Is this the beginning of the end? Michael looks at the future of the London Stock Exchange and Beeks Financial Cloud.

Five years ago we marked the bottom of the Coronavirus crash.

It went as quickly as it came.

Boris put us in lockdown and markets rocketed.

Helicopter money, furlough, work from home, and not being allowed out of your house and garden unless you were going to a supermarket.

People ploughed money into stocks, home furnishings, anything they could spend because money burnt a hole in their pockets.

At one point, it was going to take six weeks for my sofa to come from MADE, and such was the demand.

MADE eventually went bust, along with a load of other garbage floats.

The bill always comes due.

There’s a scene in the trading classic Margin Call, where Jeremy Irons’s character says he doesn’t hear a thing.

He’s referencing the music stopping.

And with everyone writing off the London Stock Exchange, are we at peak fear?

For the FTSE AIM All-Share, we’re closing in on historic support.

The 2023 October low was 670p and as I type this we’re at 679.

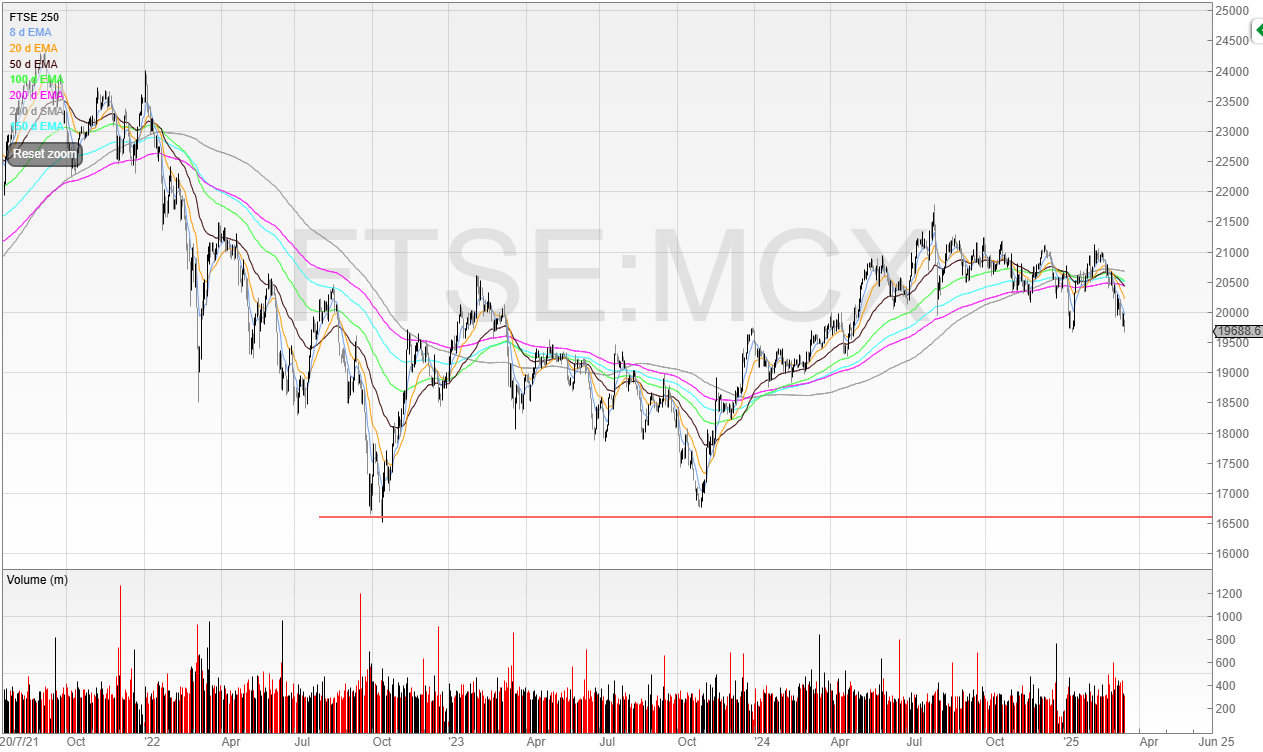

The FTSE 250 isn’t doing too great either, although holding well above the October 2023 lows.

And whilst there have been calls for reform and an urgency to do something to help the London Stock Exchange, is the situation as bad as it’s being made out to be?

Yes and no.

No, in the short-term.

Money continues to flow out of UK equities.

That’s not necessarily a problem if it was leaving the garbage only, but it is across the board. Funds are leaving the UK and being redeployed into North America and other ETFs.

And whereas people would typically invest in the UK stock market and pick stocks, these investors are dying off with that money leaving the market, and new investors are heading towards ETFs and crypto.

In the short-term, there will be plenty of quality stocks and turnarounds that will appreciate in value.

It really is a stockpicker’s market.

But in the long term, with more companies leaving the London Stock Exchange than joining, eventually quality will have been taken out and we’ll be left with the dregs: junior resources, broken business models, and frauds.

So yes, it matters. You can only squeeze the lemons for so long before the juice runs dry.

Whether anything will be done is another topic, but unless we see some changes ahead, then it’s not likely that the one-way street of outflows and companies leaving the LSE will be corrected any time soon.

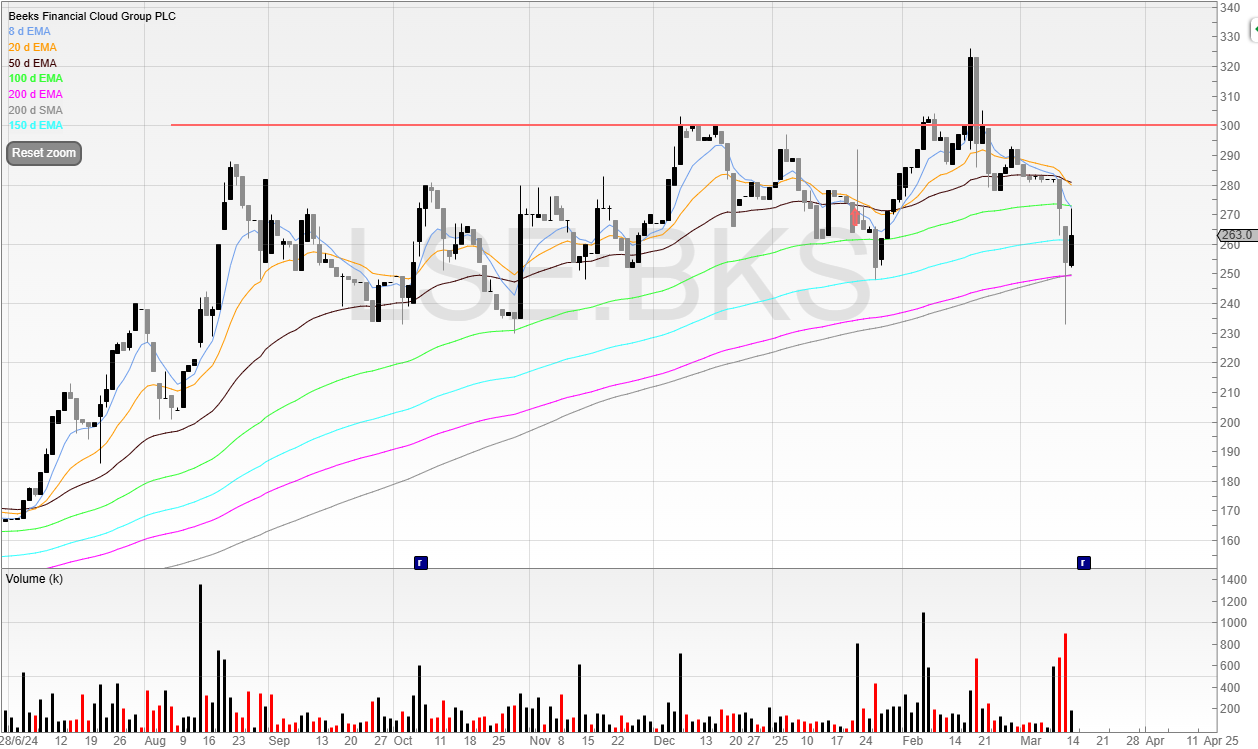

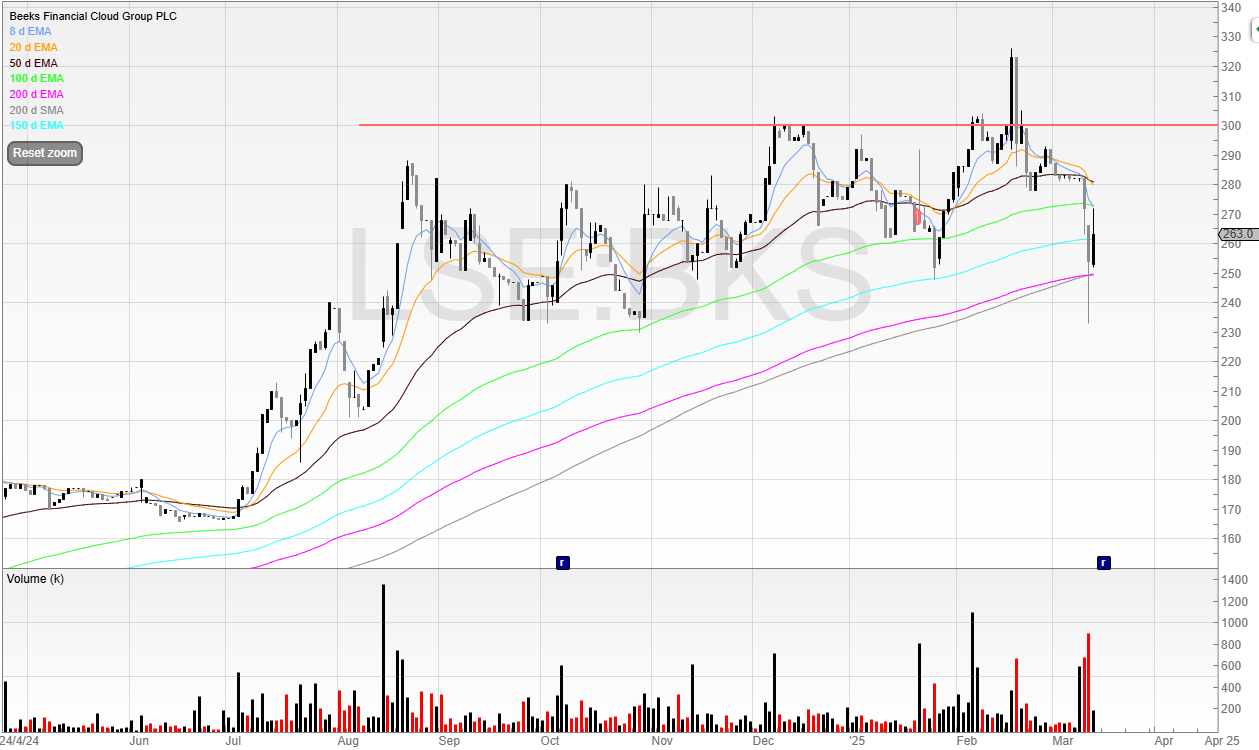

There will always be opportunities for traders out there though, one such was Beeks Financial Cloud (BKS).

The stock price started moving after this article was posted on FT.

It talks about how Nasdaq has been selectively offering clients faster connections for $10,000 a month.

This seems odd to me that Nasdaq would 1) do such a thing, and 2) sell it for only $10,000 a month.

But when the FT reached out, Nasdaq said: “Nasdaq has begun discontinuing the service”.

Beeks has been contacted and provided the following response:

“Thanks for your email to Beeks Financial Cloud. The Company does not comment on share price movements or unsubstantiated rumours. As previously announced, Interim Results will be released on Monday 17th March, with an Investor Meet Company presentation on 19th. You can register to join here:”

My guess is that if it was substantiated, then it would comment.

Therefore, this appears to have nothing to do with Beeks.

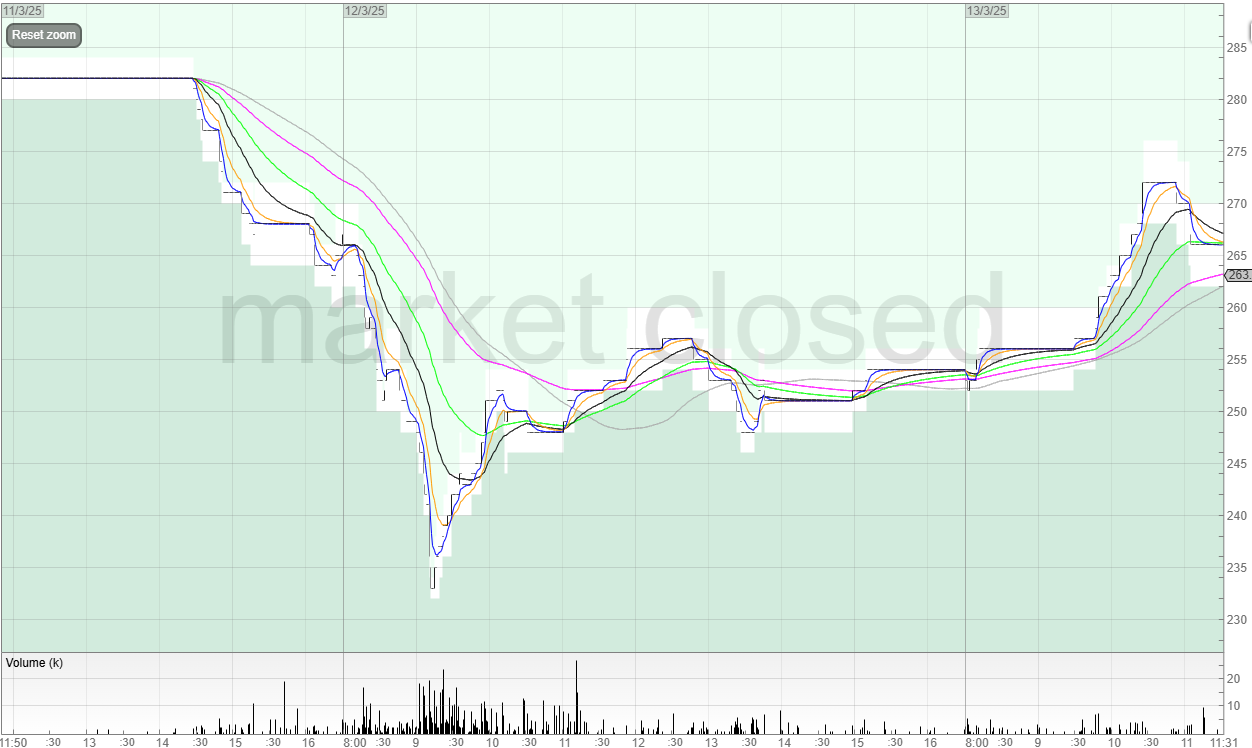

But it did a lot of damage to the share price and cleaned out a lot of stops.

Plus, stocks are selling off for any reason in recent weeks.

So for investors, this could be an opportunity to buy more.

This could’ve been a great opportunity for a puke trade too.

The market makers will always go stop hunting and as people chase the bid, the price falls further.

Once the market makers have plenty of stock, it’s then in their interest to try to stimulate demand by raising the price and selling back those shares to the market for a profit.

Remember, they also make a turn on the spread too.

The stock has rallied but not to where it previously was.

And with results on the 17th March, perhaps we may get some more detail.

But for now, having been stopped out, I’ll be watching for a breakout of the recent high.

Just because a trade stops me out doesn’t make it a bad trade.

Sometimes stops will take me out of a trade only for that stock to eventually print higher.

But stop losses are insurance and protection. What if the stock keeps falling? What if the trade doesn’t recover and instead spends six months underwater? That’s not a great return on capital efficiency and also not great for a trader’s psychology.

Sometimes a shake out allows the stock to set up an even better pattern as it’s removed some weak hands, and sets up even tighter.

I may be out of Beeks at a loss, but it’s one trade of many, and I don’t believe the story is far from over here.

~

Michael Taylor

Get Michael’s trade ideas: newsletter.buythebullmarket.com

Twitter: @shiftingshares

Got some thoughts on this week’s article from Michael? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for a specific share or the “Traders chat”

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.