Following the profit warnings from Fevertree and Creightons, Bruce questions the conventional wisdom that companies with strong brands do well in an inflationary environment. Companies covered CKN, CRL, and TM17.

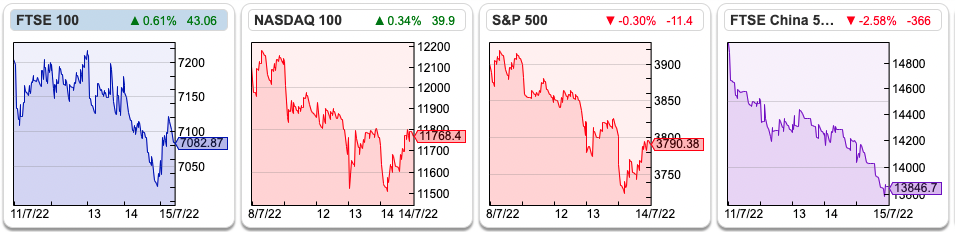

The FTSE 100 was down -1.6% last week to 7,082. The Nasdaq100 and S&P500 were down -2.95% and -2.8% respectively. The 2yr – 10yr yield curve inverted more steeply in the US, as the 2-year was driven higher by higher inflation data which increased expectations of short-term rate rises. In previous cycles that inverted yield curve has been a strong signal for future recession, and it is now more inverted than it has been since 2000.

Although I tend to focus on the price of oil (just below $100 per barrel last week), other commodities are sending a more bearish signal. Copper, which is widely regarded as a proxy for industrial activity and is also used in growth areas like Electric Vehicles, solar panels and wind turbines is down -26% YTD. According to this FT article, suggesting that ‘copper is the new oil’, production is even more concentrated than oil. Chile and Peru currently account for 38% of mined copper. Precious metals like gold and platinum are also down -5% YTD and -12% YTD respectively. Depending on the scenario you believe, commodities and precious metals should do well in a stagflation environment, but are to be avoided in a normal recession. I’m still in camp stagflation, based on my experience of 2007-9 where commodity market participants were not a good forward indicator, perhaps because many commodity funds rely on momentum strategies that are slow to call the turn. For instance, the price of oil peaked at $147 per barrel in mid-2008, before collapsing to below $40 per barrel by the end of that year.

In any case, framing the debate in terms of stagflation (good for commodities, precious metals, companies with strong brands and pricing power) versus recession (good for government bonds, and long-duration‘ bond proxies’ like Unilever) may prove flawed. I had been assuming that brands do well in an inflationary environment, but last week we saw a couple of profit warnings from higher costs: Fevertree -33%, Creightons -19% which I own and cover below. Fevertree and Creightons both have consumer brands, though Fevertree is perhaps more upmarket than the latter. That suggests it might be worth rethinking the ‘brands do well in inflationary times’ conventional wisdom. Richard has pointed out on Twitter this could also undermine his buy case on PZ Cussons too, which I also own.

Businesses exposed to financial markets also warned: Jarvis was down -25% and FinnCap -7% last week. MPAC the packaging group was down -37% as well. Bad luck to anyone holding those – I think it’s inevitable that good companies will warn. It’s not a bad idea to have a plan beforehand, buy more or average down? If you are going to ‘average down’ I’d suggest waiting at least a month following the profit warning and revisit the investment case with fresh eyes.

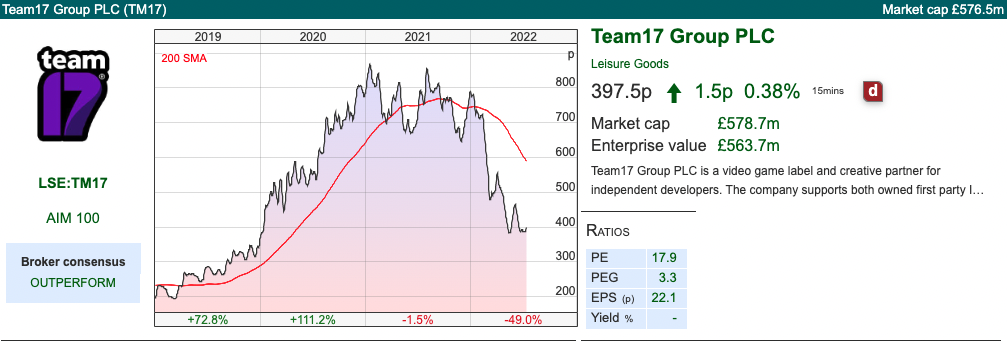

Pleasingly though Clarkson looks to be delivering good returns, though could be vulnerable if the recession fears in commodity markets play out. For instance, the shares fell -70% when commodity markets collapsed in the second half of 2008. I also look at the ‘inline’ statement from Team17, which should be taken as reassuring, as the shares of the computer game company have already sold off -49% YTD. I cover both of those below.

Clarkson H1 June 2022 Trading Update

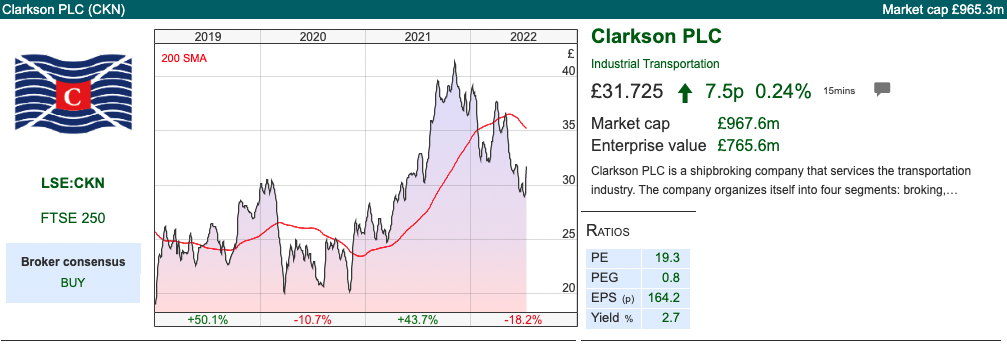

This shipping company founded in 1852 put out a brief RNS saying that it expects PBT to be not less than £42m, implying a +53% increase on H1 last year. That follows an ‘in line’ AGM statement at the start of May and strong FY results in March which I wrote about here. Performance has been strong across all divisions, but Broking (77% of revenue and reported a margin of 22% at the FY) has been performing particularly well.

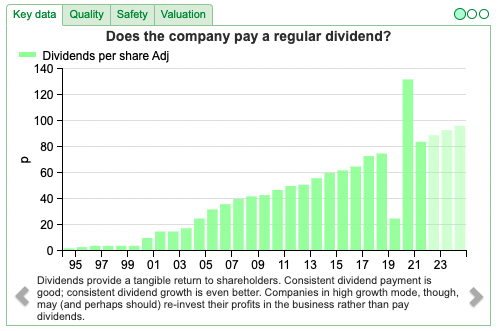

There’s no cash figure in the RNS, but this is a conservatively run company. In December they reported net cash of £122m. They also make conservative accounting choices, last year writing down the value of Platou, a Norwegian business bought close to the top of the cycle in 2014 for £281m (75% in Clarkson shares). The Sharepad dividend chart history reveals 20 years of DPS growth. The funny-looking blip in 2019/20 is because, at the start of the pandemic, they deferred their 2019 final dividend of 53p and paid the amount as an interim dividend the following year.

Valuation: The shares are trading on 17x FY Dec 2023F and 2024F. That seems very reasonable for a company with such strong dividends and quality measures.

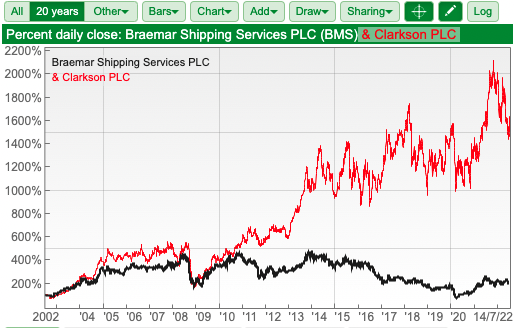

Opinion: A while ago Andrew @fundhunter_co set me a puzzle, asking why CKN had done so much better than Braemar over the long term. You can see the performance with Sharepad’s ‘multigraph feature’. If readers have insights, please do post in the ‘chat’ function.

We do know CKN enjoys an enviable long-term track record. The sector is cyclical, but CKN should benefit from more investment in offshore oil & gas, increased use of LNG tankers following the Ukraine war and higher freight costs for dry goods and chartering container ships. H1 results will be released on Monday 8 August 2022.

Team17 H1 June Trading Update

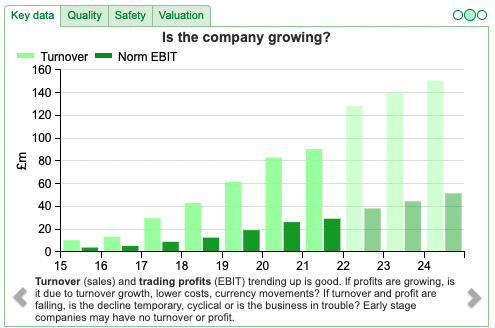

This acquisitive computer games company announced ‘in line’ trading for the half year to June. They are a publisher, who create their own games and also partner with independent developers. Aside from Worms, I’m not familiar with any of the games that they make, but they have various launches in H2: Construction Simulator, Bus Simulator: City Ride, plus seven more titles from their Games Label. We saw with Frontier Developments that games companies are reliant on successful launches of titles, so I think guidance in this sector is particularly uncertain.

History: TM17 was founded in 1990, publishing third-party games mostly for the Commodore Amiga. In 1995 they enjoyed major success with the release of Worms. A fun fact about the origins of this game is that it was designed on a Casio graph-plotting calculator by a schoolboy who was bored in a maths lesson. Once the game worked on the calculator, he ported it over to the school’s Amiga computer which was later banned by the teachers because everyone was playing it so much. After a couple of years of hard work Andy Davidson, the game’s creator approached Team17 who snapped it up and released it.

Between 1995 and 2010, TM17 were mainly a developer (rather than a publisher) focused on the Worms franchise, working with Ubisoft, Sega and Hasbro. In 2011 Debbie Bestwick led a management buyout and repositioned the group to be a publisher, launching Games Label a couple of years later to help other developers publish third-party content. Lloyds Development Capital, the Private Equity arm of Lloyds Bank took a 16% stake in 2016.

They listed on AIM in May 2018, at 165p valuing the company at £217m market cap. They raised just over £100m from external investors, with selling shareholders receiving £59m and £43m going to the company to fund growth. In July last year, they bought StoryToys, a developer and publisher of ‘edutainment’ apps for children for $26.5m, with a further $22.5m earn out. In January this year, they did a place and bought astragon, for €75m plus a further €25m earn out, funded with a £79m placing at 714p per share. Astragon is a German developer and publisher of ‘work’ simulation games Firefighting Simulator, Police Simulator, Bus Simulator etc. I wonder if they ever thought of doing an Equity Research Bank Analyst Simulator or Elon Musk’s Corporate Finance Adviser Simulator? If not, I think they are really missing an opportunity.

In the same month, they also bought Hell Let Lose for £31m plus £15m earnt out and The Label Group, as US publisher of edutainment apps, for $24m with $16m earn out.

Ownership: Debbie Bestwick, the co-founder and CEO since 2010, sold down her 44% stake at the IPO but still owns 21%. There is a long list of institutions abrdn 7.6%, Blackrock 6.1%, Liontrust 5.7%, Janus Henderson 3.8%. Interestingly Blackrock, Henderson and Fidelity all held significant stakes before the IPO.

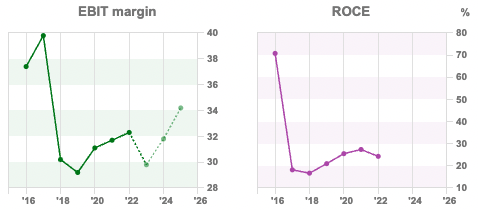

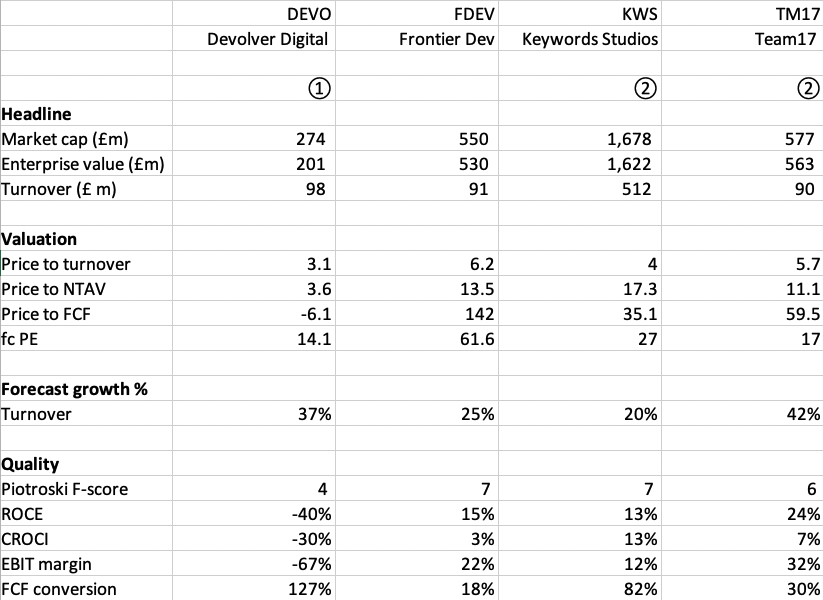

Valuation: Those acquisitions all happened after the Dec year-end, so the values aren’t recorded in the balance sheet. On current forecasts, the shares are trading on 16x Dec 2023F and 14x Dec 2024F. The 3-year average RoCE is 25% and 3-year average EBIT margin 31%, so the shares appear very good value. There is considerable risk of indigestion from all the recent deals though.

Opinion: I think I’ll wait until I see the balance sheet for the H1 before I form a view. Clearly, some shareholders didn’t like the recent flurry of acquisitions and decided to sell their shares earlier this year. Sharepad’s ‘compare’ tab (downloaded into a .CSV file) below gives readers a view of the comparative valuations within the sector.

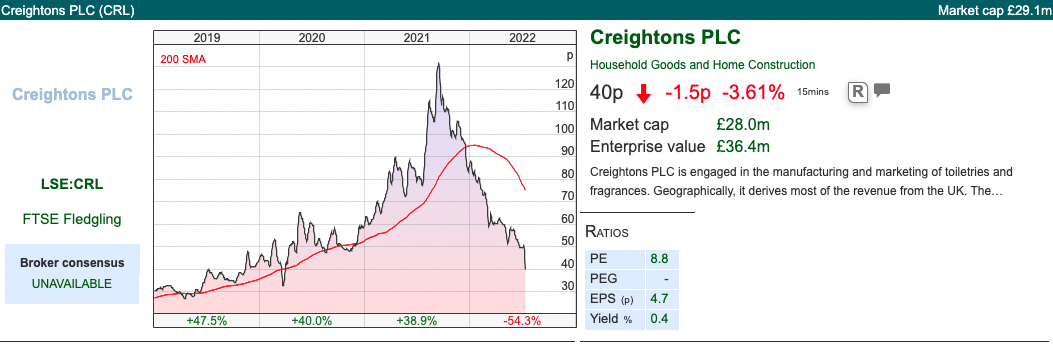

Creightons FY March 2022

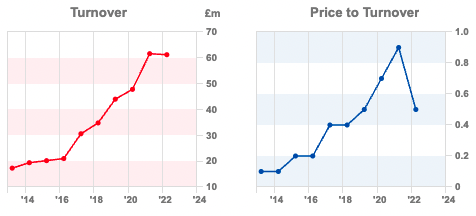

This beauty and fragrance brands company announced FY Mar 2022 revenue down -0.7% from £61m. The last couple of years the company enjoyed a large boost from £14.6m (or 24% of FY Mar 2021 revenue) of hand sanitiser sales due to the pandemic, which didn’t repeat this year. Ex acquisitions revenues were down -7%.

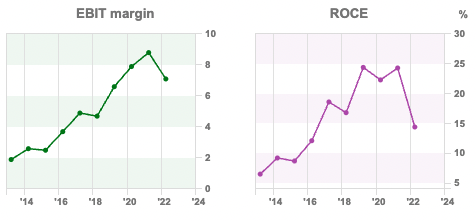

They’ve also cancelled the final dividend (0.5p) last year. Statutory PBT was down by a third to £3.5m. The gross margin actually improved slightly to 43% but the damage has been done by rising admin costs, +12% to £18.4m, which they put down to energy and insurance costs. In previous years there have been higher costs from Covid, now quantified as £600K and these have not repeated. Excluding this benefit, admin costs would have been up +19%, which is well ahead of inflation. Leo makes the general point, that management can control costs better than revenue; very often what looks like a cost ‘miss’, is in fact management investing for future revenue growth, and then if that revenue fails to come through and costs and PBT progression look terrible. I think that this is what’s happened here.

The business has swung from net cash last year to net debt of £7m, following a couple of acquisitions (Emma Hardie and Brodie & Stone). The company borrowed £3m, for 4 years secured paying 2.7% above the Bank of England rate. They have £6.3m of undrawn borrowing facilities, and also used £1.3m of invoice discounting to fund working capital as of Mar 2022.

They’ve made an exceptional charge of £602K through the p&l related to the acquisitions. £218K is legal and professional costs, and the other £384K is the difference between 125p (guaranteed to Emma Hardie shareholders) and the CRL share price at the end of March, which was 60p. If the share prices falls further (it fell below 40p following last week’s RNS) then there will be a further charge through the p&l, as the reference price will be calculated on 28 July this year. In summary, they’ve spent £9.7m on acquisitions, of which £5.6m was cash, the rest being property retention, deferred consideration, contingent consideration and issuing shares. This seems to me an unnecessarily complicated way of doing deals: to my mind, it makes sense to offer i) cash ii) shares iii) a combination of cash and shares with an earn-out. Instead, Creightons have offered shares, but at a guaranteed price – which is a poor way to structure a deal, in my view. CRL management seems to be very competent operationally, but I think that hasn’t translated into being good capital allocators when it comes to acquisitions (which is a very different skill set).

As an aside: CRL management had previously tried to buy InnovaDerma, haircare and anti-ageing creams in January 2020, in a paper deal (offering 2 Creightons shares for 3 InnovaDerma shares, a premium of just 3.5% to the target company’s 43p share price Feb 2020.) Fast forward a couple of years and Brand Architeckts have now bought IDP in March 2022 for 48p (a +70% premium to the then IDP closing price). It’s worth keeping an eye on how that deal goes too!

As a reminder, CRL is quite idiosyncratic, with an Executive Chairman, William McIllroy who owns 25% and a history of delayed financial reporting. This time last year results were delayed due to auditors not completing their work on time. That’s fairly common: Renold, Gately and ULS Technology had similar problems last year and this didn’t signal anything untoward (except that auditors are struggling with remote working). Then, in the second half of last year, there was significant insider selling in October and November following the H1 period ends in September before the company eventually released results between Christmas and New Year, just before the end of the mandatory reporting time. Worth noting too that management haven’t put out a trading statement or updated the market at all this year. I said last year that this looked to be far from best practice, and I reiterate that.

Net cash from operating activities was £1.4m versus PAT of £3.1m. Most of the difference is negative working capital movements, Inventories have increased +51% – some of that is due to acquisitions, so it’s hard to see if there’s risk of de-stocking. This is mentioned as a Key Audit Matter: there is a risk that inventory is overstated due to management’s judgement on potentially obsolete, damaged and slow-moving items in determining the net realisable value

The ‘going concern’ statement says: “we have carried out a review of our cash requirements for the next 12 months. Scenarios modelled included the removal of the Group’s largest customer and increases of 20% in costs of raw materials or overheads. These models show that even without management tackling current overhead levels or increasing prices to customers, the Group would not fully utilise available working capital resources over the next 12 months.”

Outlook: Management doesn’t give much guidance and there are no broker forecasts (or company-sponsored research from Hardman or Progressive or similar.) They now say that they will reduce overhead costs, which we should see by H1 Sept 2022 (ie this half). Previously management have published medium aspirations for FY March 2025 sales to reach £100m, with a net profit margin of 9% and RoCE to remain at 20%. I don’t think that is realistic now unless you think that the problems will quickly resolve.

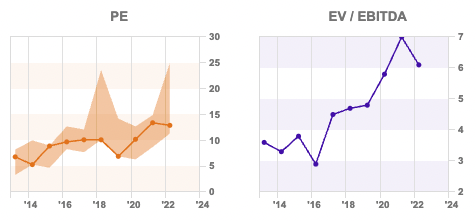

Valuation: The shares have now fallen to 0.5x of revenue. Assuming that they can eventually return to 4.3p of EPS achieved FY Mar 2021 implies a rating of 9x PER. That seems about right, though Sharepad shows that it did trade as high as 25x PER last year. The one thing in favour of the shares is the track record of RoCE (24% average over the past 3 years).

Opinion: This looks like self-inflicted harm caused by making acquisitions at the top of the cycle, combined with insider selling and extremely poor voluntary disclosure decisions. These results also show the risk of companies with ambitious revenue targets making duff acquisitions. The company has their results webinar on Wed 20th July at 11AM, and you can register here. It’s a real shame because management worked hard to tell their story to private investors doing many online presentations. I plan to be there, and hopefully, management will have convincing answers to questions.

I own the shares and am very disappointed, I should have taken the signal from insider selling in Oct Nov last year and sold out then (which would have been a 4 bagger return). This is likely to be dead money for at least 6 months, probably longer.

Notes

The author owns shares in Creightons

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Weekly Market Commentary 18/07/22| CKN, CRL, TM17| Brands warning on costs

Following the profit warnings from Fevertree and Creightons, Bruce questions the conventional wisdom that companies with strong brands do well in an inflationary environment. Companies covered CKN, CRL, and TM17.

The FTSE 100 was down -1.6% last week to 7,082. The Nasdaq100 and S&P500 were down -2.95% and -2.8% respectively. The 2yr – 10yr yield curve inverted more steeply in the US, as the 2-year was driven higher by higher inflation data which increased expectations of short-term rate rises. In previous cycles that inverted yield curve has been a strong signal for future recession, and it is now more inverted than it has been since 2000.

Although I tend to focus on the price of oil (just below $100 per barrel last week), other commodities are sending a more bearish signal. Copper, which is widely regarded as a proxy for industrial activity and is also used in growth areas like Electric Vehicles, solar panels and wind turbines is down -26% YTD. According to this FT article, suggesting that ‘copper is the new oil’, production is even more concentrated than oil. Chile and Peru currently account for 38% of mined copper. Precious metals like gold and platinum are also down -5% YTD and -12% YTD respectively. Depending on the scenario you believe, commodities and precious metals should do well in a stagflation environment, but are to be avoided in a normal recession. I’m still in camp stagflation, based on my experience of 2007-9 where commodity market participants were not a good forward indicator, perhaps because many commodity funds rely on momentum strategies that are slow to call the turn. For instance, the price of oil peaked at $147 per barrel in mid-2008, before collapsing to below $40 per barrel by the end of that year.

In any case, framing the debate in terms of stagflation (good for commodities, precious metals, companies with strong brands and pricing power) versus recession (good for government bonds, and long-duration‘ bond proxies’ like Unilever) may prove flawed. I had been assuming that brands do well in an inflationary environment, but last week we saw a couple of profit warnings from higher costs: Fevertree -33%, Creightons -19% which I own and cover below. Fevertree and Creightons both have consumer brands, though Fevertree is perhaps more upmarket than the latter. That suggests it might be worth rethinking the ‘brands do well in inflationary times’ conventional wisdom. Richard has pointed out on Twitter this could also undermine his buy case on PZ Cussons too, which I also own.

Businesses exposed to financial markets also warned: Jarvis was down -25% and FinnCap -7% last week. MPAC the packaging group was down -37% as well. Bad luck to anyone holding those – I think it’s inevitable that good companies will warn. It’s not a bad idea to have a plan beforehand, buy more or average down? If you are going to ‘average down’ I’d suggest waiting at least a month following the profit warning and revisit the investment case with fresh eyes.

Pleasingly though Clarkson looks to be delivering good returns, though could be vulnerable if the recession fears in commodity markets play out. For instance, the shares fell -70% when commodity markets collapsed in the second half of 2008. I also look at the ‘inline’ statement from Team17, which should be taken as reassuring, as the shares of the computer game company have already sold off -49% YTD. I cover both of those below.

Clarkson H1 June 2022 Trading Update

This shipping company founded in 1852 put out a brief RNS saying that it expects PBT to be not less than £42m, implying a +53% increase on H1 last year. That follows an ‘in line’ AGM statement at the start of May and strong FY results in March which I wrote about here. Performance has been strong across all divisions, but Broking (77% of revenue and reported a margin of 22% at the FY) has been performing particularly well.

There’s no cash figure in the RNS, but this is a conservatively run company. In December they reported net cash of £122m. They also make conservative accounting choices, last year writing down the value of Platou, a Norwegian business bought close to the top of the cycle in 2014 for £281m (75% in Clarkson shares). The Sharepad dividend chart history reveals 20 years of DPS growth. The funny-looking blip in 2019/20 is because, at the start of the pandemic, they deferred their 2019 final dividend of 53p and paid the amount as an interim dividend the following year.

Valuation: The shares are trading on 17x FY Dec 2023F and 2024F. That seems very reasonable for a company with such strong dividends and quality measures.

Opinion: A while ago Andrew @fundhunter_co set me a puzzle, asking why CKN had done so much better than Braemar over the long term. You can see the performance with Sharepad’s ‘multigraph feature’. If readers have insights, please do post in the ‘chat’ function.

We do know CKN enjoys an enviable long-term track record. The sector is cyclical, but CKN should benefit from more investment in offshore oil & gas, increased use of LNG tankers following the Ukraine war and higher freight costs for dry goods and chartering container ships. H1 results will be released on Monday 8 August 2022.

Team17 H1 June Trading Update

This acquisitive computer games company announced ‘in line’ trading for the half year to June. They are a publisher, who create their own games and also partner with independent developers. Aside from Worms, I’m not familiar with any of the games that they make, but they have various launches in H2: Construction Simulator, Bus Simulator: City Ride, plus seven more titles from their Games Label. We saw with Frontier Developments that games companies are reliant on successful launches of titles, so I think guidance in this sector is particularly uncertain.

History: TM17 was founded in 1990, publishing third-party games mostly for the Commodore Amiga. In 1995 they enjoyed major success with the release of Worms. A fun fact about the origins of this game is that it was designed on a Casio graph-plotting calculator by a schoolboy who was bored in a maths lesson. Once the game worked on the calculator, he ported it over to the school’s Amiga computer which was later banned by the teachers because everyone was playing it so much. After a couple of years of hard work Andy Davidson, the game’s creator approached Team17 who snapped it up and released it.

Between 1995 and 2010, TM17 were mainly a developer (rather than a publisher) focused on the Worms franchise, working with Ubisoft, Sega and Hasbro. In 2011 Debbie Bestwick led a management buyout and repositioned the group to be a publisher, launching Games Label a couple of years later to help other developers publish third-party content. Lloyds Development Capital, the Private Equity arm of Lloyds Bank took a 16% stake in 2016.

They listed on AIM in May 2018, at 165p valuing the company at £217m market cap. They raised just over £100m from external investors, with selling shareholders receiving £59m and £43m going to the company to fund growth. In July last year, they bought StoryToys, a developer and publisher of ‘edutainment’ apps for children for $26.5m, with a further $22.5m earn out. In January this year, they did a place and bought astragon, for €75m plus a further €25m earn out, funded with a £79m placing at 714p per share. Astragon is a German developer and publisher of ‘work’ simulation games Firefighting Simulator, Police Simulator, Bus Simulator etc. I wonder if they ever thought of doing an Equity Research Bank Analyst Simulator or Elon Musk’s Corporate Finance Adviser Simulator? If not, I think they are really missing an opportunity.

In the same month, they also bought Hell Let Lose for £31m plus £15m earnt out and The Label Group, as US publisher of edutainment apps, for $24m with $16m earn out.

Ownership: Debbie Bestwick, the co-founder and CEO since 2010, sold down her 44% stake at the IPO but still owns 21%. There is a long list of institutions abrdn 7.6%, Blackrock 6.1%, Liontrust 5.7%, Janus Henderson 3.8%. Interestingly Blackrock, Henderson and Fidelity all held significant stakes before the IPO.

Valuation: Those acquisitions all happened after the Dec year-end, so the values aren’t recorded in the balance sheet. On current forecasts, the shares are trading on 16x Dec 2023F and 14x Dec 2024F. The 3-year average RoCE is 25% and 3-year average EBIT margin 31%, so the shares appear very good value. There is considerable risk of indigestion from all the recent deals though.

Opinion: I think I’ll wait until I see the balance sheet for the H1 before I form a view. Clearly, some shareholders didn’t like the recent flurry of acquisitions and decided to sell their shares earlier this year. Sharepad’s ‘compare’ tab (downloaded into a .CSV file) below gives readers a view of the comparative valuations within the sector.

Creightons FY March 2022

This beauty and fragrance brands company announced FY Mar 2022 revenue down -0.7% from £61m. The last couple of years the company enjoyed a large boost from £14.6m (or 24% of FY Mar 2021 revenue) of hand sanitiser sales due to the pandemic, which didn’t repeat this year. Ex acquisitions revenues were down -7%.

They’ve also cancelled the final dividend (0.5p) last year. Statutory PBT was down by a third to £3.5m. The gross margin actually improved slightly to 43% but the damage has been done by rising admin costs, +12% to £18.4m, which they put down to energy and insurance costs. In previous years there have been higher costs from Covid, now quantified as £600K and these have not repeated. Excluding this benefit, admin costs would have been up +19%, which is well ahead of inflation. Leo makes the general point, that management can control costs better than revenue; very often what looks like a cost ‘miss’, is in fact management investing for future revenue growth, and then if that revenue fails to come through and costs and PBT progression look terrible. I think that this is what’s happened here.

The business has swung from net cash last year to net debt of £7m, following a couple of acquisitions (Emma Hardie and Brodie & Stone). The company borrowed £3m, for 4 years secured paying 2.7% above the Bank of England rate. They have £6.3m of undrawn borrowing facilities, and also used £1.3m of invoice discounting to fund working capital as of Mar 2022.

They’ve made an exceptional charge of £602K through the p&l related to the acquisitions. £218K is legal and professional costs, and the other £384K is the difference between 125p (guaranteed to Emma Hardie shareholders) and the CRL share price at the end of March, which was 60p. If the share prices falls further (it fell below 40p following last week’s RNS) then there will be a further charge through the p&l, as the reference price will be calculated on 28 July this year. In summary, they’ve spent £9.7m on acquisitions, of which £5.6m was cash, the rest being property retention, deferred consideration, contingent consideration and issuing shares. This seems to me an unnecessarily complicated way of doing deals: to my mind, it makes sense to offer i) cash ii) shares iii) a combination of cash and shares with an earn-out. Instead, Creightons have offered shares, but at a guaranteed price – which is a poor way to structure a deal, in my view. CRL management seems to be very competent operationally, but I think that hasn’t translated into being good capital allocators when it comes to acquisitions (which is a very different skill set).

As an aside: CRL management had previously tried to buy InnovaDerma, haircare and anti-ageing creams in January 2020, in a paper deal (offering 2 Creightons shares for 3 InnovaDerma shares, a premium of just 3.5% to the target company’s 43p share price Feb 2020.) Fast forward a couple of years and Brand Architeckts have now bought IDP in March 2022 for 48p (a +70% premium to the then IDP closing price). It’s worth keeping an eye on how that deal goes too!

As a reminder, CRL is quite idiosyncratic, with an Executive Chairman, William McIllroy who owns 25% and a history of delayed financial reporting. This time last year results were delayed due to auditors not completing their work on time. That’s fairly common: Renold, Gately and ULS Technology had similar problems last year and this didn’t signal anything untoward (except that auditors are struggling with remote working). Then, in the second half of last year, there was significant insider selling in October and November following the H1 period ends in September before the company eventually released results between Christmas and New Year, just before the end of the mandatory reporting time. Worth noting too that management haven’t put out a trading statement or updated the market at all this year. I said last year that this looked to be far from best practice, and I reiterate that.

Net cash from operating activities was £1.4m versus PAT of £3.1m. Most of the difference is negative working capital movements, Inventories have increased +51% – some of that is due to acquisitions, so it’s hard to see if there’s risk of de-stocking. This is mentioned as a Key Audit Matter: there is a risk that inventory is overstated due to management’s judgement on potentially obsolete, damaged and slow-moving items in determining the net realisable value

The ‘going concern’ statement says: “we have carried out a review of our cash requirements for the next 12 months. Scenarios modelled included the removal of the Group’s largest customer and increases of 20% in costs of raw materials or overheads. These models show that even without management tackling current overhead levels or increasing prices to customers, the Group would not fully utilise available working capital resources over the next 12 months.”

Outlook: Management doesn’t give much guidance and there are no broker forecasts (or company-sponsored research from Hardman or Progressive or similar.) They now say that they will reduce overhead costs, which we should see by H1 Sept 2022 (ie this half). Previously management have published medium aspirations for FY March 2025 sales to reach £100m, with a net profit margin of 9% and RoCE to remain at 20%. I don’t think that is realistic now unless you think that the problems will quickly resolve.

Valuation: The shares have now fallen to 0.5x of revenue. Assuming that they can eventually return to 4.3p of EPS achieved FY Mar 2021 implies a rating of 9x PER. That seems about right, though Sharepad shows that it did trade as high as 25x PER last year. The one thing in favour of the shares is the track record of RoCE (24% average over the past 3 years).

Opinion: This looks like self-inflicted harm caused by making acquisitions at the top of the cycle, combined with insider selling and extremely poor voluntary disclosure decisions. These results also show the risk of companies with ambitious revenue targets making duff acquisitions. The company has their results webinar on Wed 20th July at 11AM, and you can register here. It’s a real shame because management worked hard to tell their story to private investors doing many online presentations. I plan to be there, and hopefully, management will have convincing answers to questions.

I own the shares and am very disappointed, I should have taken the signal from insider selling in Oct Nov last year and sold out then (which would have been a 4 bagger return). This is likely to be dead money for at least 6 months, probably longer.

Notes

The author owns shares in Creightons

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.