A look at Buffett’s rudimentary textual analysis of management discussion of mistakes and errors. Companies covered: QTX, IPF, WATR.

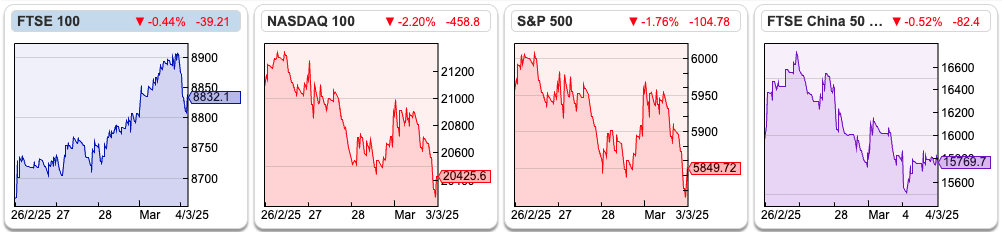

The FTSE 100 was up +2% in the last 5 days to 8,832, helped by a blistering rally in Aerospace and Defence stocks, Rolls Royce +28% and BAE Systems +18%. Over the same time, the Nasdaq100 was down -4.3% and the S&P500 down -2.2%. So far, Trump’s talk of tariffs and Europeans being forced to increase defence spending has been positive for European equity markets (the Euronext 100 is up +11% since 5th November) and less positive for the US markets (Nasdaq 100 down -3% since 5th November).

Buffett’s annual letter to shareholders was out a week ago, but with everything going on in the world, it gained less attention than it has done in the past. The Sage, who famously doesn’t use a calculator, let alone Excel spreadsheet models, has done some rudimentary Natural Language Processing of management commentary in Annual Reports. He points out that between 2019-23 he used the words “error” or “mistake” 16 times in his shareholder letters. Many other companies he looked at have never used either word.

As I was writing, this post popped up on my Instagram feed. The parody account seems to have discovered a fundamental constant of the universe.

Less fancifully, I am attracted to companies where management feel comfortable enough to discuss the challenges they face, errors made and then corrected, lessons learnt. This first drew me to Games Workshop 15 years ago, Burford’s management commentary also comes across well in their discussions on litigation finance and MS International, a third company I bought into, is another example.

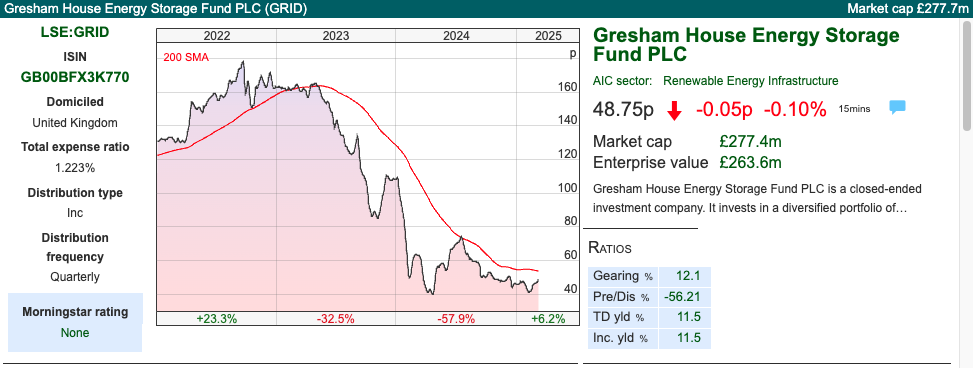

On the other hand, I recently spent some time looking at the Renewable Energy Infrastructure Funds (REIFs) which trade at around 20% to 75% discounts to NAV. It’s difficult to work out what has gone wrong at companies like NextEnergy Solar Fund (NESF) which I own, or Gresham House Energy Storage (GRID) which I don’t own. GRID’s share price fell -60% last year and NESF’s was down -29%; neither uses the word “error” nor “mistake” in their most recent H1 report.

When I published my article for Moneyweek, financial PR’s from both companies made pedantic complaints, without actually addressing my analysis of the core investment case. Life is too short to get into arguments about whether GRID was “upgrading” (management speak) or “replacing” (what I wrote) their batteries. Given’s GRID’s share price performance and the need for batteries to help store energy from intermittent energy supply, this might be an opportunity for brave investors. However, a management team that is overly focused on finessing language, when the recent past has been so difficult, is a red flag for me.

This week, I look at vehicle telematics business Quartix, international lender IPF and Water Intelligence, which does water leak detection. Of the three, my preferred investment case would be Quartix, but I don’t own any shares in QTX or the other two.

Quartix FY Dec results

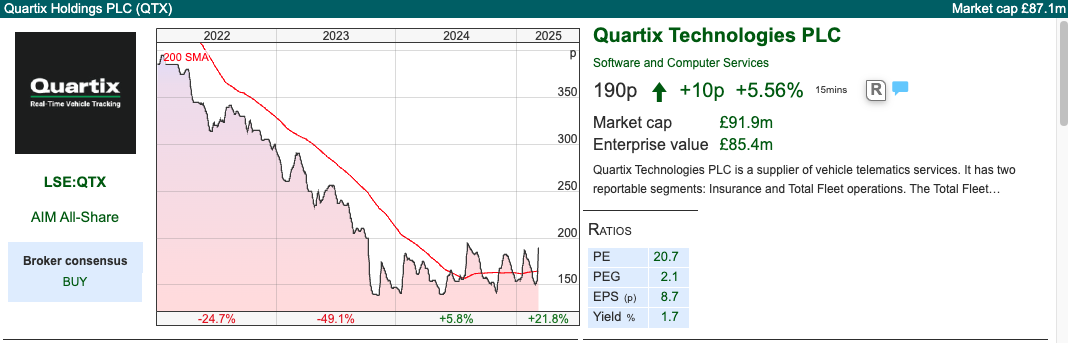

This vehicle tracking system technology company, which provides telematics data for fleets of commercial vehicles, is yet another company that peaked in mid 2021 and has struggled since then. The founder, Andy Walters, returned to the business in late 2023 to try to turn things around. He has helped to stabilise the situation, but there’s still work to do to recover momentum.

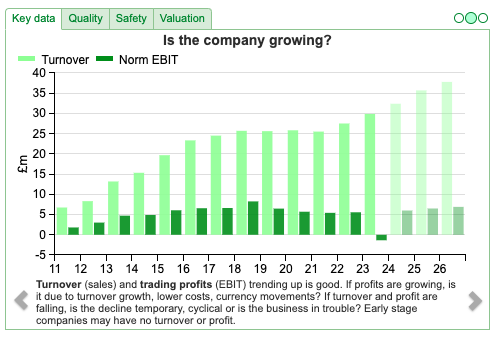

Group FY Dec 2024 revenue increased +8% to £32m and statutory PBT was £6.3m versus a loss of £1m in 2023. Some of that loss was caused by a goodwill impairment from an acquisition, Konetik, which was bought in September 2023 for €3.9m and specialised in helping companies transition their fleet of vehicles to EVs. Remarkable to see an impairment so soon after an acquisition, management did try to sell the business back to the previous owners for nil cost, but even that drastic step didn’t work, so in early 2024 they began the process of liquidation. QTX management anticipate that they will have closed down the business by the end of this year. From an accounting perspective, as Konetik was less than 10% of assets, headcount or profits, it doesn’t meet the criteria of a discontinued business under IFRS 5. That means that 2024 and 2025 numbers are probably masking a stronger underlying performance than would otherwise be the case.

Worth noting too that group net cash stood at £3.1m at the end of December, so the business isn’t distressed.

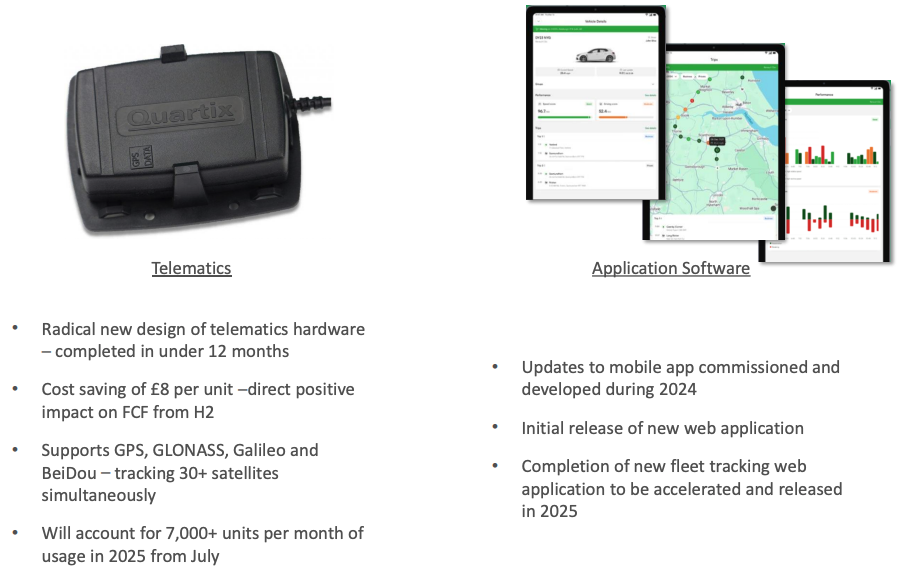

Outlook: Management talk about tight cost control and a new product launch, which should help to decrease manufacturing costs of their “black boxes” (below left). In the presentation, they say that’s a £8 cost saving per unit, but it would have been helpful to state that in percentage terms, I think? The RNS talks about a positive start to the year with recurring revenues and adj PBT both growing approximately +10%. Cavendish, their broker, have increased FY 2025F revenue by +2%, implying y-o-y growth of +11% this year and next. That translates to a +8% EPS upgrade and a substantial +52% DPS increase.

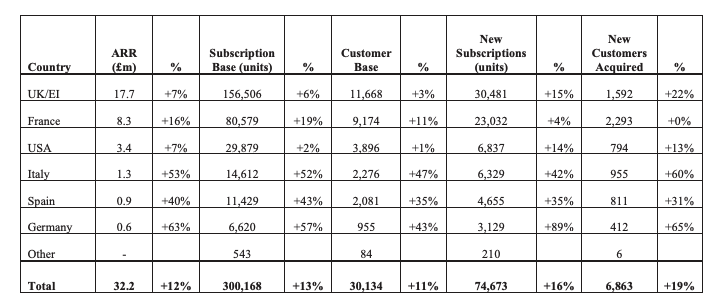

There does seem to be potential to grow the subscriber base abroad. Historically, the company has done well in the UK, Ireland and France, but looking at the bottom of the table, there’s scope for expanding rapidly in the USA, Italy, Spain and Germany.

Valuation: The shares are trading on a PER of 18x Dec 2025F and 16x the following year. That equates to just over 10x EV/EBITDA, or 2.5x forecast sales. By no means a “cheap” valuation, but likely anticipating that the founder can turn things around and return the business to a growth trajectory.

Opinion: The problem in the past has been a lack of pricing power, they don’t seem to be able to fix that yet, with new subscriptions (+16% in 2024) growing faster than revenue. Presumably there is a competitor in the market who is maintaining downward pressure on pricing?

That said, this seems like an example of an AIM company that has hit a sticky patch, but is now in a better position and could do well on a medium term view. I don’t own any, but I like the investment case with the recurring revenue and generally think that founders returning to a business to salvage the situation is a positive.

International Personal Finance FY Dec 2024 Results

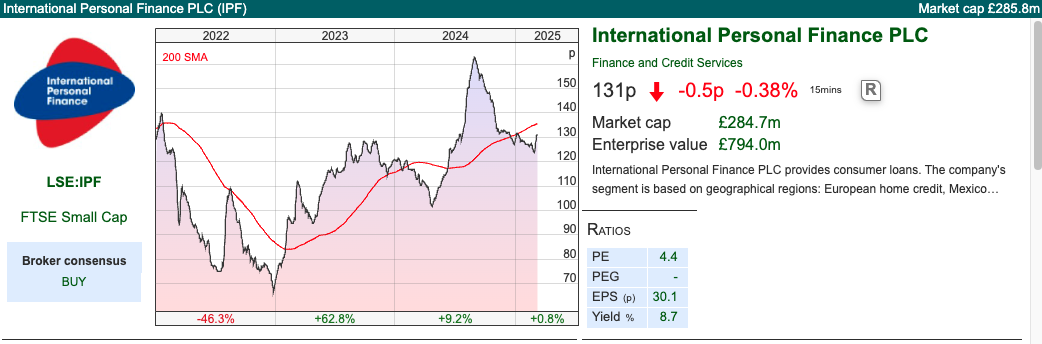

This lender to low-income people in countries like Poland, Czech Republic and Mexico describes itself as “helping to build a better world through financial inclusion by providing affordable credit products and insurance services to underserved consumers across nine markets.” That description alerts us to the fact that there is some regulatory risk, with governments uneasy about lenders targeting vulnerable people. The Polish regulator introduced a cap on pricing in 2022, capping non-interest costs at 45% of the loan value, Romania introduced a pricing cap in November last year. Those actions have hit top line growth and also caused a de-rating in the share price, as the Sharescope charts below reveal.

IPF reported FY Dec revenue down -5.4% to £726m and impairments up +25% £128m. Statutory PBT fell -13% to £73m. That equates to a cost-income ratio of 61%. There’s an exceptional charge of £11.9m relating to refinancing a bond and restructuring a business in Poland. Neither of these items strike me as genuinely exceptional. Without that charge, RoE would have been 11.5% which doesn’t suggest to me IPF is over-earning from its customers.

Outlook: Management describe the decline in revenue and profits as “strong operational and financial performance” in the outlook statement. There’s little specific, just PR style comments about financial inclusion, driving change to serve customers better. Sharescope shows excluding the 2024 exceptional item, PBT growth is expected to be flat in FY Dec 2025F, then grow mid teens thereafter.

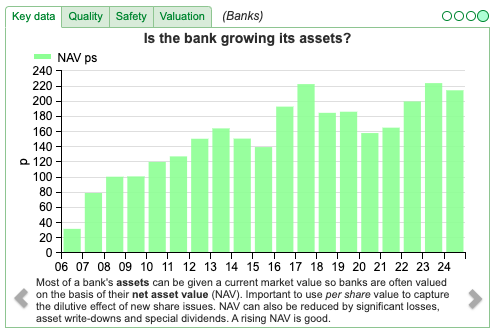

Valuation: The shares are trading on a PER ratio of less than 5x Dec 2026F, or 0.6x NAV per share. That’s good value, but worth pointing out that Georgian banks like BGEO (which I own) and TBC are even better value. IPF is more geographically diversified, but the Georgian banks operate a more diversified business model lending to corporates, SMEs and individuals, as well as being funded largely by customer deposits rather than wholesale markets.

Opinion: When things go wrong in this sector, they can go very wrong. I vaguely remember the Cattles bonds, trading at 20p in the pound during the financial crisis. Provident Financial, the doorstep lender that originally span out its international operations to create IPF as a separate entity in 2007, also got into regulatory trouble. At the moment, IPF seems on an even keel, with profitability set to improve, but if I owned it I would sell on the first sign of trouble, based on some of the mishaps with other companies in the sector.

Water Intelligence FY Dec 2024 Trading Update

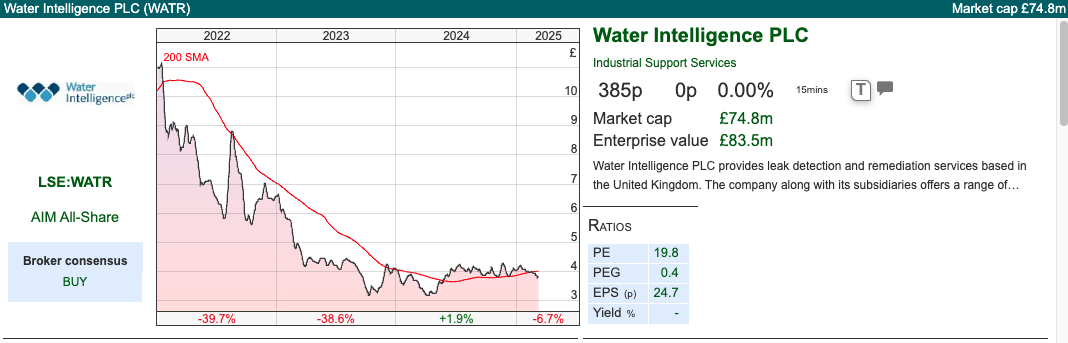

WATR is a US headquartered company listed on AIM, which tends to raise a question mark in my mind. If companies can attract more enthusiastic investors and higher valuations simply by being listed in the US, it’s a puzzle why companies like WATR and SOM are on AIM. Note 26 of last year’s Water Intelligence Annual Report describes a related party transaction between Plain Sight Systems (PSS), which is the Executive Chairman Patrick DeSouza’s vehicle, so AIM’s more lenient treatment of related party transactions could be part of the answer. The RNS says that, given that most of their operations are in the US, they have asked a UK / US law firm to explore a listing in the United States.

Secondly, management have been boosting growth through buying back franchises. This seems an odd way to expand, as I would expect franchising to be a good way to exploit a successful formula in a “capital light” way: see McDonald’s, Domino’s Pizza and Franchise Brands.

A further concern is that management take a long time to add up their FY numbers. So, for instance, last year they released a Q1 (Jan-Mar) trading statement in May and then their FY 2023 report at the end of June, half a year after their financial year end. When I last wrote about the shares in 2021, I was sceptical and that has proved justified as the shares have fallen -70% from their high of almost £13 at the end of Aug 2021. Perhaps they’re worth a second look though?

Water Intelligence is a water leak detection business, with a minimally invasive technology. Last week’s trading update reports +10% revenue growth to $83m and adj EBITDA growth of +12% to $15m. Net bank debt was $11m at the Dec year end; management also say net total debt (which includes deferred payments from acquiring franchises) was 1.48x EBITDA, which would imply $22m. That seems manageable, but I dislike the voluntary disclosure which talks about “strong” $12m cash, without explicitly stating that this cash is a gross figure, and ignores bank debt and acquisition liabilities.

Acquisitions: The group has kicked off 2025 with two more acquisitions: i) Effective Plumbing (EP) in Connecticut for $1.2m or 1x sales, and ii) an American Leak Detection Franchise (ALD) in Georgia and South Carolina for $3m, or 2x sales. There’s a further announcement about a partnership with StreamLabs Water (owned by NYSE listed, Chubb mkt cap $111bn), which monitors water quality and leak detection, using Internet of Things (IoT) technology. The idea is to boost revenue and profits, through selling StreamLabs preventative water damage products to WATR’s network. The historic track record of growth does look impressive.

Balance sheet: There’s no balance sheet in the trading update, but looking at H1 June 2024 results, there was $61m of goodwill and intangible assets, mostly from acquiring franchises. That compares to $63m of shareholders’ equity (so net tangible book value is just $2m). Presumably owning plumbing businesses outright is a more capitally intensive activity, rather than franchising. Yet the balance sheet shows around 5x more intangible assets (that don’t depreciate) versus $12m Property, Plant and Equipment.

Valuation: The shares are trading on 11x PER Dec 2025F and 2026F. That compares to Franchise Brands, which operates the Metro Rod, Metro Plumb, Willow Pumps and filta in its Water & Waste Services Division on 14x Dec 2025F, dropping to 11x the following year.

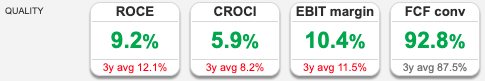

Opinion: This has always seemed an odd company to me. The valuation is much more attractive than a few years ago, but I still struggle to make sense of what is going on. Sharescope shows that RoCE has fallen from mid-teens pre-pandemic, to 9.2% last year. That makes sense as buying back franchises would likely require more capital to expand. A RoCE below 10% suggests that growth might not be creating as much value for shareholders as the previous strategy. I remember chatting with Leo and Mark about it at a Mello conference, and they couldn’t work it out either. If readers have thoughts or have dug deeper, then do please share on the chat.

Notes

Bruce Packard

The author owns shares in Lion Finance / Bank of Georgia

Got some thoughts on this week’s commentary from Bruce? Share these in the ShareScope “Weekly Market Commentary” chat. Login to ShareScope – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Bi-Weekly Market Commentary | 5/3/2025 | QTX, IPF, WATR | Buffett’s mistake count

A look at Buffett’s rudimentary textual analysis of management discussion of mistakes and errors. Companies covered: QTX, IPF, WATR.

The FTSE 100 was up +2% in the last 5 days to 8,832, helped by a blistering rally in Aerospace and Defence stocks, Rolls Royce +28% and BAE Systems +18%. Over the same time, the Nasdaq100 was down -4.3% and the S&P500 down -2.2%. So far, Trump’s talk of tariffs and Europeans being forced to increase defence spending has been positive for European equity markets (the Euronext 100 is up +11% since 5th November) and less positive for the US markets (Nasdaq 100 down -3% since 5th November).

Buffett’s annual letter to shareholders was out a week ago, but with everything going on in the world, it gained less attention than it has done in the past. The Sage, who famously doesn’t use a calculator, let alone Excel spreadsheet models, has done some rudimentary Natural Language Processing of management commentary in Annual Reports. He points out that between 2019-23 he used the words “error” or “mistake” 16 times in his shareholder letters. Many other companies he looked at have never used either word.

As I was writing, this post popped up on my Instagram feed. The parody account seems to have discovered a fundamental constant of the universe.

Less fancifully, I am attracted to companies where management feel comfortable enough to discuss the challenges they face, errors made and then corrected, lessons learnt. This first drew me to Games Workshop 15 years ago, Burford’s management commentary also comes across well in their discussions on litigation finance and MS International, a third company I bought into, is another example.

On the other hand, I recently spent some time looking at the Renewable Energy Infrastructure Funds (REIFs) which trade at around 20% to 75% discounts to NAV. It’s difficult to work out what has gone wrong at companies like NextEnergy Solar Fund (NESF) which I own, or Gresham House Energy Storage (GRID) which I don’t own. GRID’s share price fell -60% last year and NESF’s was down -29%; neither uses the word “error” nor “mistake” in their most recent H1 report.

When I published my article for Moneyweek, financial PR’s from both companies made pedantic complaints, without actually addressing my analysis of the core investment case. Life is too short to get into arguments about whether GRID was “upgrading” (management speak) or “replacing” (what I wrote) their batteries. Given’s GRID’s share price performance and the need for batteries to help store energy from intermittent energy supply, this might be an opportunity for brave investors. However, a management team that is overly focused on finessing language, when the recent past has been so difficult, is a red flag for me.

This week, I look at vehicle telematics business Quartix, international lender IPF and Water Intelligence, which does water leak detection. Of the three, my preferred investment case would be Quartix, but I don’t own any shares in QTX or the other two.

Quartix FY Dec results

This vehicle tracking system technology company, which provides telematics data for fleets of commercial vehicles, is yet another company that peaked in mid 2021 and has struggled since then. The founder, Andy Walters, returned to the business in late 2023 to try to turn things around. He has helped to stabilise the situation, but there’s still work to do to recover momentum.

Group FY Dec 2024 revenue increased +8% to £32m and statutory PBT was £6.3m versus a loss of £1m in 2023. Some of that loss was caused by a goodwill impairment from an acquisition, Konetik, which was bought in September 2023 for €3.9m and specialised in helping companies transition their fleet of vehicles to EVs. Remarkable to see an impairment so soon after an acquisition, management did try to sell the business back to the previous owners for nil cost, but even that drastic step didn’t work, so in early 2024 they began the process of liquidation. QTX management anticipate that they will have closed down the business by the end of this year. From an accounting perspective, as Konetik was less than 10% of assets, headcount or profits, it doesn’t meet the criteria of a discontinued business under IFRS 5. That means that 2024 and 2025 numbers are probably masking a stronger underlying performance than would otherwise be the case.

Worth noting too that group net cash stood at £3.1m at the end of December, so the business isn’t distressed.

Outlook: Management talk about tight cost control and a new product launch, which should help to decrease manufacturing costs of their “black boxes” (below left). In the presentation, they say that’s a £8 cost saving per unit, but it would have been helpful to state that in percentage terms, I think? The RNS talks about a positive start to the year with recurring revenues and adj PBT both growing approximately +10%. Cavendish, their broker, have increased FY 2025F revenue by +2%, implying y-o-y growth of +11% this year and next. That translates to a +8% EPS upgrade and a substantial +52% DPS increase.

There does seem to be potential to grow the subscriber base abroad. Historically, the company has done well in the UK, Ireland and France, but looking at the bottom of the table, there’s scope for expanding rapidly in the USA, Italy, Spain and Germany.

Valuation: The shares are trading on a PER of 18x Dec 2025F and 16x the following year. That equates to just over 10x EV/EBITDA, or 2.5x forecast sales. By no means a “cheap” valuation, but likely anticipating that the founder can turn things around and return the business to a growth trajectory.

Opinion: The problem in the past has been a lack of pricing power, they don’t seem to be able to fix that yet, with new subscriptions (+16% in 2024) growing faster than revenue. Presumably there is a competitor in the market who is maintaining downward pressure on pricing?

That said, this seems like an example of an AIM company that has hit a sticky patch, but is now in a better position and could do well on a medium term view. I don’t own any, but I like the investment case with the recurring revenue and generally think that founders returning to a business to salvage the situation is a positive.

International Personal Finance FY Dec 2024 Results

This lender to low-income people in countries like Poland, Czech Republic and Mexico describes itself as “helping to build a better world through financial inclusion by providing affordable credit products and insurance services to underserved consumers across nine markets.” That description alerts us to the fact that there is some regulatory risk, with governments uneasy about lenders targeting vulnerable people. The Polish regulator introduced a cap on pricing in 2022, capping non-interest costs at 45% of the loan value, Romania introduced a pricing cap in November last year. Those actions have hit top line growth and also caused a de-rating in the share price, as the Sharescope charts below reveal.

IPF reported FY Dec revenue down -5.4% to £726m and impairments up +25% £128m. Statutory PBT fell -13% to £73m. That equates to a cost-income ratio of 61%. There’s an exceptional charge of £11.9m relating to refinancing a bond and restructuring a business in Poland. Neither of these items strike me as genuinely exceptional. Without that charge, RoE would have been 11.5% which doesn’t suggest to me IPF is over-earning from its customers.

Outlook: Management describe the decline in revenue and profits as “strong operational and financial performance” in the outlook statement. There’s little specific, just PR style comments about financial inclusion, driving change to serve customers better. Sharescope shows excluding the 2024 exceptional item, PBT growth is expected to be flat in FY Dec 2025F, then grow mid teens thereafter.

Valuation: The shares are trading on a PER ratio of less than 5x Dec 2026F, or 0.6x NAV per share. That’s good value, but worth pointing out that Georgian banks like BGEO (which I own) and TBC are even better value. IPF is more geographically diversified, but the Georgian banks operate a more diversified business model lending to corporates, SMEs and individuals, as well as being funded largely by customer deposits rather than wholesale markets.

Opinion: When things go wrong in this sector, they can go very wrong. I vaguely remember the Cattles bonds, trading at 20p in the pound during the financial crisis. Provident Financial, the doorstep lender that originally span out its international operations to create IPF as a separate entity in 2007, also got into regulatory trouble. At the moment, IPF seems on an even keel, with profitability set to improve, but if I owned it I would sell on the first sign of trouble, based on some of the mishaps with other companies in the sector.

Water Intelligence FY Dec 2024 Trading Update

WATR is a US headquartered company listed on AIM, which tends to raise a question mark in my mind. If companies can attract more enthusiastic investors and higher valuations simply by being listed in the US, it’s a puzzle why companies like WATR and SOM are on AIM. Note 26 of last year’s Water Intelligence Annual Report describes a related party transaction between Plain Sight Systems (PSS), which is the Executive Chairman Patrick DeSouza’s vehicle, so AIM’s more lenient treatment of related party transactions could be part of the answer. The RNS says that, given that most of their operations are in the US, they have asked a UK / US law firm to explore a listing in the United States.

Secondly, management have been boosting growth through buying back franchises. This seems an odd way to expand, as I would expect franchising to be a good way to exploit a successful formula in a “capital light” way: see McDonald’s, Domino’s Pizza and Franchise Brands.

A further concern is that management take a long time to add up their FY numbers. So, for instance, last year they released a Q1 (Jan-Mar) trading statement in May and then their FY 2023 report at the end of June, half a year after their financial year end. When I last wrote about the shares in 2021, I was sceptical and that has proved justified as the shares have fallen -70% from their high of almost £13 at the end of Aug 2021. Perhaps they’re worth a second look though?

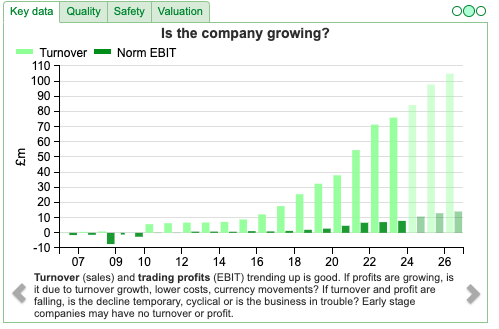

Water Intelligence is a water leak detection business, with a minimally invasive technology. Last week’s trading update reports +10% revenue growth to $83m and adj EBITDA growth of +12% to $15m. Net bank debt was $11m at the Dec year end; management also say net total debt (which includes deferred payments from acquiring franchises) was 1.48x EBITDA, which would imply $22m. That seems manageable, but I dislike the voluntary disclosure which talks about “strong” $12m cash, without explicitly stating that this cash is a gross figure, and ignores bank debt and acquisition liabilities.

Acquisitions: The group has kicked off 2025 with two more acquisitions: i) Effective Plumbing (EP) in Connecticut for $1.2m or 1x sales, and ii) an American Leak Detection Franchise (ALD) in Georgia and South Carolina for $3m, or 2x sales. There’s a further announcement about a partnership with StreamLabs Water (owned by NYSE listed, Chubb mkt cap $111bn), which monitors water quality and leak detection, using Internet of Things (IoT) technology. The idea is to boost revenue and profits, through selling StreamLabs preventative water damage products to WATR’s network. The historic track record of growth does look impressive.

Balance sheet: There’s no balance sheet in the trading update, but looking at H1 June 2024 results, there was $61m of goodwill and intangible assets, mostly from acquiring franchises. That compares to $63m of shareholders’ equity (so net tangible book value is just $2m). Presumably owning plumbing businesses outright is a more capitally intensive activity, rather than franchising. Yet the balance sheet shows around 5x more intangible assets (that don’t depreciate) versus $12m Property, Plant and Equipment.

Valuation: The shares are trading on 11x PER Dec 2025F and 2026F. That compares to Franchise Brands, which operates the Metro Rod, Metro Plumb, Willow Pumps and filta in its Water & Waste Services Division on 14x Dec 2025F, dropping to 11x the following year.

Opinion: This has always seemed an odd company to me. The valuation is much more attractive than a few years ago, but I still struggle to make sense of what is going on. Sharescope shows that RoCE has fallen from mid-teens pre-pandemic, to 9.2% last year. That makes sense as buying back franchises would likely require more capital to expand. A RoCE below 10% suggests that growth might not be creating as much value for shareholders as the previous strategy. I remember chatting with Leo and Mark about it at a Mello conference, and they couldn’t work it out either. If readers have thoughts or have dug deeper, then do please share on the chat.

Notes

Bruce Packard

The author owns shares in Lion Finance / Bank of Georgia

Got some thoughts on this week’s commentary from Bruce? Share these in the ShareScope “Weekly Market Commentary” chat. Login to ShareScope – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.