Looking for companies with real growth potential? We’ve created this Growth Stock Screening Guide to go with our off-the-shelf Growth Screen to help you learn how to spot them. It’s designed to show you the core signals we believe matter to filter for scalable, sustainable growth.

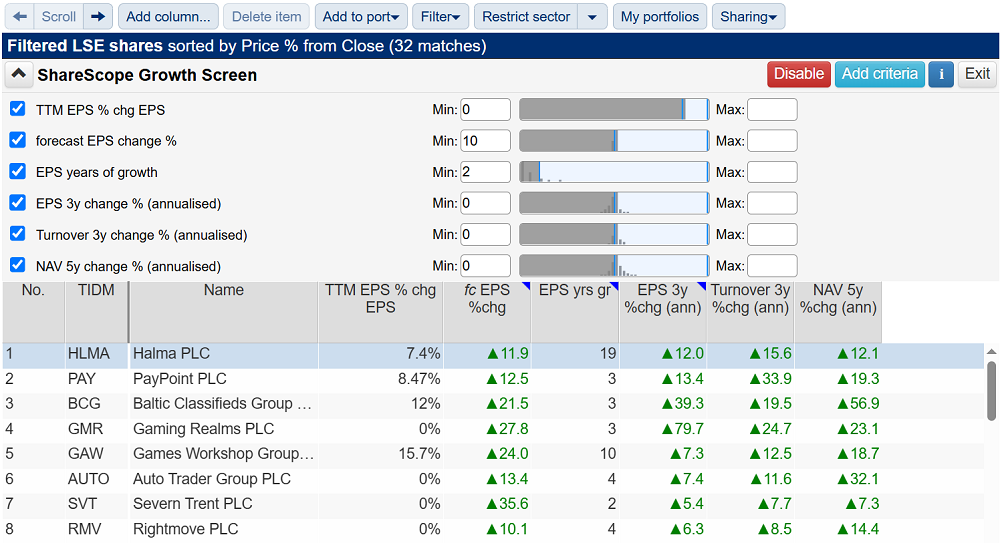

ShareScope subscribers can apply this screen at the click of a button on the home page in ShareScope – click on the “house” icon near top left of program and then scroll down the home page to the Popular Stock Screen section.

Use it as a starting point: explore the logic, dig into the data, and then make the screen your own.

What Is a Growth Stock?

A growth stock is a company with expanding earnings, strong revenue performance, and increasing value over time. These businesses reinvest profits to scale, making them attractive to investors seeking long-term capital appreciation.

Why we chose these criteria

1. EPS Growth – Proven and Predicted

- Trailing 12-Month EPS Change vs Standard EPS > 0%

This compares the most recent 12 months of earnings per share (EPS) to the company’s standard or baseline EPS. It highlights whether recent earnings are accelerating, signalling momentum that’s grounded in actual results – not just forecasts.

Jargon Lite Version: The company is improving profitability in the short term, a good sign it’s doing something right operationally.

- Forecast EPS Change > 10%

Analyst projections signal continued earnings expansion. A solid forecast provides forward-looking confidence.

Jargon Lite Version: Future profits are expected to rise more than 10%, making the stock more valuable over time.

- EPS Years of Growth > 2

Sustained earnings growth over multiple years suggests reliable performance—not just a one-off spike.

Jargon Lite Version: The company has a track record of sustained profit growth over 2 or more years.

- EPS 3-Year Change (Annualised) > 0%

Smooths out short-term volatility and highlights consistent upward trends.

Jargon Lite Version: Over a 3-year horizon, profits are reliably trending upward.

2. Revenue Momentum

- Turnover 3-Year Change (Annualised) > 0%

Sales growth is a key indicator of market demand and business scalability. Consistent revenue expansion supports profit growth.

Jargon Lite Version: Customers are spending more with the company each year over the last 3 years.

3. Value Creation

- Net Asset Value 5-Year Change (Annualised) > 0%

Rising NAV shows the company is building long-term shareholder value through reinvestment or asset accumulation.

Jargon Lite Version: At the end of each year for the last 5 years, the company’s assets were valued as positive after their liabilities have been subtracted.

Who Is This For?

This screen is ideal for:

- Long-term investors

- Growth-focused portfolios

- Anyone seeking scalable, consistent business models

Make It Your Own

This screen is a powerful starting point for growth investing, built on proven financial indicators. Now that you understand what each criterion means and why it matters, you can take it further:

- Adjust the thresholds to suit your risk tolerance or strategy

- Add new metrics that align with your investing style

- Refine, experiment, and evolve the screen to make it uniquely yours.

Learn More About Growth Investing

Want to deepen your understanding of growth strategies and how to apply them effectively? Check out Chapter 12 of our Step-by-Step Guide to Investing, where we explore what makes a successful growth company, how to spot one, and how to avoid common pitfalls.

Read Chapter 12 – Growth Investing

We’d love to hear what you think. Are these the typical criteria you would use? What additional ones would you add? Or maybe you’ve built your own version of a growth screen you swear by. Drop your thoughts in the comments — whether it’s feedback, suggestions, or new ideas.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

You need to monitor this screen as Stockopedia do.We need to know how your recommendations work over time. Only then can we be sure that your screen works.

Thanks for your comment! This screen isn’t presented as a recommendation or a model portfolio, so we don’t monitor its performance over time in the way others might.

Our Screen guides are designed to help subscribers understand how to build screens, what different criteria mean, and how those criteria relate to different investing styles or goals. The aim is educational rather than advisory.

These example screens are especially inspired by feedback from subscribers who are keen to use the powerful screening tools in ShareScope but aren’t always sure where to begin. So rather than offering fixed lists of recommended stocks, we focus on showing how certain filters work and what they’re looking for so that you can build, explore and refine your own screens with confidence.

Hope that helps explain the intent behind this content!

Have you back tested this screen?

Thanks for the comment Keith. To add to the earlier point: no, this screen hasn’t been backtested as a standalone model.

That’s because these articles aren’t intended to deliver a proven system or a set of stock picks. Instead, they’re designed to walk through how screening works, highlighting what different criteria are looking for, and how they combine to find certain kinds of companies.

The focus is very much on helping subscribers build confidence with the tools in ShareScope, especially those who’ve told us they’re keen to screen for shares but aren’t sure how to get started. We want to make that learning curve easier, and these guides aim to do just that.

seems not available on my scharescope gold.

usually the add ins are in the filters area.

Hi Ian, as Legacy ShareScope Gold has been scheduled for decommissioning with no new development, these screens are unfortunately not available in the filter area. You can find these screens in the ShareScope filter library though or on the ShareScope homepage at the click of a button. If you need any assistance with screening in ShareScope please do contact the support team.

The first line, “TTM EPS % Change to EPS”, being set to zero doesn’t seem to add much. Too many of the stocks are zero for this field so if the threshold is raised above zero – even by a small amount – then many possible stocks are excluded. I understand why its there – just not adding much in practice?

Thanks for the feedback. You’re right to say it doesn’t capture much as can be seen in the distribution. It is however fulfilling its task of stripping away the companies where the TTM EPS falls short comparatively. What’s handy about these filters is that you can amend the criteria to suit your own requirements. For example, relax the minimum requirement to -5 and you’ll capture some EPS decline stocks as long their TTM EPS has not declined by more than 5%.