Bruce looks at an old equity research note from 1993 and ponders if in some sectors customers receive a better deal than shareholders. Companies covered BARC, HL., LOK, ARC

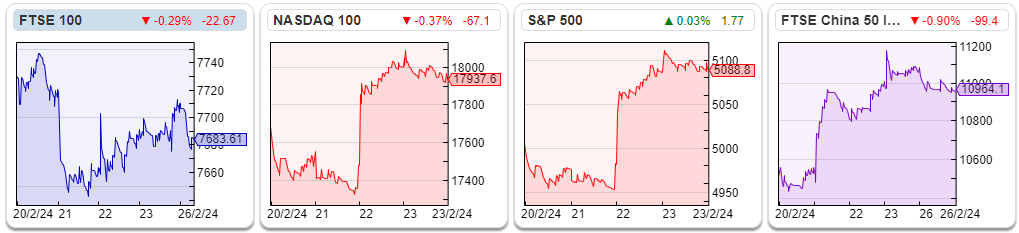

The FTSE 100 fell -0.6% last week to 7,683. The Nasdaq100 and S&P500 were up +0.5% and +1.7% respectively. The excitement was provided by Nvidia results, with the share price up +9% last week and the GPU chip maker now has a market cap of just under $2 trillion. Well done if you spotted this early, and held on. The US 10Y bond yield fell back to 4.23%, down from a peak of 4.9% in October last year.

Thank you to Jamie for covering for me while skiing. I had a good time in Sud Tyrol, the German-speaking part of Italy. Going on holiday with party people from Berlin meant that some of the crowd discovered an abandoned World War II bunker in the village, and of course, being Berliners they set about organising a – literally – underground rave.

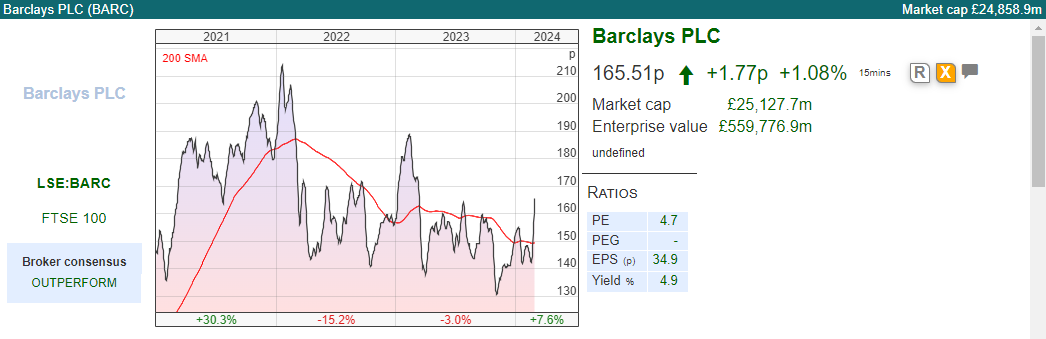

UK banks reported results last week. Barclays reported FY Dec 2023 PBT down -15% to £6.6bn, despite the falling profits they revised up their RoTE target to above 12% in FY 2026. That might seem like progress but in FY Dec 2021 Barclays reported RoTE of 13.4% on Equity Tier 1 of 15.1%, versus RoTE of 5.1% on Equity Tier 1 of 13.8% just reported.

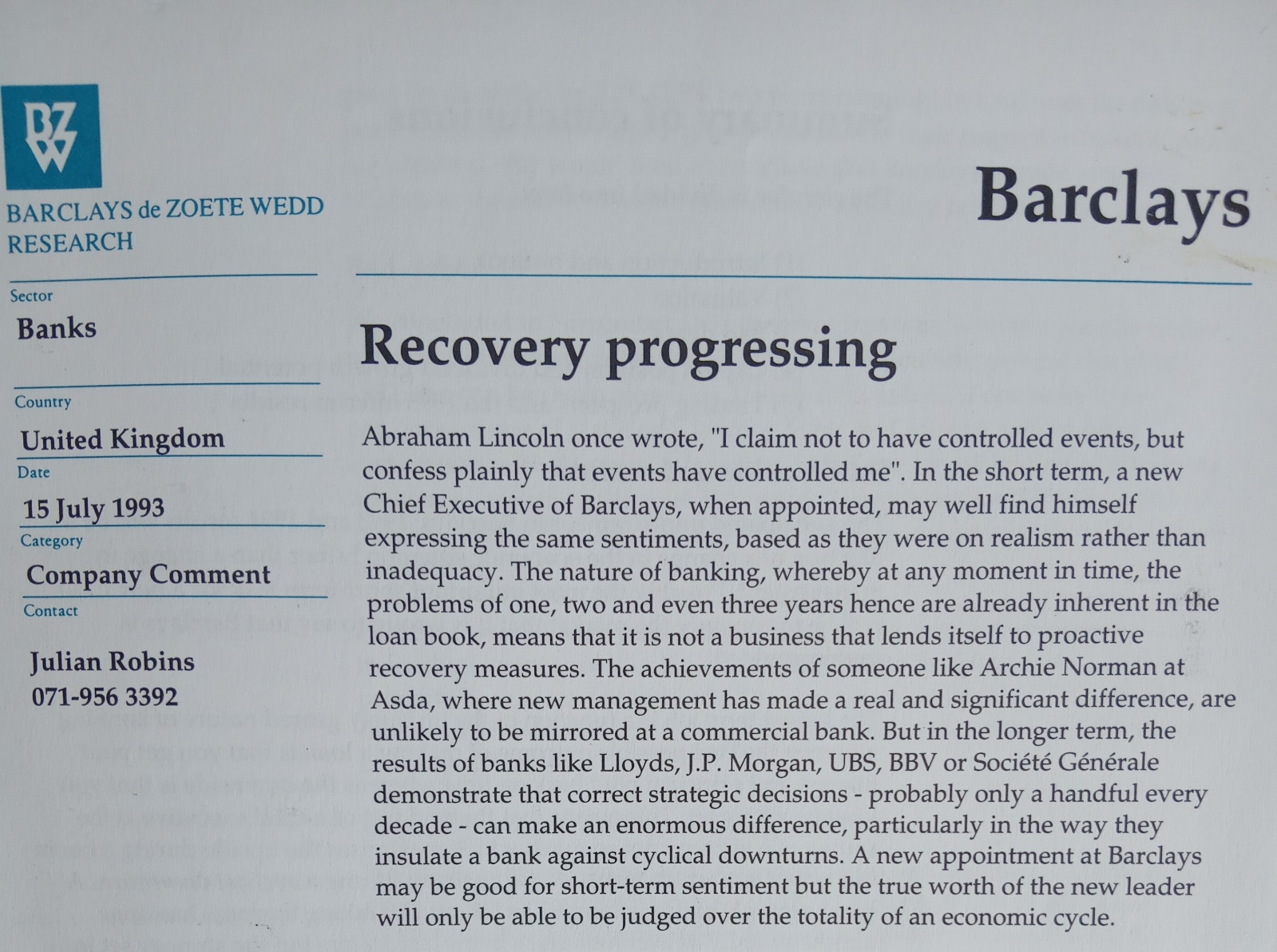

I have an equity research note from 1993, that I came across in the filing when I worked at CSFB and decided to keep (Barclays sold their equities business de Zoete Wedd to Credit Suisse in the late 1990’s so we had some of the old BZW research notes). Sadly, it isn’t the infamous Terry Smith “sell” note that he published while working at the bank, but instead by Julian Robins (who now works with Terry at Fundsmith). The note begins with an Abraham Lincoln quote “I claim not to have controlled events, but confess plainly that events have controlled me” and goes on to say that bank management only need to make a handful of correct strategic decisions every decade; the same is true of investors. Robins was referring to the fact that Barclays had lost billions in commercial property lending in the early 1990s, but fast forward 3 decades and the insights in that research note still ring true. Management of UK banks have been well rewarded for making poor decisions. Back then the BARC share price was 485p, and the bank had just reported a loss of £242m on revenues of £6.6bn in FY Dec 1992. Contrast that with a share price of 165p this week, PBT of £6.6bn on revenues of £25.4bn FY Dec 2023.

Currently, the Barclays share price is probably too low. However, there’s a lingering doubt in my mind that in some sectors senior management take the financial rewards and customers receive a reasonably good deal but shareholders lose out. I think you could make the case that this is what has happened over the last couple of decades at Vodafone too.

I could have posted a similar chart for BT Group, or Tesco and Sainsbury’s. Given that performance. shareholders in FTSE banks, telecoms or supermarkets are unlikely to be buying any yachts.

It also makes an interesting contrast with the consumer-facing US large-cap tech stocks, like Amazon and Apple where both customers and shareholders do well. To spark a fundamental re-rating I think UK banks need to show that they can raise the cost of borrowing to customers and share the benefits with shareholders. However, that would be about as politically unpopular as supermarkets raising food prices and announcing higher dividends. The FCA has already warned financial company CEOs that they should be ‘treating customers fairly’. The FCA will never write a “Dear CEO” letter to banks asking them to treat shareholders fairly, but if the UK government wants to encourage more investment in the FTSE, perhaps regulators could ponder how small shareholders have fared in the last couple of decades.

This week I look at another business that may be in the crosshairs of the FCA’s ‘treating customers fairly’ initiative, Hargreaves Lansdown. Then I look at storage company Lok’n’Store and profitable, but low growth tiddler Arcontech.

Hargreaves Lansdown H1 Dec Results

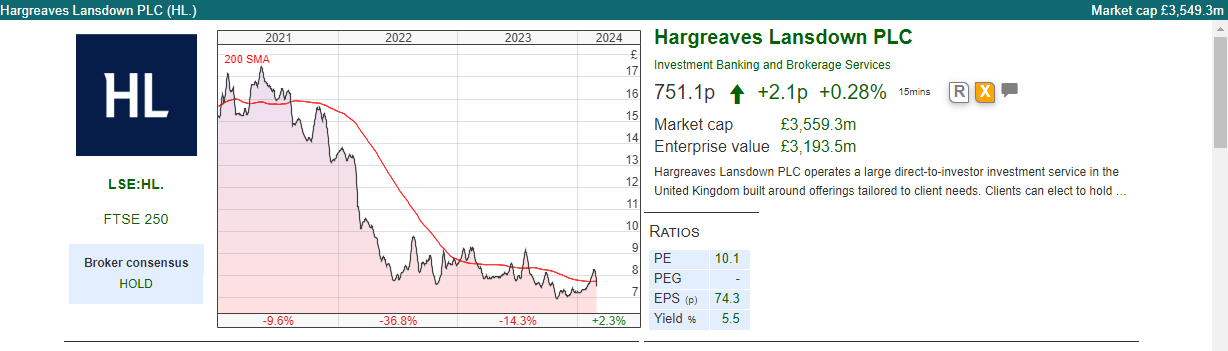

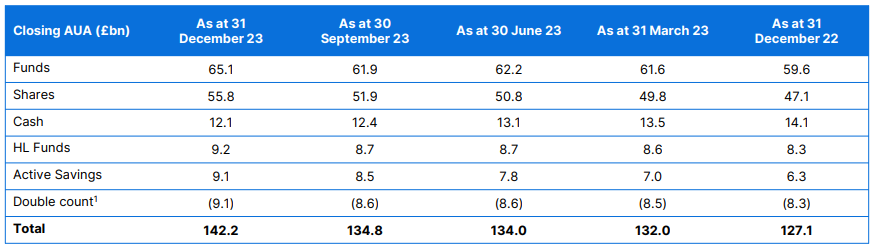

This investment platform which has a new Chief Exec and is halfway through a £225m strategic investment spend program announced H1 Dec revenues +5% to £368m but statutory PBT down -8% to £182m. The market reacted badly to the numbers, sending the shares down -7% on the morning of the results. Most likely that’s because of the low net inflows numbers between July-Dec, just £1.0bn down -38% from the same six months last year. They say that the disappointing net figure was driven by high levels of outflows in more transient accounts (Fund and Shares, rather than ISAs and Pensions). Indeed, the latter saw inflows up on previous years.

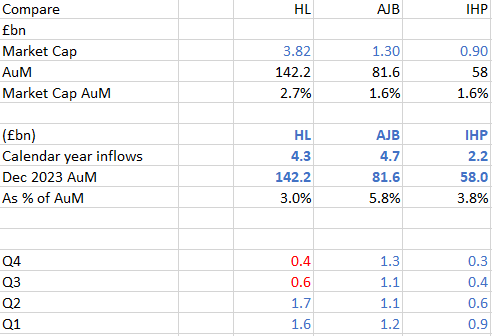

I have updated my chart from a couple of weeks ago, comparing HL. with other platforms AJB and IHP. The low level of net flows in Q3 and Q4 (ie Jul-Dec) at HL. are in red.

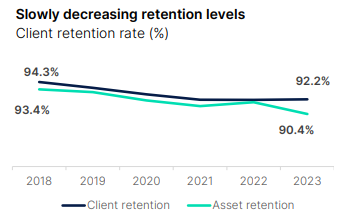

Aside from net flows, the other area to watch is client retention, which has been trending down in recent years. I am assuming that this is driven by increased competition from the likes of Pension Bee and AJ Bell. There’s also a risk of new entrants like Robinhood, eToro and Trading 212 offering commission-free trading. None of these firms have the scale that HL. does, however they could be able to affect marginal pricing. The situation reminds me a little of Northern Rock and HBOS doing a lot of damage to UK banks net interest margins by offering low-cost mortgages. Ultimately Northern Rock and HBOS failed of course, but the former building societies did significant damage to the share prices of all the UK banks.

The new Chief Exec, Dan Olley, comments on the “Dear CEO” letter received from the FCA, on the interest earned from customer cash balances, saying Hargreaves Lansdown: “retained 41% of interest during the period and expect this to be c.36% in Q3 FY24.” They don’t charge platform fees on cash. I talked about this in December last year, commenting that the FCA seems to have taken notice of the attractive “platform” economics in the sector. However, even before that the HL. shares have de-rated sharply from the 20x revenue multiple that they enjoyed pre-pandemic.

Outlook: Their FY Jun 2024 margin guidance is to be at the top end of the range for cash, but lower end of the range for share dealing, due to muted volumes. Cash currently makes up 8.5% of Assets under Administration (AuA). They also expect to spend £45m, at the top end of the range, on investment costs, but underlying costs at the low end of the range (9% to 11%).

Valuation: Sharepad forecasts show flat EPS from Jun 2024F to Jun 2026F, at 65p. That puts the shares on 11.5x PER, with the dividend 1.3x covered. That means if we see difficult markets and management forced to reduce fees then the dividend is at risk of being cut. I would imagine the two co-founders Peter Hargreaves (32% of the shares) and Stephen Lansdown (20% of the shares) will be very grumpy if the dividend is cut.

HL. is the third most shorted stock in the UK, with just under 15% of its shares out on loan, according to the FT (quoting data from S3 Partners). Among those with short positions are BlackRock; hedge funds Kintbury Capital, Millennium Management, Citadel and Marshall Wace. I am long, and I think many other amateur investors are too. It will be ironic if the FCA action causes gains for hedge funds and losses for less sophisticated investors, many of whom are HL. customers as well as shareholders, because the regulator is too draconian in defining what is ‘unfair’ behaviour.

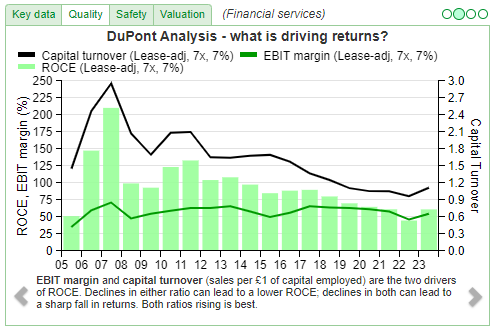

Sharepad’s DuPont analysis suggests that EBIT margins have been reasonably stable since listing, but that reduced capital turn (that is sales relative to capital) has caused the decline in RoCE.

Opinion: I own this, as I think the dividend is sustainable and the shares should enjoy a tailwind from rising UK equity markets, whenever that eventually happens. It’s not at the bargain levels of some UK fund management companies, like Polar or Miton or brokers like Cavendish but I think that HL. is a lower-risk way of playing the recovering markets theme. I am wary of the regulatory risk but think that this is probably priced in, as the shares have already fallen for four years in a row. Sharepad user Paul Bryant has also written up the HL. results in more detail, which I already posted on the chat, but here’s the link in case you missed that.

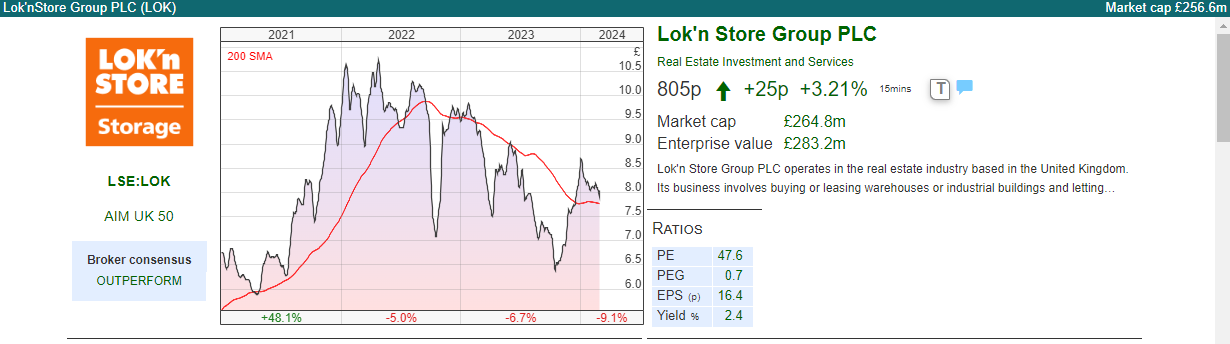

Lok’n’Store H1 Jan Trading Update

This storage company, in the same sector as Big Yellow and Safe Store, stores home contents for people who can’t throw their stuff away. Surprisingly though storage is not used just to store personal items, but also people who sell items on eBay use the Lok’n’Store as a warehouse for their inventory. Self-storage is designed to be accessible, low-cost and rented on a monthly basis. When the Lok’n’Store buildings are at full capacity they are highly cash generative. Importantly, the company is not structured as a REIT, meaning that it doesn’t have to pay out 90% of earnings.

Management announced trading was “in-line” with revenue +4.9%. Occupied space fell -2.9% to 862,554 sq. ft, but that decline was offset by raising Price per sq. ft. by 4.0%. The company has developed four new stores which will add a further 211,600 sq. ft. of capacity. They’ve also received planning permission for a further store in Barking and are anticipating receiving planning permission for another store in Eastbourne.

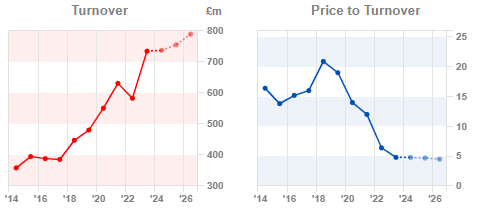

History: The company was founded in 1994 and opened its first store in Horsham Surrey. They originally listed on OFEX (which became Plus Markets, then Aquis Exchange) then listed on AIM. At the time of the AIM listing in 2000, turnover was under £3m and PBT less than half a million pounds. Since then, the track record has been strong, with steady progress excluding a couple of ‘blips’. Turnover did fall -7% during the financial crisis to £10m and the group made a small loss, showing that storage is linked to the housing market. Revenues also fell in 2018, as management sold their document storage business. Apart from that, the group has grown steadily so that revenues are forecast to be £29m FY July 2024F and PBT £10.5m. The balance sheet looks solid with £68m of long-term borrowing, versus tangible assets of £297m. Current liabilities were just £8m at FY July 2023, and net debt was just £12m.

Sharepad shows that progress with NAV has been a bit more lumpy, with it taking almost a decade following the financial crisis for NAV to exceed 2008 levels.

Currently, LOK has 937,000 sq ft of open freehold stores, with a further 485,000 sq ft in the pipeline. They’ve also expanded into leasehold (managing for other owners of properties) with 435,000 sq ft open and 50,000 sq ft in the pipeline. Leasehold is an asset-light way of growing the business.

Ownership: Andrew Jacobs and Simon Thomas, two of the founders have been selling shares. In May 2023 Simon Thomas sold 1.25m shares at 800p, but he still owns 13% of the company according to Sharepad’s DD tab. Institutional investors include BlackRock 6.8%, but other than that private client businesses like Canaccord and Investec.

Valuation: The shares are trading on July 2025F 30p EPS forecast and 21p dividend, putting them on a PER of 27x and a yield of 2.6%. That doesn’t strike me as a bargain but Cavendish, their broker, says the business is trading at a -17% discount to NAV, compared to a sector average of -14%. The broker points to recent deals, such as Shurgard’s €132m acquisition of six stores in Germany from Pickens, at a cost per square foot of 0.33 £’k, more than double LOK’s current market cap per square foot of 0.141 £’k (= £268m / 1.9m sq ft).

Opinion: Looks good, if a little unexciting. The risk is that they expand at just the wrong point in the cycle and are left with large amounts of spare capacity when people aren’t moving home. The shares fell -90% between 2007 and 2009. There’s an Investors’ Chronicle interview from Nov last year, with Lord Lee of Trafford where they discuss the company. He points out that if interest rates have peaked, then that ought to benefit property companies like LOK.

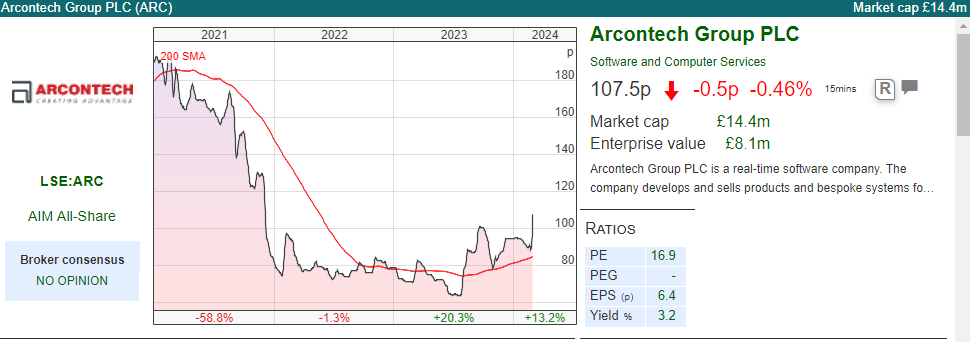

Arcontech H1 Dec 2023

This financial data company which helps banks integrate data providers (like Bloomberg and Refinitiv) announced H1 Dec revenue up +7% to £1.4m but PBT up +44% to £538K. Net cash was down slightly to £5.7m following the payment of a £468K dividend, or 3.5p per share. The company doesn’t pay an interim dividend, so that 3.5p final dividend paid last November is effectively the FY dividend.

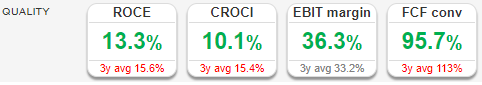

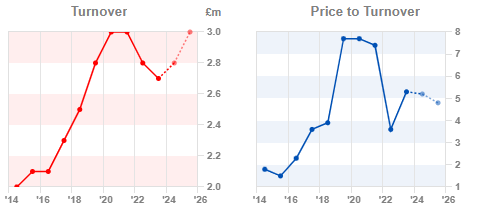

Historically, the company has reported a mid-teens RoCE and 30-40% EBIT margin, yet has struggled to grow the top line. Revenues for the FY are expected to be inline with expectations (Cavendish have £2.8m) but PBT “slightly ahead” which the company attributes to higher interest rates on their cash balances and low operational expenditure. Sharepad shows that revenue has not grown for 5 years, from £2.8m FY Jun 2019. While the pandemic was going on, management suggested lack of face-to-face meetings meant that it was harder for salesmen to showcase the product. However, the pandemic has now been over for a couple of years, and management have still failed to increase sales.

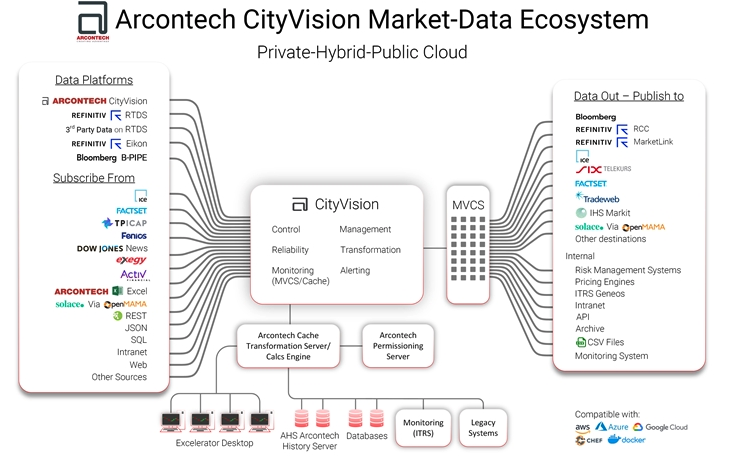

Their main product is CityVision, which allows banks to integrate different market data vendors, allowing real-time calculations, data management and data publishing. Management have put this diagram on their website to try to explain what they do. The main advantage seems to be that it can take in multiple data feeds, sending and receiving data between different platforms.

There’s also a Microsoft Excel Add-In, which I find a little surprising because when I worked in banks as an equity research analyst it was possible to have a Bloomberg or similar Excel Add-In, so I’m not sure why Arcontech’s is needed.

Recurring revenue: the company says that recurring revenue represents 100%. However, they can lose customers, for instance in Nov 2021 one customer greatly scaled back their requirements and a second customer chose not to renew its contract. Maynard and I discussed this on a podcast last summer, and he didn’t like it because the trade receivables are high (£1.3m Dec 2023 versus H1 £1.5m sales). He also suggested that perhaps the competition is large banks’ internal IT departments, who could presumably build something similar to Arcontech’s product suite.

Valuation: Cavendish has EPS declining -21% over the next two years to 5.6p in FY Jun 2025F. That puts the shares on 19x PER, which seems expensive for the historic track record of low growth. However, the cash is a quarter of the market cap and if they can grow the top line with little incremental spend then this could be very good.

Opinion: I’ve owned this for a while and the share price hasn’t gone anywhere. I’m hoping that management do something with the cash, either invest to grow the business or return it to shareholders. I am frustrated that this hasn’t performed over the last few years, but have a nagging feeling that I could lose patience and sell at exactly the wrong point. I remind myself that between 2010 and 2016 GAW reported flat revenue, before going on to be a multi-bagger. So, on balance, I will keep holding as I think the downside is limited and there could be a substantial upside if management does grow the topline.

Notes

The author owns shares in Hargreaves Lansdown and Arcontech

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Weekly Market Commentary | 27/02/2024 | BARC, HL., LOK, ARC | Where are all the shareholders’ yachts?

Bruce looks at an old equity research note from 1993 and ponders if in some sectors customers receive a better deal than shareholders. Companies covered BARC, HL., LOK, ARC

The FTSE 100 fell -0.6% last week to 7,683. The Nasdaq100 and S&P500 were up +0.5% and +1.7% respectively. The excitement was provided by Nvidia results, with the share price up +9% last week and the GPU chip maker now has a market cap of just under $2 trillion. Well done if you spotted this early, and held on. The US 10Y bond yield fell back to 4.23%, down from a peak of 4.9% in October last year.

Thank you to Jamie for covering for me while skiing. I had a good time in Sud Tyrol, the German-speaking part of Italy. Going on holiday with party people from Berlin meant that some of the crowd discovered an abandoned World War II bunker in the village, and of course, being Berliners they set about organising a – literally – underground rave.

UK banks reported results last week. Barclays reported FY Dec 2023 PBT down -15% to £6.6bn, despite the falling profits they revised up their RoTE target to above 12% in FY 2026. That might seem like progress but in FY Dec 2021 Barclays reported RoTE of 13.4% on Equity Tier 1 of 15.1%, versus RoTE of 5.1% on Equity Tier 1 of 13.8% just reported.

I have an equity research note from 1993, that I came across in the filing when I worked at CSFB and decided to keep (Barclays sold their equities business de Zoete Wedd to Credit Suisse in the late 1990’s so we had some of the old BZW research notes). Sadly, it isn’t the infamous Terry Smith “sell” note that he published while working at the bank, but instead by Julian Robins (who now works with Terry at Fundsmith). The note begins with an Abraham Lincoln quote “I claim not to have controlled events, but confess plainly that events have controlled me” and goes on to say that bank management only need to make a handful of correct strategic decisions every decade; the same is true of investors. Robins was referring to the fact that Barclays had lost billions in commercial property lending in the early 1990s, but fast forward 3 decades and the insights in that research note still ring true. Management of UK banks have been well rewarded for making poor decisions. Back then the BARC share price was 485p, and the bank had just reported a loss of £242m on revenues of £6.6bn in FY Dec 1992. Contrast that with a share price of 165p this week, PBT of £6.6bn on revenues of £25.4bn FY Dec 2023.

Currently, the Barclays share price is probably too low. However, there’s a lingering doubt in my mind that in some sectors senior management take the financial rewards and customers receive a reasonably good deal but shareholders lose out. I think you could make the case that this is what has happened over the last couple of decades at Vodafone too.

I could have posted a similar chart for BT Group, or Tesco and Sainsbury’s. Given that performance. shareholders in FTSE banks, telecoms or supermarkets are unlikely to be buying any yachts.

It also makes an interesting contrast with the consumer-facing US large-cap tech stocks, like Amazon and Apple where both customers and shareholders do well. To spark a fundamental re-rating I think UK banks need to show that they can raise the cost of borrowing to customers and share the benefits with shareholders. However, that would be about as politically unpopular as supermarkets raising food prices and announcing higher dividends. The FCA has already warned financial company CEOs that they should be ‘treating customers fairly’. The FCA will never write a “Dear CEO” letter to banks asking them to treat shareholders fairly, but if the UK government wants to encourage more investment in the FTSE, perhaps regulators could ponder how small shareholders have fared in the last couple of decades.

This week I look at another business that may be in the crosshairs of the FCA’s ‘treating customers fairly’ initiative, Hargreaves Lansdown. Then I look at storage company Lok’n’Store and profitable, but low growth tiddler Arcontech.

Hargreaves Lansdown H1 Dec Results

This investment platform which has a new Chief Exec and is halfway through a £225m strategic investment spend program announced H1 Dec revenues +5% to £368m but statutory PBT down -8% to £182m. The market reacted badly to the numbers, sending the shares down -7% on the morning of the results. Most likely that’s because of the low net inflows numbers between July-Dec, just £1.0bn down -38% from the same six months last year. They say that the disappointing net figure was driven by high levels of outflows in more transient accounts (Fund and Shares, rather than ISAs and Pensions). Indeed, the latter saw inflows up on previous years.

I have updated my chart from a couple of weeks ago, comparing HL. with other platforms AJB and IHP. The low level of net flows in Q3 and Q4 (ie Jul-Dec) at HL. are in red.

Aside from net flows, the other area to watch is client retention, which has been trending down in recent years. I am assuming that this is driven by increased competition from the likes of Pension Bee and AJ Bell. There’s also a risk of new entrants like Robinhood, eToro and Trading 212 offering commission-free trading. None of these firms have the scale that HL. does, however they could be able to affect marginal pricing. The situation reminds me a little of Northern Rock and HBOS doing a lot of damage to UK banks net interest margins by offering low-cost mortgages. Ultimately Northern Rock and HBOS failed of course, but the former building societies did significant damage to the share prices of all the UK banks.

The new Chief Exec, Dan Olley, comments on the “Dear CEO” letter received from the FCA, on the interest earned from customer cash balances, saying Hargreaves Lansdown: “retained 41% of interest during the period and expect this to be c.36% in Q3 FY24.” They don’t charge platform fees on cash. I talked about this in December last year, commenting that the FCA seems to have taken notice of the attractive “platform” economics in the sector. However, even before that the HL. shares have de-rated sharply from the 20x revenue multiple that they enjoyed pre-pandemic.

Outlook: Their FY Jun 2024 margin guidance is to be at the top end of the range for cash, but lower end of the range for share dealing, due to muted volumes. Cash currently makes up 8.5% of Assets under Administration (AuA). They also expect to spend £45m, at the top end of the range, on investment costs, but underlying costs at the low end of the range (9% to 11%).

Valuation: Sharepad forecasts show flat EPS from Jun 2024F to Jun 2026F, at 65p. That puts the shares on 11.5x PER, with the dividend 1.3x covered. That means if we see difficult markets and management forced to reduce fees then the dividend is at risk of being cut. I would imagine the two co-founders Peter Hargreaves (32% of the shares) and Stephen Lansdown (20% of the shares) will be very grumpy if the dividend is cut.

HL. is the third most shorted stock in the UK, with just under 15% of its shares out on loan, according to the FT (quoting data from S3 Partners). Among those with short positions are BlackRock; hedge funds Kintbury Capital, Millennium Management, Citadel and Marshall Wace. I am long, and I think many other amateur investors are too. It will be ironic if the FCA action causes gains for hedge funds and losses for less sophisticated investors, many of whom are HL. customers as well as shareholders, because the regulator is too draconian in defining what is ‘unfair’ behaviour.

Sharepad’s DuPont analysis suggests that EBIT margins have been reasonably stable since listing, but that reduced capital turn (that is sales relative to capital) has caused the decline in RoCE.

Opinion: I own this, as I think the dividend is sustainable and the shares should enjoy a tailwind from rising UK equity markets, whenever that eventually happens. It’s not at the bargain levels of some UK fund management companies, like Polar or Miton or brokers like Cavendish but I think that HL. is a lower-risk way of playing the recovering markets theme. I am wary of the regulatory risk but think that this is probably priced in, as the shares have already fallen for four years in a row. Sharepad user Paul Bryant has also written up the HL. results in more detail, which I already posted on the chat, but here’s the link in case you missed that.

Lok’n’Store H1 Jan Trading Update

This storage company, in the same sector as Big Yellow and Safe Store, stores home contents for people who can’t throw their stuff away. Surprisingly though storage is not used just to store personal items, but also people who sell items on eBay use the Lok’n’Store as a warehouse for their inventory. Self-storage is designed to be accessible, low-cost and rented on a monthly basis. When the Lok’n’Store buildings are at full capacity they are highly cash generative. Importantly, the company is not structured as a REIT, meaning that it doesn’t have to pay out 90% of earnings.

Management announced trading was “in-line” with revenue +4.9%. Occupied space fell -2.9% to 862,554 sq. ft, but that decline was offset by raising Price per sq. ft. by 4.0%. The company has developed four new stores which will add a further 211,600 sq. ft. of capacity. They’ve also received planning permission for a further store in Barking and are anticipating receiving planning permission for another store in Eastbourne.

History: The company was founded in 1994 and opened its first store in Horsham Surrey. They originally listed on OFEX (which became Plus Markets, then Aquis Exchange) then listed on AIM. At the time of the AIM listing in 2000, turnover was under £3m and PBT less than half a million pounds. Since then, the track record has been strong, with steady progress excluding a couple of ‘blips’. Turnover did fall -7% during the financial crisis to £10m and the group made a small loss, showing that storage is linked to the housing market. Revenues also fell in 2018, as management sold their document storage business. Apart from that, the group has grown steadily so that revenues are forecast to be £29m FY July 2024F and PBT £10.5m. The balance sheet looks solid with £68m of long-term borrowing, versus tangible assets of £297m. Current liabilities were just £8m at FY July 2023, and net debt was just £12m.

Sharepad shows that progress with NAV has been a bit more lumpy, with it taking almost a decade following the financial crisis for NAV to exceed 2008 levels.

Currently, LOK has 937,000 sq ft of open freehold stores, with a further 485,000 sq ft in the pipeline. They’ve also expanded into leasehold (managing for other owners of properties) with 435,000 sq ft open and 50,000 sq ft in the pipeline. Leasehold is an asset-light way of growing the business.

Ownership: Andrew Jacobs and Simon Thomas, two of the founders have been selling shares. In May 2023 Simon Thomas sold 1.25m shares at 800p, but he still owns 13% of the company according to Sharepad’s DD tab. Institutional investors include BlackRock 6.8%, but other than that private client businesses like Canaccord and Investec.

Valuation: The shares are trading on July 2025F 30p EPS forecast and 21p dividend, putting them on a PER of 27x and a yield of 2.6%. That doesn’t strike me as a bargain but Cavendish, their broker, says the business is trading at a -17% discount to NAV, compared to a sector average of -14%. The broker points to recent deals, such as Shurgard’s €132m acquisition of six stores in Germany from Pickens, at a cost per square foot of 0.33 £’k, more than double LOK’s current market cap per square foot of 0.141 £’k (= £268m / 1.9m sq ft).

Opinion: Looks good, if a little unexciting. The risk is that they expand at just the wrong point in the cycle and are left with large amounts of spare capacity when people aren’t moving home. The shares fell -90% between 2007 and 2009. There’s an Investors’ Chronicle interview from Nov last year, with Lord Lee of Trafford where they discuss the company. He points out that if interest rates have peaked, then that ought to benefit property companies like LOK.

Arcontech H1 Dec 2023

This financial data company which helps banks integrate data providers (like Bloomberg and Refinitiv) announced H1 Dec revenue up +7% to £1.4m but PBT up +44% to £538K. Net cash was down slightly to £5.7m following the payment of a £468K dividend, or 3.5p per share. The company doesn’t pay an interim dividend, so that 3.5p final dividend paid last November is effectively the FY dividend.

Historically, the company has reported a mid-teens RoCE and 30-40% EBIT margin, yet has struggled to grow the top line. Revenues for the FY are expected to be inline with expectations (Cavendish have £2.8m) but PBT “slightly ahead” which the company attributes to higher interest rates on their cash balances and low operational expenditure. Sharepad shows that revenue has not grown for 5 years, from £2.8m FY Jun 2019. While the pandemic was going on, management suggested lack of face-to-face meetings meant that it was harder for salesmen to showcase the product. However, the pandemic has now been over for a couple of years, and management have still failed to increase sales.

Their main product is CityVision, which allows banks to integrate different market data vendors, allowing real-time calculations, data management and data publishing. Management have put this diagram on their website to try to explain what they do. The main advantage seems to be that it can take in multiple data feeds, sending and receiving data between different platforms.

There’s also a Microsoft Excel Add-In, which I find a little surprising because when I worked in banks as an equity research analyst it was possible to have a Bloomberg or similar Excel Add-In, so I’m not sure why Arcontech’s is needed.

Recurring revenue: the company says that recurring revenue represents 100%. However, they can lose customers, for instance in Nov 2021 one customer greatly scaled back their requirements and a second customer chose not to renew its contract. Maynard and I discussed this on a podcast last summer, and he didn’t like it because the trade receivables are high (£1.3m Dec 2023 versus H1 £1.5m sales). He also suggested that perhaps the competition is large banks’ internal IT departments, who could presumably build something similar to Arcontech’s product suite.

Valuation: Cavendish has EPS declining -21% over the next two years to 5.6p in FY Jun 2025F. That puts the shares on 19x PER, which seems expensive for the historic track record of low growth. However, the cash is a quarter of the market cap and if they can grow the top line with little incremental spend then this could be very good.

Opinion: I’ve owned this for a while and the share price hasn’t gone anywhere. I’m hoping that management do something with the cash, either invest to grow the business or return it to shareholders. I am frustrated that this hasn’t performed over the last few years, but have a nagging feeling that I could lose patience and sell at exactly the wrong point. I remind myself that between 2010 and 2016 GAW reported flat revenue, before going on to be a multi-bagger. So, on balance, I will keep holding as I think the downside is limited and there could be a substantial upside if management does grow the topline.

Notes

The author owns shares in Hargreaves Lansdown and Arcontech

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.