There’s considerable institutional pressure on financial analysts to be positive, but often the most valuable information is negative: what to avoid. Bruce looks at a couple of case studies that reported last week.

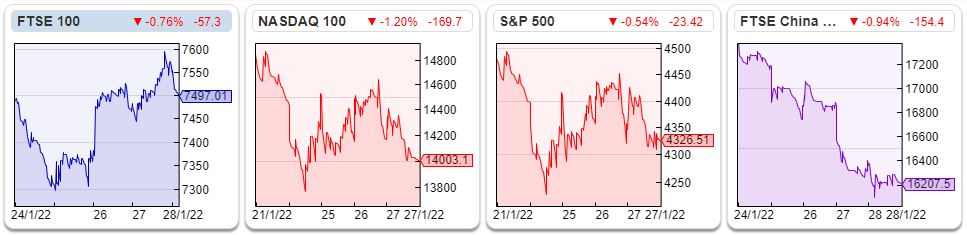

The FTSE 100 was flat last week, at 7,497. Matt Moulding’s THG fell to 134p, down -10% in the week and now down -42% since the start of this year. The Nasdaq100 was down -3% S&P500 was down -1.6% last week. In China, Evergrande, the huge property company, continues to unravel with distressed debt investor Howard Mark’s Oaktree Capital seizing collateral (land two hours drive from Shanghai), because the property developer has defaulted on its debt. The legal system in China is not independent from politics, so watch with interest. The FTSE China 50 was down -8% last week.

CBOX fell -23% last week to 250p. The Times suggested Cake Box’s fall was caused by Maynard’s article.

All the information like Cake Box’s auditor resignation was publicly available, it just took a diligent and curious person like Maynard to go digging, spot the prior year stock expense had been restated, cross check the receivables number and question the upward revaluations of property. At brokers and banks there’s significant institutional pressure to turn a blind eye to negatives and focus on the positives. US bank analyst Mike Mayo, published a book called Exile on Wall Street on this subject. Mayo* has been fired by three of his previous six employers, and been made to feel unwelcome at a fourth. Yet, often the most valuable information is negative: what to avoid. Sharepad writers don’t set out to cause share prices to tumble. Instead Maynard’s work means that companies will take more care about the numbers that they report: we should applaud his efforts.

For my part, I believe that CBOX shows the signs of a classic entrepreneur, who is less focussed on book keeping and administrative systems, instead enjoys leading people, growing the business, doing deals and being in front of customers. This is not a bad thing, if he has the support in place. My own experience of having a business partner like this was that he believed that asking for help was a sign of weakness and instead he got us into a complete muddle. We both lost serious amounts of money. Much pain would have been avoided if we had followed a good process. That wasn’t the whole story: I have enough material for a book on how not to buy a craft beer bar. The pandemic didn’t help, neither did the seller’s devious behaviour or an unsympathetic landlord; but the problems all started with some basic mistakes (driven by fear of missing out or FOMO) that we could have avoided easily.

Many companies reported trading statements last week. HEAD, COGS and RBGP results were all positive. Air Partner, which I own, received a cash bid at 125p a +54% premium to the 81p closing price from US listed “Wheels Up”.

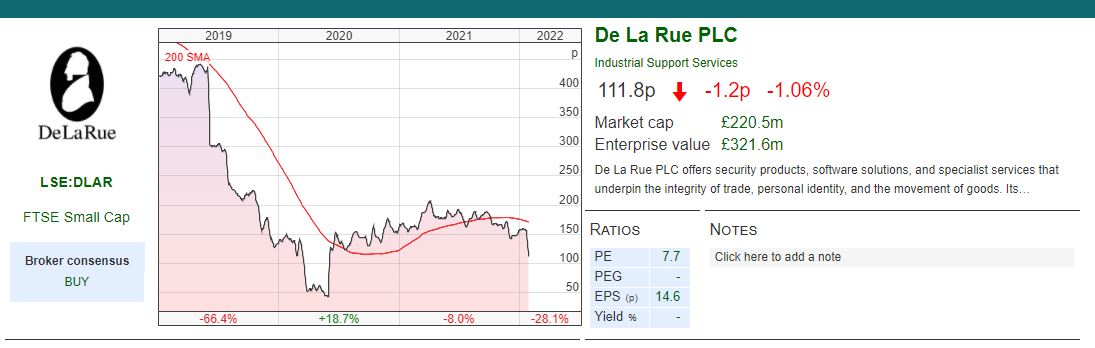

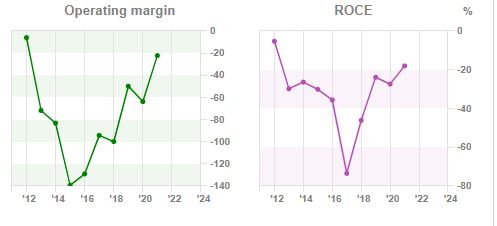

However, I’ve focused on two companies reporting this week that are case studies of what to avoid: De La Rue and Corero Networks. DLAR has lost 95% of its value in the last 10 years. Corero has lost money for decades but is now going to make its first profit. A reminder of the old adage: All I want to know is where I’m going to die, so I’ll never go there.

De La Rue FY March Trading Update

This accident prone bank note printer and authentication products (passports, driving licences, authentication labels etc) company put out a profit warning last week. They’ve warned that Omicron and Delta variants of Covid have substantially increased employee absences in their factories. They have also been hit by micro chip shortages and rising cost of raw materials. IG Design and Dr Martens in the UK and GE in the US have also warned of disruption. This could be weak management looking for an external excuse to blame, other management teams, including Headlam which reported strong results last week, seem to be coping.

DLAR adj operating PBT should now be in the £36-40m range, versus market expectations of £45-47m, so a 15-20% downward revision. Last year’s number was similar £38m and £17m in H1. But note the £22m of “exceptional” costs that the company deducts to report a statutory PBT of £9.9m FY Mar 2021. There was also a huge “below the line item” last year of minus £96m which is the movement in the pension fund. This doesn’t go through the p&l, but it is deducted from shareholders equity as I discuss below.

End March net debt expectations are unchanged, though the company doesn’t say what those expectations were either in the RNS or in the previous H1 statement. At the H1 net debt was £44m, ex £15m of lease liabilities. For reference, I think it’s fair enough to exclude leases from the net debt calculation, but investors need to be sure that they’re comparing apples with apples.

History This company has an interesting history. The founder Thomas de la Rue, originally established a business making straw hats in 1821 before realising that printing was where future riches could be made. The company was first listed on the London Stock Exchange in 1947. More recently, in 2010 there was an approach by Oberthur who offered 905p per share, which was rejected by DLAR’s Chairman Nicholas Brookes, without consulting shareholders. I think this is a good example of why we need Lord Lee’s campaign for companies to let their owners (their shareholders) know as soon as possible about potential bids, even if they have to say “there can be no certainty that an offer will ultimately be made.” DLAR shares have fallen 95% in the last 10 years following that approach and they raised £100m of equity at 110p in June 2020. I’ve spent some time on DLAR, because I think it’s an interesting case study in hidden risks.

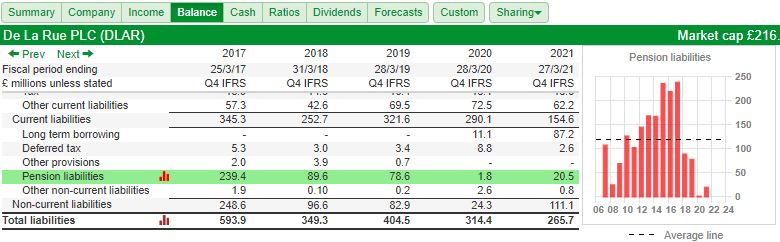

Pension deficit The £220m market cap of the company is dwarfed by the pension obligations, which were reported as £1.09bn according to the most recent H1 report. That £1.09bn is then netted of against the pension plan assets to give a deficit of £20.5m Mar 2021 (v £239m in 2017. The red chart, below right, on the Sharepad “Balance Sheet” tab shows good progress with the pension deficit liabilities falling.

But those accounting numbers may not be cautious enough. Mark Simpson did a presentation on pension accounting for Mello last year and he points out that the DLAR pension deficit under IAS 19 accounting assumptions is less conservative than the actuarial pension calculations. Companies are required to have an actuarial valuation every 3 years and DLAR’s most recent one was December 2019. There’s was a minus £143m actuarial deficit in Dec 2019, versus an accounting surplus of plus £65m March 2020 (later restated to £1.8m deficit which is the number that Sharepad shows).

That £255m difference between the actuarial and accounting number compares to the company’s current market cap of c. £220m. Mark sent me one of his slides (see next page), which I have updated with the current market DLAR market cap of c. £220m using my expert “paint” skills.

I am not suggesting that only one approach is “correct” and the other approach is “wrong”, they simply use different assumptions. Investors are often rewarded for taking the more conservative assumptions, in this case the 3 year actuarial valuation. Particularly, as Mark points out, the larger triennial calculation is likely to set the pension contributions, which is real cash leaving the business that could have been paid out in dividends or been spent on internal reinvestment for growth.

Rising corporate bond yields could help companies like De La Rue with large pension fund obligations, because a rising discount rate reduces the value of future cashflows. As investors we normally care about cashflows that we receive in future, and hence welcome a falling discount rate, but for shareholders in companies with large pension obligations the future cashflows are being paid out to former employees. There’s a cleverly worded sentence in the notes of the Annual Report: “The funding of the Recovery Plan is to be sourced from cash generation of the future business activities, but the [pension] Trustee has contractually agreed not to request any portion of the equity capital raising proceeds.”

Money is fungible, I can’t see how cash generated from future business can be separated so easily. So DLAR’s shareholders have supported the company with £100m of capital in June 2020 but are in future are obliged to pay out £150m (£25m a year until March 2029) to the company’s pension fund. If the EBITDA/net debt ratio exceeds 2.5x additional contributions will be required from shareholders.

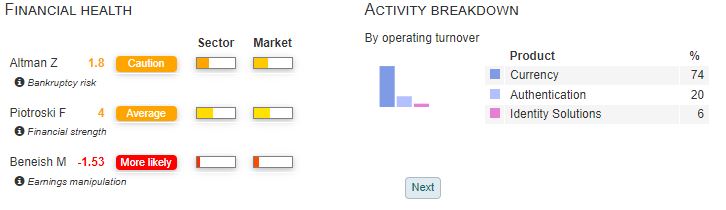

Note too, that Sharepad’s financial health measures are flashing orange / red, but they don’t specifically take into account the size of the pension obligations.

Outlook The RNS warns that management see “incremental headwinds into financial year 2022-23, with the effect of slowing the Company’s adjusted operating profit growth profile.” That’s rather troubling, because it suggests that problems will last into the next financial year and may even deteriorate further. The Board retains full confidence in the Turnaround Plan, but I’m not sure how much weight investors should attach to that. Adding to the complexity is that Crystal Amber are likely to be trying to sell their 9.9% stake.

Outlook The RNS warns that management see “incremental headwinds into financial year 2022-23, with the effect of slowing the Company’s adjusted operating profit growth profile.” That’s rather troubling, because it suggests that problems will last into the next financial year and may even deteriorate further. The Board retains full confidence in the Turnaround Plan, but I’m not sure how much weight investors should attach to that. Adding to the complexity is that Crystal Amber are likely to be trying to sell their 9.9% stake.

Opinion There’s a wide range of outcomes here. DLAR would be a really interesting to challenge to build a model on, because the debt and the pension liabilities mean that you shouldn’t just look at a forecast EPS (FY Mar 2024F of 18p, implying a PER of less than 7x) and decide whether the shares are cheap or expensive.

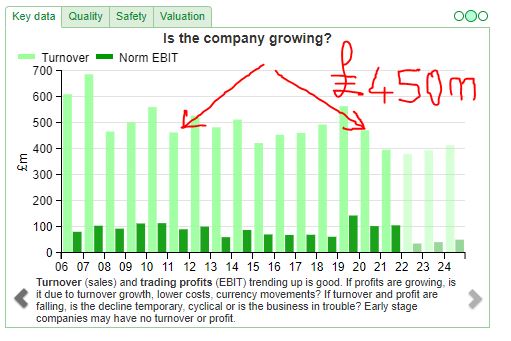

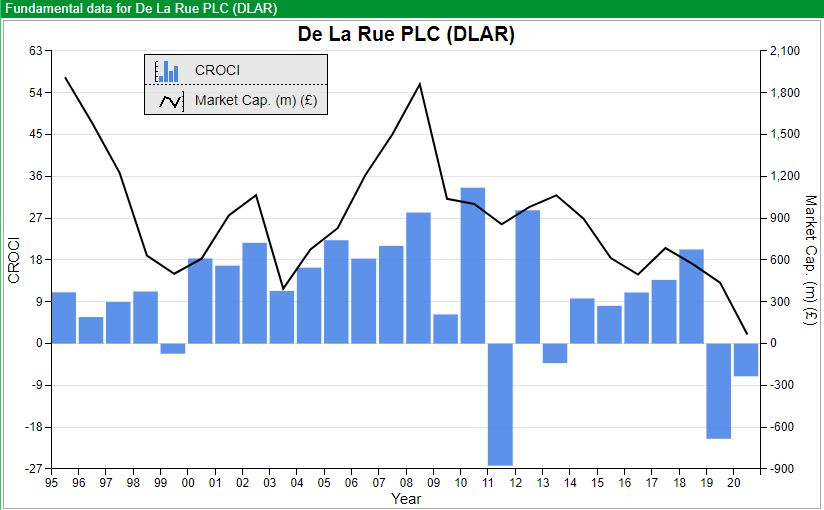

The other aspect I find fascinating is that the -95% share price fall hasn’t been caused by declining revenues (Sharepad shows £464m FY 2011). The chart belows shows falling margins and a large pension deficit leading to negative Cash ROCI (blue bars Left Hand Scale) have been enough to destroy over a billion pounds of shareholder value (black line RHS). Oberthur who offered 905p per share 10 years ago must be thanking their lucky stars that the DLAR Chairman rejected their advances!

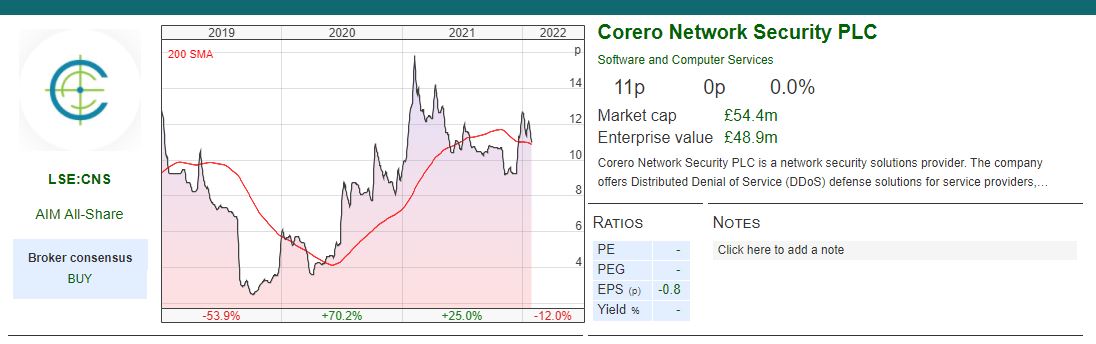

Corero Network Security FY Dec Trading Update

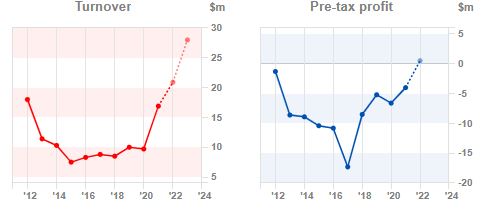

This cyber security put out a trading update saying that they expected revenues to be “broadly in-line” with market expectations of $20.9m and EBITDA materially ahead of market expectations of $4.2m. In December the company said the same thing, but with no numbers in the RNS. This goes to show just how worthless a RNS is that claims numbers are ahead of market expectations, without stating what those numbers/market expectations are. The same goes for the emphasis on EBITDA. All the more surprising then that management expect to report a maiden PBT of $1.2m to $1.6m. That should have been at the top of the page.

That said, the PBT figure is not particularly good quality, due to income recognised from the forgiveness from a US government corona aid (PPP) of $0.6m and $0.2m of forex gains. Last year the company added back $1.9m of capitalised development expense in cash from operating activities that had been amortised through the p&l. They then deducted $1.4m of investment in development expense in cash from investing. Still the cash position was healthy with $8.4m net cash at the end of December 2021.

DDoS prevention The company specialises in DDoS (Distributed Denial of Service) defence. This has been a growth area in cyber security, because DDoS attacks have been a way to blackmail large corporations, by bringing down their website. What happens is a virus infects many computers, then at a specific time floods the victim’s website with co-ordinated requests, causing it to crash. The requests come from different IP addresses, so it’s hard to stop. A DDoS attack is the cyber equivalent of everyone queuing up outside a Northern Rock branch.

Theoretically large corporations ought to pay significant money to prevent attacks. US listed based Crowdstrike (market cap $37bn) have done very well, but we haven’t seen any successful UK cyber security companies, with the possible exception of Darktrace (market cap £2.75bn, though even that is down c. -50% in the last 3 months). Similar to computer games companies, I think this is an area investors may find some opportunities in.

Ownership The other reason to take notice of Corero is that it has some impressive institutions on its shareholder list. Juniper Networks, listed in New York (revenues c. $4bn, market cap c. $10bn) owns 9.9% and they have an agreement with Corero to sell their DDoS protection solution and to Corero’s SmartWall Threat Defence Director (‘TDD’) software product in conjunction with Juniper’s routers.

Small cap institutions own Miton owns 7.3% and Herald owns 7.0%.

The largest shareholder is Jens Montanana, Non Executive Chairman who owns 38%. He has 3 decades of tech industry experience, including founding Datatec, which had a market cap of $617m when it listed on AIM in 2006 (as part of a dual listing in South Africa). The shares de-listed from AIM in 2017, but the current market cap on the Johannesburg Stock Exchange is c. $500m.

Track record of losses Scrolling back through Sharepad’s “Income” tab which goes all the way back to 1997, the company has never made a profit, until 2021. There’s $82m of retained losses on the face of the 2020 balance sheet, versus tangible book value of (shareholders equity less goodwill and capitalised development expense) of less than $1m.

To fund these losses there’s been a long history of the company coming back to investors for more money in placings. The share count has ballooned from 32m 2010 by 15x to 494m shares outstanding currently. The broker forecasts are now expecting a small PBT of less than £0.5m (versus previous forecasts of $3.3m loss in 2021). The shares are down -72% in the last 10 years, however that understates the losses if you had invested 10 years ago, and kept throwing good money after bad. It is a fascinating example, showing just how long investors are prepared to fund “jam tomorrow” stories.

Valuation Despite the losses, the shares are not particularly good value. The low level of profits suggests a forecast P/E over 100x according to Sharepad. The shares are on 3.5x 2021F sales. Sharepad’s backward looking quality metrics are not encouraging.

Clearly if the company can now grow revenue at +20% for a few years, margins and RoCE measures will improve, and the valuation ratios could look more attractive. Also the $8.4m (£6.2m) of cash is over 10% of market cap.

Outlook Hopefully we are now at a point where profits are sustainable. The Chief Exec, Lionel Chmilewsky sounds upbeat, saying he has seen: “strong momentum during 2021 which we fully expect to continue during 2022 and beyond. Given the on-going strategy and strong 2021 performance, we intend to invest in additional resources in 2022 to further drive growth.”

Opinion I once invested a small amount in Cap-XX (market cap £27m) an AIM listed Australian super capacitor company, which has been loss making since 2003. There’s something in human nature, where we like to believe we can spot the turning point, but Cap-XX and Corero suggests that investors are better to be humble and wait for reported profits even if that means missing out on the early stages of a growth phase.

Turning points Speaking of turning points, John Kingman has called the top of the UK housing market. Clearly we need houses to live in, and I wouldn’t recommend any reader sell the home that they’re living. But if you are a Buy to Let landlord, I think you should take note.

I know that every Cassandra and Laocoön has tried to call the top of the UK housing market for years, but someone will be right eventually. I think that it is John. Famous last words, but:

It really is different this time!

Bruce Packard

Notes

The author owns shares in Air Partner

*Marc Rubinstein (also ex Credit Suisse), who unlike myself and Mike Mayo, was not fired by the bank, has published a blog post on the subject of analyst calls.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

This is really a nice and informative, containing all information and also has a great impact on the new technology. Thanks for sharing it,

philippine online casino