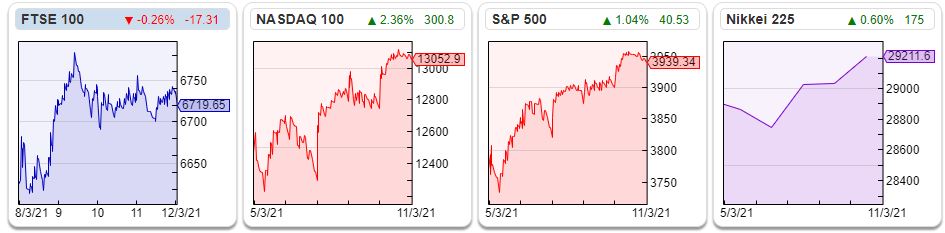

At $1720 gold is now down 9% since the start of the year, while bitcoin is up 92% to $57K over the same time period. The US treasury yield, which peaked at 1.59% earlier this month, settled at 1.53%. Despite the Nasdaq sell-off earlier in March, the index is at 13 400, still up 4% since the start of the year.

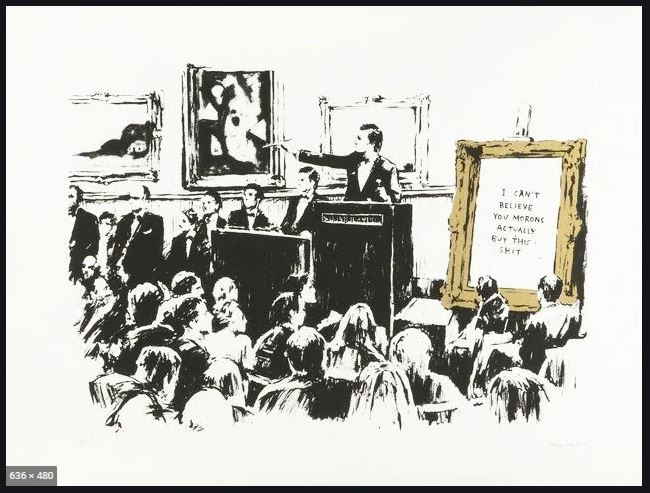

Looking at the art market suggests that there is considerable amounts of euphoria. Beeple, the contemporary artist, sold a Non-Fungible Token of a digital collage for $69m. A couple of weeks ago I wrote about the KLF in 1992, filming themselves on the island of Jura, setting fire to a million pounds worth of £50 notes, as some sort of artistic statement. Now Injective Protocol has bought, then filmed themselves burning, an original Banksy. Not only that, they are auctioning off the event as a “Non Fungible Token”. The Banksy that they burnt was titled “Morons” (2006), and showed a crowded auction room with an art sale going on, which has written on it: “I can’t believe you morons actually buy this sh*t.”

NFTs seem to have emerged from the crypto/blockchain world, where they are used to create scarcity of digital assets, that otherwise could be copied infinitely. NFT’s are a unique digital token, but unlike bitcoin or other cryptocurrencies they are not fungible. That is, NFT’s can’t be swapped, they represent something unique, whereas one bitcoin can be exchanged for another bitcoin. The early bitcoins which were mined when the price was less than $30 are now worth the same as later bitcoins now the price is $57K. Coins have to be fungible, otherwise they don’t function as coins. Strictly speaking the 100KG gold coin which thieves stole from the Bode museum in 2017 Berlin was a coin, but it was non-fungible, more like a work of art. The coin had “1 million dollars” written around the circumference, but the weight in gold was actually worth $4m when it was stolen in 2017. The thieves had to cut it up to realise the value of the gold. It was probably insured for more than the $4m because of scarcity value – there were only 6 made by the Royal Canadian Mint, but as the coin would be hard to sell (people would assume it was the stolen coin) the thieves decision to cut it up made sense, even if it meant the object was worth less as fungible gold.

Art is valuable because it is unique. It can’t be copied because the value is retained in the original piece (unless the original is a shark badly preserved in formaldehyde and the artist offers to catch a new shark and pickle it properly this time.) Banksy’s piece may be subject to copyright, but the image (below) is widely available on the internet.

Jonathan Haskell and Stian Westlake in Capitalism without Capital point out that very often intangible assets are non-fungible and firm specific. Imagine a drug company with many years of R&D, the company has a good idea of what process works, as well as many activities that have failed, and areas that should be avoided. The same goes for a software company. It’s doubtful that Microsoft could have built Excel if they hadn’t failed with their first spreadsheet, called “Multiplan”. This is valuable knowledge built up internally that is rarely captured on a balance sheet, until a company is acquired when it is recorded as “intangible assets” on the buyer’s balance sheet, the market value above accounting book value.

Judging by their website, Injective Protocol who burnt the Banksy, look as if they are a commercial operation with at least $3m of funding from venture capitalists, hoping to profit from decentralised exchange protocols. Ironically they are trying to make money by burning art, whereas the KLF were trying to create art by burning money. Cash is fungible, art is not fungible, but both are flammable.

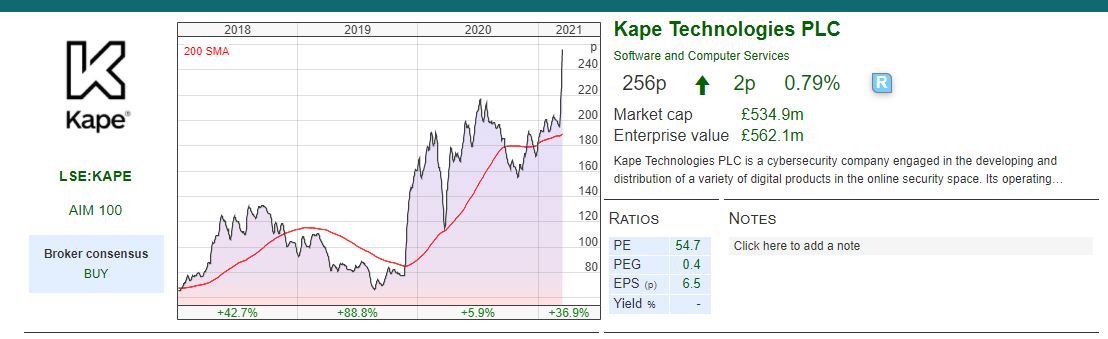

This week I look at cybersecurity firm Kape’s acquisition of Webeselenese, adtech firm Tremor’s FY Dec results and concrete screed company Somero’s FY Dec results. All three have headquarters overseas (the first two are Israeli, Somero is US headquartered) and the first two have significant amounts of intangible assets recorded on their balance sheet due to accounting judgements that management have made. An extra degree of scepticism is usually advisable for overseas companies, but they are certainly interesting.

Kape acquisition of Webselenese

Kape, the Tedi Sagi consumer cybersecurity and Virtual Private Network (VPN) business, announced the acquisition of Israel-based Webselenese, an online content publishing business focused on privacy and security for $149m total consideration. The shares were up +27% in response to the announcement.

The rationale for the deal seems to be vertical integration, supporting Kape’s product development and providing Kape with a broad audience. I think this means that Kape will hope to benefit from Webselenese’s 8.5m monthly readers (in > 30 different languages) reading about Kape’s products. Webselenese mission is to provide “honest and unbiased” information, so if customers were to be nudged towards Kape’s products, I don’t think that the company would spell this out in the RNS. Still, when a product company buys an editorial company in the same space, there’s undoubtedly a temptation to encourage “synergies”.

In terms of the financials we’re only given two numbers: Webselenese has revenue of $65m FY Dec 2020 and EBITDA of $31m, growing at +91% and +204% respectively. That makes the price 2.2x historic revenue and 5x EV/EBITDA, remarkably good value for a company growing so fast in a sector that is well liked. This is not the first time Kape management have achieved this feat. In December 2019 they paid $95m ($128m EV) for PIA, which translates as 2x revenues and 8x EV/EBITDA. By comparison, London listed Avast Plc (market cap £4.3bn), an antivirus company, trades on 7x historic revenue and 13.5 EV/EBITDA. In the US, McAfee has been loss making between 2017-20, but still trades on 3.5x FY 2020 revenue ($10.2bn market cap/$2.9bn FY 2020 revenue).

Webselenese is a privately held company headquartered in Tel Aviv, so there is no further financial information available, nor is there a link to the content that Webselenese publishes. Roll ups like this where an acquirer pays consistently less for companies that are not publicly traded can work, but the strategy can also fail spectacularly if management are buying low quality assets that are cheap for a reason. This is a judgment call for readers to make themselves.

Even without the acquisitions, Maynard has pointed out that KAPE’s reported earnings are not backed by cash flow, because marketing costs are capitalised on to the balance sheet and subsequently expensed through the income statement as an amortisation charge. The amortisation charge requires an assumption on how long the customer stays with the company – he points out that KAPE’s reported profits are flattered by the long amortisation period the company applies.

The company expects to report FY results on 17 March, so we can look at 2020 numbers in more detail then. But as of December 2019 Kape had $37m of Intellectual Property, $39m of Trademarks, $29m of customer lists, $132m of goodwill and $4m of capitalised software costs recorded on its balance sheet. In total that comes to $242m v shareholders’ equity of $155m Dec 2019. The intangible assets could be valuable, it’s hard to tell. The Altman Z score and Piotroski F score are indicating caution though.

Opinion Rather than look at the accounting in fine detail, I’d suggest the best way for investors to gain confidence before investing is to test the company’s product against competitors. Perhaps also try to find examples of Webselenese content and try to understand how Kape has been able to make acquisitions at seemingly such attractive prices. For me there are too many “red flags”, so I’ll avoid.

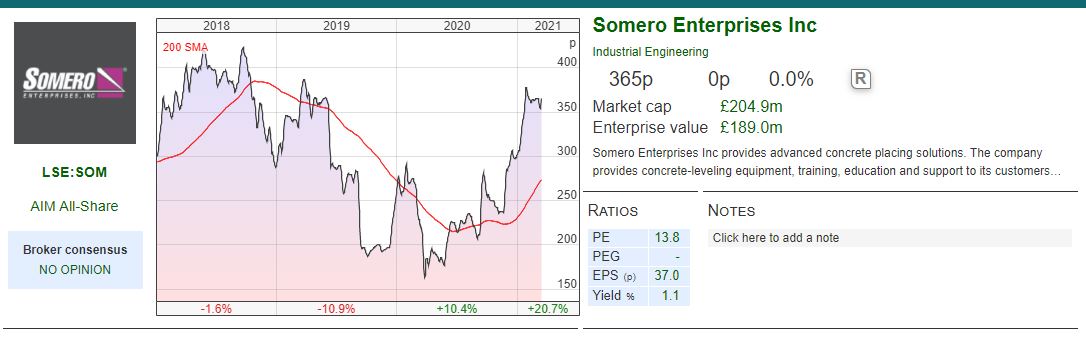

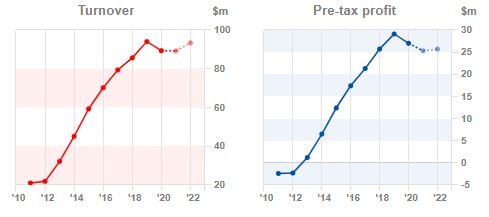

Somero FY 2020

This US headquartered concrete screed business reported FY December 2020 results with revenue down -1% to $87m, and PBT down -9% to $25m. Those FY numbers mask a difficult H1 last year, as the struggle with construction site restrictions had a serious effect on their business, with revenue down -9% and PBT down -29% H1 20 v H1 19. For comparison, in the second half revenue was up +6% H2 20 v H2 19 and the company reported record H2 sales in the US. The company finished the year with net cash of $35m. These numbers were in line with guidance issued on the 21st January (which was raised from November last year).

The company is looking to distribute $17m of that cash back to shareholders, with a declared 13cents ordinary final dividend and 18cents supplementary dividend. There’s also a $1m buyback, primarily to offset dilution from equity issued as part of the management incentive scheme.

Outlook statement The company has said that it expects a “meaningful increase” in operating costs, as they invest in sales and support staff. I think that this management team deserves the benefit of the doubt – gross margin has remained above 55% in the last five years and I think if management can see a substantial long term opportunity, shareholders should back them to achieve benefits in future years. Management guidance is for modest revenue growth and comparable EBITDA to 2020 (which is perhaps overly cautious given how weak H1 2020 was?)

Broker forecasts FinnCap, their broker, have left their forecasts unchanged and also haven’t forecast further ahead than 2021F. They forecast revenue up +5% to $93m and statutory PBT +2% to $25.1m. That implies a $3.5m or 14% jump in operating expenses to $28.5m, which management have flagged in the outlook statement. Adj EPS is forecast to be $0.34 per share, implying 14.9x PER (dollar GBP 1.39). FinnCap dividend forecast is $0.245 per share for next year, implying a yield of 4.8%.

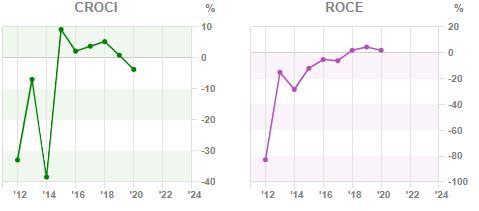

Opinion This is a business which has a volatile top line, and was loss making for three years following the financial crisis, but then recovered with peak revenue of $96m in FY 2018 and RoCE achieve was 56% in the same year. I hold as I think that the international expansion opportunity makes sense. In FY 2020 the US was 80% of sales, with Europe, China, Middle East, Latam and Rest of World all declining. This is the opposite of what I’d like to see: if the company does have a superior product, then, all things being equal, international markets ought to be growing faster from a low base than the “mature” US home market.

Tremor FY 2020

This acquisitive Israeli ad-tech firm reported FY results with gross profits +10% to $152m. The company has changed the way it reports revenues following the acquisitions of RhythmOne (April 2019) and Unruly (January 2020) revenues for programmatic advertising are now presented net of over $193m of cost that was rebilled to media companies (the figure was $117m in 2019). According to FinnCap, their broker, this change was made to bring the reporting into line with US peers, who report under US GAAP. Net revenue +12% to $184m, adjusted EBITDA flat at $60.5m, net cash of $97m and FY 2020 EPS 1.6cents remain unaffected by the accounting change.

Management are keen to highlight the record H2 adjusted EBITDA of $59m. The FY 2020 figure is $60.5m, so just a couple of million in H1. One figure not mentioned on the front page is statutory PBT, which was a loss of $7.4m FY 2020, v PBT $3.6m FY 2019. I suppose it’s normal for companies to try to highlight the numbers that make them look good, but I just find it odd when management don’t mention PBT and trumpet-adjusted EBITDA. I’m fairly sure that most investors are going to look for the p&l on page 13.

That said, depreciation and amortisation (which are non-cash items) were $45m in FY 2020, so net cash from operating activities at $35m FY 2020 was significantly higher than the statutory loss, showing how cash generative the business is. This $35m cash from operating activities was down -22% from FY 19, a less flattering trend versus the companies preferred metric Adjusted EBITDA flat at $60.5m v FY 19. There are very large swings year on year in receivables ($75m) and payables ($60m) in the cashflow statement, which go unexplained. Possibly this is due to the acquisition of Unruly? Trade receivables on the face of the balance sheet are $153m and other receivables are $17m, so total receivables seems very large for a company reporting revenues at the top of their p&l of $211m (or $405m gross of media re-billing) FY 2020. The company records a $9.6m tax benefit FY 2020, which I also find strange because normally amortisation charges are not allowable expenses to reduce taxable earnings. There is $224m of intangible assets on the balance sheet, representing 2/3 of shareholders equity.

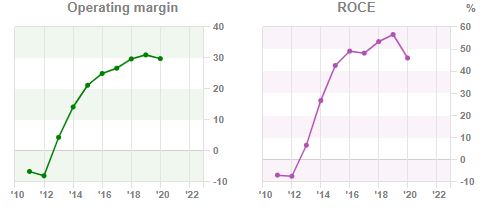

Outlook – Management say that they have seen a “very strong start to 2021” compared to the same period pre-Covid last year. They believe the performance from H2 last year can be maintained. They are also talking about a possible secondary listing in the US, presumably believing investors will give the business a more generous valuation (cf The Trade Desk trading on 205x EV/EBITDA).

Broker forecasts FinnCap have left FY 2021F forecasts unchanged, although they have upgraded four times since June 2020. They are forecasting $235m of net revenue in FY 2021F and $263m FY 2022F, implying +11% growth this year and +12% net revenue growth next year. This translates as 25c adjusted EPS FY 2021F and 31c FY 2022F. A PER of 34x 2021F falling to 21x 2022F.

Valuation comparisons FinnCap point to US peer valuations (The Trade Desk, Magnite, Pubmatic) EV/EBITDA and EV/Sales, so I have shown these comparisons using Sharepad’s “compare” tool.

The US market does seem very expensive at the moment, so it could be that valuations converge, but downwards towards TRMR. I also wonder if The Trade Desk’s 44x sales multiple might be reflecting the “winner takes nearly all” aspect of ad-tech platforms, that is, perhaps the winner deserves a very high valuation multiple, but the prizes for second, third and fourth place are meagre?

Shareholders The hedge fund Tosca own 22.5%, Saudi Arabian Mithaq own 14.9%, Schroders 14.9%. News Corp received 8.5m shares or 6.9% when they sold Unruly to Tremor in January last year. This stake is subject to an 18-month lock up which will expire halfway through this year. The institutional shareholder list should give some comfort that the intangible assets are valuable.

Opinion You can probably tell from my comments this wouldn’t be a high conviction idea for me. But if you forced me to buy either Kape or Tremor, I’d prefer Tremor. The market is consolidating at the moment – Magnite paid 33x EV/EBITDA for a business called SpotX, so a possible US listing looks like it will give TRMR some momentum. But this does seem like a sector where things can go wrong very quickly.

Bruce Packard

You can follow more of Bruce’s investing thoughts and blog at brucepackard.com and on Twitter @bruce_packard

Notes

The author owns shares in Somero

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Highly recommended did this. Very interesting information. Thanks for sharing!

raffle promo philippines