As directors go on holiday and annual reports dry up, only two companies make it through the 5 Strikes process. One is notable for how much it has grown, the other for how much it has shrunk. Richard takes a closer look at near-miss Cake Box’s annual report, published in August.

The height of summer has just passed. Few companies are publishing annual reports, and even fewer good ones are. Three companies have published since my last update and passed my minimum quality filter.

|

Name |

TIDM |

Prev AR |

Strikes |

# Strikes |

|---|---|---|---|---|

|

Gateley |

GTLY |

31/8/25 |

? Holdings ? CROCI – Debt – ROCE – Shares |

4 |

|

PHSC |

PHSC |

21/8/25 |

– Growth – ROCE |

2 |

|

Cohort |

CHRT |

20/8/25 |

? Acquisitions |

0 |

|

04/09/2025 |

||||

Summer drought

The finances of Gateley, a law firm have deteriorated this year and it no longer achieves less than three strikes. My investigation into the sector nearly two years ago did not fill me with joy. Keystone Law remains the only legal services firm that interests me. Although it’s attracting copycats, Keystone’s dispersed business model is very different to the norm and so is its financial performance.

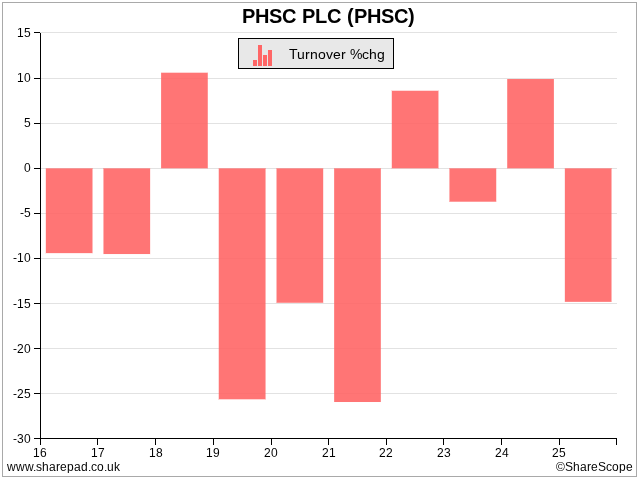

PHSC (- Growth – ROCE) qualifies technically, having scored only two strikes. However it made a loss in 2025 and even more tellingly it has been contracting (i.e. turnover has been falling) for a decade.

PHSC is a health and safety consultancy and multi-purpose acronym. It was founded as Personnel Health & Safety Consultants in 1990, grew initially by acquisition and has contracted for many years organically. In 2025 its mantra is “Professional Help at Sensible Cost”, and it turned over just £3.2 million.

The company has contracted in most years since the last time it spent money on acquisitions

Peak turnover as a listed firm was achieved in 2015, according to ShareScope. It was just £7.7 million.

PHSC’s acting chief executive is one of its co-founders. She owns more than 20% of the shares. The previous chief executive, who stepped down in January, was the other co-founder. He owns a near 20% stake.

Together they control the company, and although the annual report is quite open about the challenges PHSC faces, since the company hasn’t grown or earned profit reliably and the shares are incredibly illiquid, I won’t be taking more interest in it.

I wonder how it justifies the cost and benefits of an AIM listing.

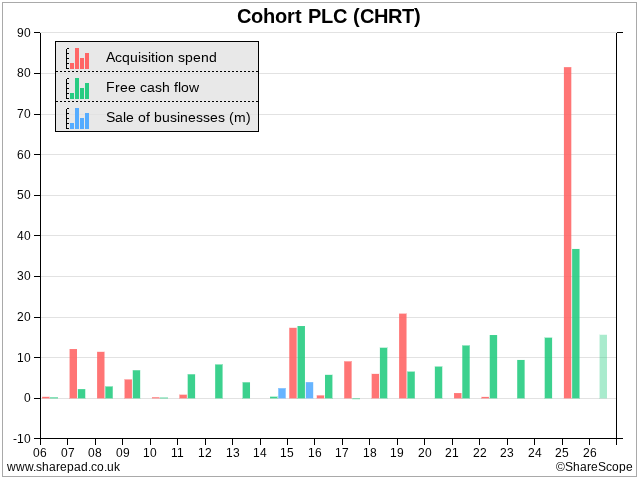

Cohort (? Acquisitions), a collection of defence technology businesses, most definitely passes 5 Strikes. It has spent less over the long-term on acquisitions than it has earned in free cash flow, but its most recent acquisition is a big one, hence the question mark against acquisition spend.

ShareScope tells us Cohort spent £81.6 million on acquisitions in 2025. The annual report tells us almost all of it went on EM Solutions, an Australian manufacturer of satellite communications terminals. Free cash flow in the same year was £36.8 million, which was significantly higher than normal. To my mind, acquisitions like EM Systems are big, and potentially risky.

Cohort’s acquisition spending in 2025 was not just high compared to free cash flow, it was high compared to previous years.

The only reason I haven’t written more about Cohort here, is that it is a constituent of interactive investor’s model Share Sleuth portfolio, so I will be publishing my verdict on the share there, very shortly.

Since I track Share Sleuth’s performance in ShareScope, I can show you my virtual trades:

Cohort has been one of my better investments (it’s in my SIPP too). However, an ebullient share price, probably in response to predictions of higher defence spending, encouraged me to take profit in 2024. The acquisition of EM Systems informed my decision to take more in July this year.

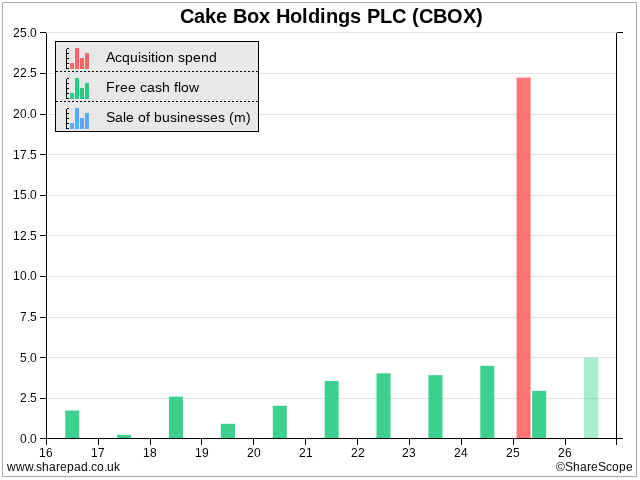

A dearth of new ideas, leads me back to cake shop franchise Cake Box, a company that fails 5 Strikes because it floated less than eight years ago.

Cake Box (provisional) [? Acquisitions]

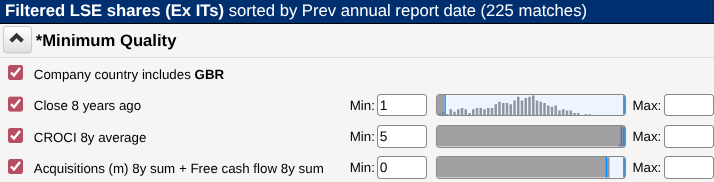

All criteria in the 5 Strikes formula require that a firm has been listed for at least eight years.

A reminder: The Minimum Quality Filter

It is notable to me that so few companies pass the Minimum Quality filter. There are 1,199 shares listed on the London Stock Exchange (excluding investment trusts), but weed out those that have failed to earn 5% Cash Return on Capital Invested over the last eight years and spent more on acquisitions than they have earned in free cashflow, and we get down to a list of 225.

Over a reasonably long period then, less than 20% of the stockmarket has generated half-decent cash flows and not spent it all (or more) on acquisitions. The Minimum Quality filter doesn’t seem like a high bar, but it is.

Cake Box fails the filter because it floated seven years ago, in June 2018, a near miss. While it made a big acquisition in 2025, spending £23 million compared to free cash flow of just £3 million, I might be able to forgive it because of its previous good behaviour. Over the seven years since it floated it has earned £22 million in free cash flow, and it has not previously spent any of it on acquisitions.

Like Cohort, Cake Box made a big acquisition in 2025, unlike Cohort, it had not spent any money on acquisitions previously.

Cake Box borrowed to fund the investment, but this did not take it over my 25% debt to capital threshold, and it also increased the share count, but only modestly. The acquisition was mostly self-funded, and if nothing bad happens, Cake Box should be a 5 Strikes pass next year.

I investigated Cake Box’s history as a listed firm in April (see The Great Cake Bubble of 2021) and though the business has had its thrills and spills, I think they are explicable. It is unique on our High Streets because of its scale (251 shops in March) and egg-free niche, which is particularly appealing to people of South Asian heritage. The acquisition was Ambala, which makes Asian sweets. These are very tasty, although only time will tell whether the purchase price was.

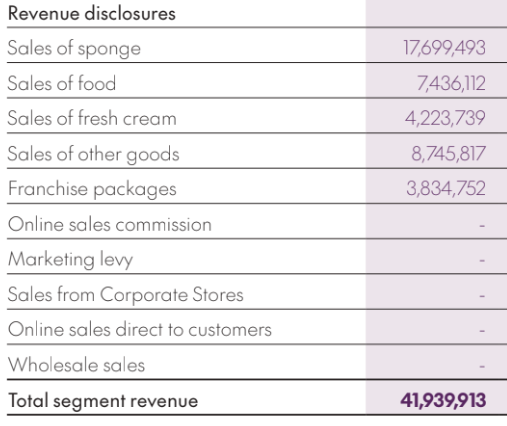

Last month, Cake Box published its annual report. I used it as an opportunity to learn more about the cake franchise. Franchises must satisfy two customers, the end customer, and the people they actually sell stuff too, the franchisees. This is what the franchise sells its franchisees:

Cake Box is mostly a sponge distributor according to its segmental report for the year to March 2025

By revenue, Cake Box makes most of its money distributing sponge, cream and other foods, ingredients, in other words, to franchisees. It does this through four national distribution centres.

Franchise packages relate to fitting out stores and training franchisees and their staff. New franchises receive fourteen days of training. They also receive regular audits and visits. It would be good to know how much profit the company makes from this small revenue stream, because some of it is one-off in nature – requiring the company to add new franchisees to earn it.

Contributions to the company’s national marketing fund, for promoting the brand and its website, also fall into the Franchise Packages category – although the company operates the fund on a break-even basis.

The Marketing Levy was separately disclosed in previous years, which is why the line is blank in this year’s segmental report.

The bottom three revenue sources relate to Ambala, acquired immediately before the financial year-end in March. Next year’s annual report will be our first chance to have a proper look at its numbers.

Richard Beddard

Contact Richard Beddard by email: richard@beddard.net, web: beddard.net

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.