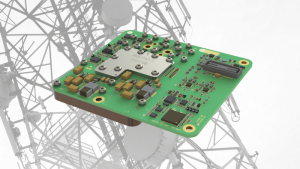

Small-Cap Spotlight Report: Filtronic (LSE: FTC)

Filtronic’s shares have defied AIM’s doom and gloom by rocketing 10-fold within three years. Maynard Paton reviews the multi-baggers announcements and asks whether we could have foreseen the huge gain. “London Stock Exchange boss warns AIM is under threat of collapse“ “London AIM market should be axed for failing to win tech floats, say think-tanks“