Beauty is in the eye of the beholder | DNLM, WIL

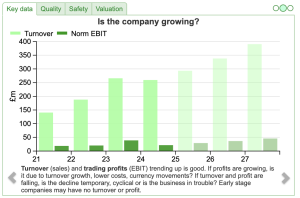

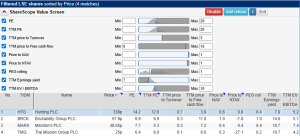

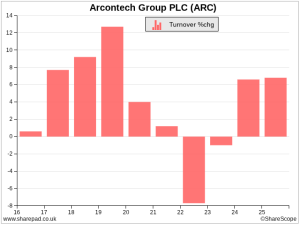

Richard considers two shares that pass his 5 Strikes screening process. The first, Dunelm (DNLM), has almost flawless numbers. The second, Wilmington (WIL), is intriguing because of the flaws in its numbers. Since I last updated you, seven shares have published annual reports and percolated through the minimum quality filter. Name TIDM Prev AR Strikes