Some of the speculative exuberance has spilled over the punch bowl at the cryptocurrency party into a number of glass half empty equities. GameStonk, err I mean GameStop, rose from below $20 a share earlier this month to over $500 per share, as retail traders from the Reddit thread “Wall Street Bets” piled in to create a short squeeze hurting a hedge fund called Melvin. The shares then fell 43% on Thursday last week as retail brokers outraged their customers by refusing to deal in the stock. The FT reported that in “overnight” (presumably OTC markets) the shares jumped +60% when the brokers reversed this decision.

GME, a Western Australia mining stock with the same ticker, rose +50% as investors looked for the next game stock to play. Perhaps they’ll get excited about Games Workshop? It sounds like GameStop if you say it quickly and miss out a syllable.

The Federal Reserve held its first meeting of 2021, and seems unlikely to take the punchbowl away from the party. We know how this ends: a few people will get rich, most won’t, and someone will publish a book afterwards. I think the best explanation comes from Matt Levine at Bloomberg and his “Bored Markets Hypothesis”. That is: at the moment people can’t do the normal things that they find fun: go to pubs, see live music, play sports, hang around the punchbowl at parties talking about bitcoin …so the stock market and social media are now their outlets to relieve the tedium of lockdown.

Empirically the Bored Markets Hypothesis makes far more sense than the Efficient Markets Hypothesis; but no professor will win a Nobel prize for BMH, so don’t expect academia to reject EMH in favour of BMH. Certainly don’t expect any MBA or CFA courses to teach the Bored Markets Hypothesis. The professors, who have never been invited to fun parties with punchbowls, instead indulge themselves by believing in rational expectations and Capital Asset Pricing Model (CAPM) equations. This leads me to suggest my own conjecture: Dreadfully Reductive Equations Alter Market Hypothesis. The DREAM Hypothesis explains why, despite the huge amounts of evidence from real life that contradicts it, economics professors continue to believe in Efficient Markets: they are living their lives in a DREAM Hypothesis.

Facebook, Apple and Tesla

More seriously Facebook, Apple and Tesla reported results last week. Tesla Q4 2020 sales were up +46% to $10.7bn and the car company achieved an “industry leading” FY 2020 operating margin of 6.3%. That “industry leading” operating margin drives Jim Chanos’ short thesis. The bulk of the 6.3% figure is from by regulatory credits, which Tesla receives from other car makers. The dollar amount of regulatory credits is likely to fall as GM, Ford etc catch up and start selling their own Electric Vehicles. Tesla do have an industry leading operating margin, but that is compared to other car makers, which have historically reported wafer thin margins and destroyed shareholder returns. So Tesla may be the best car company in the world, but it’s still a car company. Tesla doesn’t trade at a car company multiple though, it has a tech valuation multiple of 26x historic revenue.

Compare that to a tech company like Apple, which trades on less than 5x historic revenue, but has a far superior operating margin of 24%. Last week, the iPhone and iPad maker also reported fiscal Q1 revenues to 26th December +21%, to $111bn helped by sales in China. All five of Apple’s product categories were up double digit percentages, led by iPad sales +41%. iPhones sales which are still 59% of group revenue were up +17%.

Facebook reported Q4 revenues +33% to $28bn, their highest ever. Monthly Active Users (MAU) were up 12% to 2.8bn people. As privacy and adtech concerns grow, the company is moving to ecommerce, allowing customers to set up “Facebook Shops”, digital shopfronts and payments tools. For my part I have found that I have used Facebook much less over lockdowns, and have become much more engaged with Twitter and Reddit, not least because they are far more entertaining (see Bored Markets Hypothesis above).

Mello Events

Leon Boros pitched Twitter at the end of the last Mello event, perhaps the social media company’s share price is a way to make financial gains from the Bored Market Hypothesis? I will be speaking at the next Mello Event on Monday 8th February. If you haven’t attended one of these events before, I really recommend it. They are fun and insightful.

Stocks covered

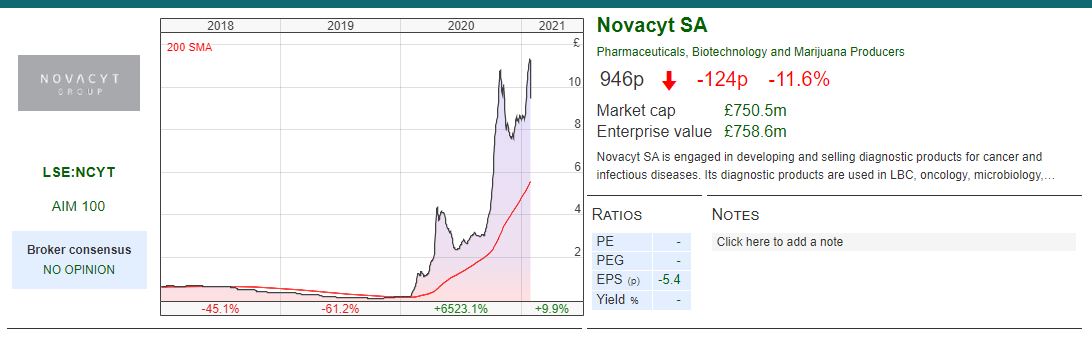

This week I look at HeiQ, SimplyBiz, Manolete and Novacyt. HeiQ said they would beat revenue expectations, profits would be inline but fell 20%. Novacyt was down 11%, despite expecting FY 2020 revenue to be 20x than the previous year.

HeiQ Trading Update Dec y/e

This Swiss headquartered textile innovation company, which listed on the LSE Main Market with a Reverse Takeover late last year, reported a trading update with revenue ahead of expectations, and PBT in line. There were no numbers telling investors what those market expectations were.

The shares were down 18% on the morning of the RNS and down 37% over two days before rallying to 174p. Perhaps the worry was that the business is too reliant on low margin sales, for instance Viroblock, which provides porous materials with durable surface protection and can be used for face filtering respirators to protect people from Covid-19.

I think a better explanation is that the run up in the share price from 112p since the Reverse Takeover occurred in November last year was over exuberance. The shares had shot up to 237p (+112%) by the 25th January based on expectations that were simply too high. Merely delivering an “in line” trading update disappointed much of the speculative money that had pushed the fabric company’s share price up.

The company gave a presentation to amateur investors on the Mello website the evening before the RNS, where they once again failed convincingly to answer my question about why they had chosen London and what requirement of Chapter 6 in the LSE’s listing rules made them ineligible for a Premium Listing. See my original comment, which is available on the Sharescope archive here.

Forecasts Following the HeiQ announcement Cenkos raised their 2020F revenue forecast by $6m to $49m, implying a +75% increase on 2019A. Curiously the broker left their 2021F forecast of $45m unchanged. The broker is forecasting 5¢ in 2020F and 7¢ in 2021F, implying a PE ratio of 45x and 32x respectively, which seems to be demanding management execute to plan.

Opinion This company is operating in hot sectors, anti-virus, sustainability etc. There are some unanswered questions about Rule 6 of the LSE’s listing rules, I’m avoiding until I know the full picture and feel comfortable with the valuation.

SimplyBiz Trading Update Dec y/e

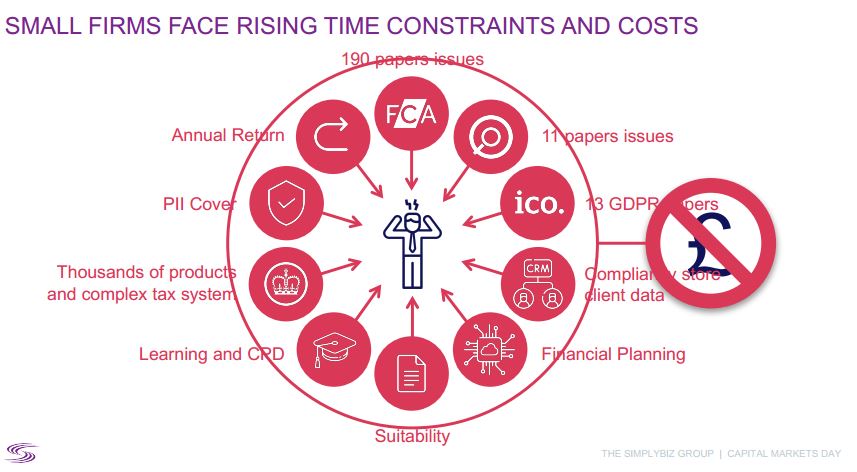

This “support services for financial advisers” company seems to have re-labelled itself as a sexy “fintech”, presumably to appeal to short term traders who are impressed by such nomenclature. They have 3,700 intermediary firms as customers, who they help with regulatory and business support. This looks a solid subscription based business, but the FY 2020 results have suffered from lockdowns and hence don’t support a “tech” growth multiple.

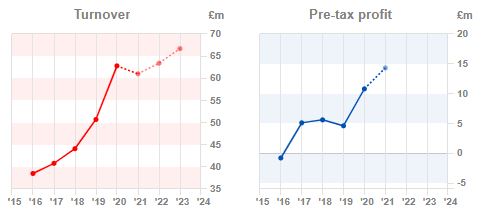

Management expect revenues to be down £2m to £61m FY Dec 2020. Net debt reduced to £19.5m at the end of 2020 v (£27m end Dec 19). They expect adjusted EPS to be 11p down 18% v FY 19, which was inline with guidance given in early December at their Capital Markets Day.

History The company was founded by Ken Davy in 2002, and listed on AIM in April 2018, raising £30m at 170p per share, valuing the company at £130m. The group helps financial advisers deal with evolving regulatory bureaucracy. The Admission Document points to regulatory reviews, such as: mortgage regulation in 2004, FG11/05 Assessing Investment Suitability in 2011, the Retail Distribution Review in 2013, the Mortgage Market Review in 2014 and (last but not least) MIFID II. These reviews often then result in new legislation, which affect the way financial intermediaries do business.

SimplyBiz charge IFA firms a monthly subscription, who in return receive compliance support services that they need to operate and give advice. Management claim that regulatory change is a key driver of growth, and creates opportunities to sell more software services to support financial advisers’ compliance requirements.

The company did have a good tracker record of revenue growth, but in FY2020 revenue fell back 3% to £61m, as lockdown restrictions impacted the group’s mortgage valuation business in the first half. Since then the housing market has recovered strongly helped by the stamp duty holiday, as demonstrated by results from companies like ULS Technology, the online mortgage conveyancing platform.

SimplyBiz held a Capital Markets Day in December 2020, suggesting over the next 2-3 years:

- Revenue growth of 5-7%,

- EBITDA margin of 35-40%

- Cashflow conversion of 70-80%, and

- 70-80% recurring revenue (SaaS and subscriptions).

At H1 the company’s Fintech & Research division (11% of group revenues) did grow rapidly by 77% to £3.2m helped by a full 6 months of trading vs three and a half months in 2019 and continued organic growth from Defaqto. Management say Defaqto is a FinTech “platform” that is used by over 5,800 advisers from 1,900 intermediary firms who were not previously customers of the Group and provides independent expert ratings on 21,000 financial products. They paid £51m for the business in March 2019, taking on £25m of debt to make the purchase.

At H1, the group had negative tangible assets, £106m of intangible assets on balance sheet, versus shareholders equity of £69m. Amortisation of intangibles was £1.5m at H1, including £0.5m of software amortised. The software has been developed for external clients, so this is the correct accounting treatment. But investors should be aware that the company’s adjusted EBITDA margin of 28% in the trading statement ignores spend that has been capitalised and recorded as intangible assets on the balance sheet, rather than expensed through the p&l.

Up until the acquisition of Defaqto, SimplyBiz was reporting RoCE in the range of 25-35%. I’m sceptical that the acquisition adds much to SimplyBiz’s core subscription support for IFAs, but perhaps that is my lack of understanding of what IFAs spend their time doing. The shares are trading on a PER of 15x 2021F and 14x 2022F.

Management incentives There is a two part Company Share Option Plan (CSOP) consisting of i) 500K of awards vesting after 3 years of service, half of which is an approved scheme and half is unapproved ii) a Management Incentive Plan (MIP) based on 15% of the value created above 105% of the market capitalisation at IPO, subject to a 7.35% dilution cap on the issued share capital at the point of vesting. I’ve struggled to get my head around the incentives, and think that the remuneration committee ought to have gone for something simpler. There are also a number of related party transactions listed in note 35 of the 2019 FY accounts.

Ownership Ken Davy the founder and Non Exec Chairman still owns 31%, Liontrust who tend to have a QARP (Quality at a Reasonable Price) approach own 11%, Fidelity 7% and Schroders 4%.

Opinion Although IFAs rely on face to face meetings with customers, the recurring revenue nature of SimplyBiz means that revenues have held up well through lockdown. That said, I think there’s a secular long term decline in face-to-face financial advice, as the regulator has taken a good hard look at incentives for financial “advisers” (in truth, financial salesmen). There is so much quality information available online now, blogs, twitter, newsletters etc. I really resent paying an IFA for “advice”. Sharepad/Sharescope is a good example, giving users information to make their own decisions, with a minimum of bureaucracy, disintermediating the “middleman”.

Full Year results should be out 16th March 2021.

Manolete Partners Profit Warning March y/e

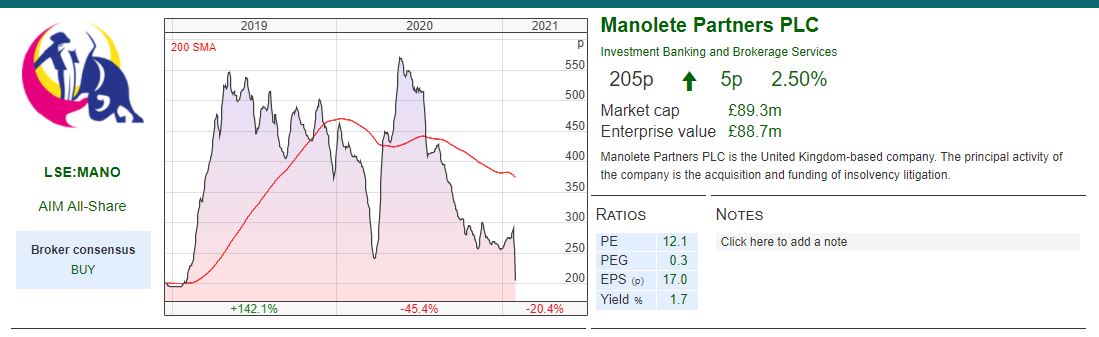

Manolete the insolvency litigation finance firm put out a trading update last Tuesday afternoon saying that new cases would be sharply lower in their H2 (their financial year end is 31st March), because of Government support and insolvency waivers. This company’s share price shows how irrelevant forecasts are to investing. If at the start of 2020 your crystal ball had correctly forecast the number of cases and severity of lockdowns in the pandemic, would you then have foreseen the second and third order effects, such as Government response, debt forbearance and insolvency waivers? Manolete share price was 236p in March last year, then rose to 585p two months later in anticipation of bumper years of insolvency cases, before falling back to 205p last week after their latest RNS.

Management claimed that they had warned about sharply lower new cases when the released their H1 results. That seems an odd claim, given that the shares fell 30% immediately after the RNS came out. So out of curiosity, I went back and looked at what they actually said (bold is mine):

“The pipeline of new cases also continues to grow at a strong rate in the first six months. We made 110 new case investments that meet our stringent selection criteria in the first half of this financial year, 69% more than the same period last year. The Board is keeping a close watch on the effects of Covid-19 as well as the Government economic support measures and the impact these two opposing factors may have on the level of corporate insolvencies and personal bankruptcies in the short and longer term.”

The H1 outlook statement does mention “a short-term sharp reduction in the number of corporate insolvencies and bankruptcies”. Management might think that they had already highlighted this, but the share price reaction down -30% suggests otherwise.

At the end of this January Manolete had 108 completed cases, double the 54 of completed cases for FY March 2020A. Cash collected after paying out insolvency estates and legal fees is up +60% to £4.8m for 9M to end of December, versus prior 9M to December 2019. That compares to investment in new cases at H1 of £3.3m cash outflows.

Hence as the number of new cases to invest in falls sharply, that actually helps the cash position. They still have around 250 ongoing live cases (up from 237 in their H1 results which they’d valued at £39m) which should generate future income (Manolete claim a long term average RoI of 177% on cases that they invest in). Management say in Q3 alone (ie Sept-Dec 2020) they had £5.1m of gross cash generated from completed cases, which covered all case costs (ongoing and completed) and all group overheads.

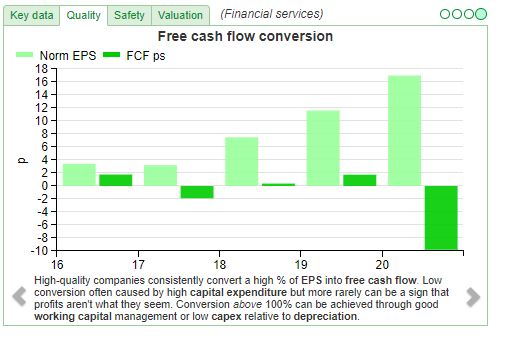

The huge divergence between RoCE 27.5% and Cash RoCI -11.9% has been a concern, hopefully the slower growth means that the cash figure starts to rise.

Opinion The question for me is: does the business need to grow at a high rate for the economics to work? If we’re in for 6-12 months sharply lower new cases, is the model broken? Soros, who was a shareholder, appears to think so and changed his mind selling out to Saudi Arabian Mithaq Capital who now own 16%.

Manolete have a £20m Revolving Credit Facility (RCF) with HSBC (of which they’ve used £7.6m as of 30 Sept 2020) and £10.7m of payables (of which £4.8m falls due within one year). The term of the RCF is until end 2022, at LIBOR plus 2.75% depending on the financial performance against covenants. That compares to shareholders’ equity of £39m, assuming you believe that management have conservatively fair valued the £39m of court cases on the asset side of the balance sheet.

I believe that the 30% share price fall last week is an over-reaction. When the music stopped for banks in 2007, the model broke, but that was because of banks’ reliance on fair value accounting AND short term funding. Manolete has the former, but not the latter. If you forced me off the fence, I’d be a buyer rather than a seller at this price. One things is certain, litigation financiers’ returns (Burford and Manolete) have been uncorrelated with the rest of the market, but perhaps not quite in the way they expected!

Novacyt Trading Update December y/e

This qPCR testing company has been a huge “Covid winner” up +7530% since January last year announced FY to Dec revenue would be up 20x to €312m and FY gross margin above 80%. The H1 v H2 2020 revenue split was €72m v €239m. I have a broker note from SP Angel published in October which was forecasting €216m of H2 revenue, but there is a more recent Numis broker note which had more optimistic figures for H2 last year. The share price was down 12% on the morning of the RNS, suggesting that investors had anticipated the Numis forecasts would be achieved or beaten. The company held €101m of cash in the bank at the end of December.

One concern has been that as the virus mutates their single gene qPCR test would fail to pick up new strains. Management say they can demonstrate ongoing accuracy and performance of their tests: “to date, the Company’s PCR product portfolio, based around a single and a two gene target for COVID-19, remains able to detect all published strains of SARS-CoV-2 with the same high level of accuracy.” That seems unclear, I think that the bulk of Novacyt’s current revenue is coming from the single gene test, a close reading of that sentence might suggest that the single gene test could be less effective?

There is also vague wording around their contract with the UK Department of Health and Social Care (DHSC) signed in September last year. The first phase of the contract was worth £250m for 300 qPCR diagnostic machines, the second phase was for a further 700 qPCR machines. According to the wording of the RNS, it is not clear which phase of the contract is being extended:

“In addition, the Company continues to support the DHSC and the NHS following the deployment of its rapid PCR testing system, for the contract with the DHSC, announced on 29 September 2020, and the Company is in active discussions with the DHSC to extend this phase of the contract.”

Outlook The company says that they’ve enjoyed a strong start to the year, but will not forecast FY 21 at this stage. They do believe that demand for Covid-19 testing will remain strong throughout most of 2021.

Opinion I couldn’t get hold of any fresh broker notes clarifying the DHSC contract extension or new forecasts. I don’t mind too much, corporate brokers only publish numbers which the company is happy with and this seems an area where not even management have any idea how rapidly testing will drop off in the second half of the year and 2022F onwards. Annualising H2 2020 revenue gives €478m, versus a market of €850m (£750m) which actually feels very reasonable for this market!

But we are clearly at “peak testing”, and the assumption about how rapidly revenue falls once testing declines is key – this is a considerable distance outside of my circle of competence. Having missed the initial share price run up in H1, this doesn’t fit my “buy and hold” style of investing. I think that we could see the company disappoint again this year, yet I can also see management could build a valuable long term business.

Bruce Packard

Notes

The author’s mother owns shares in Manolete.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Weekly Commentary: 01/02/21 – Bored Markets Hypothesis

Some of the speculative exuberance has spilled over the punch bowl at the cryptocurrency party into a number of glass half empty equities. GameStonk, err I mean GameStop, rose from below $20 a share earlier this month to over $500 per share, as retail traders from the Reddit thread “Wall Street Bets” piled in to create a short squeeze hurting a hedge fund called Melvin. The shares then fell 43% on Thursday last week as retail brokers outraged their customers by refusing to deal in the stock. The FT reported that in “overnight” (presumably OTC markets) the shares jumped +60% when the brokers reversed this decision.

GME, a Western Australia mining stock with the same ticker, rose +50% as investors looked for the next game stock to play. Perhaps they’ll get excited about Games Workshop? It sounds like GameStop if you say it quickly and miss out a syllable.

The Federal Reserve held its first meeting of 2021, and seems unlikely to take the punchbowl away from the party. We know how this ends: a few people will get rich, most won’t, and someone will publish a book afterwards. I think the best explanation comes from Matt Levine at Bloomberg and his “Bored Markets Hypothesis”. That is: at the moment people can’t do the normal things that they find fun: go to pubs, see live music, play sports, hang around the punchbowl at parties talking about bitcoin …so the stock market and social media are now their outlets to relieve the tedium of lockdown.

Empirically the Bored Markets Hypothesis makes far more sense than the Efficient Markets Hypothesis; but no professor will win a Nobel prize for BMH, so don’t expect academia to reject EMH in favour of BMH. Certainly don’t expect any MBA or CFA courses to teach the Bored Markets Hypothesis. The professors, who have never been invited to fun parties with punchbowls, instead indulge themselves by believing in rational expectations and Capital Asset Pricing Model (CAPM) equations. This leads me to suggest my own conjecture: Dreadfully Reductive Equations Alter Market Hypothesis. The DREAM Hypothesis explains why, despite the huge amounts of evidence from real life that contradicts it, economics professors continue to believe in Efficient Markets: they are living their lives in a DREAM Hypothesis.

Facebook, Apple and Tesla

More seriously Facebook, Apple and Tesla reported results last week. Tesla Q4 2020 sales were up +46% to $10.7bn and the car company achieved an “industry leading” FY 2020 operating margin of 6.3%. That “industry leading” operating margin drives Jim Chanos’ short thesis. The bulk of the 6.3% figure is from by regulatory credits, which Tesla receives from other car makers. The dollar amount of regulatory credits is likely to fall as GM, Ford etc catch up and start selling their own Electric Vehicles. Tesla do have an industry leading operating margin, but that is compared to other car makers, which have historically reported wafer thin margins and destroyed shareholder returns. So Tesla may be the best car company in the world, but it’s still a car company. Tesla doesn’t trade at a car company multiple though, it has a tech valuation multiple of 26x historic revenue.

Compare that to a tech company like Apple, which trades on less than 5x historic revenue, but has a far superior operating margin of 24%. Last week, the iPhone and iPad maker also reported fiscal Q1 revenues to 26th December +21%, to $111bn helped by sales in China. All five of Apple’s product categories were up double digit percentages, led by iPad sales +41%. iPhones sales which are still 59% of group revenue were up +17%.

Facebook reported Q4 revenues +33% to $28bn, their highest ever. Monthly Active Users (MAU) were up 12% to 2.8bn people. As privacy and adtech concerns grow, the company is moving to ecommerce, allowing customers to set up “Facebook Shops”, digital shopfronts and payments tools. For my part I have found that I have used Facebook much less over lockdowns, and have become much more engaged with Twitter and Reddit, not least because they are far more entertaining (see Bored Markets Hypothesis above).

Mello Events

Leon Boros pitched Twitter at the end of the last Mello event, perhaps the social media company’s share price is a way to make financial gains from the Bored Market Hypothesis? I will be speaking at the next Mello Event on Monday 8th February. If you haven’t attended one of these events before, I really recommend it. They are fun and insightful.

Stocks covered

This week I look at HeiQ, SimplyBiz, Manolete and Novacyt. HeiQ said they would beat revenue expectations, profits would be inline but fell 20%. Novacyt was down 11%, despite expecting FY 2020 revenue to be 20x than the previous year.

HeiQ Trading Update Dec y/e

This Swiss headquartered textile innovation company, which listed on the LSE Main Market with a Reverse Takeover late last year, reported a trading update with revenue ahead of expectations, and PBT in line. There were no numbers telling investors what those market expectations were.

The shares were down 18% on the morning of the RNS and down 37% over two days before rallying to 174p. Perhaps the worry was that the business is too reliant on low margin sales, for instance Viroblock, which provides porous materials with durable surface protection and can be used for face filtering respirators to protect people from Covid-19.

I think a better explanation is that the run up in the share price from 112p since the Reverse Takeover occurred in November last year was over exuberance. The shares had shot up to 237p (+112%) by the 25th January based on expectations that were simply too high. Merely delivering an “in line” trading update disappointed much of the speculative money that had pushed the fabric company’s share price up.

The company gave a presentation to amateur investors on the Mello website the evening before the RNS, where they once again failed convincingly to answer my question about why they had chosen London and what requirement of Chapter 6 in the LSE’s listing rules made them ineligible for a Premium Listing. See my original comment, which is available on the Sharescope archive here.

Forecasts Following the HeiQ announcement Cenkos raised their 2020F revenue forecast by $6m to $49m, implying a +75% increase on 2019A. Curiously the broker left their 2021F forecast of $45m unchanged. The broker is forecasting 5¢ in 2020F and 7¢ in 2021F, implying a PE ratio of 45x and 32x respectively, which seems to be demanding management execute to plan.

Opinion This company is operating in hot sectors, anti-virus, sustainability etc. There are some unanswered questions about Rule 6 of the LSE’s listing rules, I’m avoiding until I know the full picture and feel comfortable with the valuation.

SimplyBiz Trading Update Dec y/e

This “support services for financial advisers” company seems to have re-labelled itself as a sexy “fintech”, presumably to appeal to short term traders who are impressed by such nomenclature. They have 3,700 intermediary firms as customers, who they help with regulatory and business support. This looks a solid subscription based business, but the FY 2020 results have suffered from lockdowns and hence don’t support a “tech” growth multiple.

Management expect revenues to be down £2m to £61m FY Dec 2020. Net debt reduced to £19.5m at the end of 2020 v (£27m end Dec 19). They expect adjusted EPS to be 11p down 18% v FY 19, which was inline with guidance given in early December at their Capital Markets Day.

History The company was founded by Ken Davy in 2002, and listed on AIM in April 2018, raising £30m at 170p per share, valuing the company at £130m. The group helps financial advisers deal with evolving regulatory bureaucracy. The Admission Document points to regulatory reviews, such as: mortgage regulation in 2004, FG11/05 Assessing Investment Suitability in 2011, the Retail Distribution Review in 2013, the Mortgage Market Review in 2014 and (last but not least) MIFID II. These reviews often then result in new legislation, which affect the way financial intermediaries do business.

SimplyBiz charge IFA firms a monthly subscription, who in return receive compliance support services that they need to operate and give advice. Management claim that regulatory change is a key driver of growth, and creates opportunities to sell more software services to support financial advisers’ compliance requirements.

The company did have a good tracker record of revenue growth, but in FY2020 revenue fell back 3% to £61m, as lockdown restrictions impacted the group’s mortgage valuation business in the first half. Since then the housing market has recovered strongly helped by the stamp duty holiday, as demonstrated by results from companies like ULS Technology, the online mortgage conveyancing platform.

SimplyBiz held a Capital Markets Day in December 2020, suggesting over the next 2-3 years:

At H1 the company’s Fintech & Research division (11% of group revenues) did grow rapidly by 77% to £3.2m helped by a full 6 months of trading vs three and a half months in 2019 and continued organic growth from Defaqto. Management say Defaqto is a FinTech “platform” that is used by over 5,800 advisers from 1,900 intermediary firms who were not previously customers of the Group and provides independent expert ratings on 21,000 financial products. They paid £51m for the business in March 2019, taking on £25m of debt to make the purchase.

At H1, the group had negative tangible assets, £106m of intangible assets on balance sheet, versus shareholders equity of £69m. Amortisation of intangibles was £1.5m at H1, including £0.5m of software amortised. The software has been developed for external clients, so this is the correct accounting treatment. But investors should be aware that the company’s adjusted EBITDA margin of 28% in the trading statement ignores spend that has been capitalised and recorded as intangible assets on the balance sheet, rather than expensed through the p&l.

Up until the acquisition of Defaqto, SimplyBiz was reporting RoCE in the range of 25-35%. I’m sceptical that the acquisition adds much to SimplyBiz’s core subscription support for IFAs, but perhaps that is my lack of understanding of what IFAs spend their time doing. The shares are trading on a PER of 15x 2021F and 14x 2022F.

Management incentives There is a two part Company Share Option Plan (CSOP) consisting of i) 500K of awards vesting after 3 years of service, half of which is an approved scheme and half is unapproved ii) a Management Incentive Plan (MIP) based on 15% of the value created above 105% of the market capitalisation at IPO, subject to a 7.35% dilution cap on the issued share capital at the point of vesting. I’ve struggled to get my head around the incentives, and think that the remuneration committee ought to have gone for something simpler. There are also a number of related party transactions listed in note 35 of the 2019 FY accounts.

Ownership Ken Davy the founder and Non Exec Chairman still owns 31%, Liontrust who tend to have a QARP (Quality at a Reasonable Price) approach own 11%, Fidelity 7% and Schroders 4%.

Opinion Although IFAs rely on face to face meetings with customers, the recurring revenue nature of SimplyBiz means that revenues have held up well through lockdown. That said, I think there’s a secular long term decline in face-to-face financial advice, as the regulator has taken a good hard look at incentives for financial “advisers” (in truth, financial salesmen). There is so much quality information available online now, blogs, twitter, newsletters etc. I really resent paying an IFA for “advice”. Sharepad/Sharescope is a good example, giving users information to make their own decisions, with a minimum of bureaucracy, disintermediating the “middleman”.

Full Year results should be out 16th March 2021.

Manolete Partners Profit Warning March y/e

Manolete the insolvency litigation finance firm put out a trading update last Tuesday afternoon saying that new cases would be sharply lower in their H2 (their financial year end is 31st March), because of Government support and insolvency waivers. This company’s share price shows how irrelevant forecasts are to investing. If at the start of 2020 your crystal ball had correctly forecast the number of cases and severity of lockdowns in the pandemic, would you then have foreseen the second and third order effects, such as Government response, debt forbearance and insolvency waivers? Manolete share price was 236p in March last year, then rose to 585p two months later in anticipation of bumper years of insolvency cases, before falling back to 205p last week after their latest RNS.

Management claimed that they had warned about sharply lower new cases when the released their H1 results. That seems an odd claim, given that the shares fell 30% immediately after the RNS came out. So out of curiosity, I went back and looked at what they actually said (bold is mine):

“The pipeline of new cases also continues to grow at a strong rate in the first six months. We made 110 new case investments that meet our stringent selection criteria in the first half of this financial year, 69% more than the same period last year. The Board is keeping a close watch on the effects of Covid-19 as well as the Government economic support measures and the impact these two opposing factors may have on the level of corporate insolvencies and personal bankruptcies in the short and longer term.”

The H1 outlook statement does mention “a short-term sharp reduction in the number of corporate insolvencies and bankruptcies”. Management might think that they had already highlighted this, but the share price reaction down -30% suggests otherwise.

At the end of this January Manolete had 108 completed cases, double the 54 of completed cases for FY March 2020A. Cash collected after paying out insolvency estates and legal fees is up +60% to £4.8m for 9M to end of December, versus prior 9M to December 2019. That compares to investment in new cases at H1 of £3.3m cash outflows.

Hence as the number of new cases to invest in falls sharply, that actually helps the cash position. They still have around 250 ongoing live cases (up from 237 in their H1 results which they’d valued at £39m) which should generate future income (Manolete claim a long term average RoI of 177% on cases that they invest in). Management say in Q3 alone (ie Sept-Dec 2020) they had £5.1m of gross cash generated from completed cases, which covered all case costs (ongoing and completed) and all group overheads.

The huge divergence between RoCE 27.5% and Cash RoCI -11.9% has been a concern, hopefully the slower growth means that the cash figure starts to rise.

Opinion The question for me is: does the business need to grow at a high rate for the economics to work? If we’re in for 6-12 months sharply lower new cases, is the model broken? Soros, who was a shareholder, appears to think so and changed his mind selling out to Saudi Arabian Mithaq Capital who now own 16%.

Manolete have a £20m Revolving Credit Facility (RCF) with HSBC (of which they’ve used £7.6m as of 30 Sept 2020) and £10.7m of payables (of which £4.8m falls due within one year). The term of the RCF is until end 2022, at LIBOR plus 2.75% depending on the financial performance against covenants. That compares to shareholders’ equity of £39m, assuming you believe that management have conservatively fair valued the £39m of court cases on the asset side of the balance sheet.

I believe that the 30% share price fall last week is an over-reaction. When the music stopped for banks in 2007, the model broke, but that was because of banks’ reliance on fair value accounting AND short term funding. Manolete has the former, but not the latter. If you forced me off the fence, I’d be a buyer rather than a seller at this price. One things is certain, litigation financiers’ returns (Burford and Manolete) have been uncorrelated with the rest of the market, but perhaps not quite in the way they expected!

Novacyt Trading Update December y/e

This qPCR testing company has been a huge “Covid winner” up +7530% since January last year announced FY to Dec revenue would be up 20x to €312m and FY gross margin above 80%. The H1 v H2 2020 revenue split was €72m v €239m. I have a broker note from SP Angel published in October which was forecasting €216m of H2 revenue, but there is a more recent Numis broker note which had more optimistic figures for H2 last year. The share price was down 12% on the morning of the RNS, suggesting that investors had anticipated the Numis forecasts would be achieved or beaten. The company held €101m of cash in the bank at the end of December.

One concern has been that as the virus mutates their single gene qPCR test would fail to pick up new strains. Management say they can demonstrate ongoing accuracy and performance of their tests: “to date, the Company’s PCR product portfolio, based around a single and a two gene target for COVID-19, remains able to detect all published strains of SARS-CoV-2 with the same high level of accuracy.” That seems unclear, I think that the bulk of Novacyt’s current revenue is coming from the single gene test, a close reading of that sentence might suggest that the single gene test could be less effective?

There is also vague wording around their contract with the UK Department of Health and Social Care (DHSC) signed in September last year. The first phase of the contract was worth £250m for 300 qPCR diagnostic machines, the second phase was for a further 700 qPCR machines. According to the wording of the RNS, it is not clear which phase of the contract is being extended:

“In addition, the Company continues to support the DHSC and the NHS following the deployment of its rapid PCR testing system, for the contract with the DHSC, announced on 29 September 2020, and the Company is in active discussions with the DHSC to extend this phase of the contract.”

Outlook The company says that they’ve enjoyed a strong start to the year, but will not forecast FY 21 at this stage. They do believe that demand for Covid-19 testing will remain strong throughout most of 2021.

Opinion I couldn’t get hold of any fresh broker notes clarifying the DHSC contract extension or new forecasts. I don’t mind too much, corporate brokers only publish numbers which the company is happy with and this seems an area where not even management have any idea how rapidly testing will drop off in the second half of the year and 2022F onwards. Annualising H2 2020 revenue gives €478m, versus a market of €850m (£750m) which actually feels very reasonable for this market!

But we are clearly at “peak testing”, and the assumption about how rapidly revenue falls once testing declines is key – this is a considerable distance outside of my circle of competence. Having missed the initial share price run up in H1, this doesn’t fit my “buy and hold” style of investing. I think that we could see the company disappoint again this year, yet I can also see management could build a valuable long term business.

Bruce Packard

Notes

The author’s mother owns shares in Manolete.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.