Some background reading on cybersecurity and hacking, topical in the wake of Crowdstrike-related chaos from last week. Companies covered TRST, RNO and CRL.

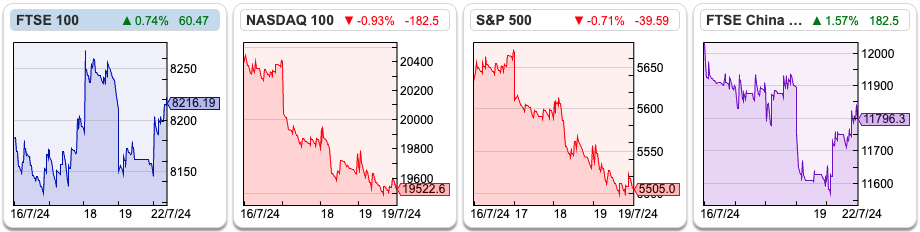

The FTSE 100 rose +0.5% to 8,216 last week. Nasdaq100 and S&P500 were down -4% and -2% respectively. For contrast, the Russell 2000 small cap index jumped +7%, encouraged by helpful inflation data, with small cap stocks expected to benefit disproportionately from interest rate cuts versus cash-rich Nasdaq100 tech stocks. The sentiment towards tech was not helped by Crowdstrike -11% on Friday, the Nasdaq-listed cybersecurity company seems to have created chaos around the world.

One of the things I like to do at Mello, if I remember, is to ask people for book recommendations. Sharepad user Vivek suggested to me in May that Nicole Perlroth’s This Is How They Tell Me the World Ends had been the most eye-opening book he had read recently. He suggested the book as background reading about hacking and cybersecurity, rather than specific company research. However, the book mentions Crowdstrike, which are still trading on a PER of 62x FY Jan 2026F, or 15x sales the same year even after last week’s news of a botched security update causing havoc.

Cybersecurity strikes me as a very difficult area for investors to research, as so many players have an interest in keeping these dark arts opaque. The book doesn’t go into detail about how to create your own “zero day exploit” to hack MS Windows but instead introduces some of the characters and organisations that do this and details about episodes that were newsworthy for a day or two, but had much longer repercussions. For instance, in 2016 a group called The Shadowbrokers leaked NSA hacking tools over the internet, which could then be used to create some of the most devastating viruses of recent times WannaCry, and NotPetya. WannaCry caused major problems for the NHS, forcing hospitals to turn patients away. NotPetya was unleashed on Ukraine, but quickly spread around the world, causing an estimated $10bn of damage. While WannaCry was attributed to North Korea and was ransomware intended to earn money, NotPetya was attributed to Russia and was created to cause destruction and lost data. The book also suggests that China uses hacking techniques to steal intellectual property from Western companies, explaining some of the geopolitical tension in recent years.

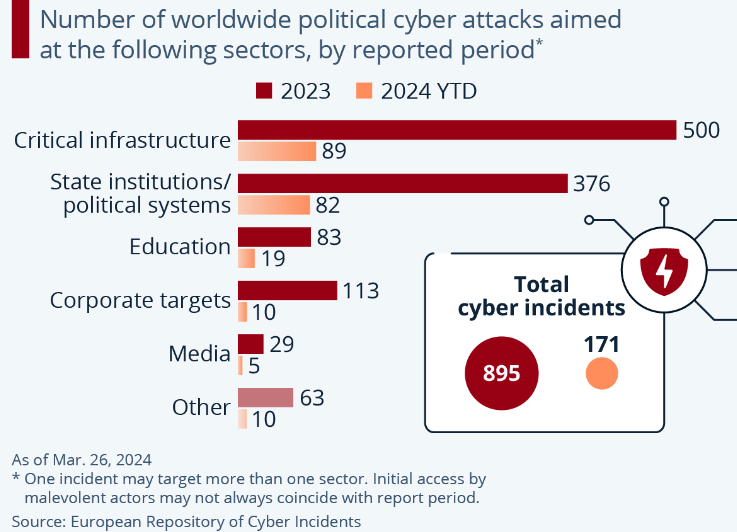

Aside from Crowdstrike’s update, last week we saw Google’s parent Alphabet in talks to buy Wiz, a cybersecurity firm valued at $23bn. Alphabet operates its own Venture Capital business, with heavy loss-making Other Bets and Moonshots divisions, preferring to invest internally than buying other start-ups (YouTube, Waze, DeepMind plus a few other exceptions). So Wiz would be the largest acquisition in Alphabet’s history. We also saw AT&T report a data breach last week, with hackers being able to see who made calls and sent messages to who (eg who called which journalists or politicians, but not the subject matter of the conversations). The same FT article mentions that in the previous 12 months companies as diverse as US healthcare giant UnitedHealth, consumer group Clorox, casino operators MGM Resorts International and Caesars Entertainment, and North Face owner VF Corporation have all reported data breaches. There was also a ransomware attack on the Indonesian government. According to this chart from Statista, taken from European Repository of Cyber Incidents data, attacks on critical infrastructure are accelerating at an alarming rate.

A few years before the pandemic I read Quiet Killers which is about microbes that cause infectious diseases. That stood me in good stead in early 2020 when everyone was scrambling to understand the Covid-19. I already feel that background reading on cybersecurity has given me some insight into last week’s news.

This week I look at Trustpilot, the customer review hosting website, industrial company Renold and personal care brands company Creightons. Of the three, I own CRL, as I am hoping to see a recovery in trading.

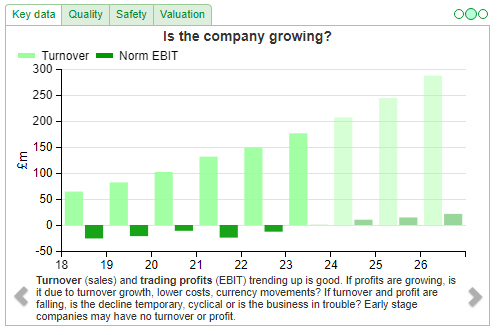

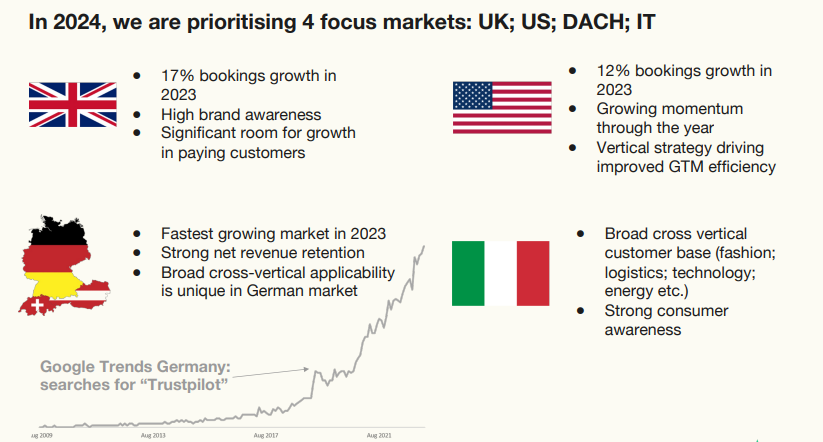

TrustPilot H1 June Trading Update

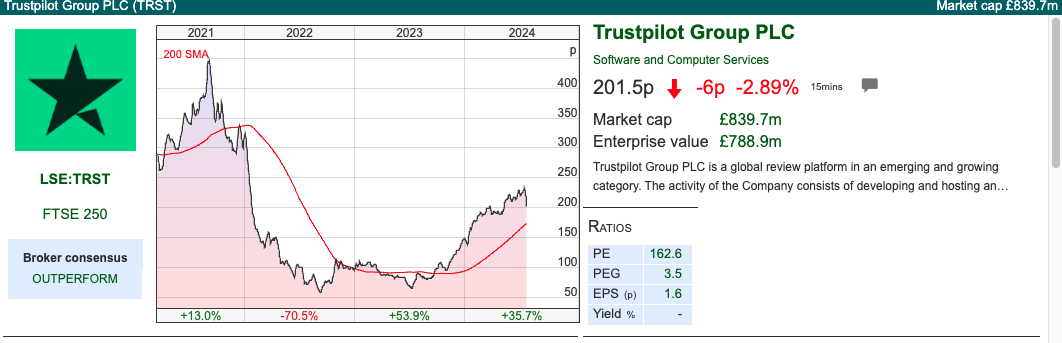

This customer reviews website that IPO’ed in March 2021 announced H1 Jun revenue +17% on a constant currency basis to $100m. Annual Recurring Revenue grew +18% on the same basis. Net cash, at $76m end of June has fallen by $16m in the last 6 months, but that is because the company has bought back $20m of shares. Still, I’m not sure that $4m of cash constitutes “strong cash generation” as management claim, the business has a historic track record of losses.

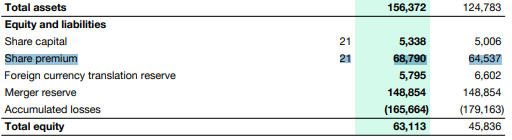

The buyback programme for $20m was announced in January, but shareholders have passed a special resolution at its AGM in June, to cancel its share premium account which should allow the company to buyback more shares in the second half. At Dec 2023 this stood at $68.79m, versus which was actually higher than total shareholders equity of $63m – the balance being explained by $166m of accumulated losses.

Although the company reported an FY Dec profit of $7.1m, this was helped by a $9m tax credit, without which loss before tax would have been $1.9m.

What it does: The website allows consumers to post reviews about businesses. TRST operate a “freemium” model, publishing reviews but charging businesses for ancillary services. For instance, allowing businesses to publish their Trustpilot rating and reviews on their own website, paid plans also offer SEO optimisation, and analytical tools that help them understand customer feedback as well as other services. Although it charges businesses, Trustpilot prevents those paying customers from removing unfavourable reviews. I noticed that the word “platform” appears 271x in the group’s IPO prospectus.

History: Trustpilot was founded in 2007 by Peter Holten Mühlmann, in Aarhus, Denmark from his parent’s garage. In 2008, he raised US $3m in equity financing from Seed Capital and other private investors. In 2014 and 2015 they raised a further $100m in equity, mainly from Vitruvian Partners (Skyscanner, JustEat and Darktrace). One of the things that surprised me was that most of the VC funding was how late stage it was, ie just a few years before the company IPO’ed, rather than helping the business grow in the early days. Although VCs like to portray themselves as backing start-ups founded in garages, the reality is that the VC industry has become about raising large sums of money and pouring it into a few businesses that are capable of achieving global scale. Hence you get Softbank’s $16bn pre-IPO investment in WeWork, while I know many small start-ups in Berlin which struggle to find backers.

TRST listed on the main market (not AIM) at 265p in March 2021 raising $55m for new growth and selling shareholders (mainly Draper Espirit, Northzone, Vitruvian, Seed Capital and Index Ventures) receiving around $500m. That valued the company at $1.1bn on admission. The current shareholder register shows that Draper Espirit currently owns 6%, and Vitruvian 5%, while the founder Peter Holten Mühlmann still holds a 2% stake. In March 2023 he announced his intention to step down, to be replaced by Adrian Blair as CEO. Zillah Byng-Thorne (ex Future, who rode a huge rise in the share price over, and left as the share price collapsed c. 85%) is the chair.

Outlook: The FY Dec outlook statement talks about continuing to deliver mid-teens revenue growth and achieving operating leverage. The gross margin is 82% so theoretically this should be a company with significant operational gearing, but in practice, it was still loss-making (ex the tax credit) after 15 years and generating $176m of revenue FY Dec 2023.

Valuation: The shares are trading on a PER of 76x Dec 2025F, dropping to 50x the following year. The forecast price/sales ratio is just under 5x. The $20m buyback represents over a third of the new money raised in 2021 at 265p, but 7% of the current market cap.

Opinion: Maynard wrote the company up here a couple of years ago, and was not impressed. I can see a couple of risks which might de-rail the business, from competition against Google to customers losing confidence due to fake reviews. I am also put off by the high valuation but could change my mind if it looks like the company is able to generate meaningful profits and cash.

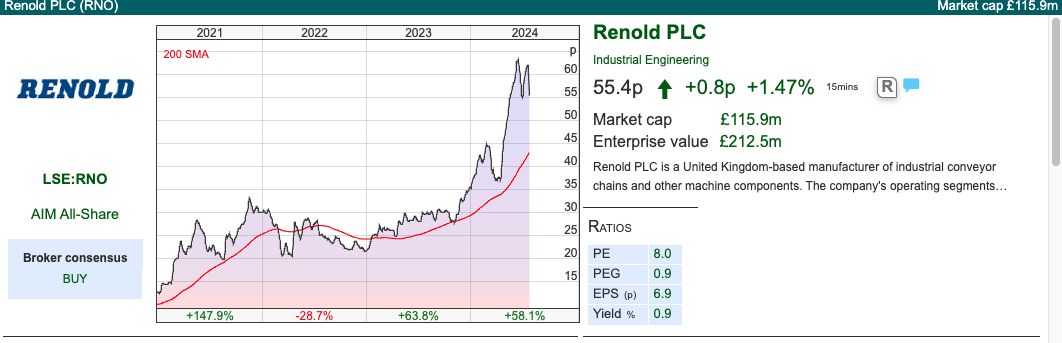

Renold FY March Results

I remember Sharepad user CockneyRebel pitching this on Mello. It’s done well, up 12x from April 2020 lows, so kudos to him!* Renold makes industrial chains and related power transmission products. They have been benefitting from some large military contracts, such as the Canadian and Australian Navy.

FY Mar 2024 Revenue was up less than +1% on a constant currency basis, to £241m. So the share price performance has been driven by improving margin to 12.3%, reducing net debt to £25m and favourable revaluation of the group’s £161m pension liabilities. The pension deficit now stands at £54m, roughly halving from £102m in Mar 2021, on an IAS 19 basis.

Outlook: Management say the business is now at an inflexion point and talk about an acquisitive growth strategy. The optimism in the text is slightly dampened by the order intake book down -12% to £227m, which was partly due to a large contract with the Australian Navy in FY Mar 2023 and partly due to supply chain conditions normalising. Management point to the H2 order intake up +7.5% on H1. Cavendish, their broker, are forecasting less than +1% sales growth FY Mar 2025F, rising to +2% the following year.

Valuation: The shares are trading on a PER of 7.7x FY Mar 2025F, but remember that although the pension deficit has reduced, at £57m currently, it’s still half the company’s market cap.

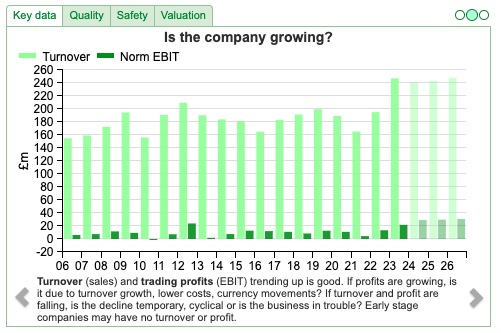

Opinion: Revenues were £209m in 2012, and growing at +9%, so it’s important not to confuse a cyclical recovery with a structural growth story. That said, the shares are not expensive, and given that the sales growth forecasts are conservative, so perhaps this has further to go? Having missed it earlier, I personally wouldn’t buy into the story here. But well done to any readers who followed Richard into it.

Creightons FY March Results

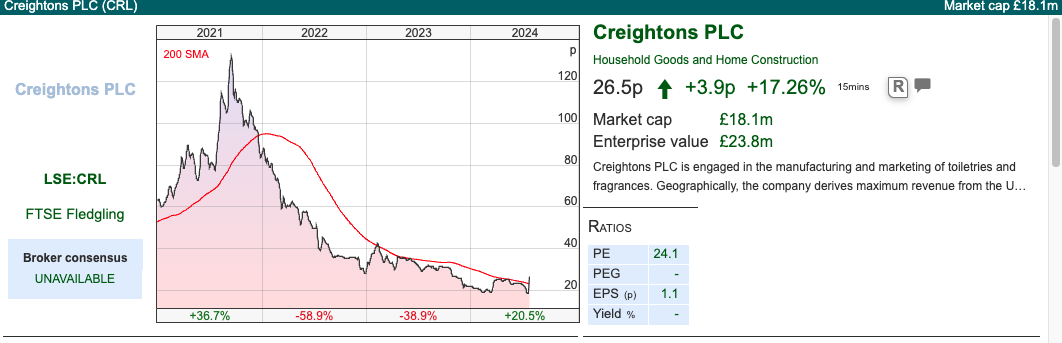

This personal care brand (Feather & Down, Frizz No More, Body Bliss among others) and white label manufacturer announced an intangible asset impairment earlier this month, followed by FY March results last week.

In an 8th July RNS, they wrote down the value of Emma Hardie, a skincare brand acquired in July 2021 for £6.2m total consideration by £4.5m – implying that management overpaid by around 3.5x! This is a non-cash charge, but is a hit to reported PBT. In order to do the deal, CRL issued shares at a guaranteed price of 125p to the selling shareholders, which resulted in an extra charge as CRL’s share price fell well below that level – they are currently 26.5p. Bernard Johnson, the Group MD responsible for the deal left the company in November last year, to be replaced by William McIllroy, taking up an Executive role who is also a 24% shareholder. Then in March this year, the company announced McIllroy would revert to a non-executive role, with Philippa Clark becoming the group MD, previously Sales and Marketing Director.

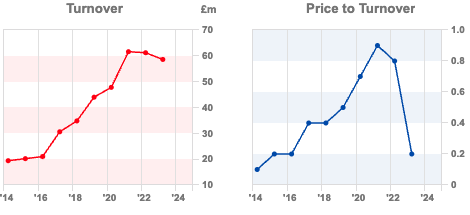

Results: FY Mar 2024 Revenues were down -9% to £53m and profit before the goodwill writedown was up +70% to £1.2m. Including the £4.4m writedown, statutory PBT was negative £3.3m. Cash generated from operations was £6.1m, helped by good working capital management and cancelling no critical capital expenditure. Net debt stood at £2.9m, though most of this is a mortgage secured on a property, so the balance sheet is in a good state. Management have reintroduced a final dividend of 0.45p, which signals confidence about the future.

Outlook: The chairman’s statement says the group is committed to recovering operating profits to previous levels (FY Mar 2024 this was 2% of sales but in H2 Sept-Mar recovered to 4% of sales). Sharepad shows in FY Mar 2021 this ratio was above 8%, implying that even with flat revenue, PBT could quadruple from the £1.2m just reported FY Mar 2024. FY Mar 2021 RoCE was 24%, versus 5.9% just reported.

There are no forecasts in the market. I feel that’s a mistake for a company with a market cap of £15m, they ought to have Cavendish or Hardman or similar writing up the investment case and helping private investors.

Valuation: Share-based payments and issuing shares for acquisitions mean that the number of shares has increased +18% from 2021 to 76.7m. Assuming flat sales and a margin recovery to 8%, would imply an EPS of 4.8p, on a 10x PER multiple implying a target price of 48p. So plenty of upside even in a conservative scenario, assuming sales recover to 2021 levels, margin recovery and a 15x PER multiple would value the shares at over 80p.

Opinion: Checking William McIllroy’s LinkedIn page, he was at university in the 1970’s, so I wonder whether the business might be put up for sale at some point. However, with the share price having seen 125p in 2021, I think management would be reluctant to sell until they can demonstrate improved performance and we see a recovery from the current levels. As I own the shares, I am hoping that the recovery comes sooner rather than later.

Notes

Bruce Packard

brucepackard.com

Bruce owns shares in Creightons

*I can’t remember precisely when he pitched it, needless to say, it wasn’t at the 2020 low, but the shares were up +64% in 2023 and +73% YTD.

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Bi-Weekly Market Commentary | 23/07/2024 | TRST, RNO, CRL | Ghost in the Machine

Some background reading on cybersecurity and hacking, topical in the wake of Crowdstrike-related chaos from last week. Companies covered TRST, RNO and CRL.

The FTSE 100 rose +0.5% to 8,216 last week. Nasdaq100 and S&P500 were down -4% and -2% respectively. For contrast, the Russell 2000 small cap index jumped +7%, encouraged by helpful inflation data, with small cap stocks expected to benefit disproportionately from interest rate cuts versus cash-rich Nasdaq100 tech stocks. The sentiment towards tech was not helped by Crowdstrike -11% on Friday, the Nasdaq-listed cybersecurity company seems to have created chaos around the world.

One of the things I like to do at Mello, if I remember, is to ask people for book recommendations. Sharepad user Vivek suggested to me in May that Nicole Perlroth’s This Is How They Tell Me the World Ends had been the most eye-opening book he had read recently. He suggested the book as background reading about hacking and cybersecurity, rather than specific company research. However, the book mentions Crowdstrike, which are still trading on a PER of 62x FY Jan 2026F, or 15x sales the same year even after last week’s news of a botched security update causing havoc.

Cybersecurity strikes me as a very difficult area for investors to research, as so many players have an interest in keeping these dark arts opaque. The book doesn’t go into detail about how to create your own “zero day exploit” to hack MS Windows but instead introduces some of the characters and organisations that do this and details about episodes that were newsworthy for a day or two, but had much longer repercussions. For instance, in 2016 a group called The Shadowbrokers leaked NSA hacking tools over the internet, which could then be used to create some of the most devastating viruses of recent times WannaCry, and NotPetya. WannaCry caused major problems for the NHS, forcing hospitals to turn patients away. NotPetya was unleashed on Ukraine, but quickly spread around the world, causing an estimated $10bn of damage. While WannaCry was attributed to North Korea and was ransomware intended to earn money, NotPetya was attributed to Russia and was created to cause destruction and lost data. The book also suggests that China uses hacking techniques to steal intellectual property from Western companies, explaining some of the geopolitical tension in recent years.

Aside from Crowdstrike’s update, last week we saw Google’s parent Alphabet in talks to buy Wiz, a cybersecurity firm valued at $23bn. Alphabet operates its own Venture Capital business, with heavy loss-making Other Bets and Moonshots divisions, preferring to invest internally than buying other start-ups (YouTube, Waze, DeepMind plus a few other exceptions). So Wiz would be the largest acquisition in Alphabet’s history. We also saw AT&T report a data breach last week, with hackers being able to see who made calls and sent messages to who (eg who called which journalists or politicians, but not the subject matter of the conversations). The same FT article mentions that in the previous 12 months companies as diverse as US healthcare giant UnitedHealth, consumer group Clorox, casino operators MGM Resorts International and Caesars Entertainment, and North Face owner VF Corporation have all reported data breaches. There was also a ransomware attack on the Indonesian government. According to this chart from Statista, taken from European Repository of Cyber Incidents data, attacks on critical infrastructure are accelerating at an alarming rate.

A few years before the pandemic I read Quiet Killers which is about microbes that cause infectious diseases. That stood me in good stead in early 2020 when everyone was scrambling to understand the Covid-19. I already feel that background reading on cybersecurity has given me some insight into last week’s news.

This week I look at Trustpilot, the customer review hosting website, industrial company Renold and personal care brands company Creightons. Of the three, I own CRL, as I am hoping to see a recovery in trading.

TrustPilot H1 June Trading Update

This customer reviews website that IPO’ed in March 2021 announced H1 Jun revenue +17% on a constant currency basis to $100m. Annual Recurring Revenue grew +18% on the same basis. Net cash, at $76m end of June has fallen by $16m in the last 6 months, but that is because the company has bought back $20m of shares. Still, I’m not sure that $4m of cash constitutes “strong cash generation” as management claim, the business has a historic track record of losses.

The buyback programme for $20m was announced in January, but shareholders have passed a special resolution at its AGM in June, to cancel its share premium account which should allow the company to buyback more shares in the second half. At Dec 2023 this stood at $68.79m, versus which was actually higher than total shareholders equity of $63m – the balance being explained by $166m of accumulated losses.

Although the company reported an FY Dec profit of $7.1m, this was helped by a $9m tax credit, without which loss before tax would have been $1.9m.

What it does: The website allows consumers to post reviews about businesses. TRST operate a “freemium” model, publishing reviews but charging businesses for ancillary services. For instance, allowing businesses to publish their Trustpilot rating and reviews on their own website, paid plans also offer SEO optimisation, and analytical tools that help them understand customer feedback as well as other services. Although it charges businesses, Trustpilot prevents those paying customers from removing unfavourable reviews. I noticed that the word “platform” appears 271x in the group’s IPO prospectus.

History: Trustpilot was founded in 2007 by Peter Holten Mühlmann, in Aarhus, Denmark from his parent’s garage. In 2008, he raised US $3m in equity financing from Seed Capital and other private investors. In 2014 and 2015 they raised a further $100m in equity, mainly from Vitruvian Partners (Skyscanner, JustEat and Darktrace). One of the things that surprised me was that most of the VC funding was how late stage it was, ie just a few years before the company IPO’ed, rather than helping the business grow in the early days. Although VCs like to portray themselves as backing start-ups founded in garages, the reality is that the VC industry has become about raising large sums of money and pouring it into a few businesses that are capable of achieving global scale. Hence you get Softbank’s $16bn pre-IPO investment in WeWork, while I know many small start-ups in Berlin which struggle to find backers.

TRST listed on the main market (not AIM) at 265p in March 2021 raising $55m for new growth and selling shareholders (mainly Draper Espirit, Northzone, Vitruvian, Seed Capital and Index Ventures) receiving around $500m. That valued the company at $1.1bn on admission. The current shareholder register shows that Draper Espirit currently owns 6%, and Vitruvian 5%, while the founder Peter Holten Mühlmann still holds a 2% stake. In March 2023 he announced his intention to step down, to be replaced by Adrian Blair as CEO. Zillah Byng-Thorne (ex Future, who rode a huge rise in the share price over, and left as the share price collapsed c. 85%) is the chair.

Outlook: The FY Dec outlook statement talks about continuing to deliver mid-teens revenue growth and achieving operating leverage. The gross margin is 82% so theoretically this should be a company with significant operational gearing, but in practice, it was still loss-making (ex the tax credit) after 15 years and generating $176m of revenue FY Dec 2023.

Valuation: The shares are trading on a PER of 76x Dec 2025F, dropping to 50x the following year. The forecast price/sales ratio is just under 5x. The $20m buyback represents over a third of the new money raised in 2021 at 265p, but 7% of the current market cap.

Opinion: Maynard wrote the company up here a couple of years ago, and was not impressed. I can see a couple of risks which might de-rail the business, from competition against Google to customers losing confidence due to fake reviews. I am also put off by the high valuation but could change my mind if it looks like the company is able to generate meaningful profits and cash.

Renold FY March Results

I remember Sharepad user CockneyRebel pitching this on Mello. It’s done well, up 12x from April 2020 lows, so kudos to him!* Renold makes industrial chains and related power transmission products. They have been benefitting from some large military contracts, such as the Canadian and Australian Navy.

FY Mar 2024 Revenue was up less than +1% on a constant currency basis, to £241m. So the share price performance has been driven by improving margin to 12.3%, reducing net debt to £25m and favourable revaluation of the group’s £161m pension liabilities. The pension deficit now stands at £54m, roughly halving from £102m in Mar 2021, on an IAS 19 basis.

Outlook: Management say the business is now at an inflexion point and talk about an acquisitive growth strategy. The optimism in the text is slightly dampened by the order intake book down -12% to £227m, which was partly due to a large contract with the Australian Navy in FY Mar 2023 and partly due to supply chain conditions normalising. Management point to the H2 order intake up +7.5% on H1. Cavendish, their broker, are forecasting less than +1% sales growth FY Mar 2025F, rising to +2% the following year.

Valuation: The shares are trading on a PER of 7.7x FY Mar 2025F, but remember that although the pension deficit has reduced, at £57m currently, it’s still half the company’s market cap.

Opinion: Revenues were £209m in 2012, and growing at +9%, so it’s important not to confuse a cyclical recovery with a structural growth story. That said, the shares are not expensive, and given that the sales growth forecasts are conservative, so perhaps this has further to go? Having missed it earlier, I personally wouldn’t buy into the story here. But well done to any readers who followed Richard into it.

Creightons FY March Results

This personal care brand (Feather & Down, Frizz No More, Body Bliss among others) and white label manufacturer announced an intangible asset impairment earlier this month, followed by FY March results last week.

In an 8th July RNS, they wrote down the value of Emma Hardie, a skincare brand acquired in July 2021 for £6.2m total consideration by £4.5m – implying that management overpaid by around 3.5x! This is a non-cash charge, but is a hit to reported PBT. In order to do the deal, CRL issued shares at a guaranteed price of 125p to the selling shareholders, which resulted in an extra charge as CRL’s share price fell well below that level – they are currently 26.5p. Bernard Johnson, the Group MD responsible for the deal left the company in November last year, to be replaced by William McIllroy, taking up an Executive role who is also a 24% shareholder. Then in March this year, the company announced McIllroy would revert to a non-executive role, with Philippa Clark becoming the group MD, previously Sales and Marketing Director.

Results: FY Mar 2024 Revenues were down -9% to £53m and profit before the goodwill writedown was up +70% to £1.2m. Including the £4.4m writedown, statutory PBT was negative £3.3m. Cash generated from operations was £6.1m, helped by good working capital management and cancelling no critical capital expenditure. Net debt stood at £2.9m, though most of this is a mortgage secured on a property, so the balance sheet is in a good state. Management have reintroduced a final dividend of 0.45p, which signals confidence about the future.

Outlook: The chairman’s statement says the group is committed to recovering operating profits to previous levels (FY Mar 2024 this was 2% of sales but in H2 Sept-Mar recovered to 4% of sales). Sharepad shows in FY Mar 2021 this ratio was above 8%, implying that even with flat revenue, PBT could quadruple from the £1.2m just reported FY Mar 2024. FY Mar 2021 RoCE was 24%, versus 5.9% just reported.

There are no forecasts in the market. I feel that’s a mistake for a company with a market cap of £15m, they ought to have Cavendish or Hardman or similar writing up the investment case and helping private investors.

Valuation: Share-based payments and issuing shares for acquisitions mean that the number of shares has increased +18% from 2021 to 76.7m. Assuming flat sales and a margin recovery to 8%, would imply an EPS of 4.8p, on a 10x PER multiple implying a target price of 48p. So plenty of upside even in a conservative scenario, assuming sales recover to 2021 levels, margin recovery and a 15x PER multiple would value the shares at over 80p.

Opinion: Checking William McIllroy’s LinkedIn page, he was at university in the 1970’s, so I wonder whether the business might be put up for sale at some point. However, with the share price having seen 125p in 2021, I think management would be reluctant to sell until they can demonstrate improved performance and we see a recovery from the current levels. As I own the shares, I am hoping that the recovery comes sooner rather than later.

Notes

Bruce Packard

brucepackard.com

Bruce owns shares in Creightons

*I can’t remember precisely when he pitched it, needless to say, it wasn’t at the 2020 low, but the shares were up +64% in 2023 and +73% YTD.

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.