As gold has continued to perform well, Bruce looks at shares in consumer brands that have historically done well in inflationary times. Company results covered: RPI, GDWN and FUTR.

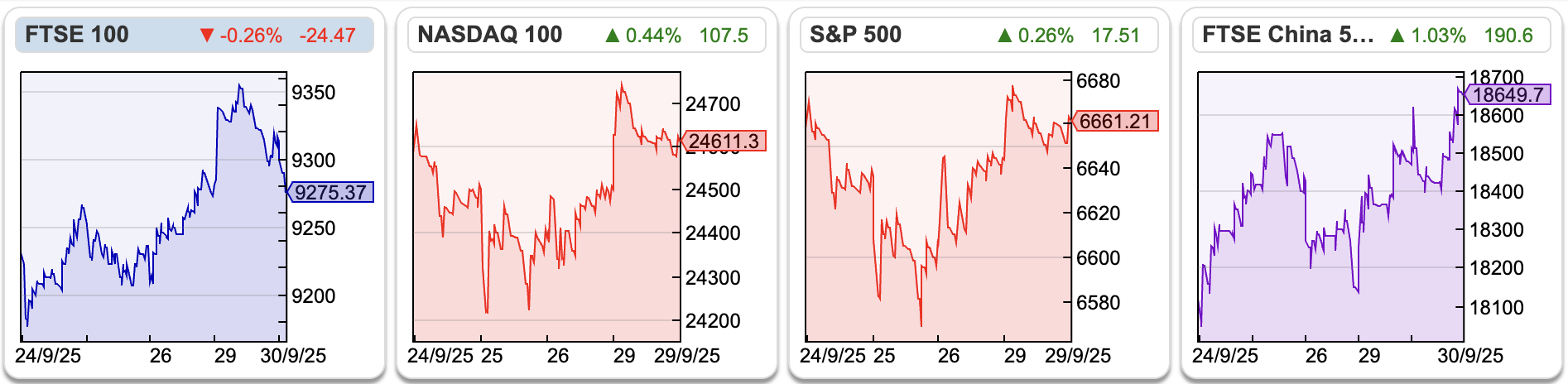

The FTSE 100 was down less than -0.5% to 9,275 over the last 5 trading days. In the US, both the Nasdaq100 and S&P500 were both down circa -0.5%. The FTSE China 50 was the best performing index over the last 5 days, up +3%.

US markets feel rather toppy at the moment, with Tether, the stable coin group, suggesting that they can raise $20bn money in a private funding round, valuing the company at close to $500bn. For comparison, Circle, it’s closest publicly traded rival has a market cap of $30bn. While a traditional bank like Barclays has a market cap of £50bn, but total assets of £1.5 trillion. I can imagine Tether might reach over a trillion of assets one day, (currently USDT has $ 170bn of assets), but even so, it is almost impossible justify a market cap around 10x bigger the Barclays.

At times like these, I enjoy listening to Mike Howell, at Crossborder Capital explaining what he thinks is going on. His basic thesis is that liquidity drives cycles and stockmarket returns. He thinks we’ve still got time, but should be prepared for the cycle to turn in the US in 2026. The US Government, via the Treasury has increasingly been funding its deficit by issuing large amounts of short-dated paper (bills). That, in turn, is effectively increases private-sector liquidity, a process he calls “Treasury QE” – but it’s likely to be be inflationary. He’s expecting problems to emerge in 2026.

That 2026 timing is driven by huge refinancing cliff. During the COVID crisis significant amounts of debt, both corporate and government borrowing was termed out to 5-6 year maturities, but that debt is all now coming due in 2026-2027 and will need to be refinanced at terms far less generous than during the pandemic. This time the crisis will likely be focused on government debt (perhaps Japanese, UK or France – he believes the US is the cleanest shirt in the dirty laundry basket) rather than mortgage backed securities, which was the problem in 2007 or TMT corporate debt in 2002.

His analysis likely explains the performance of gold, which is up +44% YTD to around $3,800 per ounce.

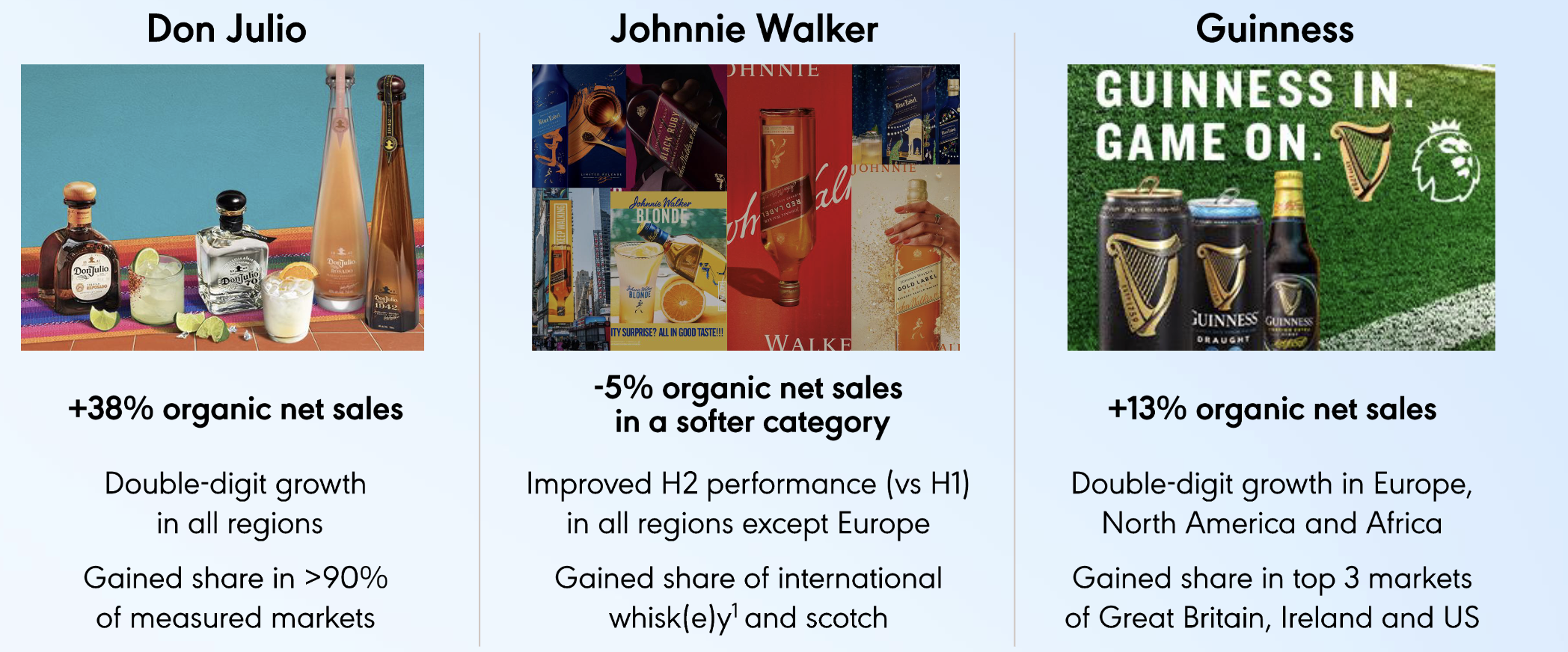

For my part, I agree with his thesis, but draw a different investment conclusion. Instead of gold I have been buying Diageo and BATS as inflation protection. Cigarettes and alcohol brands are normally able to raise prices in inflationary times, though that failed in 2022-3: both saw their share prices fall steeply in response to higher inflation as sales stalled and investors worried about both companies’ debt burden in a higher interest rate environment. So, I may be wrong, young people are drinking less and vaping has up-ended the business model of tobacco companies – but gold seems rather consensus at the moment. I reckon that Diageo brands are the ultimate “liquid assets”.

This week I look at Raspberry Pi, H1 June results, engineering firm Goodwin’s H1 Oct trading statement and media group’s Future’s pre-close FY Sept trading update.

Raspberry Pi H1 June

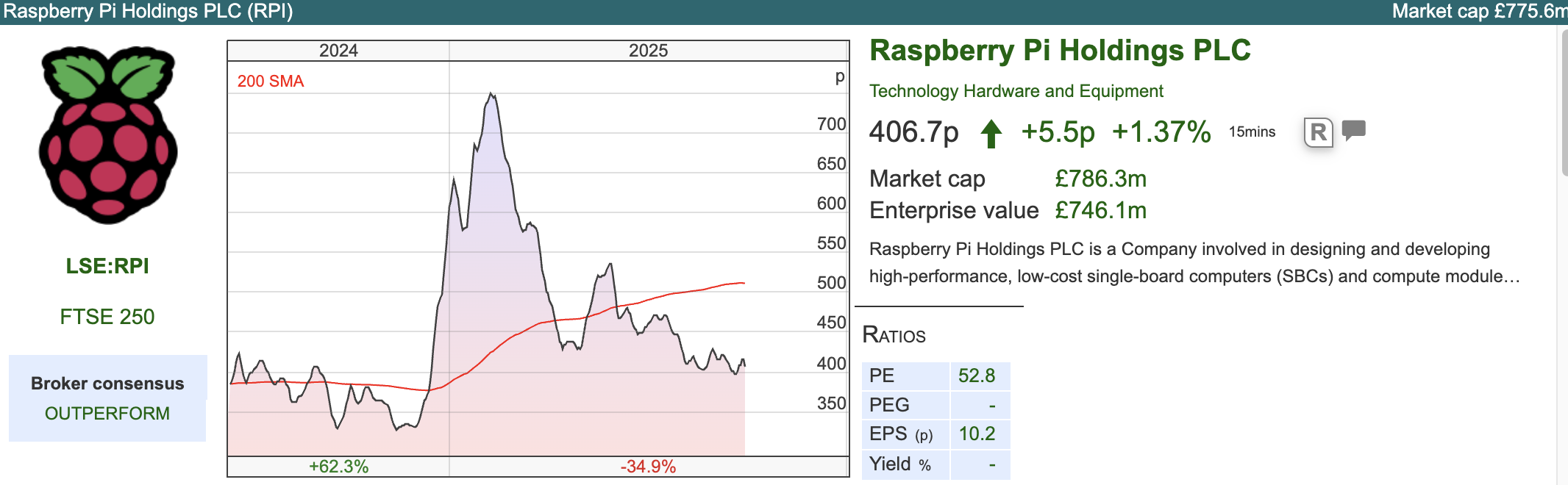

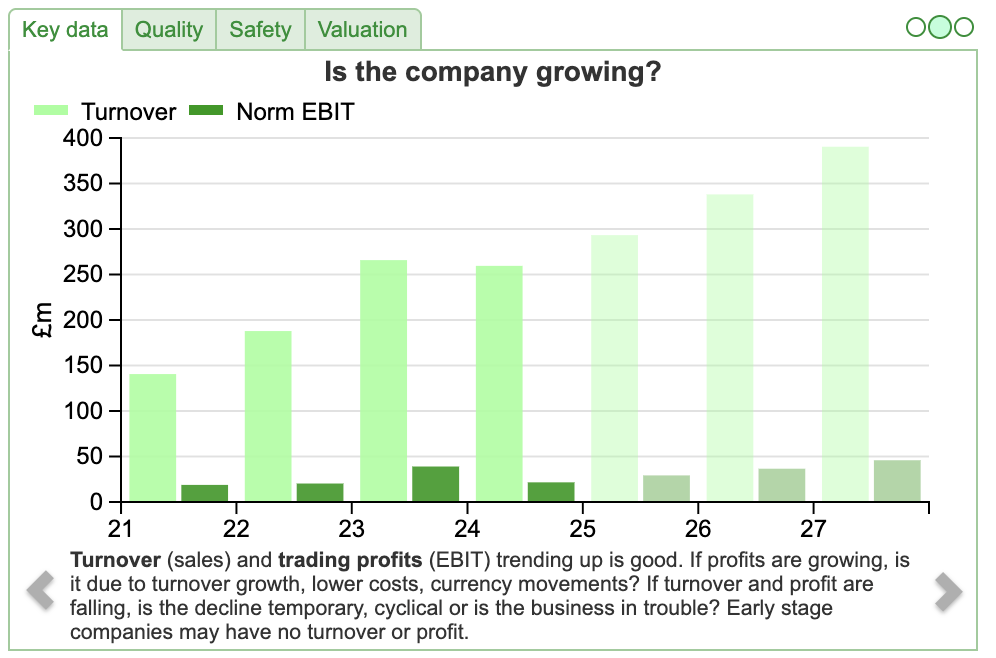

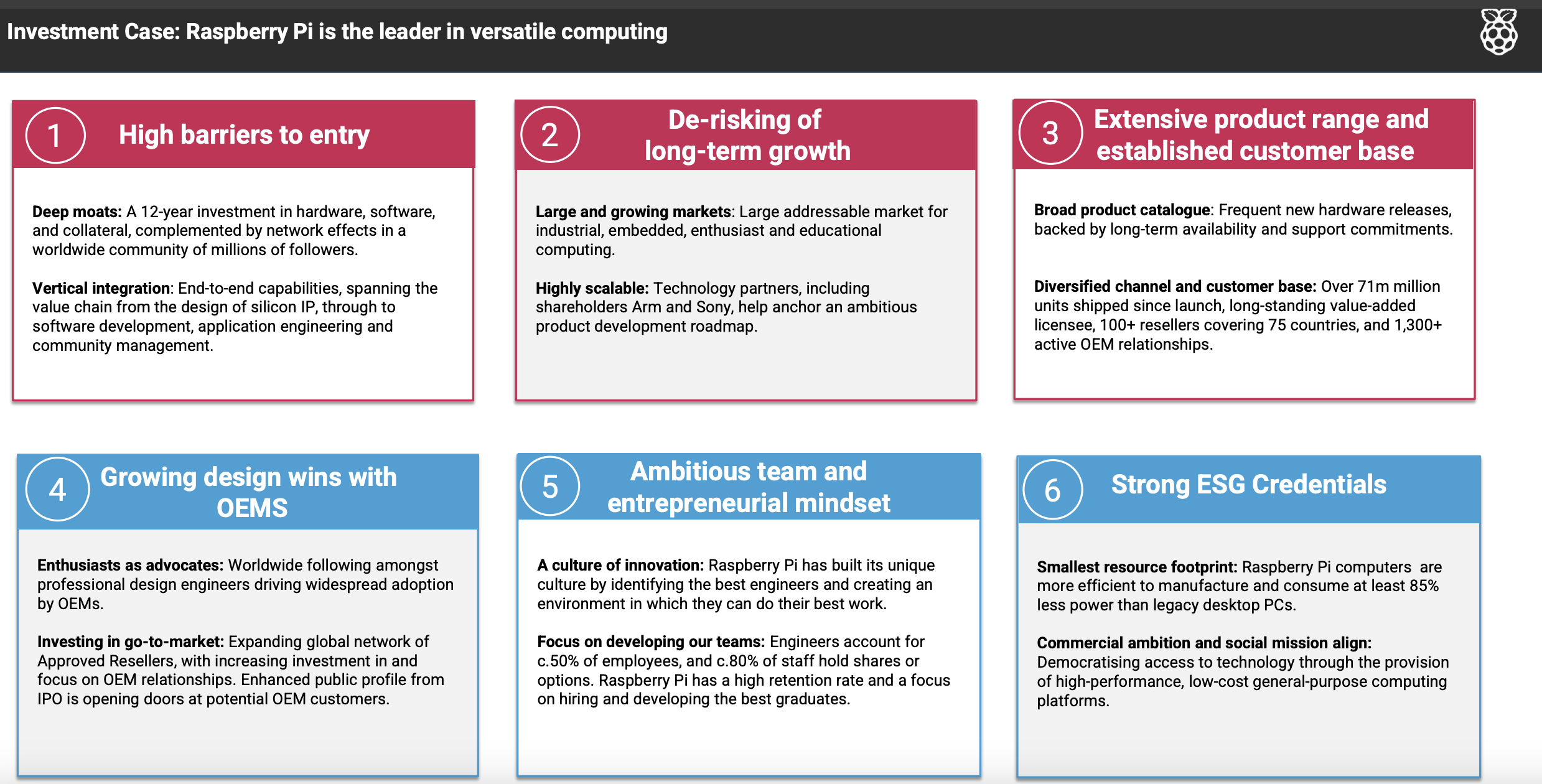

This low cost, Single Board Computer (SBC) company that IPO’ed at 280p halfway through last year, has announced H1 revenue down -6% to $136m. Statutory PBT fell -43% to $6m. The group still had $34m of net cash at the end of June, though that is down by -15% versus the previous 12 months.

Product: The ‘flagship model’ Raspberry Pi 5 with 8gb costs around £70, but that is the basic board. Customers pay extra for the whole kit, which includes keyboard, mouse, SD card, power supply and case. There’s also the Pico series, low-cost microcontroller boards, not full computers, which cost less than £15. Although the Pi is well known among hobbyists, who use it to learn to code, or connect up to other devices for a homemade “Internet of Things” IoT project, that accounts for less than 30% of revenue. Industrial and Embedded (I&E) is over 70% revenue, which is companies using the hardware as an alternative for high cost process control (for example, robotic arms, conveyor belts) or Industrial IoT (data collection, but also analysing data closer to the source). The Pi is also used in digital signage.

History: The group’s origin goes back to when Cambridge University was struggling to find enough high quality applicants for computer science courses. Many students wanted to study computer science, but didn’t have the basic knowledge because if you use a Windows computer to play games and send email, you never familiarise yourself with the low level programming. David Braben, of computer game group Frontier Developments, was a co-founder.

Hedge fund Lansdowne invested pre-IPO in 2021 at an implied valuation of $545m, then in 2023 Sony and Arm invested at similar valuation. In June 2024, the group raised £24m at the IPO by issuing 11m new shares, with selling shareholders receiving £131m from sales of existing shares. The Raspberry Pi Foundation is still the largest shareholder, with a 47% stake, followed by NY listed Arm, 8% and Lansdowne 6%.

Outlook: They say H2 2025 has started well, with H2 EBITDA ahead of last year, and higher volumes but similar product mix to H1. Profit expectations for FY Dec 2025F (Sharescope shows £25m, implying +33% growth) are unchanged. Looking ahead to FY Dec 2026F, they are encouraged by the demand environment.

Raspberry Pi 500+: In a separate RNS, a couple of days later, RPI announced the launch of the Raspberry Pi 500+, meant to serve as a desktop replacement for everyone still using Windows 10, which Microsoft no longer supports.

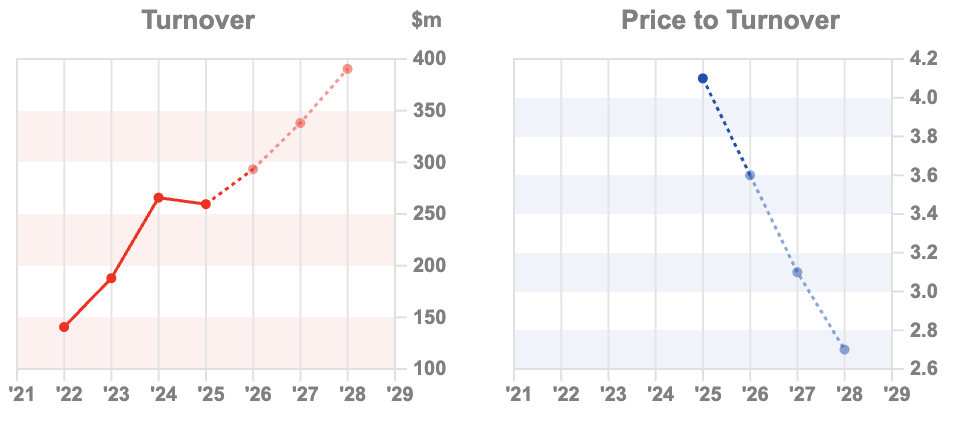

Valuation: The shares are trading on 40x PER Dec 2026F, or over 20x EV/EBITDA the same year. This is another example of a stock that has de-rated in terms of price/revenue, suggesting to me that when management listed, they chose a price that was too high. Great for selling shareholders, but disappointing for any investors who backed it at the IPO. Oxford Nanonpore has a similar graph.

Opinion: The decline in revenues and profits in this half were well flagged, caused by reduced royalty payments with lower component sales following destocking of customer inventories. I tend to wait at least two years before investing in recent IPOs, so not for me, particularly on such a rich valuation. But interesting company, I like the innovative and lateral thinking with the launch of Pi 500+. I will continue to follow and revisit the investment case next year.

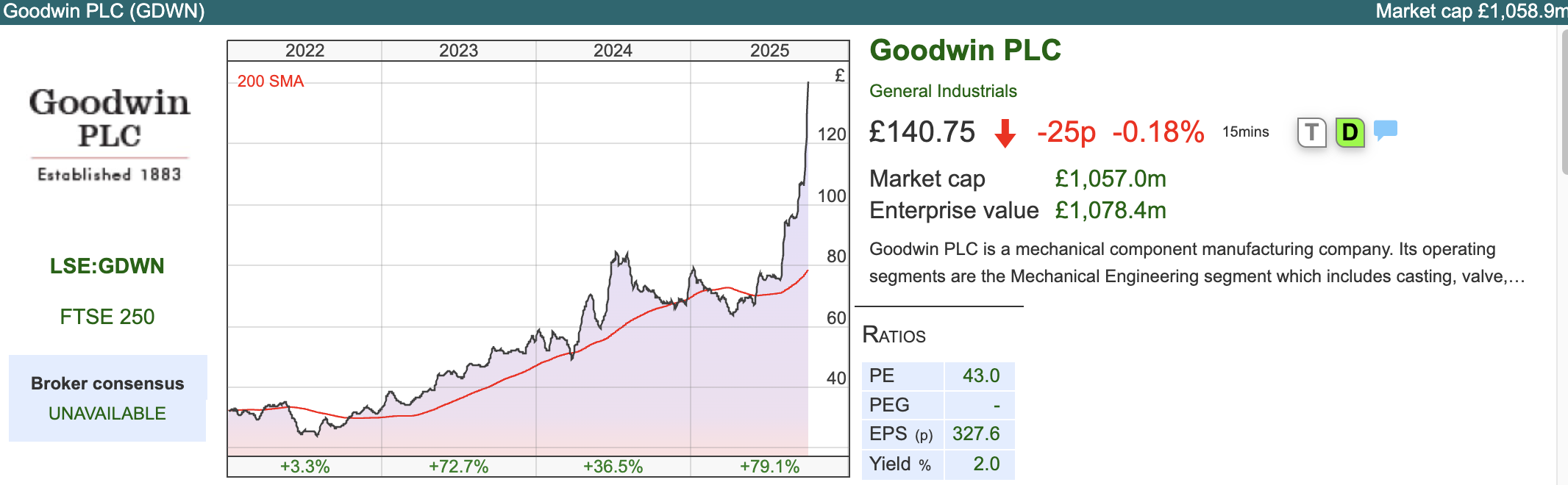

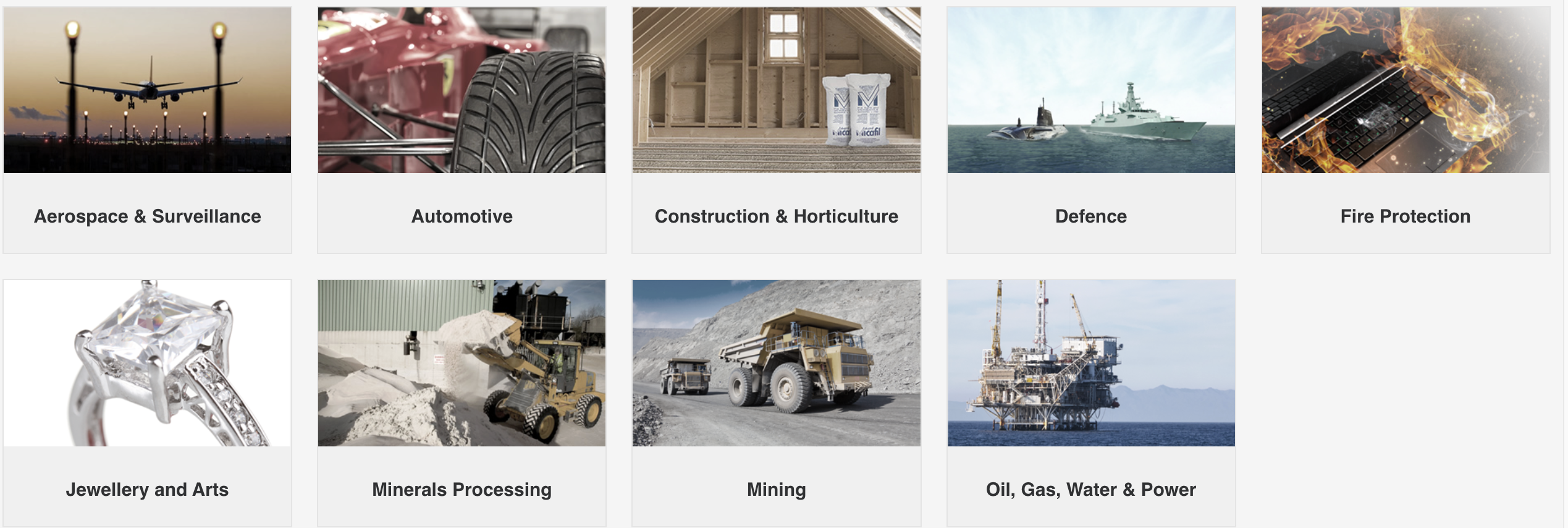

Goodwin H1 Oct Trading Update

This family-owned mechanical engineering and steel castings group has many fans, including former fund manager, Simon Young, who has written up the stock in more detail here. He points out Goodwin is 8th best performer in the FTSE All Share over the past 20 years, returning 3100%, which is particularly impressive given that most investors shun heavy industrial groups due to: cyclical demand, capital intensity, and working capital drag. The shares did struggle between 2014-18, but since then are up 7x since then.

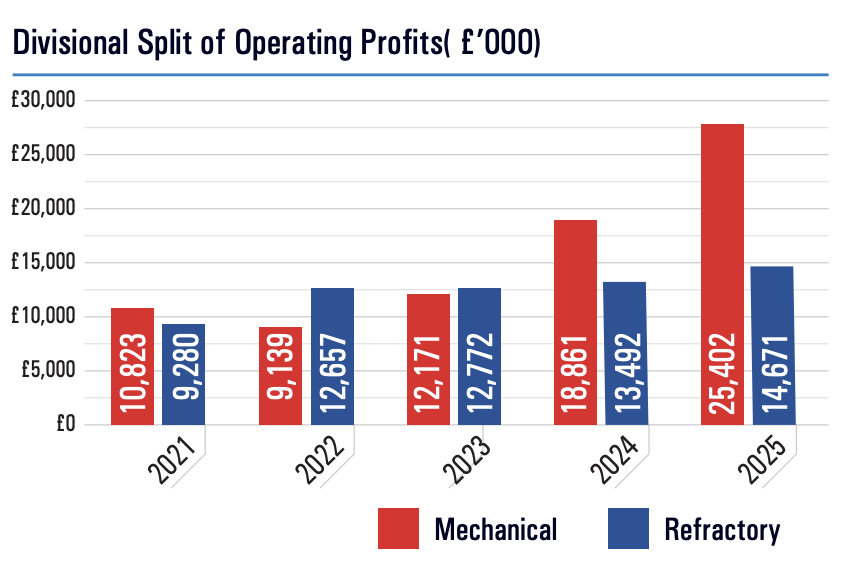

Management put out an RNS just before their H1 Oct saying that their Refractory Engineering Division, which was 37% of group profits at the FY Apr 2025, is, “significantly ahead” of trading in the same period last year (£32m revenue, £6.7m profits in H1 Oct 2024). The Mechanical Engineering Division, 63% of group profits last year which does high precision casting used in defence and nuclear industries, is also enjoying a tail wind from heavy duty submersible pumps for the mining industry.

In addition, Goodwin Steel Castings has entered into a collaboration with Northrop Grumman, the $83bn market cap US defence giant. NOC has been a long standing customer, but they’ve now formalised their relationship with a Memorandum of Understanding (MoU) combined with an initial $16m order.

In addition, Goodwin Steel Castings has entered into a collaboration with Northrop Grumman, the $83bn market cap US defence giant. NOC has been a long standing customer, but they’ve now formalised their relationship with a Memorandum of Understanding (MoU) combined with an initial $16m order.

Valuation: There are no forecasts, but assuming +15% EPS growth this year would imply a PER of 33x.

Opinion: Worth noting that EPS growth last FY was +55%, so you could extrapolate that to give you £5 of EPS, though straight line extrapolation is a likely road to disappointment. I’m particularly impressed with GDWN’s uncorrelated returns: the shares underperformed in 2020 and 2021, when we saw the liquidity fuelled vaccine rally, but since then 5 bagged at a time when some of my former winners like Impax AM, Diageo, Creightons or Fevertree have fallen between 60-90%. A few years ago, various people had suggested that all the money printing that went on during the pandemic would be inflationary, but no one was suggesting that a metal bashing company like Goodwin’s share price would benefit from rising energy costs and higher interest rates. Well done to Rhomboid who has for years been running a concentrated portfolio of GAW, GDWN and a couple of other stocks.

Future FY Sept Trading Update

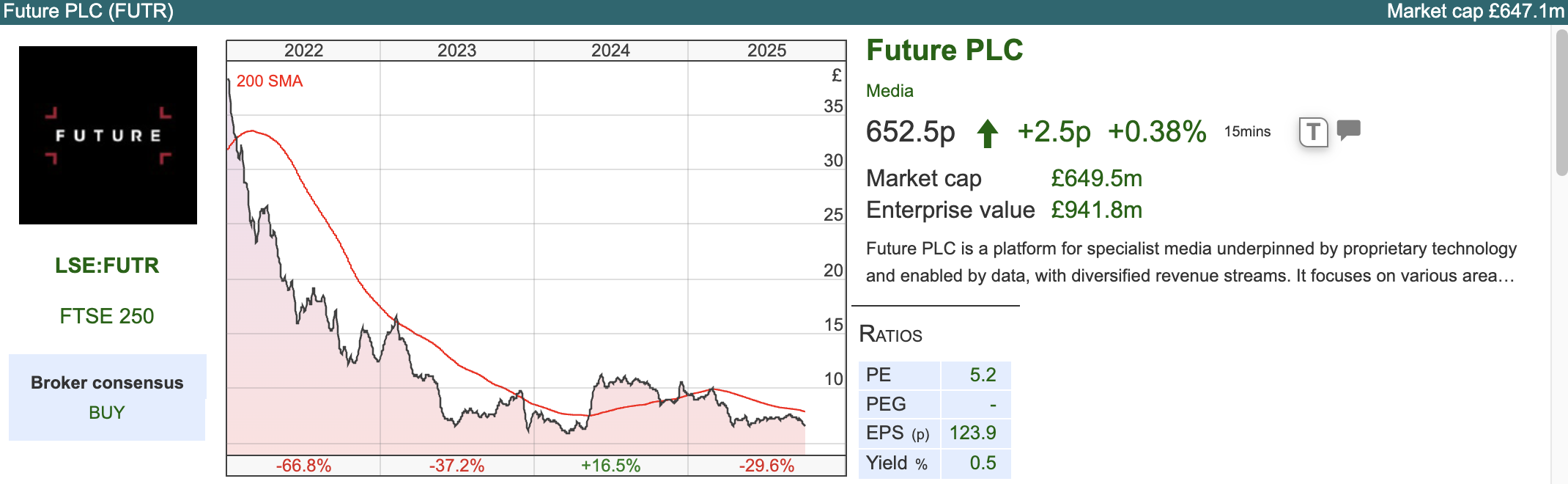

Normally when a company trading on 5x PER announces an “in line” trading update, the share price spikes higher, as expectations are low, so “in line” is taken positively. However, this media company, which publishes Country Life, Marie Claire, MoneyWeek and online review sites Techradar and Tom’s Guide, plus price comparison website GoCompare is at risk of people asking LLMs or AI Agents to help them shop around.

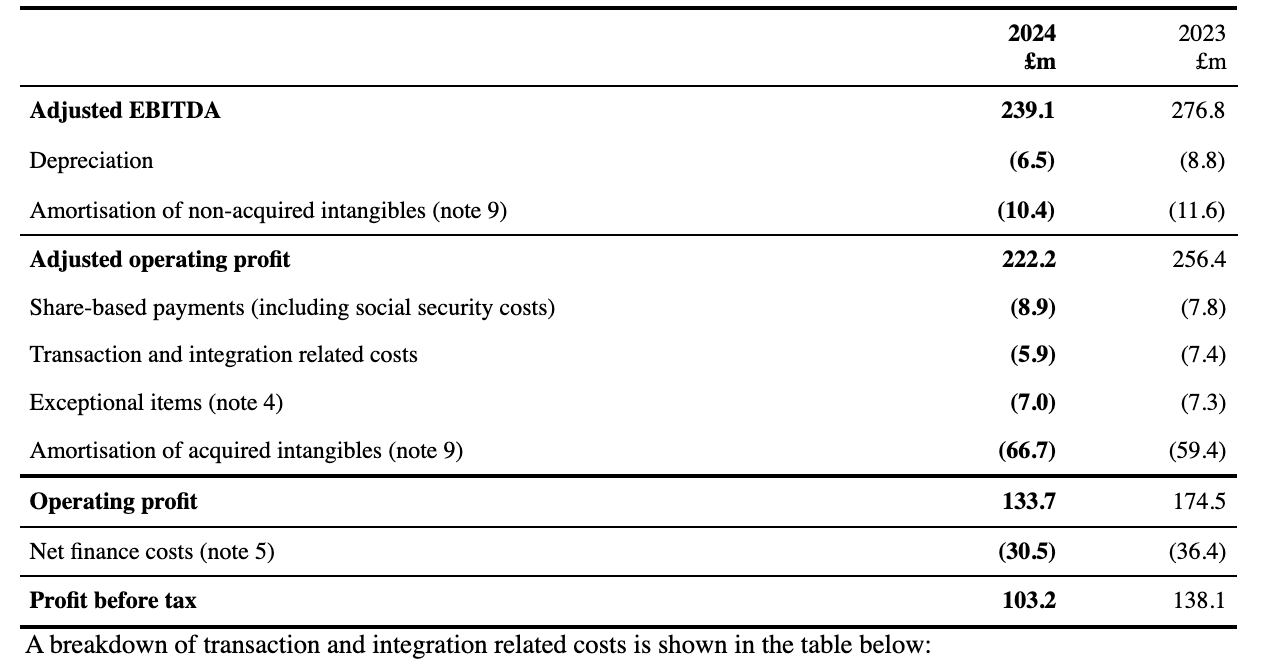

Management said they are on track to achieve Revenue of £743m, implying a -6% y-o-y decline and adj operating PBT of £205m, implying a -6% y-o-y. Note that there tend to be big adjustments between the management’s preferred number and the statutory PBT which was £103m last year, £119m below the adjusted operating figure FY Sept 2024.

They are struggling with a decline of programmatic (ie website embedded) advertising and affiliate revenue declined in H2, but magazine subscription revenue remains resilient. Cash generation is good.

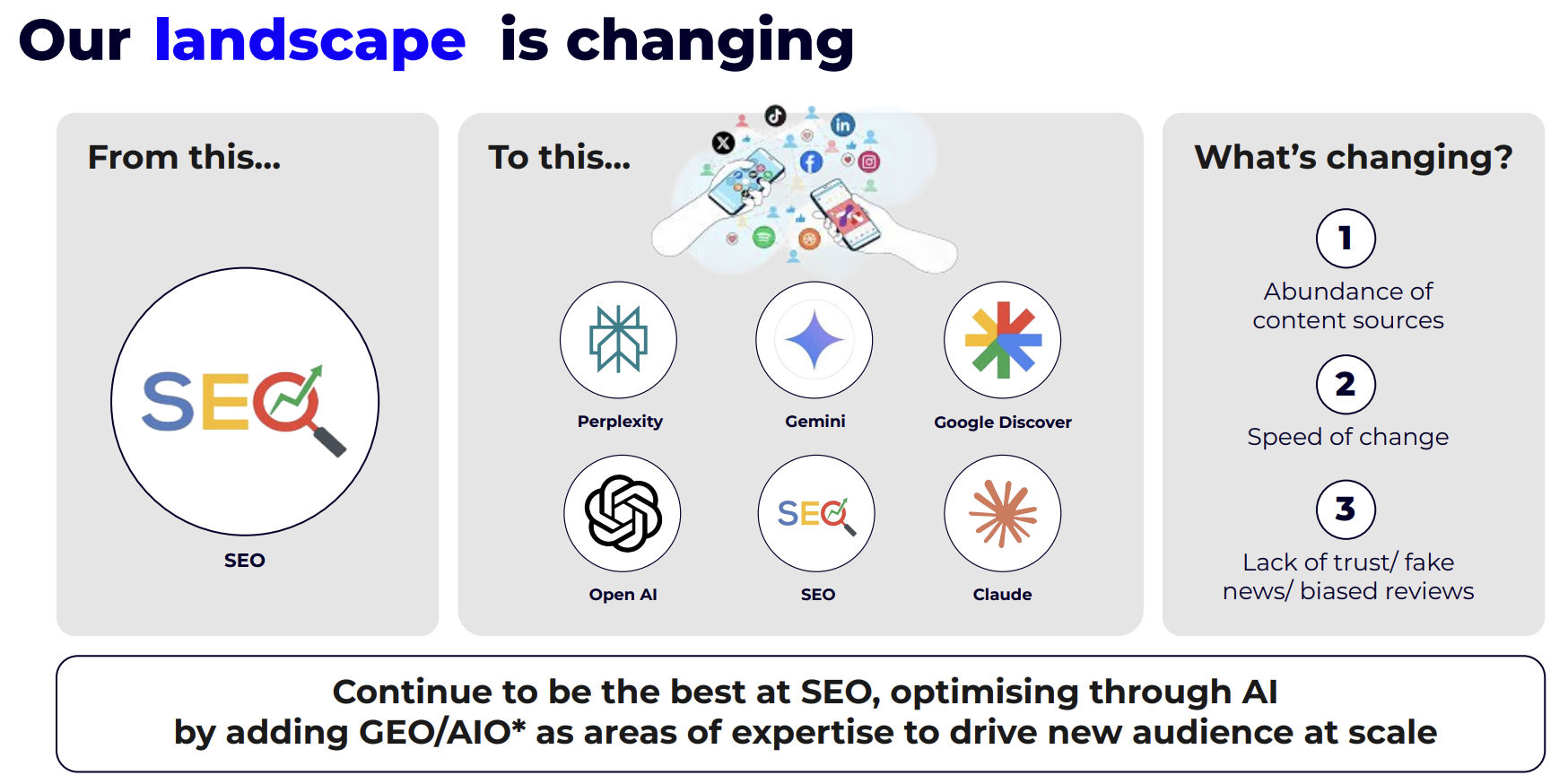

Analyst call: Management admitted on their analyst call that Large Language Models (LLMs) and AI Agents are changing the landscape of Search Engine Optimisation (SEO) and affiliate marketing. LLMs are able to summarise content and answer questions without users needing to click on links, which is how Future’s businesses have traditionally been rewarded. I discussed this trend with a friend in the pub, who suggested the Trustpilot may turn out to be the winner, because the LLMs consider the reviews on TRST site more valuable than Future’s content. This is a landscape that can change very quickly though.

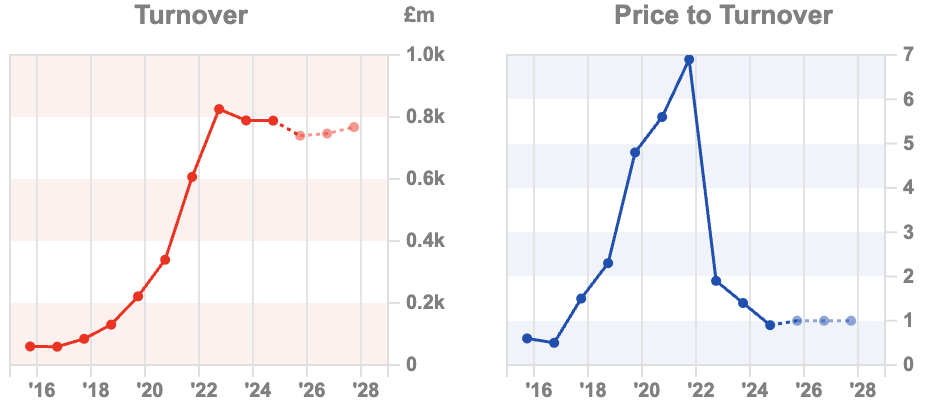

Valuation: The shares are trading on less than 5x PER Sept 2026F, and 3.5x EV/EBITDA the same year. That’s clearly a distressed valuation, but potentially a value trap if revenue continues to decline. The chart below shows that revenue was growing strongly as the company made acquisitions, but the risk is that we see an accelerated decline.

Opinion: I would avoid. It’s possible that the initiatives management presented on Friday afternoon do bear fruit, and FUTR can respond to the LLM threat. I try to avoid companies just because they appear cheap on valuation ratios, as FUTR does, because more often than not the share price is signalling that problems are deep seated. Could be an interesting turnaround story at some stage, but need to see evidence that strategic response is working, rather than just management speak and slides.

Opinion: I would avoid. It’s possible that the initiatives management presented on Friday afternoon do bear fruit, and FUTR can respond to the LLM threat. I try to avoid companies just because they appear cheap on valuation ratios, as FUTR does, because more often than not the share price is signalling that problems are deep seated. Could be an interesting turnaround story at some stage, but need to see evidence that strategic response is working, rather than just management speak and slides.

Bruce Packard

@bruce_packard

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Bi-Weekly Market Commentary | 01/10/2025 | RPI, GDWN and FUTR | The Liquidity Cycle and Liquid Assets

As gold has continued to perform well, Bruce looks at shares in consumer brands that have historically done well in inflationary times. Company results covered: RPI, GDWN and FUTR.

The FTSE 100 was down less than -0.5% to 9,275 over the last 5 trading days. In the US, both the Nasdaq100 and S&P500 were both down circa -0.5%. The FTSE China 50 was the best performing index over the last 5 days, up +3%.

US markets feel rather toppy at the moment, with Tether, the stable coin group, suggesting that they can raise $20bn money in a private funding round, valuing the company at close to $500bn. For comparison, Circle, it’s closest publicly traded rival has a market cap of $30bn. While a traditional bank like Barclays has a market cap of £50bn, but total assets of £1.5 trillion. I can imagine Tether might reach over a trillion of assets one day, (currently USDT has $ 170bn of assets), but even so, it is almost impossible justify a market cap around 10x bigger the Barclays.

At times like these, I enjoy listening to Mike Howell, at Crossborder Capital explaining what he thinks is going on. His basic thesis is that liquidity drives cycles and stockmarket returns. He thinks we’ve still got time, but should be prepared for the cycle to turn in the US in 2026. The US Government, via the Treasury has increasingly been funding its deficit by issuing large amounts of short-dated paper (bills). That, in turn, is effectively increases private-sector liquidity, a process he calls “Treasury QE” – but it’s likely to be be inflationary. He’s expecting problems to emerge in 2026.

That 2026 timing is driven by huge refinancing cliff. During the COVID crisis significant amounts of debt, both corporate and government borrowing was termed out to 5-6 year maturities, but that debt is all now coming due in 2026-2027 and will need to be refinanced at terms far less generous than during the pandemic. This time the crisis will likely be focused on government debt (perhaps Japanese, UK or France – he believes the US is the cleanest shirt in the dirty laundry basket) rather than mortgage backed securities, which was the problem in 2007 or TMT corporate debt in 2002.

His analysis likely explains the performance of gold, which is up +44% YTD to around $3,800 per ounce.

For my part, I agree with his thesis, but draw a different investment conclusion. Instead of gold I have been buying Diageo and BATS as inflation protection. Cigarettes and alcohol brands are normally able to raise prices in inflationary times, though that failed in 2022-3: both saw their share prices fall steeply in response to higher inflation as sales stalled and investors worried about both companies’ debt burden in a higher interest rate environment. So, I may be wrong, young people are drinking less and vaping has up-ended the business model of tobacco companies – but gold seems rather consensus at the moment. I reckon that Diageo brands are the ultimate “liquid assets”.

This week I look at Raspberry Pi, H1 June results, engineering firm Goodwin’s H1 Oct trading statement and media group’s Future’s pre-close FY Sept trading update.

Raspberry Pi H1 June

This low cost, Single Board Computer (SBC) company that IPO’ed at 280p halfway through last year, has announced H1 revenue down -6% to $136m. Statutory PBT fell -43% to $6m. The group still had $34m of net cash at the end of June, though that is down by -15% versus the previous 12 months.

Product: The ‘flagship model’ Raspberry Pi 5 with 8gb costs around £70, but that is the basic board. Customers pay extra for the whole kit, which includes keyboard, mouse, SD card, power supply and case. There’s also the Pico series, low-cost microcontroller boards, not full computers, which cost less than £15. Although the Pi is well known among hobbyists, who use it to learn to code, or connect up to other devices for a homemade “Internet of Things” IoT project, that accounts for less than 30% of revenue. Industrial and Embedded (I&E) is over 70% revenue, which is companies using the hardware as an alternative for high cost process control (for example, robotic arms, conveyor belts) or Industrial IoT (data collection, but also analysing data closer to the source). The Pi is also used in digital signage.

History: The group’s origin goes back to when Cambridge University was struggling to find enough high quality applicants for computer science courses. Many students wanted to study computer science, but didn’t have the basic knowledge because if you use a Windows computer to play games and send email, you never familiarise yourself with the low level programming. David Braben, of computer game group Frontier Developments, was a co-founder.

Hedge fund Lansdowne invested pre-IPO in 2021 at an implied valuation of $545m, then in 2023 Sony and Arm invested at similar valuation. In June 2024, the group raised £24m at the IPO by issuing 11m new shares, with selling shareholders receiving £131m from sales of existing shares. The Raspberry Pi Foundation is still the largest shareholder, with a 47% stake, followed by NY listed Arm, 8% and Lansdowne 6%.

Outlook: They say H2 2025 has started well, with H2 EBITDA ahead of last year, and higher volumes but similar product mix to H1. Profit expectations for FY Dec 2025F (Sharescope shows £25m, implying +33% growth) are unchanged. Looking ahead to FY Dec 2026F, they are encouraged by the demand environment.

Raspberry Pi 500+: In a separate RNS, a couple of days later, RPI announced the launch of the Raspberry Pi 500+, meant to serve as a desktop replacement for everyone still using Windows 10, which Microsoft no longer supports.

Valuation: The shares are trading on 40x PER Dec 2026F, or over 20x EV/EBITDA the same year. This is another example of a stock that has de-rated in terms of price/revenue, suggesting to me that when management listed, they chose a price that was too high. Great for selling shareholders, but disappointing for any investors who backed it at the IPO. Oxford Nanonpore has a similar graph.

Opinion: The decline in revenues and profits in this half were well flagged, caused by reduced royalty payments with lower component sales following destocking of customer inventories. I tend to wait at least two years before investing in recent IPOs, so not for me, particularly on such a rich valuation. But interesting company, I like the innovative and lateral thinking with the launch of Pi 500+. I will continue to follow and revisit the investment case next year.

Goodwin H1 Oct Trading Update

This family-owned mechanical engineering and steel castings group has many fans, including former fund manager, Simon Young, who has written up the stock in more detail here. He points out Goodwin is 8th best performer in the FTSE All Share over the past 20 years, returning 3100%, which is particularly impressive given that most investors shun heavy industrial groups due to: cyclical demand, capital intensity, and working capital drag. The shares did struggle between 2014-18, but since then are up 7x since then.

Management put out an RNS just before their H1 Oct saying that their Refractory Engineering Division, which was 37% of group profits at the FY Apr 2025, is, “significantly ahead” of trading in the same period last year (£32m revenue, £6.7m profits in H1 Oct 2024). The Mechanical Engineering Division, 63% of group profits last year which does high precision casting used in defence and nuclear industries, is also enjoying a tail wind from heavy duty submersible pumps for the mining industry.

Valuation: There are no forecasts, but assuming +15% EPS growth this year would imply a PER of 33x.

Opinion: Worth noting that EPS growth last FY was +55%, so you could extrapolate that to give you £5 of EPS, though straight line extrapolation is a likely road to disappointment. I’m particularly impressed with GDWN’s uncorrelated returns: the shares underperformed in 2020 and 2021, when we saw the liquidity fuelled vaccine rally, but since then 5 bagged at a time when some of my former winners like Impax AM, Diageo, Creightons or Fevertree have fallen between 60-90%. A few years ago, various people had suggested that all the money printing that went on during the pandemic would be inflationary, but no one was suggesting that a metal bashing company like Goodwin’s share price would benefit from rising energy costs and higher interest rates. Well done to Rhomboid who has for years been running a concentrated portfolio of GAW, GDWN and a couple of other stocks.

Future FY Sept Trading Update

Normally when a company trading on 5x PER announces an “in line” trading update, the share price spikes higher, as expectations are low, so “in line” is taken positively. However, this media company, which publishes Country Life, Marie Claire, MoneyWeek and online review sites Techradar and Tom’s Guide, plus price comparison website GoCompare is at risk of people asking LLMs or AI Agents to help them shop around.

Management said they are on track to achieve Revenue of £743m, implying a -6% y-o-y decline and adj operating PBT of £205m, implying a -6% y-o-y. Note that there tend to be big adjustments between the management’s preferred number and the statutory PBT which was £103m last year, £119m below the adjusted operating figure FY Sept 2024.

They are struggling with a decline of programmatic (ie website embedded) advertising and affiliate revenue declined in H2, but magazine subscription revenue remains resilient. Cash generation is good.

Analyst call: Management admitted on their analyst call that Large Language Models (LLMs) and AI Agents are changing the landscape of Search Engine Optimisation (SEO) and affiliate marketing. LLMs are able to summarise content and answer questions without users needing to click on links, which is how Future’s businesses have traditionally been rewarded. I discussed this trend with a friend in the pub, who suggested the Trustpilot may turn out to be the winner, because the LLMs consider the reviews on TRST site more valuable than Future’s content. This is a landscape that can change very quickly though.

Valuation: The shares are trading on less than 5x PER Sept 2026F, and 3.5x EV/EBITDA the same year. That’s clearly a distressed valuation, but potentially a value trap if revenue continues to decline. The chart below shows that revenue was growing strongly as the company made acquisitions, but the risk is that we see an accelerated decline.

Bruce Packard

@bruce_packard

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.