Environmental, social and governance (ESG) investing is a strategy that bets on companies trying to make the world a better place. Alpesh asks is this just another high-minded idealist fad? Or does the global good make it worth the risk?

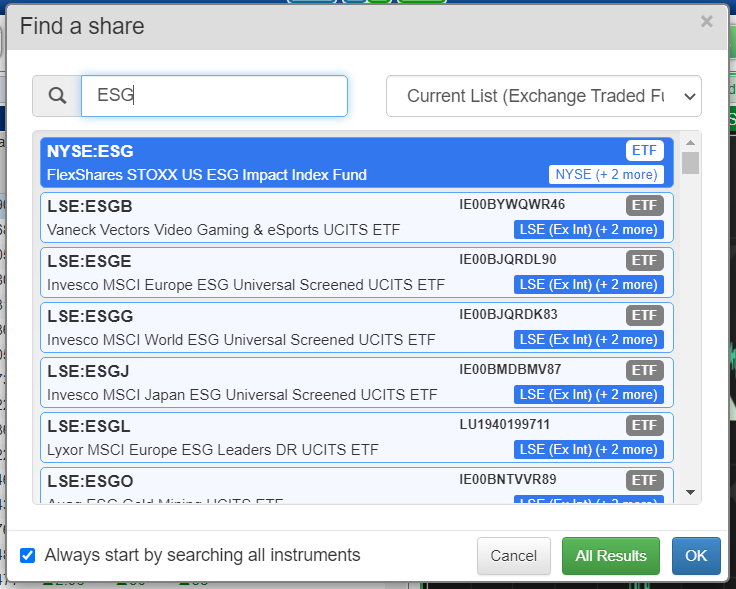

Type ESG into Sharescope or SharePad’s ETF list and you’ll find around a hundred funds. I randomly picked 10 – none of them were up over the past 6 months.

Concerns over climate change and social issues have increased investors’ interest in ESG funds over recent years. Indeed, analysis solutions that use ESG as their main criteria, like ESG Footprint, are emerging in response to market interest.

However, not everyone is convinced. Some voices suggest that EGS investment managers are opportunistic hype merchants who are actually delaying overdue regulatory action.

Other criticisms are that the S in ESG needs more definition. Without really working out what the “Social” in ESG stands for, the risk is an investment that merely pretends to take on social conditions but ignores the negative effects industry can have on communities and individuals.

Furthermore, a “green premium” is not uncommon in the financial industry. But what might prove more trouble for investors is underperformance. However, a new generation of ESG fund managers is trying to make the sector less risk-averse.

Another concern that investor flows into ESG seem to ignore is who is regulating the ESG rating industry? Some commenters are worried that ESG ratings lack transparency, lack consistent criteria, and are affected by conflicts of interest.

That’s not to say that there are no good ideas in the ESG space. Water ETFs could address a looming global issue: water scarcity. It’s hard to imagine the devastating effects of a water shortage, so urgent action is necessary.

Something that might not surprise readers is the gender imbalance between preferences for ESG investing. According to Danske Invest research, almost 60% of men were happy to invest in businesses that ignored sustainability as long as they provided profits. For women, this figure was 41%.

That said, many fund managers have exited from firms in recent years due to ESG issues. Facebook (now Meta), Chinese stocks backed by the CPC, and some fracking firms are all examples of the type of stocks that some fund managers have turned their back on.

Many investors are happy to invest in green pensions. However, some analysts are calling on default pension funds to become more active in green investment and remove the responsibility from employees.

For advocates of ESG, ethical investing is about more than just returns. There is also an emotional component. However, it’s not always clear which businesses are offering genuine sustainability and which are engaging in cynical “greenwashing.”

Summary

Is ESG just another green fad beloved by high-minded idealists? Or is it an effective method to enact social and environmental change? With questions about the legitimacy of ESG rating agencies, a level of healthy scepticism is required.

Events over the last few weeks in Ukraine have demonstrated an interesting point. When seen through an ESG lens, the defence sector is considered an example of an unethical investment. However, in the face of military aggression, self-defence is actually ethical?

So, is EGS just too simple a tool to analyse what is right and wrong? In light of skepticism and recent events, its limitations are perhaps clear.

Alpesh Patel OBE

Founder of Alpesh Patel Special Edition of ShareScope

What is your view on Environmental, social and governance (ESG) investing? We’d love to hear from you! Let us know in the comments section below.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.