Richard scratches the itch that is payments company PayPoint. Maybe his time would have been better spent investigating one of the other companies on his research list, Cranswick, say, or Castings, but he has no regrets.

The main focus of this article is PayPoint. There’s no snappy adjective I can use to describe Paypoint because the company is complicated. It’s a payments company, but that covers a wide gamut.

Part of me regrets choosing PayPoint, one of nine companies to achieve less than three strikes according to my 5 strikes system. It was an act of spontaneity.

5 Strikes

Every two weeks, I award strikes against the companies that have published annual reports and pass my Minimum Quality filter, and then put them in a table ordered by Annual Report date, most recent first.

Top of the list is Liontrust, an asset manager, but I don’t invest in other investors. I choose shares myself because I can do a better job than they can. Over the very long term I would expect, or at least hope, asset managers’ performance would reflect the performance of their investments (although I admit that might be naive).

PayPoint was simply the next company on the list.

| Name | TIDM | AR date | Strikes | #Strikes |

|---|---|---|---|---|

| Liontrust Asset Management | LIO | 5/7/24 | – Shares | 1 |

| PayPoint | PAY | 5/7/24 | – Holdings – Growth | 2 |

| Polar Capital | POLR | 5/7/24 | – Growth | 1 |

| Telecom plus | TEP | 5/7/24 | – CROCI – Debt – Growth | 3 |

| Severfield | SFR | 2/7/24 | – Growth – ROCE | 2 |

| Auto Trader | AUTO | 1/7/24 | 0 | |

| Cranswick | CWK | 1/7/24 | ? Holdings | 0 |

| Enwell Energy | ENW | 28/6/24 | – Holdings ? CROCI – Growth – ROCE | 4 |

| Record | REC | 28/6/24 | ? Holdings | 0 |

| Motorpoint | MOTR | 26/6/24 | – CROCI – Debt – Growth – ROCE | 4 |

| Triad Group | TRD | 26/6/24 | – CROCI – Growth – ROCE | 3 |

| Castings | CGS | 25/6/24 | – Growth – ROCE | 2 |

| Oxford Instruments | OXIG | 25/6/24 | – Holdings – Growth | 2 |

Notes: This article explains each strike, but the Minimum Quality filter has been modified. This is the new version.

I wouldn’t have considered Polar Capital, because it is an asset manager like Liontrust.

Scientific instrument maker Oxford Instruments (2 strikes) and online car market Auto Trader (0 strikes) are two of the 40 or so companies I review annually for interactive investor. I have just completed the review of Oxford Instruments and Auto Trader will follow soon.

But I could have looked further down the list and investigated Severfield (2 strikes). It claims to be the UK’s leading structural steel expert.

Also, sausage, pie, and bacon maker Cranswick (0 strikes), and had I wanted to investigate Record (0 strikes), Maynard’s article might have given me a head start.

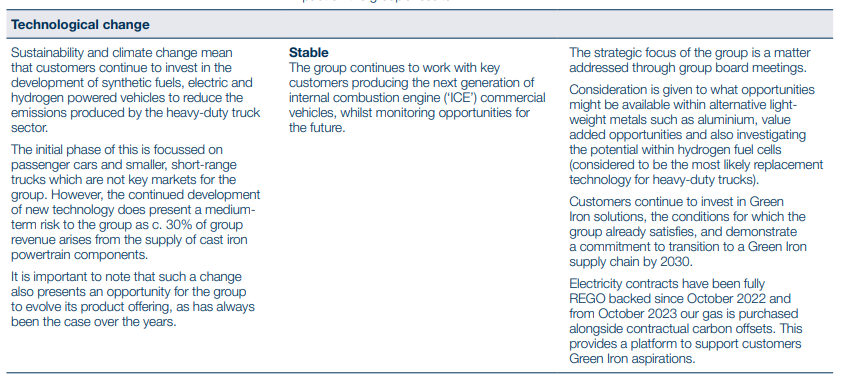

I could have looked into Castings (2 strikes). Castings is a manufacturer of iron components for trucks and tractors. It has supplied the same handful of largely European lorry makers since time immemorial. Its strategy is to supply more of, say, each Scania or Volvo truck.

My Castings trades in interactive investor’s model Share Sleuth portfolio

I got cold feet in 2020 because iron is heavy and everyone wants to make vehicles lighter. Castings might have to learn to manufacture a lighter metal. Developing new capabilities from scratch is difficult and time-consuming, so Castings would likely acquire a firm that already makes, say, aluminium parts, which would be risky too.

This risk did not occur to me in a flash of insight. It has been listed in Castings’ risk report for a number of years. I checked the annual report for 2024, and it is still there:

Source: Castings Annual Report 2024

I reconsidered my verdict on Castings in 2021, but despite warming to the company because it was facing up to the risk, I didn’t take it any further.

And I did not take the opportunity this time. Instead, I went down the rabbit hole that is PayPoint because the company often passes my filters for quality. It felt like an itch I needed to scratch.

I decided to let the numbers do the talking and see what they told me.

Paypoint (-Holdings -Growth)

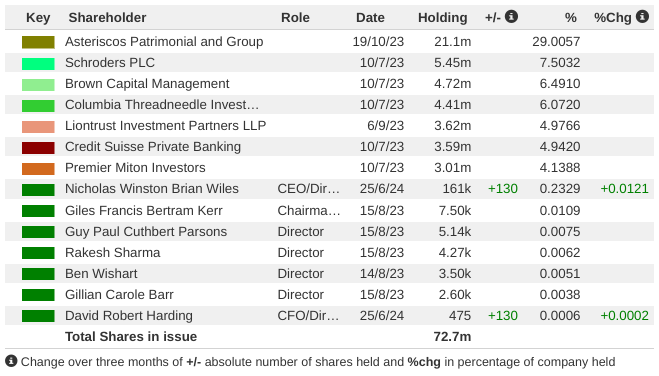

PayPoint received two strikes. The first is the directors’ relatively modest holdings. Chief executive Nick Wiles has been on the board since 2009, but he owns just over £1 million worth of shares.

£1 million may sound like a significant holding but in the context of Mr Wiles’ annual remuneration, over £1 million in 2023 and 2024, it is modest. Other board holdings are negligible.

The company has a major shareholder in the form of an investment company, Asteriscos Patrimonial. AP started building a stake when it acquired 9.5% of the shares in 2020. Today it owns 29% of the company, a controlling stake because it is enough to block a special resolution – a takeover for example.

Asteriscos Patrimonial must see something in PayPoint, but I prefer to make my own mind up.

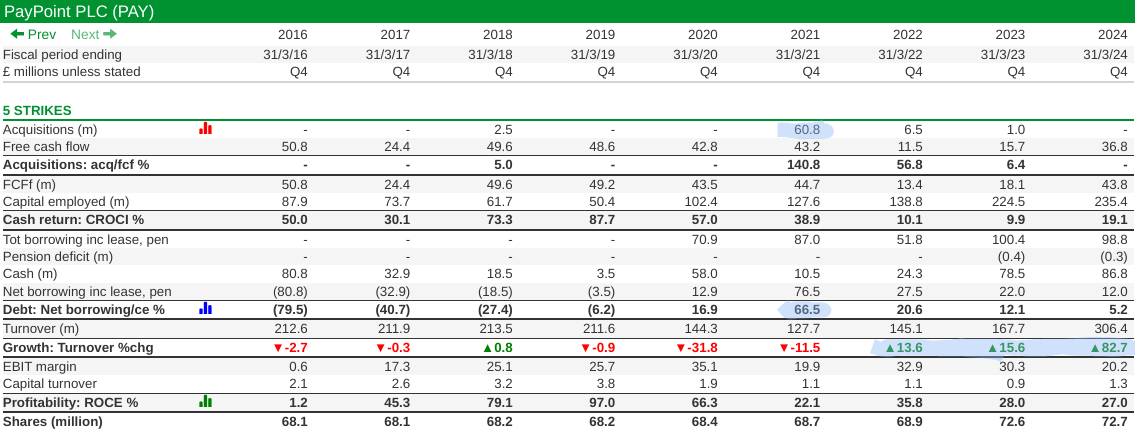

The second strike is for growth, which as you can see from the “Growth: turnover %chg” row in the table below was negative in the years leading up to 2022. It has been strongly positive since then:

Source “5 Strikes” custom table in SharePad

The likely source of the growth is acquisitions, as indicated in the first column in the table. In the financial year 2021, PayPoint spent over £61 million on acquisitions. In 2022, it spent £6.5 million, and in 2023, it spent £62 million (although that figure seems to be missing in SharePad, it is from the annual report).

These were the notable acquisitions:

| Date | Acquisition | Notes |

|---|---|---|

| Feb 2021 | Handepay and Merchant Rentals | Handepay: “Top 4” card payment business Merchant rentals: Card terminal leasing |

| April 2021 | RSM 2000 | Digital payments (direct debit processing, card, text payments), became part of PayPoint’s MultiPay |

| Feb 2023 | Appreciate | Gift cards, vouchers, prepay savings (Park Christmas club) |

They represent PayPoint’s diversification, a strategic necessity because prior to 2021 most of the company’s revenue and profit came from PayPoint terminals.

These devices are in tens of thousands of convenience stores, and although newer versions also work as EPoS (Electronic Point of Sales) systems (modern tills, the thing you tap or put your card in), PayPoint’s original purpose was to collect cash payments for utility and mobile phone companies.

This business is very profitable but in decline because we are using less and less cash. The acquisitions beefed up PayPoint’s capabilities in other areas, principally its ability to take card payments (Handepay), facilitate online payments (RSM 2000) and vouchers and gift cards (Appreciate, now Love2shop), which distributes vouchers and gift cards to businesses (to reward employees) and Christmas savers.

At a serious cost to my well-being, I tried to define PayPoint’s many sources of revenue:

| Revenue stream | Net revenue 2024 £m |

|---|---|

| Service fees* | 19.7 |

| Card payments** | 32.7 |

| ATMs and Counter Cash* | 8.8 |

| Other shopping** | 3.2 |

| E-commerce (Collect+) | 11.8 |

| Cash – bill payments & top ups* | 27.8 |

| Digital* | 13.8 |

| Cash through to digital* | 6.8 |

| Other payments and banking | 5.1 |

| Love2shop** | 51.3 |

| Total | 181 |

| *At risk from decline in cash? | 63.1 |

| **Beefed up by acquisition since 2021 | 128.8 |

To summarise, PayPoint rents PayPoint terminals (Service fees), card readers, and ATMs to retailers and also collects a fee for transactions (which it shares with the retailer). The rental and transaction revenue is rolled up together in some categories in the table, like Card payments and ATMs and Counter Cash, but listed separately in others. Cash through to digital is fees earned when a member of the public uses cash to buy vouchers to use online. This is done via a PayPoint terminal.

PayPoint also collects a fee online when people transact through MultiPay (Digital).

Accounting for vouchers and gift cards (Love2shop) is complicated. PayPoint sometimes earns revenue when it resells them and sometimes earns a commission when they are used or expire. It also earns interest on customer deposits in Park Christmas Savings, a savings scheme.

I reckon about 35% of the business in revenue terms is the cash-based legacy part, which is contracting.

71% of the business has been beefed up by acquisition since 2021. It is not all acquired revenue. PayPoint had a small card payment business before 2021, from which it earned £8.7 million in revenue (compared to £32.7 million). Substantially it is acquired.

This leads me to conclude that PayPoint’s stable-looking track record implied by only two strikes is misleading. It belies big changes within the company.

The question is whether the new businesses are of similar quality to the legacy cash payments business. I fear that PayPoint occupied a particularly profitable niche, but that will become less profitable over time. Meanwhile, it may have invested in lower-quality businesses. Judging by my bank statements, card payments is a competitive industry. Instinctively I am dubious about Love2shop.

Confirming these notions would be tricky.

Not only does it mean offsetting the impact of a declining revenue stream against, maybe, a growing one, but the company does not divulge the profitability of these businesses.

And while it has a long track record, its track record in managing the parts of the business that it intends to grow is much shorter.

I regret nothing

I don’t really regret choosing PayPoint. Not all research can lead to investment. We learn from the rabbit holes we crawl down.

However, I have put a “C” in the number of strikes column for the PayPoint entry in my 5 strikes table so it says 2C. “C” is for complications, change, and confusion. It will remind me not to crawl down the rabbit hole again for a while.

In future, I might also order the table by number of strikes rather than data, so that if I am lazy again and tempted to pick the first interesting company I see, at least I will pick a company with the least strikes!

~

Contact Richard Beddard by email: richard@beddard.net, Twitter: @RichardBeddard, web: beddard.net

Got some thoughts on this week’s article from Richard? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for a specific share.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.