We have seen a disconnect between the performance of Nasdaq 100 (+19% YTD) versus US regional banks (-28% YTD). Companies covered: two large acquisitions by RAT, FRAN plus G4M’s profit warning.

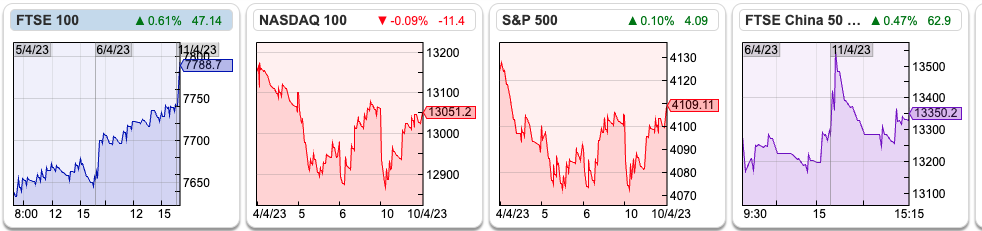

The FTSE 100 was up +2% over the last 5 trading days to 7,788. The S&P500 was flat, while the Nasdaq100 was down -1% over the same time period. Gold has reached $2030 per ounce and is now up +12% YTD. That compares to the industrial metal copper +5% YTD and oil -1% YTD at $85 per barrel of Brent Crude. The US 10Y is yielding 3.4%, which is a similar level to 6 months ago, though the yield curve has become significantly more inverted (which is normally a recession indicator).

The FTSE 100 was up +2% over the last 5 trading days to 7,788. The S&P500 was flat, while the Nasdaq100 was down -1% over the same time period. Gold has reached $2030 per ounce and is now up +12% YTD. That compares to the industrial metal copper +5% YTD and oil -1% YTD at $85 per barrel of Brent Crude. The US 10Y is yielding 3.4%, which is a similar level to 6 months ago, though the yield curve has become significantly more inverted (which is normally a recession indicator).

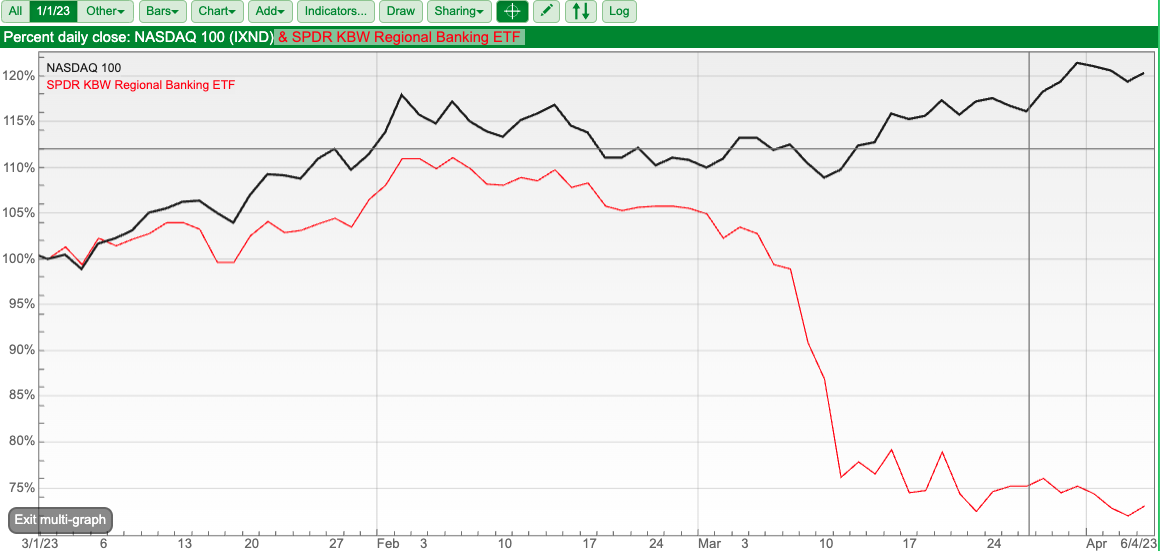

I enjoy the flexibility of Sharepad’s multigraph feature, which allows users to compare not just a variety of companies with each other, but also Indices (for instance the Nasdaq 100) with an ETF (The KBW Regional Bank ETF). That chart (below) reveals a remarkable disconnect with the Nasdaq 100 (up +19% YTD) versus the KRE US regional banks index (down -28% YTD). Within the Nasdaq, NVIDIA the GPU chip maker is the best performer YTD, up +85%, and Meta (previously known as Facebook) the second best, up +80% YTD. Both of those companies have a market cap of over half a trillion dollars. Ironically, banking problems and the liquidity support response provided by Central Banks appear to be most helpful to large, cash-rich tech firms.

The tech firms may not be immune from banking problems. One pathway through which this might happen is Venture Capital firms. In the UK many VC firms have retained large stakes in businesses that they have listed. For instance, IP Group still owns just over 10% of Oxford Nanopore, Andreessen Horowitz 8.6% of Wise, Index Ventures is the largest shareholder in Funding Circle with 16%, and Exponent owns 12% of Moonpig. Retaining an equity stake in an asset you are selling is a sensible way of insuring against the regret of allowing the buyer to capture the subsequent upside. If we are entering a more difficult funding environment for start-ups, now that lock-ups are expiring we may see the VCs sell their more liquid public market holdings to support loss-making, earlier-stage unlisted start-ups. That in turn may put pressure on the share prices of WISE, ONT, FCH or MOON. Indeed, we may see a disconnect between recently listed tech companies, and more established tech.

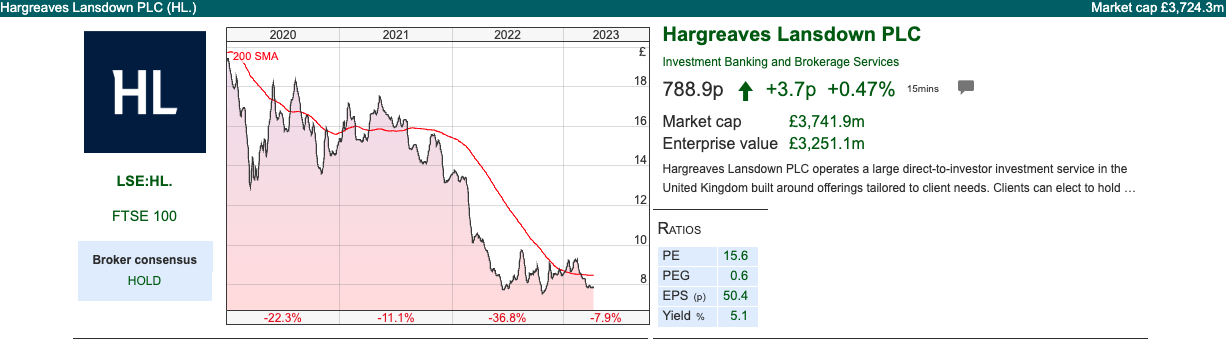

I remain cautiously positioned, but have recently bought some Hargreaves Lansdown shares. The HL. share price is down -20% from the beginning of March, and the dividend yield is now above 5%, so I think the investment case should be relatively defensive. I also have a soft spot for highly profitable companies which have recently experienced declining revenues; HL. revenue fell -8% to June 2022. I’d rather buy into those types of companies than fast-growing story stocks that don’t generate profits.

I’ve also used HL. to buy a Blackrock cash fund, yielding just under 4% after costs, versus 1% I was earning in my savings account at a high street bank. Previously I had believed that banks net interest margins would expand as interest rates rose, and inevitably banks would not pass on the benefit of higher rates to savers. I had not appreciated how easy it has become to buy higher-yielding cash money market funds in the UK, through the likes of HL. and similar. This strikes me as a reason to question the investment case in UK banks and rising interest rates, as their funding costs could squeeze net interest margins faster than investors were anticipating.

None of my portfolio changes should be interpreted as recommendations; the point of Sharepad is to allow users to do their own research, think and invest independently. I believe that it is helpful to share my thought process, particularly when I change my mind.

This week I look at a couple of deals: Investec has sold their Wealth and Investment division for £839m in Rathbones equity. Franchise Brands has made a large acquisition from a financial seller. Plus Gear4Music’s profit warning.

Rathbones Investec

Rathbones announced last week that it is buying the Wealth and Investments (W&I) division of Investec, the London-listed South African bank, for an implied value of £839m in an all-share deal. Investec will become Rathbones largest shareholder, with a 41.25% of the economic interest, but 29.9% of the voting rights. Keeping the voting rights below the 30% threshold means that Investec doesn’t need to make an offer for all of Rathbones, which is the normal Takeover Panel rule. Investec will have a 2-year lock-up when it won’t be able to sell Rathbones shares, then in the following years will only be able to sell a third of its holding, with the lock-up expiring after four years.

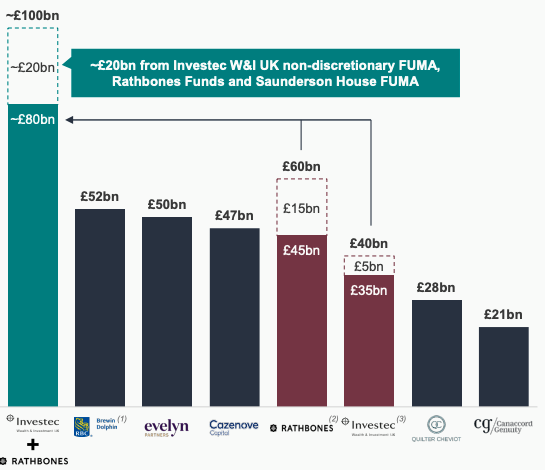

The combination should create a wealth manager with c. £100bn of discretionary Funds under Management (FuM), overtaking the likes of Brewin Dolphin and Cazenove Capital. I listened into the conference call, and Investec management suggested that the total market size was £2 trillion, so that’s still only 5% market share of a huge market. The deal does still require regulators’ approval though and is expected to complete in Q4.

They expect to create £60m of pretax synergies (taxed at 30%, and capitalised on 12x earnings that represent half a billion of value alone). That’s a quarter of the W&I divisions historic costs and the deal values division at 2.1% of FUM under management or just under 2.5x historic revenues or 15x historic earnings (pre-synergies).

Rathbones management believe scale is important in this sector and before the deal they already expected to invest a total of £40m in their digital capability. Add to that a further £98m integrating Investec’s W&I division and this looks to be a significant investment. I would imagine they see the benefit of fixed IT spend to create a platform with increasing revenues; however, I am less convinced that scale benefits customers in the bespoke financial advice sector.

Results: Rathbones reported FY Dec results at the beginning of March, with revenues growing +4.6% to £456m but PBT down by a third to £64m. That equates to an underlying profit margin of 21% (down from 28% in 2021). £13m of that profit decline came from deferred acquisition costs and a charge for integrating Sanderson House and Speirs & Jeffrey. However, underlying operating expenses also rose +14% to £358m, outpacing revenue growth of +5% to £455m.

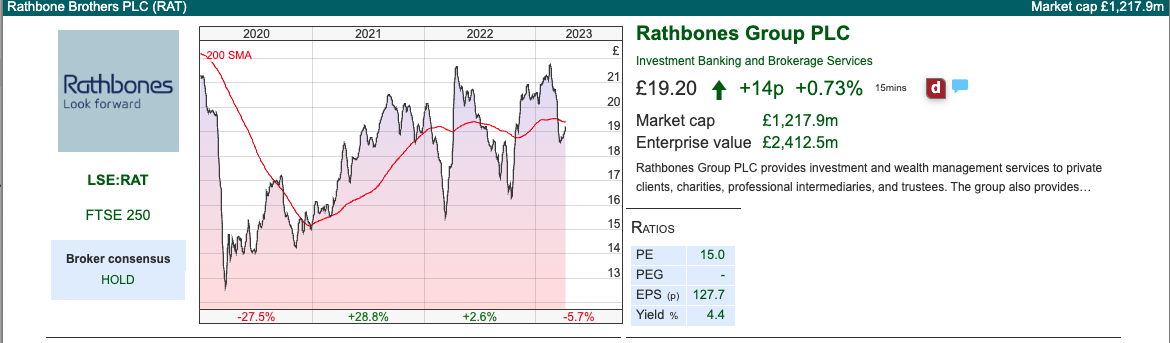

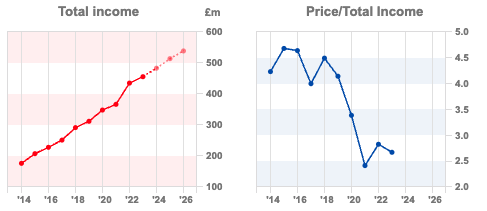

In the outlook statement, they suggested a “high 20’s” operating profit margin. If they achieve that high operating margin it would suggest that this business has a ‘moat’ that can’t easily be breached by lower-cost competitors. The chart below shows how the price/total sales multiple has de-rated from about 4.5x a couple of years ago to 2.5x, even as revenue has continued to grow but margins have declined.

Valuation: A price of 2.1% of FuM for Investec’s Wealth and Investments business seems a reasonable valuation. Rathbones itself is trading on 2.0x Dec 2022 FuM. That equates to 13x PER Dec 2024F (pre deal).

Opinion: Over the years there have been a number of attempts to disrupt the wealth management space, such as Nutmeg (now owned by JP Morgan). Arguably Hargreaves Lansdown (£127bn of AuM) and Abrdn (£500bn of AuM) which bought the Interactive Investor platform for £1.49bn last year (16x historic earnings, 2.8% of AuM), are now so large they are not considered ‘disruptors’. In February I wrote about HL.’s strategy offering ‘hybrid’ advice: a combination of automated guidance with personalised help from human advisors.

Financial advice does seem to be an area with potentially attractive economics for shareholders. What puts me off though is that I don’t understand a typical Wealth Management client. I prefer to avoid Wealth Management “advice” (often sales with commission built into the product) and instead buy a combination of i) low-cost index trackers, ii) individual shares, using Sharepad to help support my decision-making. Having pondered this, I decided last week to take a position in Hargreaves Lansdown.

Franchise Brands buys Pirtek Europe

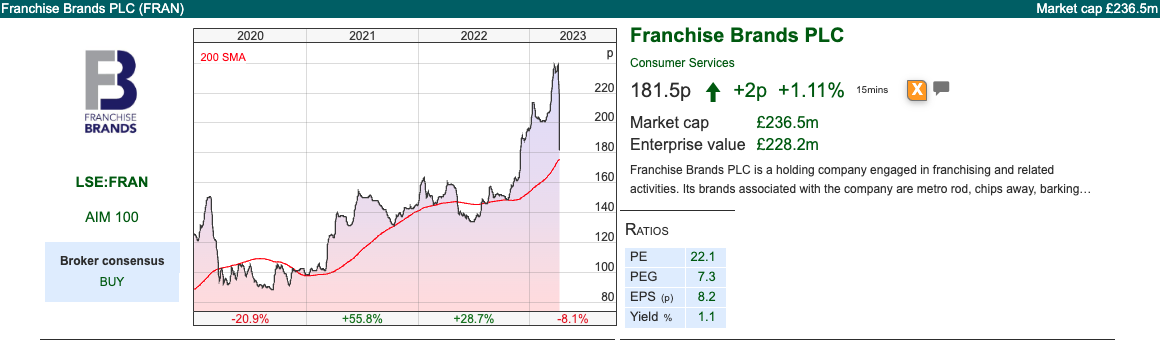

This plumbing franchise has expanded into Europe, buying Pirtek Europe, a hydraulic hose and related services business, for £212m (of which £12m is a cash and working capital adjustment). This is a significant deal given that FRAN’s own market cap is c. £240m. The consideration will be funded by a £90m placing at 180p, £19m of shares issued directly to Pirtek shareholders and £110m of new debt facilities. The debt facility consists of a £55m RCF and a £55m Term Loan, between 200-300bp above Sonia (the replacement of Libor).

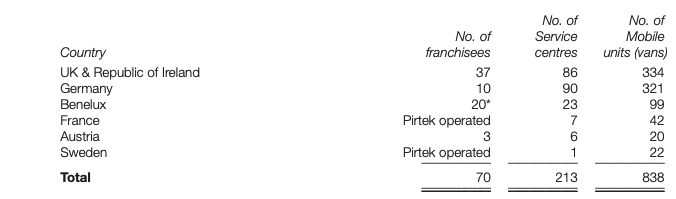

Pirtek has 70 franchisees, with system sales of £164m in 2022. Below is a list of their activities:

Background: Pirtek was founded in 1980 by a couple of Australians, Peter Duncan and Wally Davey, before becoming a franchiser in 1985. They were bought by Private Equity (Vision Capital) in 2007, then changing hands a couple of times in 2015 and 2018. The sellers are PNC Capital Finance, which has $314bn of AuM and is a subsidiary of PNC Bank in the USA. Pirtek currently operates in 8 European countries, with a mixture of franchisees and corporately operated centres. They are market-leading in the UK, Ireland, Germany and the Netherlands, then number two in Belgium, Austria, and Sweden, and number three in France.

The price represents 13.6x Dec 2022 adj EBITDA. I don’t know why any management team persists with adj EBITDA multiples, as investors care about profits, not adj EBITDA. There is a lock-up where there will be no disposals of the 10m consideration shares for 12 months, then on an orderly market basis; which presumably means PNC won’t dump shares and smash the FRAN share price.

Forecasts and Valuation: The enlarged Group is forecast to achieve £155m FY Dec 2023F revenue, or £168 million on a pro forma basis (ie assuming the acquisition happened on the 1st of Jan). Forecast revenue is expected to rise by +8% to £182m FY Dec 2024F, according to Allenby, their broker. Adj PBT of £22m FY 2023F and £28m 2024F, which equates to a PER 19x Dec 2023F and 16.5x PER Dec 2024F, on Allenby’s forecasts.

Opinion: This looks like an expansion inline with FRAN’s existing expertise. One concern I have had in the past is that growth prospects might be limited in the UK, but now with Filta’s (cooking oil) and Pirtek (hydraulic hoses) investors could justify paying a premium for the international growth. The shares have been a very strong performer in the last six months, so last week’s share price fall towards the placing price could represent a good entry level? There is some execution risk, especially as they are buying from Private Equity sellers, and leveraging up their balance sheet at a difficult point in the economic cycle. So far management have an enviable track record and the business has been relatively recession-proof though.

Gear4Music FY Mar trading update

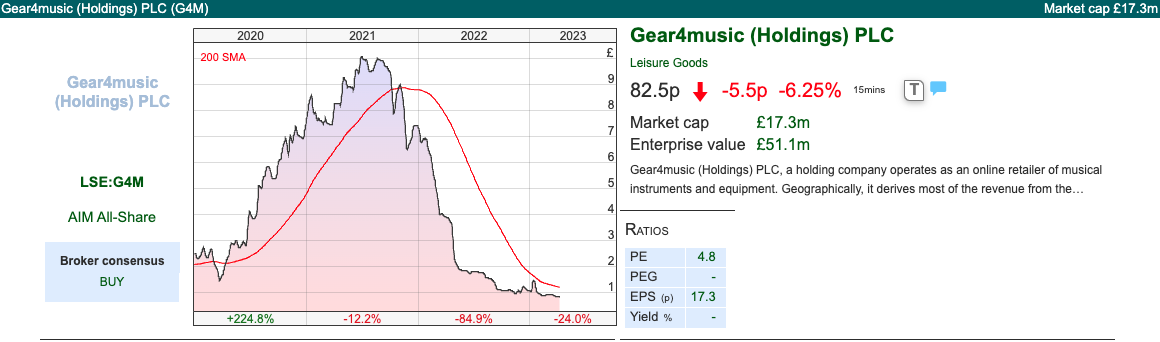

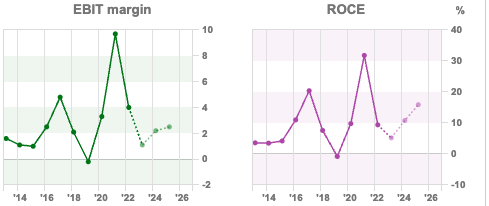

This online retailer of musical instruments reported total FY Mar 2023 sales +3% to £152m. There were contrasting trends though with the UK declining -1% to £82m, whereas Europe and the Rest of the World grew +8% to £70m. Sharepad shows forecasts were for £155m of sales, EBITDA of £8.9m and a profit of £1m, which is confirmed by a footnote in the RNS: so a slight miss. The shares fell -15% on the morning of the announcement.

The trading statement only gives an EBITDA range of £7.3m-£7.7m implying the group was loss-making, impacted by weak demand in the last two months of their financial year (February and March). They talk about a return to profitable growth in FY Mar 2024F, as growth initiatives such as AV.com gain traction and the company cuts back on overheads. They also say that courier disruption in the UK affected trading in their busiest period. Despite the lack of profits, net debt reduced from £24m to £14.5m, versus a current market cap of £17m.

Forecasts: Progressive, the paid-for research house, have reduced revenue forecasts for Mar 2024F by -6% to £161m and -8% to £174m Mar 2025F. The low margins mean that results in a -57% drop in PBT and EPS in Mar 2024F and -49% drop in both measures Mar 2025F. Progressive’s new net debt forecast for end Mar 2025F is £11m.

Valuation: On those forecasts, the shares are trading on 16x Mar 2024F and 9x Mar 2025F. The shares are on just 0.1x forecast Mar 2024F revenue, which indicates distress (similar to clothes retailer Superdry). The Founder/Chief Exec, Andrew Wass, still owns 23%, let’s hope that he can turn things around.

Opinion: The shares were a “pandemic” winner as many bought musical instruments in 2020 and the share price peaked at around £10 in mid-2021. A mere -6% revenue decline in FY Mar 2022 and excess inventory were enough to drive a particularly savage sell-off. This could now be a good entry point, but the low margins and net debt mean there are risks too. In the past, I have worried about competition from Amazon.

I think we can be confident that in 3 years’ time the shares won’t be at 82.5p – but trying to figure out the direction of the variance is a challenge. For my own portfolio, I already have significant exposure to a similar “turnaround” situation: (Superdry!) I don’t need another, so will avoid.

Notes

The author owns shares in Hargreaves Lansdown and Superdry

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Weekly Market Commentary | 11/04/23 | RAT, FRAN, G4M | Tech disconnecting from banks

We have seen a disconnect between the performance of Nasdaq 100 (+19% YTD) versus US regional banks (-28% YTD). Companies covered: two large acquisitions by RAT, FRAN plus G4M’s profit warning.

I enjoy the flexibility of Sharepad’s multigraph feature, which allows users to compare not just a variety of companies with each other, but also Indices (for instance the Nasdaq 100) with an ETF (The KBW Regional Bank ETF). That chart (below) reveals a remarkable disconnect with the Nasdaq 100 (up +19% YTD) versus the KRE US regional banks index (down -28% YTD). Within the Nasdaq, NVIDIA the GPU chip maker is the best performer YTD, up +85%, and Meta (previously known as Facebook) the second best, up +80% YTD. Both of those companies have a market cap of over half a trillion dollars. Ironically, banking problems and the liquidity support response provided by Central Banks appear to be most helpful to large, cash-rich tech firms.

The tech firms may not be immune from banking problems. One pathway through which this might happen is Venture Capital firms. In the UK many VC firms have retained large stakes in businesses that they have listed. For instance, IP Group still owns just over 10% of Oxford Nanopore, Andreessen Horowitz 8.6% of Wise, Index Ventures is the largest shareholder in Funding Circle with 16%, and Exponent owns 12% of Moonpig. Retaining an equity stake in an asset you are selling is a sensible way of insuring against the regret of allowing the buyer to capture the subsequent upside. If we are entering a more difficult funding environment for start-ups, now that lock-ups are expiring we may see the VCs sell their more liquid public market holdings to support loss-making, earlier-stage unlisted start-ups. That in turn may put pressure on the share prices of WISE, ONT, FCH or MOON. Indeed, we may see a disconnect between recently listed tech companies, and more established tech.

I remain cautiously positioned, but have recently bought some Hargreaves Lansdown shares. The HL. share price is down -20% from the beginning of March, and the dividend yield is now above 5%, so I think the investment case should be relatively defensive. I also have a soft spot for highly profitable companies which have recently experienced declining revenues; HL. revenue fell -8% to June 2022. I’d rather buy into those types of companies than fast-growing story stocks that don’t generate profits.

I’ve also used HL. to buy a Blackrock cash fund, yielding just under 4% after costs, versus 1% I was earning in my savings account at a high street bank. Previously I had believed that banks net interest margins would expand as interest rates rose, and inevitably banks would not pass on the benefit of higher rates to savers. I had not appreciated how easy it has become to buy higher-yielding cash money market funds in the UK, through the likes of HL. and similar. This strikes me as a reason to question the investment case in UK banks and rising interest rates, as their funding costs could squeeze net interest margins faster than investors were anticipating.

None of my portfolio changes should be interpreted as recommendations; the point of Sharepad is to allow users to do their own research, think and invest independently. I believe that it is helpful to share my thought process, particularly when I change my mind.

This week I look at a couple of deals: Investec has sold their Wealth and Investment division for £839m in Rathbones equity. Franchise Brands has made a large acquisition from a financial seller. Plus Gear4Music’s profit warning.

Rathbones Investec

Rathbones announced last week that it is buying the Wealth and Investments (W&I) division of Investec, the London-listed South African bank, for an implied value of £839m in an all-share deal. Investec will become Rathbones largest shareholder, with a 41.25% of the economic interest, but 29.9% of the voting rights. Keeping the voting rights below the 30% threshold means that Investec doesn’t need to make an offer for all of Rathbones, which is the normal Takeover Panel rule. Investec will have a 2-year lock-up when it won’t be able to sell Rathbones shares, then in the following years will only be able to sell a third of its holding, with the lock-up expiring after four years.

The combination should create a wealth manager with c. £100bn of discretionary Funds under Management (FuM), overtaking the likes of Brewin Dolphin and Cazenove Capital. I listened into the conference call, and Investec management suggested that the total market size was £2 trillion, so that’s still only 5% market share of a huge market. The deal does still require regulators’ approval though and is expected to complete in Q4.

They expect to create £60m of pretax synergies (taxed at 30%, and capitalised on 12x earnings that represent half a billion of value alone). That’s a quarter of the W&I divisions historic costs and the deal values division at 2.1% of FUM under management or just under 2.5x historic revenues or 15x historic earnings (pre-synergies).

Rathbones management believe scale is important in this sector and before the deal they already expected to invest a total of £40m in their digital capability. Add to that a further £98m integrating Investec’s W&I division and this looks to be a significant investment. I would imagine they see the benefit of fixed IT spend to create a platform with increasing revenues; however, I am less convinced that scale benefits customers in the bespoke financial advice sector.

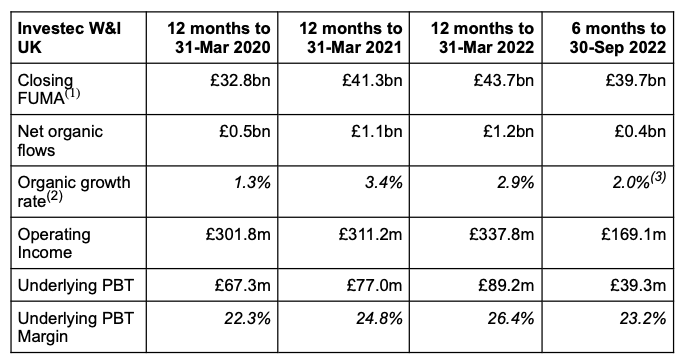

Results: Rathbones reported FY Dec results at the beginning of March, with revenues growing +4.6% to £456m but PBT down by a third to £64m. That equates to an underlying profit margin of 21% (down from 28% in 2021). £13m of that profit decline came from deferred acquisition costs and a charge for integrating Sanderson House and Speirs & Jeffrey. However, underlying operating expenses also rose +14% to £358m, outpacing revenue growth of +5% to £455m.

In the outlook statement, they suggested a “high 20’s” operating profit margin. If they achieve that high operating margin it would suggest that this business has a ‘moat’ that can’t easily be breached by lower-cost competitors. The chart below shows how the price/total sales multiple has de-rated from about 4.5x a couple of years ago to 2.5x, even as revenue has continued to grow but margins have declined.

Valuation: A price of 2.1% of FuM for Investec’s Wealth and Investments business seems a reasonable valuation. Rathbones itself is trading on 2.0x Dec 2022 FuM. That equates to 13x PER Dec 2024F (pre deal).

Opinion: Over the years there have been a number of attempts to disrupt the wealth management space, such as Nutmeg (now owned by JP Morgan). Arguably Hargreaves Lansdown (£127bn of AuM) and Abrdn (£500bn of AuM) which bought the Interactive Investor platform for £1.49bn last year (16x historic earnings, 2.8% of AuM), are now so large they are not considered ‘disruptors’. In February I wrote about HL.’s strategy offering ‘hybrid’ advice: a combination of automated guidance with personalised help from human advisors.

Financial advice does seem to be an area with potentially attractive economics for shareholders. What puts me off though is that I don’t understand a typical Wealth Management client. I prefer to avoid Wealth Management “advice” (often sales with commission built into the product) and instead buy a combination of i) low-cost index trackers, ii) individual shares, using Sharepad to help support my decision-making. Having pondered this, I decided last week to take a position in Hargreaves Lansdown.

Franchise Brands buys Pirtek Europe

This plumbing franchise has expanded into Europe, buying Pirtek Europe, a hydraulic hose and related services business, for £212m (of which £12m is a cash and working capital adjustment). This is a significant deal given that FRAN’s own market cap is c. £240m. The consideration will be funded by a £90m placing at 180p, £19m of shares issued directly to Pirtek shareholders and £110m of new debt facilities. The debt facility consists of a £55m RCF and a £55m Term Loan, between 200-300bp above Sonia (the replacement of Libor).

Pirtek has 70 franchisees, with system sales of £164m in 2022. Below is a list of their activities:

Background: Pirtek was founded in 1980 by a couple of Australians, Peter Duncan and Wally Davey, before becoming a franchiser in 1985. They were bought by Private Equity (Vision Capital) in 2007, then changing hands a couple of times in 2015 and 2018. The sellers are PNC Capital Finance, which has $314bn of AuM and is a subsidiary of PNC Bank in the USA. Pirtek currently operates in 8 European countries, with a mixture of franchisees and corporately operated centres. They are market-leading in the UK, Ireland, Germany and the Netherlands, then number two in Belgium, Austria, and Sweden, and number three in France.

The price represents 13.6x Dec 2022 adj EBITDA. I don’t know why any management team persists with adj EBITDA multiples, as investors care about profits, not adj EBITDA. There is a lock-up where there will be no disposals of the 10m consideration shares for 12 months, then on an orderly market basis; which presumably means PNC won’t dump shares and smash the FRAN share price.

Forecasts and Valuation: The enlarged Group is forecast to achieve £155m FY Dec 2023F revenue, or £168 million on a pro forma basis (ie assuming the acquisition happened on the 1st of Jan). Forecast revenue is expected to rise by +8% to £182m FY Dec 2024F, according to Allenby, their broker. Adj PBT of £22m FY 2023F and £28m 2024F, which equates to a PER 19x Dec 2023F and 16.5x PER Dec 2024F, on Allenby’s forecasts.

Opinion: This looks like an expansion inline with FRAN’s existing expertise. One concern I have had in the past is that growth prospects might be limited in the UK, but now with Filta’s (cooking oil) and Pirtek (hydraulic hoses) investors could justify paying a premium for the international growth. The shares have been a very strong performer in the last six months, so last week’s share price fall towards the placing price could represent a good entry level? There is some execution risk, especially as they are buying from Private Equity sellers, and leveraging up their balance sheet at a difficult point in the economic cycle. So far management have an enviable track record and the business has been relatively recession-proof though.

Gear4Music FY Mar trading update

This online retailer of musical instruments reported total FY Mar 2023 sales +3% to £152m. There were contrasting trends though with the UK declining -1% to £82m, whereas Europe and the Rest of the World grew +8% to £70m. Sharepad shows forecasts were for £155m of sales, EBITDA of £8.9m and a profit of £1m, which is confirmed by a footnote in the RNS: so a slight miss. The shares fell -15% on the morning of the announcement.

The trading statement only gives an EBITDA range of £7.3m-£7.7m implying the group was loss-making, impacted by weak demand in the last two months of their financial year (February and March). They talk about a return to profitable growth in FY Mar 2024F, as growth initiatives such as AV.com gain traction and the company cuts back on overheads. They also say that courier disruption in the UK affected trading in their busiest period. Despite the lack of profits, net debt reduced from £24m to £14.5m, versus a current market cap of £17m.

Forecasts: Progressive, the paid-for research house, have reduced revenue forecasts for Mar 2024F by -6% to £161m and -8% to £174m Mar 2025F. The low margins mean that results in a -57% drop in PBT and EPS in Mar 2024F and -49% drop in both measures Mar 2025F. Progressive’s new net debt forecast for end Mar 2025F is £11m.

Valuation: On those forecasts, the shares are trading on 16x Mar 2024F and 9x Mar 2025F. The shares are on just 0.1x forecast Mar 2024F revenue, which indicates distress (similar to clothes retailer Superdry). The Founder/Chief Exec, Andrew Wass, still owns 23%, let’s hope that he can turn things around.

Opinion: The shares were a “pandemic” winner as many bought musical instruments in 2020 and the share price peaked at around £10 in mid-2021. A mere -6% revenue decline in FY Mar 2022 and excess inventory were enough to drive a particularly savage sell-off. This could now be a good entry point, but the low margins and net debt mean there are risks too. In the past, I have worried about competition from Amazon.

I think we can be confident that in 3 years’ time the shares won’t be at 82.5p – but trying to figure out the direction of the variance is a challenge. For my own portfolio, I already have significant exposure to a similar “turnaround” situation: (Superdry!) I don’t need another, so will avoid.

Notes

The author owns shares in Hargreaves Lansdown and Superdry

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.