Bruce looks at the BoE twice-yearly Financial Stability Report and wonders if the regulator is too sanguine about the risks of stagflation. Companies covered PRV, the industrial filtration company, and forex/payments companies EQLS and AGFX.

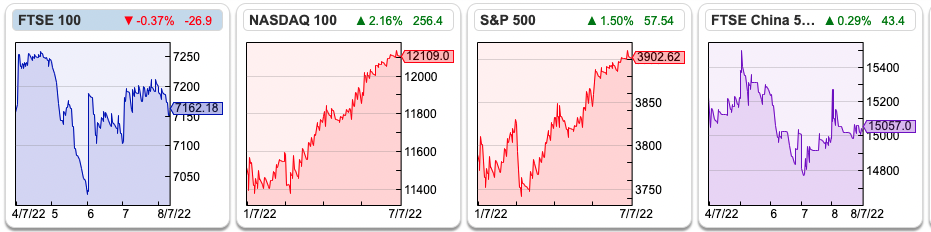

The FTSE 100 was flat at 7,162, the S&P 500 and Nasdaq100 were up +2.0% and +4.5% respectively. That stock market optimism is in contrast to the US bond markets, with the 10Y bond yield remaining just below 3% last week, and is now below the level of the 2-year treasury yield. The inverted yield curve is normally seen as a recession indicator, implying that the Fed will have to reduce interest rates in the medium term. I’m sure readers followed the exciting politics in the UK. The impact on the pound was a +1.8% rise versus the Euro and a -1.2% fall versus the US Dollar (ie the FTSE 100 and currency markets shrugged with indifference at the Prime Minister’s resignation.)

Last week the Bank of England released their H1 Financial Stability Report of the past 6 months, plus some forward-looking comments. According to their report, 80% of UK mortgages are at a fixed rate, compared with 55% five years ago and likely below 10% in the 1990s, which was the last time interest rates rose steeply. This means that the BoE seems relaxed about the stress on households in the next 6 months; and next year they think the number of households in financial difficulties will remain significantly below the levels seen in the 2007-8 crisis. Current market expectations are for a further rise of c. 150bp by the end of the year. I think there’s a chance that they are underestimating the of stagflation and the Central Bank has to act more aggressively.

Regulators are keen to avoid panics, but an unintended consequence of stepping in to provide liquidity is that the normal market feedback mechanisms are suppressed and risk is mispriced. Or as one old broker told me: the seeds of the next crisis are planted in the previous one. I commented almost exactly year ago, that the G7 Central Banks had created $7trillion of liquidity in just 8 months at the start of the pandemic, which could mean that we pay a high price for ‘stability’ in future years. There’s a good summary of the current situation by Nouriel Roubini, one of the few economists who understood the 2007-8 crisis (as it happened, not with hindsight.) Related to his clear thinking, I also find that he writes in sentences that I can understand, for instance:

The next crisis will not be like its predecessors. In the 1970s, we had stagflation but no massive debt crises, because debt levels were low. After 2008, we had a debt crisis followed by low inflation or deflation, because the credit crunch had generated a negative demand shock. Today, we face supply shocks in a context of much higher debt levels, implying that we are heading for a combination of 1970s-style stagflation and 2008-style debt crises.

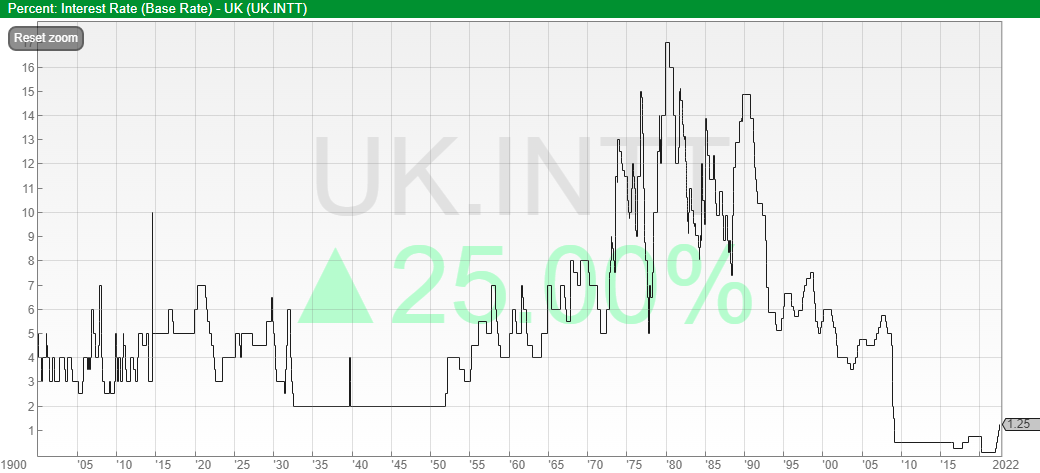

Ouch. Sharepad has UK interest rates going back to 1900, so you can see the current 1.25% rising to 2.75% the context of the last 120 years.

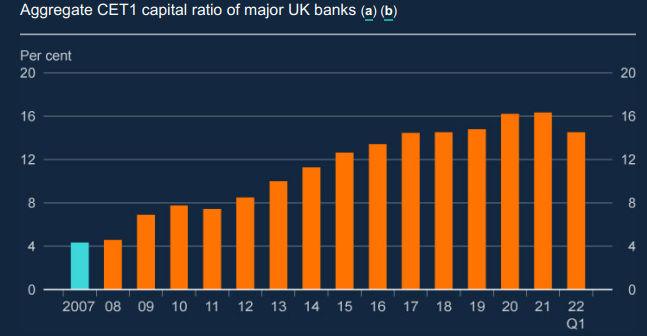

On a more positive note, banks are much better capitalised at 14.5% (as measured by Core Equity Tier 1 ratios) than they were in the last downturn (4% CET 1 ratios), as the BoE chart below points out. I think they will need those equity cushions to absorb rising bad debts in future years.

My guess is that we might see problems first in the corporate sector, with over-indebted companies struggling to re-finance their debt in a rising rate environment, then followed by UK households who have fixed their mortgages for 2-5 years.

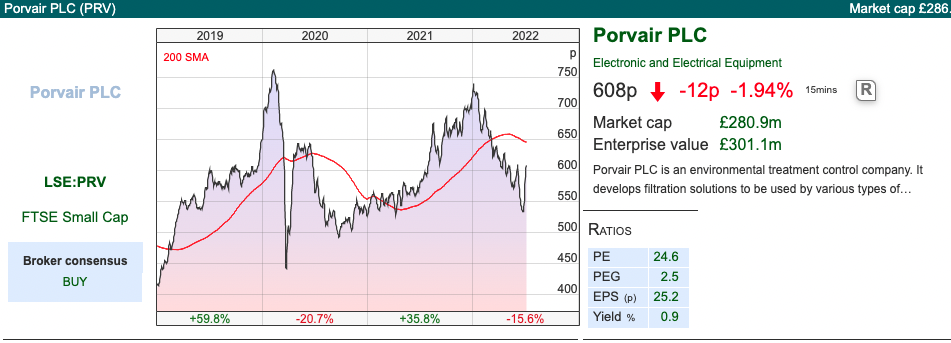

This week I look at Porvair, plus forex and payments companies Equals and Argentex. I continue to put cash slowly to work, by more of Argentex last week, but remain a long way from being fully invested.

Porvair H1 Results

This industrial filtration company, which has rebranded itself as environmental technology, reported H1 results to end of May. Revenues were +18% to £82m, and statutory PBT was +7% to £9.5m. The company made £4m of acquisitions in FY Nov 2021, excluding those and currency effects, revenue growth was +15%. Net cash was £12m (ex-lease liabilities) and they have agreed £24m 4-year RCF (Revolving Credit Facility) with Barclays and Citi in May last year. In case sharp-eyed readers think that it’s odd that the company has net cash, but reports £566K of finance costs in the p&l and £194K of interest paid in the cashflow statement, those costs relate to the pension scheme and lease liabilities respectively.

Below the line, in ‘Other Comprehensive Income’ there’s a £3m positive actuarial gain from the pension plan, presumably as the discount rate used to value the liabilities has risen and a £3.3m forex gain. It’s easy to overlook these below-the-line items, but together they come to £6.4m, compared to reported profit after tax of £7.4m in H1.

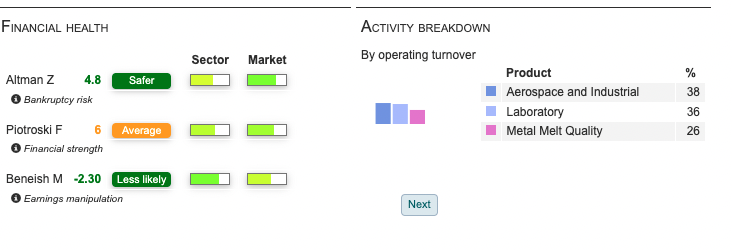

This is another company that makes the ‘voluntary disclosure’ decision not to reconcile profits to cash flow on the face of the cash flow statement, instead pointing readers to note 5. Net cash from operations was £5.65m whereas statutory PBT was £9.5m, and we discover in the note that there was a £1.5m negatives from pension costs (ie pension liability decreased because of the discount rate, but the annual costs are still around 20% of profits) and a £4.9m increase in working capital. That £4.9m is not large in the context of £82m H1 revenue, but it’s always worth checking when a company decides to tuck away the reconciliation in the notes of the accounts. Aside from that, the company looks in good financial health, as Sharepad’s metrics show.

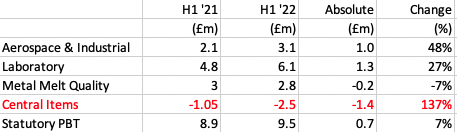

Divisionally, 2 of the 3 divisions are doing well. Revenue was up +18% in Aerospace & Industrial and +22% in Laboratory. Both these divisions reported £31m of revenue in H1, but Laboratory is almost double the profit margin, with £6.1m of adjusted operating profit v £3.1m at Aerospace & Industrial. The third division, Metal Melt Quality makes filters for molten aluminium, ductile iron and nickel-cobalt alloys. The previous year management cut back on sales and marketing costs, which flattered last year’s adjusted operating profit margin of 16%, and led to a 7% decline in PBT H1 v H1 last year. One thing to note is although the divisional performance all looks healthy, there are £1.4m of central items. It’s a fairly standard piece of financial PR to trumpet strong profit growth in the company’s divisions, then quietly reveal large increase in central items. These costs are things like new business development costs, R&D and general financial costs.

Outlook: Management describe the outlook as ‘promising’. The current order book (they don’t give a figure) is flattered though by increasing lead times. When it comes to margins and they believe they can pass on cost increases to customers. Many companies are saying this at the moment, it’s hard to know the pricing power of an industrial company, I suspect it we will only know in 6 months or a year’s time how realistic this is.

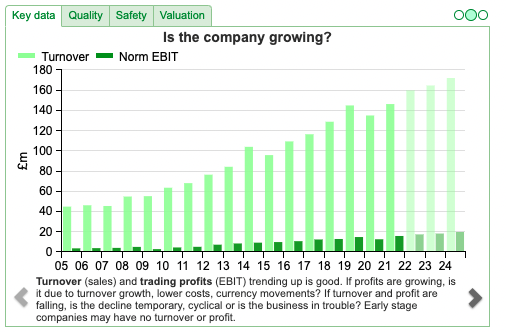

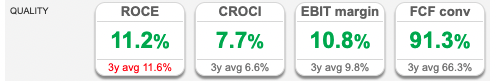

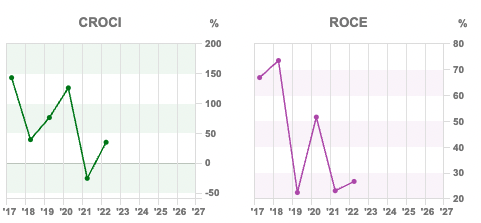

Valuation: The shares are on 21x Nov 2023F and 20x Nov 2024F. I like the long-term track record of growth, but RoCE has been stuck in low single digits though, so I don’t see much reason to get excited about the investment case at the current valuation.

Opinion: Looking at the long-term history this is another stock that had a difficult early life as a listed company in the mid-1990s until after the financial crisis. Then shares then went on to be a ‘ten bagger’ in the most recent decade, with revenue doubling. I do wonder if the flow of funds into ESG investments has pushed up the valuation and given Porvair a premium rating which would not otherwise be justified? That may support the share price, but over the longer term, I would have thought RoCE has to improve to justify the rating.

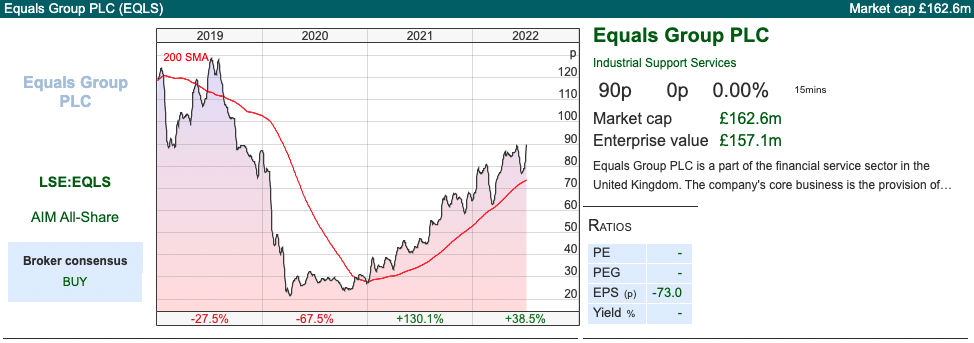

Equals H1 June Trading Update

This forex/payments company focused on SMEs put out an RNS last week saying revenues were up +84% to £31m for H1 to June. That continues the positive trend from May when they said that the daily average revenue for the 91 business days of the year were up +86%, and raised FY EBITDA guidance which the company announced ahead of their AGM in May. In last week’s statement, they once again raised guidance (but again without saying what the current market expectations are.)

Gross profits were up +47% to £15m though cash balances rose a less impressive £1.2m. The cash figure has been held back by ‘earnouts’ from 3 small acquisitions made in prior years, which should come to an end after 2022. The Annual Report suggests the amount due this year is £800K, so not a large item and in turn suggesting that cash would have increased £2m in H1. So perhaps there is less operational gearing in the model that might be assumed?

Equals give a useful split of revenues by product type (International Payments is 1/2 of revenues, followed by Cards and Solutions both c. 1/6) and customer type (SMEs, Corporates, Large Enterprises c.3/4 and their ‘White Label’ offering that is used by other organisations 1/4).

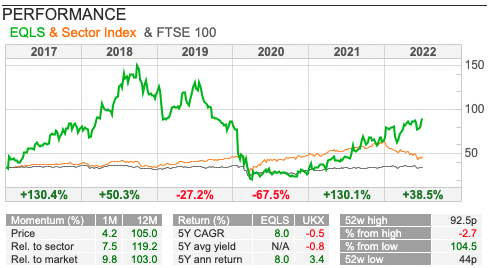

Valuation: The shares are trading on a PER 20x FY Dec 2022F, and 15x Dec 2023F. The price to sales ratio drops to 2.1x Dec 2023F as the revenue growth is forecast to continue. This share has been a volatile ride, loss-making for the last 3 years – which caused the share price to collapse. Well done to anyone who called bottom at the end of 2020.

Opinion: I would imagine all forex companies are currently benefiting from volatility, so it’s hard to assess how much of that +84% revenue increase is a structural growth story. Equals is now twice the size (in market cap) than AGFX and trades at a premium valuation – that’s an impressive reversal from a year and a half ago when Equals was trading on 2.2x sales versus AGFX 5x sales. Back then AGFX market cap was twice the size of EQLS.

Could we see another reversal? I prefer to own AGFX whose FY March 2022 results were also released last week, and I write about below.

Argentex FY March Results

This forex company that serves corporates and institutions, announced revenues +23% to £34.5m and statutory PBT was up +35% to £10.4m for FY Mar 2022. Revenue was in line with guidance from their trading statement in April. Operating profit margins were up a positive surprise, to 31.9% (guidance was for a ‘broadly inline’ with 30.9% Mar 2021). However, these results are a 5% miss on the EPS line v Sharepad’s consensus forecast of 7.4p.

Cash (and cash equivalents) was £37.9m, an increase of £11.1m on the prior year. However, that includes client balances and excludes collateral placed with counterparties. They’ve changed how they disclose this in the current year. As the business deals with swaps, which settle in future, a quarter of their revenue does not convert into cash until at least 6 months later – so they need to be confident that counterparties will settle, otherwise, they are taking serious credit risk. So there’s a timing difference with cash and reported profits. The currency swaps also explain why Sharepad’s CRoCI measure was -25% and FCF conversion was -127% but CRoCI has now risen to +35% just reported and FCF conversion has risen to 179%.

AGFX are going to change their year-end from March to December. They say that this is to address the historic split H1 46% v H2 54% – I think that it’s understandable that investors are nervous about an H2 weighting, tending to treat it as a profit warning. Instead, we are likely to have a heavy H1 weighting in future years (August and December are much quieter months in financial markets). The consensus among the investors on Twitter is that management are using the changed year-end to manage down forecast revenue growth from +24% FY Mar 2023F previously to +13% (note from their new broker Singer CM).

Notwithstanding the lower growth expectations, management are expanding internationally by opening offices in the Netherlands and Australia. They already have a payments licence for the Netherlands, however, under MiFID II they need to be licensed as an investment firm to do forward FX transactions in Europe.

They are also building an online trading solution – though originally the idea was for AGFX to operate like a private bank, with high-touch personal service. Instead, they’re now talking about being a technology ‘platform’ – that word yet again! I listened into the investor call on InvestorMeetCompany and my impression is that there really is a story about investment generating future revenue, but that the timing is uncertain. On the same call, management put up a ‘competitor analysis’ slide, showing that they beat EQLS on both price and service – but Mark Simpson points out EQLS is growing revenue 3-4x faster than AGFX.

The other risk is reliance on a few key clients. Their top 20 clients generate 36% of total revenue (versus 35% at the time of the IPO in 2019). They do say though that in any given year the list of the top 20 changes. To give some idea of materiality: the top 20 clients on average generate £621K of revenue, versus the long tail of customers who generate £14K on average.

Outlook: They are confident that the level of revenue growth will continue as expected in FY23 without putting a number to those expectations (Sharepad shows +19% revenue growth to £41m but that is calculated using a stale Numis forecast I think?) Singer CM doesn’t make their note publicly available, but I’ve phoned around my contacts in MI5, the CIA and Mossad and someone has kindly got hold of it and sent me a screenshot. Singers are already forecasting a December year-end and show EPS of 4.9p 2022F, 6.4p Dec 2023F and 10.1p 2024F. So be aware that the forecasts on Sharepad have been muddied by the change in year-end.

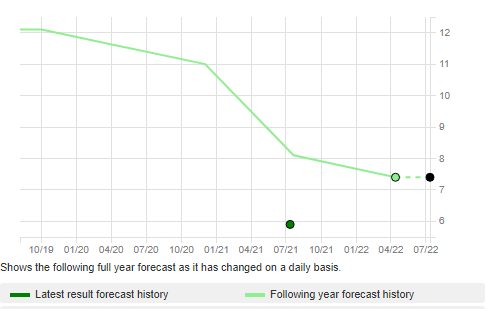

Management have been poor at expectations management in the past. Sharepad ‘forecast’ tab shows how FY Mar 2022 EPS of 7p just reported has been cut -40% from the original FY Mar 2022F 12p a couple of years ago. AGFX management may well have gone the other way and ‘lowballed’ the estimates.

I find that keeping track of EPS change dynamics really useful, so recommend that feature if you haven’t come across it before. When we compare valuation multiples like PER or P/Sales, it’s easy to forget that the sales and EPS forecasts tend to be dynamic numbers, with expectations often moving up or down.

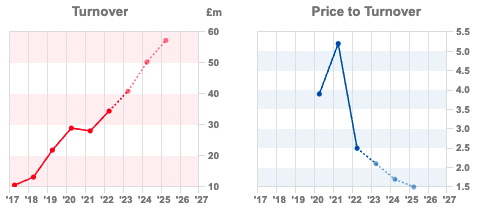

Valuation: On Singers, their new broker, forecasts AGFX are trading on PER 15x Dec 2022F, dropping to 7x 2024F. The shares are on 1.5x Singers 2024F forecast revenue, to my mind that looks rather good value if remotely achievable. Certainly, relative to history the shares have experienced a steep de-rating.

Opinion: I feel like AGFX is a business that is doing all the right things: they are investing for future growth, opening offices in the Netherlands and Australia and applying for regulatory licences, but again the timing of the payback is uncertain. It would be useful if management were honest with their investors about what hasn’t worked. At the time of the IPO, they wanted to double the sales force in 2 years but failed to hit this target. They have said in the past that the first couple of years a salesman fails to generate significant revenue, then in year three average revenue per annum increases significantly c. £0.5m to c. £1.1m in year four. So my theory is they have hired more junior sales staff, but suffered high levels of attrition among recent joiners before those more recent hires became productive.

Pre-IPO they demonstrated very strong growth, with revenue doubling in two years from 2017 to 2019, but the advisers should have suggested more caution I think (see Calnex and Cerillion for examples of companies that have IPO’ed and managed expectations well.) So I think a young Chief Exec has been poorly advised by their financial PR (FTI Consulting) and former broker (Numis, who they have now replaced). I own it and am prepared to be patient, but can understand investors who bought at much higher levels and are frustrated.

Notes

The author owns shares in AGFX

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Weekly Market Commentary 11/07/22| PRV, EQLS, AGFX| The seeds have been planted

Bruce looks at the BoE twice-yearly Financial Stability Report and wonders if the regulator is too sanguine about the risks of stagflation. Companies covered PRV, the industrial filtration company, and forex/payments companies EQLS and AGFX.

The FTSE 100 was flat at 7,162, the S&P 500 and Nasdaq100 were up +2.0% and +4.5% respectively. That stock market optimism is in contrast to the US bond markets, with the 10Y bond yield remaining just below 3% last week, and is now below the level of the 2-year treasury yield. The inverted yield curve is normally seen as a recession indicator, implying that the Fed will have to reduce interest rates in the medium term. I’m sure readers followed the exciting politics in the UK. The impact on the pound was a +1.8% rise versus the Euro and a -1.2% fall versus the US Dollar (ie the FTSE 100 and currency markets shrugged with indifference at the Prime Minister’s resignation.)

Last week the Bank of England released their H1 Financial Stability Report of the past 6 months, plus some forward-looking comments. According to their report, 80% of UK mortgages are at a fixed rate, compared with 55% five years ago and likely below 10% in the 1990s, which was the last time interest rates rose steeply. This means that the BoE seems relaxed about the stress on households in the next 6 months; and next year they think the number of households in financial difficulties will remain significantly below the levels seen in the 2007-8 crisis. Current market expectations are for a further rise of c. 150bp by the end of the year. I think there’s a chance that they are underestimating the of stagflation and the Central Bank has to act more aggressively.

Regulators are keen to avoid panics, but an unintended consequence of stepping in to provide liquidity is that the normal market feedback mechanisms are suppressed and risk is mispriced. Or as one old broker told me: the seeds of the next crisis are planted in the previous one. I commented almost exactly year ago, that the G7 Central Banks had created $7trillion of liquidity in just 8 months at the start of the pandemic, which could mean that we pay a high price for ‘stability’ in future years. There’s a good summary of the current situation by Nouriel Roubini, one of the few economists who understood the 2007-8 crisis (as it happened, not with hindsight.) Related to his clear thinking, I also find that he writes in sentences that I can understand, for instance:

The next crisis will not be like its predecessors. In the 1970s, we had stagflation but no massive debt crises, because debt levels were low. After 2008, we had a debt crisis followed by low inflation or deflation, because the credit crunch had generated a negative demand shock. Today, we face supply shocks in a context of much higher debt levels, implying that we are heading for a combination of 1970s-style stagflation and 2008-style debt crises.

Ouch. Sharepad has UK interest rates going back to 1900, so you can see the current 1.25% rising to 2.75% the context of the last 120 years.

On a more positive note, banks are much better capitalised at 14.5% (as measured by Core Equity Tier 1 ratios) than they were in the last downturn (4% CET 1 ratios), as the BoE chart below points out. I think they will need those equity cushions to absorb rising bad debts in future years.

My guess is that we might see problems first in the corporate sector, with over-indebted companies struggling to re-finance their debt in a rising rate environment, then followed by UK households who have fixed their mortgages for 2-5 years.

This week I look at Porvair, plus forex and payments companies Equals and Argentex. I continue to put cash slowly to work, by more of Argentex last week, but remain a long way from being fully invested.

Porvair H1 Results

This industrial filtration company, which has rebranded itself as environmental technology, reported H1 results to end of May. Revenues were +18% to £82m, and statutory PBT was +7% to £9.5m. The company made £4m of acquisitions in FY Nov 2021, excluding those and currency effects, revenue growth was +15%. Net cash was £12m (ex-lease liabilities) and they have agreed £24m 4-year RCF (Revolving Credit Facility) with Barclays and Citi in May last year. In case sharp-eyed readers think that it’s odd that the company has net cash, but reports £566K of finance costs in the p&l and £194K of interest paid in the cashflow statement, those costs relate to the pension scheme and lease liabilities respectively.

Below the line, in ‘Other Comprehensive Income’ there’s a £3m positive actuarial gain from the pension plan, presumably as the discount rate used to value the liabilities has risen and a £3.3m forex gain. It’s easy to overlook these below-the-line items, but together they come to £6.4m, compared to reported profit after tax of £7.4m in H1.

This is another company that makes the ‘voluntary disclosure’ decision not to reconcile profits to cash flow on the face of the cash flow statement, instead pointing readers to note 5. Net cash from operations was £5.65m whereas statutory PBT was £9.5m, and we discover in the note that there was a £1.5m negatives from pension costs (ie pension liability decreased because of the discount rate, but the annual costs are still around 20% of profits) and a £4.9m increase in working capital. That £4.9m is not large in the context of £82m H1 revenue, but it’s always worth checking when a company decides to tuck away the reconciliation in the notes of the accounts. Aside from that, the company looks in good financial health, as Sharepad’s metrics show.

Divisionally, 2 of the 3 divisions are doing well. Revenue was up +18% in Aerospace & Industrial and +22% in Laboratory. Both these divisions reported £31m of revenue in H1, but Laboratory is almost double the profit margin, with £6.1m of adjusted operating profit v £3.1m at Aerospace & Industrial. The third division, Metal Melt Quality makes filters for molten aluminium, ductile iron and nickel-cobalt alloys. The previous year management cut back on sales and marketing costs, which flattered last year’s adjusted operating profit margin of 16%, and led to a 7% decline in PBT H1 v H1 last year. One thing to note is although the divisional performance all looks healthy, there are £1.4m of central items. It’s a fairly standard piece of financial PR to trumpet strong profit growth in the company’s divisions, then quietly reveal large increase in central items. These costs are things like new business development costs, R&D and general financial costs.

Outlook: Management describe the outlook as ‘promising’. The current order book (they don’t give a figure) is flattered though by increasing lead times. When it comes to margins and they believe they can pass on cost increases to customers. Many companies are saying this at the moment, it’s hard to know the pricing power of an industrial company, I suspect it we will only know in 6 months or a year’s time how realistic this is.

Valuation: The shares are on 21x Nov 2023F and 20x Nov 2024F. I like the long-term track record of growth, but RoCE has been stuck in low single digits though, so I don’t see much reason to get excited about the investment case at the current valuation.

Opinion: Looking at the long-term history this is another stock that had a difficult early life as a listed company in the mid-1990s until after the financial crisis. Then shares then went on to be a ‘ten bagger’ in the most recent decade, with revenue doubling. I do wonder if the flow of funds into ESG investments has pushed up the valuation and given Porvair a premium rating which would not otherwise be justified? That may support the share price, but over the longer term, I would have thought RoCE has to improve to justify the rating.

Equals H1 June Trading Update

This forex/payments company focused on SMEs put out an RNS last week saying revenues were up +84% to £31m for H1 to June. That continues the positive trend from May when they said that the daily average revenue for the 91 business days of the year were up +86%, and raised FY EBITDA guidance which the company announced ahead of their AGM in May. In last week’s statement, they once again raised guidance (but again without saying what the current market expectations are.)

Gross profits were up +47% to £15m though cash balances rose a less impressive £1.2m. The cash figure has been held back by ‘earnouts’ from 3 small acquisitions made in prior years, which should come to an end after 2022. The Annual Report suggests the amount due this year is £800K, so not a large item and in turn suggesting that cash would have increased £2m in H1. So perhaps there is less operational gearing in the model that might be assumed?

Equals give a useful split of revenues by product type (International Payments is 1/2 of revenues, followed by Cards and Solutions both c. 1/6) and customer type (SMEs, Corporates, Large Enterprises c.3/4 and their ‘White Label’ offering that is used by other organisations 1/4).

Valuation: The shares are trading on a PER 20x FY Dec 2022F, and 15x Dec 2023F. The price to sales ratio drops to 2.1x Dec 2023F as the revenue growth is forecast to continue. This share has been a volatile ride, loss-making for the last 3 years – which caused the share price to collapse. Well done to anyone who called bottom at the end of 2020.

Opinion: I would imagine all forex companies are currently benefiting from volatility, so it’s hard to assess how much of that +84% revenue increase is a structural growth story. Equals is now twice the size (in market cap) than AGFX and trades at a premium valuation – that’s an impressive reversal from a year and a half ago when Equals was trading on 2.2x sales versus AGFX 5x sales. Back then AGFX market cap was twice the size of EQLS.

Could we see another reversal? I prefer to own AGFX whose FY March 2022 results were also released last week, and I write about below.

Argentex FY March Results

This forex company that serves corporates and institutions, announced revenues +23% to £34.5m and statutory PBT was up +35% to £10.4m for FY Mar 2022. Revenue was in line with guidance from their trading statement in April. Operating profit margins were up a positive surprise, to 31.9% (guidance was for a ‘broadly inline’ with 30.9% Mar 2021). However, these results are a 5% miss on the EPS line v Sharepad’s consensus forecast of 7.4p.

Cash (and cash equivalents) was £37.9m, an increase of £11.1m on the prior year. However, that includes client balances and excludes collateral placed with counterparties. They’ve changed how they disclose this in the current year. As the business deals with swaps, which settle in future, a quarter of their revenue does not convert into cash until at least 6 months later – so they need to be confident that counterparties will settle, otherwise, they are taking serious credit risk. So there’s a timing difference with cash and reported profits. The currency swaps also explain why Sharepad’s CRoCI measure was -25% and FCF conversion was -127% but CRoCI has now risen to +35% just reported and FCF conversion has risen to 179%.

AGFX are going to change their year-end from March to December. They say that this is to address the historic split H1 46% v H2 54% – I think that it’s understandable that investors are nervous about an H2 weighting, tending to treat it as a profit warning. Instead, we are likely to have a heavy H1 weighting in future years (August and December are much quieter months in financial markets). The consensus among the investors on Twitter is that management are using the changed year-end to manage down forecast revenue growth from +24% FY Mar 2023F previously to +13% (note from their new broker Singer CM).

Notwithstanding the lower growth expectations, management are expanding internationally by opening offices in the Netherlands and Australia. They already have a payments licence for the Netherlands, however, under MiFID II they need to be licensed as an investment firm to do forward FX transactions in Europe.

They are also building an online trading solution – though originally the idea was for AGFX to operate like a private bank, with high-touch personal service. Instead, they’re now talking about being a technology ‘platform’ – that word yet again! I listened into the investor call on InvestorMeetCompany and my impression is that there really is a story about investment generating future revenue, but that the timing is uncertain. On the same call, management put up a ‘competitor analysis’ slide, showing that they beat EQLS on both price and service – but Mark Simpson points out EQLS is growing revenue 3-4x faster than AGFX.

The other risk is reliance on a few key clients. Their top 20 clients generate 36% of total revenue (versus 35% at the time of the IPO in 2019). They do say though that in any given year the list of the top 20 changes. To give some idea of materiality: the top 20 clients on average generate £621K of revenue, versus the long tail of customers who generate £14K on average.

Outlook: They are confident that the level of revenue growth will continue as expected in FY23 without putting a number to those expectations (Sharepad shows +19% revenue growth to £41m but that is calculated using a stale Numis forecast I think?) Singer CM doesn’t make their note publicly available, but I’ve phoned around my contacts in MI5, the CIA and Mossad and someone has kindly got hold of it and sent me a screenshot. Singers are already forecasting a December year-end and show EPS of 4.9p 2022F, 6.4p Dec 2023F and 10.1p 2024F. So be aware that the forecasts on Sharepad have been muddied by the change in year-end.

Management have been poor at expectations management in the past. Sharepad ‘forecast’ tab shows how FY Mar 2022 EPS of 7p just reported has been cut -40% from the original FY Mar 2022F 12p a couple of years ago. AGFX management may well have gone the other way and ‘lowballed’ the estimates.

I find that keeping track of EPS change dynamics really useful, so recommend that feature if you haven’t come across it before. When we compare valuation multiples like PER or P/Sales, it’s easy to forget that the sales and EPS forecasts tend to be dynamic numbers, with expectations often moving up or down.

Valuation: On Singers, their new broker, forecasts AGFX are trading on PER 15x Dec 2022F, dropping to 7x 2024F. The shares are on 1.5x Singers 2024F forecast revenue, to my mind that looks rather good value if remotely achievable. Certainly, relative to history the shares have experienced a steep de-rating.

Opinion: I feel like AGFX is a business that is doing all the right things: they are investing for future growth, opening offices in the Netherlands and Australia and applying for regulatory licences, but again the timing of the payback is uncertain. It would be useful if management were honest with their investors about what hasn’t worked. At the time of the IPO, they wanted to double the sales force in 2 years but failed to hit this target. They have said in the past that the first couple of years a salesman fails to generate significant revenue, then in year three average revenue per annum increases significantly c. £0.5m to c. £1.1m in year four. So my theory is they have hired more junior sales staff, but suffered high levels of attrition among recent joiners before those more recent hires became productive.

Pre-IPO they demonstrated very strong growth, with revenue doubling in two years from 2017 to 2019, but the advisers should have suggested more caution I think (see Calnex and Cerillion for examples of companies that have IPO’ed and managed expectations well.) So I think a young Chief Exec has been poorly advised by their financial PR (FTI Consulting) and former broker (Numis, who they have now replaced). I own it and am prepared to be patient, but can understand investors who bought at much higher levels and are frustrated.

Notes

The author owns shares in AGFX

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.