The latest haul of 5 strikes shares includes Halma and RS, proof perhaps that big companies can gallop, or at least trot. Richard also doffs his cap to Bloomsbury Publishing and works out how profitable Next 15 really is.

We’re in a low period for annual report publishing as the large number of companies that have year ends that coincide with the calendar year-end in December have now mostly published.

That means only six companies have published annual reports and also passed my Minimum Quality Filter since I took stock two weeks ago.

The next step in the process is to find flaws in their financial track records. The more flaws there are, the more difficult the company will be to analyse, and, probably, the less reliable its past will be as a guide to the future.

5 Strikes

5 Strikes is my way of finding businesses that have grown under their own steam in SharePad, without giving shareholders too many headaches.

They have not required investors or lenders to stump up ever more capital to grow or borrowed unsustainably.

To my mind, these businesses are more predictable than companies that haven’t shown they know how to profit, and businesses that try to transform themselves overnight through large acquisitions.

| Name | TIDM | AR Date | Strikes | Score |

|---|---|---|---|---|

| Halma | HLMA | 24/6/24 | – Holdings | 1 |

| Mitie | MTO | 21/6/24 | ? Holdings – CROCI – Growth – ROCE – Shares | 4 |

| Bloomsbury Publishing | BMY | 17/6/24 | 0 | |

| Vodafone | VOD | 14/6/24 | – Holdings – Debt – Growth – ROCE | 4 |

| RS | RS1 | 12/6/24 | – Holdings | 1 |

| Eckoh | ECK | 11/6/24 | – Acquisitions ? CROCI -Growth – ROCE – Shares | 4 |

Notes: This article explains each strike, but the Minimum Quality filter has been modified. This is the new version.

Three companies achieved less than three strikes: Bloomsbury Publishing, Halma, and RS.

Bloomsbury Publishing (0 strikes)

Bloomsbury is a book and information publisher. Its most successful authors are romantasy (romance/fantasy) writer Sarah J Maas, and JK Rowling. While JK Rowling’s newer pseudonymous adult detective fiction is not published by Bloomsbury, the publisher still earns a huge annuity from Harry Potter books. It owns the rights to publish them in English (outside the US).

The publisher also has another cash cow: Bloomsbury Digital Resources (BDR), academic publications in the arts, humanities and social sciences.

It has grown by investing in the work of countless authors and steadily acquiring other publishers and information sources.

With a pristine financial history and a mission to publish “works of excellence and originality”, it may not surprise you to know that it is one of the 40 shares I review annually at Interactive Investor. I expect to write it up there in July. I also own the shares.

Halma (- Holdings)

Halma is a curiosity. It is proof that companies can keep buying up smaller self-similar businesses using their own cash flows and grow quite big while remaining highly profitable.

Halma describes itself as a group of 50 or so small and medium-sized technology businesses that make the world safer, cleaner and healthier. Together they earned turnover of more than £2 billion in 2024 and have a market capitalisation of over £10 billion.

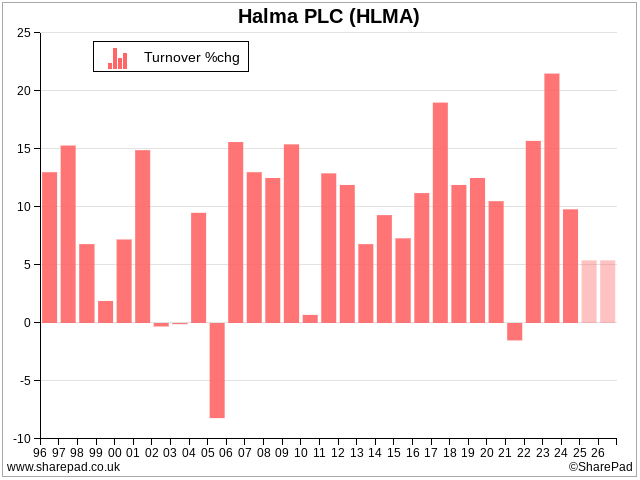

As I explained in a more detailed introduction to the share two years ago, we need to be concerned with two statistics for a rough assessment of whether Halma’s multi-decade strategy is still on track. The first is turnover growth:

Double-digit growth has been the norm for much of the 2000s.

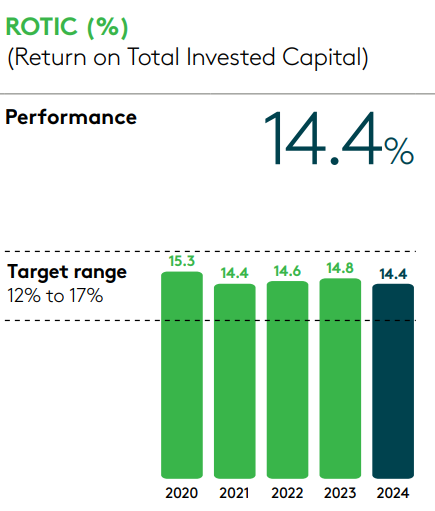

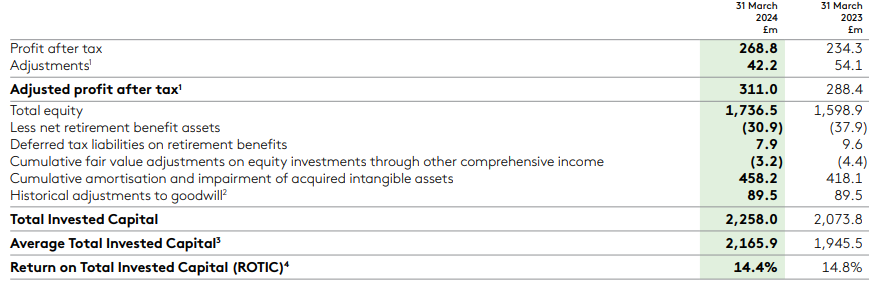

The second is Return on Total Invested Capital (ROTIC). This is a fully loaded version of ROCE that uses after-tax adjusted profit for the numerator, return, and includes goodwill and intangible assets at their cost (unamortised) values in the denominator, total invested capital.

This ratio is useful because acquisitions are a critical part of Halma’s strategy. It is not enough to know that Halma earns decent profit from its operations, we need to know whether it earns a decent return on the purchase cost as well. ROTIC covers both influences on returns.

ROTIC is not available in SharePad but is self-reported by Halma:

Source: Halma annual report 2024.

A cursory look at the financial track record suggests nothing much has changed, and after a post-pandemic wobble in the share price, it seems traders agree. The elephant is still galloping:

Halma only scores 1 strike. The directors own just 0.05% of the shares.

RS (- Holdings)

Unlike Bloomsbury and Halma, I have not investigated RS before. It is even bigger than Halma. Its turnover is almost £3 billion.

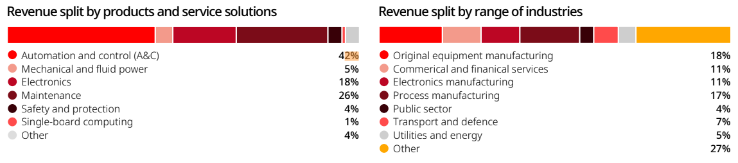

RS is a distributor of products used in the maintenance, repair, and operation (MRO) of machinery and equipment. You can get a feel for the kind of product by browsing RS’ catalogue. It includes components, like power supplies and transformers, tools, sensors, cables and safety gear. Its strategic focus is industrial automation, which brings in 42% of revenue.

Source: RS annual report 2024.

RS says it is one of the few global distributors that buy in bulk and sell in small quantities to customers as they need them. Most of its competitors are smaller local or regional distributors, often with narrower and less technical and specialist product ranges.

Like Halma, the directors hold only 0.05% of the shares. But otherwise, RS may be another trotting elephant, although it did experience a small decline in revenue in 2024. That was, in part, due to the high level of demand for electronics during the pandemic, which has normalised.

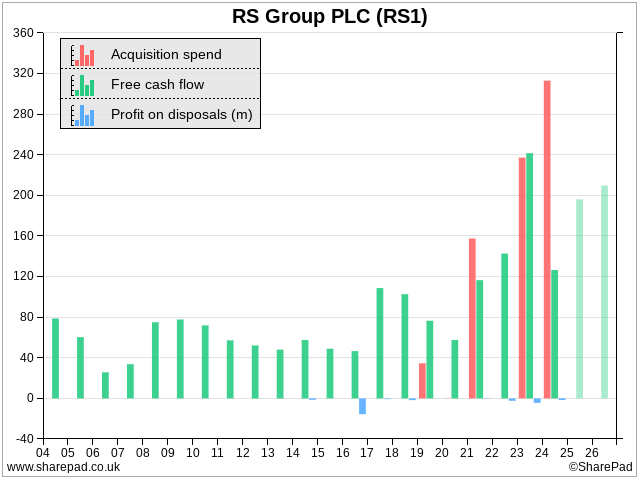

Intriguingly, RS has become a lot more dependent on acquisitions in recent years:

Next 15: Roll your own ROTIC

Not all acquisitive companies obligingly calculate Return on Total Invested Capital for us like Halma does, and in any case, methodologies vary. It makes sense to calculate our own version so we can compare one company to another.

Unfortunately, it is not a trivial undertaking.

It would be a good idea to check RS’ ROTIC, but I have unfinished business with Next 15.

Next 15 is an agglomeration of marketing and business consultancies that has grown by acquisition. I took a first look at the business about a month ago and one of the things on my to-do list is to calculate its ROTIC.

We can do this by adding back acquired intangible assets to operating profit and deducting 25% (the current rate of corporation tax in the UK) to turn it into an after-tax number.

Then we can take SharePad’s value for capital employed, deduct the book value of goodwill and acquired intangible assets (these are amortised values) and replace them with the cost values, which will be higher. We can find cost values in the note on intangible assets in the annual report (Note 11 in Next 15’s report for the year to 31 January 2024).

The trouble is, companies do not always distinguish between intangible assets that were acquired and those that were developed internally. We must make assumptions. To be consistent, I count intangible assets that can only be created through acquisition and ignore intangible assets like software, which can be developed internally or acquired, treating them as if they were developed internally.

There are three types of intangible asset that can only be created through acquisition listed in Next 15’s annual report: Goodwill, customer relationships (the value of contracts identified at the time of acquisition), and the capitalised cost of non-compete agreements (non-compete agreements prevent vendors from competing with the business they sold Next 15 for a period post-acquisition).

My sums suggest Next 15’s ROTIC is between 13% and 15%. Both figures add back the amortisation of the acquired intangible assets to profit because we have included them in capital employed. The higher 15% ROTIC figure adds back other exceptional costs that Next 15 adjusts out of its numbers. The lower 13% figure includes these costs.

Even though Next 15’s ROTIC is lower than SharePad’s ROCE figure of 21%, 13-15% is still a decent return.

~

Contact Richard Beddard by email: richard@beddard.net, Twitter: @RichardBeddard, web: beddard.net

Got some thoughts on this week’s article from Richard? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for a specific share.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.