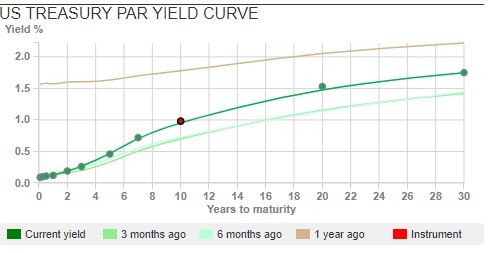

Banks and other “covid losers” were up strongly at the start of last week as Pfizer announced they believe they have a credible vaccine. US Treasuries 10 year yield jumped up to 0.98% (the red dot on the chart below) from the 0.79% last week. This is a significant move, the yield curve seems to be steepening as investors anticipate “reflation”.

A particular anxiety

Wetherspoons put out a trading update with like-for-like sales down 27%, up until the most recent lockdown. Tim Martin warned don’t expect a return to pre-covid conditions soon:

“A particular anxiety in the hospitality industry relates to the future timescale for the ending of “temporary” regulations. Veterans of the industry will recall that the afternoon closing of pubs between about 3pm and 6pm was imposed in the First World War, to encourage munitions workers to return to their factories – but the requirement for afternoon closing was only abolished in 1986.”

This week Wey Education, the online school reported FY results. Manolete, the litigation finance company announced H1 results, and Ocean Wilsons, the Brazilian marine services released Q3 results.

Wey Education FY to 31 Aug

History The company was incorporated in 2007, and came to PLUS markets (now owned by Aquis Exchange) in 2011. Wey then moved up to the AIM market in 2015, listing at 3.5p valuing the company at £3.3m market cap. Since listing on AIM revenue has grown 41% CAGR. There are two separate divisions InterHigh and Academy 21.

InterHigh (roughly 2/3 of revenue) was founded in 2005 by Paul and Jacqueline Daniell (Wey’s current Chief Executive) to provide an online, fee paying secondary school. InterHigh is an interactive online school with full classroom participation between teacher and students, plus a virtual campus so pupils don’t miss out on the social aspects of school. Students can speak to, message or email the teacher directly, as well as contact each other online through the platform. The pupils’ parents are the customers and fees are around £3,000 per annum (versus an independent school of £15,000 per annum and a top boarding school would be more than £40,000 per annum). Around 40% of the pupils are based overseas, pupils also include “career teens” for instance young athletes or child actors who struggle to fit into the traditional school schedule.

Academy21 (roughly 1/3 of revenue) was founded in 2011, and bought by Wey at the end of 2017 for £1.6m. This division provides online lessons for pupils with complex behavioural, medical and mental health issues. Specialist teachers deliver online lessons to groups of up to 15 learners who will be logging in from all over the country. The Local Authorities, rather than the parents, pay the fees.

A couple of years after listing, the share price peaked at 40p in January 2018. David Massie the Executive Chairman had hoped to expand the business to the developing world, specifically Nigeria and China. However forecasts were repeatedly missed and the shares more than halved in value in the next 6 months. Then in the second half of 2018 David Massie the Executive Chairman stepped down due to ill health, and died later in the same year. The share price fell below 6p in April 2019 but was gradually recovering even before covid, which has obviously been a boon to the shares. Share count has increased from 94m at the time of the AIM listing in 2015 to 141m currently.

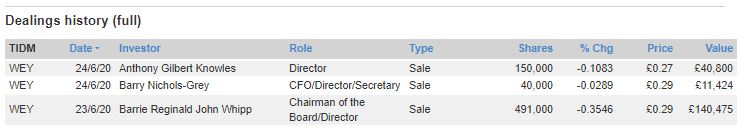

Significant shareholders: David Massie’s Estate still owns 15%, and this could create an overhang. However, given the strength of results, if the estate did want to sell I suspect that there would be institutional interest. Other large shareholders are Gresham House at 19.6%, Jacqueline and Paul Daniell (Chief Executive and her husband) 7.5%, Unicorn VCT 7%. There has been some director selling at close to the share price highs “to meet demand from investors.” That old chestnut.

Results: The company has an August year end and reported revenue up 38% to £8.4m, and statutory PBT of £500K versus a loss of £694K last year. The cash balance was £6.5m at the end of August. It is not clear how management intend to spend this cash, acquiring a rival platform or even physical buildings makes little sense.

Although the company seems to be widely perceived as a “Covid winner” up more than 50% since the start of March, the company did sound one note of caution over Academy21. Local Authorities can now provide online services themselves when schools are closed, which negatively affected Academy21 over the summer.

The company is investing in technology and also marketing, for instance hiring Colin Jackson and Frankie Bridge* as “Brand Ambassadors”. This has increased admin expenses up 32% to £4.5m, so although the gross margin is high at 60%, admin expenses are growing at just below the rate of revenue growth. On the investor call hosted by https://www.investormeetcompany.com/ management said that their marketing budget had increased from £600k to £1m this year, but that in future the marketing spend would level off. If this is true, it suggests that there is considerable operational gearing if revenue continues to grow anywhere close to the historic CAGR.

The outlook statement is “unequivocally optimistic”. On the call, the Chief Executive talked about going from “thousands” of students to “tens of thousands”. In other words management believe that they can scale the business by an order of magnitude.

At 24p the shares are trading on just less than 5x historic revenues. The question remains how big the market might be for online education and how well the business can scale? I’m not sure anyone really knows, but results so far have been encouraging. Given that Wey’s offering is around 5x cheaper than a physical independent school and 13x less than a traditional boarding school, it suggests that there should be plenty of room to grow.

Manolete H1 to 30 September

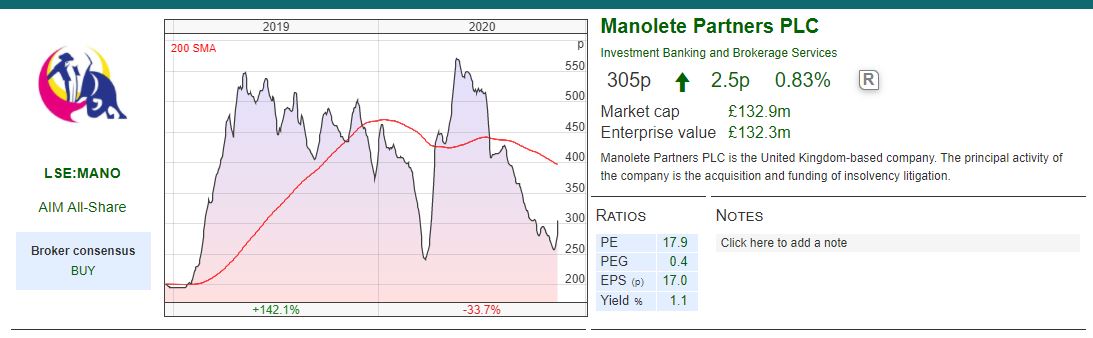

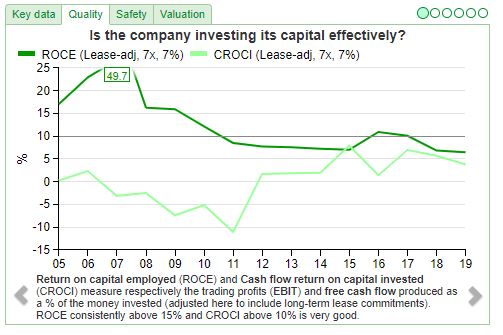

Manolete released H1 results with revenues up 153% to £19m and PBT up 49% to £6.4m. Despite the impressive accounting profit growth, cash was down to just £2.6m at the end of September. This compares to £8.4m 31 March 2020. The difference between the cash position down and the accounting profit up can be explained by a £5.4m fair value adjustment (that is, management wrote up the value of cases) and a £3m increase in working capital as trade receivables increased (cases that have settled, but that they haven’t received the cash for yet). Sharepad shows a RoCE of 27.5% (ranking in the top 6%: 81 out of 1,300) but a CROCI of -11.9% (ranking in the bottom 25%: 973 out of 1,297).

Like Burford, Manolete has come under attack from short sellers as the accounting profits (including fair value adjustments) are slow to convert to cash in the bank. Tom Winnifrith published a short attack when the price was 515p on July 10 warning that the shares would more than halve, so give him his due he’s been right in the short term.

2 days after the results Manolete announced a case win realising £2.8n of net cash. However the timing of the settlement (a third this November, a third by December 2021, and the final third by December 2022) explains why the company’s cash conversion is so poor. A previous large case settlement announced earlier in the year had a 10-year long payment plan. The company refers to these assets as cash, but I think it is better to call them receivables, because they are certainly not cash in the bank. Management suggest this is merely a timing issue with little risk that they won’t be able to collect their wins (they have assumed an Expected Credit Loss) of 4%. I can see why a short seller might not give management the benefit of the doubt.

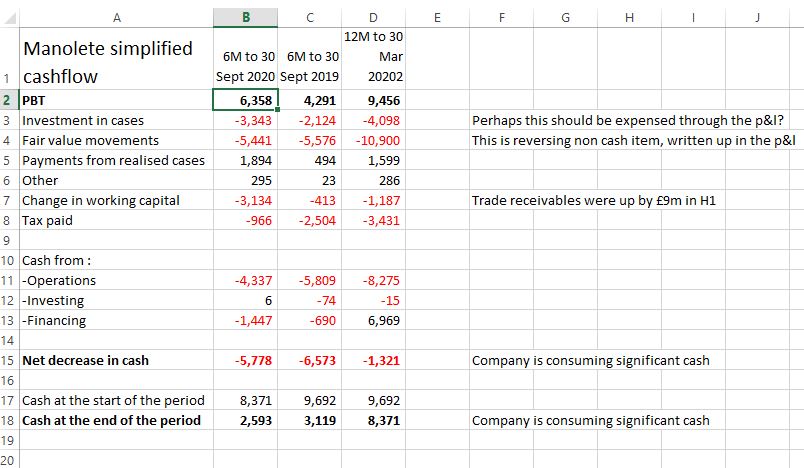

On the next page I have constructed a simplified cashflow statement in Excel, using the company’s own numbers, but removing non-essential items for simplicity, with comments on the rows. Readers can see how PBT of £6,358K in H1 converts to ‘Cash from Operations’ of minus £4,337K, due to i) investment in cases, ii) fair value movements, and iii) changes in working capital (mainly a £9m increase in receivables, less a £5.9m increase in payables) and form a view.

Longer term my concern would be that a “Gresham’s law” applies in litigation finance, where bad litigation finance assets drive out good ones. Burford has $2.7bn of assets under management, and LCM raised $150m in a third party fund, and plans to launch another one. So there doesn’t seem to be much constraint on the amount of capital that can chase after diminishing returns.

As of 30 September Soros owns 9.2%, Miton 7.8% and Amati 3%. My mother also owns some.

Valuation: If investors are prepared to accept the company’s accounting, the shares look remarkably good value for a 27.5% RoCE business, with strong growth prospects and good margins. The forecast PER is just 12x. The bank has £20m borrowing facility from HSBC charged at LIBOR +1.75%, of which it has drawn down £8m. The shares were up 7.5% on the day of results, and have now recovered to 305p versus a low of 253p on 3rd November. Manolete was supposed to be a winner from covid, because insolvencies and disputes are likely to rise. Longer term this could still be true, but the fact the share price fell peak to trough 57% in the last 6 months warns against drawing conclusions that are too one dimensional.

Ocean Wilsons Q3 Trading Update

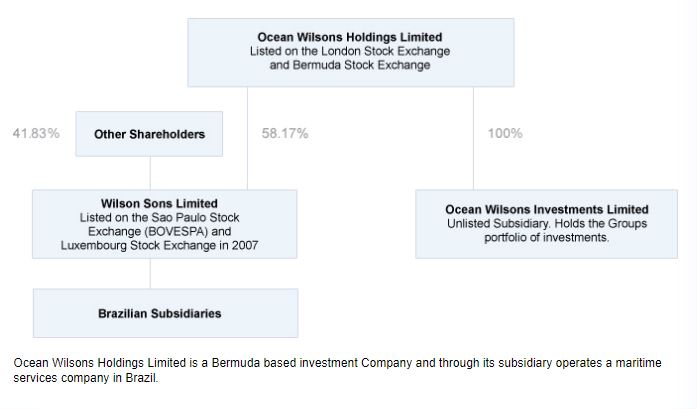

This is a holding company that owns a 58% interest in Wilson Sons (Brazilian ports and maritime services) and a 100% ownership in an investment subsidiary (Ocean Wilsons Investments). Wilson Sons was set up in the Brazilian port of Salvador by two Scottish brothers, Edward and Fleetwood Pellow Wilson in 1837.

Investments At 30 September 2020, the investment portfolio including cash under management amounted to US$281.8 million. So this portfolio represents US$7.94(£6.11) per Ocean Wilsons share. The company lists out the funds it invests in on page 19 of the Annual Report. The largest holding is Findlay Park American Fund at 9.6% of NAV, the next two largest are Adelphi European Select Equity Fund and Egerton Long- Short 5.5% and 4.8% respectively. Investing in dozens of hedge funds makes little sense as anyone who has been reading the newspapers in the last 10 years could have told management. There is no evidence that anyone can pick winning hedge funds, and fees mean that most of the benefits go to the hedge fund managers, not the end investor. Hence Warren Buffett easily won his ten year bet with Protégé Partners.**

Given that the investment portfolio represents around 92% of the current market price, we might reasonably ask how badly the Wilson Sons business (58% owned by the holding company) is performing.

Wilson Sons results The company reported revenues down 17% versus Q3 last year to $88m, mainly due to lower container terminal results. Statutory Q3 profit was down 20% to $10.4m, though FX adjusted profit was down 53% as the Brazilian Real weakened 34% against the US dollar.

9M YTD Revenues were $262m, and 9M YTD PBT was $24m. Wilson Sons net debt was $363m at the end of September, with $50m falling due in 1 year. The company has plenty of near term liquidity $112m of cash and short term investments. Equity was $428m and tangible equity (excludes goodwill and intangibles of $29m) $399m.

Ports businesses can be excellent investments, because they represent natural monopolies. As an example Lord Lee mentions Associated British Ports which was the first of Margaret Thatcher’s privatisations in 1983. The shares were sold to the public at 112p, and over the next couple of decades were a 70 bagger, before eventually being bought by a Goldman Sachs led consortium and delisted. 70x increase! In 2013 the Government listed Royal Mail on the London Stock Exchange at 330p (current price 278p) and was accused of selling too cheaply.

SharePad’s ratios are calculate for the Ocean Wilsons, the holding company. Wilson Sons, the operating company, is only listed in Luxembourg and Sao Paolo and not available on SharePad.

Valuation: To value this business, let’s start with the most recent Wilson Sons reported tangible book value of $399m x 58% that the holding company owns = $231m or £178m. Divide that by 35.4m Ocean Wilsons Hlds shares outstanding and we have 503p per share tangible book value. Plus the 611p of investment funds in the separate investment subsidiary, suggests that the business is worth 1114p to a value investor not willing to pay more than NAV.

To my mind though, I like the idea of owning a ports business in Brazil. Ports are capitally intensive businesses, but they do have moats (if that is not mixing a metaphor?). RoE has been volatile over the last five years, 16% in 2017 falling to 3% in 2018, and averaging 9% since 2015. I am hoping that the company can make more than mid-teens RoE, as it did in the 2003 to 2013 decade, so I would suggest the business should trade on at least 1.5x tangible book, if not higher.

Between 2003 and 2013 Ocean Wilsons 14 bagged, peaking at £14.52, but the most recent decade has not been so kind with the shares roughly halving. I bought the shares at 709p in 2016.

No activism: At this point investors might be wondering why an activist does not take a position and start agitating to break up the company. After all, the investment performance has been far from impressive since 2015, with the portfolio up just 15% in 5 years. A low cost index tracker of the S&P500 would have done considerably better. The largest shareholder is Hansa Investment Company, who have a close relationship with company management. They own 26% of Ocean Wilsons shares and the company’s directors W Saloman and C Townsend own a further 25%. Presumably at some point management will pick up a newspaper and realise that hedge funds are not good value? If not, I suggest to them that they should let me manage their $285m portfolio.

Codemasters bid

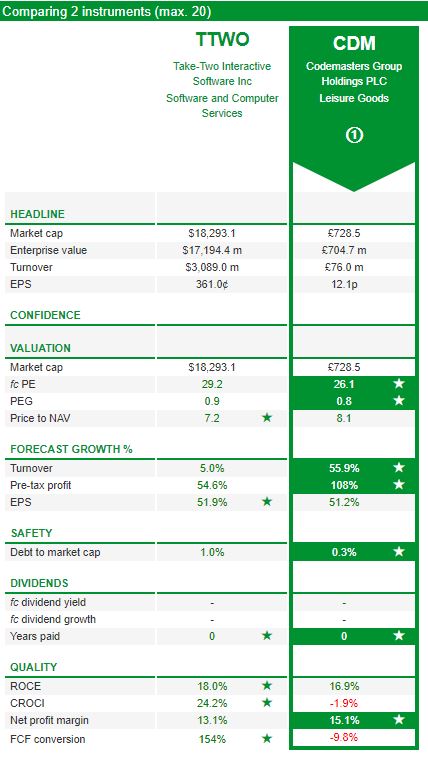

On 6th November Codemasters (the computer game racing company) received a take over approach from Take-Two Interactive Software at a price of 485p, comprising 120p in cash and 365p worth of Take-Two Interactive shares. Management said that they would recommend shareholders to accept the offer, despite the premium being just 11% versus the previous day’s closing price.

I covered Codemasters in the Weekly on 12th October saying: “the computer games industry is clearly consolidating, and with its attractive gross margin, Codemasters looks like it could be a winner.” My analysis was half correct, I just wasn’t expecting Codemasters to be gobbled up by a larger US rival.

Given that 75% of the proceeds are in Take-Two shares listed on Nasdaq, and roughly 30x larger by market cap, Codemaster shareholders need to take a view on the acquirer:

Take-Two owns the labels Rockstar Games (which owns Grand Theft Auto, the most successful car game franchise and Red Dead), 2K, and Private Division, as well as Social Point, a leading developer of mobile games. I’ve used the “compare” tool on SharePad for a quick comparison above. The FT and other media are reporting that institutional shareholders are reluctant to accept the bid, because they believe that it under values Codemasters, and I’m sympathetic to this view.

Readacross: Investors may want to think about the other likely targets. FDEV, Team17, Sumo and Keywords Studios. I’d be surprised if anyone bid for the latter, because of the integration risk given that KWS has made around 50 acquisitions since IPO. Of the others, perhaps Sumo (whose focus is around “game engines”) could represent an interesting diversification for a larger player?

That said the listed computer game companies have been a real UK success story, both in terms of their games and their share price performance on AIM. I feel that it would be a shame if these successes were to be swallowed up by overseas rivals, particularly if the premium offered was so ungenerous.

Bruce Packard

Notes

The author owns shares in Ocean Wilsons and Wey Education.

*Yes I’m too old to know who she is too. Frankie used to be in a girl band “The Saturdays”, is married to a footballer, but more importantly has 1.3m followers on Instagram. Many of her followers are parents of young children.

** “Over a ten-year period commencing on January 1, 2008, and ending on December 31, 2017, the S&P 500 will outperform a portfolio of funds of hedge funds, when performance is measured on a basis net of fees, costs and expenses.” – The S&P Index tracker that Buffett chose was up 7.1% CAGR, Protégé Partners’ 5 hedge fund picks were up 2% CAGR net of fees.

https://blog.longnow.org/02018/02/09/warren-buffett-wins-million-dollar-long-bet/

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Weekly Commentary: 16/11/20 – Reflation trade

Banks and other “covid losers” were up strongly at the start of last week as Pfizer announced they believe they have a credible vaccine. US Treasuries 10 year yield jumped up to 0.98% (the red dot on the chart below) from the 0.79% last week. This is a significant move, the yield curve seems to be steepening as investors anticipate “reflation”.

A particular anxiety

Wetherspoons put out a trading update with like-for-like sales down 27%, up until the most recent lockdown. Tim Martin warned don’t expect a return to pre-covid conditions soon:

“A particular anxiety in the hospitality industry relates to the future timescale for the ending of “temporary” regulations. Veterans of the industry will recall that the afternoon closing of pubs between about 3pm and 6pm was imposed in the First World War, to encourage munitions workers to return to their factories – but the requirement for afternoon closing was only abolished in 1986.”

This week Wey Education, the online school reported FY results. Manolete, the litigation finance company announced H1 results, and Ocean Wilsons, the Brazilian marine services released Q3 results.

Wey Education FY to 31 Aug

History The company was incorporated in 2007, and came to PLUS markets (now owned by Aquis Exchange) in 2011. Wey then moved up to the AIM market in 2015, listing at 3.5p valuing the company at £3.3m market cap. Since listing on AIM revenue has grown 41% CAGR. There are two separate divisions InterHigh and Academy 21.

InterHigh (roughly 2/3 of revenue) was founded in 2005 by Paul and Jacqueline Daniell (Wey’s current Chief Executive) to provide an online, fee paying secondary school. InterHigh is an interactive online school with full classroom participation between teacher and students, plus a virtual campus so pupils don’t miss out on the social aspects of school. Students can speak to, message or email the teacher directly, as well as contact each other online through the platform. The pupils’ parents are the customers and fees are around £3,000 per annum (versus an independent school of £15,000 per annum and a top boarding school would be more than £40,000 per annum). Around 40% of the pupils are based overseas, pupils also include “career teens” for instance young athletes or child actors who struggle to fit into the traditional school schedule.

Academy21 (roughly 1/3 of revenue) was founded in 2011, and bought by Wey at the end of 2017 for £1.6m. This division provides online lessons for pupils with complex behavioural, medical and mental health issues. Specialist teachers deliver online lessons to groups of up to 15 learners who will be logging in from all over the country. The Local Authorities, rather than the parents, pay the fees.

A couple of years after listing, the share price peaked at 40p in January 2018. David Massie the Executive Chairman had hoped to expand the business to the developing world, specifically Nigeria and China. However forecasts were repeatedly missed and the shares more than halved in value in the next 6 months. Then in the second half of 2018 David Massie the Executive Chairman stepped down due to ill health, and died later in the same year. The share price fell below 6p in April 2019 but was gradually recovering even before covid, which has obviously been a boon to the shares. Share count has increased from 94m at the time of the AIM listing in 2015 to 141m currently.

Significant shareholders: David Massie’s Estate still owns 15%, and this could create an overhang. However, given the strength of results, if the estate did want to sell I suspect that there would be institutional interest. Other large shareholders are Gresham House at 19.6%, Jacqueline and Paul Daniell (Chief Executive and her husband) 7.5%, Unicorn VCT 7%. There has been some director selling at close to the share price highs “to meet demand from investors.” That old chestnut.

Results: The company has an August year end and reported revenue up 38% to £8.4m, and statutory PBT of £500K versus a loss of £694K last year. The cash balance was £6.5m at the end of August. It is not clear how management intend to spend this cash, acquiring a rival platform or even physical buildings makes little sense.

Although the company seems to be widely perceived as a “Covid winner” up more than 50% since the start of March, the company did sound one note of caution over Academy21. Local Authorities can now provide online services themselves when schools are closed, which negatively affected Academy21 over the summer.

The company is investing in technology and also marketing, for instance hiring Colin Jackson and Frankie Bridge* as “Brand Ambassadors”. This has increased admin expenses up 32% to £4.5m, so although the gross margin is high at 60%, admin expenses are growing at just below the rate of revenue growth. On the investor call hosted by https://www.investormeetcompany.com/ management said that their marketing budget had increased from £600k to £1m this year, but that in future the marketing spend would level off. If this is true, it suggests that there is considerable operational gearing if revenue continues to grow anywhere close to the historic CAGR.

The outlook statement is “unequivocally optimistic”. On the call, the Chief Executive talked about going from “thousands” of students to “tens of thousands”. In other words management believe that they can scale the business by an order of magnitude.

At 24p the shares are trading on just less than 5x historic revenues. The question remains how big the market might be for online education and how well the business can scale? I’m not sure anyone really knows, but results so far have been encouraging. Given that Wey’s offering is around 5x cheaper than a physical independent school and 13x less than a traditional boarding school, it suggests that there should be plenty of room to grow.

Manolete H1 to 30 September

Manolete released H1 results with revenues up 153% to £19m and PBT up 49% to £6.4m. Despite the impressive accounting profit growth, cash was down to just £2.6m at the end of September. This compares to £8.4m 31 March 2020. The difference between the cash position down and the accounting profit up can be explained by a £5.4m fair value adjustment (that is, management wrote up the value of cases) and a £3m increase in working capital as trade receivables increased (cases that have settled, but that they haven’t received the cash for yet). Sharepad shows a RoCE of 27.5% (ranking in the top 6%: 81 out of 1,300) but a CROCI of -11.9% (ranking in the bottom 25%: 973 out of 1,297).

Like Burford, Manolete has come under attack from short sellers as the accounting profits (including fair value adjustments) are slow to convert to cash in the bank. Tom Winnifrith published a short attack when the price was 515p on July 10 warning that the shares would more than halve, so give him his due he’s been right in the short term.

2 days after the results Manolete announced a case win realising £2.8n of net cash. However the timing of the settlement (a third this November, a third by December 2021, and the final third by December 2022) explains why the company’s cash conversion is so poor. A previous large case settlement announced earlier in the year had a 10-year long payment plan. The company refers to these assets as cash, but I think it is better to call them receivables, because they are certainly not cash in the bank. Management suggest this is merely a timing issue with little risk that they won’t be able to collect their wins (they have assumed an Expected Credit Loss) of 4%. I can see why a short seller might not give management the benefit of the doubt.

On the next page I have constructed a simplified cashflow statement in Excel, using the company’s own numbers, but removing non-essential items for simplicity, with comments on the rows. Readers can see how PBT of £6,358K in H1 converts to ‘Cash from Operations’ of minus £4,337K, due to i) investment in cases, ii) fair value movements, and iii) changes in working capital (mainly a £9m increase in receivables, less a £5.9m increase in payables) and form a view.

Longer term my concern would be that a “Gresham’s law” applies in litigation finance, where bad litigation finance assets drive out good ones. Burford has $2.7bn of assets under management, and LCM raised $150m in a third party fund, and plans to launch another one. So there doesn’t seem to be much constraint on the amount of capital that can chase after diminishing returns.

As of 30 September Soros owns 9.2%, Miton 7.8% and Amati 3%. My mother also owns some.

Valuation: If investors are prepared to accept the company’s accounting, the shares look remarkably good value for a 27.5% RoCE business, with strong growth prospects and good margins. The forecast PER is just 12x. The bank has £20m borrowing facility from HSBC charged at LIBOR +1.75%, of which it has drawn down £8m. The shares were up 7.5% on the day of results, and have now recovered to 305p versus a low of 253p on 3rd November. Manolete was supposed to be a winner from covid, because insolvencies and disputes are likely to rise. Longer term this could still be true, but the fact the share price fell peak to trough 57% in the last 6 months warns against drawing conclusions that are too one dimensional.

Ocean Wilsons Q3 Trading Update

This is a holding company that owns a 58% interest in Wilson Sons (Brazilian ports and maritime services) and a 100% ownership in an investment subsidiary (Ocean Wilsons Investments). Wilson Sons was set up in the Brazilian port of Salvador by two Scottish brothers, Edward and Fleetwood Pellow Wilson in 1837.

Investments At 30 September 2020, the investment portfolio including cash under management amounted to US$281.8 million. So this portfolio represents US$7.94(£6.11) per Ocean Wilsons share. The company lists out the funds it invests in on page 19 of the Annual Report. The largest holding is Findlay Park American Fund at 9.6% of NAV, the next two largest are Adelphi European Select Equity Fund and Egerton Long- Short 5.5% and 4.8% respectively. Investing in dozens of hedge funds makes little sense as anyone who has been reading the newspapers in the last 10 years could have told management. There is no evidence that anyone can pick winning hedge funds, and fees mean that most of the benefits go to the hedge fund managers, not the end investor. Hence Warren Buffett easily won his ten year bet with Protégé Partners.**

Given that the investment portfolio represents around 92% of the current market price, we might reasonably ask how badly the Wilson Sons business (58% owned by the holding company) is performing.

Wilson Sons results The company reported revenues down 17% versus Q3 last year to $88m, mainly due to lower container terminal results. Statutory Q3 profit was down 20% to $10.4m, though FX adjusted profit was down 53% as the Brazilian Real weakened 34% against the US dollar.

9M YTD Revenues were $262m, and 9M YTD PBT was $24m. Wilson Sons net debt was $363m at the end of September, with $50m falling due in 1 year. The company has plenty of near term liquidity $112m of cash and short term investments. Equity was $428m and tangible equity (excludes goodwill and intangibles of $29m) $399m.

Ports businesses can be excellent investments, because they represent natural monopolies. As an example Lord Lee mentions Associated British Ports which was the first of Margaret Thatcher’s privatisations in 1983. The shares were sold to the public at 112p, and over the next couple of decades were a 70 bagger, before eventually being bought by a Goldman Sachs led consortium and delisted. 70x increase! In 2013 the Government listed Royal Mail on the London Stock Exchange at 330p (current price 278p) and was accused of selling too cheaply.

SharePad’s ratios are calculate for the Ocean Wilsons, the holding company. Wilson Sons, the operating company, is only listed in Luxembourg and Sao Paolo and not available on SharePad.

Valuation: To value this business, let’s start with the most recent Wilson Sons reported tangible book value of $399m x 58% that the holding company owns = $231m or £178m. Divide that by 35.4m Ocean Wilsons Hlds shares outstanding and we have 503p per share tangible book value. Plus the 611p of investment funds in the separate investment subsidiary, suggests that the business is worth 1114p to a value investor not willing to pay more than NAV.

To my mind though, I like the idea of owning a ports business in Brazil. Ports are capitally intensive businesses, but they do have moats (if that is not mixing a metaphor?). RoE has been volatile over the last five years, 16% in 2017 falling to 3% in 2018, and averaging 9% since 2015. I am hoping that the company can make more than mid-teens RoE, as it did in the 2003 to 2013 decade, so I would suggest the business should trade on at least 1.5x tangible book, if not higher.

Between 2003 and 2013 Ocean Wilsons 14 bagged, peaking at £14.52, but the most recent decade has not been so kind with the shares roughly halving. I bought the shares at 709p in 2016.

No activism: At this point investors might be wondering why an activist does not take a position and start agitating to break up the company. After all, the investment performance has been far from impressive since 2015, with the portfolio up just 15% in 5 years. A low cost index tracker of the S&P500 would have done considerably better. The largest shareholder is Hansa Investment Company, who have a close relationship with company management. They own 26% of Ocean Wilsons shares and the company’s directors W Saloman and C Townsend own a further 25%. Presumably at some point management will pick up a newspaper and realise that hedge funds are not good value? If not, I suggest to them that they should let me manage their $285m portfolio.

Codemasters bid

On 6th November Codemasters (the computer game racing company) received a take over approach from Take-Two Interactive Software at a price of 485p, comprising 120p in cash and 365p worth of Take-Two Interactive shares. Management said that they would recommend shareholders to accept the offer, despite the premium being just 11% versus the previous day’s closing price.

I covered Codemasters in the Weekly on 12th October saying: “the computer games industry is clearly consolidating, and with its attractive gross margin, Codemasters looks like it could be a winner.” My analysis was half correct, I just wasn’t expecting Codemasters to be gobbled up by a larger US rival.

Given that 75% of the proceeds are in Take-Two shares listed on Nasdaq, and roughly 30x larger by market cap, Codemaster shareholders need to take a view on the acquirer:

Take-Two owns the labels Rockstar Games (which owns Grand Theft Auto, the most successful car game franchise and Red Dead), 2K, and Private Division, as well as Social Point, a leading developer of mobile games. I’ve used the “compare” tool on SharePad for a quick comparison above. The FT and other media are reporting that institutional shareholders are reluctant to accept the bid, because they believe that it under values Codemasters, and I’m sympathetic to this view.

Readacross: Investors may want to think about the other likely targets. FDEV, Team17, Sumo and Keywords Studios. I’d be surprised if anyone bid for the latter, because of the integration risk given that KWS has made around 50 acquisitions since IPO. Of the others, perhaps Sumo (whose focus is around “game engines”) could represent an interesting diversification for a larger player?

That said the listed computer game companies have been a real UK success story, both in terms of their games and their share price performance on AIM. I feel that it would be a shame if these successes were to be swallowed up by overseas rivals, particularly if the premium offered was so ungenerous.

Bruce Packard

Notes

The author owns shares in Ocean Wilsons and Wey Education.

*Yes I’m too old to know who she is too. Frankie used to be in a girl band “The Saturdays”, is married to a footballer, but more importantly has 1.3m followers on Instagram. Many of her followers are parents of young children.

** “Over a ten-year period commencing on January 1, 2008, and ending on December 31, 2017, the S&P 500 will outperform a portfolio of funds of hedge funds, when performance is measured on a basis net of fees, costs and expenses.” – The S&P Index tracker that Buffett chose was up 7.1% CAGR, Protégé Partners’ 5 hedge fund picks were up 2% CAGR net of fees.

https://blog.longnow.org/02018/02/09/warren-buffett-wins-million-dollar-long-bet/

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.