Bitcoin has shot past $100,000. Its market cap now stands at nearly $2 trillion. Not bad for what is deemed a nothing asset by many.

Dogecoin – a joke coin with no real tangible useful value and a picture of a cute little dog – made up more than 64% of the S&P 500 constituents earlier this month.

That means some of the best companies in the world are less valuable than a coin that does nothing.

The efficient market, eh?

Luckily, you know this is nonsense.

If markets were efficient, then people wouldn’t be buying the coin the “Hawk Tuah Girl” created that somehow hit $490 million before collapsing more than 90%.

One wallet allegedly bought 17.5% of the memecoin’s supply worth around $933,000 and sold it less than two hours later for a profit of $1.3 million. Not bad, if you don’t mind buying $993,000 of worthless garbage. And whilst I’ve bought plenty of worthless garbage before, certainly not ~£730k of it.

Even though the crypto euphoria is not spilling into the UK stock market, I did touch the Wall Street bull’s nether regions in NYC the other week for good luck and so I am partly, if not fully responsible, for the market’s recent rise.

But stocks are breaking out, and stocks are actually going up on good news instead of down, which is a positive.

Here are some on my watchlist.

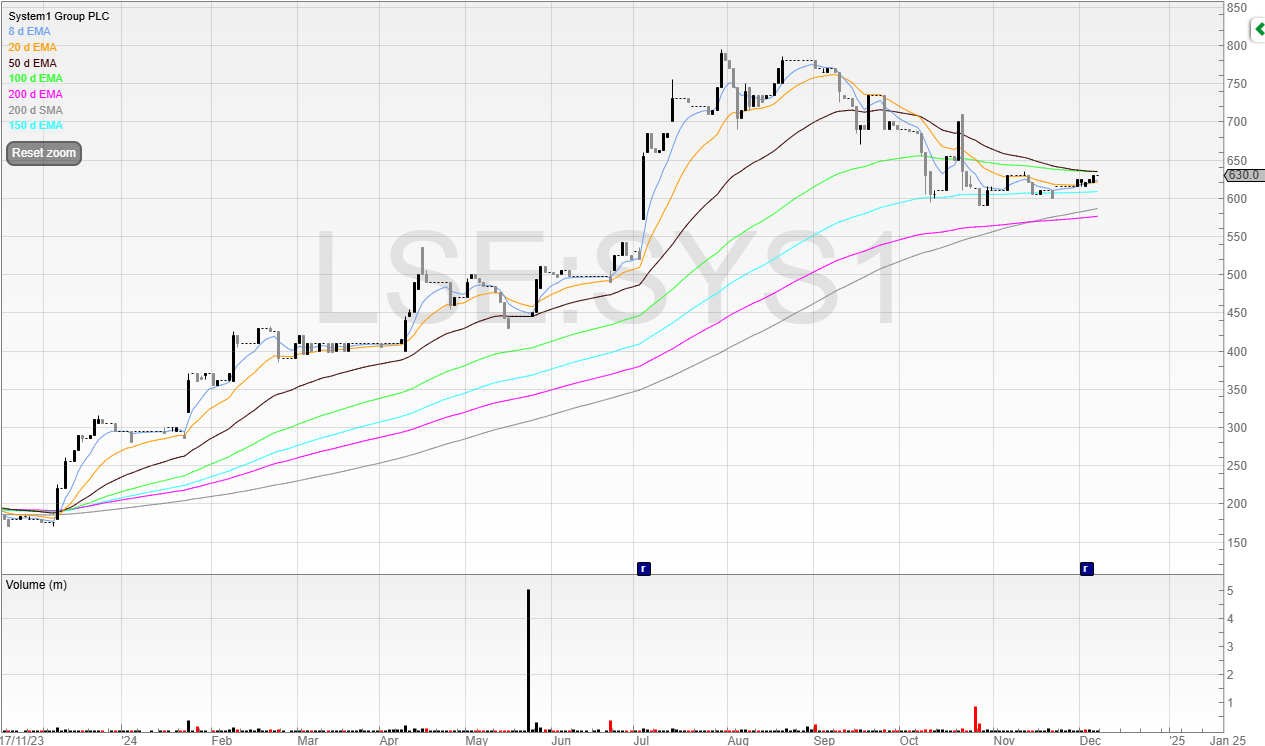

System1 (SYS1)

System1 is the old Brainjuicer. The new name is equally as silly as the old one, but a rose by any other name would smell as sweet.

The chart is clearly stage 2 territory here.

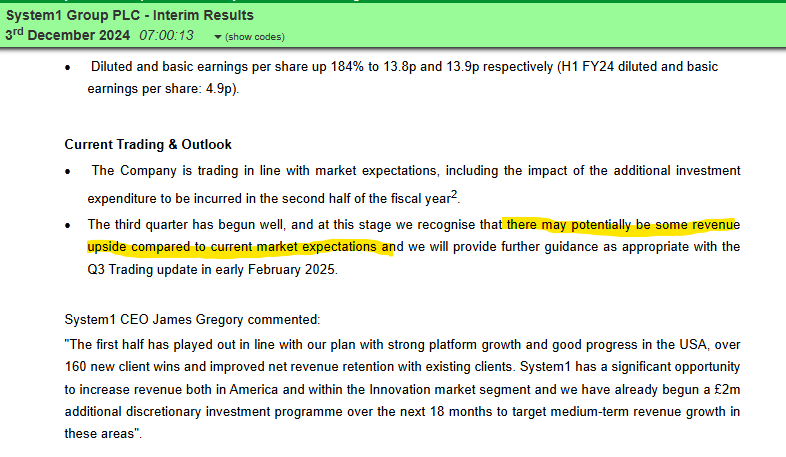

The results came out this week and there was a hint of a potential revenue upgrade.

Obviously, revenue is not profit, but it’s a good sign of growth for the top line.

I don’t consider this stock cheap at 40x earnings.

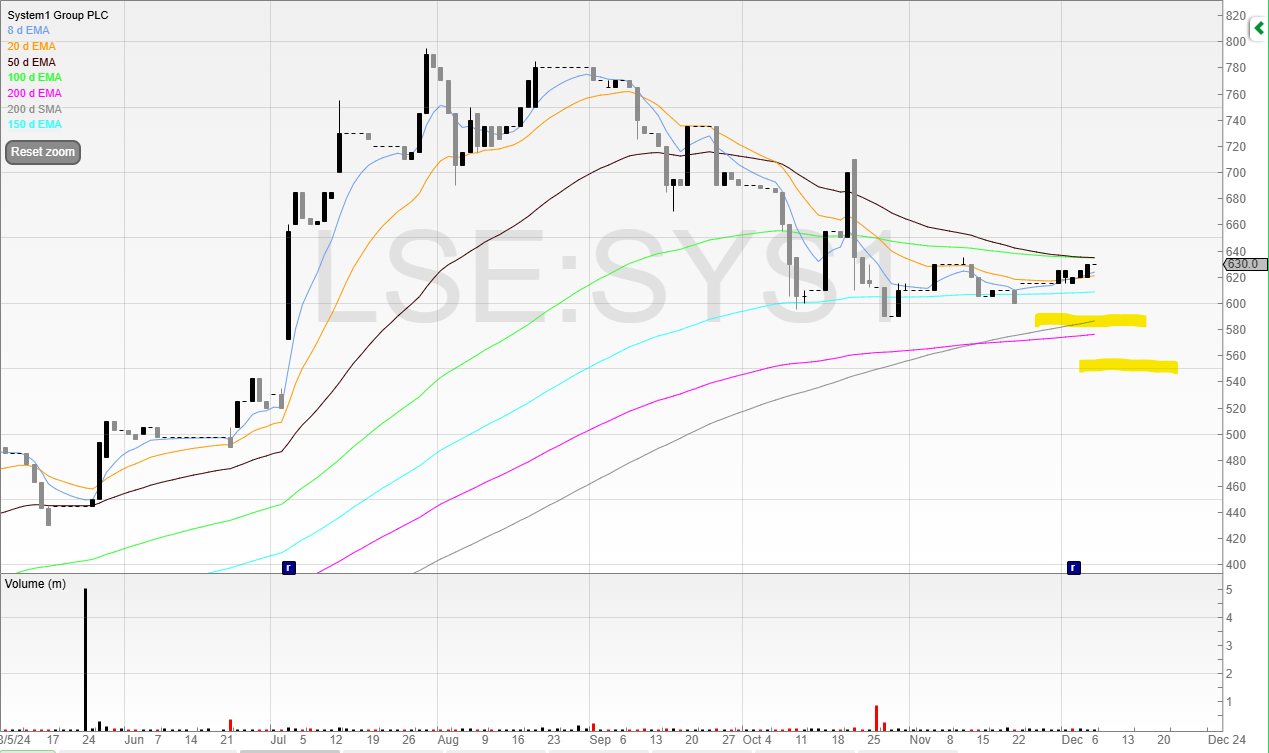

I’ve taken a small position with a stop loss below the Big Round Number and long-term 200-moving averages.

I’ve staggered my stops here, to reduce my position as the stock falls and where I can be confident the trend may have come to an end.

Ideally, I want to average up here.

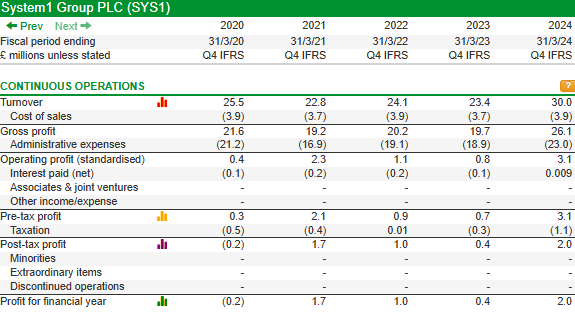

The stock provides market research data and insight services to help businesses make informed marketing decisions using its three proprietary products.

- Test Your Ad: Evaluate the potential effectiveness of advertisements before they are launched, providing insights into how they will perform with target audiences.

- Test Your Innovation: Assess new product ideas or concepts to predict their success in the market.

- Test Your Brand: Measures brand health and effectiveness, helping companies understand their brand’s position and perception in the market.

And that’s pretty much all I know so far. Should this become a more serious position I intend to research further, but for a starter, the chart and basic red-light checkup is all I need.

Be careful though – this stock is illiquid and the spread is wide. Plus, it’s only £80 million market cap.

And if there is bad news then you can expect this stock to absolutely crater given its valuation.

Burberry (BRBY)

I wrote about Burberry a few weeks ago. The chart is now looking like an excellent risk/reward.

It’s holding above 900p and threatening to break out of recent highs and the 200-exponential moving average.

The next Big Round Number would be 1,000p.

Even though this is typically out of the market cap size that I’d trade, I like the chart and the fact that the stock put out what seemed like bad news yet the price rallied.

That seems to me that the market was expecting worse, and there could be a trend trade based on market sentiment revaluing the stock as “very bad” to “bad” or even “neutral”.

Plus, if the turnaround does start to appear, then this could be a nice Trade 2 Hold.

Michael holds a long position in System1 (SYS1).

Michael Taylor

Get Michael’s trade ideas: newsletter.buythebullmarket.com

Got some thoughts on this week’s article from Michael? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for a specific share or the “Traders chat”

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.