A look at two charts that suggest reasons for growing optimism, even as the UK performance has lagged other markets. Companies covered CEY, CBG and ANP.

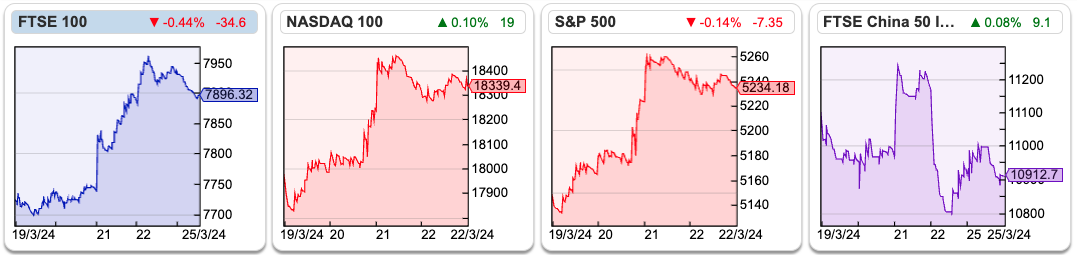

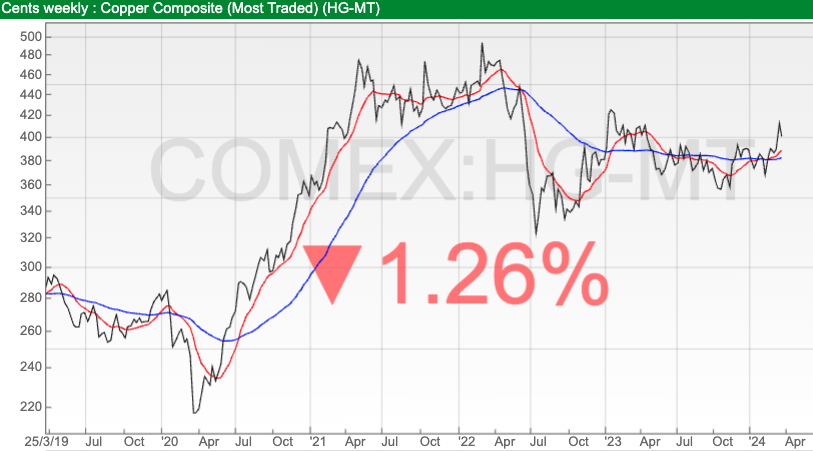

The FTSE 100 was up +2.2% last week to 7,869. The Nasdaq100 was also strong up +3% and the S&P500 up +2.3%. China and Japan enjoyed contrasting fortunes last week, with XIN0 down -1.7% but NIK up +4.4%. The US yield curve remains inverted, but it looks increasingly likely that we have avoided a deep recession from rising interest rates. I mentioned in January that if the inverted yield curve is no longer a reliable indicator of recessions, because of the actions of Central Banks, then the copper price (Sharepad ticker HG-MT) was still worth following. Back then copper was forming a “wedge”, making lower highs, and higher lows – and I was waiting to see which way it broke out.

Looking at the same chart now, with copper up +11% since the start of November, it looks like the trend has broken out decisively on the upside. Spot price is trading above both the 16 (red) and the 64 (blue) day moving average. That should be good news for equities, particularly UK equities that haven’t enjoyed the same bounce as the US markets.

Vanguard Smaller Companies ETF, which tracks 2,000 small caps globally, has also resumed its upward trend. Since the start of November VIGSCA is up +20%, again with the current price trading above both the 16 and 64-day moving averages.

AIM remains slightly below its long-term moving average, however, it should be only a matter of time before the UK market follows these two charts, breaking out on the upside. In addition, Central Banks in the UK and USA are likely to err on the dovish side in election years, so I am feeling increasingly optimistic. I’m not really a market timer, but I did say in April 2021 that we were near the top. Since then, of the three stocks mentioned, Cerillion has more than doubled, D4T4 (now Celebrus) is down by a third, but RBGP which I said at the time “looked very expensive” is down more than 90%.

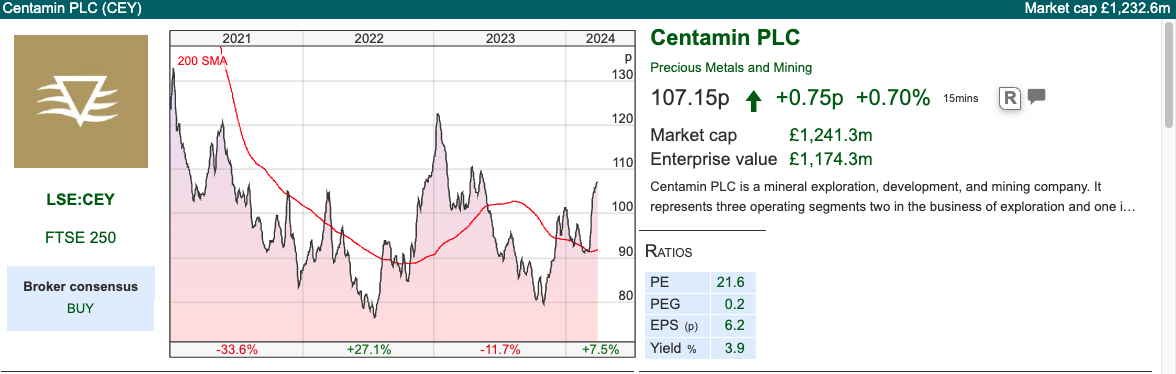

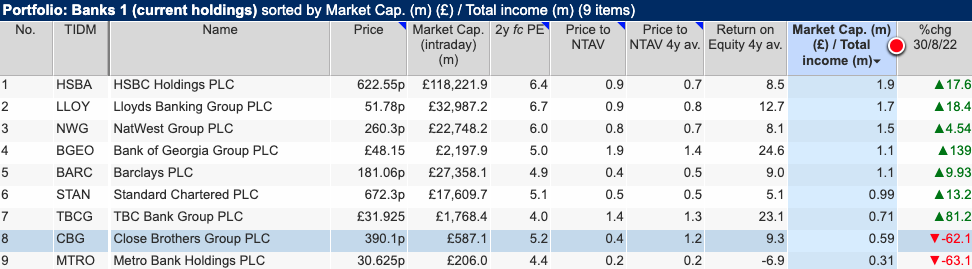

This week I look at Close Brothers results, the shares have rallied +32% since the lows at the beginning of March after management had cut the dividend, but are still trading 0.4x book value. I also look at animal feed business, Anpario and Egyptian gold miner Centamin.

Centamin FY Dec results

I mentioned Centamin a week ago, as the gold price has risen c. 20% since the beginning of November, so their results seem worth a comment: Centamin reported FY Dec 2023 revenues rose +13% to $891m and PBT up +14% to $195m. They have $153m of cash, and a RCF of $150m, which they didn’t draw on in 2023.

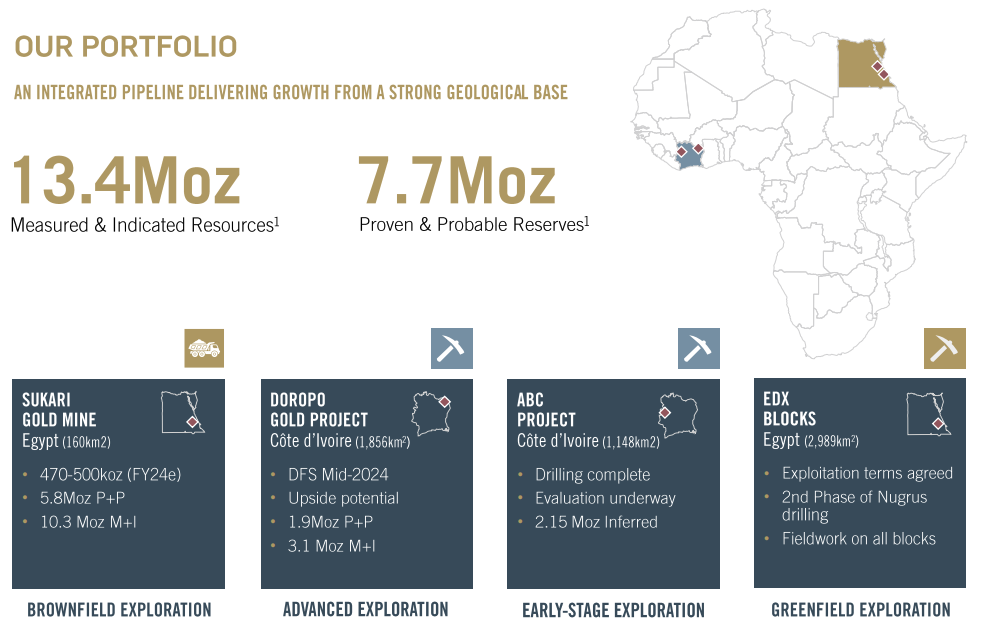

The company’s main goldmine, Sukari, is in Egypt and has produced 5.7m ounces of gold (worth $12bn at the current price) since 2009. The company says that as of today the projected mine life is over ten years, and they plan to mine half a million ounces (currently worth $1bn) a year. They believe that their costs are in the lower half of the industry cost curve. They also have other exploration assets in Egypt and the Cote d’Ivoire.

Outlook: For FY Dec 2024F they are forecasting a range of 470K to 500K ounces (v 456K just reported) and are targeting all-in sustaining costs of US$1,200-1,350 per ounce sold. The oil price is the most significant commodity affecting management’s cost assumptions. There was a $15m saving last year, despite using 2.3 million litres more than budgeted (actual fuel used in 2023 was 165m litres). In 2024F, diesel consumption across the Sukari operation is expected to be 160m litres equating to $145 million at $0.90/litre. In other words, EPS is sensitive to both the gold price and fuel costs, longer-term there is a decarbonisation plan to use solar panels rather than diesel.

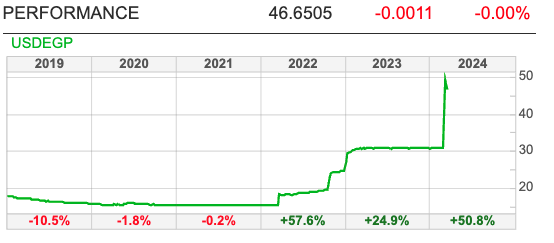

Sharepad shows that the Egyptian Pound is competing with the Turkish Lira as the most fun country to visit a short flight away from Europe. USDEGP has devalued significantly over the past few years, from around 16 in early 2022 to 47, with the most recent de-valuation early March. Centamin points out that their revenues are denominated in US dollars, but the devaluation might cause problems with local supply chains.

Valuation: CEY shares are trading on a PER of 8.4x FY Dec 2024F and 9.4x the following year. EV/EBITDA is forecast to be around 3x FY Dec 2024F. Those forecasts are obviously dependent on the price that they achieve for their gold. But it’s pleasing to note that the current spot price of $2,170 is 11% above last year’s average realised price of $1,948 per ounce.

Comparison with Goldplat: AIM tiddler Goldplat also reported H1 results at the start of this week, with revenues +82% to £37m and PBT following disposals of £1.6m. GDP had a net cash of £1.7m. This strikes me as speculative and illiquid, sensitive in both directions to movements in the gold price, but with some similarities to Sylvania (bi-products of mine tailings). On WH Ireland’s FY Jun 2024F forecasts the shares are trading on a PER of 4x, dropping to below 3x in Jun 2025 (EV/EBITDA below 1x). I can imagine that there could be an upside if the price of gold continues to strengthen, but I really would not recommend any small-cap gold company with high conviction. That said, I bought a small position in GDP on Monday morning.

Opinion: It’s hard to think of a professional fund manager who has made their fortune investing in the mining sector, so I tend to be underweight mining shares. There’s a Charles Darwin quote, from The Voyages of the Beagle, “a person with a copper-mine will gain; with silver he may gain; but with gold he is sure to lose.”

I’ve used Sharepad’s “multigraph” feature to chart the relationship (Precious in red, Industrial metals in black) back to 1999. Both enjoyed strong performance up to the financial crisis, and then for a while Precious outperformed strongly as interest rates fell close to zero and investors worried about Central Bank credibility, but ultimately Industrial and Precious metals have ended up increasing in value 1.5x over 25 years. That implies that both have struggled to keep pace with inflation, at a time when inflation was itself mostly low single digits.

Precious metal stocks are an idea for contrarians. I own Capital Drilling, however, Centamin seems like a sensible company with potential upside and Goldplats (or similar) is speculative. As always, this is to flag the idea of using Sharepad to do further research.

Close Brothers H1 to January Results

This specialist bank, with a Wealth Management division and which also owns market maker Winterfloods is down -50% YTD. The share price was trending down in H2 last year but then sold off steeply in January when the FCA began an investigation into the interest rates charged to customers for loans for motor finance. Customers have complained that they were being treated unfairly, banks rejected those complaints but then in a couple of instances, the Financial Ombudsman Service (FOS) then ruled in favour of the customers. The two banks ruled against were Lloyds and Barclays, but Close Brothers also operated a similar commission model historically and may need to compensate customers who seek redress. The FCA launched an investigation, which is scheduled to conclude before the end of September, but on the 15th of February CBG announced they would cut their dividend.

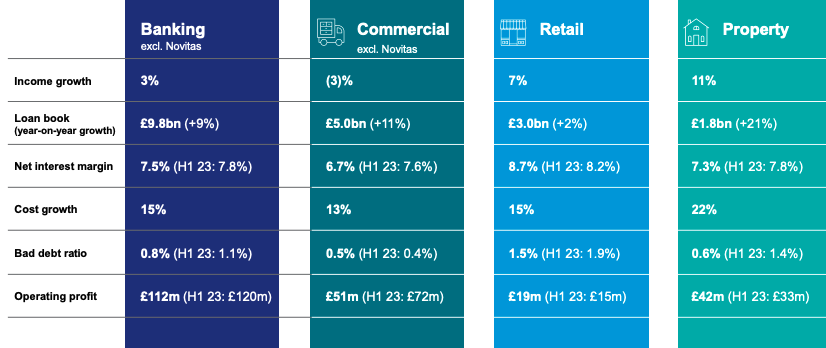

The results themselves – which are backwards looking – were “in-line”, as management have not yet made a provision against any future customer redress. H1 revenue was down -1% to £470m, but statutory PBT was up 8x to £94m, as in H1 2023 they had taken a £115m charge for a litigation finance business, Novitas. They acquired this business in 2017, but in July 2021 they decided to close it down due to large losses. The Novitas loan book is in run-off and stood at £263m, however, they’ve already accumulated provisions of £199m against the book (76% coverage ratio), meaning the net figure is just £63m – versus a group loan book on the face of the balance sheet of £9.6bn. For comparison, Motor Finance, which is the area the FCA is investigating was £2bn, or 20% of the loan book.

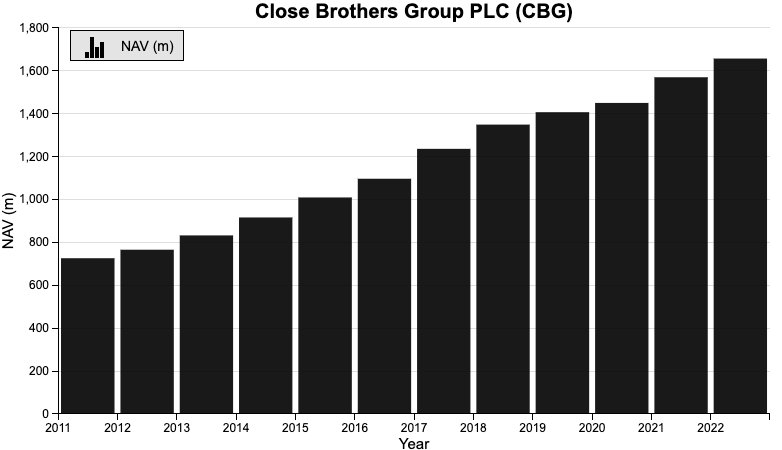

Capital: CBG’s Common Equity Tier 1 (CET1) ratio stood at 13.0%, or £1.35bn, at the end of January, above the 9.5% requirement. Management talked about various actions that they could take to increase CET1 by £400m by the end of FY July 2025F. Unlike most of the UK banks, CBG has managed to generate RoE in the mid-to-high teens over the last decade, high enough to both pay a dividend and grow NAV from £726m in 2011 to £1.83bn H1 Jan 2024 (equating to NAV per share of £11). The dividend has now been cancelled, and I think we can be confident that management’s plan to accumulate capital is realistic.

The company has helpfully provided analyst estimates of customer redress: the average total estimated impact between FY Jul 2024F-FY Jul 2026F is £271m (Low: £150m; High:£350m; Number of analysts: 6). So that feels like the bank should be able to absorb even the worst case scenario. However, in the meantime, management might have to slow loan growth, forego other investment opportunities, securitise assets or cut back on higher-margin lending. All of that would likely have a negative impact on growth prospects and profitability.

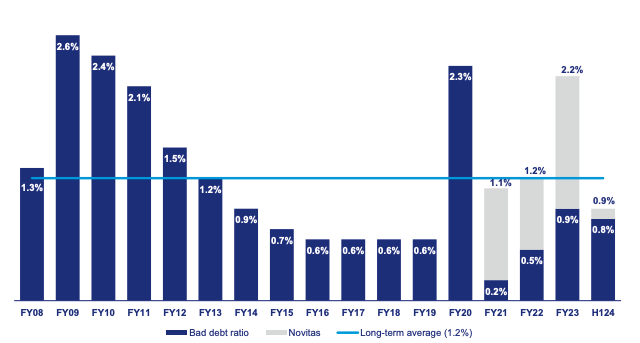

Outlook: Management have suggested that underlying loan growth of +4% is ‘broadly sustainable’ in H2. They expect costs to increase 8-10% and they expect the bad debt ratio to be below the long-term average of 1.2% in H2 (versus 0.8% just reported).

Their wealth management division, CBAM, which has £18bn of AuM, is continuing to see net inflows of £732m (an annualised net inflow rate of 9%). They expect this division to deliver a margin over the long term of 20%, versus 8% currently, which they say is suppressed by the cost of hiring investment managers. Winterflood, the market-making business lost £3m on revenues of £34m in H1, but they believe this should rebound when trading activity on AIM picks up.

On the call, management was asked if the bad publicity around the FCA investigation was affecting any part of the business. Management confirmed that they had continued to see deposit inflows since January with no impact on the lending side of the balance sheet either. They said one area they saw some weakness was inflows in CBAM, as wealthy people were slightly reluctant to transfer large sums of money, although they implied at the moment this was not significant enough to worry about. Martin Lewis, of Moneysavingexpert.com, has launched a free car finance reclaim tool on his website. This has been downloaded over 1m times, but CBG reckon they represent just 2.4% of these complaints.

Valuation: The shares are trading on 0.4x book value and 0.6x total income. I think FY Jun 2025F PER is anyone’s guess, instead, I would assume that in 18 months’ time the bank can go back to generating a 15% RoE on a NAV of £11 per share, which would imply EPS of 165p, suggesting the bank is on a ‘normalised’ PER of below 2.5x – even after the recent +30% bounce. Sharepad shows that the bank achieved a peak RoE of 18.5% in 2015, and I think that it is conceivable the group could achieve that level of profitability again, particularly if CBAM and Winterflood are firing on all cylinders.

Opinion: This looks like an interesting special situation. There’s an obvious catalyst in September when the FCA is scheduled to announce their conclusions into the motor finance market. I have read the FOS complaints and discussed it with a friend who is running a small hedge fund, and we both think that the bad news is in the price and the regulator has overstepped the mark. In our view, it ought to be the car dealers who received the undisclosed commissions who should be compensating clients, but it is easier for the FCA to go after the banks who offered the loans. I’m flagging this as an uncertain situation which I think has an upside – I have bought shares myself, but please remember to DYOR.

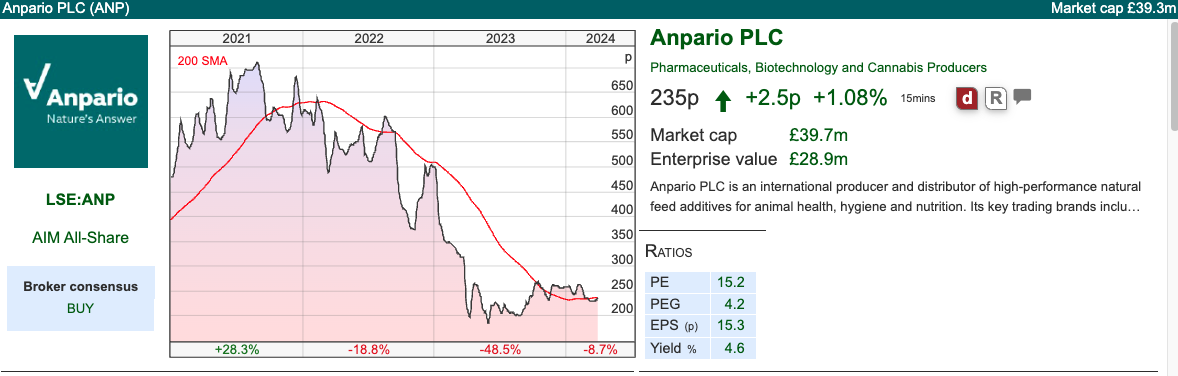

Anpario H1 to January Results

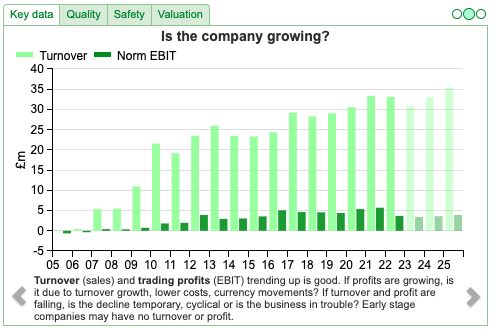

This animal natural feed additives business has struggled as the global agricultural sector has suffered higher energy costs (which feed through to fertiliser and other raw materials) and excessive stock levels of animal nutrition products. The company reported FY revenues down -6% to £31m, and PBT down -25% to £2.8m. However, they generated £8m of cash from operations, just under half of which came from a working capital reduction. ANP had a year-end cash balance of £10.6m and they are still paying a FY dividend of 10.7p (v 10.5p FY 2022). The company also did a £9m buyback last year, via a tender offer.

History: This company started life as Agil, an animal feed additives business to target a range of infections. They reversed into a listed biotech shell in 2006, at a placing price of 3p per share, raising £5m, implying a market cap on admission of £7.5m for the enlarged group. 18 years ago they were generating £755K of PBT on £5.2m of sales, however, they already had a global business, with just 6% of revenue coming from the UK (45% Europe ex UK, 24% Asia).

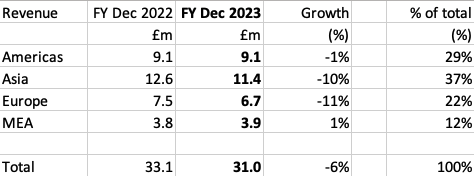

The current disclosed revenue split is in the table below. However, that’s not particularly helpful, as within those geographies there have been diverging trends with them saying that Latin America (a third of Americas region) was down -30%, while the USA has been a better performer up +4%. Similarly in Asia, which is the group’s largest region at 37%: China (13% of group sales) has been weak, but Malaysia and Indonesia were up +18% and +25% respectively.

A couple of years ago the company warned that higher raw material prices would hurt the business, and the gross margin has fallen from 52% in FY Dec 2020 to 43% two years later in 2022. The gross margin has now recovered to 45% in the year just reported, but profits have remained under pressure as revenue has declined.

Outlook: Management say that Q4 of last year saw a welcome improvement in sales volumes and gross margins, which has continued into 2024. They say that the full benefits of cost reductions should be seen in 2024 and they remain confident in the long-term profitability of the company.

Valuation: The shares are trading on 13.6x PER 2025F and 1.3x sales the same year. That seems undemanding for a business generating a low to mid-teens RoCE before the pandemic. Note that Sharepad’s CashRoCI of 19.8% is much stronger than RoCE of 6.9%, as management improved the working capital situation (FCF conv 282%).

Opinion: Revenue has increased by 6x over the last 18 years, albeit at an uneven rate. I think that last year’s decline was likely a temporary blip, as I would imagine that demand for animal feed should continue to grow at least as fast as the global economy. This is a Lord Lee stock, and following the -70% share price decline from mid-2021 this looks like an attractive entry point. Thumbs up from me, although I haven’t bought any myself. The chart looks to have formed a bowl.

Notes

Bruce owns shares in Close Brothers and Goldplats

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Weekly Market Commentary | 26/03/2024 | CEY, CBG, ANP | A couple of important break-outs

The FTSE 100 was up +2.2% last week to 7,869. The Nasdaq100 was also strong up +3% and the S&P500 up +2.3%. China and Japan enjoyed contrasting fortunes last week, with XIN0 down -1.7% but NIK up +4.4%. The US yield curve remains inverted, but it looks increasingly likely that we have avoided a deep recession from rising interest rates. I mentioned in January that if the inverted yield curve is no longer a reliable indicator of recessions, because of the actions of Central Banks, then the copper price (Sharepad ticker HG-MT) was still worth following. Back then copper was forming a “wedge”, making lower highs, and higher lows – and I was waiting to see which way it broke out.

Looking at the same chart now, with copper up +11% since the start of November, it looks like the trend has broken out decisively on the upside. Spot price is trading above both the 16 (red) and the 64 (blue) day moving average. That should be good news for equities, particularly UK equities that haven’t enjoyed the same bounce as the US markets.

Vanguard Smaller Companies ETF, which tracks 2,000 small caps globally, has also resumed its upward trend. Since the start of November VIGSCA is up +20%, again with the current price trading above both the 16 and 64-day moving averages.

AIM remains slightly below its long-term moving average, however, it should be only a matter of time before the UK market follows these two charts, breaking out on the upside. In addition, Central Banks in the UK and USA are likely to err on the dovish side in election years, so I am feeling increasingly optimistic. I’m not really a market timer, but I did say in April 2021 that we were near the top. Since then, of the three stocks mentioned, Cerillion has more than doubled, D4T4 (now Celebrus) is down by a third, but RBGP which I said at the time “looked very expensive” is down more than 90%.

This week I look at Close Brothers results, the shares have rallied +32% since the lows at the beginning of March after management had cut the dividend, but are still trading 0.4x book value. I also look at animal feed business, Anpario and Egyptian gold miner Centamin.

Centamin FY Dec results

I mentioned Centamin a week ago, as the gold price has risen c. 20% since the beginning of November, so their results seem worth a comment: Centamin reported FY Dec 2023 revenues rose +13% to $891m and PBT up +14% to $195m. They have $153m of cash, and a RCF of $150m, which they didn’t draw on in 2023.

The company’s main goldmine, Sukari, is in Egypt and has produced 5.7m ounces of gold (worth $12bn at the current price) since 2009. The company says that as of today the projected mine life is over ten years, and they plan to mine half a million ounces (currently worth $1bn) a year. They believe that their costs are in the lower half of the industry cost curve. They also have other exploration assets in Egypt and the Cote d’Ivoire.

Outlook: For FY Dec 2024F they are forecasting a range of 470K to 500K ounces (v 456K just reported) and are targeting all-in sustaining costs of US$1,200-1,350 per ounce sold. The oil price is the most significant commodity affecting management’s cost assumptions. There was a $15m saving last year, despite using 2.3 million litres more than budgeted (actual fuel used in 2023 was 165m litres). In 2024F, diesel consumption across the Sukari operation is expected to be 160m litres equating to $145 million at $0.90/litre. In other words, EPS is sensitive to both the gold price and fuel costs, longer-term there is a decarbonisation plan to use solar panels rather than diesel.

Sharepad shows that the Egyptian Pound is competing with the Turkish Lira as the most fun country to visit a short flight away from Europe. USDEGP has devalued significantly over the past few years, from around 16 in early 2022 to 47, with the most recent de-valuation early March. Centamin points out that their revenues are denominated in US dollars, but the devaluation might cause problems with local supply chains.

Valuation: CEY shares are trading on a PER of 8.4x FY Dec 2024F and 9.4x the following year. EV/EBITDA is forecast to be around 3x FY Dec 2024F. Those forecasts are obviously dependent on the price that they achieve for their gold. But it’s pleasing to note that the current spot price of $2,170 is 11% above last year’s average realised price of $1,948 per ounce.

Comparison with Goldplat: AIM tiddler Goldplat also reported H1 results at the start of this week, with revenues +82% to £37m and PBT following disposals of £1.6m. GDP had a net cash of £1.7m. This strikes me as speculative and illiquid, sensitive in both directions to movements in the gold price, but with some similarities to Sylvania (bi-products of mine tailings). On WH Ireland’s FY Jun 2024F forecasts the shares are trading on a PER of 4x, dropping to below 3x in Jun 2025 (EV/EBITDA below 1x). I can imagine that there could be an upside if the price of gold continues to strengthen, but I really would not recommend any small-cap gold company with high conviction. That said, I bought a small position in GDP on Monday morning.

Opinion: It’s hard to think of a professional fund manager who has made their fortune investing in the mining sector, so I tend to be underweight mining shares. There’s a Charles Darwin quote, from The Voyages of the Beagle, “a person with a copper-mine will gain; with silver he may gain; but with gold he is sure to lose.”

I’ve used Sharepad’s “multigraph” feature to chart the relationship (Precious in red, Industrial metals in black) back to 1999. Both enjoyed strong performance up to the financial crisis, and then for a while Precious outperformed strongly as interest rates fell close to zero and investors worried about Central Bank credibility, but ultimately Industrial and Precious metals have ended up increasing in value 1.5x over 25 years. That implies that both have struggled to keep pace with inflation, at a time when inflation was itself mostly low single digits.

Precious metal stocks are an idea for contrarians. I own Capital Drilling, however, Centamin seems like a sensible company with potential upside and Goldplats (or similar) is speculative. As always, this is to flag the idea of using Sharepad to do further research.

Close Brothers H1 to January Results

This specialist bank, with a Wealth Management division and which also owns market maker Winterfloods is down -50% YTD. The share price was trending down in H2 last year but then sold off steeply in January when the FCA began an investigation into the interest rates charged to customers for loans for motor finance. Customers have complained that they were being treated unfairly, banks rejected those complaints but then in a couple of instances, the Financial Ombudsman Service (FOS) then ruled in favour of the customers. The two banks ruled against were Lloyds and Barclays, but Close Brothers also operated a similar commission model historically and may need to compensate customers who seek redress. The FCA launched an investigation, which is scheduled to conclude before the end of September, but on the 15th of February CBG announced they would cut their dividend.

The results themselves – which are backwards looking – were “in-line”, as management have not yet made a provision against any future customer redress. H1 revenue was down -1% to £470m, but statutory PBT was up 8x to £94m, as in H1 2023 they had taken a £115m charge for a litigation finance business, Novitas. They acquired this business in 2017, but in July 2021 they decided to close it down due to large losses. The Novitas loan book is in run-off and stood at £263m, however, they’ve already accumulated provisions of £199m against the book (76% coverage ratio), meaning the net figure is just £63m – versus a group loan book on the face of the balance sheet of £9.6bn. For comparison, Motor Finance, which is the area the FCA is investigating was £2bn, or 20% of the loan book.

Capital: CBG’s Common Equity Tier 1 (CET1) ratio stood at 13.0%, or £1.35bn, at the end of January, above the 9.5% requirement. Management talked about various actions that they could take to increase CET1 by £400m by the end of FY July 2025F. Unlike most of the UK banks, CBG has managed to generate RoE in the mid-to-high teens over the last decade, high enough to both pay a dividend and grow NAV from £726m in 2011 to £1.83bn H1 Jan 2024 (equating to NAV per share of £11). The dividend has now been cancelled, and I think we can be confident that management’s plan to accumulate capital is realistic.

The company has helpfully provided analyst estimates of customer redress: the average total estimated impact between FY Jul 2024F-FY Jul 2026F is £271m (Low: £150m; High:£350m; Number of analysts: 6). So that feels like the bank should be able to absorb even the worst case scenario. However, in the meantime, management might have to slow loan growth, forego other investment opportunities, securitise assets or cut back on higher-margin lending. All of that would likely have a negative impact on growth prospects and profitability.

Outlook: Management have suggested that underlying loan growth of +4% is ‘broadly sustainable’ in H2. They expect costs to increase 8-10% and they expect the bad debt ratio to be below the long-term average of 1.2% in H2 (versus 0.8% just reported).

Their wealth management division, CBAM, which has £18bn of AuM, is continuing to see net inflows of £732m (an annualised net inflow rate of 9%). They expect this division to deliver a margin over the long term of 20%, versus 8% currently, which they say is suppressed by the cost of hiring investment managers. Winterflood, the market-making business lost £3m on revenues of £34m in H1, but they believe this should rebound when trading activity on AIM picks up.

On the call, management was asked if the bad publicity around the FCA investigation was affecting any part of the business. Management confirmed that they had continued to see deposit inflows since January with no impact on the lending side of the balance sheet either. They said one area they saw some weakness was inflows in CBAM, as wealthy people were slightly reluctant to transfer large sums of money, although they implied at the moment this was not significant enough to worry about. Martin Lewis, of Moneysavingexpert.com, has launched a free car finance reclaim tool on his website. This has been downloaded over 1m times, but CBG reckon they represent just 2.4% of these complaints.

Valuation: The shares are trading on 0.4x book value and 0.6x total income. I think FY Jun 2025F PER is anyone’s guess, instead, I would assume that in 18 months’ time the bank can go back to generating a 15% RoE on a NAV of £11 per share, which would imply EPS of 165p, suggesting the bank is on a ‘normalised’ PER of below 2.5x – even after the recent +30% bounce. Sharepad shows that the bank achieved a peak RoE of 18.5% in 2015, and I think that it is conceivable the group could achieve that level of profitability again, particularly if CBAM and Winterflood are firing on all cylinders.

Opinion: This looks like an interesting special situation. There’s an obvious catalyst in September when the FCA is scheduled to announce their conclusions into the motor finance market. I have read the FOS complaints and discussed it with a friend who is running a small hedge fund, and we both think that the bad news is in the price and the regulator has overstepped the mark. In our view, it ought to be the car dealers who received the undisclosed commissions who should be compensating clients, but it is easier for the FCA to go after the banks who offered the loans. I’m flagging this as an uncertain situation which I think has an upside – I have bought shares myself, but please remember to DYOR.

Anpario H1 to January Results

This animal natural feed additives business has struggled as the global agricultural sector has suffered higher energy costs (which feed through to fertiliser and other raw materials) and excessive stock levels of animal nutrition products. The company reported FY revenues down -6% to £31m, and PBT down -25% to £2.8m. However, they generated £8m of cash from operations, just under half of which came from a working capital reduction. ANP had a year-end cash balance of £10.6m and they are still paying a FY dividend of 10.7p (v 10.5p FY 2022). The company also did a £9m buyback last year, via a tender offer.

History: This company started life as Agil, an animal feed additives business to target a range of infections. They reversed into a listed biotech shell in 2006, at a placing price of 3p per share, raising £5m, implying a market cap on admission of £7.5m for the enlarged group. 18 years ago they were generating £755K of PBT on £5.2m of sales, however, they already had a global business, with just 6% of revenue coming from the UK (45% Europe ex UK, 24% Asia).

The current disclosed revenue split is in the table below. However, that’s not particularly helpful, as within those geographies there have been diverging trends with them saying that Latin America (a third of Americas region) was down -30%, while the USA has been a better performer up +4%. Similarly in Asia, which is the group’s largest region at 37%: China (13% of group sales) has been weak, but Malaysia and Indonesia were up +18% and +25% respectively.

A couple of years ago the company warned that higher raw material prices would hurt the business, and the gross margin has fallen from 52% in FY Dec 2020 to 43% two years later in 2022. The gross margin has now recovered to 45% in the year just reported, but profits have remained under pressure as revenue has declined.

Outlook: Management say that Q4 of last year saw a welcome improvement in sales volumes and gross margins, which has continued into 2024. They say that the full benefits of cost reductions should be seen in 2024 and they remain confident in the long-term profitability of the company.

Valuation: The shares are trading on 13.6x PER 2025F and 1.3x sales the same year. That seems undemanding for a business generating a low to mid-teens RoCE before the pandemic. Note that Sharepad’s CashRoCI of 19.8% is much stronger than RoCE of 6.9%, as management improved the working capital situation (FCF conv 282%).

Opinion: Revenue has increased by 6x over the last 18 years, albeit at an uneven rate. I think that last year’s decline was likely a temporary blip, as I would imagine that demand for animal feed should continue to grow at least as fast as the global economy. This is a Lord Lee stock, and following the -70% share price decline from mid-2021 this looks like an attractive entry point. Thumbs up from me, although I haven’t bought any myself. The chart looks to have formed a bowl.

Notes

Bruce owns shares in Close Brothers and Goldplats

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.