Richard unearths five good-quality businesses that have recently published annual reports. Top of the list are InterContinental Hotels (IHG), and MoneySupermarket (MONY)…

Joyfully, I am away on holiday but my holiday is mistimed in one respect. The post-Christmas lull in annual report publishing has come to an end. A large number of companies with financial year-ends that coincide with the calendar year-end have started publishing their reports for 2023.

Five companies had published annual reports and achieved less than three strikes before I left. That is to say, there is not much to put us off looking into them further. We will catch up with the backlog next time!

5 pass 5 Strikes

The disappointing thing about the quintet is that directors at only one of them, Me Group, own substantial shareholdings. Generally, it is a good thing if board members are owners because it gives them a powerful incentive to grow the value of the business.

| Name | TIDM | Strikes | # Strikes |

|---|---|---|---|

| InterContinental Hotels | IHG | – Holdings – Debt | 2 |

| Me Group | MEGP | – Growth | 1 |

| Moneysupermarket.com | MONY | – Holdings | 1 |

| Senior | SNR | ? Holdings ? Acquisitions ? Debt – ROCE | 2 |

| SThree | STEM | – Holdings | 1 |

| Source: SharePad and Richard Beddard | |||

| Our guide to 5 Strikes: How the system works, and what the strikes mean. | |||

Some of these companies are very big though, so expecting executives to own a significant percentage of the business may be asking too much.

The paucity of other strikes means all these shares are worth looking into.

InterContinental Hotels

You will almost certainly have heard of and probably stayed in some of IHG’s hotel brands. It owns 19 of them and claims there is a brand for everyone. They include the ‘luxury’ InterContinental brand, ‘premium’ Crowne Plaza, and ‘essential’ Holiday Inn chain.

The company is among the world’s largest hotel groups, duking it out with other famous names like Marriott, Hilton, and Hyatt.

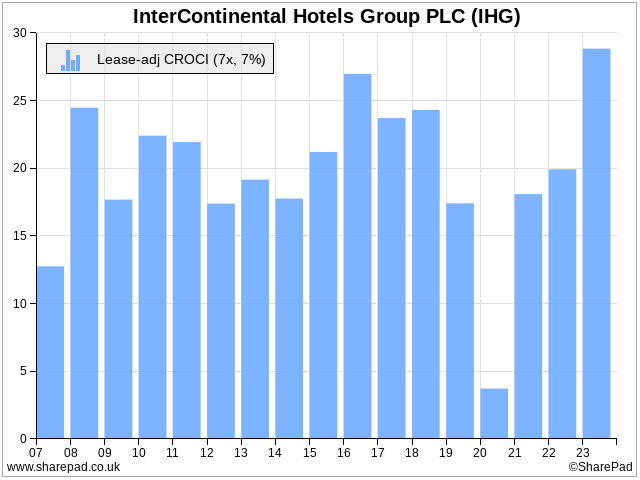

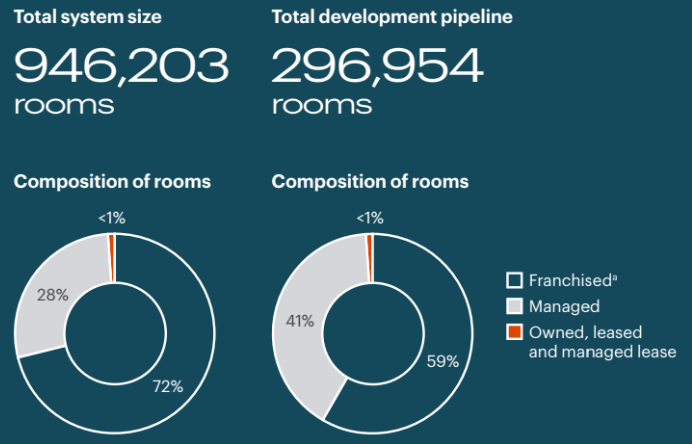

Phil Oakley examined the business in 2018. He noted that IHG had reduced the number of hotels it owned since the previous big recession in 2008/9. In 2008, IHG owned 15% of its rooms. In 2017, the proportion was 3%. In the just-published annual report for 2023, the proportion was less than 1%.

Meanwhile, the number of managed rooms has gone up from 24% to 28% and the number of franchised rooms from 61% to 72%.

This process has increased the company’s profitability because most of the costs accrue to franchisees and owners, while IHG’s franchise and management fees are predominantly based on revenue.

Franchisees bear the cost of owning or leasing, and operating the hotel. Where IHG is the manager but not the owner, the owner typically reimburses the employee costs.

Since much of the cost of owning and operating a hotel is fixed, profits from hotel franchises hold up better than owned or leased hotels when times are tough and people are less inclined to travel.

There is a profit-share element in IHGs management fee though, so revenue from managed hotels will be more variable than for franchised hotels.

Since the financial crisis of 2008, InterContinental Hotels has generated impressive returns, except during the height of the pandemic when we could not travel for long periods.

You might well ask, what do franchisees and owners get in return for shouldering all this cost? They get customers, attracted by IHG’s famous brands, retained by its loyalty scheme, and booked through its booking system. They also get tools that help them with marketing, operations, and procurement.

In other words, IHG has taken on the bits of running hotels that scale efficiently, which enables it to grow with relatively low levels of investment, and then it shares some of the benefits of that scale with franchisees and owners.

This is a symbiotic relationship, as long as the mothership, IHG, does not try and take too much from it. Franchisees can be powerful clients which, if they feel hard done by, band together and revolt.

In 2019, franchisees at Domino’s Pizza UK refused to open any more stores until the company addressed grievances about their profit share.

Looking at the company’s growth plans, it seems the balance of franchised and managed hotels might shift slightly in favour of managed hotels. The proportion of managed hotel rooms in IHGs development pipeline is 36%, compared to 59% for franchised rooms.

Source: InterContinental Hotels annual report 2023

Assuming IHG achieved its entire pipeline, that would take the number of managed rooms to just under 387,000, and the number of franchised rooms to just over 856,000. That is 31%, and 69% of the eventual total respectively.

This may be happening because IHG is focusing on growing the luxury and premium categories rather than its biggest category, essentials. At posher hotels, management arrangements are more common.

It is only a small change in the balance but it may mean IHG’s revenue becomes slightly less resilient as a result. Not only is revenue from franchisees more resilient in downturns, but so is revenue from the essential hotels.

Guided by the Strikes

Apart from very modest director shareholdings, the only strike against IHG is its level of debt (borrowings and leases) as a percentage of capital, which is 72%. This is way above my arbitrary limit of 25%.

This statistic is, of course, influenced by two numbers: net debt and capital. The bigger the net debt, and the smaller the amount of capital required to run the business, the higher the debt-to-capital ratio.

Almost certainly the ratio is high because the company employs so little capital, not because it has borrowed too much. It can easily afford the repayments from the high returns it achieves.

Moneysupermarket.com

MoneySuperMarket is the UK’s market-leading price comparison site and another “capital light business”. It is not even afflicted by a high level of debt relative to its diminutive capital. Its debt-to-capital ratio is 14.3%.

A mission for our times. Source: Moneysupermarket annual report

Phil wrote MoneySuperMarket up in May, noting a new and potentially scary challenge to its biggest earner: insurance. But, considering Google’s failure to break into price comparison, he questioned whether the incumbent price comparison sites have anything to worry about.

Apparently not: Amazon announced the closure of its insurance shop in January.

SThree

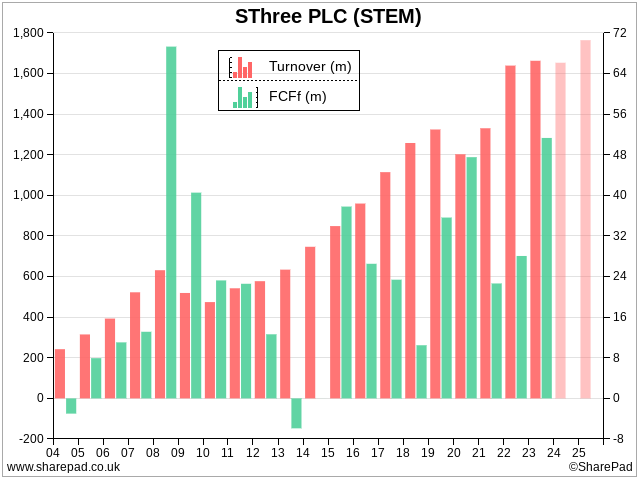

SThree is a staffing company that supplies specialist contractors: scientists, technologists, engineers and mathematicians, hence its ticker: STEM. The company says the contracting element of this formula translates into repeating revenue and sustainable cash flow, and the STEM element brings growth because scientists and the rest are in high demand.

Except during the first year of the pandemic, and two years following the financial crisis, this appears to have been broadly true.

Perhaps reassuringly, even though turnover fell in 2009, 2010 and 2020, free cash flow was particularly strong in those years, suggesting SThree is unlikely to get into trouble during downturns.

A trading update for the first quarter of 2024 published last week revealed that it had experienced a downturn much more modest than those precursors.

Me

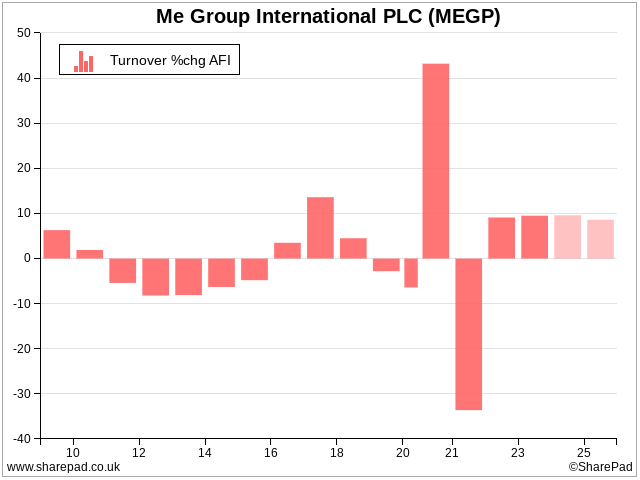

Me Group, formerly PhotoMe, is a photo booth, digital printing kiosk, unattended washing machine and vending machine operator. It received only one strike, which was for growth.

In eight of the last sixteen years, turnover has fallen whether we adjust for inflation or not. Here I have used SharePad’s inflation-adjusted measure of turnover:

The big question I would be asking as I read Me’s annual report is whether the pattern is likely to repeat in future.

Analysts do not think so, over the next two years at least.

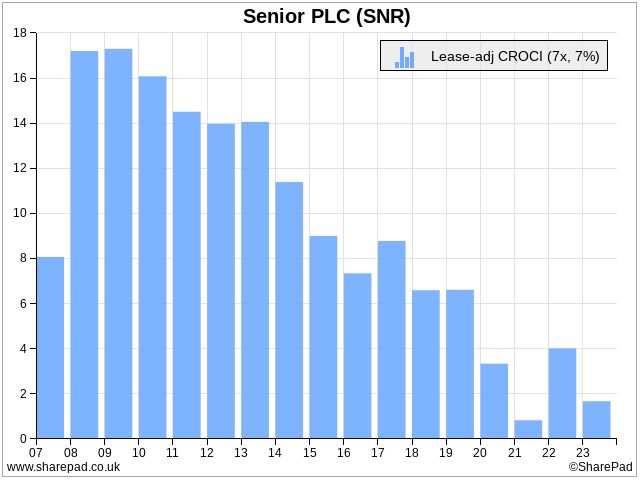

Senior

At first glance, Senior is the least enticing of the quintet. The company makes components that improve the efficiency of planes and trucks.

There is nothing wrong with that, but it squeezed into this group with a number of borderline strikes. It is not that profitable, its debt is slightly on the high side, it has been spending more on acquisitions than it has earned in cash flow recently, and it is definitely not being run for cash:

~

Contact Richard Beddard by email: richard@beddard.net, Twitter: @RichardBeddard, web: beddard.net

Got some thoughts on this week’s article from Richard? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for a specific share

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.