UK banks BARC and NWG reported Q1 results, with contrasting trends in customer deposits. Also covered: bid approaches for MGP, NUM and SMV, plus a look at AOM.

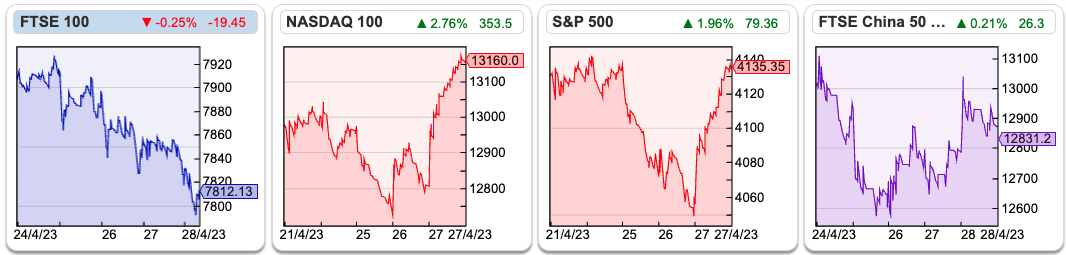

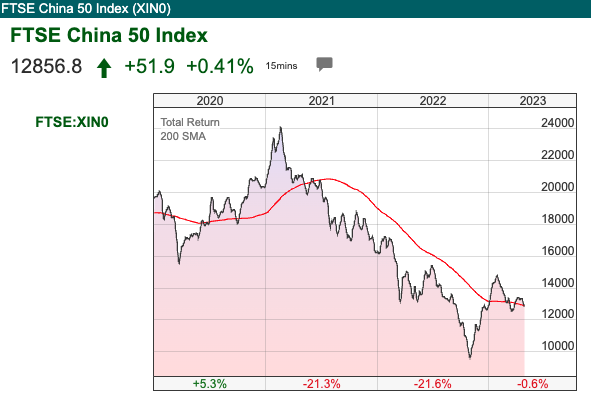

Last week the FTSE 100 was down -1.3% to 7,812. The Nasdaq100 was up +1.3% while the S&P 500 was broadly flat in the last 5 days. The FTSE China 50 was down -1.5% in the last 5 days and down -15% from its peak at the end of January. This FT article suggests half a trillion dollars have been wiped off the value of Chinese equities since mid-April.

I mention this because both Matt King at Citi and Mike Howell at CrossBorder Capital have a theory that Asian Central Banks (mainly China and Japan) have created hundreds of billions of dollars of liquidity, which has driven the global rally since last October. They differ in their conclusions, with Matt King suggesting that this is not sustainable, and a sell-off is likely. Mike Howell has been more optimistic but is now becoming concerned about a liquidity crunch. Either way, it might make sense to look to the Chinese stock market as a lead indicator for the S&P500, FTSE and AIM.

Last week we saw a bid approaches for three companies i) healthcare company Medica, ii) stockbroker Numis and iii) mortgage conveyancer Smoove (I own the latter). While the bid premium for Medica was not particularly generous, Deutsche Bank are offering a whopping +72% premium to the undisturbed Numis share price. Deutsche bought Morgan Grenfell in the early 1990s, however just before the pandemic they closed their entire equities business. European banks have rarely been considered “smart money” when acquiring London-based stockbrokers. More recently the German bank was seen as potentially affected by the same issues as Credit Suisse and Deutsche shares fall -27% in the middle of March.

This week I start with a look at Barclays and NatWest Q1 results, and see how these banks are doing in light of problems with US regional banks and Credit Suisse in March. Barclays results looked reassuring, but the £20bn of deposit outflows at NatWest are more concerning. Lloyds Q1 results will be on 3rd May, if I had to guess I would suggest the trends might resemble NWG more than BARC.

I then go on to look at Medica, Smoove and ActiveOps.

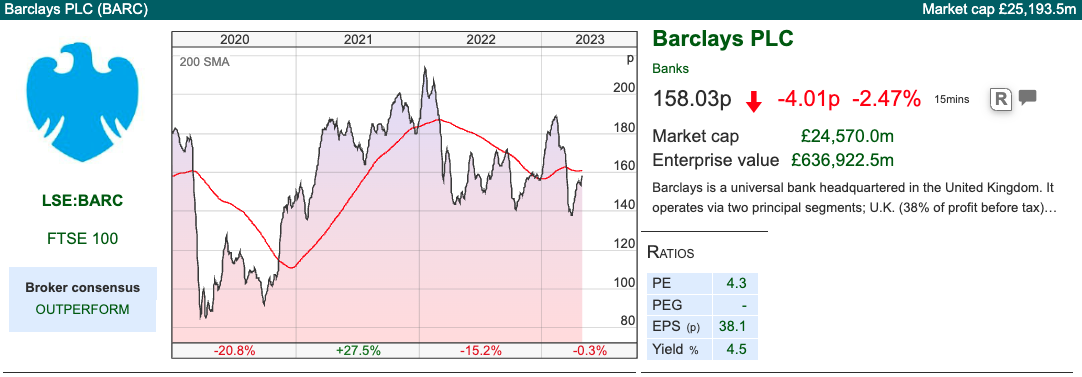

Barclays Q1 March results

Barclays UK retail bank reported customer deposits shrinking by 1% to £54bn, with the loan/deposit ratio rising from 87% in Dec to 90% at the end of March, in part because they bought specialist mortgage lender Kensington Mortgages (KMC) last quarter. Banks used to operate with a loans/deposit ratio of between 1.3x and 1.7x before the financial crisis (Northern Rock, with its reliance on wholesale funding was an outlier with a L/D ratio above 3x).

The UK bank bad debt impairments more than doubled to £113m in the quarter, v Q1 2022, which equates to 20bp of loans (very manageable). Rising bad debts didn’t prevent UK bank PBT increasing +27% to £754m and the UK bank reporting a Return on Tangible Equity of 20%. Net Interest Margin was 3.18% in Q1 2023, versus 2.62% as the bank failed to pass on the benefit of rising interest rates to savers. The Global Markets business (what used to be Barclays Capital) saw revenues decline -8% to £2,492 and Investment Banking fees were down -7% to £603m. So struggling a bit in the current environment, but not disastrous either.

Deposit balances for Barclays group were up £9.9bn in Q1 to £556bn. The group also reported a Liquidity Coverage Ratio (LCR) of 163% and a Net Stable Funding Ratio (NSFR) of 139%, both well above the regulatory minimum. Group RoTE was 15% for Q1, versus FY 2022 of 10.4%. The Core Equity Tier 1 ratio was 13.6%. In summary, investors were reassured by the bank’s reported numbers.

Valuation: Barclays Tangible Book Value was 301p, so the shares are trading at 50% discount to book. The current valuation implies that RoTE will fall back below the bank’s cost of equity. That’s possible, however, the bank’s valuation is already discounting significant deterioration.

Opinion: I’m not a fan of the universal banking model, as I think borrowers have received a much better deal than savers and shareholders over the last couple of decades. Barclays do look as if they are navigating this difficult environment better than NatWest which I look at below.

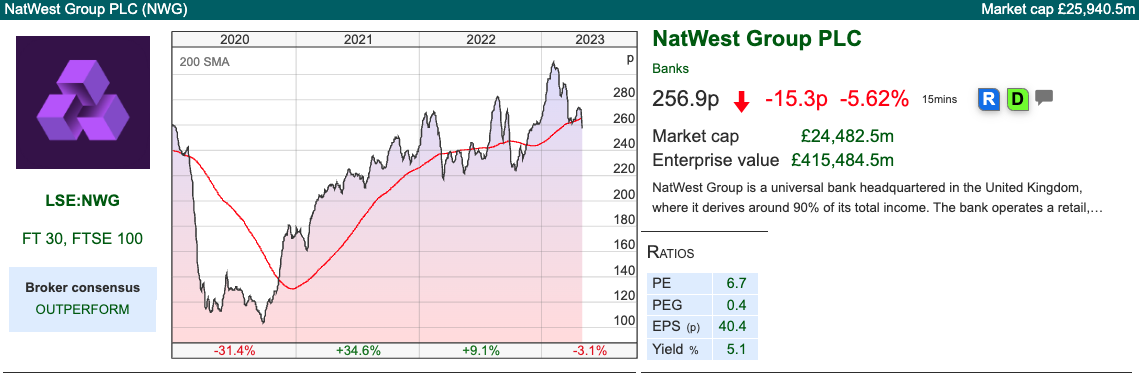

NatWest Q1 March results

NatWest’s UK Retail Banking division reported total income up +32% and PBT up +40%. However, that division did see around £4bn of deposit outflows. Management attribute deposit outflows to customers having to make payments to the Inland Revenue and increased competition for savings, rather than events in the USA or Switzerland. Private Banking, which presumably is wealthy customers with higher balances, also saw deposit outflows of £3.9bn, of 9.5% of starting balances. The Commercial & Institutional division, which will be uninsured corporate deposits saw balances decrease by less than 2%.

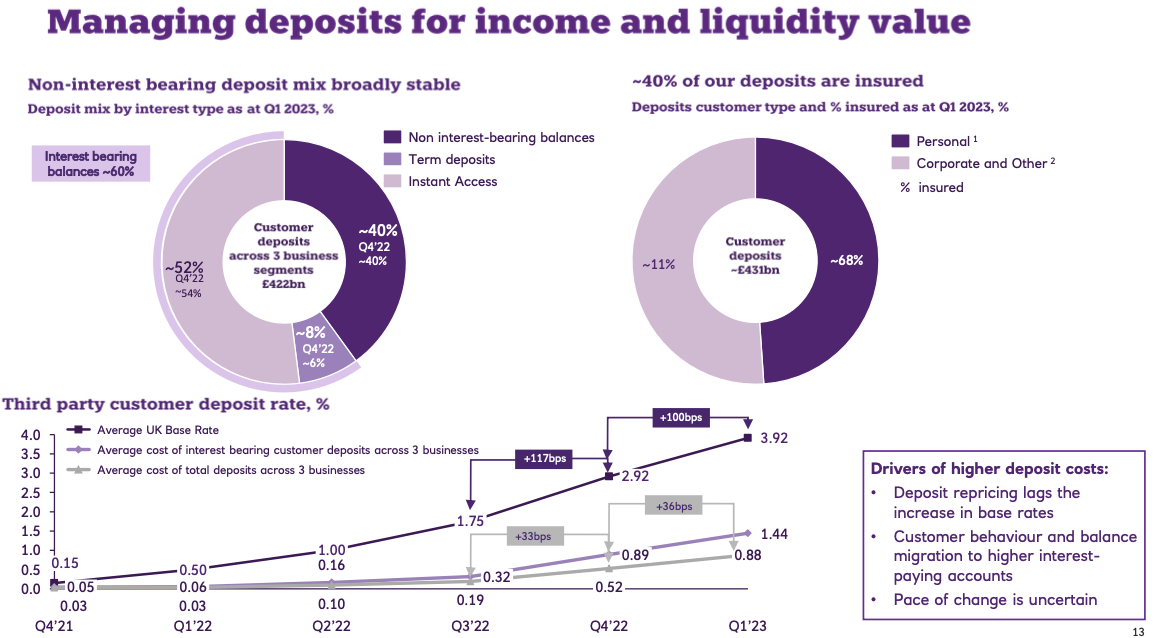

Group deposit balances stood at £430.5bn at the end of the quarter, down by £20bn. That compares to £4bn of deposit growth in Q1 2022 last year. Annualising the current rate of deposit outflows would suggest around -18% decline over the year, which I think would be concerning. We may see margin pressure as the bank has to pass on the benefit of interest rate rises to savers or pay up to attract wholesale funding. The LCR at 139% was lower than BARC’s. The NSFR at 141% was slightly better than BARC but was down from 152% in Mar 2022. Management put up this slide below, which I’m not sure is as reassuring as they intend it to be.

Valuation: NWG is currently trading on 5x Dec 2024F PER, and the shares are trading on a slight discount to the tangible book value of 278p. Valuation alone is rarely a good reason to buy bank shares, in my experience.

Opinion: Marshall Wace, the shrewd hedge fund, disclosed a significant short position in the shares in early April. I think that this is likely Ian Smillie, another ex-CSFB banks analyst I worked with. Ian was the equity research analyst at ABN Amro in 2008 when the Dutch bank were taken over by Royal Bank. He then left RBS to work at Marshall Wace, and the hedge fund promptly opened a short position on his former employer. I bumped into Ian in the pub around that time, and he told me over a beer that he was dubious that RBS would be able to return excess capital to shareholders, which subsequent events proved to be the correct analysis. If you are long NatWest, then you should bear in mind that there’s some smart money on the other side of the trade.

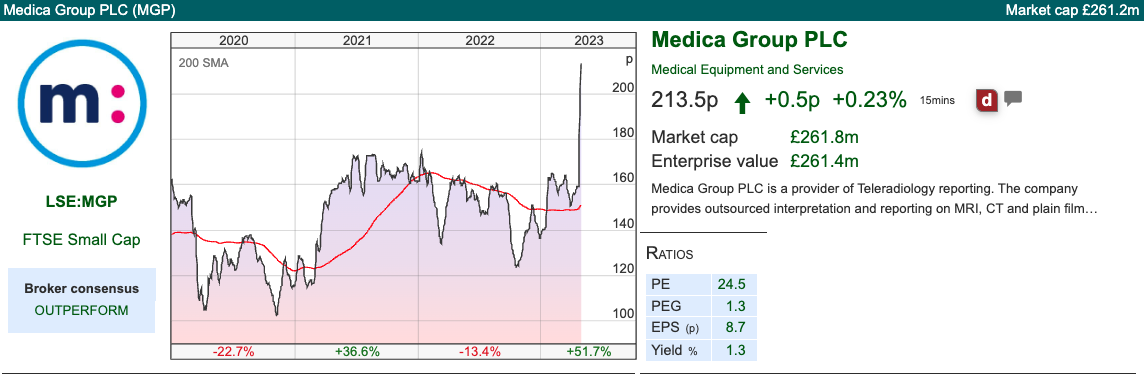

Medica Private Equity bid

Medica announced a 212p cash bid from Private Equity firm IK Investment Partners. That represents a +33% premium to the previous closing price, and values MGP at a PER of 18x Dec 2024F, dropping to below 15x 2025F. The price-to-sales multiple of the bid is 2.8x Dec 2024F. IK’s bid has been recommended by the board but only has 20% irrevocable undertakings which is quite low. We may see a rival bid emerge, and the share price is trading slightly above the 212p level. The deal is structured as a scheme of arrangement, so needs 75% rather than 90% acceptance.

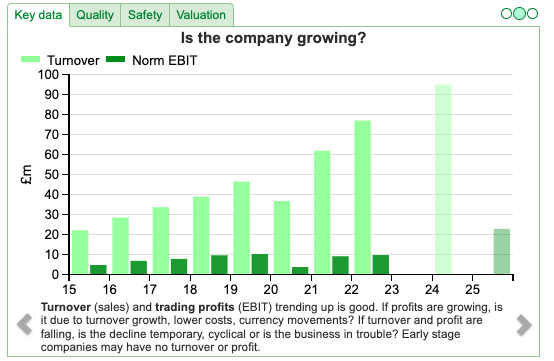

I last wrote about MGP here, the company was listed on the LSE in March 2017 at 135p (implying a price/revenue multiple of 4.5x, roughly double what IK’s bid values the company at) by Private Equity firm CBPE. After six years as a listed company, a Private Equity bid of just 212p doesn’t seem like a good return for shareholders who have held over that time. Despite being a health company that helps the NHS outsource interpretation of MRI and CT scans, the company had a difficult pandemic as non-urgent surgery was put on hold. The NHS is now working through the backlog though and MGP revenues have more than doubled in the two years to FY Dec 2022.

Shareholders: Gresham House owns 19.7% and they have given their irrevocable undertakings to the bidco). However, Aberforth Partners 9%, BGF IM, 6%, Fidelity 5.3%, Artemis 4.99%, Miton 4.9% and several other institutions on the register have not.

Opinion: This seems a fair price, but not overly generous. I don’t own the shares, but generally am against buying IPOs from PE firms. By the same token, I would be reluctant to sell to a PE firm, unless the takeover premium was substantial. My impression is that PE firms rarely make money by improving businesses, instead the bulk of their gains come from timing their buying and selling activity (ie at attractive prices to the PE firm) and this extracts value at the expense of public market investors in the listed companies.

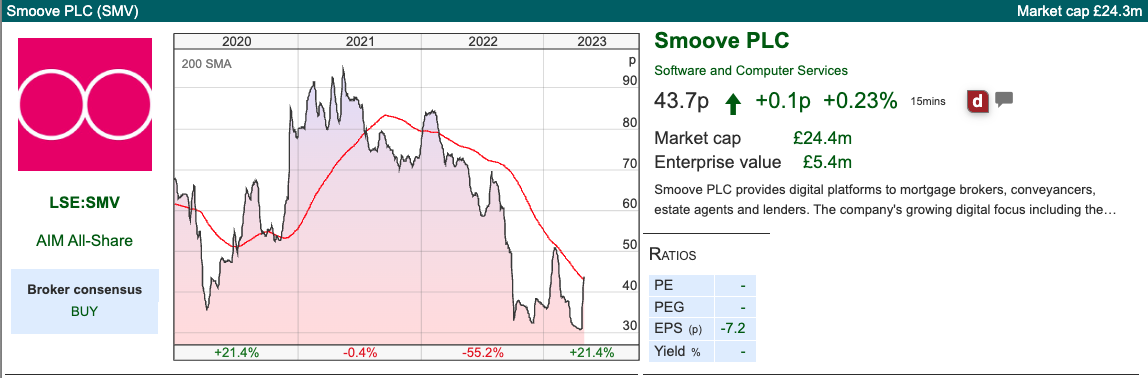

Smoove bid

Smoove, the mortgage conveyancing company that used to be called ULS Technology, also announced a couple of approaches. One came from PEXA Group, an Australian conveyancing firm that also has operations in the UK. The UK Takeover Code panel rules require PEXA to either make an offer by 5pm on 22 May or announce that it does not intend to make an offer. The so-called “Put Up or Shut Up” rule means that Pexa can’t then come back with another offer within 12 months.

A second approach for SMV came from somewhere else, but a transaction that would not have been covered by the Takeover Panel rules – which normally require anyone buying more than 30% of the shares to make an offer for the entire company. That second approach has now been withdrawn though. Curious!

I own the shares and am now pleased that I “averaged down” a month ago. My thinking was that performance ought to improve at some point and the valuation was too pessimistic as SMV’s market cap was close to the £17m cash balance that it reported for H1 to 30th September. Smoothe has a March year-end, and last year they put out a trading statement at the end of April, so management should now put out a trading statement updating investors on progress for FY Mar 2023F.

The current forecasts in the market are for a £6m pre-tax loss this year, and a £4m pre-tax loss FY Mar 2024F. The latest data from the Bank of England shows mortgage approvals for house purchases down -37% y-o-y, so it’s currently a tough operating environment for mortgage conveyancing. However, assuming Smoove’s conveyancing solution, called Digital Move, really is as good as management claim they ought to be taking market share in a shrinking market.

Opinion: There’s not enough information to form a view at the moment. I’m not intending to sell my shares unless there’s a very attractive offer. SMV valuation peaked at almost 160p in 2018, so I would imagine that many other investors are keen to see a successful turnaround plan executed, rather than sell out at the bottom of the market.

ActiveOps FY Mar Trading Update

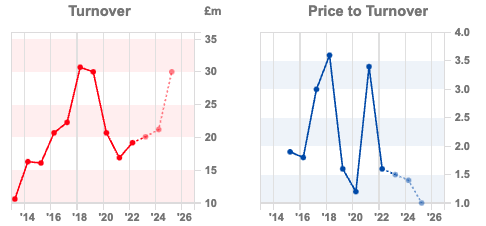

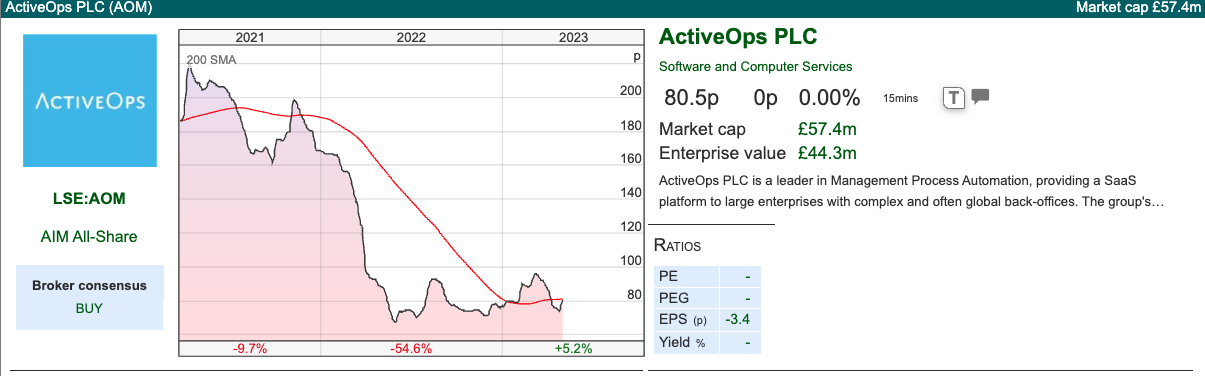

At the back of my mind is a note to look out for some of the 2021 IPOs that have sold off more than -50%, as some of these could now have an attractive investment case. ActiveOps is a Management Process Automation (MPA) enterprise software company that could be an example. They said last week they would be ahead of market expectations (range £24.6-£25.1m for revenue, and an £0.5m adj EBITDA loss).

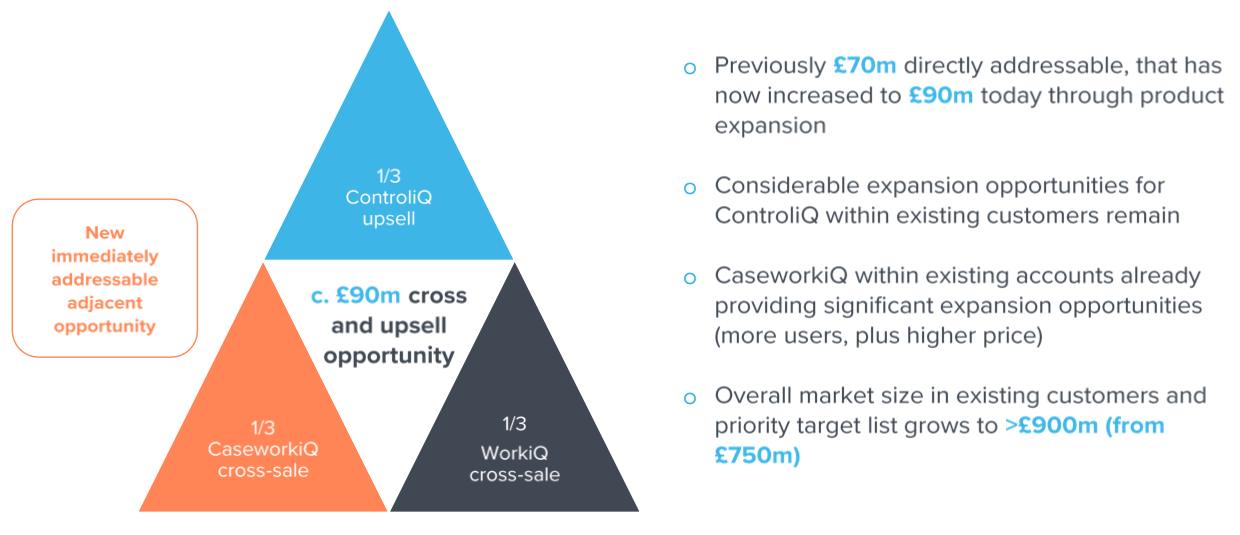

Being harsh, it looks like revenue is only slightly ahead, the RNS says “at least” £25m, implying +11% growth. On the adj EBITDA line last year’s loss reverses to an expected positive (though presumably still loss-making on a statutory basis). Slightly disappointingly they point to currency movements, rather than anything more fundamental as a source of the positive surprise. In their H1 presentation, they talk about a £90m cross and upsell opportunity, which implies revenues could grow by 3.5x from the current FY Mar 2023F level.

The company has offices in 7 countries, but its software is used in over 40 countries, presumably as the corporates they sell to are multi-nationals. At H1 revenue was split 53% Europe and Middle East, 25% North America and 23% Asia. They have 80 clients, including banks and insurance companies. They sell their software through established partnerships with consultancies such as KPMG and PricewaterhouseCoopers and providers of complementary enterprise software such as Microsoft.

History: The company’s history goes back to 1994 when co-founders Richard Jeffrey and Neil Bentley worked as management consultants at a firm called OCP and developed the AOM methodology. In 2005 they quit OCP, to develop their operations management software business and offer a cloud-based solution. Originally OCP was a shareholder but sold in 2007. Calculus Capital, an EIS investment vehicle founded by ex -Phillips and Drew/UBS corporate financier John Glencross invested £5m in 2014. In Aug 2019 AOM bought US-based OpenConnect for $7m. Then in 2020, they sold a non-core business to Rocket Software for $19m, meaning that by the end of Dec 2020, they had £7m of net cash, so they didn’t need to come to AIM to raise money.

Like many “vaccine rally” IPOs this looks like a case of selling shareholders taking advantage of frothy market conditions to exit. The company listed in March 2021, at 168p, with selling shareholders (Calculus Capital, Neil Bentley, Paul Moroney and the Hauschild family) receiving £75m. Calculus sold down their 29% stake to 6%.

The IPO valued the company on admission at a market cap of £120m. The shares sold off sharply in the first half of 2022, however looking at their March 2022 trading update it’s hard to understand what caused that. The company’s March 2022 RNS said that “trading is in line with previously upwardly revised management expectations”. Perhaps it was caused by lockups expiring, but Sharepad doesn’t show Directors selling at that time. In fact, Chief Executive Richard Jeffrey bought 157K shares at 95p in March last year following the sell-off, he currently owns 13.7%.

Shareholders: Schroders own 8.6%, Tellworth 6.3%, Gresham House 4.9%, Scottish Value 3.6% and Soros 3%. Presumably, most of these institutions (not Calculus who were sellers) backed the IPO at the wrong price.

Valuation: The shares are trading on 2.2x Mar 2024F revenues. They are currently loss-making, so they report negative EBIT margin and RoCE, but the gross margin at 80% is attractive. Although not profitable, they appear to be strongly cash generative with £15.4m of net cash at the year-end, up from £11m in March. The RNS says that cash has risen to £17.5m after the March year-end, which currently represents 30% of the market cap.

Opinion: I bought a starter position last week, attracted by the long history, growing revenue, operational gearing and cash. There are obviously risks because it is not clear to me what caused the sell-off this time last year. In December last year, Martin Flitton wrote up the investment case. He then added to his thoughts following last week’s RNS, concluding: “The drivers for the business appear firmly intact, with hybrid working and continued digitalisation playing to its strengths, along with business belt tightening historically benefitting the likes of AOM.” I intend to use Sharepad to do more research and understand the investment case better before increasing (or cutting back) my position size.

Notes

The author owns shares in Smoove and ActiveOps

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Weekly Market Commentary | 02/05/23 | BARC, NWG, MGP, NUM, SMV, AOM | A liquidity crunch?

UK banks BARC and NWG reported Q1 results, with contrasting trends in customer deposits. Also covered: bid approaches for MGP, NUM and SMV, plus a look at AOM.

Last week the FTSE 100 was down -1.3% to 7,812. The Nasdaq100 was up +1.3% while the S&P 500 was broadly flat in the last 5 days. The FTSE China 50 was down -1.5% in the last 5 days and down -15% from its peak at the end of January. This FT article suggests half a trillion dollars have been wiped off the value of Chinese equities since mid-April.

I mention this because both Matt King at Citi and Mike Howell at CrossBorder Capital have a theory that Asian Central Banks (mainly China and Japan) have created hundreds of billions of dollars of liquidity, which has driven the global rally since last October. They differ in their conclusions, with Matt King suggesting that this is not sustainable, and a sell-off is likely. Mike Howell has been more optimistic but is now becoming concerned about a liquidity crunch. Either way, it might make sense to look to the Chinese stock market as a lead indicator for the S&P500, FTSE and AIM.

Last week we saw a bid approaches for three companies i) healthcare company Medica, ii) stockbroker Numis and iii) mortgage conveyancer Smoove (I own the latter). While the bid premium for Medica was not particularly generous, Deutsche Bank are offering a whopping +72% premium to the undisturbed Numis share price. Deutsche bought Morgan Grenfell in the early 1990s, however just before the pandemic they closed their entire equities business. European banks have rarely been considered “smart money” when acquiring London-based stockbrokers. More recently the German bank was seen as potentially affected by the same issues as Credit Suisse and Deutsche shares fall -27% in the middle of March.

This week I start with a look at Barclays and NatWest Q1 results, and see how these banks are doing in light of problems with US regional banks and Credit Suisse in March. Barclays results looked reassuring, but the £20bn of deposit outflows at NatWest are more concerning. Lloyds Q1 results will be on 3rd May, if I had to guess I would suggest the trends might resemble NWG more than BARC.

I then go on to look at Medica, Smoove and ActiveOps.

Barclays Q1 March results

Barclays UK retail bank reported customer deposits shrinking by 1% to £54bn, with the loan/deposit ratio rising from 87% in Dec to 90% at the end of March, in part because they bought specialist mortgage lender Kensington Mortgages (KMC) last quarter. Banks used to operate with a loans/deposit ratio of between 1.3x and 1.7x before the financial crisis (Northern Rock, with its reliance on wholesale funding was an outlier with a L/D ratio above 3x).

The UK bank bad debt impairments more than doubled to £113m in the quarter, v Q1 2022, which equates to 20bp of loans (very manageable). Rising bad debts didn’t prevent UK bank PBT increasing +27% to £754m and the UK bank reporting a Return on Tangible Equity of 20%. Net Interest Margin was 3.18% in Q1 2023, versus 2.62% as the bank failed to pass on the benefit of rising interest rates to savers. The Global Markets business (what used to be Barclays Capital) saw revenues decline -8% to £2,492 and Investment Banking fees were down -7% to £603m. So struggling a bit in the current environment, but not disastrous either.

Deposit balances for Barclays group were up £9.9bn in Q1 to £556bn. The group also reported a Liquidity Coverage Ratio (LCR) of 163% and a Net Stable Funding Ratio (NSFR) of 139%, both well above the regulatory minimum. Group RoTE was 15% for Q1, versus FY 2022 of 10.4%. The Core Equity Tier 1 ratio was 13.6%. In summary, investors were reassured by the bank’s reported numbers.

Valuation: Barclays Tangible Book Value was 301p, so the shares are trading at 50% discount to book. The current valuation implies that RoTE will fall back below the bank’s cost of equity. That’s possible, however, the bank’s valuation is already discounting significant deterioration.

Opinion: I’m not a fan of the universal banking model, as I think borrowers have received a much better deal than savers and shareholders over the last couple of decades. Barclays do look as if they are navigating this difficult environment better than NatWest which I look at below.

NatWest Q1 March results

NatWest’s UK Retail Banking division reported total income up +32% and PBT up +40%. However, that division did see around £4bn of deposit outflows. Management attribute deposit outflows to customers having to make payments to the Inland Revenue and increased competition for savings, rather than events in the USA or Switzerland. Private Banking, which presumably is wealthy customers with higher balances, also saw deposit outflows of £3.9bn, of 9.5% of starting balances. The Commercial & Institutional division, which will be uninsured corporate deposits saw balances decrease by less than 2%.

Group deposit balances stood at £430.5bn at the end of the quarter, down by £20bn. That compares to £4bn of deposit growth in Q1 2022 last year. Annualising the current rate of deposit outflows would suggest around -18% decline over the year, which I think would be concerning. We may see margin pressure as the bank has to pass on the benefit of interest rate rises to savers or pay up to attract wholesale funding. The LCR at 139% was lower than BARC’s. The NSFR at 141% was slightly better than BARC but was down from 152% in Mar 2022. Management put up this slide below, which I’m not sure is as reassuring as they intend it to be.

Valuation: NWG is currently trading on 5x Dec 2024F PER, and the shares are trading on a slight discount to the tangible book value of 278p. Valuation alone is rarely a good reason to buy bank shares, in my experience.

Opinion: Marshall Wace, the shrewd hedge fund, disclosed a significant short position in the shares in early April. I think that this is likely Ian Smillie, another ex-CSFB banks analyst I worked with. Ian was the equity research analyst at ABN Amro in 2008 when the Dutch bank were taken over by Royal Bank. He then left RBS to work at Marshall Wace, and the hedge fund promptly opened a short position on his former employer. I bumped into Ian in the pub around that time, and he told me over a beer that he was dubious that RBS would be able to return excess capital to shareholders, which subsequent events proved to be the correct analysis. If you are long NatWest, then you should bear in mind that there’s some smart money on the other side of the trade.

Medica Private Equity bid

Medica announced a 212p cash bid from Private Equity firm IK Investment Partners. That represents a +33% premium to the previous closing price, and values MGP at a PER of 18x Dec 2024F, dropping to below 15x 2025F. The price-to-sales multiple of the bid is 2.8x Dec 2024F. IK’s bid has been recommended by the board but only has 20% irrevocable undertakings which is quite low. We may see a rival bid emerge, and the share price is trading slightly above the 212p level. The deal is structured as a scheme of arrangement, so needs 75% rather than 90% acceptance.

I last wrote about MGP here, the company was listed on the LSE in March 2017 at 135p (implying a price/revenue multiple of 4.5x, roughly double what IK’s bid values the company at) by Private Equity firm CBPE. After six years as a listed company, a Private Equity bid of just 212p doesn’t seem like a good return for shareholders who have held over that time. Despite being a health company that helps the NHS outsource interpretation of MRI and CT scans, the company had a difficult pandemic as non-urgent surgery was put on hold. The NHS is now working through the backlog though and MGP revenues have more than doubled in the two years to FY Dec 2022.

Shareholders: Gresham House owns 19.7% and they have given their irrevocable undertakings to the bidco). However, Aberforth Partners 9%, BGF IM, 6%, Fidelity 5.3%, Artemis 4.99%, Miton 4.9% and several other institutions on the register have not.

Opinion: This seems a fair price, but not overly generous. I don’t own the shares, but generally am against buying IPOs from PE firms. By the same token, I would be reluctant to sell to a PE firm, unless the takeover premium was substantial. My impression is that PE firms rarely make money by improving businesses, instead the bulk of their gains come from timing their buying and selling activity (ie at attractive prices to the PE firm) and this extracts value at the expense of public market investors in the listed companies.

Smoove bid

Smoove, the mortgage conveyancing company that used to be called ULS Technology, also announced a couple of approaches. One came from PEXA Group, an Australian conveyancing firm that also has operations in the UK. The UK Takeover Code panel rules require PEXA to either make an offer by 5pm on 22 May or announce that it does not intend to make an offer. The so-called “Put Up or Shut Up” rule means that Pexa can’t then come back with another offer within 12 months.

A second approach for SMV came from somewhere else, but a transaction that would not have been covered by the Takeover Panel rules – which normally require anyone buying more than 30% of the shares to make an offer for the entire company. That second approach has now been withdrawn though. Curious!

I own the shares and am now pleased that I “averaged down” a month ago. My thinking was that performance ought to improve at some point and the valuation was too pessimistic as SMV’s market cap was close to the £17m cash balance that it reported for H1 to 30th September. Smoothe has a March year-end, and last year they put out a trading statement at the end of April, so management should now put out a trading statement updating investors on progress for FY Mar 2023F.

The current forecasts in the market are for a £6m pre-tax loss this year, and a £4m pre-tax loss FY Mar 2024F. The latest data from the Bank of England shows mortgage approvals for house purchases down -37% y-o-y, so it’s currently a tough operating environment for mortgage conveyancing. However, assuming Smoove’s conveyancing solution, called Digital Move, really is as good as management claim they ought to be taking market share in a shrinking market.

Opinion: There’s not enough information to form a view at the moment. I’m not intending to sell my shares unless there’s a very attractive offer. SMV valuation peaked at almost 160p in 2018, so I would imagine that many other investors are keen to see a successful turnaround plan executed, rather than sell out at the bottom of the market.

ActiveOps FY Mar Trading Update

At the back of my mind is a note to look out for some of the 2021 IPOs that have sold off more than -50%, as some of these could now have an attractive investment case. ActiveOps is a Management Process Automation (MPA) enterprise software company that could be an example. They said last week they would be ahead of market expectations (range £24.6-£25.1m for revenue, and an £0.5m adj EBITDA loss).

Being harsh, it looks like revenue is only slightly ahead, the RNS says “at least” £25m, implying +11% growth. On the adj EBITDA line last year’s loss reverses to an expected positive (though presumably still loss-making on a statutory basis). Slightly disappointingly they point to currency movements, rather than anything more fundamental as a source of the positive surprise. In their H1 presentation, they talk about a £90m cross and upsell opportunity, which implies revenues could grow by 3.5x from the current FY Mar 2023F level.

The company has offices in 7 countries, but its software is used in over 40 countries, presumably as the corporates they sell to are multi-nationals. At H1 revenue was split 53% Europe and Middle East, 25% North America and 23% Asia. They have 80 clients, including banks and insurance companies. They sell their software through established partnerships with consultancies such as KPMG and PricewaterhouseCoopers and providers of complementary enterprise software such as Microsoft.

History: The company’s history goes back to 1994 when co-founders Richard Jeffrey and Neil Bentley worked as management consultants at a firm called OCP and developed the AOM methodology. In 2005 they quit OCP, to develop their operations management software business and offer a cloud-based solution. Originally OCP was a shareholder but sold in 2007. Calculus Capital, an EIS investment vehicle founded by ex -Phillips and Drew/UBS corporate financier John Glencross invested £5m in 2014. In Aug 2019 AOM bought US-based OpenConnect for $7m. Then in 2020, they sold a non-core business to Rocket Software for $19m, meaning that by the end of Dec 2020, they had £7m of net cash, so they didn’t need to come to AIM to raise money.

Like many “vaccine rally” IPOs this looks like a case of selling shareholders taking advantage of frothy market conditions to exit. The company listed in March 2021, at 168p, with selling shareholders (Calculus Capital, Neil Bentley, Paul Moroney and the Hauschild family) receiving £75m. Calculus sold down their 29% stake to 6%.

The IPO valued the company on admission at a market cap of £120m. The shares sold off sharply in the first half of 2022, however looking at their March 2022 trading update it’s hard to understand what caused that. The company’s March 2022 RNS said that “trading is in line with previously upwardly revised management expectations”. Perhaps it was caused by lockups expiring, but Sharepad doesn’t show Directors selling at that time. In fact, Chief Executive Richard Jeffrey bought 157K shares at 95p in March last year following the sell-off, he currently owns 13.7%.

Shareholders: Schroders own 8.6%, Tellworth 6.3%, Gresham House 4.9%, Scottish Value 3.6% and Soros 3%. Presumably, most of these institutions (not Calculus who were sellers) backed the IPO at the wrong price.

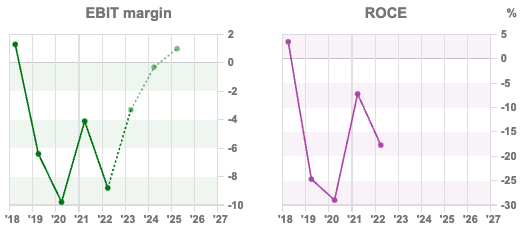

Valuation: The shares are trading on 2.2x Mar 2024F revenues. They are currently loss-making, so they report negative EBIT margin and RoCE, but the gross margin at 80% is attractive. Although not profitable, they appear to be strongly cash generative with £15.4m of net cash at the year-end, up from £11m in March. The RNS says that cash has risen to £17.5m after the March year-end, which currently represents 30% of the market cap.

Opinion: I bought a starter position last week, attracted by the long history, growing revenue, operational gearing and cash. There are obviously risks because it is not clear to me what caused the sell-off this time last year. In December last year, Martin Flitton wrote up the investment case. He then added to his thoughts following last week’s RNS, concluding: “The drivers for the business appear firmly intact, with hybrid working and continued digitalisation playing to its strengths, along with business belt tightening historically benefitting the likes of AOM.” I intend to use Sharepad to do more research and understand the investment case better before increasing (or cutting back) my position size.

Notes

The author owns shares in Smoove and ActiveOps

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.