The FTSE 100 was up less than half a percent last week to 7,164, towards the top of the trading range that it has occupied since early May. The Nasdaq 100 was up +1.1% ahead of the S&P500 +0.6%. The China 50 was one of the best performing major indices up +2.8% to 18,291 as other emerging markets like India and Russia rose just over +3% in the week.

Yet there are some warning signs: trade in China Evergrande’s bonds was halted on Friday, when they fell more than 20%, past the daily limit. The FT reported that one offshore bond maturing in 2025 was trading at 26 cents on the dollar. This is worth paying attention to because it may turn into a systemic Chinese property market rout; the yield on the Bank of America US Dollar Chinese high yield bond index has risen to 13%. That compares to a 4.5% yield on US Corporate high yield bonds (iShares Markit $ High Yield IHYU). George Soros, who knows a thing or two about losing billions investing in former communist countries, published a bearish article suggesting those investing in China will soon face a rude awakening.

Jackson Hole

At the end of last month was the Jackson Hole symposium, the Central Banker’s equivalent of Glastonbury Festival, where they all get together and discuss interest rates, the economy, banking and throw TVs out of hotel windows, like the rock stars that they now are. This year’s symposium was titled Macroeconomic Policy in an Uneven Economy. The Federal Reserve Chair Jerome Powell made some remarks, but I think more interesting was a paper by Atif Mian, Ludwig Straub and Amir Sufi called What Explains the Decline in r? “r” being the natural interest rate, such as the US long bond yield, which SharePad has data for going back to the early 1990s (see next page).

“r” is used to calculate the cost of equity, which discounts future cashflows in analyst equity valuation models. The Undercover Fund Manager has written a good blog post on how a lower discount rate assumption increases valuation. Some commentators cite this as a cause for the outperformance of the US FAMANG stocks, particularly Amazon.

No one predicted this long term trend, after the event economists are now trying to come up with theories why it has happened. It’s important for Central Bankers because if the trend reverses it’s going to be rather uncomfortable for corporates and individuals who have borrowed heavily, or for the banks who lent them money, depending on how sudden the reversal is.

I think most people assumed that falling long bond yields and falling inflation were something to do with ageing populations in the developed world. Charles Goodhart has written a book about it: The Great Demographic Reversal: Ageing Societies, Waning Inequality, and an Inflation Revival

Sufi et al think something else is going on, and the trend has been driven by a concentration of wealth. The ultra-rich (the 0.1%) behave differently to the rest of us, they have much higher saving rates regardless of their age than us 99.9%. They also spend less of their wealth on “consumption”, which provides jobs and incomes to others, instead the super wealthy accumulate investments, equities, bonds, but also trophy assets like art, yachts, vineyards and football teams.

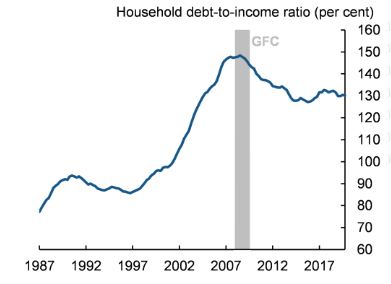

But that effect pushes everyone else to borrow more. Hence the UK ratio of household debt / disposable income rose from 85% in 1997 to almost 150% in 2007, just ahead of the financial crisis, as this chart from the Bank of England shows.

So Sufi and co-authors believe that rising inequality, rather than demographics, have driven the long bond yield down. Linking debt burdens and wealth inequality to instability has a long history going back to classical times, Plutarch describes Solon’s economic reforms in 6th century BC Athens and 100 years later Livy wrote about the Plebeian Secession in Rome. In ancient economies, debts were not secured on property, but on the person so if they failed to pay, then defaulter became a slave. Fortunately the world has moved on. In modern economies most household debt is secured on homes. For some reason the system only seems to function well if debt grows faster than GDP, which in turn means Central Banks need to cut interest rates to avoid widespread defaults and people losing their homes whenever there is a slow down. Except, mathematically that trend can’t continue indefinitely, interest rates have been reduce to zero now and stresses have begun to emerge.

I think that the wealth inequality theory doesn’t explain some aspects of how bond markets are functioning in the real world, for instance: Germany, which has an egalitarian society, less household debt and ageing demographic has 10y bond yield of -50bp, whereas Turkey is more unequal and younger, but has a 10y bond yield of almost 20%. So I doubt inequality is the only cause, instead demographics are likely to be a significant driver of falling “r” too.

Either way, if the trend does reverse and “r” begins to rise, this is likely to be disproportionately negative for companies whose value is driven by cashflow expectations far out into the future (growth stocks). Amazon particularly has had a remarkable run, so it’s worth pondering what might cause the long-term trend to reverse. Secondly, I do think that it’s worth having some “dry powder” money available and not be fully invested, because it seems inevitable that there is more instability to come in the future.

This week I look at CentralNic, the webhosting and online marketing business which reported H1 results and Arcontech the financial data platform FY results. Plus CMC Markets profit warning and the possible read across to other stocks that may suffer from reduced activity as lockdowns have ended and people enjoyed the summer in pubs and restaurants.

CentralNic H1 to June

This webhosting, domain names and online performance marketing business reported revenue +57% to $175m for H1 to June. However more than half of that increase came from acquisitions (SafeBrands in January 2021 and Wando Internet Solutions February 2021) so organic revenue growth was +20%. CentralNic made a statutory loss $600K v $1.8m loss last year. Management prefer to highlight “adjusted EBITDA” +36% to $20.5m. Net debt fell $1m to $84m.

Outlook Management expect full year revenues and profits to be at least at the upper end of market expectations. SharePad shows FY 2021F revenues of $335m and PBT of $27m. That profit forecast looks odd, given the business was loss-making in H1 and FY 2020. It’s possible that acquisitions in H1 have transformed the business, but the track record isn’t encouraging. SafeBrands, based in France, reported revenue of under €5m and was loss-making in 2019 and 2020. Berlin-based Wando reported revenues of €4.9m and EBITDA of €1.2m in 2020. CentralNic itself has been loss making for the last 3 years, and the largest profit ever reported was just $2m in 2015.

Financials The balance sheet looks top-heavy with intangible assets $262m, which is more than double shareholders’ equity of $119m. Net debt is $84m, which is mostly a €105m bond, rather than bank debt. Despite being denominated in Euros, the bond is listed on the Oslo Stock Exchange, which seems a rather curious arrangement for a company with an Aussie Chief Exec, a German Finance Director, that reports in US dollars and whose shares are listed in the UK on AIM.

I listened in to the management call on investormeetcompany.com and management point to competitors in the US which are both higher market cap and report higher margins. Hence they argue there are increasing returns to scale and operating leverage, so as the company grows profitability should improve. That makes sense in theory, but in practice that means that the benefits of scale are already being enjoyed by CentralNic’s competitors, which creates a significant moat that CentralNic is on the wrong side of. Management responded to that critique by pointing to their historic revenue growth, from $3m 10 years ago to over $300m. Given that the business is still not profitable though, I do wonder if the growth is creating any value and what reinvestment in the business is needed just to stand still.

Ownership This is another Kestrel partners stock (like ULS Technology and K3 Business Technology, which I’ve covered in the past). Kestrel own 24%, inter.services GmbH 15.9%, which is a family office run by Horst Oskar Siffrin, a German diplomat. Other more recognisable names, such as Schroders own 5.8%, Herald IM 4.1% and BlackRock 3.4%.

Valuation Assuming the forecasts are correct, CentralNic is trading on 2021F 14x PER. That shrinks to 0.9x revenue and PER 11.7x 2023F, which is good value for a software company in this market.

Opinion The track record of low profitability (and losses) plus the refinancing risk from the €105m bond means I’m cautious for now; but maybe management really have transformed the business. I don’t have a high conviction one way or the other, so I’d suggest CNIC could be worth doing more research to get comfortable that management can deliver what they say.

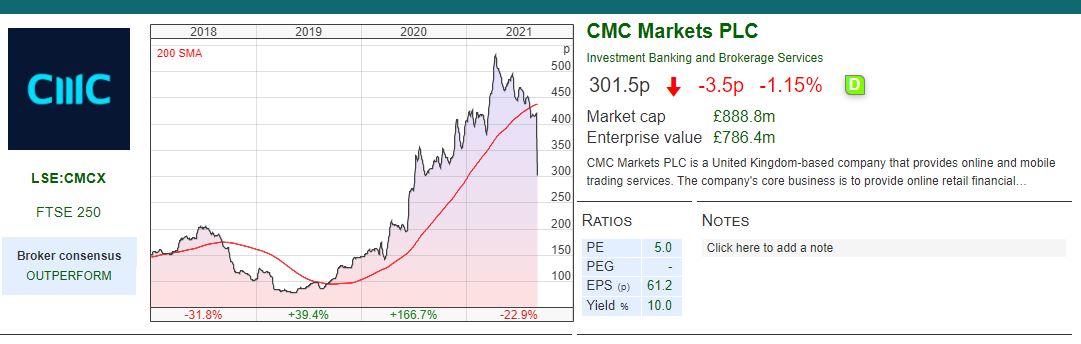

CMC Markets H1 profit warning

The online CFD trading and spread betting platform put out a profit warning for the first five months of their financial year (ie April to August). Like BOTB, they look to be a victim of the “Bored Markets Hypothesis”, as lockdowns have ended activity in July and August has been subdued now that people can go to pubs and restaurants. The shares were down -27% on the morning of the RNS, which even though the risk of a warning seems obvious with the benefit of hindsight, the share price reaction suggests that some investors have been caught out.

Readacross I noticed that 888 online betting company is up +42% YTD, and wondered if they might also suffer from the same trends. However, 888 put out an RNS the day before CMC Markets saying that through July and August revenues were up by mid-single digit percentage. IG Group was down -7% on the “read across”, but their late July RNS said to expect 5-7% revenue growth over the medium term in their ‘Core Markets +’ division and 25-30% in their ‘High Potential Markets’. Mark Simpson @DangerCapital has suggested stockbroker AJ Bell might be vulnerable. AJB FY Sept 2022F revenue forecasts of £154m imply that activity will grow 5% in the next financial year, and the stock is expensive trading on 40x PER 2022F.

Forecasts CMC now expect that if current market conditions prevail for the rest of the FY to end March, then revenue should range between £250-280m (versus £332m previously forecast and down -46% compared to FY March 2021). Perhaps even more disappointingly the company doesn’t seem to be able to reduce operating costs (£184m FY March 2021) to suit the more difficult environment, warning that expenses will track moderately higher year on year. That shows operational leverage working in the wrong direction, by my back of the envelope calculation PBT could be down c. 70% vs £224m reported FY March 2021.

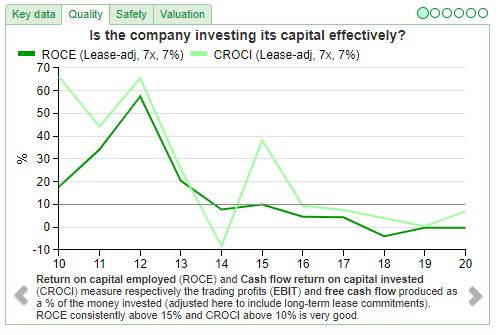

Opinion CMC has a history of high but volatile profitability, SharePad shows that ROCE has averaged 28% back to FY March 2013, but that average hides a wide range. The Group was loss-making in 2013 versus a ROCE of 62% FY March 2021. Like BOTB, I don’t think the long term prospects of the business are under threat, the group had £102m of net cash at the end of March. It’s more a case of expectations being extrapolated from a one-off windfall year, which has proved far too optimistic.

Arcontech FY to June 2021

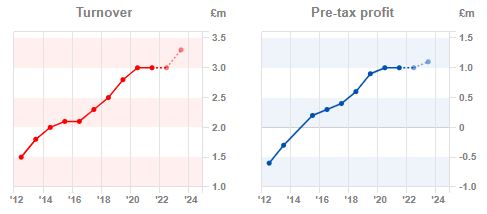

This financial markets data company released lacklustre FY results to June 2021. I own a small position and it’s been my worst performing stock in 2021, down -30% YTD. Revenue was up +1% to £3m and PBT was flat at £1.04m. The company had £5.4m of net cash on the balance sheet as of the end of June.

90% of Arcontech’s revenue is recurring and SharePad shows impressive profitability measures, for instance CROCI of 25%, is in the top 10% of the 852 companies quoted on AIM. But the problem is that even before the pandemic, the company was struggling to expand. Then, in the last 18 months many of Arcontech’s potential clients have been cautious about making changes to their market data systems, and postponed projects in Arcontech’s pipeline until the return to the office.

ARC is not a market data vendor like Bloomberg, Refinitiv or Thomson Reuters, instead Arcontech’s software enables financial institutions to receive, process and transmit market data from those providers. Arcontech has an impressive client list, according to its website: Barclays, Bank of England, Citi, JP Morgan, Lloyds Bank, Morgan Stanley and Santander. I think that Arcontech’s system reduces interdependencies and prevents banks and fund managers becoming too reliant on one data vendor, but generally management do a poor job of explaining their platform to investors, for instance they haven’t given a presentation to PIWorld.

Outlook The outlook statement says that they have the strongest list of prospective new customers for a long time, but notes the market remains uncertain. So they expect profits for FY June 2022F to be flat or down, but they’re confident they’ll return to growth longer term. They also talk about small acquisitions, given the £5m of net cash on their balance sheet.

Broker forecasts Finncap, their broker, published a 26 page note on the day of the results. They cut their FY June 2022F adjusted EPS forecast by -13%, but published new forecasts for FY June 2023F showing +9% revenue growth and an increase of +20% adjusted EPS. The shares were off 20% last week as investors focussed on the FY 2022F reduction, but I thought that this presented an opportunity for anyone prepared to take an 18 month view, so I bought some more shares.

Ownership Leon Boros, the well-known private investor owns 3.7%. Reverse engineering Leon’s process, he seems to like small, highly profitable companies with net cash and operational gearing. Leon enjoyed a lot of success with Bioventix, but was also a fan of BOTB, when the operational gearing meant that the share price was really being punished as revenue expectations disappointed over the last few months. Hopefully ARC is more BVXP than BOTB and I’d suggest +9% revenue growth in FY June 2023F is undemanding when compared to the SharePad summary graph showing the trend going back to 2012.

Opinion If you like investing in shares where the price chart is forming a nice upward trending bowl, then this definitely is not the stock for you. But in my experience, I’ve done better owning a highly profitable Return on Capital business that is struggling to grow (Arcontech), than a business growing revenue strongly, but that is struggling for profitability (CentralNic). I’ve been too early on this one, but I’m hoping that eventually ARC management can grow the top line, at which point I think the business could look very attractive.

Notes

The author owns shares in Arcontech

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Weekly Commentary 06/09/21: The Decline in r

The FTSE 100 was up less than half a percent last week to 7,164, towards the top of the trading range that it has occupied since early May. The Nasdaq 100 was up +1.1% ahead of the S&P500 +0.6%. The China 50 was one of the best performing major indices up +2.8% to 18,291 as other emerging markets like India and Russia rose just over +3% in the week.

Yet there are some warning signs: trade in China Evergrande’s bonds was halted on Friday, when they fell more than 20%, past the daily limit. The FT reported that one offshore bond maturing in 2025 was trading at 26 cents on the dollar. This is worth paying attention to because it may turn into a systemic Chinese property market rout; the yield on the Bank of America US Dollar Chinese high yield bond index has risen to 13%. That compares to a 4.5% yield on US Corporate high yield bonds (iShares Markit $ High Yield IHYU). George Soros, who knows a thing or two about losing billions investing in former communist countries, published a bearish article suggesting those investing in China will soon face a rude awakening.

Jackson Hole

At the end of last month was the Jackson Hole symposium, the Central Banker’s equivalent of Glastonbury Festival, where they all get together and discuss interest rates, the economy, banking and throw TVs out of hotel windows, like the rock stars that they now are. This year’s symposium was titled Macroeconomic Policy in an Uneven Economy. The Federal Reserve Chair Jerome Powell made some remarks, but I think more interesting was a paper by Atif Mian, Ludwig Straub and Amir Sufi called What Explains the Decline in r? “r” being the natural interest rate, such as the US long bond yield, which SharePad has data for going back to the early 1990s (see next page).

“r” is used to calculate the cost of equity, which discounts future cashflows in analyst equity valuation models. The Undercover Fund Manager has written a good blog post on how a lower discount rate assumption increases valuation. Some commentators cite this as a cause for the outperformance of the US FAMANG stocks, particularly Amazon.

No one predicted this long term trend, after the event economists are now trying to come up with theories why it has happened. It’s important for Central Bankers because if the trend reverses it’s going to be rather uncomfortable for corporates and individuals who have borrowed heavily, or for the banks who lent them money, depending on how sudden the reversal is.

I think most people assumed that falling long bond yields and falling inflation were something to do with ageing populations in the developed world. Charles Goodhart has written a book about it: The Great Demographic Reversal: Ageing Societies, Waning Inequality, and an Inflation Revival

Sufi et al think something else is going on, and the trend has been driven by a concentration of wealth. The ultra-rich (the 0.1%) behave differently to the rest of us, they have much higher saving rates regardless of their age than us 99.9%. They also spend less of their wealth on “consumption”, which provides jobs and incomes to others, instead the super wealthy accumulate investments, equities, bonds, but also trophy assets like art, yachts, vineyards and football teams.

But that effect pushes everyone else to borrow more. Hence the UK ratio of household debt / disposable income rose from 85% in 1997 to almost 150% in 2007, just ahead of the financial crisis, as this chart from the Bank of England shows.

So Sufi and co-authors believe that rising inequality, rather than demographics, have driven the long bond yield down. Linking debt burdens and wealth inequality to instability has a long history going back to classical times, Plutarch describes Solon’s economic reforms in 6th century BC Athens and 100 years later Livy wrote about the Plebeian Secession in Rome. In ancient economies, debts were not secured on property, but on the person so if they failed to pay, then defaulter became a slave. Fortunately the world has moved on. In modern economies most household debt is secured on homes. For some reason the system only seems to function well if debt grows faster than GDP, which in turn means Central Banks need to cut interest rates to avoid widespread defaults and people losing their homes whenever there is a slow down. Except, mathematically that trend can’t continue indefinitely, interest rates have been reduce to zero now and stresses have begun to emerge.

I think that the wealth inequality theory doesn’t explain some aspects of how bond markets are functioning in the real world, for instance: Germany, which has an egalitarian society, less household debt and ageing demographic has 10y bond yield of -50bp, whereas Turkey is more unequal and younger, but has a 10y bond yield of almost 20%. So I doubt inequality is the only cause, instead demographics are likely to be a significant driver of falling “r” too.

Either way, if the trend does reverse and “r” begins to rise, this is likely to be disproportionately negative for companies whose value is driven by cashflow expectations far out into the future (growth stocks). Amazon particularly has had a remarkable run, so it’s worth pondering what might cause the long-term trend to reverse. Secondly, I do think that it’s worth having some “dry powder” money available and not be fully invested, because it seems inevitable that there is more instability to come in the future.

This week I look at CentralNic, the webhosting and online marketing business which reported H1 results and Arcontech the financial data platform FY results. Plus CMC Markets profit warning and the possible read across to other stocks that may suffer from reduced activity as lockdowns have ended and people enjoyed the summer in pubs and restaurants.

CentralNic H1 to June

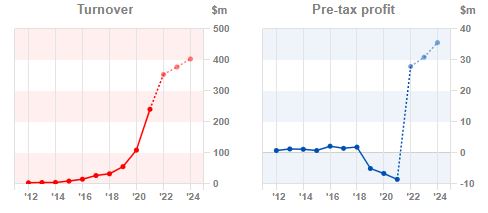

This webhosting, domain names and online performance marketing business reported revenue +57% to $175m for H1 to June. However more than half of that increase came from acquisitions (SafeBrands in January 2021 and Wando Internet Solutions February 2021) so organic revenue growth was +20%. CentralNic made a statutory loss $600K v $1.8m loss last year. Management prefer to highlight “adjusted EBITDA” +36% to $20.5m. Net debt fell $1m to $84m.

Outlook Management expect full year revenues and profits to be at least at the upper end of market expectations. SharePad shows FY 2021F revenues of $335m and PBT of $27m. That profit forecast looks odd, given the business was loss-making in H1 and FY 2020. It’s possible that acquisitions in H1 have transformed the business, but the track record isn’t encouraging. SafeBrands, based in France, reported revenue of under €5m and was loss-making in 2019 and 2020. Berlin-based Wando reported revenues of €4.9m and EBITDA of €1.2m in 2020. CentralNic itself has been loss making for the last 3 years, and the largest profit ever reported was just $2m in 2015.

Financials The balance sheet looks top-heavy with intangible assets $262m, which is more than double shareholders’ equity of $119m. Net debt is $84m, which is mostly a €105m bond, rather than bank debt. Despite being denominated in Euros, the bond is listed on the Oslo Stock Exchange, which seems a rather curious arrangement for a company with an Aussie Chief Exec, a German Finance Director, that reports in US dollars and whose shares are listed in the UK on AIM.

I listened in to the management call on investormeetcompany.com and management point to competitors in the US which are both higher market cap and report higher margins. Hence they argue there are increasing returns to scale and operating leverage, so as the company grows profitability should improve. That makes sense in theory, but in practice that means that the benefits of scale are already being enjoyed by CentralNic’s competitors, which creates a significant moat that CentralNic is on the wrong side of. Management responded to that critique by pointing to their historic revenue growth, from $3m 10 years ago to over $300m. Given that the business is still not profitable though, I do wonder if the growth is creating any value and what reinvestment in the business is needed just to stand still.

Ownership This is another Kestrel partners stock (like ULS Technology and K3 Business Technology, which I’ve covered in the past). Kestrel own 24%, inter.services GmbH 15.9%, which is a family office run by Horst Oskar Siffrin, a German diplomat. Other more recognisable names, such as Schroders own 5.8%, Herald IM 4.1% and BlackRock 3.4%.

Valuation Assuming the forecasts are correct, CentralNic is trading on 2021F 14x PER. That shrinks to 0.9x revenue and PER 11.7x 2023F, which is good value for a software company in this market.

Opinion The track record of low profitability (and losses) plus the refinancing risk from the €105m bond means I’m cautious for now; but maybe management really have transformed the business. I don’t have a high conviction one way or the other, so I’d suggest CNIC could be worth doing more research to get comfortable that management can deliver what they say.

CMC Markets H1 profit warning

The online CFD trading and spread betting platform put out a profit warning for the first five months of their financial year (ie April to August). Like BOTB, they look to be a victim of the “Bored Markets Hypothesis”, as lockdowns have ended activity in July and August has been subdued now that people can go to pubs and restaurants. The shares were down -27% on the morning of the RNS, which even though the risk of a warning seems obvious with the benefit of hindsight, the share price reaction suggests that some investors have been caught out.

Readacross I noticed that 888 online betting company is up +42% YTD, and wondered if they might also suffer from the same trends. However, 888 put out an RNS the day before CMC Markets saying that through July and August revenues were up by mid-single digit percentage. IG Group was down -7% on the “read across”, but their late July RNS said to expect 5-7% revenue growth over the medium term in their ‘Core Markets +’ division and 25-30% in their ‘High Potential Markets’. Mark Simpson @DangerCapital has suggested stockbroker AJ Bell might be vulnerable. AJB FY Sept 2022F revenue forecasts of £154m imply that activity will grow 5% in the next financial year, and the stock is expensive trading on 40x PER 2022F.

Forecasts CMC now expect that if current market conditions prevail for the rest of the FY to end March, then revenue should range between £250-280m (versus £332m previously forecast and down -46% compared to FY March 2021). Perhaps even more disappointingly the company doesn’t seem to be able to reduce operating costs (£184m FY March 2021) to suit the more difficult environment, warning that expenses will track moderately higher year on year. That shows operational leverage working in the wrong direction, by my back of the envelope calculation PBT could be down c. 70% vs £224m reported FY March 2021.

Opinion CMC has a history of high but volatile profitability, SharePad shows that ROCE has averaged 28% back to FY March 2013, but that average hides a wide range. The Group was loss-making in 2013 versus a ROCE of 62% FY March 2021. Like BOTB, I don’t think the long term prospects of the business are under threat, the group had £102m of net cash at the end of March. It’s more a case of expectations being extrapolated from a one-off windfall year, which has proved far too optimistic.

Arcontech FY to June 2021

This financial markets data company released lacklustre FY results to June 2021. I own a small position and it’s been my worst performing stock in 2021, down -30% YTD. Revenue was up +1% to £3m and PBT was flat at £1.04m. The company had £5.4m of net cash on the balance sheet as of the end of June.

90% of Arcontech’s revenue is recurring and SharePad shows impressive profitability measures, for instance CROCI of 25%, is in the top 10% of the 852 companies quoted on AIM. But the problem is that even before the pandemic, the company was struggling to expand. Then, in the last 18 months many of Arcontech’s potential clients have been cautious about making changes to their market data systems, and postponed projects in Arcontech’s pipeline until the return to the office.

ARC is not a market data vendor like Bloomberg, Refinitiv or Thomson Reuters, instead Arcontech’s software enables financial institutions to receive, process and transmit market data from those providers. Arcontech has an impressive client list, according to its website: Barclays, Bank of England, Citi, JP Morgan, Lloyds Bank, Morgan Stanley and Santander. I think that Arcontech’s system reduces interdependencies and prevents banks and fund managers becoming too reliant on one data vendor, but generally management do a poor job of explaining their platform to investors, for instance they haven’t given a presentation to PIWorld.

Outlook The outlook statement says that they have the strongest list of prospective new customers for a long time, but notes the market remains uncertain. So they expect profits for FY June 2022F to be flat or down, but they’re confident they’ll return to growth longer term. They also talk about small acquisitions, given the £5m of net cash on their balance sheet.

Broker forecasts Finncap, their broker, published a 26 page note on the day of the results. They cut their FY June 2022F adjusted EPS forecast by -13%, but published new forecasts for FY June 2023F showing +9% revenue growth and an increase of +20% adjusted EPS. The shares were off 20% last week as investors focussed on the FY 2022F reduction, but I thought that this presented an opportunity for anyone prepared to take an 18 month view, so I bought some more shares.

Ownership Leon Boros, the well-known private investor owns 3.7%. Reverse engineering Leon’s process, he seems to like small, highly profitable companies with net cash and operational gearing. Leon enjoyed a lot of success with Bioventix, but was also a fan of BOTB, when the operational gearing meant that the share price was really being punished as revenue expectations disappointed over the last few months. Hopefully ARC is more BVXP than BOTB and I’d suggest +9% revenue growth in FY June 2023F is undemanding when compared to the SharePad summary graph showing the trend going back to 2012.

Opinion If you like investing in shares where the price chart is forming a nice upward trending bowl, then this definitely is not the stock for you. But in my experience, I’ve done better owning a highly profitable Return on Capital business that is struggling to grow (Arcontech), than a business growing revenue strongly, but that is struggling for profitability (CentralNic). I’ve been too early on this one, but I’m hoping that eventually ARC management can grow the top line, at which point I think the business could look very attractive.

Notes

The author owns shares in Arcontech

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.