Bruce Packard reviews how past Mello London presenters have performed, revealing funds outpacing most small-cap companies. He also analyses updates from Diageo (DGE), Ceres Power (CWR) and Solid State (SOLI) – exploring what their latest moves say about the wider market mood.

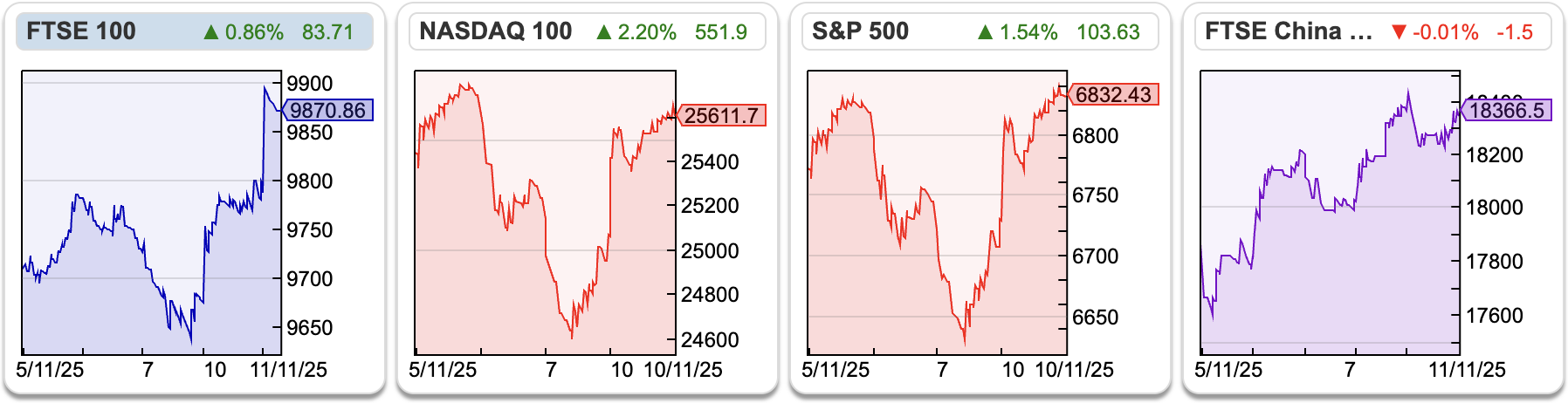

The FTSE 100 was up +1.6% to 9,870 over the last 5 trading days. Assuming that the budget isn’t as gloomy as everyone seems to expect, we may see FTSE 10,000 before the end of the year. The Nasdaq100 was down -1.4% as investors worried about an AI bubble. The FTSE China 50 was up strongly though +2.9%, and is now up +33%, along with the Hang Seng (Hong Kong) is the best performing index this year. Worth bearing in mind, next time Donald Trump claims credit for strong US equity market.

The FTSE 100 was up +1.6% to 9,870 over the last 5 trading days. Assuming that the budget isn’t as gloomy as everyone seems to expect, we may see FTSE 10,000 before the end of the year. The Nasdaq100 was down -1.4% as investors worried about an AI bubble. The FTSE China 50 was up strongly though +2.9%, and is now up +33%, along with the Hang Seng (Hong Kong) is the best performing index this year. Worth bearing in mind, next time Donald Trump claims credit for strong US equity market.

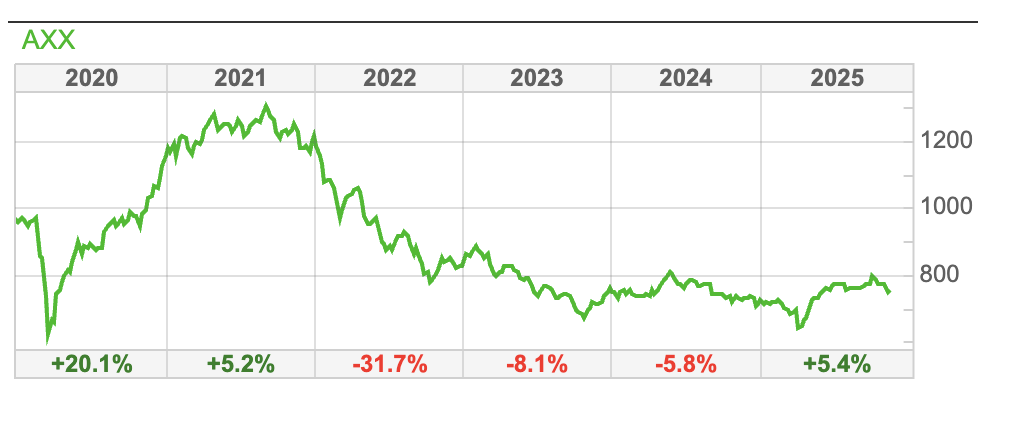

As it is the Mello London conference next week (Tuesday 18th and Wednesday 19th), I thought I would use Sharescope to do some analysis on the performance of companies and funds that have presented in the past. I have the Events Timetable from May 2023, so I have used Sharescope’s portfolio tab to create a new portfolio of the funds and companies who were there and then sort by share price performance. AIM is at a similar level than it was 2 and a half years ago.

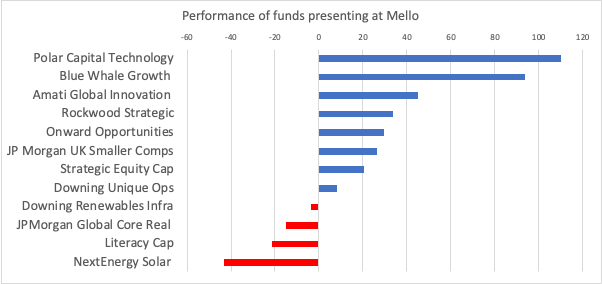

I was expecting to find a wider distribution of company performance (that is, more extreme outcomes on both positive and negative sides) than funds. Instead, I was surprised that Polar Capital Technology Trust and Blue Whale Growth, up +110% and +94% respectively, both did better than the best performing company The Property Franchise Group +67%. To be pedantic, Belvoir management presented at Mello, but then later merged into TPFG in an all-share deal.

I was expecting to find a wider distribution of company performance (that is, more extreme outcomes on both positive and negative sides) than funds. Instead, I was surprised that Polar Capital Technology Trust and Blue Whale Growth, up +110% and +94% respectively, both did better than the best performing company The Property Franchise Group +67%. To be pedantic, Belvoir management presented at Mello, but then later merged into TPFG in an all-share deal.

Below is the chart for the funds, using downloaded data from Sharescope to create an Excel chart. Both Polar and Blue Whale have benefited from owning Nvidia and the AI boom. Next Energy Solar Fund at the bottom should have done well from rising energy costs, but funded its expansion with debt and has been harmed by rising interest rates and the UK government’s review of Renewable Obligation Certificates (“ROC”) and Feed-in Tariffs (“FiT”) which could limit the group’s ability to increase prices for their solar energy.

The mean average performance was +23% and the median (the middle value) of 12 funds was JP Morgan Smaller Companies +26%.

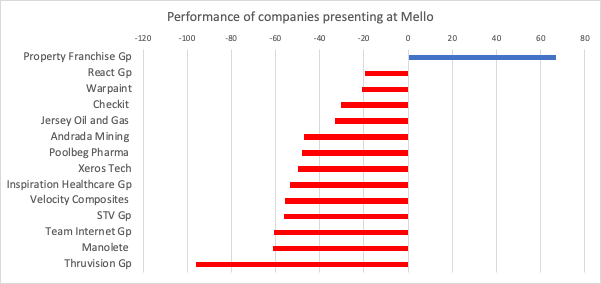

The companies tended to perform worse than the funds, in fact TPFG was the only company to be in positive territory, as the chart below shows.

The mean average company performance was -40%, and the median of 15 stocks was -47%. To be clear, we shouldn’t blame David for this. Instead, it’s worth pondering why a couple of years ago, management teams from AIM listed companies like Filtronic +931%, MS International +244%, Concurrent Technologies +254% or even from the sub £500m market end of the FTSE All Share like Funding Circle and Saga (both up +135%) didn’t come to the event to tell their story to private investors in May 2023.

During a bull market I would expect many of the smaller companies presenting at Mello to outperform the fund managers. So if I repeat the same exercise in a couple of years, we’d likely see a very different result. For now, it is worth bearing in mind the inherent optimism bias in any Chief Exec who stands up in front of investors.

My second conclusion is to be open-minded about investing in funds that might generate returns uncorrelated to my core portfolio of AIM shares. At the Moneyweek conference a couple of days ago, Polar Capital Global Healthcare Trust, India Capital Growth, Vietnam Enterprise Investments (VEIL) and AVI Japan Opportunity Trust (AJOT) all came across well. As always, the idea is to gain some insight from conferences and presentations, but then to use Sharescope to compare performance and further research.

This week I look at Diageo’s Q1 update and new Chief Exec appointment. Then hydrogen fuel cell company Ceres Power, which is up +480% in the last 6 months and Solid State, the maker of rugged computing and power components.

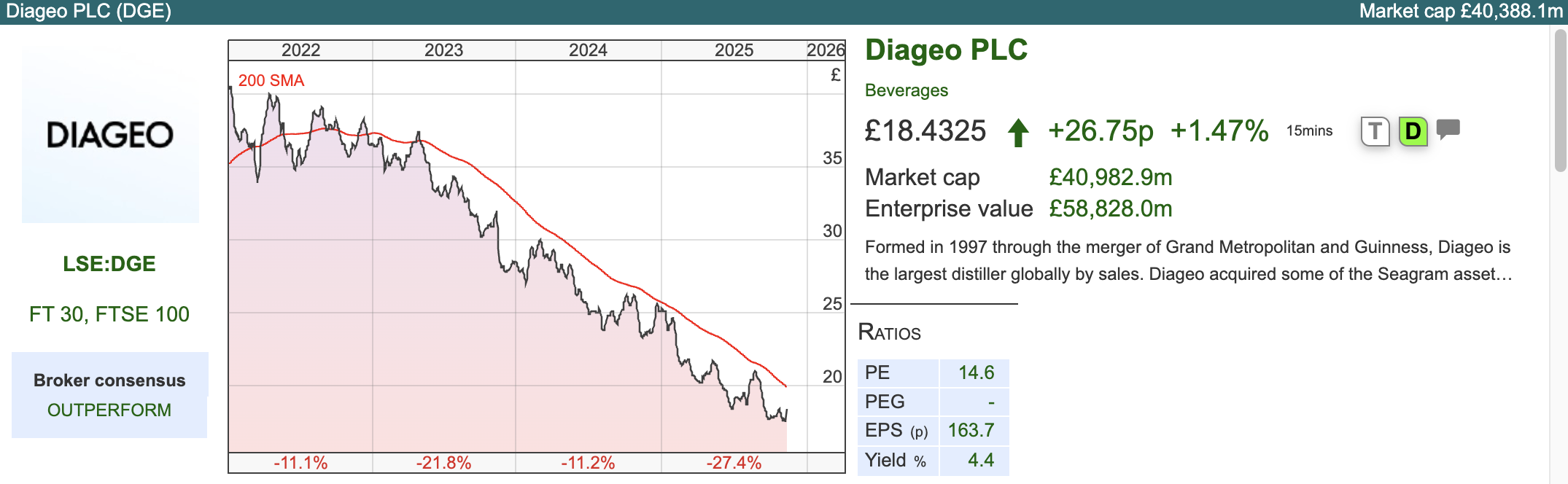

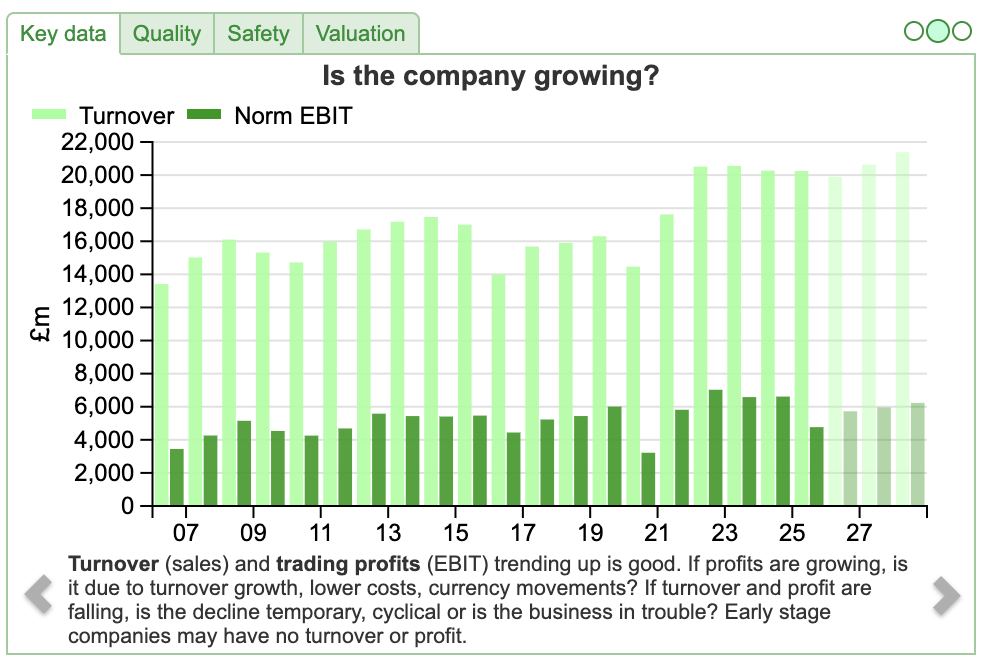

Diageo Q1 Sept Trading update

The owner of spirits brands like Smirnoff, Johnnie Walker, Tangueray gin and of course Guinness, has been struggling to grow revenue since the pandemic ended. In Q1 September reported sales were down -2.2%, with China sales down -13%. The Chinese decline is blamed on reduced consumption of the baijiu category, a sorghum based white spirit, typically 40% ABV or over. Baijiu is an essential component of formal business and government dinners/banquets, has become associated with “gift giving” culture (some might call it bribery and corruption) so has become unfashionable according to contact I spoke to. The -13% decline reported is an acceleration from the -8% sales decline at the FY Jun 2025 results. So, it’s not clear what Diageo mean when they say that Baijiu sales are declining due to “market policy”.

The owner of spirits brands like Smirnoff, Johnnie Walker, Tangueray gin and of course Guinness, has been struggling to grow revenue since the pandemic ended. In Q1 September reported sales were down -2.2%, with China sales down -13%. The Chinese decline is blamed on reduced consumption of the baijiu category, a sorghum based white spirit, typically 40% ABV or over. Baijiu is an essential component of formal business and government dinners/banquets, has become associated with “gift giving” culture (some might call it bribery and corruption) so has become unfashionable according to contact I spoke to. The -13% decline reported is an acceleration from the -8% sales decline at the FY Jun 2025 results. So, it’s not clear what Diageo mean when they say that Baijiu sales are declining due to “market policy”.

Outlook: Management lowered FY Jun 2026F expectations for organic net sales growth to “flat to slightly down” from “to be at a similar level [which was flat] to fiscal 25”. At an operating profit level they expect low to mid single digits growth [previously just mid single digits].

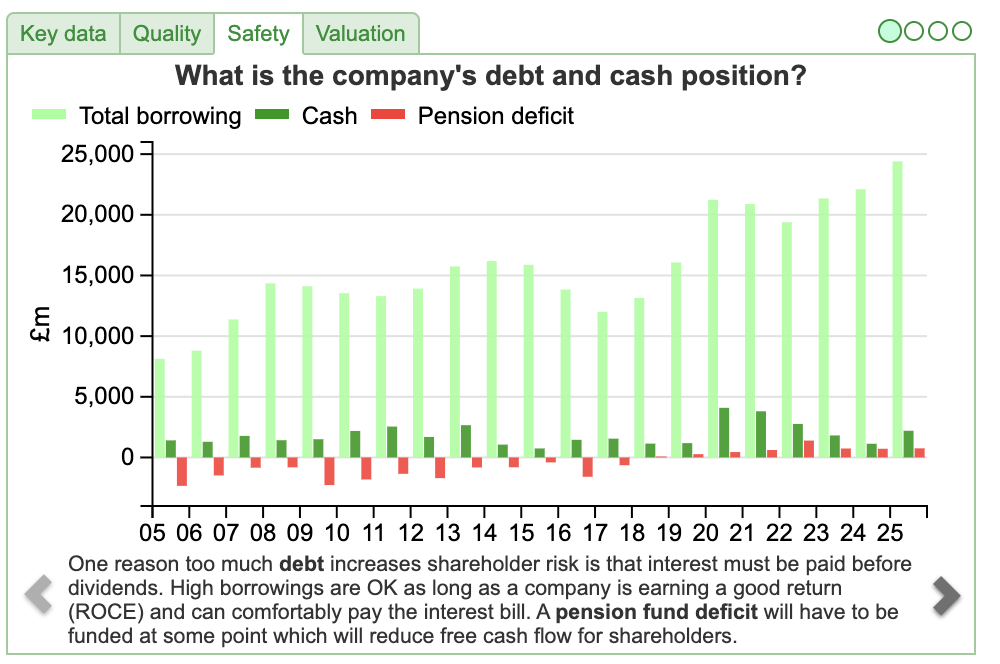

Following some over priced historic acquisitions, Diageo is carrying an uncomfortably large ($21.9bn) amount of net debt (3.4x FY Jun 2025 EBITDA) for a company struggling to grow sales. They re-iterated that they expect to be well within the leverage target range of 2.5-3.0x net debt to adjusted EBITDA no later than FY Jun 2028F. Intangible assets at $14.8bn are a third larger than shareholders’ equity.

New Chief Exec: A couple of days after the results, DGE announced Sir Dave Lewis (ex Unilever, then responsible for turnaround at Tesco) would be appointed Chief Exec. Nik Jhangiani, who had been acting as Diageo’s interim Chief Exec and was considered an early frontrunner for the top job, will return to his role as finance chief upon Lewis’s arrival. The shares reacted positively up +7%, though there’s always the possibility the new Chief Exec “kitchen sinks” his first set of results after he joins in January next year.

Valuation: Assuming no downward revision to earnings, the shares are trading on a PER of 14x both Jun 2026F and 2027F, with revenue expected to decline this year and then grow just under +4% next year. That equates to 11x EV/EBITDA and a dividend yield of 4.4% (1.6x covered).

Opinion: It’s not clear to me why revenue growth has stalled. I bought at £20 per share after the FY results in August, which weren’t as bad as some investors had been anticipating. Dave Lewis comes with an excellent track record for cost cutting and turnarounds. Diageo doesn’t have a cost problem though, the problem is revenue. Sharescope reveals that revenue has been stagnant since FY Jun 2022, and the group has struggled in its two most important markets: USA and China. I think we need to see marketing initiatives to reinvigorate sales, which seems more of a challenge if consumers are drinking less alcohol.

Ceres Power licence agreement with Weichai

Anything hydrogen related comes with a “caveat emptor” in the first sentence. That said, Ceres has been listed since Nov 2004 (raising £15m at 120p, implying a market cap of £60m on admission) and the after 4 consecutive years of share price declines, has rebounded strongly this year and rejoined the FTSE 250.

Anything hydrogen related comes with a “caveat emptor” in the first sentence. That said, Ceres has been listed since Nov 2004 (raising £15m at 120p, implying a market cap of £60m on admission) and the after 4 consecutive years of share price declines, has rebounded strongly this year and rejoined the FTSE 250.

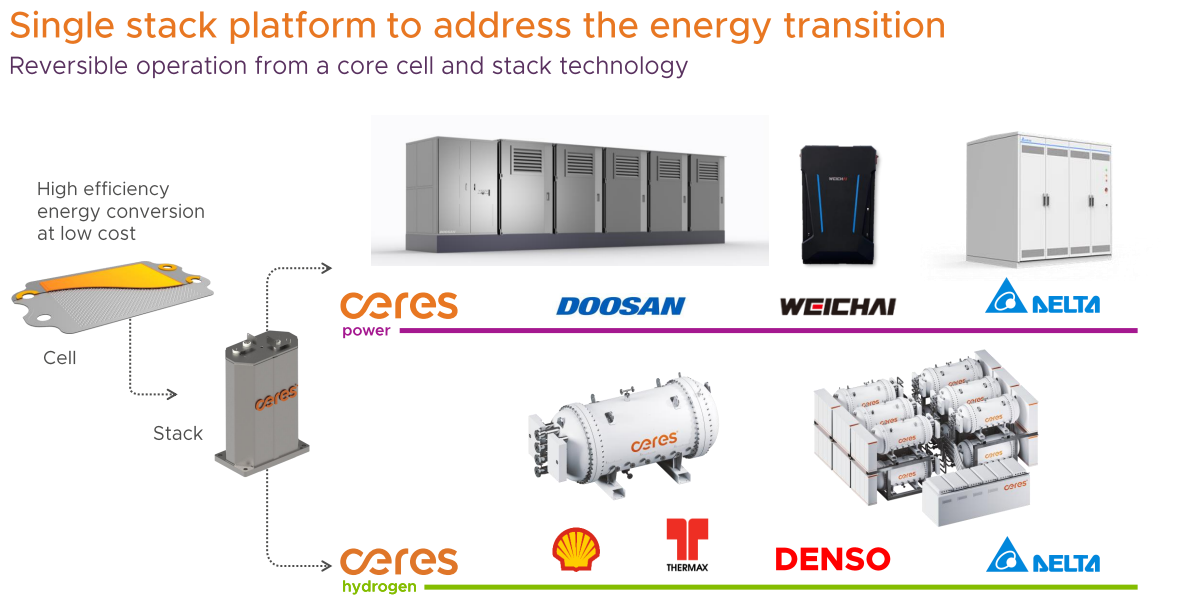

Ceres develops solid oxide hydrogen fuel cells for power generation, electrolysis (green hydrogen) and energy storage. They have an asset-light, licensing model partnering with established companies like Bosch in Germany, Miura in Japan, and Doosan in Korea. They already had a commercial relationship with Weichai in China, however they have signed a new agreement which should see revenue recognition for the licence fees are likely to be booked in FY Dec 2026F. They reiterate current year revenues will remain as previously guided, which implies a fall of -37% to £32m and a pre-tax loss of £36m.

At their June half year the group reported £104m of cash. Forecasts imply losses out to FY Dec 2027F, but current forecasts of growing revenue and narrowing losses, implies they don’t need to raise more equity, helped by their 77% gross margin and asset light business model. Inevitably they refer to themselves as a “single stack platform”.

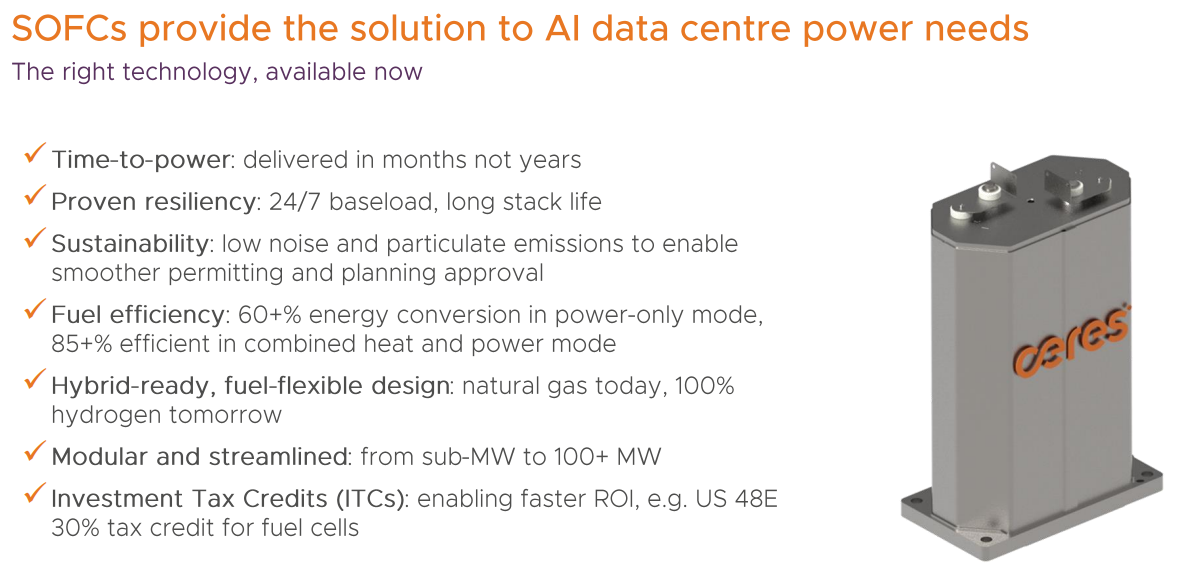

The new agreement relates to stationary (ie not vehicles) power markets. So this is a way to benefit from all the dollars being thrown at AI-led energy demand. Their H1 analyst pack suggest 22GW of solid oxide fuel cell opportunity by 2030, of which just over half would be data centres. Hydrogen does seem to be a credible solution to AI data centre needs as even natural gas turbines have wait times of 7-10 years.

The new agreement relates to stationary (ie not vehicles) power markets. So this is a way to benefit from all the dollars being thrown at AI-led energy demand. Their H1 analyst pack suggest 22GW of solid oxide fuel cell opportunity by 2030, of which just over half would be data centres. Hydrogen does seem to be a credible solution to AI data centre needs as even natural gas turbines have wait times of 7-10 years.

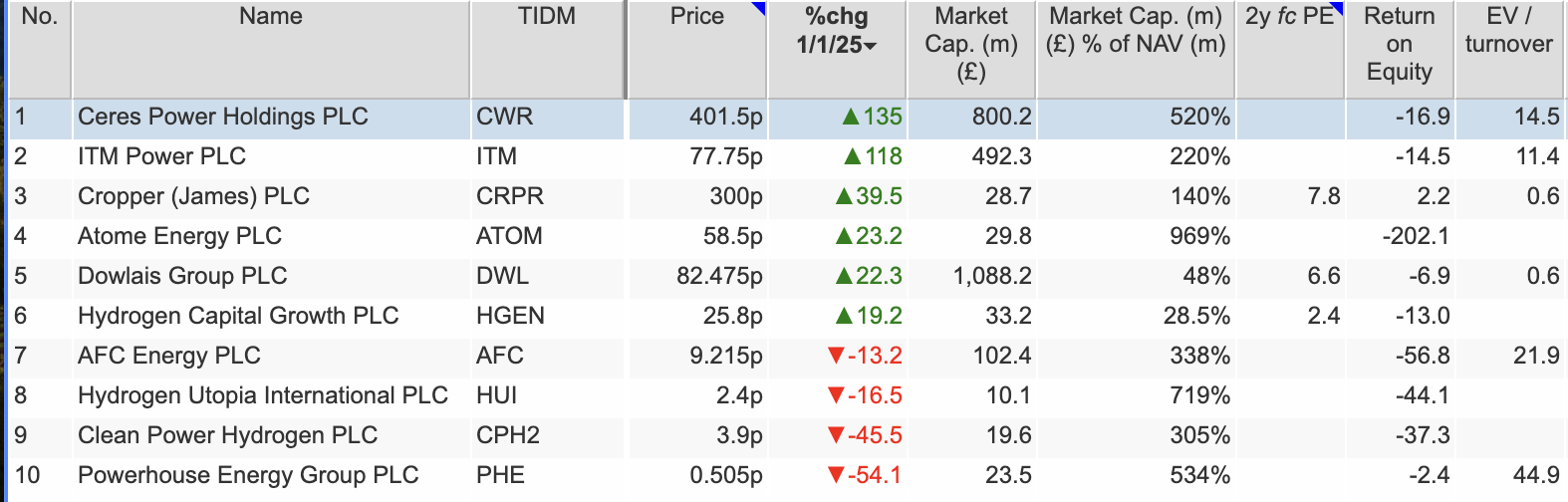

Comparison with other hydrogen stocks: AFC, which raised £23m at 10p per share in July but reported just £107K of revenue, also put out an RNS last week pointing to US listed hydrogen fuel cell shares rebounding due to AI power needs. This data centre infrastructure buildout is expected to drive demand for affordable hydrogen and like many other group’s, AFC Energy believes this is future market opportunity for its fuel cell generator systems. ITM Power, which has been backed by Peter Hargreaves and German industrial company Linde is also up strongly in the last 6 months.

Valuation: There are no forecast earnings, but on a EV/turnover they are on 14.5x. This has been a “jam tomorrow” story for as long as I can remember, Sharescope shows accumulated losses of £280m in retained profits (or really, retained losses) of the balance sheet. Some investors seem prepared to look through the expensive rating but not for value investors.

Opinion: A contact mentioned to me that connecting large battery technology to solar power is not truly sustainable, as the carbon footprint required is too large. So I wonder if hydrogen for stationary power markets is the future. Picking the winners is not be straightforward though, even if hydrogen fuel cells do play an integral part in the green economy and benefit from AI data centre demands,

There have been many “false dawns” for this stock, with the share price peaking at over £15 per share in the 2021 liquidity fuelled pandemic bubble. My view is that this could make sense as part of a diversified portfolio if you can time your entry point.

Solid State H1 Sept Trading Update

This rugged computer, power and communications equipment group has failed to benefit from increased defence spending. In November last year management reported trading “in line with market expectations for the full year”. Then a week later announced a second trading update saying that as a consequence of the UK Strategic Defence Review a large order would be delayed, and they would be “materially below”, asking Cavendish to slash FY Mar 2025 EPS by -58%. That emphasises the risk of lumpy orders for this type of company. They do have impressive blue chip customers though.

This rugged computer, power and communications equipment group has failed to benefit from increased defence spending. In November last year management reported trading “in line with market expectations for the full year”. Then a week later announced a second trading update saying that as a consequence of the UK Strategic Defence Review a large order would be delayed, and they would be “materially below”, asking Cavendish to slash FY Mar 2025 EPS by -58%. That emphasises the risk of lumpy orders for this type of company. They do have impressive blue chip customers though.

Last week’s H1 September trading update was also in-line, which they set out in a simple table at the bottom of the RNS.

Defence and Security sales, which were a third of group revenue FY Mar 2025 are now more than offsetting a weaker Industrial sector. For instance in October they announced an $11m UK MoD order for Project CAIN, supplying ruggedised systems such as a MPU5 and Wave Relay Radio Technology.

During H1 Sept £23m of revenue has now been recognised which had been delayed from delivery in the prior year, which they had warned about last November. Excluding this, and currency effects, they suggest underlying revenue growth is between 5-7%. There’s no mention of net debt, but this stood at £7m at the end of March.

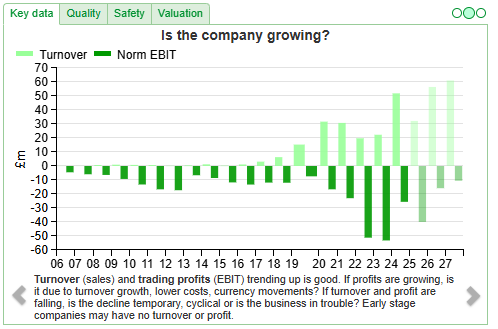

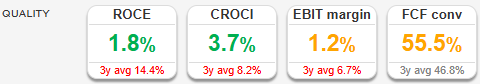

Outlook: The order book stood at £97m at the end of October, compared to £102m in May. Management say that order intake at the start of the second half is positive, underpinning expectations for the full year. H1 Sept results will be announced on the 1st December. Cavendish say the group’s medium-term target remains above 10% adjusted EBIT margins, compared to 1% last year and 6% forecast FY Mar 2026F. Sharescope’s quality indicators show last years profitability measures were well below the 3 year averages, so there’s good reason to believe that the numbers should recover.

RoCE peaked at 16.9% in FY Mar 2024, after revenue had compounded at 25% CAGR between 2020 and 2024.

Valuation: The shares are trading on 14x Mar 2027F, which equates to 7x EV/EBITDA. I can’t see investors giving this a much higher rating, due to the lumpy nature of orders. However, I can see that there’s potential to re-invigorate growth, sales grew by 2.5x for the 4 years from FY Mar 2020 to FY Mar 2024. Currently, forecast sales are 10% below that FY Mar 2024 peak level.

Opinion: The share price was recovering nicely earlier this year but then management suggested in their outlook statement in July that USA customer programmes were being delayed by macro-economic and geopolitical uncertainty. That sounds like a temporary headwind, rather than anything more fundamental or long term. The S&P500 is up +17% YTD and the Bloomberg News count of stories citing a US “recession” has dropped to its lowest since the data starts in 2015, so management teams should not be blaming macro-economic headwinds for lacklustre sales growth in the USA.

I’ve owned SOLI for over a decade, and like the margin expansion story. I’m pondering whether to take some profits from MS International and reinvest into Solid State.

Bruce Packard

@bruce_packard

Notes

Bruce owns shares in Solid State

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Its fascinating to ponder why top AIM stars didnt present at Mello last May – perhaps they knew their performance would overshadow the funds? As for Diageo, good luck to the new boss Dave Lewis – turning around stalled revenue in alcohol is like trying to sell fewer drinks, which sounds tricky. Hydrogen seems everyones new hobby horse, with Ceres Power and AFC Energy galloping, but remember, caveat emptor applies more than usual – dont get carried away by the hype before checking the Sharescope. Solid State appears steady, but defence spending unpredictability makes their business a rollercoaster. Always remember, conferences are for insight, but dont forget to double-check with Sharescope – its like taking a map on a treasure hunt!