Most traders focus on when to buy or sell – but how your trade is executed can make or break your results.

Michael Taylor explains the key differences between SETS and SETSqx, and how understanding them can save you costly mistakes.

Most new traders think that buying and selling involves clicking a few buttons.

They’re not wrong, but there is a lot that goes on behind the scenes that matters.

Understanding how SETS and SETSqx actually work can save you money and help you avoid some spectacularly bad trade executions.

I learned this the hard way in 2017 when I had left an order with a market maker to be executed, only to watch orders going through at better prices and at the end of the day nothing had been done.

My belief that paying £40 with a phone broker would mean better execution. What actually happened is the broker called a market maker, left it with them, and the market maker was in no urgency to execute my trade unless it suited them and neither was there any incentive for them to tell me I could get filled elsewhere as it would mean they’d potentially lose out on some business.

So they got the upside without any downside, and I got nothing.

This is why I never leave orders working with market makers. They either fill me or I go somewhere else. It’s their choice.

But if you are a new trader, unless you understand how market makers work, and how the SETS and SETSqx platforms operate, this would be an easy mistake to make when looking at execution.

If you are dealing with a phone broker, using an Execute & Eliminate order is best in my opinion. The issue with Fill Or Kill is that if you wanted 100,000 shares at a certain price, the market maker may be able to do only 90,000 and as a result you’d get nothing done.

Whereas if you used an Execute & Eliminate order, this directs the order to execute as many shares as possible at your desired price, then the order is killed, or eliminated.

This does, of course, mean you can end up with a tiny number of shares, but removes the possibility of not getting a decent portion of what you asked for because you used a FOK. E&E is the best, in my opinion.

The two systems

The London Stock Exchange operates two main electronic trading platforms: SETS (Stock Exchange Electronic Trading Service) and SETSqx (SETS for smaller quoted companies).

I always wonder why it isn’t SEETS but it’s a question I may never have the answer to.

Think of SETS as the M1. High volume, continuous traffic, generally efficient. Apart from that section where they’ll likely be building until 2028.

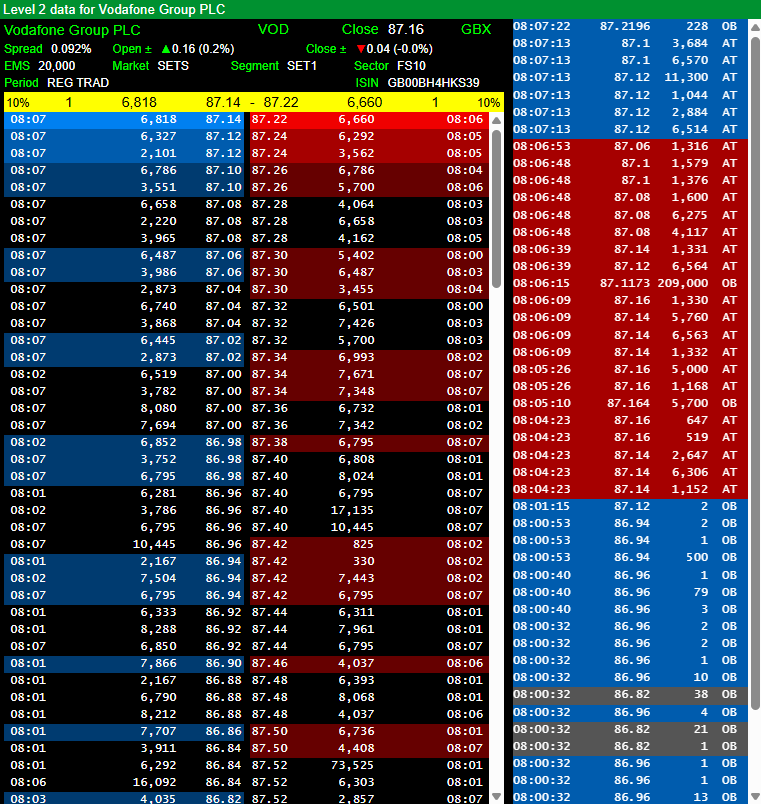

Here’s the Level 2 data for SETS stock Vodafone.

SETSqx is more like a country road with occasional passing places where you need to wait for someone coming the other way.

SETS is the continuous order book system used for the most liquid UK shares. Your FTSE 100 constituents, FTSE 250 companies, and the most actively traded smaller companies. We’re talking about shares like Unilever, AstraZeneca, and Lloyds Banking Group. When you place an order on SETS, it goes into an electronic order book where it can be matched instantly with another trader’s order on the opposite side. Buy orders meet sell orders in real-time, all day long during market hours. You can always use RSP here if you want to (assuming your broker offers it, and if it doesn’t, then leave because you need to have access to market makers to get decent quality execution).

SETSqx is the Stock Exchange Electronic Trading System (Quotes and Crosses) which is a hybrid system combining periodic electronic auctions with quote-driven market making for smaller, less liquid stocks. These auctions are thinner than soggy bread and are just a complete waste of time, unless there’s some arbitrage to do done, which most of the time there isn’t, and if there is someone has usually narrowed the gap.

Most AIM shares trade on SETSqx.

Here’s a Level view of SETSqx traded stock Warpaint.

Why the platform matters

Here’s a practical example. Let’s say you’re buying shares in a FTSE 100 company on SETS. You want 1,000 shares at 500p. If there are sellers offering shares at 500p or below in the order book, your trade executes immediately. The spread might be tight – perhaps 498p bid, 500p offer. You know exactly what you’re getting.

You can always use the RSP to see if you can get an even better price as often market makers will offer prices within the spread.

But if you want to finesse an order even more, you can go on the bid with Direct Market Access to place your order onto the book.

Let’s say you’re happy to pay a maximum of 495p. You can put 1,000 shares onto the order book at 495p and wait to see if your order is matched.

If it is, great. You saved 5p on your buy. But there is no guarantee of this happening.

Now imagine you’re buying 5,000 shares in a small AIM company on SETSqx. The market makers might be quoting 45p-50p. That’s a 10% spread right there. Your order doesn’t go into a continuous order book. Instead, it either gets picked up by a market maker at their quoted price, or you can use Direct Market Access for one of the twice-daily auctions at 11am and 3pm where orders are batched and matched (again, ignore these).

The SETSqx auction

SETSqx auctions are peculiar beasts. Between the 11am and 3pm auctions, your orders sit in a queue. Market makers can still interact with your order, but there’s no continuous matching. Then at the auction times, all the orders are matched at a single uncrossing price designed to execute the maximum volume.

This means two things for traders. First, if you need to get in or out of a SETSqx stock quickly, you’re at the mercy of market maker quotes – and they know it. Second, if you can wait for an auction, you might get a better price than trading in between auctions. But my experience is that if you want to get out, just get out. SETSqx auctions are terrible because most traders don’t know about Direct Market Access, and even fewer brokers offer it.

Knowing which platform you’re on

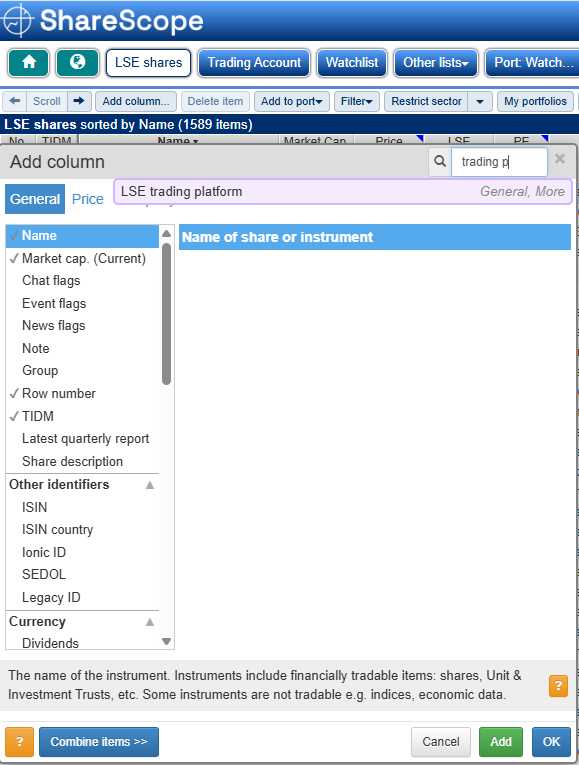

ShareScope and other trading platforms will tell you which trading service a stock uses, but you need to actually look. There’s a pattern, though: FTSE 100 and FTSE 250 stocks all trade on SETS. Most AIM stocks and smaller Main Market companies are on SETSqx. When in doubt, check before you trade.

If you want to check on ShareScope, simply add “Trading platform” as a column.

This will then always tell you in the blue screen.

It’s very easy to tell from the chart what platform a stock trades on. SETS stocks can be more erratic with more smaller movements, whereas SETSqx price trends tend to be more orderly.

The liquidity difference matters enormously for technical trading. Support and resistance levels work better on SETS because there’s continuous price discovery. On SETSqx, prices can move because of maker behaviour. A “breakout” on a SETSqx stock might just be a market maker adjusting their quote, not genuine buying pressure.

In my next article we’ll look more at the SETS auction and what this means for traders.

Michael Taylor

Get Michael’s trade ideas: https://newsletter.buythebullmarket.com/

Free educational content: @shiftingshares

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

There are five uncrosses, not two:

8am, 9am, 11am, 2pm and 4:35pm.

Yes, there are five auctions. For some reason I thought they had reduced some like the noon auction that was silently removed. The final auction starts at 4.30 on both SETS and SETSqx.