Back in 2016 we began testing and tracking three model portfolios based on Joel Greenblatt’s magic formula approach (click here to read more about this) and last year we added a forth model (click here to read this article).

Regular readers will know how these portfolios are put together. Here’s a quick recap for the benefit of those new to them:

- Qualifying shares are found using the Greenblatt Magic formula filter in SharePad. This can be found in the Filter Library.

- Four portfolios of 20 shares from mixed sectors of the stock market. This is to avoid having too many shares from one sector which can occur when using Greenblatt’s approach in its purest form.

The four portfolios are:

- A Simple Magic formula portfolio based on Greenblatt’s approach.

- A lease-adjusted Magic formula portfolio where return on capital (ROCE) and EBIT yield are adjusted for hidden debts (leases) associated with rented properties, plant and machinery.

- A portfolio of cheap stuff with high EBIT yields – again adjusted for hidden debts.

- Lease-adjusted Magic Formula plus momentum – the ranking scores from the lease-adjusted Greenblatt Magic formula with an additional filter based on a three month relative strength index (RSI) as a measure of momentum and in-turn focused on high RSI values between 60 and 70 (excluding shares with an RSI of over 70 which is commonly considered to be “overbought”).

Magic formula stocks for 2019

The 2019 portfolios for each of the four models are shown below.

Simple Magic formula:

(The above filter criteria has been added into the library of filters within SharePad. Simply go to: Filter -> Apply filter -> Library -> “Greenblatt Magic Formula: Simple”)

Lease-adjusted Magic Formula:

(The above filter criteria has been added into the library of filters within SharePad. Simply go to: Filter -> Apply filter -> Library -> “Greenblatt Magic Formula: Lease-adjusted”)

Cheap stuff – with high EBIT yield:

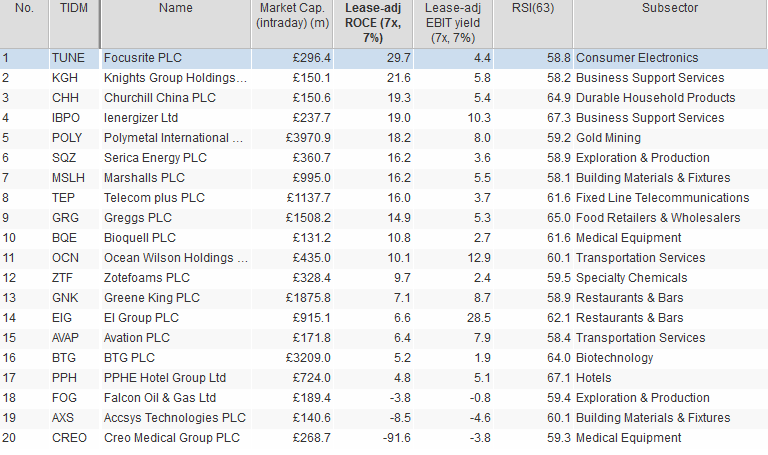

Lease-adjusted Magic Formula plus momentum:

Note: Due to market conditions we have expanded the range of the RSI to 58-72 as the 60-70 range returned fewer than 20 shares.

2018 Magic formula stocks Performance

As with most portfolios, 2018 was a tough year for all four of the Magic Formula models with the new ‘Lease-adjusted Magic Formula plus momentum’ performing the best.

You can read the January 2018 article outlining the Magic Formula stock portfolios for 2018 here.

For reference, the FTSE All-Share Total Return index returned -8.9% over the same period.

Simple Magic Formula:

Invested amount £100,000

Final value £81,264.50

Loss -£18,735.51

Return -18.7%

Lease-adjusted Magic Formula:

Note: during 2018 Trinity Mirror changed its name to Reach

Invested amount £100,000

Final value £78,151.81

Loss -£21,848.12

Return -21.8%

Cheap stuff – with high EBIT yield:

Note: during 2018 Trinity Mirror changed its name to Reach

Invested amount £100,000

Final value £82,295.22

Loss -£17,704.79

Return -17.7%

Lease-adjusted Magic Formula plus momentum:

Note: Based on original model of high RSI values between 60 and 70

Invested amount £100,000

Final value £92,386.74

Loss -£7,613.28

Return -7.6%

Pre-2018 Magic formula stocks Performance

To read article on 2017 performance click here

To read article on 2016 performance click here

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.