Eagle Eye is an intriguing business with improving numbers that just fails to make the 5 Strikes cut. Richard also examines a trio of businesses that supply products for buildings. James Halstead, with only one strike, is not what he is looking for.

5 Strikes

Since my last update, six companies have published annual reports and passed my minimum quality filter (see the explainer linked in the table for more detail).

|

Name |

TIDM |

Prev AR |

Strikes |

# Strikes |

|---|---|---|---|---|

|

Bellway |

BWY |

27/10/25 |

? Holdings – CROCI – Growth – ROCE |

4 |

|

Eagle Eye |

EYE |

23/10/25 |

– CROCI – ROCE – Shares |

3 |

|

Gattaca |

GATC |

23/10/25 |

– CROCI – Growth – ROCE |

3 |

|

Volution |

FAN |

22/10/25 |

? Holdings ? Acquisitions – Borrowings |

1 |

|

James Halstead |

JHD |

17/10/25 |

– Growth |

1 |

|

Thorpe (F W) |

TFW |

15/10/25 |

? Growth |

0 |

|

29/10/2025 |

||||

After checking whether the directors are invested (low director holdings as a percentage of total shares receives a strike or query), I cast my eye over six financial statistics going back eight years.

I am looking for blemishes in the company’s financial track record that must be explained if I am to have enough confidence to invest. Fewer blemishes means less work, and more confidence, so I focus on shares that score less than three strikes.

Three of the six shares fall into this category. I will be evaluating FW Thorpe and Volution on interactive investor because FW Thorpe is in the Share Sleuth model portfolio I run, and Volution is a candidate for it. Here, I will restrict myself to commenting on how I applied the 5 Strikes criteria to them in this article.

I recently dropped James Halstead as a candidate for the same portfolio. That’s not because James Halstead is a bad business, I only gave it one strike, it’s because it is not the kind of business I am looking for.

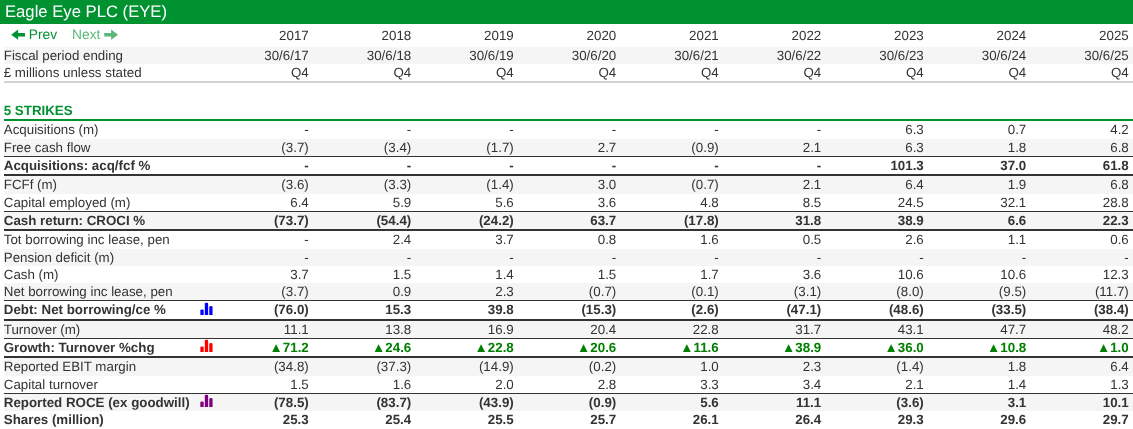

Eagle Eye (- CROCI – ROCE – Shares)

Before we take a brief look at the businesses that scored less than 3 strikes, I’d like to introduce Eagle Eye, which achieved 3 strikes and just failed to meet the cut. My custom 5 Strikes table shows the last eight years of data for the six criteria I deem most important, and the factors that comprise them:

Source: ShareScope

Acquisitions did not feature until 2023, but it has since then. To my mind Eagle Eye did not spend an alarming amount, in each of the years acquisition spend was less than or equal to free cash flow.

Eagle Eye received a strike for CROCI (Cash Return on Capital Invested) and ROCE (Return on Capital). These are both measures of profitability, the former in cash terms, and the second in terms of profit. If both are consistently positive, and ROCE is usually in double figures, it shows the business has earned decent returns.

Net borrowings are negative (i.e. the company has more cash than debt), and growth is positive

The share count has also increased by about 17% over the period, which means the company has diluted shareholders quite significantly. I award a strike if a company has increased the share count by more than 10% (a bit more than 1% a year on average).

One per-cent should be more than enough to fund employee and executive share schemes. More than 1% suggests the company is not growing entirely under its own steam, it has raised money, probably to fund investment.

The reason I mention Eagle Eye is that, ignoring negative CROCI in 2021 (probably Covid related), it has earned high cash returns in recent years. Negative CROCI was a feature of the results in the previous decade. Perhaps this is a change that has stuck.

ROCE has been less impressive, but this may not be because the company has performed poorly. Eagle Eye will be writing down (amortising) the value of the acquired intangible assets. I add these accounting costs back to profit because they relate to historical transactions (acquisitions) and not current operating costs.

Things are changing at Eagle Eye, perhaps for the better, but it’s a bit complicated, and a bit premature, for me just now.

You may have noticed I haven’t explained what Eagle Eye does. That’s because I look at the numbers before I decide whether to investigate a company further.

If a company gets my attention though, needing to find out what it does is an itch I must scratch. This is a dangerous moment because I can be a bit sniffy about certain types of business.

A friend of mine has just invested in Nichols, the owner of Vimto and other sweet drinks brands. Nichols is a 5 strikes share, and may well be a good long-term investment. I mentioned to him what I wrote last May. I can’t get excited about Nichols because sweet drinks are bad for us, which is why you don’t see me writing about gambling stocks and tobacco companies.

My friend replied: “I’ve long ago dismissed my own personal likes and dislikes on investment decisions, as I don’t consider myself a good judge of others’ tastes in comparison to mine.”

I agree, my preferences can limit my investment options. But I only need to find 20 or so businesses that, in my rough calculus, do more good than harm and also make good money, to be happy. I am sure there are more than twenty businesses I can be comfortable with.

After reviewing Eagle Eye’s numbers, and forming my hypotheses, I scratched the inevitable itch. Eagle Eye has developed a software platform for retailers. They use it to design and run loyalty schemes.

At the risk of sounding like an anti-capitalist, I am almost as allergic to loyalty schemes as I am to sweet drinks. Discounts don’t keep me coming back, good products do, and decent service. But it is important to keep an open mind, because other people seem to like offers and promotions and while I hate (and switch off) relentless marketing, it is not an unalloyed evil.

Mindful of another friend’s old adage, “a bargain is not a bargain unless you would have bought it anyway”, I have enjoyed the odd bargain in my time.

Eagle Eye has an entertaining origin story. Its founder, Steve Rothwell, wanted to buy his mates a beer, even though he couldn’t go to the pub with them. That inspired him to set up buymeabeer.com, which morphed into Eagle Eye.

The company has big customers, and kindness is part of its DNA. Even though I can be sniffy about marketing, the company markets itself in a way that appeals to me.

Source: ShareScope

Steve Rothwell retired from the board this summer, though he is still an advisor and major shareholder. He’s not Eagle Eye’s biggest individual shareholder though, that honour goes to non-executive director Sir Terry Leahy, the fabled former chief executive of Tesco (also a customer of Eagle Eye).

I’m sure there are wrinkles in the details, including the acquisition of Untie Nots, now the nattily named EagleAI, in 2023. But I am going to keep Eagle Eye in my peripheral vision.

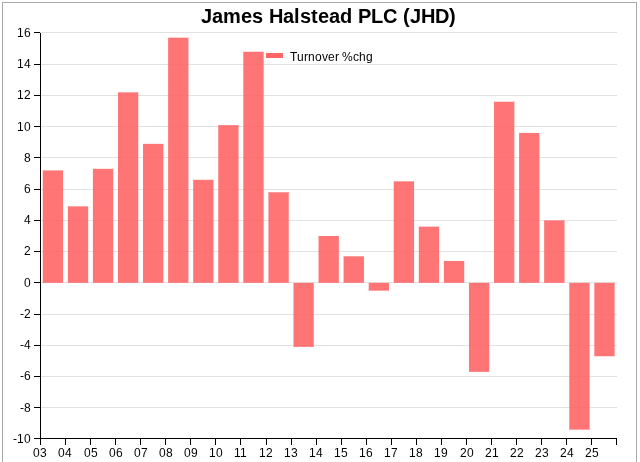

James Halstead [- Growth]

Also in my peripheral vision is James Halstead, an immensely profitable and reliable manufacturer and distributor of vinyl flooring. My beef with James Halstead is growth.

I’ve dated this chart right back to early this century, when James Halstead was in the final throes of divesting businesses, transforming from a conglomerate into a focused business.

During the first decade of the century it was a reliable grower. Since then James Halstead has contracted in five years out of 13. If we adjust for inflation we can see it hasn’t grown in real terms at all:

This is all the more puzzling because James Halstead earns a truly impressive Return on Capital. It could choose to invest these returns, but mostly it pays an ever more generous dividend and allows cash to build up in its bank account.

In the absence of other explanations, I am assuming it cannot find opportunities to invest at a suitable return. Every year I check the annual report to see if that has changed.

This year I have drawn a blank. The company is busy. It is launching new products, upgrading its factories, and improving its logistics in far flung locations, as it does most years.

The problem is these incremental measures don’t seem to move the growth needle.

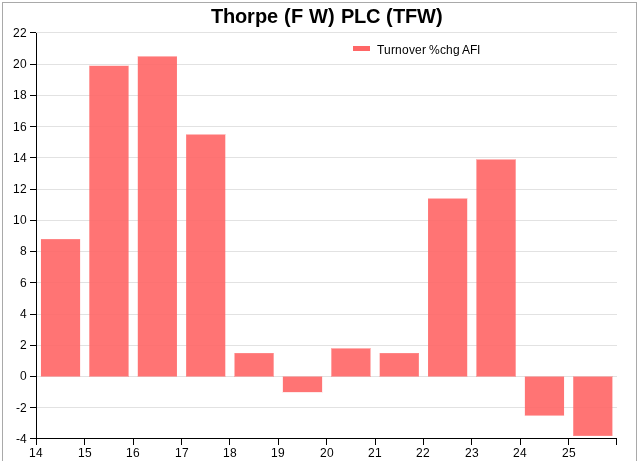

FW Thorpe [? Growth]

FW Thorpe is similar in many ways to James Halstead. It too is family owned. It makes lighting systems, which like vinyl flooring, are used to kit out factories, hospitals, schools. hotels, offices and shops. Both companies try to hold on to customers as projects go from specification to installation, by providing superior service. Both companies are highly profitable and cash rich.

But lighting systems are a more technical product, so there is perhaps more scope for innovation and differentiation, and FW Thorpe has found things to invest in: its own technologies, various European lighting companies, and an as yet unprofitable stake in a business that makes EV chargers.

As a result, FW Thorpe has grown, even after adjusting for inflation:

It has, though, contracted very slightly over the last two years, but I don’t think this is a symptom of problems in the business. Demand is highest when companies are confident and investing in their premises, and public bodies have money to spend. Neither appears to be true at the moment.

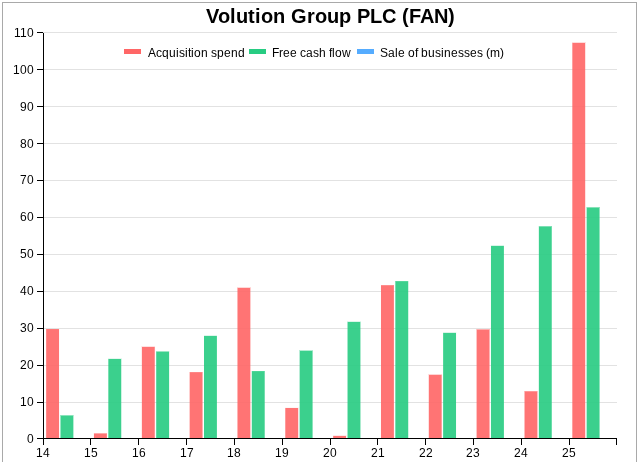

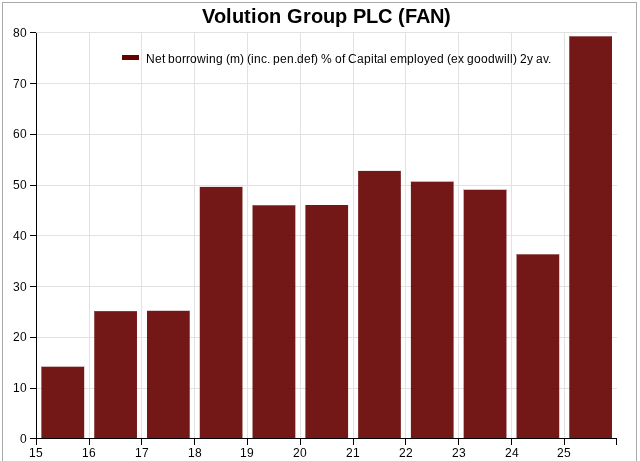

Volution [? Holdings ? Acquisitions – Borrowings]

Volution is another prosperous business. It makes ventilation systems for houses, mostly, but also commercial premises. It is the most acquisitive of this trio of companies that supply products for buildings.

In the year to July 2025, Volution has really given me something to think about, spending more than it earned in free cash flow for the first time since 2018:

No doubt the acquisition is a major contributor to the rise in Volution’s financial obligations as a proportion of the firms capital, which is now well outside my comfort zone:

The acquisition was Fantech, an Australian business. It completed last December.

Richard Beddard

Contact Richard Beddard by email: richard@beddard.net, web: beddard.net

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.