A look at the capex boom from Artificial Intelligence and data centres, and who the winner(s) might be. Companies covered: W7L’s bid for BAR, EAH and VNET.

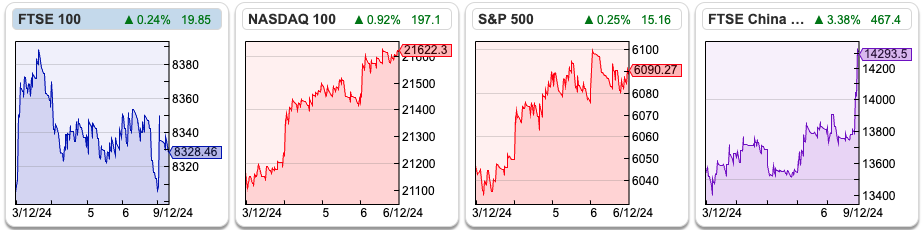

The FTSE 100 was flat last week at 8,328. The Nasdaq100 was much stronger +3.3%, while the S&P was up around +1% over the last 5 trading days. The FTSE China 50 Index was very strong +5.5%, the Communist Party politburo announced it would loosen monetary policy. China’s 10-year government bond yield hit a record low of 1.92% last week, versus 4.2% for the US government bond yield. Presumably, the Renminbi peg to the dollar is coming under pressure if the ‘risk-free’ rate available on US government bonds incentivises investors to seek higher yields outside of China.

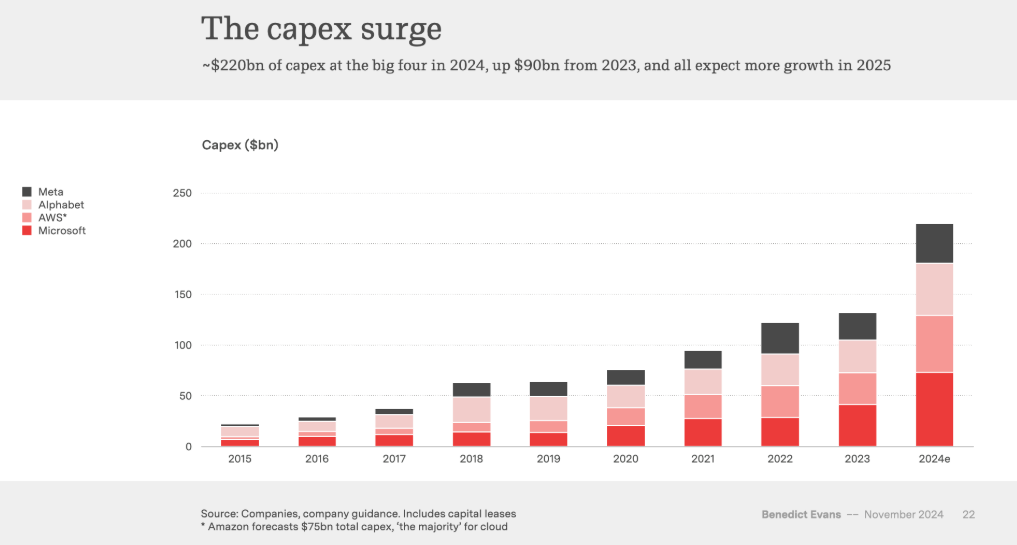

Ben Evans has released his annual 100 slide presentation, on trends in technology. One thing that I hadn’t noticed, is how capital intensive AI has become. Meta, Alphabet, Amazon and Microsoft spent $220bn of capex in 2024, with more growth expected in 2025.

Arguably LLM’s are all the same technology, the only moat is capital and scale, in which case my money would be on AWS to win. The online retailer is building the world’s biggest supercomputer, Project Rainier, and is trying to convince AWS customers to use their inhouse Tranium chips, rather than Nvidia’s H100.

The AI boom seems very different to the most recent decades, when companies like Microsoft, Google (Alphabet), Amazon and Facebook (Meta) could self-fund their own growth out of cashflow. That’s a reflection on the attractive economics of software, which replicates without much marginal costs or incremental capital. But those software economics don’t apply to AI, Sam Altman of OpenAI is proposing to spend multi-trillion dollar sums on data centres.

There’s also this interesting blog post by Lux Capital, which points out that data centres now consume the same amount of energy as the global aviation industry and are now the single largest source of new electricity consumption in the US, more than Electric Vehicle charging. AI draws abundant attention, yet 90% of new data centre demand is for traditional computer processing for the continued digitalisation of our lives.

In the UK we saw bids for pub chain Loungers, waste collection and recycling group Renewi and the insurance company Direct Line, at the end of November. The latter was spun out of Royal Bank of Scotland at 200p per share more than a decade ago, and now Aviva is bidding for the company. Then last week we also saw a bid for Brand Architekts from Warpaint. Finally, General Atlantic, a c. $80bn PE fund established in 1980 by Chuck Feeney, co-founder of Duty-Free Shoppers, published its offer document for Learning Technologies Group.

This week I look at H1 results for ECO Animal Health, the animal feed additives business and Vianet, which has two divisions i) the vending machine and ii) beer monitoring for pubco’s. I start with Warpaint’s bid for Brand Architekts.

Warpaint bids for Brand Architekts

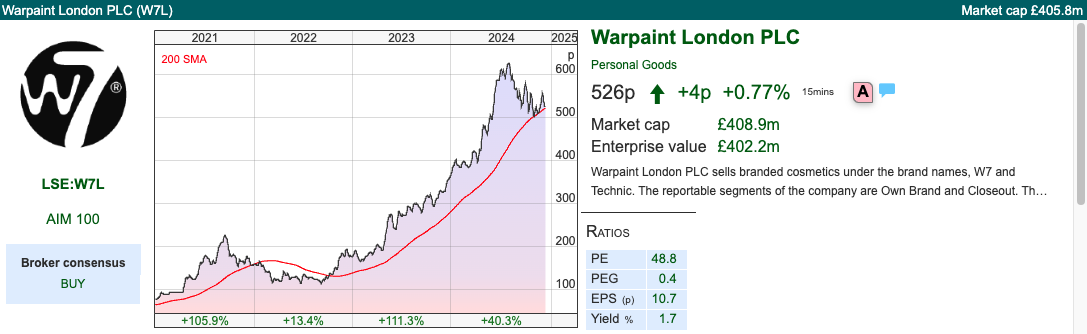

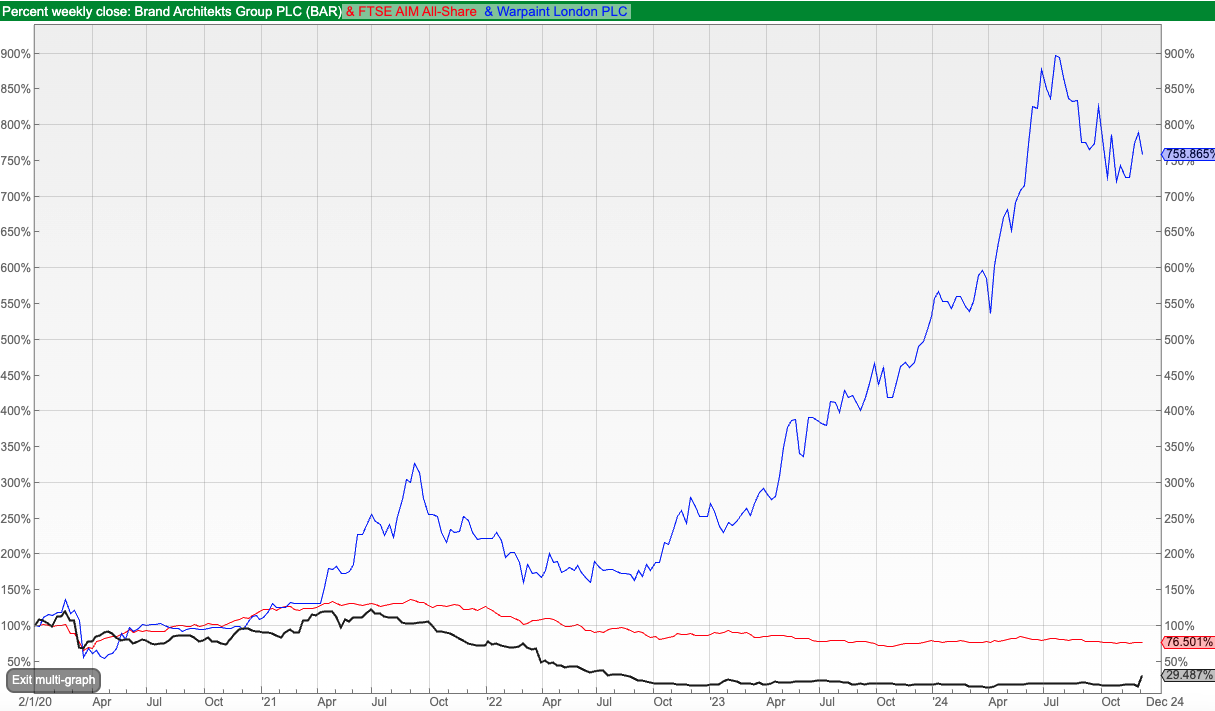

I have lost count of the bids for smaller UK companies coming from overseas and Private Equity firms, but this is different. Warpaint management team has a good track record on AIM and are buying BAR, which has struggled to make profits. Below is Sharescope’s multigraph feature, showing just how strongly W7L (in blue) has outperformed both BAR and the AXX (AIM index) back to the beginning of 2020.

Warpaint’s offer is a very generous 48p per share in cash, double the closing price of 24p per share on 4th December. Shareholders can elect to receive 0.0916 shares in W7L, on 4th Dec Warpaint’s share price was 524p, so that equates to 48p per share. To pay for the deal Warpaint have done a placing at 510p per share, raising £14m.

Rationale for the deal: In 2017 Warpaint bought Retra, which owned the brands Technic, Body Collection and Man’s Stuff for £18m and in 2018 Marvin Leeds Marketing, Warpaint’s US distributor for $2m. Management point to the growth in Retra sales and profits, following the acquisition to justify buying Brand Architekts.

Warpaint believes that Brand Architekts has a number of high-quality health, beauty and personal care brands with a well-established customer base which complements Warpaint’s existing customer relationships and its brand portfolio. Warpaint believes the Acquisition will strengthen the Enlarged Warpaint Group’s customer proposition and facilitate cross-selling opportunities by leveraging a wider brand offering and broader customer relationships.

The trouble with this is that BAR has not made a profit since FY June 2019. Perhaps Warpaint’s management can turn things around, and W7L’s market cap is above £400m, so even if the deal goes wrong, at £14m it’s a bolt-on acquisition, not an existential risk.

Trading update: The recommended offer RNS also included a W7L ‘inline with expectations’ trading update for FY Dec. They say that trading in the US has been particularly strong in H2 Jun-Dec, benefitting from an initial order from Walmart. Management expect to report US revenue growth of around +20% at a significantly higher margin to that achieved FY Dec 2023. The US was only 5% of sales at H1, but in the first half of the year, they appointed a new management team, so that looks like good progress.

Constructive talks are ongoing with Walmart regarding the supply of more products. The RNS also names Boots, Superdrug in the UK and Etos in the Netherlands. W7L are also in talks with other large new retailers in Europe, the US and the UK.

Valuation: Brand Architekts was forecast to be loss-making this year, but the price represents 0.7x FY Jun 2025F turnover and 7x EV/EBITDA. Warpaint is currently trading on a PER of 17x Dec 2026F, and 3x sales the same year.

Opinion: I last wrote up Warpaint when they presented at Mello in May 2023, where management came across well explaining the strategy of making “dupes”, which mirror more expensive brands without being direct copies. More recently, Cockney Rebel mentioned the shares in his Substack email a week ago, pondering whether one of the big retailers like Tesco or M&S might jump on the ‘as good but cheaper’ bandwagon, and if this might benefit Creightons. So at the back of my mind, I’m wondering if Warpaint’s acquisition might signal that management are nervous that others with more firepower might copy their “dupes” business model. The irony of a “dupes” business being copied by a retailer is not lost on me.

I should mention that Cockney Rebel sold his Warpaint earlier this year, but has now bought some back at this level.

ECO Animal Health H1 Sept Results

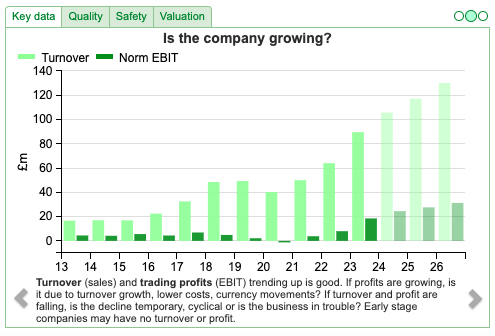

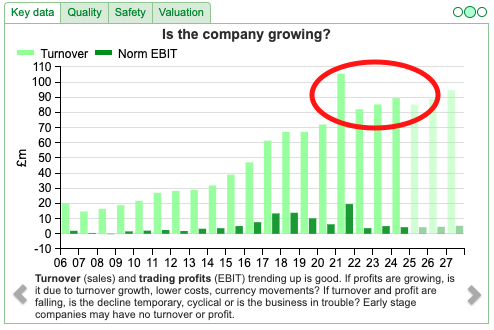

I am amused that this company describes itself as “a rapidly growing global animal health company” at the top of its RNS; followed by the first bullet point “group revenue decreased by -13%”. Sharescope is forecasting £85m FY Mar 2025F revenue, down -20% from that achieved FY Mar 2021.

The group made a loss before tax of £1.4m. The Chief Exec, David Hallas, warns that trading performance is typically H2 weighted. Using Sharescope to confirm, we can see that the last couple of years there has been a roughly 40/60 split. In the commentary, he suggested that the order book gives him confidence in achieving FY Mar 2025F consensus forecasts of £85m revenue and £7.2m adj EBITDA.

Cash balances decreased to £18.3m. One thing to note is that less than 40% of the cash balances are held in the UK. Around half is held in China, mostly in a 51% owned JV. Given capital controls, that cash probably can’t be accessed to be distributed back to shareholders. I came across a fascinating book recommendation, The China Business Conundrum: Ensure That “Win-Win” Doesn’t Mean Western Companies Lose Twice about doing business in China.

EAH management plans to hold a Capital Markets Day in early 2025. That may signal that management have exciting new products or markets to talk about, but at the back of my mind, the reported losses and cash stuck in the China JV might also signal a capital raise is a possibility. Over the last 2.5 years, the company has spent over £20m on R&D, and there’s £40m of intangible assets capitalised on the balance sheet, versus shareholders’ equity of £82m.

EAH’s main product is Aivlosin, which generates 80% of revenues. This is a patented antibiotic, effective against both respiratory and enteric (gut) diseases in pigs and poultry. The medicine is used as an additive to animal feed for a period of seven days until the initial infection has cleared. This means it’s relatively simple to give to animals, which is a key differentiator when dealing with large herds. In the last few years management have been saying that they would like to become less dependent on Aivlosin, but so far little progress has been seen on this aspiration.

China and Japan generated £59m of revenues in FY Mar 2021 or 56% of the group. That has declined to just £8m a H1 Sept, or a quarter of group revenue. They blame the recent decline in China on low disease incidence during the summer. The longer-term decline has been driven by a wholesale decline in pork prices I think, which meant farmers were not prepared to spend the same amount on antibiotics like Aivlosin.

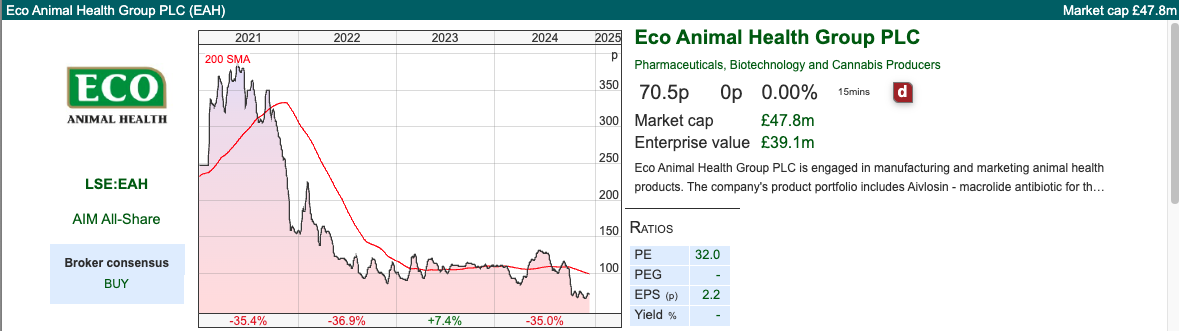

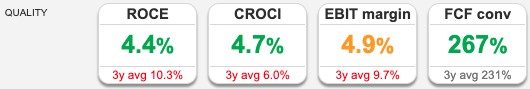

Valuation: Despite the shares having fallen over -80% from their mid-2021 peak, the shares still look expensive on a PER basis. They are trading on 33x Mar 2026F earnings. They look more attractive on EV/EBITDA 5x or 0.5x forecast sales. So implicitly the PER valuation is assuming that margins recover or that the R&D spend starts generating a significant return. That’s possible, but at the current valuation, investors are paying upfront when the track record has been disappointing.

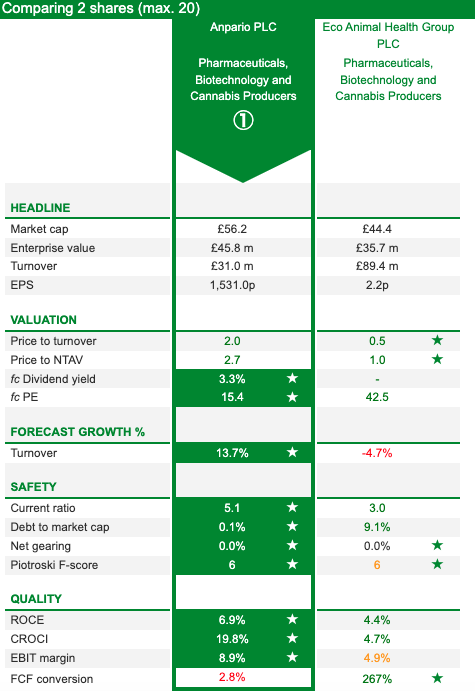

Opinion: EAH operates in the same sector as Anpario, the feed additives business. However the latter now seems to be recovering and is up +30% YTD, with an encouraging chart. I would need to understand the EAH investment case versus Anpario. Once again, I am put off by management’s voluntary disclosure. What they choose to reveal about themselves, rather than just the statutory reporting. Does the EAH Chief Executive believe that a -20% decline in revenue over the past few years is genuinely “rapidly growing”?

Vianet H1 Sept Results

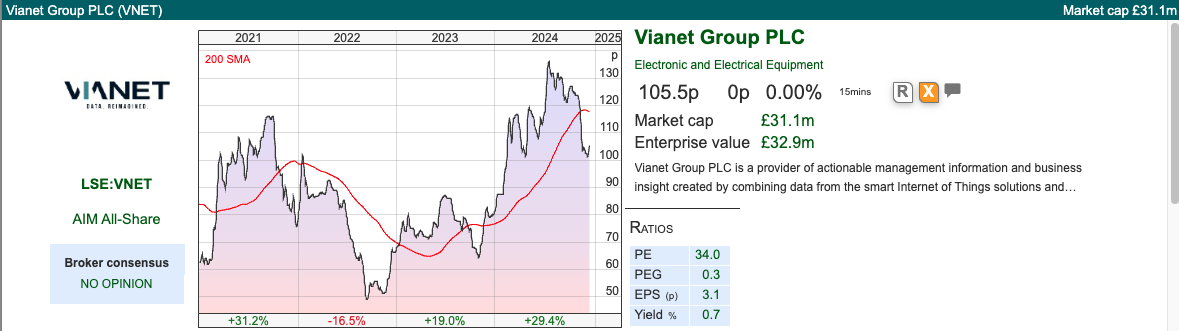

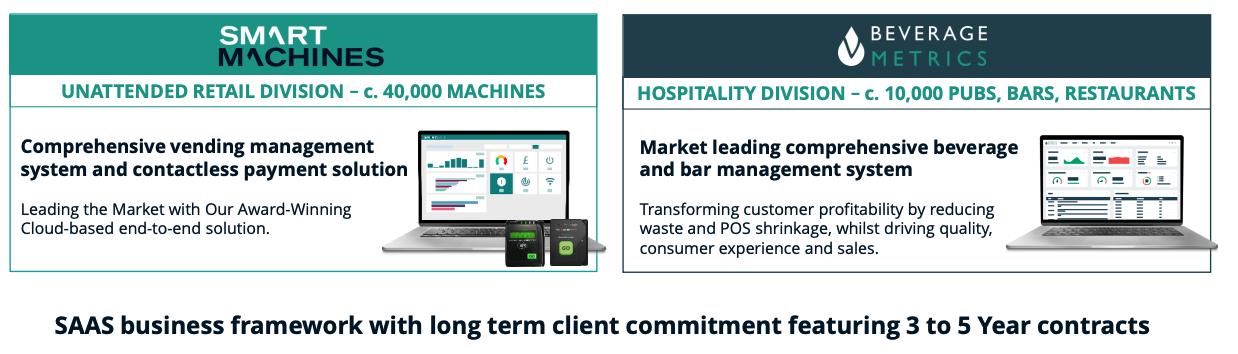

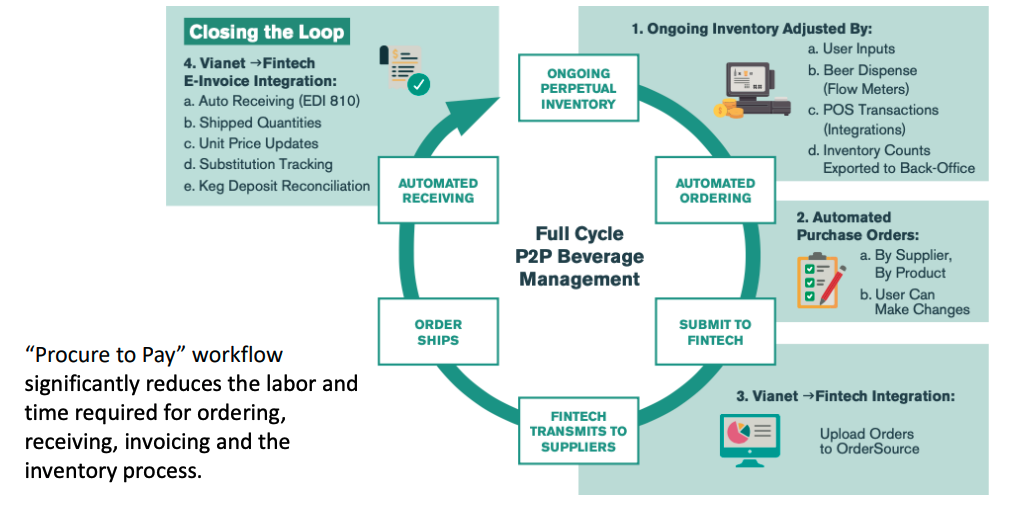

This “Internet of Things” business reported H1 results to September. The company consists of two divisions i) Hospitality, 58% of group revenue, which helps pub companies manage their estates with draught beer monitoring; ii) Unattended Retail, 42% of group revenue, which is a vending machine division. The Hospitality division was loss-making for 2 years during the pandemic, and management cut VNET’s dividend in response. They had already reinstated a FY dividend of less than 1p per share, versus FY 2019 dps of 5.7p. As net debt has been paid down to £1m, they are now resuming the interim dividend of 0.3p per share. The company reported a small statutory PBT of less than £20K.

Outlook: Despite the recent budget increasing labour cost pressure on pubs and restaurants, management believe that pubco’s will want to invest in their technology which helps with waste reduction and working capital. They say that H2 has started in line with FY Mar 2025F expectations. Cavendish, their broker, has +13% revenue growth and adj EPS of 6.2p, up +77% from FY Mar 2024. The broker is forecasting +5% EPS growth to 6.5p FY Mar 2026F.

Opportunity: There are currently 12k leased venues in the UK, down from 19k 15 years ago. That’s been an obvious headwind for VNET. However, Cavendish suggests that the acquisition of Beverage Metrics “platform” (that word again!) in May last year, could quadruple the Total Addressable Market (TAM) in the UK, as they expect BM to appeal to company-owned and independent venues. Beyond the UK, VNET has developed US and European operations, with a TAM of 50k bars and 380k potential customers in total.

For the Unattended Retail division management are focusing on the UK and Europe. They operate 36k of vending machines, versus 300k in the UK and a further 3m machines in mainland Europe. Customers already include coffee companies Douwe Egberts, Lavazza and support services company Compass. Cavendish mention the possibility to expand into adjacent markets such as car washes, EV charging points, ticket machines, laundromats, photo booths and arcade games.

Worth noting that although the company claims 84% of revenue is recurring and switching costs are high (churn less than 2% a year), during the pandemic, revenue did fall sharply from £16m to £8m. I don’t think management could have prevented that decline, but how you define the phrase “recurring revenue” is open to interpretation.

Valuation: EV/EBITDA of 6x, and a PER of 15x Mar 2026F. Given the low level of net debt, a gross margin of 67%, a mid-teens PER ratio seems reasonable to me. Cavendish are only forecasting a DPS of 1.2p, but presumably, there could be scope for management to increase the payout ratio in future years.

Opinion: The shares are down -20% since the start of November, despite management saying H1 was in line with expectations in a trading RNS a month ago and Cavendish re-iterating forecasts. That seems harsh, perhaps investors were anticipating EPS upgrades, which have failed to come through. I have owned this since before the pandemic, the track record has been patchy, but I think it could now represent Growth at a Reasonable Price (GaaRP).

~

Bruce Packard

Notes

Bruce owns shares in VNET

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Bi-Weekly Market Commentary | 10/12/2024 | BAR, EAH, VNET | The Capex Surge

The FTSE 100 was flat last week at 8,328. The Nasdaq100 was much stronger +3.3%, while the S&P was up around +1% over the last 5 trading days. The FTSE China 50 Index was very strong +5.5%, the Communist Party politburo announced it would loosen monetary policy. China’s 10-year government bond yield hit a record low of 1.92% last week, versus 4.2% for the US government bond yield. Presumably, the Renminbi peg to the dollar is coming under pressure if the ‘risk-free’ rate available on US government bonds incentivises investors to seek higher yields outside of China.

Ben Evans has released his annual 100 slide presentation, on trends in technology. One thing that I hadn’t noticed, is how capital intensive AI has become. Meta, Alphabet, Amazon and Microsoft spent $220bn of capex in 2024, with more growth expected in 2025.

Arguably LLM’s are all the same technology, the only moat is capital and scale, in which case my money would be on AWS to win. The online retailer is building the world’s biggest supercomputer, Project Rainier, and is trying to convince AWS customers to use their inhouse Tranium chips, rather than Nvidia’s H100.

The AI boom seems very different to the most recent decades, when companies like Microsoft, Google (Alphabet), Amazon and Facebook (Meta) could self-fund their own growth out of cashflow. That’s a reflection on the attractive economics of software, which replicates without much marginal costs or incremental capital. But those software economics don’t apply to AI, Sam Altman of OpenAI is proposing to spend multi-trillion dollar sums on data centres.

There’s also this interesting blog post by Lux Capital, which points out that data centres now consume the same amount of energy as the global aviation industry and are now the single largest source of new electricity consumption in the US, more than Electric Vehicle charging. AI draws abundant attention, yet 90% of new data centre demand is for traditional computer processing for the continued digitalisation of our lives.

In the UK we saw bids for pub chain Loungers, waste collection and recycling group Renewi and the insurance company Direct Line, at the end of November. The latter was spun out of Royal Bank of Scotland at 200p per share more than a decade ago, and now Aviva is bidding for the company. Then last week we also saw a bid for Brand Architekts from Warpaint. Finally, General Atlantic, a c. $80bn PE fund established in 1980 by Chuck Feeney, co-founder of Duty-Free Shoppers, published its offer document for Learning Technologies Group.

This week I look at H1 results for ECO Animal Health, the animal feed additives business and Vianet, which has two divisions i) the vending machine and ii) beer monitoring for pubco’s. I start with Warpaint’s bid for Brand Architekts.

Warpaint bids for Brand Architekts

I have lost count of the bids for smaller UK companies coming from overseas and Private Equity firms, but this is different. Warpaint management team has a good track record on AIM and are buying BAR, which has struggled to make profits. Below is Sharescope’s multigraph feature, showing just how strongly W7L (in blue) has outperformed both BAR and the AXX (AIM index) back to the beginning of 2020.

Warpaint’s offer is a very generous 48p per share in cash, double the closing price of 24p per share on 4th December. Shareholders can elect to receive 0.0916 shares in W7L, on 4th Dec Warpaint’s share price was 524p, so that equates to 48p per share. To pay for the deal Warpaint have done a placing at 510p per share, raising £14m.

Rationale for the deal: In 2017 Warpaint bought Retra, which owned the brands Technic, Body Collection and Man’s Stuff for £18m and in 2018 Marvin Leeds Marketing, Warpaint’s US distributor for $2m. Management point to the growth in Retra sales and profits, following the acquisition to justify buying Brand Architekts.

Warpaint believes that Brand Architekts has a number of high-quality health, beauty and personal care brands with a well-established customer base which complements Warpaint’s existing customer relationships and its brand portfolio. Warpaint believes the Acquisition will strengthen the Enlarged Warpaint Group’s customer proposition and facilitate cross-selling opportunities by leveraging a wider brand offering and broader customer relationships.

The trouble with this is that BAR has not made a profit since FY June 2019. Perhaps Warpaint’s management can turn things around, and W7L’s market cap is above £400m, so even if the deal goes wrong, at £14m it’s a bolt-on acquisition, not an existential risk.

Trading update: The recommended offer RNS also included a W7L ‘inline with expectations’ trading update for FY Dec. They say that trading in the US has been particularly strong in H2 Jun-Dec, benefitting from an initial order from Walmart. Management expect to report US revenue growth of around +20% at a significantly higher margin to that achieved FY Dec 2023. The US was only 5% of sales at H1, but in the first half of the year, they appointed a new management team, so that looks like good progress.

Constructive talks are ongoing with Walmart regarding the supply of more products. The RNS also names Boots, Superdrug in the UK and Etos in the Netherlands. W7L are also in talks with other large new retailers in Europe, the US and the UK.

Valuation: Brand Architekts was forecast to be loss-making this year, but the price represents 0.7x FY Jun 2025F turnover and 7x EV/EBITDA. Warpaint is currently trading on a PER of 17x Dec 2026F, and 3x sales the same year.

Opinion: I last wrote up Warpaint when they presented at Mello in May 2023, where management came across well explaining the strategy of making “dupes”, which mirror more expensive brands without being direct copies. More recently, Cockney Rebel mentioned the shares in his Substack email a week ago, pondering whether one of the big retailers like Tesco or M&S might jump on the ‘as good but cheaper’ bandwagon, and if this might benefit Creightons. So at the back of my mind, I’m wondering if Warpaint’s acquisition might signal that management are nervous that others with more firepower might copy their “dupes” business model. The irony of a “dupes” business being copied by a retailer is not lost on me.

I should mention that Cockney Rebel sold his Warpaint earlier this year, but has now bought some back at this level.

ECO Animal Health H1 Sept Results

I am amused that this company describes itself as “a rapidly growing global animal health company” at the top of its RNS; followed by the first bullet point “group revenue decreased by -13%”. Sharescope is forecasting £85m FY Mar 2025F revenue, down -20% from that achieved FY Mar 2021.

The group made a loss before tax of £1.4m. The Chief Exec, David Hallas, warns that trading performance is typically H2 weighted. Using Sharescope to confirm, we can see that the last couple of years there has been a roughly 40/60 split. In the commentary, he suggested that the order book gives him confidence in achieving FY Mar 2025F consensus forecasts of £85m revenue and £7.2m adj EBITDA.

Cash balances decreased to £18.3m. One thing to note is that less than 40% of the cash balances are held in the UK. Around half is held in China, mostly in a 51% owned JV. Given capital controls, that cash probably can’t be accessed to be distributed back to shareholders. I came across a fascinating book recommendation, The China Business Conundrum: Ensure That “Win-Win” Doesn’t Mean Western Companies Lose Twice about doing business in China.

EAH management plans to hold a Capital Markets Day in early 2025. That may signal that management have exciting new products or markets to talk about, but at the back of my mind, the reported losses and cash stuck in the China JV might also signal a capital raise is a possibility. Over the last 2.5 years, the company has spent over £20m on R&D, and there’s £40m of intangible assets capitalised on the balance sheet, versus shareholders’ equity of £82m.

EAH’s main product is Aivlosin, which generates 80% of revenues. This is a patented antibiotic, effective against both respiratory and enteric (gut) diseases in pigs and poultry. The medicine is used as an additive to animal feed for a period of seven days until the initial infection has cleared. This means it’s relatively simple to give to animals, which is a key differentiator when dealing with large herds. In the last few years management have been saying that they would like to become less dependent on Aivlosin, but so far little progress has been seen on this aspiration.

China and Japan generated £59m of revenues in FY Mar 2021 or 56% of the group. That has declined to just £8m a H1 Sept, or a quarter of group revenue. They blame the recent decline in China on low disease incidence during the summer. The longer-term decline has been driven by a wholesale decline in pork prices I think, which meant farmers were not prepared to spend the same amount on antibiotics like Aivlosin.

Valuation: Despite the shares having fallen over -80% from their mid-2021 peak, the shares still look expensive on a PER basis. They are trading on 33x Mar 2026F earnings. They look more attractive on EV/EBITDA 5x or 0.5x forecast sales. So implicitly the PER valuation is assuming that margins recover or that the R&D spend starts generating a significant return. That’s possible, but at the current valuation, investors are paying upfront when the track record has been disappointing.

Opinion: EAH operates in the same sector as Anpario, the feed additives business. However the latter now seems to be recovering and is up +30% YTD, with an encouraging chart. I would need to understand the EAH investment case versus Anpario. Once again, I am put off by management’s voluntary disclosure. What they choose to reveal about themselves, rather than just the statutory reporting. Does the EAH Chief Executive believe that a -20% decline in revenue over the past few years is genuinely “rapidly growing”?

Vianet H1 Sept Results

This “Internet of Things” business reported H1 results to September. The company consists of two divisions i) Hospitality, 58% of group revenue, which helps pub companies manage their estates with draught beer monitoring; ii) Unattended Retail, 42% of group revenue, which is a vending machine division. The Hospitality division was loss-making for 2 years during the pandemic, and management cut VNET’s dividend in response. They had already reinstated a FY dividend of less than 1p per share, versus FY 2019 dps of 5.7p. As net debt has been paid down to £1m, they are now resuming the interim dividend of 0.3p per share. The company reported a small statutory PBT of less than £20K.

Outlook: Despite the recent budget increasing labour cost pressure on pubs and restaurants, management believe that pubco’s will want to invest in their technology which helps with waste reduction and working capital. They say that H2 has started in line with FY Mar 2025F expectations. Cavendish, their broker, has +13% revenue growth and adj EPS of 6.2p, up +77% from FY Mar 2024. The broker is forecasting +5% EPS growth to 6.5p FY Mar 2026F.

Opportunity: There are currently 12k leased venues in the UK, down from 19k 15 years ago. That’s been an obvious headwind for VNET. However, Cavendish suggests that the acquisition of Beverage Metrics “platform” (that word again!) in May last year, could quadruple the Total Addressable Market (TAM) in the UK, as they expect BM to appeal to company-owned and independent venues. Beyond the UK, VNET has developed US and European operations, with a TAM of 50k bars and 380k potential customers in total.

For the Unattended Retail division management are focusing on the UK and Europe. They operate 36k of vending machines, versus 300k in the UK and a further 3m machines in mainland Europe. Customers already include coffee companies Douwe Egberts, Lavazza and support services company Compass. Cavendish mention the possibility to expand into adjacent markets such as car washes, EV charging points, ticket machines, laundromats, photo booths and arcade games.

Worth noting that although the company claims 84% of revenue is recurring and switching costs are high (churn less than 2% a year), during the pandemic, revenue did fall sharply from £16m to £8m. I don’t think management could have prevented that decline, but how you define the phrase “recurring revenue” is open to interpretation.

Valuation: EV/EBITDA of 6x, and a PER of 15x Mar 2026F. Given the low level of net debt, a gross margin of 67%, a mid-teens PER ratio seems reasonable to me. Cavendish are only forecasting a DPS of 1.2p, but presumably, there could be scope for management to increase the payout ratio in future years.

Opinion: The shares are down -20% since the start of November, despite management saying H1 was in line with expectations in a trading RNS a month ago and Cavendish re-iterating forecasts. That seems harsh, perhaps investors were anticipating EPS upgrades, which have failed to come through. I have owned this since before the pandemic, the track record has been patchy, but I think it could now represent Growth at a Reasonable Price (GaaRP).

~

Bruce Packard

Notes

Bruce owns shares in VNET

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.