A look at some of Cathie Wood’s “Big Ideas” and ARKK ETF portfolio. Companies covered PRV, PZC and BATS.

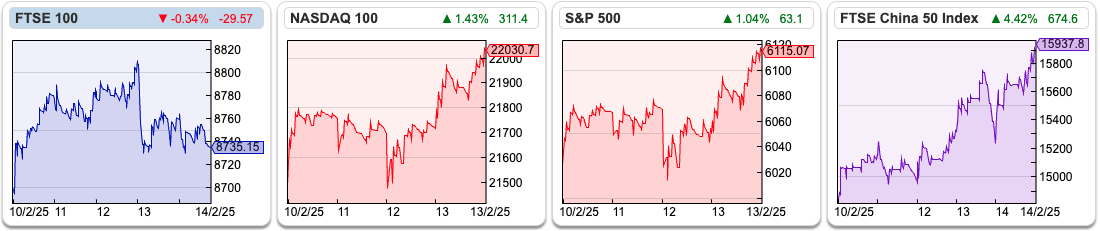

The FTSE 100 ended the week around 8,735, up +0.4%. The Nasdaq100 and S&P500 were up +1.2% and +0.5%, respectively. The best-performing index YTD has been the FTSE China 50, +15% followed by the German DAX +13%. Both China and Germany run large trade surpluses, so in theory, they should be most vulnerable to tariffs and trade wars. I’m assuming that investors believe large, global corporations in those indices will prove more resilient than small companies (eg the German Mittelstandt, Chinese smaller companies). Interesting to note the divergence between the FTSE China 50 and the Shanghai Composite, which has been flat YTD.

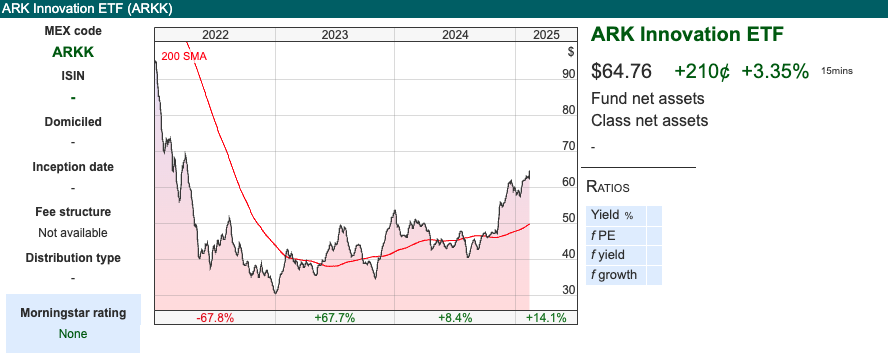

I know it’s rather unfashionable to mention Cathie Wood’s ARKK Innovation ETF these days. She hasn’t done too badly in the last couple of years, despite selling Nvidia too early. I do enjoy her “Big Ideas” presentation every year.

Occasionally, exciting, disruptive story stocks do also become multibaggers, or disruption hits a sector in a way that reduces overall profitability, so her slides are worth paying attention to.

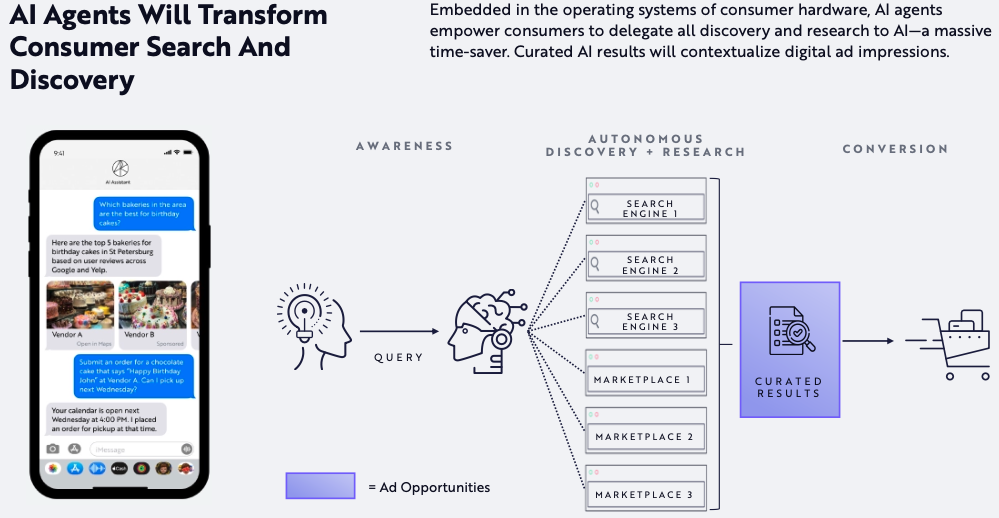

For instance, I’ve been pondering whether AI Agents might disrupt price comparison websites like GoCompare (owned by Future) and Moneysupermarket. The early promise of the internet was that prices would be easier to compare, companies like Amazon and Wise have achieved that aim; many corporations have responded by making direct comparisons of price and quality more difficult. I have been researching wearable devices like smartwatches, sleep trackers and various other devices. They are not easy to compare in part because the quality is subjective and in part because companies often avoid selling for a consistently comparable price online, instead they have a “flash sale” and/or discount code. Maybe in 5 years, I’ll ask an AI agent to help me choose and buy in the most cost-effective way.

As of the end of last year, her top holding was Tesla (9%) followed by Roku, the streaming service and Coinbase, the crypto platform. Other top 10 holdings include Roblox, Palantir, Shopify, Robinhood and Block (previously Square). You can also watch “In The Know with Cathie” on YouTube.

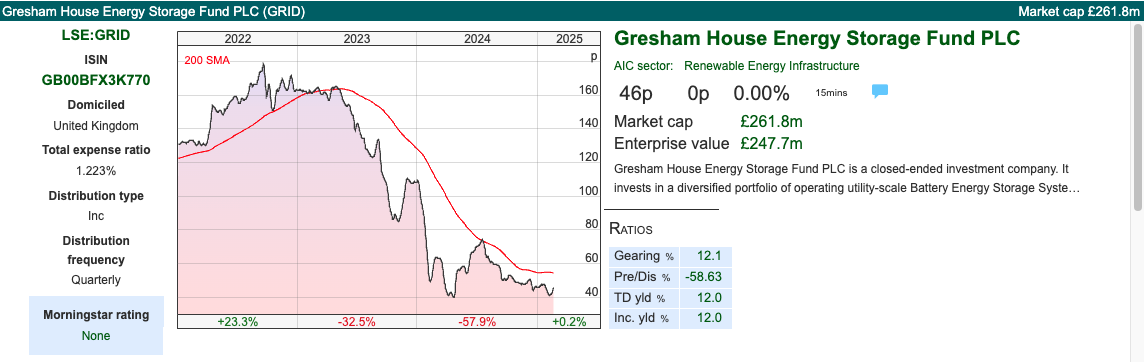

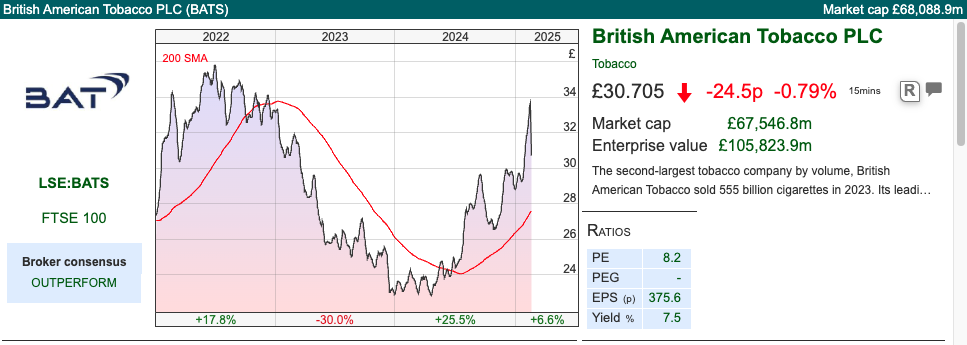

One interesting observation from Andrew Latto is that many investors assumed higher discount rates would be negative for ARKK innovation and similar portfolios, as these companies tend to have high valuations that implicitly extrapolated profits into the far future. In reality, it’s been indebted high-yielding stocks like BATS (see below) and Renewables Energy Investment Funds (REIFs) like GRID (below) or NESF that have been badly hit by the rising “risk-free rate”.

This week, I look at industrial filtration company Porvair, which is enjoying slow but steady growth. Then, I look at a couple of consumer companies: PZ Cussons, which has struggled with Nigerian currency devaluation, and BATS, the tobacco company trying to emphasise its less harmful smokeless categories.

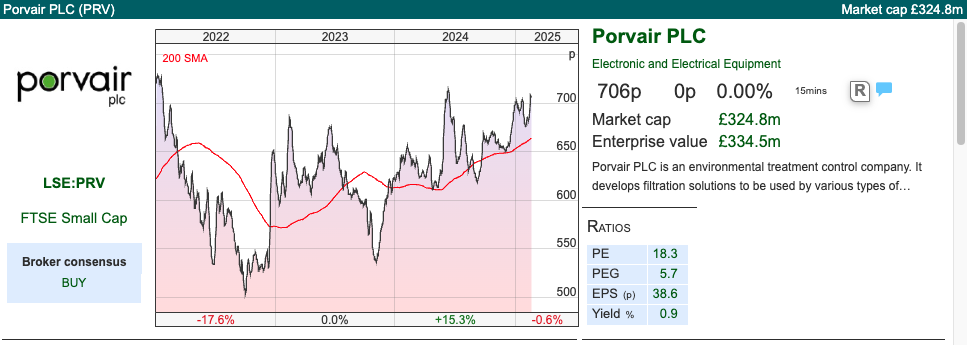

Porvair FY Nov results

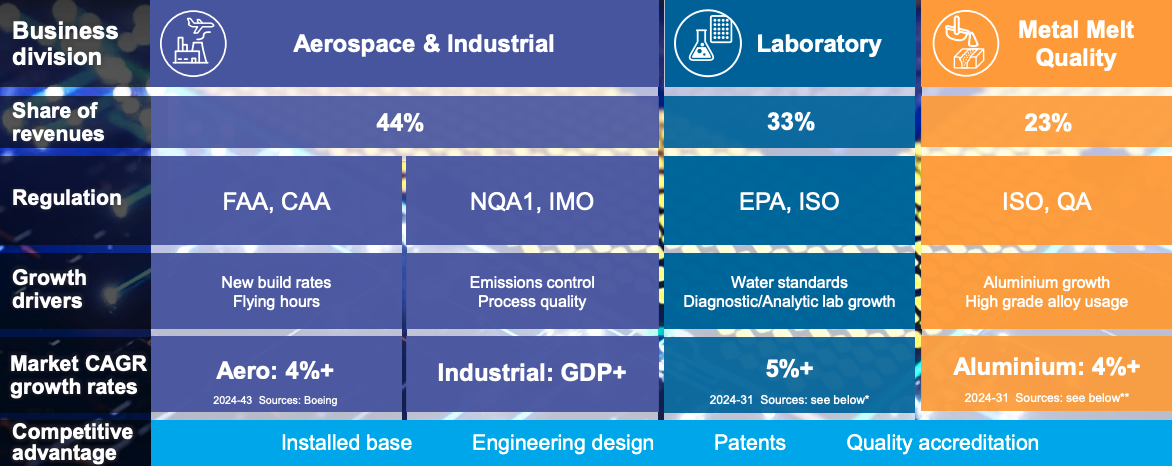

This filtration and environmental technology group reported FY Nov revenues +9% to £193m and statutory PBT +4% to £21m. However, if we exclude acquisitions, then group underlying revenue growth halves to +4%.

Management say that trading conditions were mixed, with weakness in Laboratory (revenue +7%) and Industrial consumables offset by strong Aerospace (revenue +21%) and Petrochemical markets (revenue +37%). That Laboratory revenue growth of +7% may sound like a creditable performance, however, that includes a FY of Ratiolab, acquired last year. Excluding that acquisition, organic revenue fell -1%. The Metal Melt Quality division, which is around a quarter of the group saw revenue and profits decline by -8% and -9% respectively. Despite the change in mix means that the operating margin falls holds steady at just under 13%.

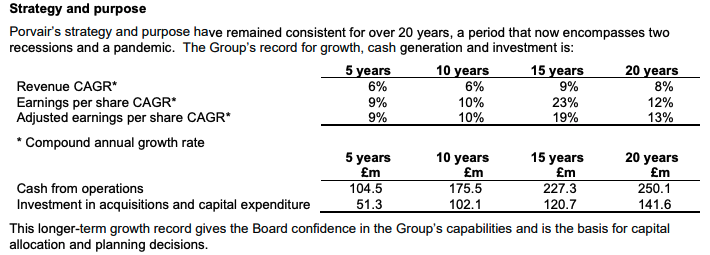

The Chief Exec, Ben Stocks, announced he was standing down in April 2024. His successor, Hooman Caman Javvi, has joined the company and will assume the role following the AGM on 15th April. Readers will know I like to pay particular attention to “voluntary disclosure”, what companies choose to reveal about themselves, rather than merely their statutory obligations. So I wanted to highlight this section below, with the long-term track record, which warms my heart.

Balance sheet: The group has made 10 acquisitions since 2015, so there’s £90m of goodwill and intangible assets on the balance sheet, versus net assets of £153m. There’s a small pension deficit of £6m, but in general the balance sheet looks in good shape with net cash of £14m at the end of November.

Outlook: The Board is optimistic for the future, pointing to new products in aerospace, Seal Analytical and Kbiosystems; the installation of a new manufacturing line for aluminium filtration; industrial demand recovery in the US; and increased Laboratory in-house manufacturing through Hungary. Sharepad shows revenue and EPS growth at c. +3% this year and next, which seems undemanding and well below historic averages.

Valuation: The shares are trading on a PER of 18x Nov 2025F. That might seem expensive, given the lack of growth. Alternatively, you might wonder if the new Chief Exec has scope to exceed those undemanding expectations.

Opinion: Looks good, seems like Quality at a Reasonable Price (QaaRP) though struggling to grow recently. The long-term track record suggests that this is a business where the share price can tread water for a few years, then take off and multi-bag (between 2010 and 2021 the shares rose in value 12x). Personally, I don’t like buying ahead of a new Chief Exec, in case he takes the opportunity to re-set expectations lower in his first 6 months. In this case, forecasts don’t look particularly demanding, so that may not happen. Still, I would prefer to revisit towards the end of this year.

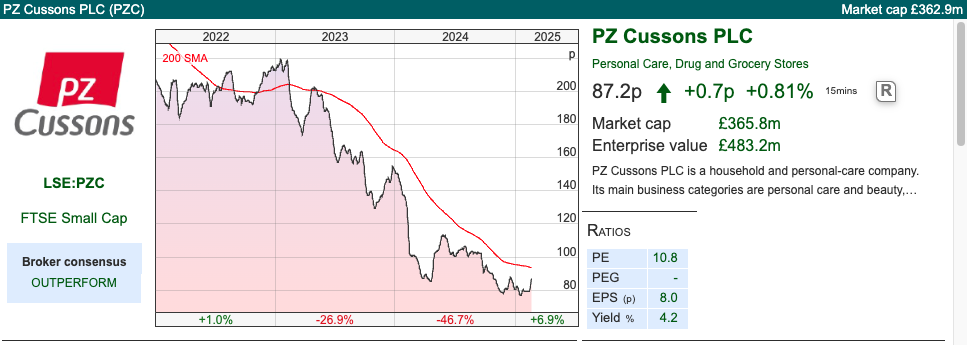

PZ Cussons H1 Nov results

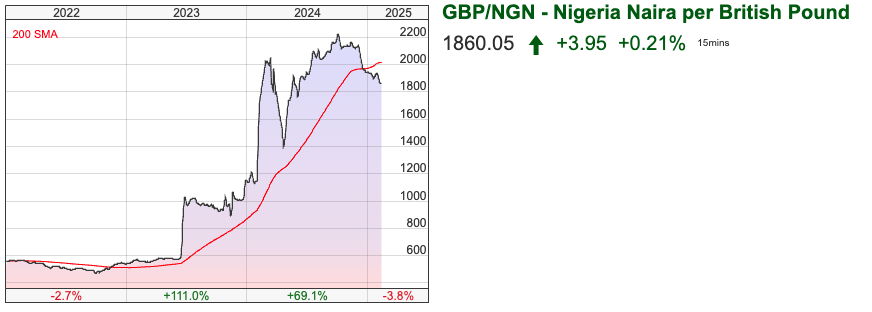

This consumer brands company has been hurt by the Nigerian Naira currency devaluation. The Naira devalued in 2023, from 450 to the US dollar to almost 800. I thought that the situation would then stabilise as the oil price was steady. However, that’s not the case, and the Naira fell to 1700 to the US dollar late last year. Once people lose faith in a currency, it can struggle to regain credibility. I’ve used Sharescope to show the currency versus the pound in this chart, there’s been some relief since November, but it’s too early to say if that’s the last of the devaluation.

With that in mind, PZ Cussons reported H1 group revenue down -10% to £249m, of which £43m was attributable to Naira devaluation. On a like-for-like basis, revenue growth was +7%. Management also reported a statutory profit of £6m, versus a statutory loss of £96m FY May 2024. However, when you see a currency devaluation, it’s always worth checking for “below the line” items in the “statement of comprehensive income”. The FY May 2024 loss grows to £167m, mainly due to “exchange differences on translation of foreign operations”, but I’m happy to say there’s no large “below the line” write down in the most recent H1.

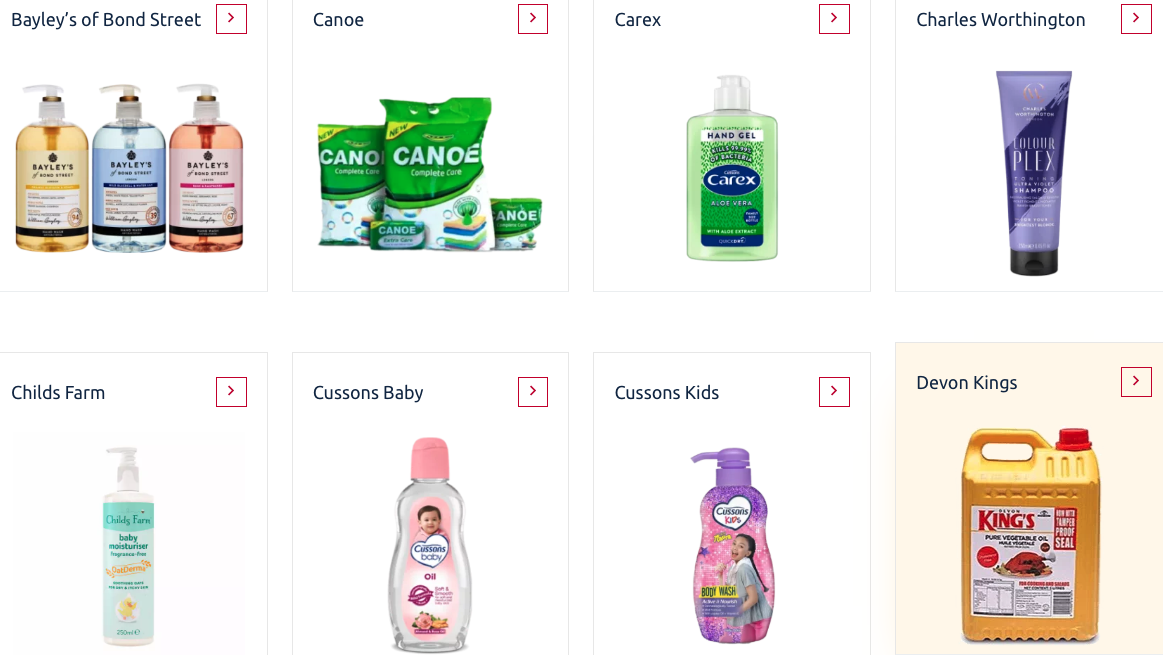

The company’s brands include Carex, Childs Farm, Cussons, Morning Fresh, Rafferty’s Garden, St Tropez, some others I hadn’t heard of, and Imperial Leather.

The adj operating profit margin fell 20bp to 10.8%, which is a little disappointing. However, the margin improved 70bp, if we exclude the Nigerain JV (PZ Wilmar) which is equity accounted. Management say that there was a positive margin benefit from PZ Wilmar last year, and a more normal level of profit this half. On a non-adjusted basis, the group margin is 5.4%, which shows room for improvement. Unilever reports an adjusted operating margin of 19.6%, and a statutory GAAP margin of 19.0%.

Net debt stood at £106m H1 Nov 2024, a +8% small increase versus £98m Nov 2023, but a reduction versus May last year. As of the 31st May 2023, there was £204m of cash in the Nigerian subsidiary, which they couldn’t upstream to the group because of Nigerian capital controls. Then capital controls were abandoned in June 2023 (which devalued the currency) and management have now repatriated all excess cash to the UK, so there shouldn’t be another significant hit, even if the Naira continues to devalue. There’s a £325m committed facility from the banks, consisting of a term loan and an RCF. Management point out that even if the term loan is not extended beyond its current maturity of November 2025, they have sufficient headroom with the RCF versus current levels of borrowing.

Outlook: In September 2024 management provided FY May 2025 guidance for adj operating profit of £47-53m. Performance to the end of January has been in line with our expectations and management expect Group LFL revenue growth trends to continue in the balance of the year. However, they have raised FY guidance by £5m, as they’ve taken out an assumed £5m of non-cash costs related to FX losses on intercompany loans, relating to the Nigerian business. In other words, the underlying guidance hasn’t changed, but numbers have been revised upwards by c. 10% as a result of non-cash accounting estimates.

Valuation: The shares are on a PER 10x May 2026F. Revenue growth looks to be low single digits, but some improvement in margins means that EPS is expected to outpace that slightly. A significant catalyst might be if there’s more radical restructuring, for instance exiting Nigeria or disposing of other brands. Someone on BlueSky suggested that Lord Lee had been talking up the PZC investment case on the Investors’ Chronicle podcast, but I can’t find the specific clip.

Opinion: This is yet another stock that I bought into the “turnaround story” far too early. I’m encouraged by these results and will ponder whether to average down. I’d need to feel comfortable that the situation had stabilised though, as I had previously thought “all the bad news is in the price” – only to see further problems. If I were looking at the investment case with fresh eyes, I might be more upbeat.

BATS FY Dec Results

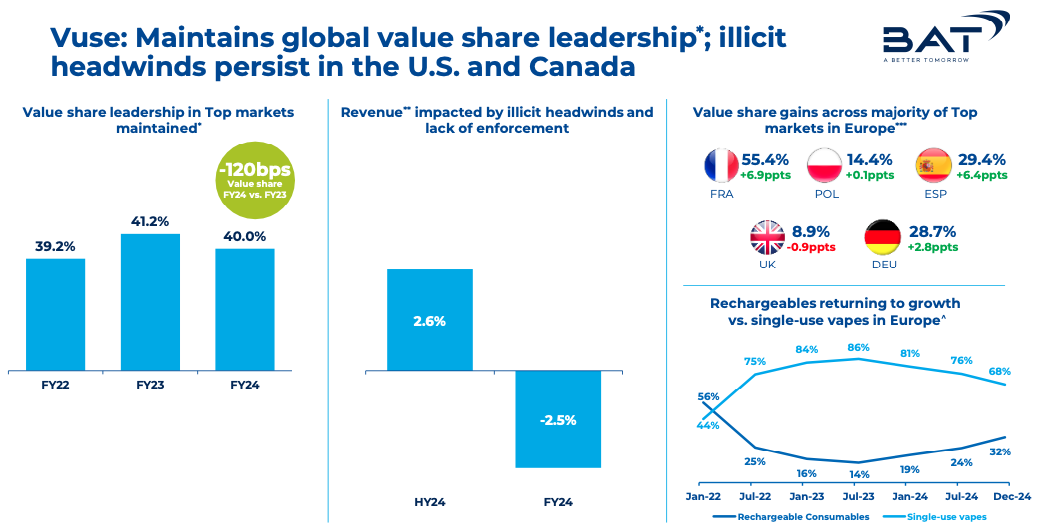

This tobacco and nicotine company is an interesting example of the disconnect between the story management would like to tell: reducing cigarette sales replaced by new, less harmful categories. Cigarette (BATS calls them “combustibles”) sales were down -5% by volume and -10% by volume in the US. However Vapour units -6% and Heated Products (HP) fell -12% reported, or down -0.3% on an organic basis, have both been shrinking. Smokeless categories represent 17.5% of group revenue, but that’s hardly changed over the last couple of years. The problem has been that Chinese vapes (brands include Elf Bar and Lost Mary), which are unauthorised and have more eye-catching marketing targeted at the young, seem to be winning versus the Vuse brand. BATS management have been complaining for a few years that there is a lack of enforcement against these illicit single-use Chinese vape products. Their quoted 40% market share for Vuse excludes the rival Chinese brands.

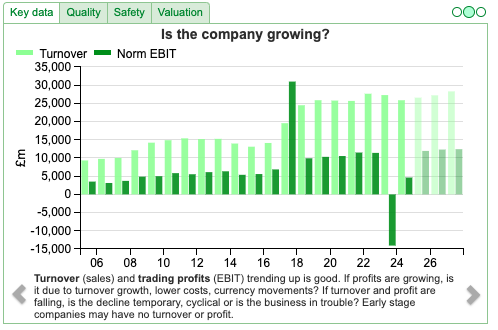

BATS reported group revenue down -5.2% to £25.9bn, or excluding the sale of Russian and Belarus business, up +1.3% on an organic basis. Statutory PBT was £3.5bn, a healthy swing from the £17bn loss last year, caused mainly by a goodwill impairment writedown related to the acquisition of Reynolds in 2016. Adjusted net debt stood at £30.6bn, a -10% reduction versus the previous year end. The ratio of adj net debt to adj EBITDA ratio stood at of 2.44x, though that rises to 2.75x if we don’t exclude the provision for Canadian litigation, below. 2.75x looks high, but manageable, especially as Central Bank interest rates seem to have peaked.

It’s worth flagging the commentary on page 18 about class action litigation in Quebec, Canada. Management have recognised a provisions charge of £6.2bn, which management are treating as an adjusting item. I’m not sure whether readers would treat that adjustment as “exceptional”; tobacco companies do seem to face frequent litigation risk.

Outlook: The company is expecting +1% revenue growth, on a constant currency basis. They also warn that performance should be H2 weighted, which given the disappointments of recent years is likely to have spooked investors with the shares down -8% on the morning of the RNS. Still, the dividend of 240p is expected to grow slightly and management feel confident enough to announce a further £900m buyback.

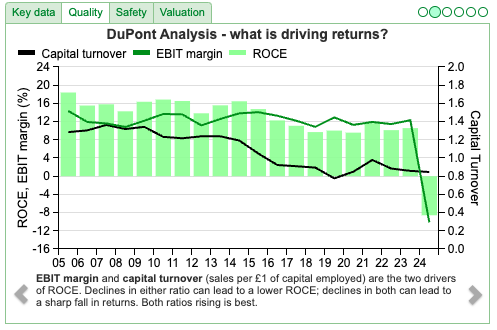

Valuation: The shares are trading on around 8x PER Dec 2025F. There’s not much growth forecast, either in revenue or profits. Historically, tobacco companies enjoyed attractive economics and above-average RoCE, but with litigation risk. It seems the litigation risk remains, but the companies are also coming under competitive pressure from single-use vape brands.

Opinion: My hope is that the US government begins to enforce its own rules around vaping products. I took a large position in mid-2023, a few months too early as the shares briefly fell below £23 per share in late 2023. Revisiting this 18 months later, I think my investment thesis has yet to be falsified. Probably not for everyone, but I am happy to continue holding.

~

Notes

Bruce Packard

Bruce owns shares in PZ Cussons and BATS

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Bi-Weekly Market Commentary | 19/2/2025 | PRV, PZC, BATS | Big Ideas

A look at some of Cathie Wood’s “Big Ideas” and ARKK ETF portfolio. Companies covered PRV, PZC and BATS.

The FTSE 100 ended the week around 8,735, up +0.4%. The Nasdaq100 and S&P500 were up +1.2% and +0.5%, respectively. The best-performing index YTD has been the FTSE China 50, +15% followed by the German DAX +13%. Both China and Germany run large trade surpluses, so in theory, they should be most vulnerable to tariffs and trade wars. I’m assuming that investors believe large, global corporations in those indices will prove more resilient than small companies (eg the German Mittelstandt, Chinese smaller companies). Interesting to note the divergence between the FTSE China 50 and the Shanghai Composite, which has been flat YTD.

I know it’s rather unfashionable to mention Cathie Wood’s ARKK Innovation ETF these days. She hasn’t done too badly in the last couple of years, despite selling Nvidia too early. I do enjoy her “Big Ideas” presentation every year.

Occasionally, exciting, disruptive story stocks do also become multibaggers, or disruption hits a sector in a way that reduces overall profitability, so her slides are worth paying attention to.

For instance, I’ve been pondering whether AI Agents might disrupt price comparison websites like GoCompare (owned by Future) and Moneysupermarket. The early promise of the internet was that prices would be easier to compare, companies like Amazon and Wise have achieved that aim; many corporations have responded by making direct comparisons of price and quality more difficult. I have been researching wearable devices like smartwatches, sleep trackers and various other devices. They are not easy to compare in part because the quality is subjective and in part because companies often avoid selling for a consistently comparable price online, instead they have a “flash sale” and/or discount code. Maybe in 5 years, I’ll ask an AI agent to help me choose and buy in the most cost-effective way.

As of the end of last year, her top holding was Tesla (9%) followed by Roku, the streaming service and Coinbase, the crypto platform. Other top 10 holdings include Roblox, Palantir, Shopify, Robinhood and Block (previously Square). You can also watch “In The Know with Cathie” on YouTube.

One interesting observation from Andrew Latto is that many investors assumed higher discount rates would be negative for ARKK innovation and similar portfolios, as these companies tend to have high valuations that implicitly extrapolated profits into the far future. In reality, it’s been indebted high-yielding stocks like BATS (see below) and Renewables Energy Investment Funds (REIFs) like GRID (below) or NESF that have been badly hit by the rising “risk-free rate”.

This week, I look at industrial filtration company Porvair, which is enjoying slow but steady growth. Then, I look at a couple of consumer companies: PZ Cussons, which has struggled with Nigerian currency devaluation, and BATS, the tobacco company trying to emphasise its less harmful smokeless categories.

Porvair FY Nov results

This filtration and environmental technology group reported FY Nov revenues +9% to £193m and statutory PBT +4% to £21m. However, if we exclude acquisitions, then group underlying revenue growth halves to +4%.

Management say that trading conditions were mixed, with weakness in Laboratory (revenue +7%) and Industrial consumables offset by strong Aerospace (revenue +21%) and Petrochemical markets (revenue +37%). That Laboratory revenue growth of +7% may sound like a creditable performance, however, that includes a FY of Ratiolab, acquired last year. Excluding that acquisition, organic revenue fell -1%. The Metal Melt Quality division, which is around a quarter of the group saw revenue and profits decline by -8% and -9% respectively. Despite the change in mix means that the operating margin falls holds steady at just under 13%.

The Chief Exec, Ben Stocks, announced he was standing down in April 2024. His successor, Hooman Caman Javvi, has joined the company and will assume the role following the AGM on 15th April. Readers will know I like to pay particular attention to “voluntary disclosure”, what companies choose to reveal about themselves, rather than merely their statutory obligations. So I wanted to highlight this section below, with the long-term track record, which warms my heart.

Balance sheet: The group has made 10 acquisitions since 2015, so there’s £90m of goodwill and intangible assets on the balance sheet, versus net assets of £153m. There’s a small pension deficit of £6m, but in general the balance sheet looks in good shape with net cash of £14m at the end of November.

Outlook: The Board is optimistic for the future, pointing to new products in aerospace, Seal Analytical and Kbiosystems; the installation of a new manufacturing line for aluminium filtration; industrial demand recovery in the US; and increased Laboratory in-house manufacturing through Hungary. Sharepad shows revenue and EPS growth at c. +3% this year and next, which seems undemanding and well below historic averages.

Valuation: The shares are trading on a PER of 18x Nov 2025F. That might seem expensive, given the lack of growth. Alternatively, you might wonder if the new Chief Exec has scope to exceed those undemanding expectations.

Opinion: Looks good, seems like Quality at a Reasonable Price (QaaRP) though struggling to grow recently. The long-term track record suggests that this is a business where the share price can tread water for a few years, then take off and multi-bag (between 2010 and 2021 the shares rose in value 12x). Personally, I don’t like buying ahead of a new Chief Exec, in case he takes the opportunity to re-set expectations lower in his first 6 months. In this case, forecasts don’t look particularly demanding, so that may not happen. Still, I would prefer to revisit towards the end of this year.

PZ Cussons H1 Nov results

This consumer brands company has been hurt by the Nigerian Naira currency devaluation. The Naira devalued in 2023, from 450 to the US dollar to almost 800. I thought that the situation would then stabilise as the oil price was steady. However, that’s not the case, and the Naira fell to 1700 to the US dollar late last year. Once people lose faith in a currency, it can struggle to regain credibility. I’ve used Sharescope to show the currency versus the pound in this chart, there’s been some relief since November, but it’s too early to say if that’s the last of the devaluation.

With that in mind, PZ Cussons reported H1 group revenue down -10% to £249m, of which £43m was attributable to Naira devaluation. On a like-for-like basis, revenue growth was +7%. Management also reported a statutory profit of £6m, versus a statutory loss of £96m FY May 2024. However, when you see a currency devaluation, it’s always worth checking for “below the line” items in the “statement of comprehensive income”. The FY May 2024 loss grows to £167m, mainly due to “exchange differences on translation of foreign operations”, but I’m happy to say there’s no large “below the line” write down in the most recent H1.

The company’s brands include Carex, Childs Farm, Cussons, Morning Fresh, Rafferty’s Garden, St Tropez, some others I hadn’t heard of, and Imperial Leather.

The adj operating profit margin fell 20bp to 10.8%, which is a little disappointing. However, the margin improved 70bp, if we exclude the Nigerain JV (PZ Wilmar) which is equity accounted. Management say that there was a positive margin benefit from PZ Wilmar last year, and a more normal level of profit this half. On a non-adjusted basis, the group margin is 5.4%, which shows room for improvement. Unilever reports an adjusted operating margin of 19.6%, and a statutory GAAP margin of 19.0%.

Net debt stood at £106m H1 Nov 2024, a +8% small increase versus £98m Nov 2023, but a reduction versus May last year. As of the 31st May 2023, there was £204m of cash in the Nigerian subsidiary, which they couldn’t upstream to the group because of Nigerian capital controls. Then capital controls were abandoned in June 2023 (which devalued the currency) and management have now repatriated all excess cash to the UK, so there shouldn’t be another significant hit, even if the Naira continues to devalue. There’s a £325m committed facility from the banks, consisting of a term loan and an RCF. Management point out that even if the term loan is not extended beyond its current maturity of November 2025, they have sufficient headroom with the RCF versus current levels of borrowing.

Outlook: In September 2024 management provided FY May 2025 guidance for adj operating profit of £47-53m. Performance to the end of January has been in line with our expectations and management expect Group LFL revenue growth trends to continue in the balance of the year. However, they have raised FY guidance by £5m, as they’ve taken out an assumed £5m of non-cash costs related to FX losses on intercompany loans, relating to the Nigerian business. In other words, the underlying guidance hasn’t changed, but numbers have been revised upwards by c. 10% as a result of non-cash accounting estimates.

Valuation: The shares are on a PER 10x May 2026F. Revenue growth looks to be low single digits, but some improvement in margins means that EPS is expected to outpace that slightly. A significant catalyst might be if there’s more radical restructuring, for instance exiting Nigeria or disposing of other brands. Someone on BlueSky suggested that Lord Lee had been talking up the PZC investment case on the Investors’ Chronicle podcast, but I can’t find the specific clip.

Opinion: This is yet another stock that I bought into the “turnaround story” far too early. I’m encouraged by these results and will ponder whether to average down. I’d need to feel comfortable that the situation had stabilised though, as I had previously thought “all the bad news is in the price” – only to see further problems. If I were looking at the investment case with fresh eyes, I might be more upbeat.

BATS FY Dec Results

This tobacco and nicotine company is an interesting example of the disconnect between the story management would like to tell: reducing cigarette sales replaced by new, less harmful categories. Cigarette (BATS calls them “combustibles”) sales were down -5% by volume and -10% by volume in the US. However Vapour units -6% and Heated Products (HP) fell -12% reported, or down -0.3% on an organic basis, have both been shrinking. Smokeless categories represent 17.5% of group revenue, but that’s hardly changed over the last couple of years. The problem has been that Chinese vapes (brands include Elf Bar and Lost Mary), which are unauthorised and have more eye-catching marketing targeted at the young, seem to be winning versus the Vuse brand. BATS management have been complaining for a few years that there is a lack of enforcement against these illicit single-use Chinese vape products. Their quoted 40% market share for Vuse excludes the rival Chinese brands.

BATS reported group revenue down -5.2% to £25.9bn, or excluding the sale of Russian and Belarus business, up +1.3% on an organic basis. Statutory PBT was £3.5bn, a healthy swing from the £17bn loss last year, caused mainly by a goodwill impairment writedown related to the acquisition of Reynolds in 2016. Adjusted net debt stood at £30.6bn, a -10% reduction versus the previous year end. The ratio of adj net debt to adj EBITDA ratio stood at of 2.44x, though that rises to 2.75x if we don’t exclude the provision for Canadian litigation, below. 2.75x looks high, but manageable, especially as Central Bank interest rates seem to have peaked.

It’s worth flagging the commentary on page 18 about class action litigation in Quebec, Canada. Management have recognised a provisions charge of £6.2bn, which management are treating as an adjusting item. I’m not sure whether readers would treat that adjustment as “exceptional”; tobacco companies do seem to face frequent litigation risk.

Outlook: The company is expecting +1% revenue growth, on a constant currency basis. They also warn that performance should be H2 weighted, which given the disappointments of recent years is likely to have spooked investors with the shares down -8% on the morning of the RNS. Still, the dividend of 240p is expected to grow slightly and management feel confident enough to announce a further £900m buyback.

Valuation: The shares are trading on around 8x PER Dec 2025F. There’s not much growth forecast, either in revenue or profits. Historically, tobacco companies enjoyed attractive economics and above-average RoCE, but with litigation risk. It seems the litigation risk remains, but the companies are also coming under competitive pressure from single-use vape brands.

Opinion: My hope is that the US government begins to enforce its own rules around vaping products. I took a large position in mid-2023, a few months too early as the shares briefly fell below £23 per share in late 2023. Revisiting this 18 months later, I think my investment thesis has yet to be falsified. Probably not for everyone, but I am happy to continue holding.

~

Notes

Bruce Packard

Bruce owns shares in PZ Cussons and BATS

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.