Looking at the returns from investing in football clubs, Bruce suggests the key is to identify well managed teams that have developed an effective way of operating. Stocks covered DARK, and profit warnings from TET and GHH.

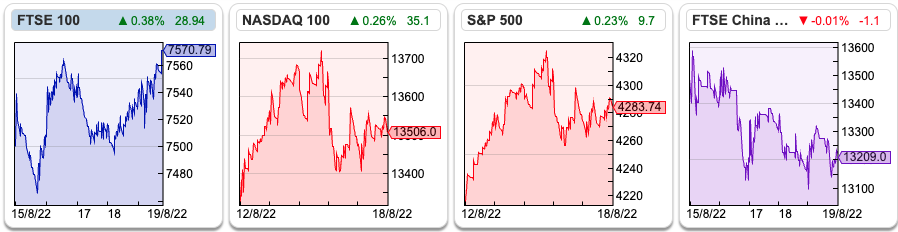

The FTSE 100 was up +0.9% last week to 7,571. The S&P500 was down -0.5%, and the Nasdaq100 fell -1.35%. The US 10Y Govt bond yield rose to 2.93% and the price of oil fell back to $94 per barrel, a -4.5% decline during the week.

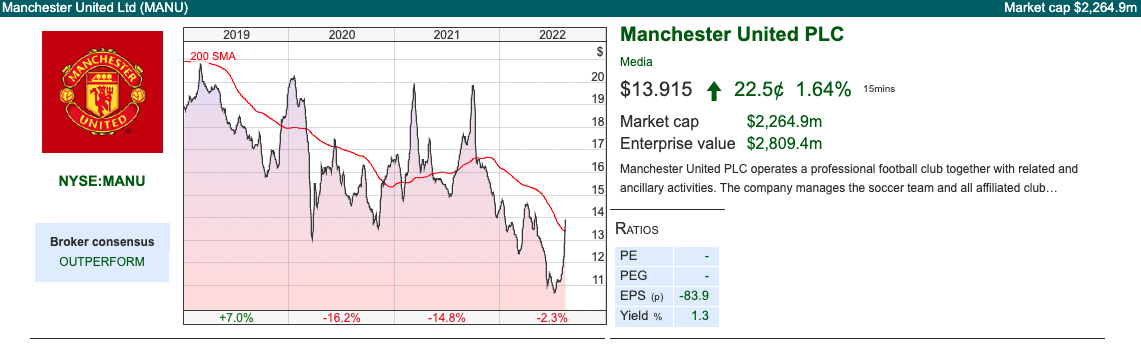

Man Utd shares were up +8.5% last week, despite their 4-0 drubbing by Brentford FC. The hope seems to be that poor performance on the pitch could lead to a change in ownership, as Sir Jim Ratcliffe of Ineos has expressed interest in buying the club. An interesting example of how detached football finance has become from the results on Saturdays.

Steve Clapham has written an interesting piece on Man Utd financial performance, and concludes that football clubs rarely make good investments. I think that’s probably correct, but the wrong generalisation to make. It’s like saying acting is not a good career choice, because you will probably spend most of your time as a waiter. On the other hand, an Oscar winning actor is a great career choice.

Nick Train points out that Manchester United was a 200 bagger when it listed on AIM in 1991 (with a market cap of £20m). Lindsell Train still owns over 20% of the company’s Class A shares, which have less voting rights than the Glazer’s who own the B shares . The fund manager made the investment case a couple of years ago:

If you think about iconic sports franchises 50 years ago a lot of them are still the same as they are today. They don’t change that much. Sure Liverpool can do better for a while than Manchester United but Liverpool and Manchester United have remained great rivals and great franchises for a very long time.

Manchester Utd was a beneficiary of globalisation in the 1990s and 2000s, as they managed to capture the benefit of TV money coming into the game. However, I think it’s unlikely that it will be a 200 bagger over the next couple of decades. Capital from Russian oligarchs, American billionaires and later oil rich Sovereign Wealth Funds have bid up the price and wages of players. Manchester Utd’s problems are another example of how too much capital chasing the same assets (world beating players) results in deteriorating returns.

Now, upside from owning football clubs seems to be available buying lower division teams (Brighton, Brentford etc) and applying data analytics to improve performance and achieve promotion. That seems to have more in common with the original investment case in Man Utd in the early 1990s. I’d equate it to buying small/micro cap stocks on AIM, and hoping that they can benefit from expanding markets to grow profits. Impax AM is a good example of a company that started small on AIM, but has benefited from capital flowing into an area where they’d already built up an effective way of operating. Perhaps we should name that investment strategy as ‘just a bus stop in Hounslow’ which is a Brentford FC chant.

As a Brentford FC fan, my favourite player was Stan Bowles from the early 1980s, the former England player, who fell out with various managers. He was seen as unmanageable, so ended up playing for Brentford in the old Third Division, which provided a lot of entertainment. There was something about watching one maverick star surrounded by a hard-working team that was far more entertaining than watching eleven talented individuals failing to meld into a cohesive side.

I’m also a great admirer of Matthew Benham, Brentford FC’s current owner whose background is derivative trading and sports betting. He also seems to be something of a maverick, enjoying challenging conventional wisdom as much as the results on the pitch, though the latter haven’t been too bad either. Interestingly he grew up in Slough, so perhaps I should pitch him my Slough based hedge fund?

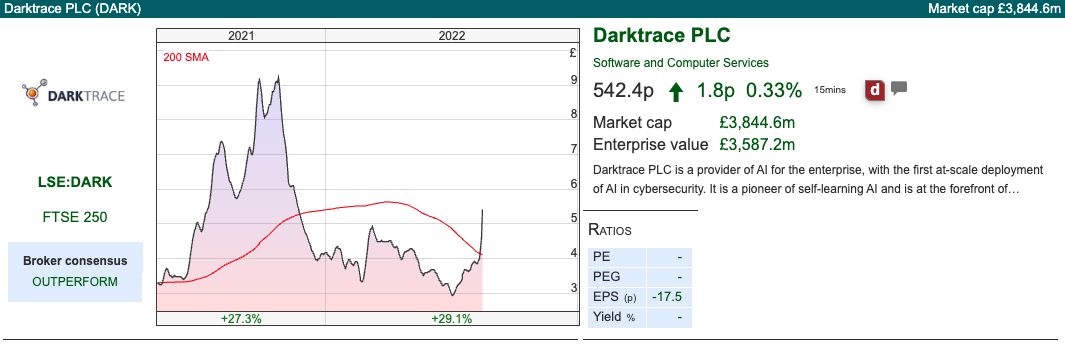

This week I look at Darktrace, the cyber security firm that has received an approach. I also look at profit warnings from Gooch & Housego and Treatt. Recently those two companies have been regarded as ‘expensive quality’, so it’s interesting that they are finding it hard to pass on input cost inflation to customers and are both suffering from margin pressure.

Darktrace

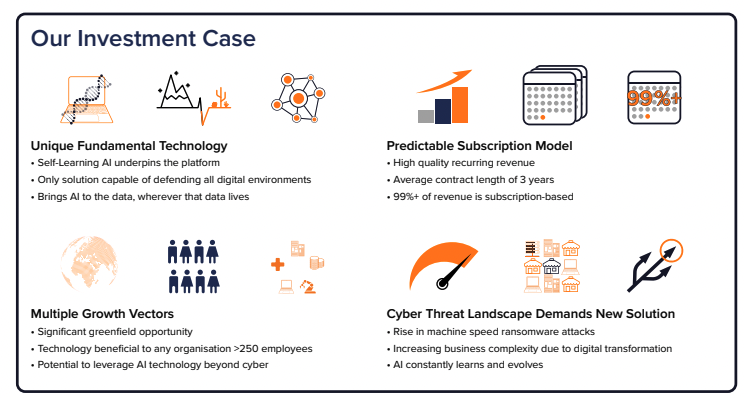

Last week this cyber security company announced a preliminary approach from Thomas Bravo, the Private Equity investors, and the shares rose +27%. Darktrace was funded in its early years by Mike Lynch of Autonomy via his investment vehicle: Invoke. More recently KKR, Insight Ventures and Vitruvian have led funding rounds.

Darktrace listed at 250p per share, valuing the company at £1.7bn in April last year. They only raised £130m from the issue of new shares, with a further £21m raised going to selling shareholders. They intended to use £35m-45m to increase the company’s R&D spending and £35m-45m on marketing. The remaining proceeds would be used to strengthen the balance. Since then the shares have been volatile, to say the least, with a 52w high of 985p and a 52w low of 287p.

In July this year they guided that FY June 2022 revenue would at least $417m, implying +48% growth. They also said adjusted EBITDA margin for the year should be no less than 19.5%, versus the previous guidance range of 15% to 17%. For context, with £26m of depreciation and amortisation and £19m of share based payments in H1, the PBT margin was less than 4% though.

For FY June 2023 they guided revenue growth of between 29% and 32% and an EBITDA margin of between 15-18%. However, high cash payments related to taxes of awards made to employees at the IPO, mean that free cash flow will be 10-15% below the normal range (as a proportion of adjusted EBITDA). The company has plenty of investor material on their website, but I also found this TechCrunch presentation by Chief Exec / Co-Founder Poppy Gustafsson interesting to watch. Sometimes it is good to watch management presentations from a couple of years ago, because you can get a feel for how things have developed versus their view of the world back then. She describes the product by drawing an analogy to the human immune system, with threats from viruses and other microbes, but for enterprise networks.

Ownership: Summit Partners the Venture Capitalist owns 14%, Mike Lynch and his wife Angela Bacares own 12.4%, American PE firm KKR 10%, and LGIM 5.2%.

Valuation: This looks very expensive on PER basis, despite the decline from that 52W high. The shares are on a PER of 158x FY May 2023F, dropping to 93x FY May 2024F. The low margins though mean that the price/sales ratio looks a more reasonable 6x current financial year, dropping to below 5x FY May 2024F. So presumably investors are assuming that the company can improve margins as revenues grow.

Opinion: It’s difficult for a non specialist to assess the quality of Darktrace’s product, though the historic revenue growth does look impressive. Presumably Thomas Bravo will take more care with their due diligence than Hewlett Packard did when they acquired Autonomy. HP later took an $8bn impairment charge which it blamed on the Autonomy team. The former CFO of Autonomy Sushovan Hussain has been convicted of fraud in the US. Former CEO Mike Lynch is fighting extradition to the USA to face a criminal trial and denies any wrong doing.

Treatt

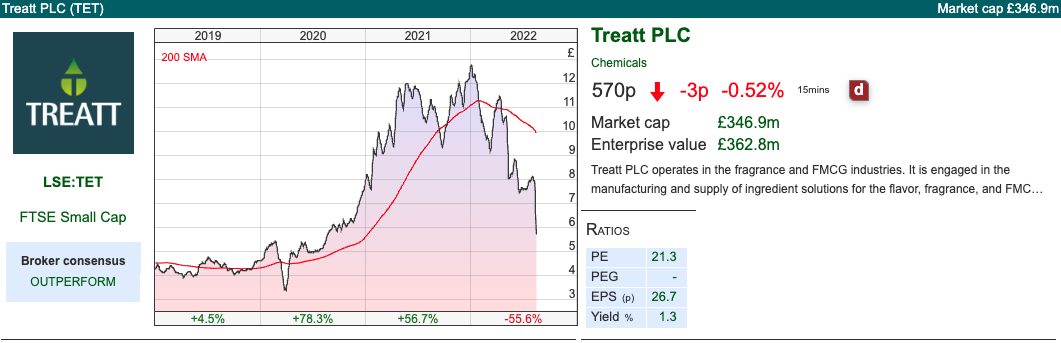

Bad luck to holders of this flavouring and fragrance company. Theoretically it ought to have been defensive, but last week they announced FY Sept PBT is expected to be £15m (v £22m previous guidance announced in their H1 results in May). The reasons given are i) disappointing tea sales (including iced tea) in the USA, which is negative for margins ii) devaluation of sterling versus US dollar, means that their FX hedging has also been negative for margins iii) cost inflation that hasn’t been fully passed on to customers iv) China subsidiary affected by lockdowns.

For context, tea was 6% of group revenue in H1, so that first explanation seems unlikely to be responsible for the bulk of the £7m PBT shortfall. Similarly China was 5% of group revenue. It is natural for companies to try to spin profit warnings as ‘temporary blips’ when actually there’s been a more fundamental deterioration, so caution is needed to cross check explanations make sense. Instead I am concerned that management were making profits on their FX trading, which flattered the profitability but wasn’t sustainable. In the past management have suggested that branded beverages were “affordable luxuries”, and therefore protected against rising inflationary pressures. That seems not to be the case though, if TET can’t pass on input cost increases to their customers.

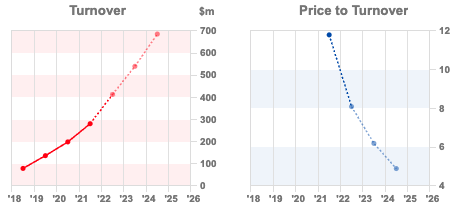

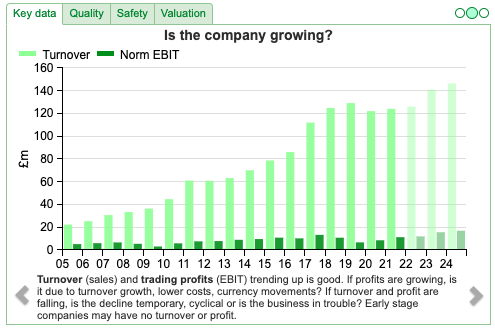

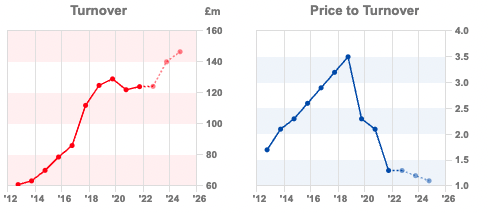

They still expect to report strong revenue growth (they said +15% in May) so the -30% cut to FY PBT is almost entirely a margin impact. TET’s gross margin peaked at 34% in FY Sept 2021 so perhaps we were due some mean reversion? The H1 to March 2022 figure was 27.5%, versus 25% from 2012-2020. The EBIT margin shows a similar expansion, followed by a forecast decline.

TET reported net debt of £20m at March 2022, an increase of £11m over the previous 6 months, driven by their working capital cycle. That looks easily manageable in the context of a market cap of £347m and shareholders’ equity of £115m.

Valuation: FY Sept 2023F PBT has now been cut -20% to £19.7m and by -24% to £20.0m FY Sept 2024F. Hence, the 30% decline in the share price last week hasn’t resulted in a significant de-rating. The shares are trading on a PER 21x Sept 2023F and 20x Sept 2024F.

Opinion: This is a quality company, with the shares up 8x in the last decade. So the profit warning could be a buying opportunity, depending on whether you trust the explanation that the hit to margins has been caused by temporary factors. I am concerned that we could see margin pressure continue for 2023, so there’s a chance of further disappointment.

Gooch & Housego Trading Update

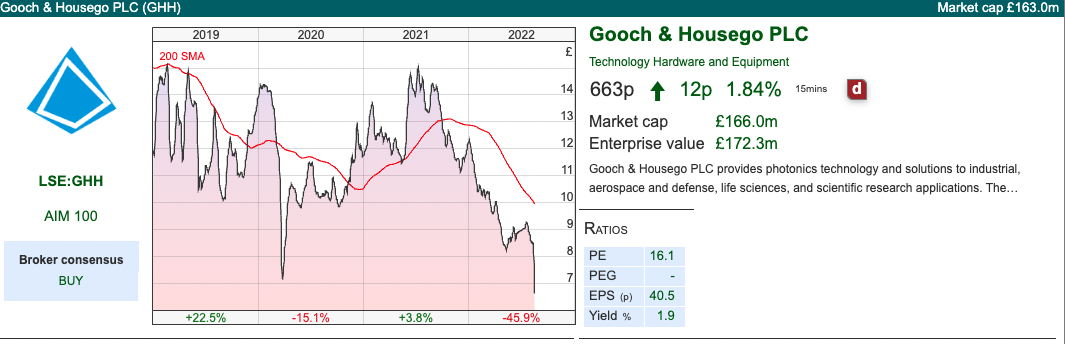

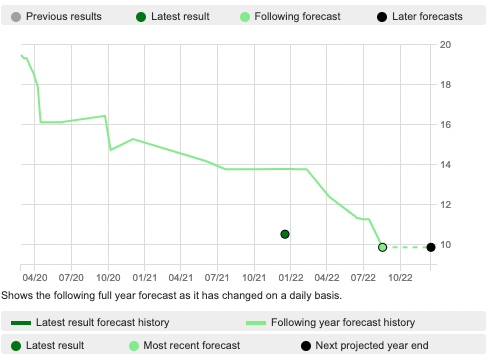

This photonics engineering company with customers in telecoms, aerospace, defence, space and life sciences sector announced a trading update for FY to September. They now say that FY Sept adj PBT is likely to be £3.5m lower than management’s previous expectations (without saying what those expectations were). Sharepad shows how PBT forecasts has halved from £20m over the last couple of years £10m, because the company had already guided lower a couple of times.

In last week’s RNS they once again blame Covid related factors for the disappointment, namely staff absences and supply chain shortages. That looks like weak management trying to ‘spin’ results, as the same factors have not held back the likes of SDI or Judges. In the same RNS they said that Mark Webster will be stepping down as CEO and will be succeeded by Charlie Peppiatt (ex TT Electronics and Stadium Group). That looks to be the correct decision, a couple of years ago the board decided to compensate the Executive Directors for the loss in value of their LTIP which had failed to pay out following poor performance. A basic salary of £350K a year was not enough to motivate the Chief Executive.

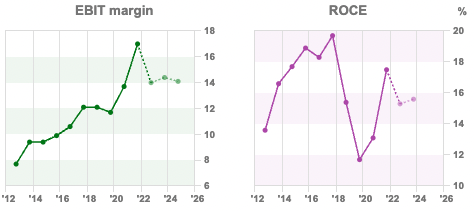

I am against companies re-pricing their incentive schemes. I said at the start of last year that I was disappointed that the major shareholders had agreed to this. They include Octopus 13%, Invesco 11.9%, Abrdn 6.6%, Blackrock 5.8%. Perhaps there have been some conversations behind closed doors though, and hopefully the new Chief Executive will be a catalyst for improvement. The company has an excellent long term track record, but has lost its way recently, as this chart from Sharepad shows. PBT peaked at £8.9m with an EBIT margin of 11.9% in FY Sept 2017. Hopefully they can rebuild from the current disappointment and get back on track.

Outlook: The current order book stood at £141m at the end of July (a +44% increase on July last year). They talk about double digit volume growth and an improving EBIT margin (currently 9.1%) in FY Sept 2023F.

However, in the shorter term it is not unknown for a new Chief Executive in a ‘turnaround’ situation to announce further disappointing results to rebase expectations, in the first 6-12m of his tenure when he can blame the problems on his predecessor. Antonio Horta-Osario was particularly good at this when he was appointed Chief Exec of Lloyds, and Stephen Hester did similar at Royal Bank. GHH mention input cost inflation, so it’s possible that although the order book is strong, the margin disappoints.

Net debt ex IFRS 16 leases was £5.9m, they have Revolving Credit Facility (RCF of $40m committed/ $30m uncommitted) so the revenue fall is unlikely to cause financial distress.

Valuation: The shares are trading on a PER of 15x Sept 2023F and 13x Sept 2024F, which looks good value if the forecasts can be achieved. The price/revenue has de-rated as the revenue growth and margins have faltered, suggesting if the new Chief Exec can deliver, then we could see a significant re-rating.

Opinion: The shares have halved from £15 valuation 6 months ago, but for me it’s too early in the turnaround to take a position. The investment case could begin to look interesting in 2023 though. One to add to the watchlist I think.

Bruce Packard

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Weekly Market Commentary 22/08/22 | MANU, DARK, TET, GHH | Just a bus stop in Hounslow

Looking at the returns from investing in football clubs, Bruce suggests the key is to identify well managed teams that have developed an effective way of operating. Stocks covered DARK, and profit warnings from TET and GHH.

The FTSE 100 was up +0.9% last week to 7,571. The S&P500 was down -0.5%, and the Nasdaq100 fell -1.35%. The US 10Y Govt bond yield rose to 2.93% and the price of oil fell back to $94 per barrel, a -4.5% decline during the week.

Man Utd shares were up +8.5% last week, despite their 4-0 drubbing by Brentford FC. The hope seems to be that poor performance on the pitch could lead to a change in ownership, as Sir Jim Ratcliffe of Ineos has expressed interest in buying the club. An interesting example of how detached football finance has become from the results on Saturdays.

Steve Clapham has written an interesting piece on Man Utd financial performance, and concludes that football clubs rarely make good investments. I think that’s probably correct, but the wrong generalisation to make. It’s like saying acting is not a good career choice, because you will probably spend most of your time as a waiter. On the other hand, an Oscar winning actor is a great career choice.

Nick Train points out that Manchester United was a 200 bagger when it listed on AIM in 1991 (with a market cap of £20m). Lindsell Train still owns over 20% of the company’s Class A shares, which have less voting rights than the Glazer’s who own the B shares . The fund manager made the investment case a couple of years ago:

If you think about iconic sports franchises 50 years ago a lot of them are still the same as they are today. They don’t change that much. Sure Liverpool can do better for a while than Manchester United but Liverpool and Manchester United have remained great rivals and great franchises for a very long time.

Manchester Utd was a beneficiary of globalisation in the 1990s and 2000s, as they managed to capture the benefit of TV money coming into the game. However, I think it’s unlikely that it will be a 200 bagger over the next couple of decades. Capital from Russian oligarchs, American billionaires and later oil rich Sovereign Wealth Funds have bid up the price and wages of players. Manchester Utd’s problems are another example of how too much capital chasing the same assets (world beating players) results in deteriorating returns.

Now, upside from owning football clubs seems to be available buying lower division teams (Brighton, Brentford etc) and applying data analytics to improve performance and achieve promotion. That seems to have more in common with the original investment case in Man Utd in the early 1990s. I’d equate it to buying small/micro cap stocks on AIM, and hoping that they can benefit from expanding markets to grow profits. Impax AM is a good example of a company that started small on AIM, but has benefited from capital flowing into an area where they’d already built up an effective way of operating. Perhaps we should name that investment strategy as ‘just a bus stop in Hounslow’ which is a Brentford FC chant.

As a Brentford FC fan, my favourite player was Stan Bowles from the early 1980s, the former England player, who fell out with various managers. He was seen as unmanageable, so ended up playing for Brentford in the old Third Division, which provided a lot of entertainment. There was something about watching one maverick star surrounded by a hard-working team that was far more entertaining than watching eleven talented individuals failing to meld into a cohesive side.

I’m also a great admirer of Matthew Benham, Brentford FC’s current owner whose background is derivative trading and sports betting. He also seems to be something of a maverick, enjoying challenging conventional wisdom as much as the results on the pitch, though the latter haven’t been too bad either. Interestingly he grew up in Slough, so perhaps I should pitch him my Slough based hedge fund?

This week I look at Darktrace, the cyber security firm that has received an approach. I also look at profit warnings from Gooch & Housego and Treatt. Recently those two companies have been regarded as ‘expensive quality’, so it’s interesting that they are finding it hard to pass on input cost inflation to customers and are both suffering from margin pressure.

Darktrace

Last week this cyber security company announced a preliminary approach from Thomas Bravo, the Private Equity investors, and the shares rose +27%. Darktrace was funded in its early years by Mike Lynch of Autonomy via his investment vehicle: Invoke. More recently KKR, Insight Ventures and Vitruvian have led funding rounds.

Darktrace listed at 250p per share, valuing the company at £1.7bn in April last year. They only raised £130m from the issue of new shares, with a further £21m raised going to selling shareholders. They intended to use £35m-45m to increase the company’s R&D spending and £35m-45m on marketing. The remaining proceeds would be used to strengthen the balance. Since then the shares have been volatile, to say the least, with a 52w high of 985p and a 52w low of 287p.

In July this year they guided that FY June 2022 revenue would at least $417m, implying +48% growth. They also said adjusted EBITDA margin for the year should be no less than 19.5%, versus the previous guidance range of 15% to 17%. For context, with £26m of depreciation and amortisation and £19m of share based payments in H1, the PBT margin was less than 4% though.

For FY June 2023 they guided revenue growth of between 29% and 32% and an EBITDA margin of between 15-18%. However, high cash payments related to taxes of awards made to employees at the IPO, mean that free cash flow will be 10-15% below the normal range (as a proportion of adjusted EBITDA). The company has plenty of investor material on their website, but I also found this TechCrunch presentation by Chief Exec / Co-Founder Poppy Gustafsson interesting to watch. Sometimes it is good to watch management presentations from a couple of years ago, because you can get a feel for how things have developed versus their view of the world back then. She describes the product by drawing an analogy to the human immune system, with threats from viruses and other microbes, but for enterprise networks.

Ownership: Summit Partners the Venture Capitalist owns 14%, Mike Lynch and his wife Angela Bacares own 12.4%, American PE firm KKR 10%, and LGIM 5.2%.

Valuation: This looks very expensive on PER basis, despite the decline from that 52W high. The shares are on a PER of 158x FY May 2023F, dropping to 93x FY May 2024F. The low margins though mean that the price/sales ratio looks a more reasonable 6x current financial year, dropping to below 5x FY May 2024F. So presumably investors are assuming that the company can improve margins as revenues grow.

Opinion: It’s difficult for a non specialist to assess the quality of Darktrace’s product, though the historic revenue growth does look impressive. Presumably Thomas Bravo will take more care with their due diligence than Hewlett Packard did when they acquired Autonomy. HP later took an $8bn impairment charge which it blamed on the Autonomy team. The former CFO of Autonomy Sushovan Hussain has been convicted of fraud in the US. Former CEO Mike Lynch is fighting extradition to the USA to face a criminal trial and denies any wrong doing.

Treatt

Bad luck to holders of this flavouring and fragrance company. Theoretically it ought to have been defensive, but last week they announced FY Sept PBT is expected to be £15m (v £22m previous guidance announced in their H1 results in May). The reasons given are i) disappointing tea sales (including iced tea) in the USA, which is negative for margins ii) devaluation of sterling versus US dollar, means that their FX hedging has also been negative for margins iii) cost inflation that hasn’t been fully passed on to customers iv) China subsidiary affected by lockdowns.

For context, tea was 6% of group revenue in H1, so that first explanation seems unlikely to be responsible for the bulk of the £7m PBT shortfall. Similarly China was 5% of group revenue. It is natural for companies to try to spin profit warnings as ‘temporary blips’ when actually there’s been a more fundamental deterioration, so caution is needed to cross check explanations make sense. Instead I am concerned that management were making profits on their FX trading, which flattered the profitability but wasn’t sustainable. In the past management have suggested that branded beverages were “affordable luxuries”, and therefore protected against rising inflationary pressures. That seems not to be the case though, if TET can’t pass on input cost increases to their customers.

They still expect to report strong revenue growth (they said +15% in May) so the -30% cut to FY PBT is almost entirely a margin impact. TET’s gross margin peaked at 34% in FY Sept 2021 so perhaps we were due some mean reversion? The H1 to March 2022 figure was 27.5%, versus 25% from 2012-2020. The EBIT margin shows a similar expansion, followed by a forecast decline.

TET reported net debt of £20m at March 2022, an increase of £11m over the previous 6 months, driven by their working capital cycle. That looks easily manageable in the context of a market cap of £347m and shareholders’ equity of £115m.

Valuation: FY Sept 2023F PBT has now been cut -20% to £19.7m and by -24% to £20.0m FY Sept 2024F. Hence, the 30% decline in the share price last week hasn’t resulted in a significant de-rating. The shares are trading on a PER 21x Sept 2023F and 20x Sept 2024F.

Opinion: This is a quality company, with the shares up 8x in the last decade. So the profit warning could be a buying opportunity, depending on whether you trust the explanation that the hit to margins has been caused by temporary factors. I am concerned that we could see margin pressure continue for 2023, so there’s a chance of further disappointment.

Gooch & Housego Trading Update

This photonics engineering company with customers in telecoms, aerospace, defence, space and life sciences sector announced a trading update for FY to September. They now say that FY Sept adj PBT is likely to be £3.5m lower than management’s previous expectations (without saying what those expectations were). Sharepad shows how PBT forecasts has halved from £20m over the last couple of years £10m, because the company had already guided lower a couple of times.

In last week’s RNS they once again blame Covid related factors for the disappointment, namely staff absences and supply chain shortages. That looks like weak management trying to ‘spin’ results, as the same factors have not held back the likes of SDI or Judges. In the same RNS they said that Mark Webster will be stepping down as CEO and will be succeeded by Charlie Peppiatt (ex TT Electronics and Stadium Group). That looks to be the correct decision, a couple of years ago the board decided to compensate the Executive Directors for the loss in value of their LTIP which had failed to pay out following poor performance. A basic salary of £350K a year was not enough to motivate the Chief Executive.

I am against companies re-pricing their incentive schemes. I said at the start of last year that I was disappointed that the major shareholders had agreed to this. They include Octopus 13%, Invesco 11.9%, Abrdn 6.6%, Blackrock 5.8%. Perhaps there have been some conversations behind closed doors though, and hopefully the new Chief Executive will be a catalyst for improvement. The company has an excellent long term track record, but has lost its way recently, as this chart from Sharepad shows. PBT peaked at £8.9m with an EBIT margin of 11.9% in FY Sept 2017. Hopefully they can rebuild from the current disappointment and get back on track.

Outlook: The current order book stood at £141m at the end of July (a +44% increase on July last year). They talk about double digit volume growth and an improving EBIT margin (currently 9.1%) in FY Sept 2023F.

However, in the shorter term it is not unknown for a new Chief Executive in a ‘turnaround’ situation to announce further disappointing results to rebase expectations, in the first 6-12m of his tenure when he can blame the problems on his predecessor. Antonio Horta-Osario was particularly good at this when he was appointed Chief Exec of Lloyds, and Stephen Hester did similar at Royal Bank. GHH mention input cost inflation, so it’s possible that although the order book is strong, the margin disappoints.

Net debt ex IFRS 16 leases was £5.9m, they have Revolving Credit Facility (RCF of $40m committed/ $30m uncommitted) so the revenue fall is unlikely to cause financial distress.

Valuation: The shares are trading on a PER of 15x Sept 2023F and 13x Sept 2024F, which looks good value if the forecasts can be achieved. The price/revenue has de-rated as the revenue growth and margins have faltered, suggesting if the new Chief Exec can deliver, then we could see a significant re-rating.

Opinion: The shares have halved from £15 valuation 6 months ago, but for me it’s too early in the turnaround to take a position. The investment case could begin to look interesting in 2023 though. One to add to the watchlist I think.

Bruce Packard

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.