Screening for consistently high margins and ROE leads to property franchisor Belvoir. Maynard Paton weighs up the small-cap’s acquisitive history, super cash flow, visible management and immediate prospects.

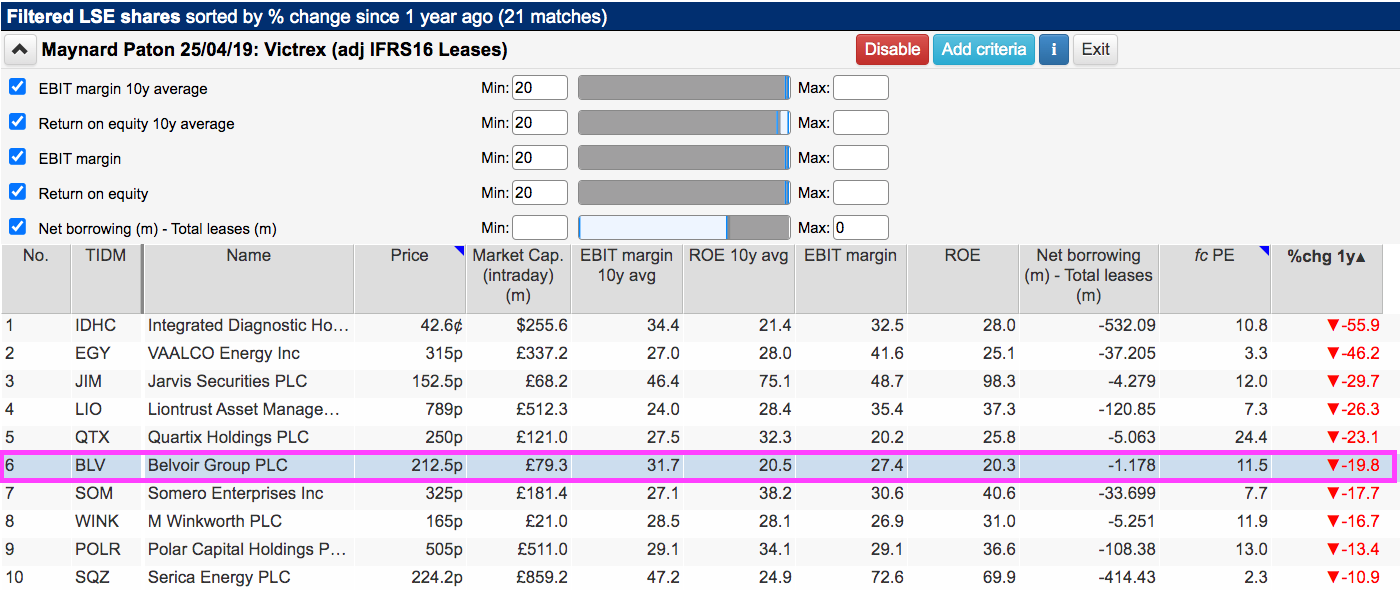

Today I have revisited a SharePad screen that applies two ratios favoured by ‘quality’ investors — operating margin and return on equity (ROE).

The exact criteria I re-used were:

- An operating margin (latest and 10-year average) of 20% or more, and;

- An ROE (latest and 10-year average) of 20% or more.

Any business with a margin and ROE of at least 20% is probably quite special.

To narrow the field down further, I also sought companies that carried net cash (i.e. net borrowings excluding IFRS 16 finance leases of less than zero):

(You can run this screen for yourself by selecting the “Maynard Paton 25/04/19: Victrex” filter within SharePad’s brilliant Filter Library. My instructions show you how.)

This time the filter returned 21 matches, including Impax Asset Management, Somero Enterprises, Jarvis Securities and Quartix.

I selected Belvoir because it was among the worst share-price performers of the last twelve months. Let’s take a closer look.

The History of Belvoir

“I believed… the lettings market would grow in the future. At the time, lettings was very much a second-class citizen to sales, quite often the [lettings] agency was poked upstairs in a little back room in an estate-agency shop. I felt this was not really the right way to go about it, that lettings ought to be a profession itself.”

“I thought we would develop Belvoir on core values, and those core values were professionalism, I wanted to make sure we were in the mainstream market; I developed it on specialism, because I felt that lettings was a specialist entity in itself; and thirdly on customer care, because if you looked at it from a customer’s point of view, you were going to crack it.”

So recounted Mike Goddard during this informative 4m37s YouTube video about how he and his wife Stephanie founded Belvoir during 1995.

Belvoir has since evolved from the Goddard’s original lettings agency in Grantham to what the group now claims to be the country’s largest property franchisor. Franchised estate-agency and lettings offices now total approximately 325.

Belvoir operated as a pure lettings-franchise business under the Belvoir brand until 2014, but several acquisitions thereafter broadened the group into estate-agency sales and mortgage advice. Notable purchases included:

- Newton Fallowell (£6 million)

- Goodchilds (£3 million)

- Northwood (£13 million)

- Brook Financial Services (£2 million)

- MAB Gloucester (£4 million)

- Lovelle (£2 million)

- Nicholas Humphreys (£4 million)

- TIME (£4 million)

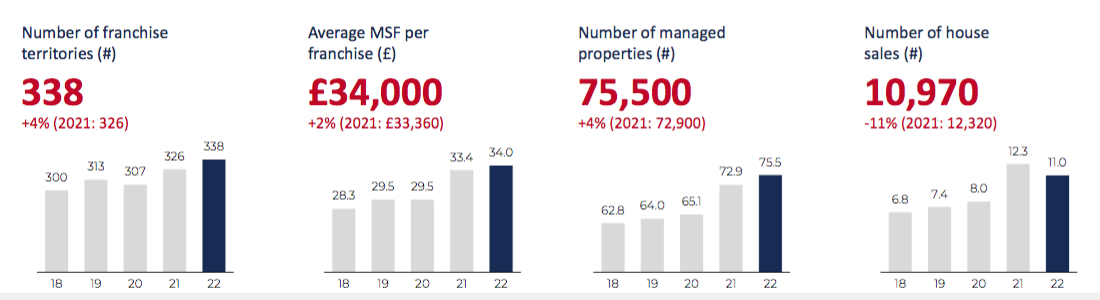

The average franchise branch last year generated revenue of £316k, of which £34k (11%) was paid to Belvoir in exchange for using an established brand and various support services.

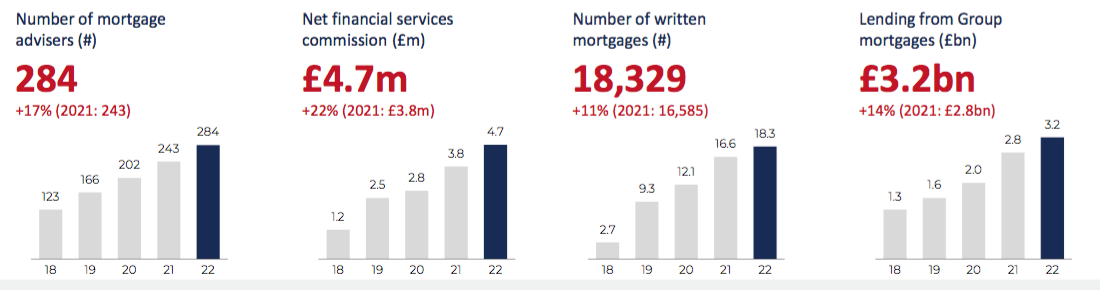

The network currently manages more than 75,000 rental properties and last year handled almost 11,000 residential sales. Belvoir’s financial services division is now the largest appointed representative of mortgage intermediary Mortgage Advice Bureau and consists of 284 (mostly self-employed) financial advisers.

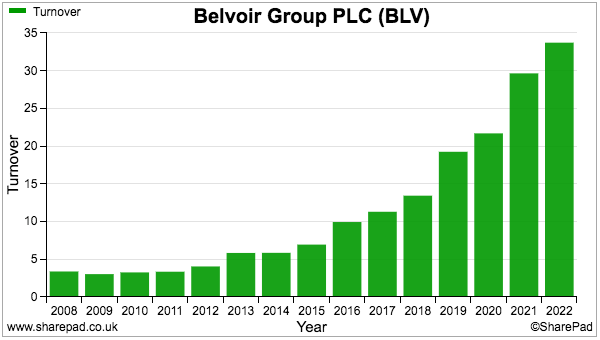

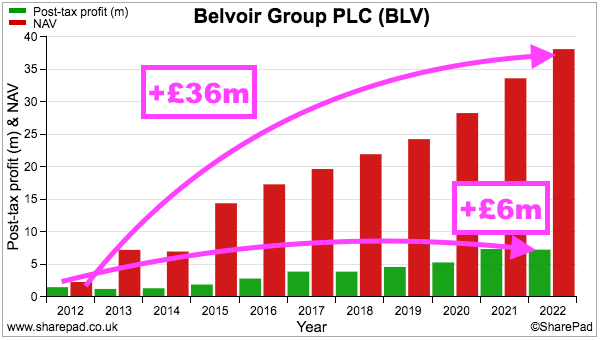

Belvoir joined AIM during 2012, at which point revenue was £4 million and profit was £2 million. The aforementioned acquisitions have since helped push revenue to £34 million and profit to £9 million:

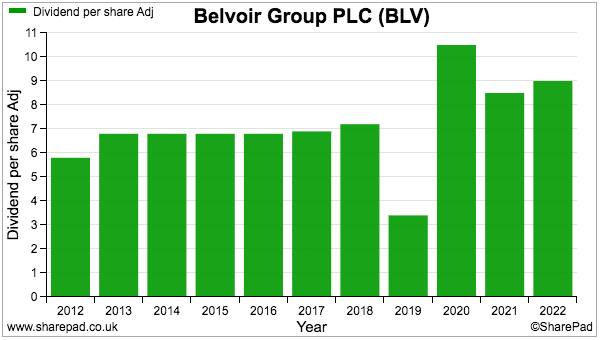

The pandemic interfered with the final 2019 dividend, but shareholders received catch-up payments during 2020:

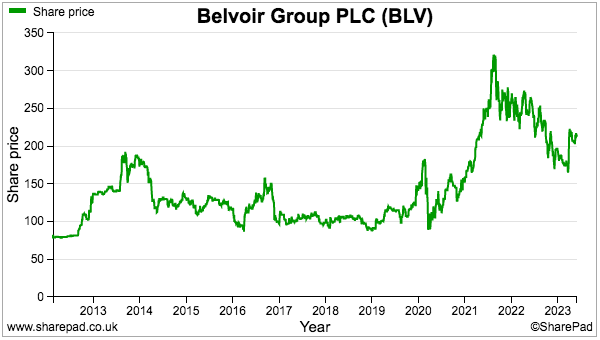

The financial history has delivered a useful share-price gain:

Anybody buying at the 75p flotation price had quadrupled their money when the shares topped 300p during 2021. The recent 213p supports a £79 million market cap.

Growth by acquisition

Expenditure on those aforementioned acquisitions totals £38 million, which is a significant investment given profit last year was £9 million.

Have those purchases complemented an underlying growth story…

…or have they masked a stagnant (or even shrinking) core business?

Changes to the number of franchise branches provide a mixed picture:

- Newton Fallowell: 31 acquired, 39 now;

- Goodchilds: 16 acquired, 0 now (rebranded Newton Fallowell);

- Northwood: 87 acquired, 91 now;

- Lovelle: 17 acquired, 16 now, and;

- Nicholas Humphreys: 21 acquired, 20 now.

I calculate the group has reduced the acquired businesses by a net six offices, which is not ideal for expanding the network. Mind you, the acquired branches that remained open may have improved their performance as part of Belvoir to counterbalance those that were no longer viable.

I should add the original Belvoir chain has increased its estate by 17 offices to 159 since the group’s flotation.

Belvoir commendably provides lots of statistics to help shareholders judge its progress:

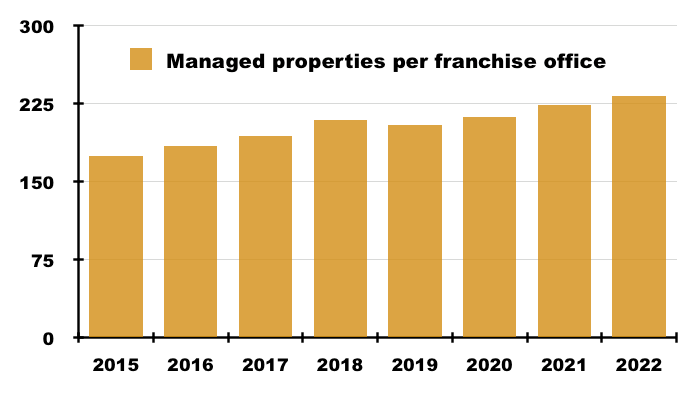

I calculate Belvoir’s letting income per franchise office has advanced from £20k to £27k since 2015:

Adding a sales function to previously lettings-only branches has meanwhile helped Belvoir’s sales income increase from £2k to £7k per franchise office.

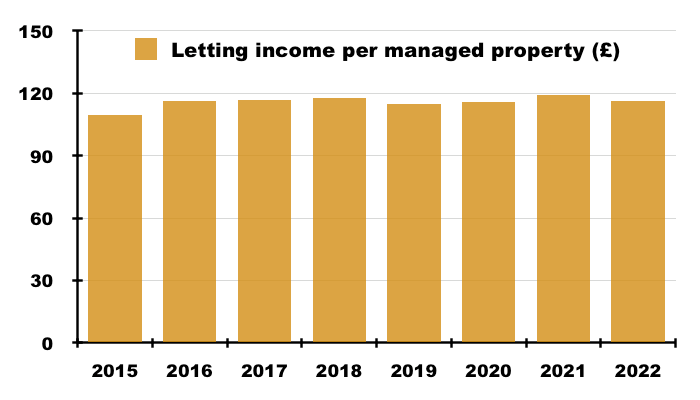

Further number-crunching shows letting income per managed property static at almost £120 a year…

… which means lettings growth has been derived primarily from franchise offices managing a greater number of rental properties:

Collecting £120 a year from a rental property does not sound a lot, but the average weekly rent charged by the group’s franchisees is £207.55 or almost £11k a year. Franchisees charging landlords 10% and Belvoir then taking its 11% from franchisees gets to that £120.

Turning to the financial-services division…

…productivity among Belvoir’s mortgage specialists appears to have improved.

I reckon each advisor arranged an average 55 mortgages during 2017, which had increased to 70 by 2022. Revenue per adviser over the same period has climbed from £48k to £69k.

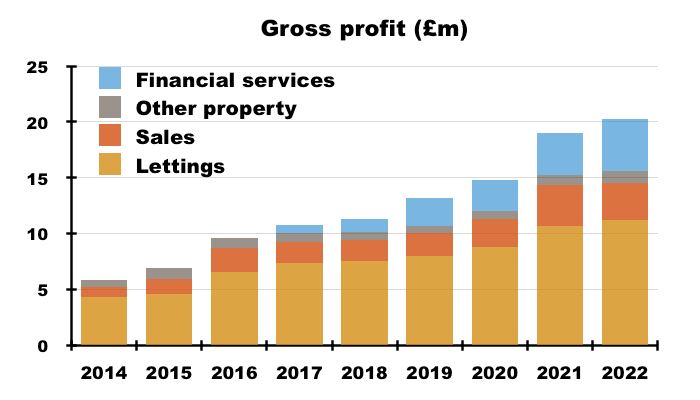

Financial-services activities represent 23% of Belvoir’s gross profit:

The original lettings service last year generated 55% of gross profit.

Belvoir’s SharePad summary

SharePad’s summary for Belvoir is shown below:

The second row emphasises 2023 will not show fantastic progress versus 2022, although the middle row confirms Belvoir has no net debt and no pension complications.

The bottom row meanwhile discloses terrific cash flow as well as the decent margin and ROE numbers flagged by my initial SharePad screen.

Let’s start with the ‘quality’ ratios.

Cash conversion and ROE

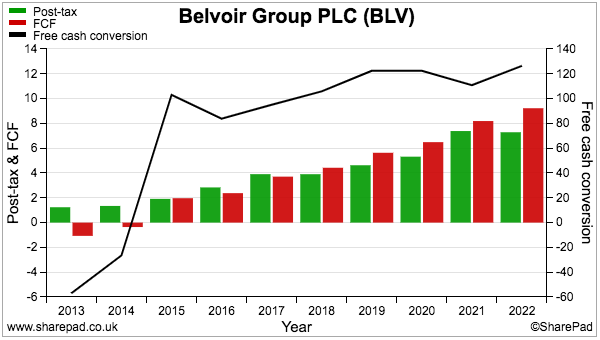

Belvoir has demonstrated superb cash conversion:

The black line (right axis) shows free cash flow exceeding reported earnings for each of the last five years.

Earnings can convert into high levels of cash flow if:

1) Significant cash is generated through working-capital movements (e.g. upfront customer payments and delayed supplier payments), and/or;

2) Expenditure on tangible assets (e.g. property, plant and equipment) and intangible assets (e.g. capitalised development costs) is substantially less than the associated depreciation and amortisation charged against profit.

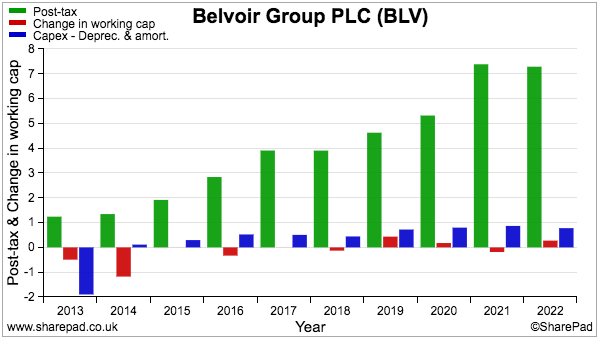

The chart below compares Belvoir’s earnings to the group’s working-capital cash movements and ‘excess’ capital expenditure:

The positive blue bars reflect Belvoir recording a greater deprecation/amortisation charge than cash spent on tangible/intangible assets.

The 2022 annual report explains what is happening. Belvoir unusually (and admirably!) does not adjust reported profit for the amortisation of acquired intangibles.

Cash expenditure on intangibles was £10,000 last year…

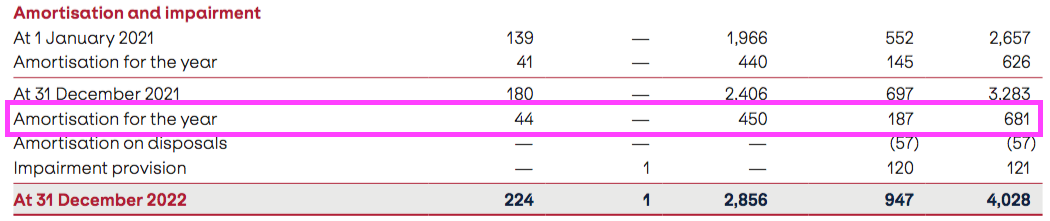

…but amortisation of (acquired) intangible assets was £681,000:

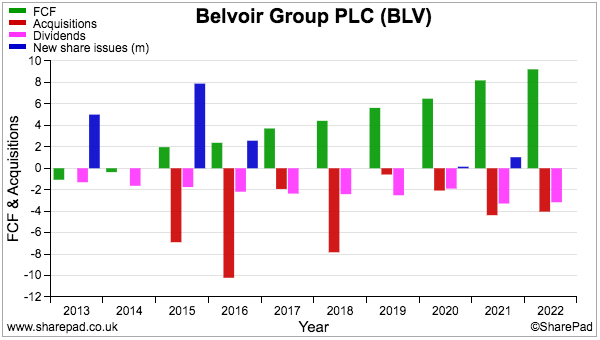

This next chart shows how a combination of free cash flow (£41 million) and share issues (£16 million) have funded the acquisitions (£38 million) alongside dividends (£23 million) since 2013:

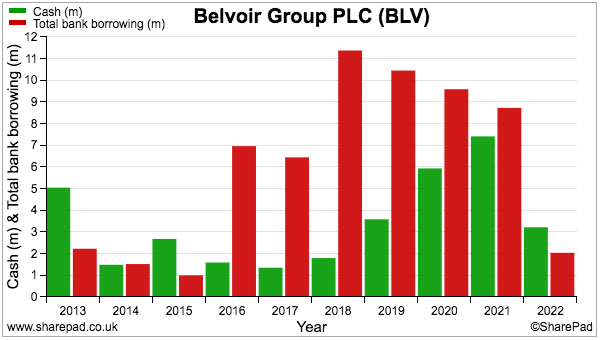

The acquisition expense did prompt net debt to reach almost £10 million during 2018, but last year cash exceeded bank debt for the first time since 2015:

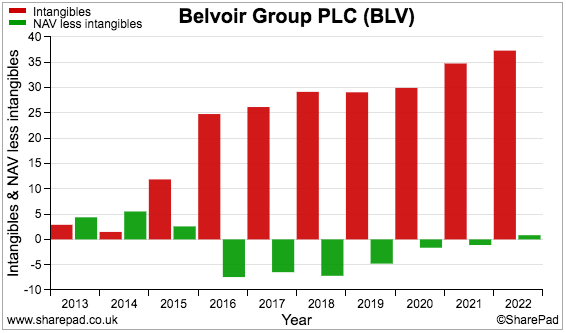

The acquired goodwill and intangibles now dominate Belvoir’s balance sheet:

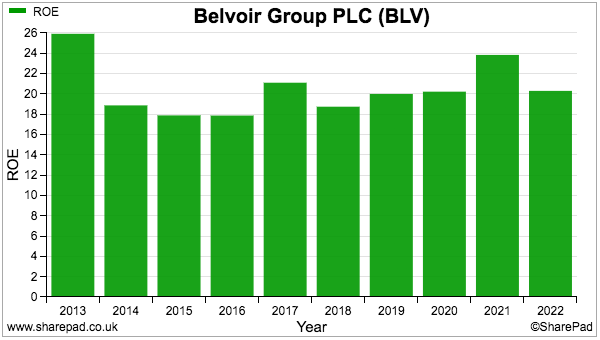

Conventional ROE calculations suggest the acquired intangibles have generated worthwhile returns. ROE last year was 20% and the ten-year average is also 20%:

This next chart provides further perspective on the effectiveness of Belvoir’s expansion. Between 2012 and 2022, earnings improved by almost £6 million while net asset value advanced by nearly £36 million:

Employing an extra £36 million of shareholder equity to generate an extra £6 million of earnings suggests Belvoir has reinvested shareholders’ money at a useful 16%.

That said, decent double-digit returns ought to be expected. The bulk of Belvoir’s expansion has after all depended upon acquiring private businesses at single-digit profit multiples.

Margin and employee productivity

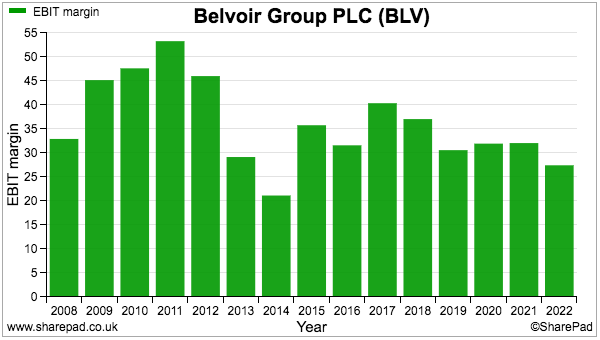

Belvoir’s operating margin is impressive, with 27% registered during 2022 and at least 20% recorded every year since the flotation:

The lower margin since 2017 appears due to Belvoir’s entry into financial services. Commissions paid to the self-employed advisers last year absorbed a hefty £13 million, or 74%, of the division’s revenue of £18 million.

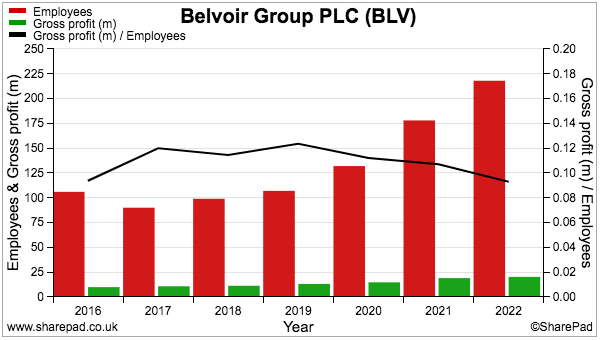

Belvoir’s in-house employees took home aggregate wages of £7.5 million last year:

Exclude the £955k collected by the three executives, and the average staff salary last year was not huge at £30k. Belvoir’s healthy group margin may therefore be due to keeping a lid on employee costs. Indeed, gross profit per employee at close to £100k…

…ought to leave ample room for profit given the £30k average staff wage and costs beyond commissions and employees were limited to less than £3 million last year.

A downside to keeping salaries at £30k could be high staff turnover; 40% of employees have a length of service of less than two years.

More concerning perhaps is gross profit per employee remaining stagnant, which does imply Belvoir has not improved its efficiency during recent years.

Indeed, my calculations suggest a lack of ‘scalability’ between the enlarged workforce versus the number of rental properties under management and the number of franchise branches:

I have to presume many of Belvoir’s new recruits work in the financial-services division, the headcount of which may not correlate exactly to the number of franchise offices and the size of their lettings estates.

Management

The aforementioned Mike Goddard no longer runs Belvoir. He stepped down from executive duties during 2018, left the group during 2019 and had sold almost all of his remaining shares by 2020.

In charge today is Dorian Gonsalves, who became an estate agent for Countrywide during 1998, joined Belvoir during 2005 and by 2010 had become the group’s chief executive:

The board encouragingly includes two other sector veterans:

- Executive Michelle Brook, who founded her own mortgage-advice business before selling up to Belvoir, and;

- Non-exec Mark Newton, who established his own property-franchising business before also selling up to Belvoir.

The finance director has been in place for a reassuring nine years.

The directors are sadly not huge shareholders…

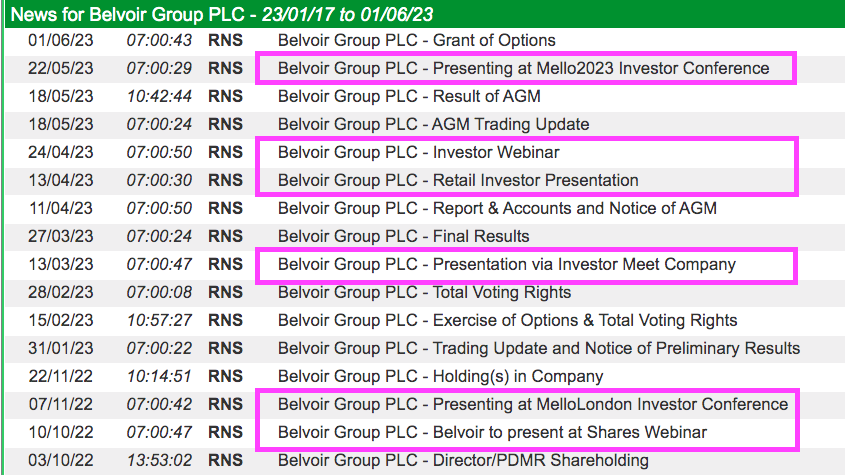

…but are welcome regulars on the private-investor webinar circuit…

…which is no doubt because 51% of Belvoir is owned by individual investors.

Shareholders may want to keep an eye on the board’s pay. Mr Gonsalves last year enjoyed a 16% pay rise (to £235k) and 57% bonus increase (to £192k) during a year when franchisee income and group profit remained flat and the dividend was lifted only 6%.

The board’s latest LTIP does not seem too challenging:

“A floor of 57.8p per share and a cap of 66.5p per share applies to the EPS Performance Condition. The floor requires the Belvoir Group to achieve the cumulative diluted adjusted EPS for the three years to 31 December 2025 as per the current market forecast for that period.”

Earnings per share were 20p last year and another three years of 20p would give a 60p cumulative result — which would fall within the LTIP’s 57.8p to 66.5p per share target range.

Note that the 2022 LTIP award has a lower threshold than the 2021 LTIP, which required minimum three-year cumulative earnings of 62.7p rather than 57.8p per share:

“A floor of 62.7p per share and a cap of 72.1p per share applies to the EPS Performance Condition. The floor requires the Belvoir Group to achieve the cumulative diluted adjusted EPS for the three years to 31 December 2024 as per the current market forecast for that period“.

Valuation and summary

SharePad shows estimated earnings for the next three years bobbing around the 19p per share mark:

Belvoir’s shares, therefore, trade at approximately 11 times earnings, with a possible dividend yield of 4.5%:

The valuation hardly looks expensive in light of the sustained 20%-plus margin and ROE flagged by my SharePad filter. But from what I can tell, Belvoir’s expansion is dependent mostly on acquisitions and superior underlying growth has not been very obvious.

An update last month described 2023 trading as “very resilient“:

“The Group’s performance continues to be very resilient despite the uncertainty in the housing market created by the mini budget in Q4 2022 and subsequent increases in interest rates.”

Income from franchisees has to date gained 5% on 2022, assisted in part by traditional lettings-only branches handling greater residential sales. An acquisition ensured total financial-services profit has so far increased 8% on last year, although the division’s underlying decline was 12%.

True, higher interest rates seem likely to stifle the general housing market and may well restrict Belvoir’s near-term progress. But the group showed no intentions of curtailing its acquisition activity:

“With the Group now in a net cash position, it is well-placed to secure good quality earnings accretive businesses that are complementary to the Group.”

Management’s webinar comments have talked of future deals of up to £15 million, and the £34 million approach for Property Franchise during 2017 underlines Belvoir’s high ambitions:

Property Franchise’s market cap has since tripled to £100 million, which suggests Belvoir was right to make the approach and Property Franchise was right to reject it.

The outperformance of Property Franchise following Belvoir’s approach could in fact mean Property Franchise is the better business of the two. Just like Belvoir, Property Franchise claims to be the country’s largest property franchisor and, funnily enough, was also among the 21 matches from this SharePad screen.

All told Belvoir does appear to be a reasonable if unspectacular business, and I would like to think its sizeable lettings-related income will prove very dependable in any property-market slowdown. But I feel a review of Property Franchise is required to give greater shareholder perspective and to perhaps highlight a more attractive sector opportunity.

Until next time, I wish you safe and healthy investing with SharePad.

Maynard Paton

Maynard writes about his portfolio at maynardpaton.com and co-hosts the Private Investor’s Podcast with Roland Head. Maynard does not own shares in Belvoir.

Got some thoughts on this week’s article from Maynard? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for a specific share.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.