Richard’s 5 Strikes system puts three very different businesses in the frame: Athleisure brand Lululemon, Gamma Communications – an IT company that supplies communications systems, and MS International, which manufactures naval cannon.

Bingo!

Well, almost Bingo. In my last article, I promised to order the results of my 5 Strikes system by number of strikes to focus on the most promising companies first. Since then only five companies have published annual reports and passed my minimum quality filter.

None of them achieved 0 strikes, but after that, we have the full set: 1,2,3,4 and X (more than four strikes).

| Name | TIDM | AR date | Strikes | # Strikes |

|---|---|---|---|---|

| Gamma Communications | GAMA | 18/7/24 | – Holdings | 1 |

| MS International | MSI | 12/7/24 | – CROCI – ROCE | 2 |

| Celebrus Technologies | CLBS | 9/7/24 | – Holdings – CROCI – Growth ? ROCE | 3 |

| Creightons | CRL | 18/7/24 | – CROCI – Growth – ROCE – Shares | 4 |

| Speedy Hire | SDY | 17/7/24 | – Holdings ? CROCI – Debt – Growth – ROCE | X |

Note: This article explains each strike, but the Minimum Quality filter it describes has been modified. This is the new version.

The businesses I am most interested in are those that achieve less than three strikes, because these are the least complicated, at least in terms of their financial performance. Consequently, they may be easiest to analyse. They have fewer blemishes that need to be explained, and their past stability makes it easy to imagine what they might achieve in future.

This time, I gave Gamma Communications only one strike and MS International two. Before I scratch the surface of them, I have also run Lululemon through the 5 Strikes process.

Lululemon is a Canadian company listed in the USA on Nasdaq. It did not come up in my routine trawl, because that is restricted to companies listed here in the UK.

LULU’s not a lemon

It was on a recent visit to Norway that I realised how attached I am to my Lululemon stretch-down jacket. In all seasons bar the height of summer it goes everywhere with me. It is warm, very light, water resistant, fits under a waterproof outer shell if it is very wet or chilly, and it is extremely comfortable. Frankly, it doesn’t feel like I am wearing it. I am not telling this to sell you one, but when you can’t imagine owning a better version of a thing it might be a signal.

I can also reveal, though you may not want me to, that I am utterly dependent on the Always in Motion long boxer.

The thing about Norway, particularly the west coast, and doubly so the islands to the west of the west coast, where we were, is the weather is very unpredictable. It can often be summer at the bottom of a hill and winter when you get to the top, or indeed half an hour later at the bottom. Such conditions are made for my jacket.

Me, left, modelling not one but two items of Lululemon clothing in Norway (only one is visible)

Lululemon designs and sells clothes for the athleisure market, and my “in” to the investment is that I like the product.

The same thing attracted me to Garmin, the company that makes GPS enabled devices like sports watches and instrumentation for planes, boats and automobiles. In fact, my love of Garmin led to an investment that initially floundered but now may be vindicating me. No doubt my love of the product gave me confidence when something was troubling traders in 2022:

The “b” indicates a buy in the Share Sleuth model portfolio, which Richard runs for interactive investor. He also owns the shares.

Traders have lost faith in Lululemon in 2024, and although one positive experience by no means guarantees another one, I find myself in a similar position to Garmin 2022:

But it wasn’t just the products that gave me confidence in Garmin, I also checked the company’s financial track record, and that is the next step for Lululemon:

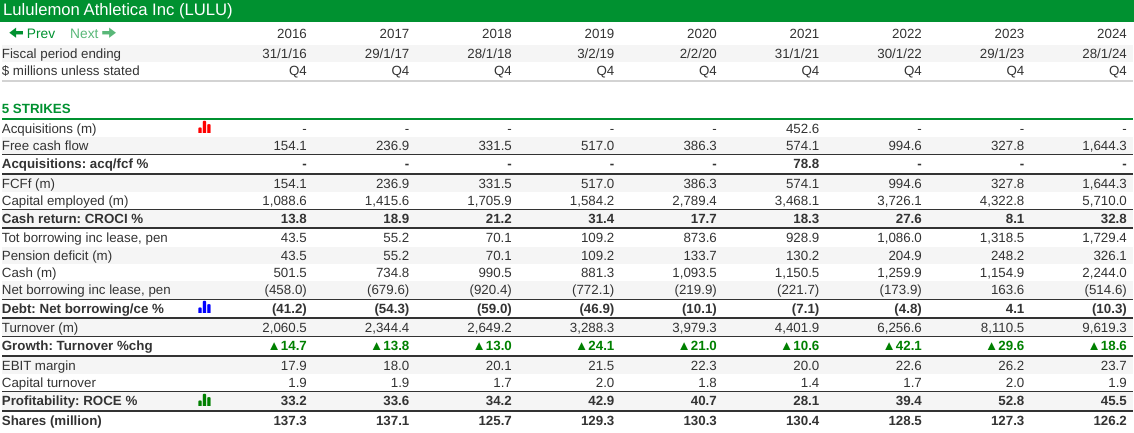

Source: 5 Strikes custom filter in SharePad

I’ll spare you the small print. There is nothing wrong with these numbers. Lululemon has grown mostly under its own steam (acquisition spend is a tiny proportion of free cash flow). The company has earned a positive Cash Return on Capital Invested every year, and only once has CROCI been less than 10%.

Net borrowing is negative. Lululemon has achieved double-digit revenue growth while earning impressive returns on capital and its share count has fallen over the years.

I awarded Lululemon just one strike, for directors’ holdings.

The executives own less than 0.2% of the company.

Lululemon has a $34 billion market capitalisation, which implies directors own shares worth about $68 million. That sounds like a lot. But it begs a question: How much of a really big company should directors own, to align their interests with shareholders?

Calvin McDonald, the company’s chief executive of six years earned about $1.3 million in salary in the year to January 2024 and more than $5 million in cash bonuses. He also earned £10 million in shares and share options. His total remuneration in the year to January 2024 was almost $16.5 million.

He owns about 86,000 shares, which are worth roughly $23 million. Is $23 million a lot of money at stake for a person who can earn $16.5 million in one year? I think I’d have to be one to know.

My home town, Cambridge, has one of the UK’s 20 Lululemon stores. The staff are cheery and in my experience universally American. I imagine it’s a similar setup to the nearby Apple and Tesla stores, although I have never been in them.

I wonder if they are cheery about their salaries. McDonald’s compensation is 845 times the pay of LULUs median employee in its largest markets (those that contribute more than 5% of revenue) – principally the US (52% of total employees), Canada (24%) and China (10%). The median employee is an “educator” (aka store associate), who earned $19,518 (after annualising its many part-time employee’s income) in 2024.

Pay at retailers is famously low, but I am surprised it is so low at a progressive company like Lululemon. A company that is mindful, driving positive change, and even repairs products for free.

I am still pondering this conundrum.

According to third-party benchmarking, Lululemon says employee engagement is higher than average for retail. On recruitment site Glassdoor, its rating is 4.2 out of 5, which is good for a retailer.

Lululemon says it rewards exceptional performance, and provides lots of benefits (including a lifetime discount). Glass half-full, most people are not particularly ambitious, many may be earning extra money while they are in education for example. They are happy to work for the company because they are fans, and it has a good vibe. The performance culture is sufficient to retain and promote the best of its 38,000 employees.

I haven’t yet peered into the future through the prism of Lululemon’s risk report and strategy. The company believes its “runway for growth” is substantial, but it is also increasingly international and that may be what traders are fretting about.

Gamma Communications

I am coming to Gamma cold. It is a layer in the ecosystem that supplies IT to businesses and the public sector. Specifically, it supplies communications systems: mashups of its own systems and partners like Cisco, Microsoft and Amazon. It powers call centres and internal communications systems.

Gamma grew up supplying SMEs (Small and Medium-sized enterprises) through resellers like Softcat, which was Gamma’s partner of the year in 2022. It is also trying to grow its business with larger enterprises, which it supplies directly rather than going through a middleman.

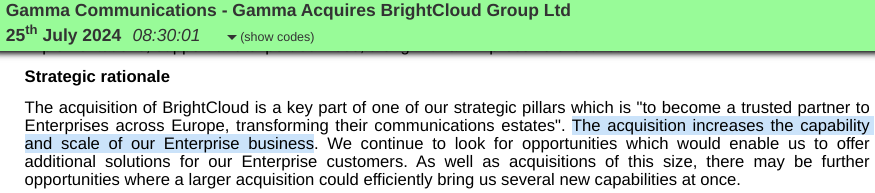

My “in” with Gamma is not familiarity. It might be acquisitions.

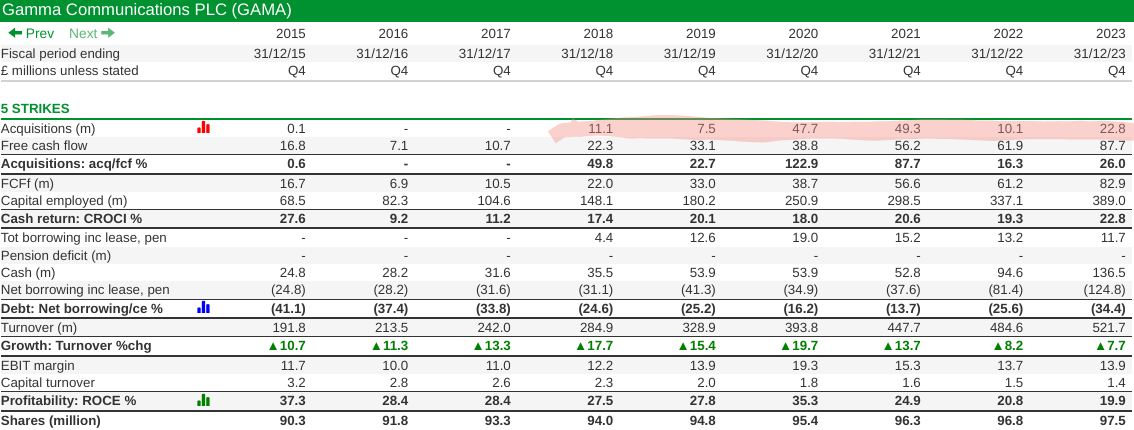

Gamma’s financial track record is unblemished, but it has become more dependent on acquisitions for growth, which has slowed somewhat.

The acquisition spending is not alarming. Since 2018 when they started, Gamma has only spent half of its free cash flow on acquisitions so it is living within its means. Perhaps slower growth, though, explains why Gamma is shifting its attention to larger companies.

And perhaps acquisitions are one of the ways it can do this. Gamma’s latest acquisition was last week, for example. Like most of the others, it was small, and therefore probably not too risky. It “increased the capability and scale” of Gamma’s Enterprise (large company) business.

Source: SharePad

MS International

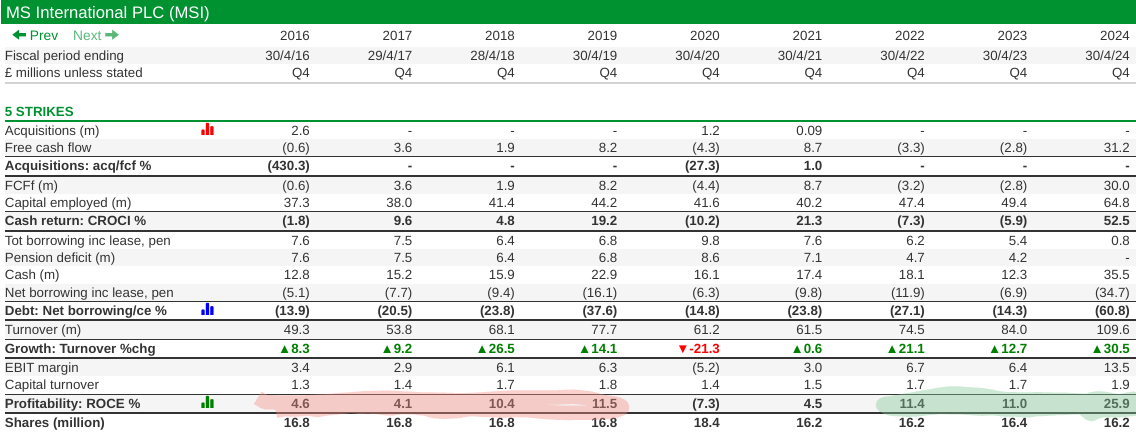

As usual, I have run out of time to cover all the businesses I’d like to, and as MSI scored strikes for CROCI and ROCE, arguably the most damning of strikes, I will just share the little I know.

We have a bit of history, MSI and I:

The “b”s indicate buys in the Share Sleuth model portfolio, which Richard runs for interactive investor. The “s” indicates the sale of the entire holding. Richard also owned MSI during the period.

MSI is four businesses that manufacture naval cannons for warships, petrol station forecourts, petrol station branding, and steel forgings.

I lost confidence in the company in January 2019 because the performance of its four divisions in terms of profit margins and growth was underwhelming and volatile.

Volatility, of course, works both ways. In 2024 MSI’s returns are anything but underwhelming. That’s because of deliveries to the Royal Navy, but the company’s cannons have also been chosen by the US and German navies, with deliveries starting in the current year.

Now that MSI has three major NATO customers and governments are serious about rearming, traders have backed the story with their money.

In the annual report for the year to March 2024, MSI describes the defence business as “the dominant division of growth potential”.

The sustainability of that growth would be my focus, were I to research MSI further.

~

Contact Richard Beddard by email: richard@beddard.net, Twitter: @RichardBeddard, web: beddard.net

Got some thoughts on this week’s article from Richard? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for a specific share.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.