with Elon Musk’s SpaceX has a May year end. They announced last week “significant growth in revenue and profits” and “stronger results for the Full Year than current market expectations.” Management haven’t been any more specific, but Cavendish are their broker, and have raised FY May 2025F revenue forecasts by +7% to £43.4m and EPS by +25% to 4.0p.

The shares were only up +7% in response. I think that this is explained by leaving next year (FY May 2026F) unchanged.

The company’s history goes back to the 1970s and currently, the products are a mix of transceivers, amplifiers and diplexers. There are 3 design sites in the North of England (Manchester, Leeds and Sedgefield) and an assembly and testing centre on the East coast of the USA. The product range and wider technology capabilities are supported by their own IP and in-house knowledge, and they have a portfolio of patents. The vision is to continue to innovate with RF, Microwave and mmWave communication, delivering transformative wireless solutions through design and manufacture leadership.

Partnership with SpaceX: Earlier this year management announced a partnership with Elon Musk’s SpaceX, whose main product is Starlink (Low Earth Orbit LEO satellites), which provide high-speed internet to users all around the world. The US company will buy E-band SSPA modules from FTC, scheduled for delivery in FY May 2025F, with further order flow expected. FTC has issued 22m warrants (strike price 33p, so well in the money currently) to SpaceX across two tranches, to enable SpaceX to subscribe for up to a maximum of 10% of the Company’s existing share capital, with such warrants expected to vest, once $60m (£48m) of orders have been placed by SpaceX.

The accounting for these warrants results in a non-cash charge of around £10m. So worth noting that statutory FY May 2025F EPS is forecast by Cavendish to be -0.3p. The warrants seem to be a clever way of Musk benefiting from using Filtronic’s technology; but could also suggest that SpaceX, valued at $350bn earlier this month in a private funding round, has all the power in the commercial relationship.

Balance Sheet: Cavendish are forecasting £10m of net cash at the end of May next year. Shareholders’ equity was £15m at the last FY, of which under £3m was goodwill and intangible assets. So it looks to me that even if management need to invest to keep up with increased demand, they can fund this internally.

Valuation: The shares are trading on a PER of 19x May 2025F, but rising to 26x May 2026F . Note the unchanged FY May 2026F EPS forecasts implies a -6% decline in revenue and a -25% decline in EPS next year, from 3p down from 4p. That is reflecting the lumpy nature of contracts.

In June I pointed out a similar dynamic with Intercede (IGP), and a reader on the chat function asked if I had even read the results. However, IGP shares have fallen in recent months, so I do think it’s important to look at what’s happening to next year’s broker forecasts, not just the upbeat commentary in the outlook statement.

Opinion: It looks like FTC management are doing the right things and winning contracts, so could be very exciting. Well done to holders, someone with a background in telecoms did mention this to me before the pandemic, but I didn’t invest because it felt outside my circle of competence. So if people do understand the technology better, please share your thoughts on the chat. Readers should be aware that contracts are “lumpy”, and you can’t just extrapolate in a straight line to future years though.

Impax Mandate Loss / AuM outflows

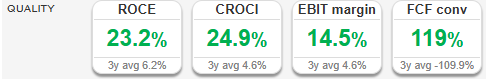

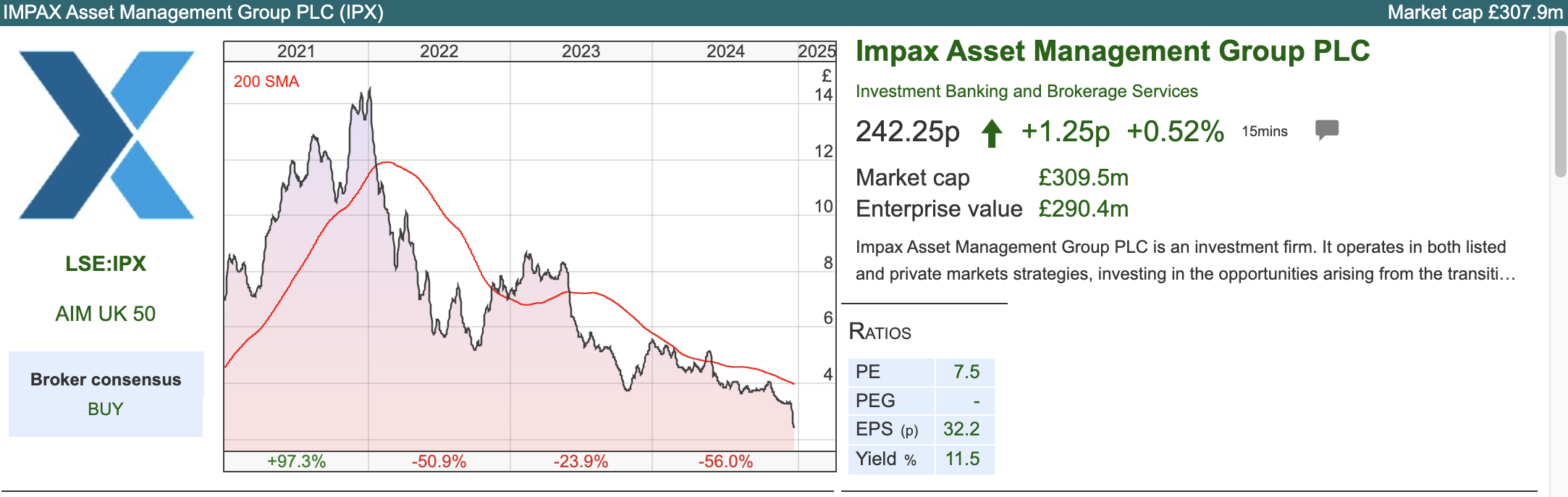

An active fund manager enjoying strong inflows is a wonderful business, and one seeing outflows is not. Impax, down from over £14 per share at the end of 2021, is the latter. The environmentally focused fund manager announced that St James’s Place would terminate a Sustainable and Responsible investing mandate, worth £5bn (or 14% of AuM) and expected to reduce IPX’s revenue by £13m (8% of previous revenue forecasts). The lost SRE mandate was clearly a lower margin account (around 24bps v group fee margin of 44bp).

An active fund manager enjoying strong inflows is a wonderful business, and one seeing outflows is not. Impax, down from over £14 per share at the end of 2021, is the latter. The environmentally focused fund manager announced that St James’s Place would terminate a Sustainable and Responsible investing mandate, worth £5bn (or 14% of AuM) and expected to reduce IPX’s revenue by £13m (8% of previous revenue forecasts). The lost SRE mandate was clearly a lower margin account (around 24bps v group fee margin of 44bp).

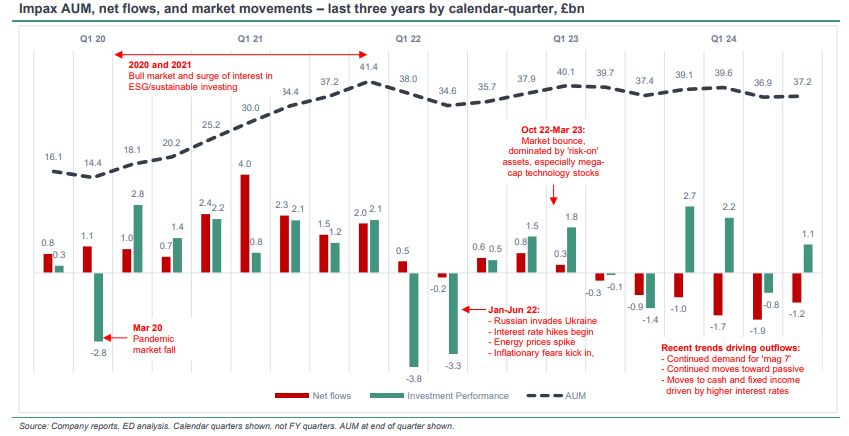

Nonetheless, IPX shares fell -25% on the day of the announcement. Equity Development, who publish sponsored research on the company cut FY Sept 2025F by 11% reflecting that the mandate would likely take effect this coming Feb, halfway through the year. The FY Sept 2026F EPS forecast was cut by -20%, reflecting a FY loss of the management fee. Equity Development have left the dividend untouched, meaning that the shares now trade on a yield of 11%. Below is a chart that I have taken from their most recent note, that shows quarterly AuM, market movements and net flows.

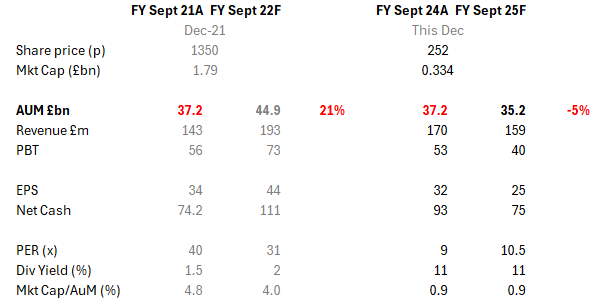

For fun, I’ve dug out the headline numbers from Dec 2021 (grey), when IPX share price was 1350p to compare with the current month, with the share price around 250p. The historic AuM Sept 2021A is the same as the most recent AuM figure of £37.2bn. The difference is that 3 years ago, when everyone was excited about environmental investing, Impax was forecast to grow AuM +21%, whereas following the mandate loss AuM is now forecast to fall -5% in the current financial year (see red highlights below).

The bottom of the table shows how rather than falls in AuM, the share price decline has been driven by a huge de-rating from 30-40x PER to 9-10.5x. Using the old rule of thumb of paying 4% Market Cap/AuM for a fund manager has been an expensive mistake, the current market is less than 1% of AuM.

Opinion: I first bought Impax at below 45p, and sold some – but not enough! – at 1300p. I then started buying back, with the benefit of hindsight too early in Oct 2023 and June 2024 at c. 380p. Silly me. I’m not rushing to average down again, but my thinking is that Impax has been doing this for decades, and environmental investing comes in and out of fashion.

More generally I think it’s a fascinating example of how investors can value the same amount of assets and revenues at wildly different ratings, depending on the second derivative, whether they think performance is improving or deteriorating.

Goodwin H1 Oct 2024

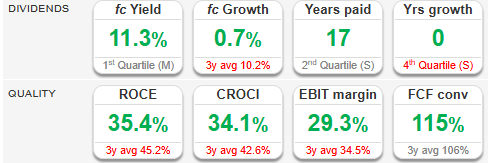

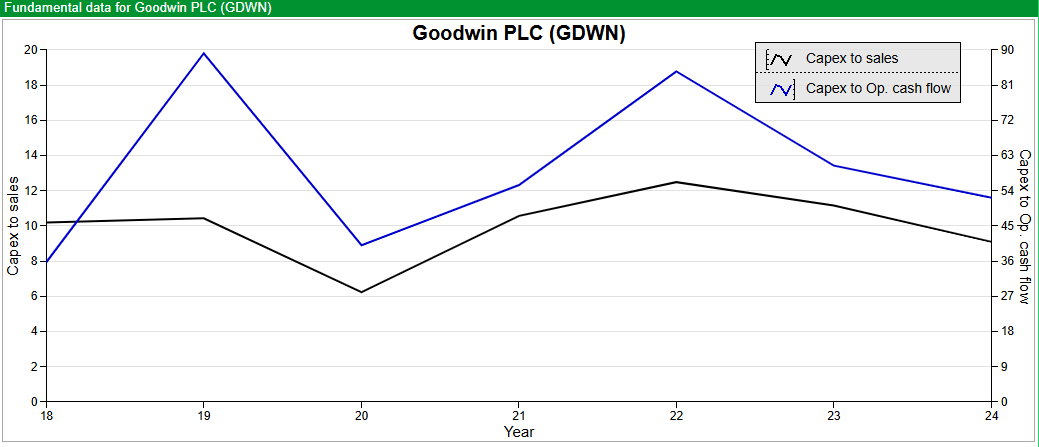

This casting company has a fan base among several investors I follow on Bluesky and X/Twitter. JM Securities No. 3 (a vehicle for the Goodwin family) owns a controlling stake of just over 50%, which means GDWN isn’t a stock that professional fund managers tend to own. Nevertheless, the shares have been very strong since the pandemic though, trebling in value since July 2022. A good example (yet again) of amateur investors doing better than the professionals.

This casting company has a fan base among several investors I follow on Bluesky and X/Twitter. JM Securities No. 3 (a vehicle for the Goodwin family) owns a controlling stake of just over 50%, which means GDWN isn’t a stock that professional fund managers tend to own. Nevertheless, the shares have been very strong since the pandemic though, trebling in value since July 2022. A good example (yet again) of amateur investors doing better than the professionals.

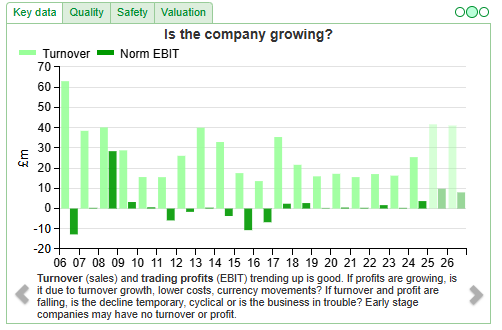

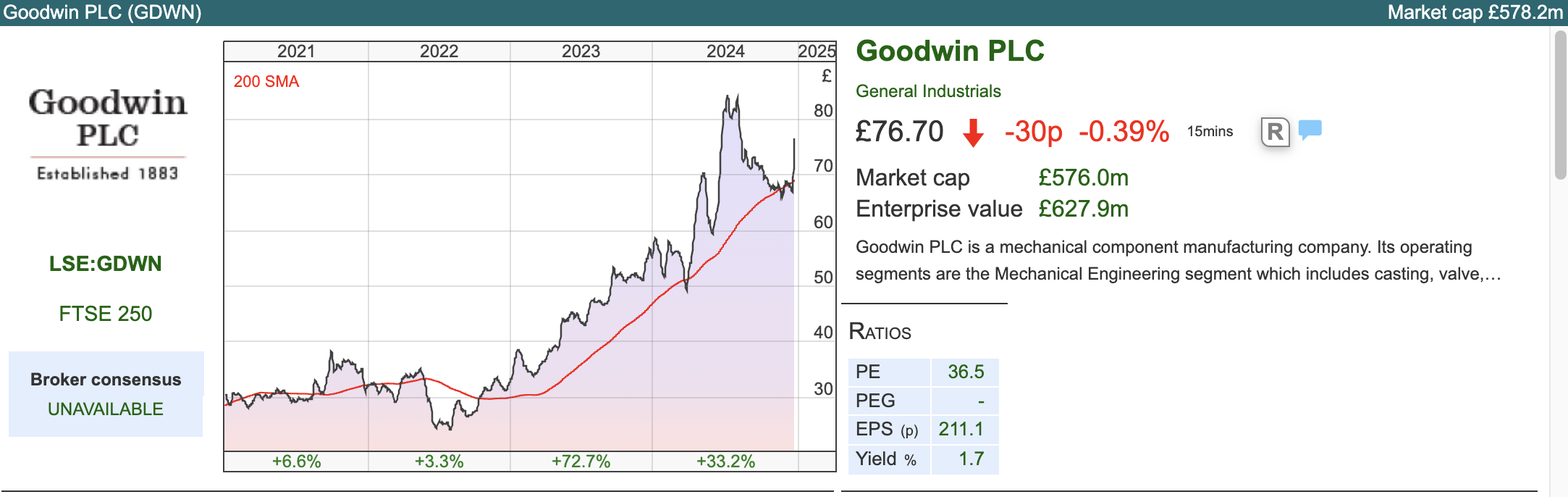

H1 revenues were up +9% to £106m and H1 statutory PBT was up +38% to £17m. That follows a 3-year period of rising capital expenditure, with capex to operating cashflow (blue) peaking at 80%. This is now beginning to pay-off, which Richard wrote about a year ago.

At most capital-intensive businesses, operating cash flow and capital expenditure are lumpy, varying significantly from year to year. Profits of course smooth this out, with the non-cash depreciation charge going through the p&l. What is good to see, is a UK management team investing in the business and seeing a decent return on that investment.

Some of the spending has been financed with debt, but net debt at £39m is now reducing, down from £55m the previous H1, helped by strong cash generation. The current forward order book stands at £296m, an +11% increase on H1 last year.

Management say that with a lower level of capital expenditure forecast, long-term contracts successfully negotiated and increasing profitability, the Group will benefit from lower level of debt as it starts to fall within the facility they arranged in 2021 to borrow money at an interest rate of 1% until 2031. That last nugget of information strikes me as a piece of “voluntary disclosure” that genuinely helps the investment case.

Valuation: Like many businesses of this type, management don’t feel the need to pay a broker for forecasts. Multiplying H1 EPS by 2x gives a rough FY April 2025 EPS of £3, putting the shares on a PER of 26x. Assuming a 50% payout ratio would give a dividend yield of 2%.

Opinion: Maynard has also written admiringly about the company in October 2021, before the share price really took off. I haven’t looked at it in as much detail, but I can see that this is a “buy and forget” type of investment. My one quibble would be that revenue has been uneven, with a couple of periods of declines – lumpy contracts, once again. So I would imagine that might happen again, which could present a buying opportunity. If I owned it, I wouldn’t sell here, but as a new buyer, I could try to time my entry for the next time we see a revenue decline. Overall though, gets the thumbs up from me, and I can see why it has a fan club on social media.

~

Bruce Packard

Notes

Bruce owns shares in Impax AM

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Bi-Weekly Market Commentary | 24/12/2024 | FTC, IPX, GDWN | Comparing the 2021 IPO vintage Nasdaq v AIM

The Bank of England left interest rates unchanged at 4.75% but is clearly more dovish than the Fed; more members of the Monetary Policy Committee dissented in favour of cuts than markets had expected. The UK stockmarket, particularly AIM looks much better value than the US.

Out of curiosity, I looked at how the performance of Nasdaq 2021 vintage of IPO’s and SPACs, using my Sharepad IPO filter. On the Nasdaq, there were 575 IPOs and SPACs that year, the best performing DJT, Trump Media & Technology (the investment vehicle behind “Truth Social”), up +4400%. The company generated $1m of revenue in Q3 this year, versus a market cap of $7.7bn. Matt Levine at Bloomberg has suggested perhaps DJT could merge with Elon Musk’s X. Of the 575 IPOs in the US, just 77 are in positive territory (or 13%). 325 (or 56%) of the recent listings are down more than -80% or more.

The 2021 vintage on AIM was 59 companies, with 7 in positive territory (or 12%). 25 (or 42%) of the recent listings are down -80% or more. So that looks to be a similar probability distribution of investing in a winning 2021 IPO, it’s just the winners in the US markets can turn into very big winners.

4Basebio (congratulations to Leon Boros who tipped it in April 2020, ahead of the spin-out from Expedeon) was the best performer on AIM, up +794%. Interestingly the second best performer was also a corporate spinout from Ashstead, (AT. Ashtead Technology Hldngs) up +215%. This suggests to me a couple of rules of thumb 1) avoid whatever Private Equity is selling, but 2) be open to whatever publicly listed corporate management teams are spinning out. Still, a hit rate of 7 out of 59 supports the idea that IPO stands for “It’s Probably Overpriced”.

Below I look at Filtronic’s H1 Nov positive trading update, environmental asset manager Impax loss of a big mandate and Goodwin’s encouraging H1 October results.

FTC H1 Nov Trading Update

The shares were only up +7% in response. I think that this is explained by leaving next year (FY May 2026F) unchanged.

The company’s history goes back to the 1970s and currently, the products are a mix of transceivers, amplifiers and diplexers. There are 3 design sites in the North of England (Manchester, Leeds and Sedgefield) and an assembly and testing centre on the East coast of the USA. The product range and wider technology capabilities are supported by their own IP and in-house knowledge, and they have a portfolio of patents. The vision is to continue to innovate with RF, Microwave and mmWave communication, delivering transformative wireless solutions through design and manufacture leadership.

Partnership with SpaceX: Earlier this year management announced a partnership with Elon Musk’s SpaceX, whose main product is Starlink (Low Earth Orbit LEO satellites), which provide high-speed internet to users all around the world. The US company will buy E-band SSPA modules from FTC, scheduled for delivery in FY May 2025F, with further order flow expected. FTC has issued 22m warrants (strike price 33p, so well in the money currently) to SpaceX across two tranches, to enable SpaceX to subscribe for up to a maximum of 10% of the Company’s existing share capital, with such warrants expected to vest, once $60m (£48m) of orders have been placed by SpaceX.

The accounting for these warrants results in a non-cash charge of around £10m. So worth noting that statutory FY May 2025F EPS is forecast by Cavendish to be -0.3p. The warrants seem to be a clever way of Musk benefiting from using Filtronic’s technology; but could also suggest that SpaceX, valued at $350bn earlier this month in a private funding round, has all the power in the commercial relationship.

Balance Sheet: Cavendish are forecasting £10m of net cash at the end of May next year. Shareholders’ equity was £15m at the last FY, of which under £3m was goodwill and intangible assets. So it looks to me that even if management need to invest to keep up with increased demand, they can fund this internally.

Valuation: The shares are trading on a PER of 19x May 2025F, but rising to 26x May 2026F . Note the unchanged FY May 2026F EPS forecasts implies a -6% decline in revenue and a -25% decline in EPS next year, from 3p down from 4p. That is reflecting the lumpy nature of contracts.

In June I pointed out a similar dynamic with Intercede (IGP), and a reader on the chat function asked if I had even read the results. However, IGP shares have fallen in recent months, so I do think it’s important to look at what’s happening to next year’s broker forecasts, not just the upbeat commentary in the outlook statement.

Opinion: It looks like FTC management are doing the right things and winning contracts, so could be very exciting. Well done to holders, someone with a background in telecoms did mention this to me before the pandemic, but I didn’t invest because it felt outside my circle of competence. So if people do understand the technology better, please share your thoughts on the chat. Readers should be aware that contracts are “lumpy”, and you can’t just extrapolate in a straight line to future years though.

Impax Mandate Loss / AuM outflows

Nonetheless, IPX shares fell -25% on the day of the announcement. Equity Development, who publish sponsored research on the company cut FY Sept 2025F by 11% reflecting that the mandate would likely take effect this coming Feb, halfway through the year. The FY Sept 2026F EPS forecast was cut by -20%, reflecting a FY loss of the management fee. Equity Development have left the dividend untouched, meaning that the shares now trade on a yield of 11%. Below is a chart that I have taken from their most recent note, that shows quarterly AuM, market movements and net flows.

For fun, I’ve dug out the headline numbers from Dec 2021 (grey), when IPX share price was 1350p to compare with the current month, with the share price around 250p. The historic AuM Sept 2021A is the same as the most recent AuM figure of £37.2bn. The difference is that 3 years ago, when everyone was excited about environmental investing, Impax was forecast to grow AuM +21%, whereas following the mandate loss AuM is now forecast to fall -5% in the current financial year (see red highlights below).

The bottom of the table shows how rather than falls in AuM, the share price decline has been driven by a huge de-rating from 30-40x PER to 9-10.5x. Using the old rule of thumb of paying 4% Market Cap/AuM for a fund manager has been an expensive mistake, the current market is less than 1% of AuM.

Opinion: I first bought Impax at below 45p, and sold some – but not enough! – at 1300p. I then started buying back, with the benefit of hindsight too early in Oct 2023 and June 2024 at c. 380p. Silly me. I’m not rushing to average down again, but my thinking is that Impax has been doing this for decades, and environmental investing comes in and out of fashion.

More generally I think it’s a fascinating example of how investors can value the same amount of assets and revenues at wildly different ratings, depending on the second derivative, whether they think performance is improving or deteriorating.

Goodwin H1 Oct 2024

H1 revenues were up +9% to £106m and H1 statutory PBT was up +38% to £17m. That follows a 3-year period of rising capital expenditure, with capex to operating cashflow (blue) peaking at 80%. This is now beginning to pay-off, which Richard wrote about a year ago.

At most capital-intensive businesses, operating cash flow and capital expenditure are lumpy, varying significantly from year to year. Profits of course smooth this out, with the non-cash depreciation charge going through the p&l. What is good to see, is a UK management team investing in the business and seeing a decent return on that investment.

Some of the spending has been financed with debt, but net debt at £39m is now reducing, down from £55m the previous H1, helped by strong cash generation. The current forward order book stands at £296m, an +11% increase on H1 last year.

Management say that with a lower level of capital expenditure forecast, long-term contracts successfully negotiated and increasing profitability, the Group will benefit from lower level of debt as it starts to fall within the facility they arranged in 2021 to borrow money at an interest rate of 1% until 2031. That last nugget of information strikes me as a piece of “voluntary disclosure” that genuinely helps the investment case.

Valuation: Like many businesses of this type, management don’t feel the need to pay a broker for forecasts. Multiplying H1 EPS by 2x gives a rough FY April 2025 EPS of £3, putting the shares on a PER of 26x. Assuming a 50% payout ratio would give a dividend yield of 2%.

Opinion: Maynard has also written admiringly about the company in October 2021, before the share price really took off. I haven’t looked at it in as much detail, but I can see that this is a “buy and forget” type of investment. My one quibble would be that revenue has been uneven, with a couple of periods of declines – lumpy contracts, once again. So I would imagine that might happen again, which could present a buying opportunity. If I owned it, I wouldn’t sell here, but as a new buyer, I could try to time my entry for the next time we see a revenue decline. Overall though, gets the thumbs up from me, and I can see why it has a fan club on social media.

~

Bruce Packard

Notes

Bruce owns shares in Impax AM

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.