Structural Change in the City

It always amazes me how debt can lead to innovation. Humans find ingenious solutions. The Bank of England was founded in 1694 because the 9-year war against France was expensive. Usefully that enabled us to continue to increase the debt which brought about the South Sea Bubble and subsequent crash in 1720. After World War 1 the war debt gave rise to an innovative expansion plan which led to the roaring 20’s and the 1929 crash.

The financial crisis of 2008 led to an innovative new concept called quantitative easing. Since then our stock market is now up 110% from its 2009 lows, the Trainline IPO at £1.7bn market cap confirms that ticket machines are worth more than trains and Beyond Meat, the loss-making producer of expensive plant burgers has a market capitalisation above $10bn. What happens next isn’t the most joyful prospect.

Yet over time markets go up and we need to invest. So where to invest is important. As each market cycle changes so do the sectors. I recall the fund manager of Throgmorton Trust telling me in 2000 that he was selling his technology shares and investing in mining stocks which at the time was such a sharp turnaround of positioning I struggled to comprehend it. It proved to be the right call as commodity prices increased as technology shares crashed.

This time feels like one of those moments in history when structural changes in our economy means it is important that our investments are positioned in the right industry. We are in a time of technology enabling businesses to access huge markets globally creating Unicorn companies. Facebook is launching its own cryptocurrency. With these enabling technologies is coming the need for more legislation and regulation to ensure consumers are protected. In short, the result is that businesses are succeeding faster than ever before, and industries are changing more rapidly than before. The winners take it all while the losers become zombie companies rather than going bust by virtue of low interest rates. Investors naturally want to be on the side of the winners and avoid the zombies.

Financial Services

Nowhere is this structural change more apparent than in our own financial services industry. Regulation is increasing resulting in higher costs for small companies and favouring the creation of scale players. At the same time technology is reducing costs and enabling access to stock markets for large and wide audiences, as ShareScope readers of this will be aware. The increasing benefits of scale are enabling cost reductions to the end consumer. The price of share dealing has come down, the cosy city establishment is being rumbled as pressure mounts on fund manager fees and the old tradition of paying what is called “trail commission” – a pay back from the fund manager to the distributor has been outlawed. This is what has built Hargreaves Lansdown into the £8.8bn company it is today.

Hargreaves Lansdown

Hargreaves Lansdown, as one of the winners of these macro enabled events has recently been criticised for supporting Woodford. Its shares have fallen 24% in the last month as it has suffered criticism for not limiting its exposure and potentially not therefore having proper risk controls in place. Has it become complacent is a valid question?

- Vanguard, the Pennsylvanian fund giant with $5.6trn in assets came to the UK in 2009 with a plan to import cutthroat price competition into the UK funds market. Initially it focussed on passive index tracking funds but launched active funds three years ago. Once a fund has a three-year track record it becomes more marketable so last week as their active funds reached a three-year anniversary a fee cut was instigated. The Vanguard Global Equity Income fund for example cut its management fee from 0.6% to 0.48%. In world where investors will buy bonds yielding 1% these differences matter.

- The arrival of scale competition in the financial services industry combined with increasing technology and high fixed costs of regulation is changing the structure of the industry. Product providers, in fund management houses need to be large or specialist as do the fund distribution houses. There are parallels in the food industry. Iain Gorham, the previous CEO of Hargreaves Lansdown used to explain it well at analyst meetings. He maintained that consumers may go to the corner shop for a pint of milk of some specialist cheese, but the staple foods will come from Tesco. The supermarket needs to use the benefit of their scale to exert pressure on suppliers which in the case of supermarket is the farmers. Hargreaves Lansdown, as a large fund supermarket likened itself to Tesco and so needed to exert pressure on their fund providers. And so, they negotiated discounts for their customers.

- Strange to find there are no Vanguard funds in their Wealth 50 list of favoured funds. It could just be that Vanguard is bigger than Hargreaves Lansdown and gives the discount to everyone rather than just Hargreaves Lansdown customers. Possibly Hargreaves Lansdown has found a supplier that is bigger than them who is about to expose their business model as being one that uses exclusive discounts to drive their customer numbers and consequently revenue. In the food industry this is akin to Heinz refusing to discount their baked beans for Tesco, so they get put at the back of the shop. But it is unheard of in financial services where trust is paramount.

- Hargreaves have also launched their own funds. The most popular of these is currently the HL Select Global Growth Shares fund which carries a management fee of 0.6% (higher than Vanguard). These are the equivalent of the Tesco own branded products.

- Over recent years the discounters, Lidl and Aldi have fared better than Tesco. Which suggests investors need to alight on Hargreaves Lansdown’s successor, the discounter of the funds industry. AJ Bell and Interactive Investor are both cheaper than Hargreaves Lansdown making Hargreaves look a little more like Waitrose than Tesco.

- In 1982, just as supermarkets were starting to build larger store formats Dairy Crest launched the first new British Cheese in 300 years, Lymeswold, which heralded a new era of Artisan cheesemaking. Today, there are more varieties of English cheese than there are French cheeses with over 700 different varieties. As the supermarkets grew larger so did the number of specialist products. The same has happened in the craft beer industry where the number of craft breweries increased 64% over the 5 years to 2017. This has left those stuck in the middle ground between the global brewing giants and the artisan beer suppliers with a problem. And so, Fullers has sold its iconic brewery in Hammersmith to Japanese firm Asahi so London Pride has now become Japanese.

- In the food and beverages industry the dominance of the large players has coincided with a huge increase in the number of specialist artisan suppliers. I suspect the fund industry is approaching a time of structural change where the large fund supermarkets control the pricing of the mainstream products while the artisan fund industry is about to enjoy a new boom. Investors should be positioned to benefit from these trends.

Quoted participants in fund distribution

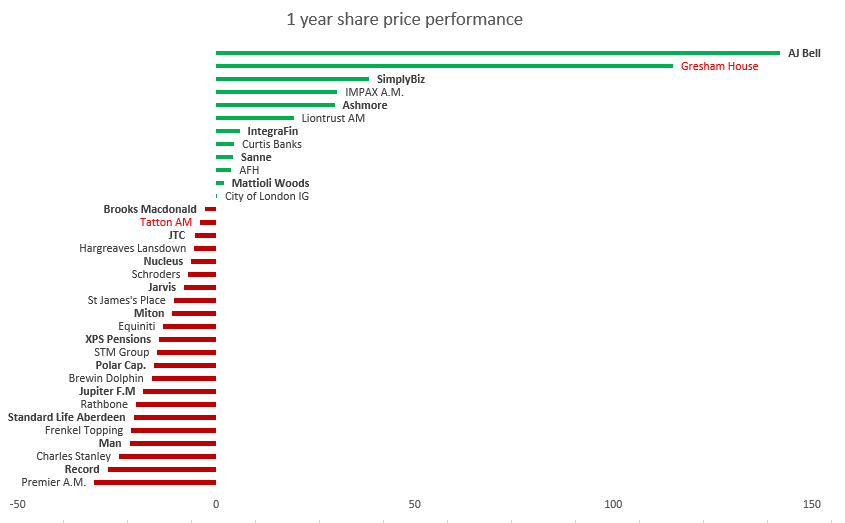

Below is a chart of quoted participants in the fund supply chain ranked by their share price performance over the last 12 months. AJ Bell has been an outstanding performer from its IPO in December but as that isn’t a full 12-month period we could argue it’s not a fair comparator.

Source: SharePad / Excel

Four of the “artisan” fund managers show a strong positive performance in Gresham House, Impax, Ashmore, and Liontrust while the fund manager most stuck in the middle, Jupiter is a laggard. We can also see several of the old model traditional wealth managers such as Brewin Dolphin and Rathbone are laggards.

Which Stocks?

In this new world of “artisan or scale” the only wrong place to be is in the middle. Good businesses run the risk of just carrying on doing what they do and becoming complacent which arguably may apply to Hargreaves Lansdown. Now they have international competition they may need to change. One company that is building scale in discretionary fund management is Tatton Asset Management. While Gresham House has built a collection of very artisan style fund management business over recent years. A brief summary of the two companies is below:

Tatton Asset Management

Share Price 229p

Mkt Cap £128m

History

Founded in 2007 by Paul Hogarth. He previously founded Bankhall in the early 90’s and sold it to Lynx Group in 2001. The business was subsequently sold to Skandia in 2002. Paul became a main board director of Skandia until leaving in 2006 to set up Tatton Asset Management. Initially the group focussed on supporting advisers through the Paradigm Partners compliance services business and in 2007 extended the services to mortgage aggregation. Discretionary fund management services were added in 2013 and in July 2017 the company came to the AIM market at 156p/share raising £8.1m net for the company and £40m for selling shareholders with 59.2% of the company being placed out to investors.

Model

The business model has three divisions

- Investment Management (51% revenue Mar 19). Providing a suite of private client portfolios for distribution through independent financial advisers. The company is the lowest cost provider in the market at 0.15% management fee. Competitors such as Brewin Dolphin charge 0.35%. This is a scalable business as independent financial advisers are cost sensitive as well as service and performance sensitive.

- Mortgages (15.3% revenue March 19) Aggregation of mortgages sold through mortgage advisers. The mortgages business has similar attributes to the investment management business in that it is a scale business.

- Consulting (34.5% revenue March 2019) The consulting business is focused on compliance services for the group advisers and is a less scalable platform as it relies on people providing a service and revenues are not recurring.

AUM (Assets Under Management) in the Discretionary Fund Management business is £6.1bn while the company makes a 53% operating margin. This is a platform style business in the same way that Hargreaves Lansdown, AJ Bell, Integrafin and Nucleus are platform businesses.

ROCE

The company earns a healthy ROCE of 47.8% while having £12.2m cash on the balance sheet. This is a sign of the company owning a competitive advantage which in the investment management business appears to be around the lowest pricing in the space, alongside respectable performance and a broad product range. The lowest pricing will prevent smaller competition coming into the market as they can reduce the pricing as they gain scale. It is a market where the winner takes all.

Valuation

The shares are not a value play trading on a current year PE ratio of 17.4X but the yield of 3.7% is helpful if it takes time for the growth to outpace the valuation.

Personal View

The company has recently announced a partnership with Tenet which has the effect of growing the number of advisers the company supplies product to by 293 appointed representative firms on top of the 445 existing. It would be logical to see growth accelerate accordingly which is not what the brokers are forecasting so we can hope for some earnings upgrades. This could be one of tomorrows large companies with positive earnings surprises during 2019.

Threats

The two threats that could upset this happy outcome would be the market threat and the Vanguard threat. As the investment management fee is a % of assets when markets decline so to Tatton’s revenues. The more significant threat would be if Vanguard turned its sights on discretionary fund management. Right now, Vanguard are focussed on supplying funds wholesale over platforms. To distribute though independent financial advisers requires a lot of time and effort so I suspect this is unlikely to be their focus, but it is possible.

Gresham House

Share Price 610p

Market Cap £162m

History

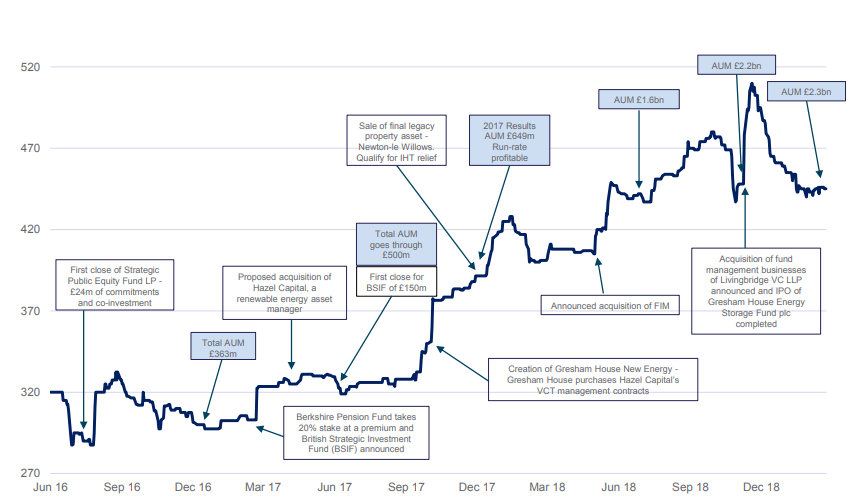

New management joined in December 2014 and set about building a specialist asset management business under the leadership of Tony Dalwood. In transforming this business from an investment trust to an AIM listed specialist alternatives fund manager the company has made 4 acquisitions at the same time as launching new funds such as the Strategic Public Equity Fund Gresham House Forestry LP, British Strategic Investment Fund and Gresham House Energy Storage Fund plc as well as selling off the legacy property. The journey is illustrated below.

Model

The model is one of growing into specialist sectors of fund management where management fees are more resilient, and profitability is better. At the end of 2018 the company managed £2.3bn of AUM spread across Forestry, Housing & Infrastructure, New Energy, Private companies (VCT’s etc) as well as specialist public equity funds. Fee rates on these highly specialist funds vary from 0.9% to 2.5% per year which is higher than a typical equity fund of 0.75% due to their specialist nature. Around half the funds also carry performance fees which has the potential to produce some high operating margins. I note that the analysts don’t forecast any performance fees.

Most of the assets are illiquid by their nature and consequently are held in closed ended funds which are locked in for up to 25 years negating the risk that has caused Woodford grief. This provides a very high level of fee visibility alongside high margin potential.

The strategy of the company is to grow the AUM from £2.3bn to £4bn over the “medium term” and I suspect we could debate the meaning of “medium term” for some while.

ROCE

Forecasts assume £9m of operating profit in the year to December 2019 which would be a 9.1% ROE. This low ROE is a result of having made 4 acquisitions since 2015 and most of the assets are goodwill and intangibles on the balance sheet. My suspicion is that at this early stage of development the forecasts are kept low. I note that the broker forecasts assume flat assets under management over the course of 2019 which one could argue is extremely cautious

Valuation

The shares are now highly valued having appreciated 35% since the March results. They now trade on a 2019 PE ratio of 21X and yield only 0.8% while having net cash on the balance sheet.

Personal View

This is a highly specialist artisan business with the potential to be highly profitable. The funds are very secure but the flip side is they are also harder to grow. The valuation is expensive, but this has the potential to produce significantly more profitability than is currently being forecast. It is positioned in the right place. Expensive financial stocks can become very expensive. See AJ Bell for details.

Threats

Revenues are market sensitive although markets such as forestry are less volatile than equity markets. Regulation could always be a threat, particularly where they are involved with private company asset management if there is an inquiry post Woodford’s private company involvement. Competitive threats are lower down the risk list due to the locked in nature of the funds.

Summary

The City that I have known and loved is being disintermediated on the back of technology and regulation. The need to be a scale player or an artisan has now become very urgent. Lessons can be learned from the food and beverages world. Those that get left in the middle will fail. Tatton Asset Management and Gresham House both look well placed at opposite ends of the spectrum. While Hargreaves Lansdown is entering a new competitive threat as the larger end of the market becomes global. On a rating of 31X this year’s EPS the shares could still be vulnerable despite the recent falls.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Weekly Commentary: 24/06/19

Structural Change in the City

It always amazes me how debt can lead to innovation. Humans find ingenious solutions. The Bank of England was founded in 1694 because the 9-year war against France was expensive. Usefully that enabled us to continue to increase the debt which brought about the South Sea Bubble and subsequent crash in 1720. After World War 1 the war debt gave rise to an innovative expansion plan which led to the roaring 20’s and the 1929 crash.

The financial crisis of 2008 led to an innovative new concept called quantitative easing. Since then our stock market is now up 110% from its 2009 lows, the Trainline IPO at £1.7bn market cap confirms that ticket machines are worth more than trains and Beyond Meat, the loss-making producer of expensive plant burgers has a market capitalisation above $10bn. What happens next isn’t the most joyful prospect.

Yet over time markets go up and we need to invest. So where to invest is important. As each market cycle changes so do the sectors. I recall the fund manager of Throgmorton Trust telling me in 2000 that he was selling his technology shares and investing in mining stocks which at the time was such a sharp turnaround of positioning I struggled to comprehend it. It proved to be the right call as commodity prices increased as technology shares crashed.

This time feels like one of those moments in history when structural changes in our economy means it is important that our investments are positioned in the right industry. We are in a time of technology enabling businesses to access huge markets globally creating Unicorn companies. Facebook is launching its own cryptocurrency. With these enabling technologies is coming the need for more legislation and regulation to ensure consumers are protected. In short, the result is that businesses are succeeding faster than ever before, and industries are changing more rapidly than before. The winners take it all while the losers become zombie companies rather than going bust by virtue of low interest rates. Investors naturally want to be on the side of the winners and avoid the zombies.

Financial Services

Nowhere is this structural change more apparent than in our own financial services industry. Regulation is increasing resulting in higher costs for small companies and favouring the creation of scale players. At the same time technology is reducing costs and enabling access to stock markets for large and wide audiences, as ShareScope readers of this will be aware. The increasing benefits of scale are enabling cost reductions to the end consumer. The price of share dealing has come down, the cosy city establishment is being rumbled as pressure mounts on fund manager fees and the old tradition of paying what is called “trail commission” – a pay back from the fund manager to the distributor has been outlawed. This is what has built Hargreaves Lansdown into the £8.8bn company it is today.

Hargreaves Lansdown

Hargreaves Lansdown, as one of the winners of these macro enabled events has recently been criticised for supporting Woodford. Its shares have fallen 24% in the last month as it has suffered criticism for not limiting its exposure and potentially not therefore having proper risk controls in place. Has it become complacent is a valid question?

Quoted participants in fund distribution

Below is a chart of quoted participants in the fund supply chain ranked by their share price performance over the last 12 months. AJ Bell has been an outstanding performer from its IPO in December but as that isn’t a full 12-month period we could argue it’s not a fair comparator.

Source: SharePad / Excel

Four of the “artisan” fund managers show a strong positive performance in Gresham House, Impax, Ashmore, and Liontrust while the fund manager most stuck in the middle, Jupiter is a laggard. We can also see several of the old model traditional wealth managers such as Brewin Dolphin and Rathbone are laggards.

Which Stocks?

In this new world of “artisan or scale” the only wrong place to be is in the middle. Good businesses run the risk of just carrying on doing what they do and becoming complacent which arguably may apply to Hargreaves Lansdown. Now they have international competition they may need to change. One company that is building scale in discretionary fund management is Tatton Asset Management. While Gresham House has built a collection of very artisan style fund management business over recent years. A brief summary of the two companies is below:

Tatton Asset Management

Share Price 229p

Mkt Cap £128m

History

Founded in 2007 by Paul Hogarth. He previously founded Bankhall in the early 90’s and sold it to Lynx Group in 2001. The business was subsequently sold to Skandia in 2002. Paul became a main board director of Skandia until leaving in 2006 to set up Tatton Asset Management. Initially the group focussed on supporting advisers through the Paradigm Partners compliance services business and in 2007 extended the services to mortgage aggregation. Discretionary fund management services were added in 2013 and in July 2017 the company came to the AIM market at 156p/share raising £8.1m net for the company and £40m for selling shareholders with 59.2% of the company being placed out to investors.

Model

The business model has three divisions

AUM (Assets Under Management) in the Discretionary Fund Management business is £6.1bn while the company makes a 53% operating margin. This is a platform style business in the same way that Hargreaves Lansdown, AJ Bell, Integrafin and Nucleus are platform businesses.

ROCE

The company earns a healthy ROCE of 47.8% while having £12.2m cash on the balance sheet. This is a sign of the company owning a competitive advantage which in the investment management business appears to be around the lowest pricing in the space, alongside respectable performance and a broad product range. The lowest pricing will prevent smaller competition coming into the market as they can reduce the pricing as they gain scale. It is a market where the winner takes all.

Valuation

The shares are not a value play trading on a current year PE ratio of 17.4X but the yield of 3.7% is helpful if it takes time for the growth to outpace the valuation.

Personal View

The company has recently announced a partnership with Tenet which has the effect of growing the number of advisers the company supplies product to by 293 appointed representative firms on top of the 445 existing. It would be logical to see growth accelerate accordingly which is not what the brokers are forecasting so we can hope for some earnings upgrades. This could be one of tomorrows large companies with positive earnings surprises during 2019.

Threats

The two threats that could upset this happy outcome would be the market threat and the Vanguard threat. As the investment management fee is a % of assets when markets decline so to Tatton’s revenues. The more significant threat would be if Vanguard turned its sights on discretionary fund management. Right now, Vanguard are focussed on supplying funds wholesale over platforms. To distribute though independent financial advisers requires a lot of time and effort so I suspect this is unlikely to be their focus, but it is possible.

Gresham House

Share Price 610p

Market Cap £162m

History

New management joined in December 2014 and set about building a specialist asset management business under the leadership of Tony Dalwood. In transforming this business from an investment trust to an AIM listed specialist alternatives fund manager the company has made 4 acquisitions at the same time as launching new funds such as the Strategic Public Equity Fund Gresham House Forestry LP, British Strategic Investment Fund and Gresham House Energy Storage Fund plc as well as selling off the legacy property. The journey is illustrated below.

Model

The model is one of growing into specialist sectors of fund management where management fees are more resilient, and profitability is better. At the end of 2018 the company managed £2.3bn of AUM spread across Forestry, Housing & Infrastructure, New Energy, Private companies (VCT’s etc) as well as specialist public equity funds. Fee rates on these highly specialist funds vary from 0.9% to 2.5% per year which is higher than a typical equity fund of 0.75% due to their specialist nature. Around half the funds also carry performance fees which has the potential to produce some high operating margins. I note that the analysts don’t forecast any performance fees.

Most of the assets are illiquid by their nature and consequently are held in closed ended funds which are locked in for up to 25 years negating the risk that has caused Woodford grief. This provides a very high level of fee visibility alongside high margin potential.

The strategy of the company is to grow the AUM from £2.3bn to £4bn over the “medium term” and I suspect we could debate the meaning of “medium term” for some while.

ROCE

Forecasts assume £9m of operating profit in the year to December 2019 which would be a 9.1% ROE. This low ROE is a result of having made 4 acquisitions since 2015 and most of the assets are goodwill and intangibles on the balance sheet. My suspicion is that at this early stage of development the forecasts are kept low. I note that the broker forecasts assume flat assets under management over the course of 2019 which one could argue is extremely cautious

Valuation

The shares are now highly valued having appreciated 35% since the March results. They now trade on a 2019 PE ratio of 21X and yield only 0.8% while having net cash on the balance sheet.

Personal View

This is a highly specialist artisan business with the potential to be highly profitable. The funds are very secure but the flip side is they are also harder to grow. The valuation is expensive, but this has the potential to produce significantly more profitability than is currently being forecast. It is positioned in the right place. Expensive financial stocks can become very expensive. See AJ Bell for details.

Threats

Revenues are market sensitive although markets such as forestry are less volatile than equity markets. Regulation could always be a threat, particularly where they are involved with private company asset management if there is an inquiry post Woodford’s private company involvement. Competitive threats are lower down the risk list due to the locked in nature of the funds.

Summary

The City that I have known and loved is being disintermediated on the back of technology and regulation. The need to be a scale player or an artisan has now become very urgent. Lessons can be learned from the food and beverages world. Those that get left in the middle will fail. Tatton Asset Management and Gresham House both look well placed at opposite ends of the spectrum. While Hargreaves Lansdown is entering a new competitive threat as the larger end of the market becomes global. On a rating of 31X this year’s EPS the shares could still be vulnerable despite the recent falls.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.