Bruce looks at trends in core inflation, plus observes first-hand that the UK economy has been stronger than many predicted. Companies covered AJB, ETP and HEAD.

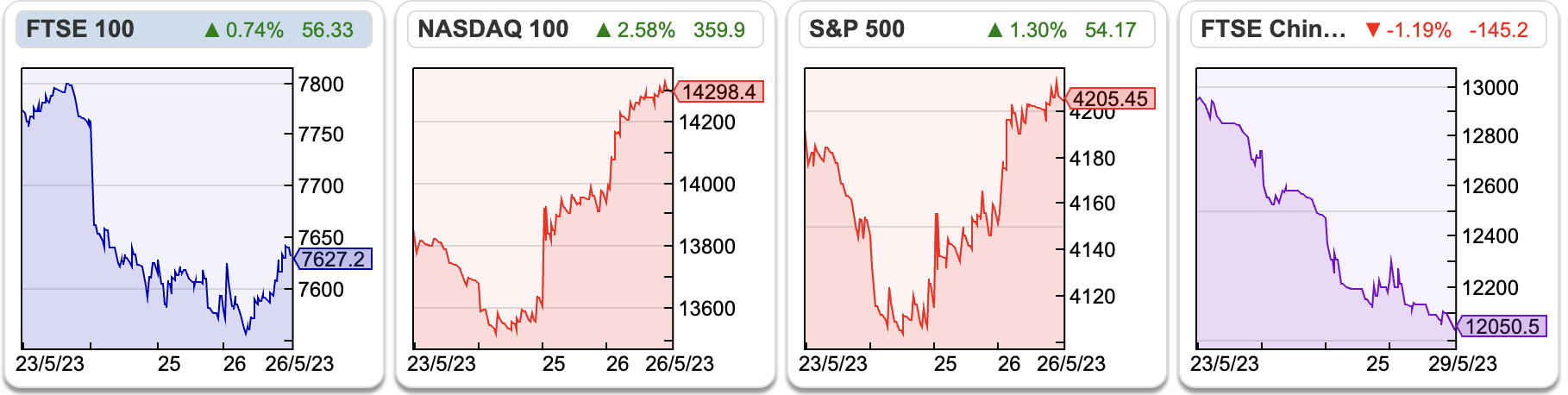

The FTSE 100 was down -1.7% in the last 5 days to 7,627. The Nasdaq100 was up +2.5% and the S&P 500 was flat. The price of gold was $1948 per ounce, down less than 2% in the last 20 days. The US 10Y long bond yield was 3.8%, which is approaching the 3.95% peak (seen in Mar 2023, just before SVB imploded). On Sunday night, the US agreed to a debt ceiling deal.

Last week UK inflation (CPI) fell back to 8.7% for April, though that is above the Bank of England’s forecast of 8.4%. Food price inflation remained closed to its 45-year peak of 19.1%. Central Banks encourage financial markets to focus on “core” inflation, which adjusts out volatile items like food and energy prices, rather than the headline number. This is a similar concept to companies removing exceptional items like write-downs or restructuring charges from their earnings calculation to produce a more flattering underlying number. The problem is that even this more flattering underlying/core inflation figure now looks bad, rising from +6.2% in March to +6.8% in April. That is a similar level to the early 1990s when interest rates were in double digits.

UK gilt yields jumped on the news, and the futures market is now suggesting interest rates will peak at above 5.25% at the end of this year. I raised the possibility last week that the UK stock market might do better than the housing market over the medium term. UK building society Nationwide, which is the UK’s second-largest mortgage lender after Lloyds/HBOS raised fixed-rate mortgages by 45bp last Friday, and I think it’s quite likely we see two-year fixes above 6%.

Last week we saw a very successful Mello conference in Chiswick. It was good to meet many Sharepad subscribers. It sounds like this one was particularly challenging for David to organise, with many company management preferring to present online, rather than physically meet investors. It was clear though that the people who did attend took a lot from the conference, comparing notes, swapping stories and chatting with management for more colour after the presentations.

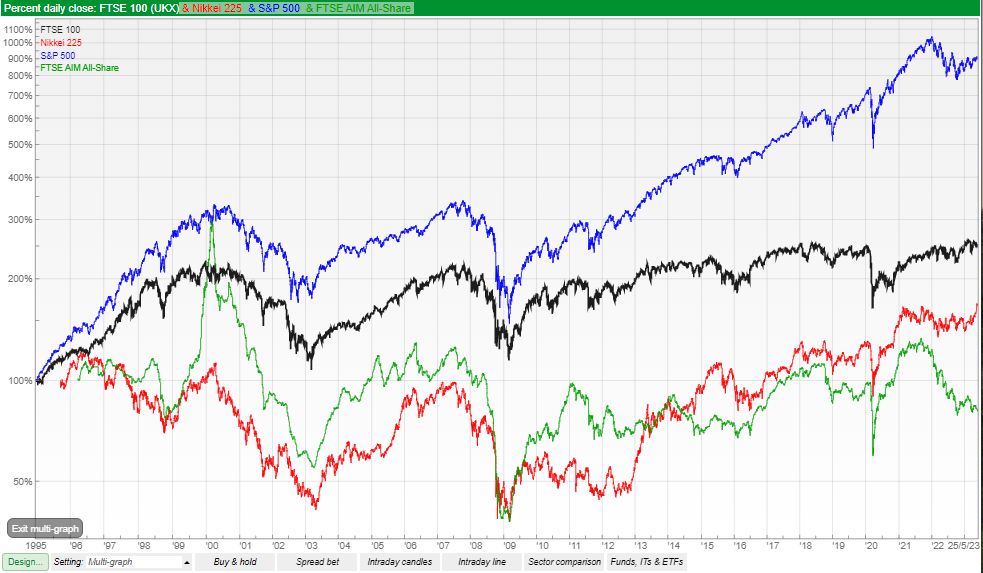

Steve Clapham produced a rather downbeat presentation on the US stockmarket, which I agree with. He generalised from this to markets everywhere: but the FTSE 100, AIM and Japan have gone nowhere for a couple of decades. The chart below shows on a log scale the outperformance of the US (blue) versus the other stock market indices since the mid-1990s.

When I asked him about the reason for the difference, he suggested government borrowing, deregulation and poor infrastructure was the reason for poor UK performance. I don’t know the answer, but his reply made little sense to me and was met with scepticism from other members of the audience. My view is that we should be bearish on the US indices, but there will be some quality compounders emerging in the next decade, hopefully, less concentrated in the West Coast of the USA and instead more from the UK and elsewhere in the world.

Another observation is that London seems to be really buzzing. The UK is supposed to be close to a recession, with lots of gloom in the media. The evidence from my own eyes suggested activity and energy from people out and about in the city; first-hand research suggests that London pubs were full on Tuesday evening, despite a beer costing over £6 for a pint. Compare this to Berlin, where activity appears to be more subdued, Germany is in recession and forecast by the IMF to be the weakest of the world’s largest economies. I am sure that this will reverse at some point, and the UK will be in recession while Germany does better, and the UK media will be even more gloomy.

This week I look at AJ Bell, Eneraqua’s profit warning and Headlam. ETP published results which claimed to be “significantly ahead of previous management expectations” yet the share price was punished, falling -50%. Recently we have seen similar from Shoezone and SDI. I think that this trend of upbeat sounding – but vague – commentary from management in the RNS, but their brokers slashing forecasts for future years, is worth flagging. I may keep track of all of the company managements who include the phrase “ahead of expectations” in their RNS, but the share price falls – then publish the list in a few months.

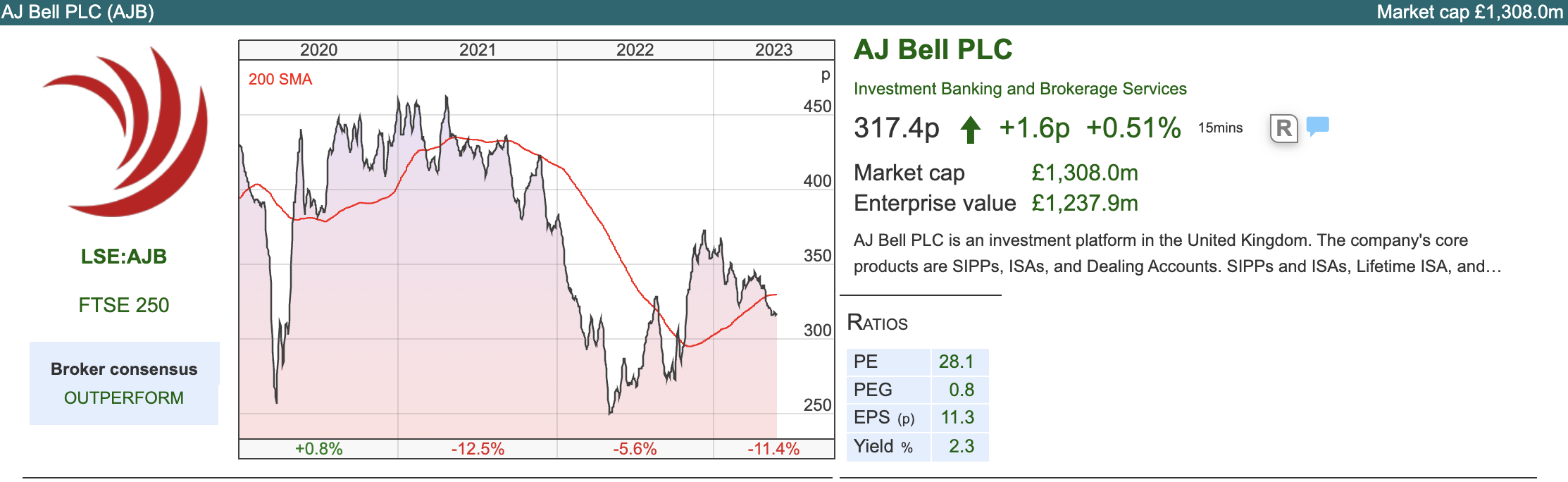

AJ Bell H1 to March

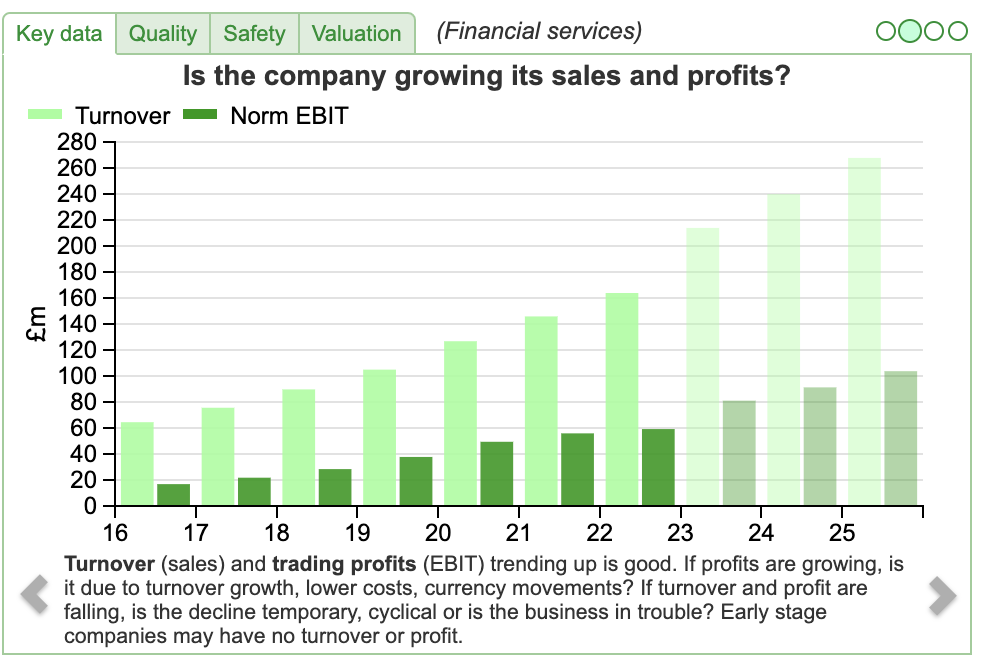

The stockbroker and fund administrator, which naturally calls itself a platform, announced revenue +37% to £104m and PBT up +61% to £42m. That’s an impressive 40% PBT margin. They also raised their interim dividend +26%, which is a sign of confidence.

AJB Assets Under Administration (AuA) were up +7% to £69bn. They saw £2bn of net new inflows in H1, which compares to £3.2bn over the same period for Hargreaves Lansdown, which has roughly double the amount of AuA (£132bn). For comparison, abrdn has £69bn of AuA but hasn’t announced net flows for 2023 yet.

I was interested to compare prices, so I have taken fee information from each provider’s website. I have to admit that the disclosure of fees in this industry can be (deliberately) hard to compare. Below is my best effort to compare each company. Service levels, website clunkiness and dealing execution are much harder to compare, so this might not be comparing apples with apples.

History: Founded in 1995 by Andy Bell and Nicholas Littlefair as a pension administrator, AJ Bell became an “execution only” online SIPP provider in 2000. In 2007 they acquired a stockbroker called Lawshare (now AJ Bell Securities) bringing ‘‘in-house’’ the provision of dealing, custody and investment administration services to Sippdeal and Sippcentre customers. The deal paved the way for the transformation to a full investment platform in 2011; offering ISAs and general investment/dealing accounts in addition to the existing SIPP products. In 2018, they listed at around 160p (range in the prospectus 154p to 166p) valuing the company at c. £650m. Customer numbers roughly doubled over the pandemic, to 445K, however, the shares also saw a sharp sell-off early last year as market conditions became more difficult and trading activity slowed.

Andy Bell stepped down as CEO last year but still owns 22% of the shares. The shares are mostly held by private individuals, only Liontrust has a disclosable stake at 22%.

Andy Bell stepped down as CEO last year but still owns 22% of the shares. The shares are mostly held by private individuals, only Liontrust has a disclosable stake at 22%.

Valuation: The shares are trading on 19x Sept 2024F and 17x Sept 2025F. Like HL. RoCE and EBIT margins are impressive but have been trending down in the last few years. The dividend yield of 3% is not as attractive as HL.’s or abrdn.

Opinion: Looks good. I own Hargreaves Lansdown, for me buying AJ Bell doesn’t add much diversification. This strikes me as a sector where amateur investors might enjoy an “edge” over professional fund managers. Investors can judge the marketing, evaluate the platforms, discuss with friends and take an informed view how well these companies are doing and invest accordingly.

Eneraqua FY Jan 2023 results

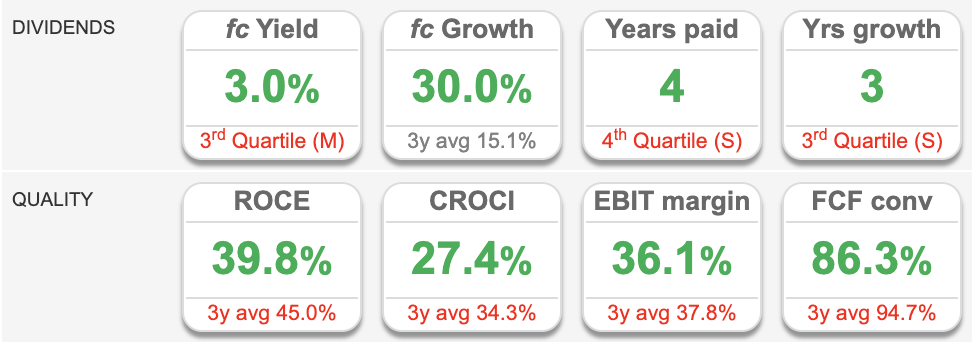

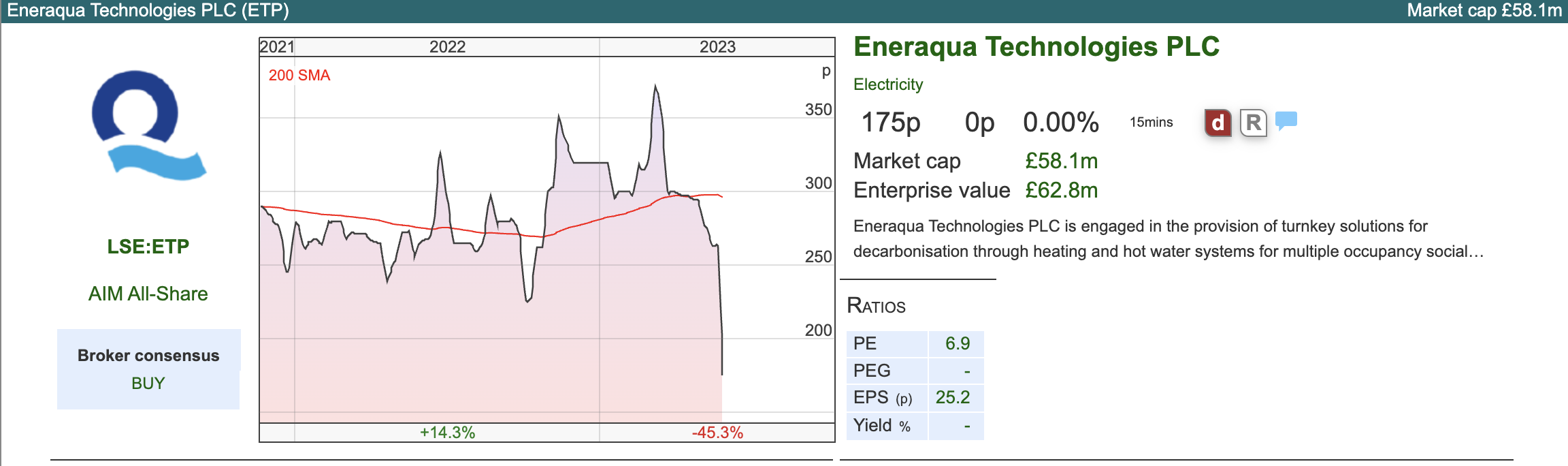

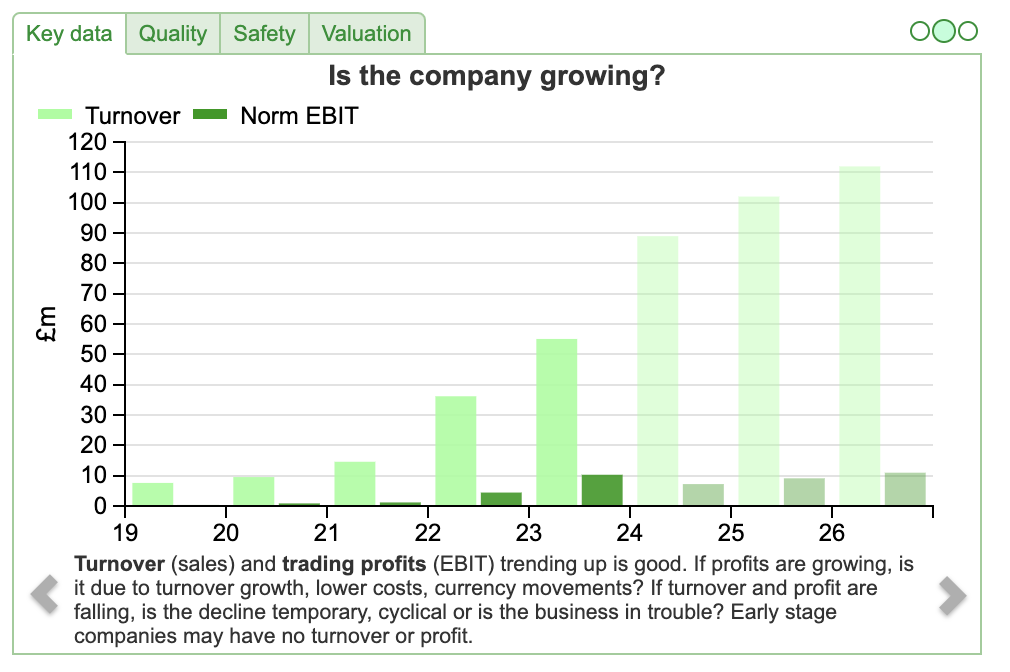

This energy and water efficiency company, which operates under the Cenergist brand, has reported remarkable results. They delivered +52% revenue growth to £55m, with a record order book of £130m and adj PBT growth of +79% to £10m for FY 2023. The outlook statement said that we should see revenues “significantly ahead” of previous management expectations for FY 2024F. Yet the share price crashed by 50% last week on the day of their results.

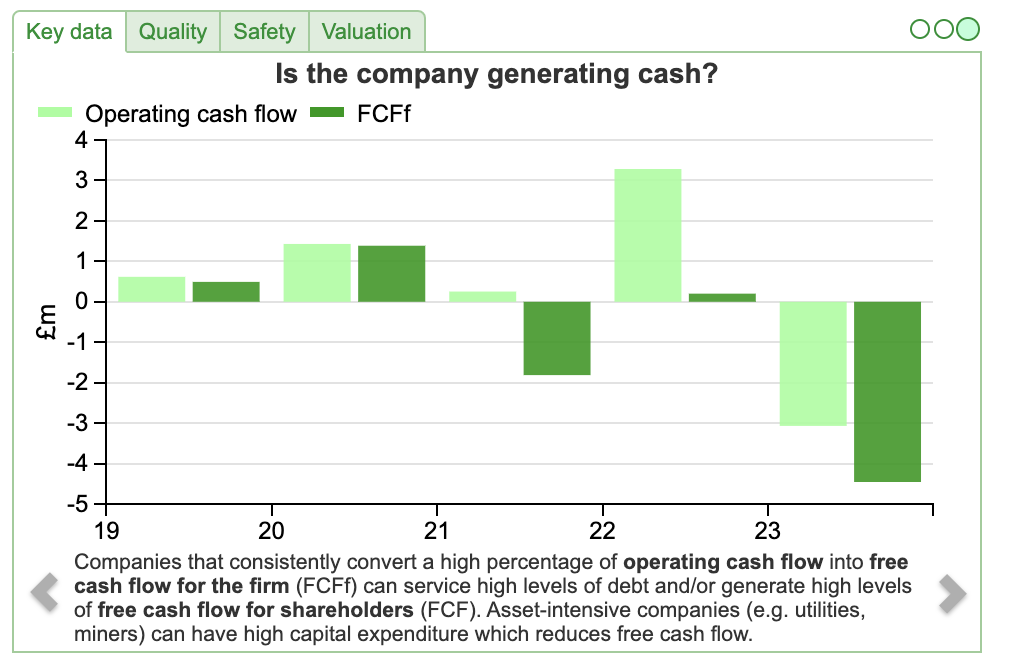

The damage appears to have been done by the phrase “high-single-digit PBT margins”, whereas Sharepad was showing PBT forecasts for Jan 2024F of £12.1m, implying a PBT margin of 13.6%. That implies that the profits could halve versus those prior forecasts. Management attribute this disappointment to inflation bringing forward higher margin work to the year just reported, and delaying lower margin projects pushed back to the current financial year. Other areas of concern are cash conversion declining alarmingly from 66% to -26% for FY Jan 2023. They expect cash conversion to recover to above 100% this financial year.

Group working capital strain meant that the balance sheet swung from £4.1m of net cash Jan 2022 to net debt of £3.0m just reported, excluding IFRS 16 liabilities. They put this down to longer lead times for components, plus clients making late changes to project plans which in turn meant an increased level of trade receivables at the year-end.

History: The company was founded by Mitesh Dhanak, the current CEO, in August 2012, to provide technical and financial consultancy to councils and housing associations, for instance, an £8m heating program with the London Borough of Hackney. In 2017 they then adapted their offering to “turnkey solutions”, for multiple occupancy social housing, focussing on heating and hot water systems. They have operations in the UK, Spain, the Netherlands and India.

They listed on AIM in November 2021, at 277p with the company receiving £9m, and selling shareholders receiving £8m. The market cap following admission was £92m, with 33.2m shares outstanding. They seem to have made a mistake with their prior year EPS calculation, with diluted EPS of either 18p (note 5 of the RNS) or 24.9p (table at the front of the RNS).

When they listed at the end of 2021, FinnCap was their NOMAD and broker, though they have now switched to Singers and Liberum. To switch advisers so soon after their IPO seems a little unusual.

Ownership: The founder / CEO’s wife owns 14% of the company, while he owns 5%, according to the company’s most recent October presentation on their website. The figures on Sharepad suggest 17%, which may be more up-to-date. Other insiders also owns substantial stakes. The largest institution is the wealth manager Charles Stanley 5.6%, followed by Slater Investments 5.1%.

Valuation: The shares are trading on 9x Jan 2025F, though I think there must be considerable uncertainty over the forecasts. There’s a small 1.2p dividend, but the yield is not going to provide much support. On the positive side, Sharepad’s financial health indicators reveal that the risk of a catastrophic failure are low.

Opinion: Revenues are forecast to increase 9x FY Jan 2024F, compared to those reported in FY Jan 2020. I am put off by the errors with the two EPS calculations, plus more fundamentally the margin pressure and declining cash conversation which all suggest to me that this is a company that is growing too quickly and some of the financial controls are not as good as they could be. If that isn’t enough, it is also a vaccine rally 2021 vintage IPO. It could be that this is a temporary blip and now the shares have halved in value they represent good value. In my view, there could be more bad news to come. If management are struggling with the very strong growth, it could take longer than they anticipate to fix problems, so I will avoid.

Opinion: Revenues are forecast to increase 9x FY Jan 2024F, compared to those reported in FY Jan 2020. I am put off by the errors with the two EPS calculations, plus more fundamentally the margin pressure and declining cash conversation which all suggest to me that this is a company that is growing too quickly and some of the financial controls are not as good as they could be. If that isn’t enough, it is also a vaccine rally 2021 vintage IPO. It could be that this is a temporary blip and now the shares have halved in value they represent good value. In my view, there could be more bad news to come. If management are struggling with the very strong growth, it could take longer than they anticipate to fix problems, so I will avoid.

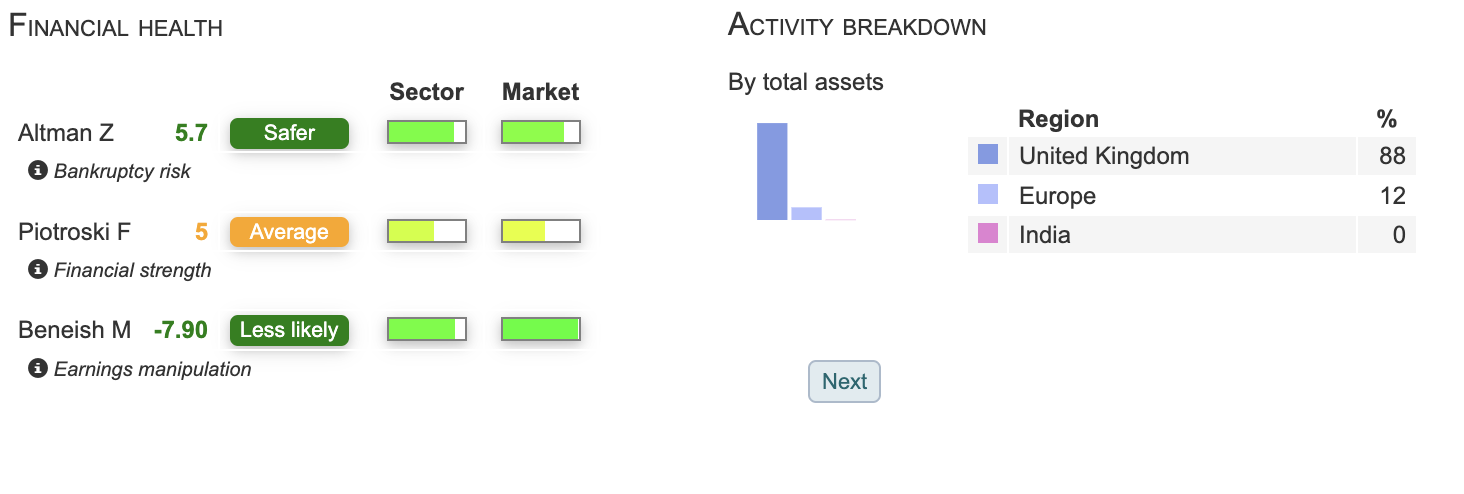

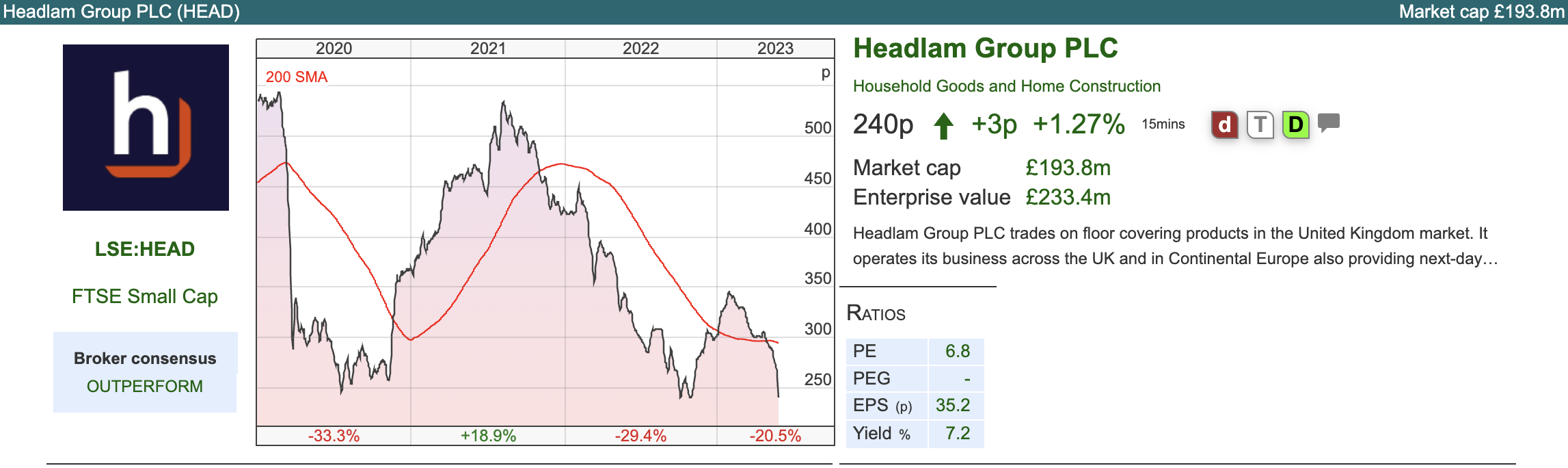

Headlam AGM statement FY Dec 2023

This floor coverings business (carpets and tiles) that operates 67 brands across the UK (c. 87%) and Europe (c. 13%) announced an AGM update. Revenue for the first four months was up +3.4%, but they warn that was achieved with volumes in the residential market (c. 2/3 of group revenue) falling. I assume that when people move house they tend to buy new carpets etc so the HEAD investment case probably is sensitive to the housing market. I noted that even before last week’s inflation data, UK mortgage approvals for house purchases were down -36% Q1 v Q1 last year. That said, Sharepad was showing forecast revenue growth of less than 1% in Dec 2023F, to £667m, rising to +3% in 2024F. The AGM statement also talks about a lower gross margin, and before last week EPS was forecast to decline -23%, so management seem to have set expectations low.

Like ETP, the financial health indicators are suggesting that though earnings might disappoint, the balance sheet is less likely to be a problem.

On the day of the RNS, the shares were down -10%, suggesting that their brokers likely reduced forecasts.

On the day of the RNS, the shares were down -10%, suggesting that their brokers likely reduced forecasts.

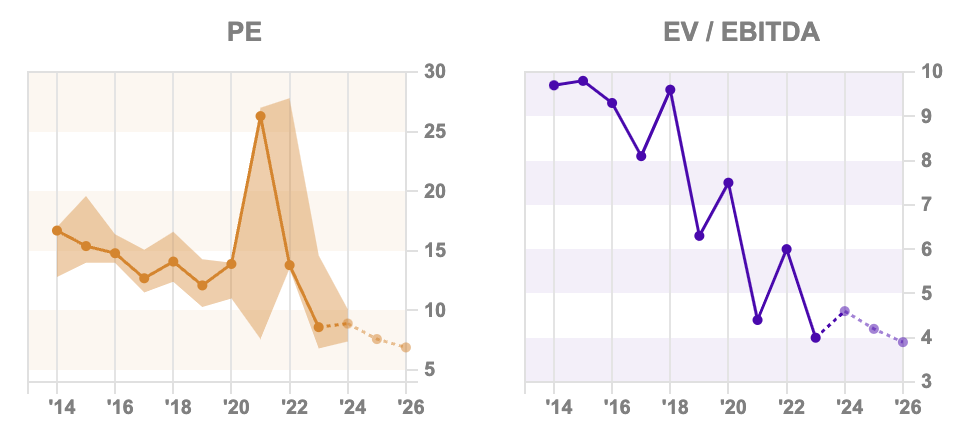

Valuation: The shares are trading on 7.5x PER Dec 2024F. In 2024F the dividend yield at 7.6% is actually higher than the PER ratio of 7.5x the same year. Before the pandemic, this was delivering mid-teens RoCE, though top-line growth was only low single digits.

Opinion: This looks like it could be interesting – at the right time. The FY Dec presentation (released in March) talks about £200m of revenue growth over the next five years, which would imply revenue of +5% CAGR. Fundamentally I don’t think there’s much wrong with the company’s medium-term investment case, conditions are clearly difficult now and if anything may deteriorate further. My view on the UK housing market is negative, so I would not buy now though.

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Weekly Market Commentary | 30/05/23 | AJB, ETP, HEAD | Inflation core

Bruce looks at trends in core inflation, plus observes first-hand that the UK economy has been stronger than many predicted. Companies covered AJB, ETP and HEAD.

The FTSE 100 was down -1.7% in the last 5 days to 7,627. The Nasdaq100 was up +2.5% and the S&P 500 was flat. The price of gold was $1948 per ounce, down less than 2% in the last 20 days. The US 10Y long bond yield was 3.8%, which is approaching the 3.95% peak (seen in Mar 2023, just before SVB imploded). On Sunday night, the US agreed to a debt ceiling deal.

Last week UK inflation (CPI) fell back to 8.7% for April, though that is above the Bank of England’s forecast of 8.4%. Food price inflation remained closed to its 45-year peak of 19.1%. Central Banks encourage financial markets to focus on “core” inflation, which adjusts out volatile items like food and energy prices, rather than the headline number. This is a similar concept to companies removing exceptional items like write-downs or restructuring charges from their earnings calculation to produce a more flattering underlying number. The problem is that even this more flattering underlying/core inflation figure now looks bad, rising from +6.2% in March to +6.8% in April. That is a similar level to the early 1990s when interest rates were in double digits.

UK gilt yields jumped on the news, and the futures market is now suggesting interest rates will peak at above 5.25% at the end of this year. I raised the possibility last week that the UK stock market might do better than the housing market over the medium term. UK building society Nationwide, which is the UK’s second-largest mortgage lender after Lloyds/HBOS raised fixed-rate mortgages by 45bp last Friday, and I think it’s quite likely we see two-year fixes above 6%.

Last week we saw a very successful Mello conference in Chiswick. It was good to meet many Sharepad subscribers. It sounds like this one was particularly challenging for David to organise, with many company management preferring to present online, rather than physically meet investors. It was clear though that the people who did attend took a lot from the conference, comparing notes, swapping stories and chatting with management for more colour after the presentations.

Steve Clapham produced a rather downbeat presentation on the US stockmarket, which I agree with. He generalised from this to markets everywhere: but the FTSE 100, AIM and Japan have gone nowhere for a couple of decades. The chart below shows on a log scale the outperformance of the US (blue) versus the other stock market indices since the mid-1990s.

When I asked him about the reason for the difference, he suggested government borrowing, deregulation and poor infrastructure was the reason for poor UK performance. I don’t know the answer, but his reply made little sense to me and was met with scepticism from other members of the audience. My view is that we should be bearish on the US indices, but there will be some quality compounders emerging in the next decade, hopefully, less concentrated in the West Coast of the USA and instead more from the UK and elsewhere in the world.

Another observation is that London seems to be really buzzing. The UK is supposed to be close to a recession, with lots of gloom in the media. The evidence from my own eyes suggested activity and energy from people out and about in the city; first-hand research suggests that London pubs were full on Tuesday evening, despite a beer costing over £6 for a pint. Compare this to Berlin, where activity appears to be more subdued, Germany is in recession and forecast by the IMF to be the weakest of the world’s largest economies. I am sure that this will reverse at some point, and the UK will be in recession while Germany does better, and the UK media will be even more gloomy.

This week I look at AJ Bell, Eneraqua’s profit warning and Headlam. ETP published results which claimed to be “significantly ahead of previous management expectations” yet the share price was punished, falling -50%. Recently we have seen similar from Shoezone and SDI. I think that this trend of upbeat sounding – but vague – commentary from management in the RNS, but their brokers slashing forecasts for future years, is worth flagging. I may keep track of all of the company managements who include the phrase “ahead of expectations” in their RNS, but the share price falls – then publish the list in a few months.

AJ Bell H1 to March

The stockbroker and fund administrator, which naturally calls itself a platform, announced revenue +37% to £104m and PBT up +61% to £42m. That’s an impressive 40% PBT margin. They also raised their interim dividend +26%, which is a sign of confidence.

AJB Assets Under Administration (AuA) were up +7% to £69bn. They saw £2bn of net new inflows in H1, which compares to £3.2bn over the same period for Hargreaves Lansdown, which has roughly double the amount of AuA (£132bn). For comparison, abrdn has £69bn of AuA but hasn’t announced net flows for 2023 yet.

I was interested to compare prices, so I have taken fee information from each provider’s website. I have to admit that the disclosure of fees in this industry can be (deliberately) hard to compare. Below is my best effort to compare each company. Service levels, website clunkiness and dealing execution are much harder to compare, so this might not be comparing apples with apples.

Rising to £120 flat fee for those with over £30K

History: Founded in 1995 by Andy Bell and Nicholas Littlefair as a pension administrator, AJ Bell became an “execution only” online SIPP provider in 2000. In 2007 they acquired a stockbroker called Lawshare (now AJ Bell Securities) bringing ‘‘in-house’’ the provision of dealing, custody and investment administration services to Sippdeal and Sippcentre customers. The deal paved the way for the transformation to a full investment platform in 2011; offering ISAs and general investment/dealing accounts in addition to the existing SIPP products. In 2018, they listed at around 160p (range in the prospectus 154p to 166p) valuing the company at c. £650m. Customer numbers roughly doubled over the pandemic, to 445K, however, the shares also saw a sharp sell-off early last year as market conditions became more difficult and trading activity slowed.

Valuation: The shares are trading on 19x Sept 2024F and 17x Sept 2025F. Like HL. RoCE and EBIT margins are impressive but have been trending down in the last few years. The dividend yield of 3% is not as attractive as HL.’s or abrdn.

Opinion: Looks good. I own Hargreaves Lansdown, for me buying AJ Bell doesn’t add much diversification. This strikes me as a sector where amateur investors might enjoy an “edge” over professional fund managers. Investors can judge the marketing, evaluate the platforms, discuss with friends and take an informed view how well these companies are doing and invest accordingly.

Eneraqua FY Jan 2023 results

This energy and water efficiency company, which operates under the Cenergist brand, has reported remarkable results. They delivered +52% revenue growth to £55m, with a record order book of £130m and adj PBT growth of +79% to £10m for FY 2023. The outlook statement said that we should see revenues “significantly ahead” of previous management expectations for FY 2024F. Yet the share price crashed by 50% last week on the day of their results.

The damage appears to have been done by the phrase “high-single-digit PBT margins”, whereas Sharepad was showing PBT forecasts for Jan 2024F of £12.1m, implying a PBT margin of 13.6%. That implies that the profits could halve versus those prior forecasts. Management attribute this disappointment to inflation bringing forward higher margin work to the year just reported, and delaying lower margin projects pushed back to the current financial year. Other areas of concern are cash conversion declining alarmingly from 66% to -26% for FY Jan 2023. They expect cash conversion to recover to above 100% this financial year.

Group working capital strain meant that the balance sheet swung from £4.1m of net cash Jan 2022 to net debt of £3.0m just reported, excluding IFRS 16 liabilities. They put this down to longer lead times for components, plus clients making late changes to project plans which in turn meant an increased level of trade receivables at the year-end.

History: The company was founded by Mitesh Dhanak, the current CEO, in August 2012, to provide technical and financial consultancy to councils and housing associations, for instance, an £8m heating program with the London Borough of Hackney. In 2017 they then adapted their offering to “turnkey solutions”, for multiple occupancy social housing, focussing on heating and hot water systems. They have operations in the UK, Spain, the Netherlands and India.

They listed on AIM in November 2021, at 277p with the company receiving £9m, and selling shareholders receiving £8m. The market cap following admission was £92m, with 33.2m shares outstanding. They seem to have made a mistake with their prior year EPS calculation, with diluted EPS of either 18p (note 5 of the RNS) or 24.9p (table at the front of the RNS).

When they listed at the end of 2021, FinnCap was their NOMAD and broker, though they have now switched to Singers and Liberum. To switch advisers so soon after their IPO seems a little unusual.

Ownership: The founder / CEO’s wife owns 14% of the company, while he owns 5%, according to the company’s most recent October presentation on their website. The figures on Sharepad suggest 17%, which may be more up-to-date. Other insiders also owns substantial stakes. The largest institution is the wealth manager Charles Stanley 5.6%, followed by Slater Investments 5.1%.

Valuation: The shares are trading on 9x Jan 2025F, though I think there must be considerable uncertainty over the forecasts. There’s a small 1.2p dividend, but the yield is not going to provide much support. On the positive side, Sharepad’s financial health indicators reveal that the risk of a catastrophic failure are low.

Headlam AGM statement FY Dec 2023

This floor coverings business (carpets and tiles) that operates 67 brands across the UK (c. 87%) and Europe (c. 13%) announced an AGM update. Revenue for the first four months was up +3.4%, but they warn that was achieved with volumes in the residential market (c. 2/3 of group revenue) falling. I assume that when people move house they tend to buy new carpets etc so the HEAD investment case probably is sensitive to the housing market. I noted that even before last week’s inflation data, UK mortgage approvals for house purchases were down -36% Q1 v Q1 last year. That said, Sharepad was showing forecast revenue growth of less than 1% in Dec 2023F, to £667m, rising to +3% in 2024F. The AGM statement also talks about a lower gross margin, and before last week EPS was forecast to decline -23%, so management seem to have set expectations low.

Like ETP, the financial health indicators are suggesting that though earnings might disappoint, the balance sheet is less likely to be a problem.

Valuation: The shares are trading on 7.5x PER Dec 2024F. In 2024F the dividend yield at 7.6% is actually higher than the PER ratio of 7.5x the same year. Before the pandemic, this was delivering mid-teens RoCE, though top-line growth was only low single digits.

Opinion: This looks like it could be interesting – at the right time. The FY Dec presentation (released in March) talks about £200m of revenue growth over the next five years, which would imply revenue of +5% CAGR. Fundamentally I don’t think there’s much wrong with the company’s medium-term investment case, conditions are clearly difficult now and if anything may deteriorate further. My view on the UK housing market is negative, so I would not buy now though.

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.