A look at the decline of the London Stock Exchange, versus the remarkable performance of the LSEG share price. Companies covered: BGEO, RFX, AGFX

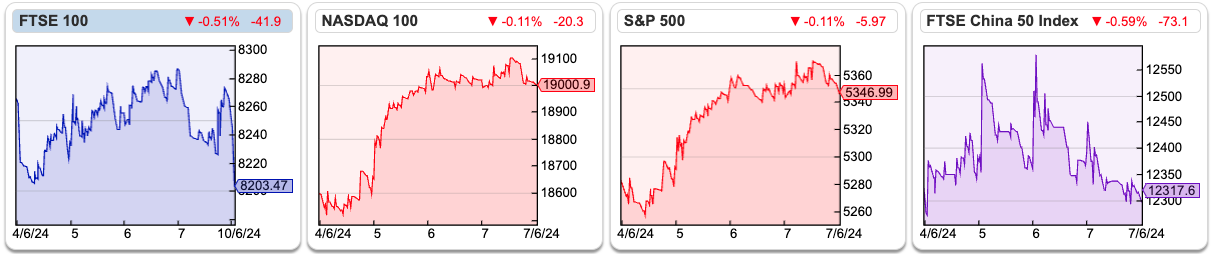

The FTSE 100 fell -0.8% in the last 5 days to 8,203. The Nasdaq100 was up +2.5% and the S&P500 +1.3%. The Nasdaq is the second-best performing major index +13 YTD, behind only Japan’s Nikkei +16%. The worst performing indices are Brazil’s Bovespa -8% YTD, followed by the Shanghai Composite +2.5% YTD. Copper (HG-MT) has fallen -11% from its peak in mid-May, but is still up +15% YTD.

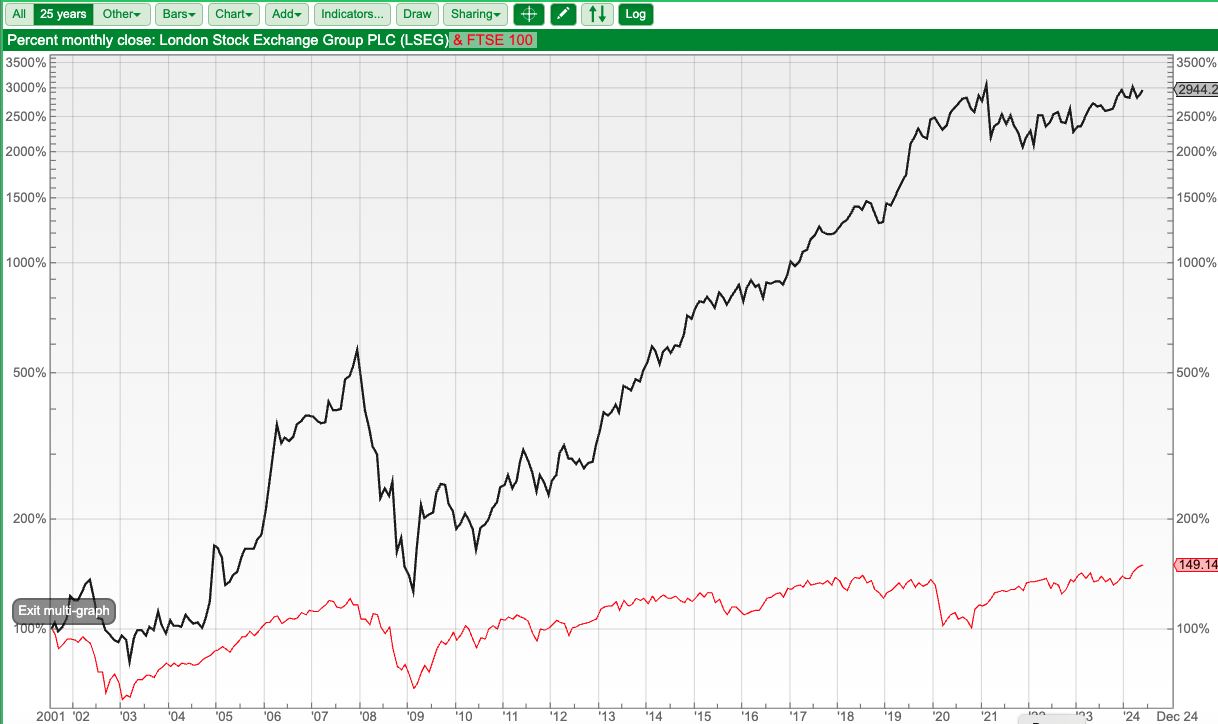

One of the fun things I enjoy about using Sharepad is the flexibility of the ‘multi-graph’ feature. Adding shares and indices to the same portfolio means you compare how a company’s share has performed relative to an index. For instance, this remarkable graph (below) shows that since 2001 the FTSE 100 is up circa +50%, while the LSEG share price is up by almost 30x since it listed in July 2001.

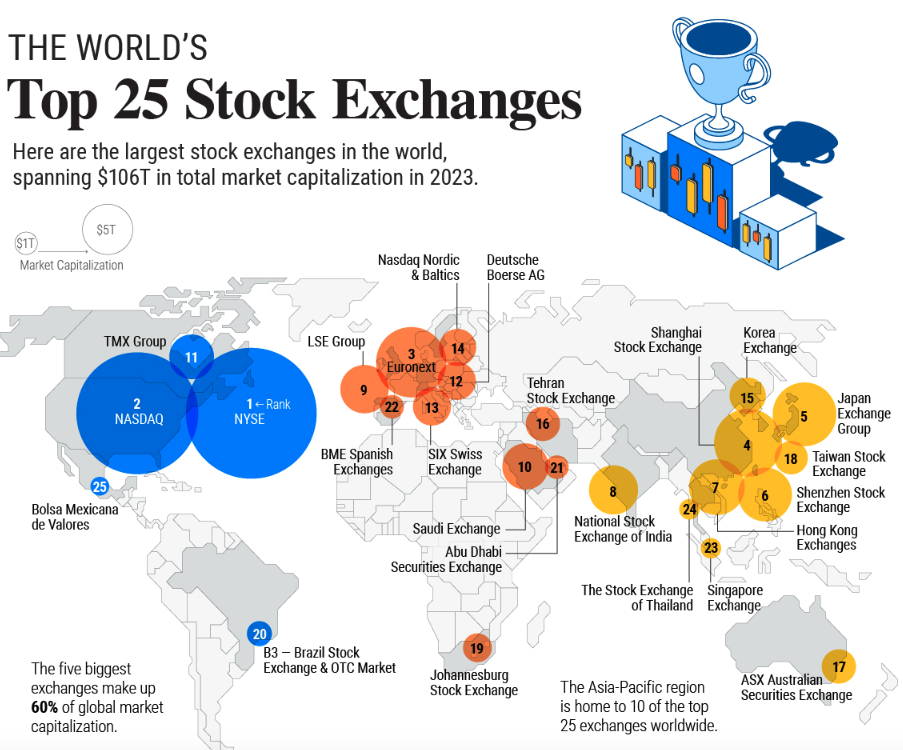

It seems bizarre that the LSEG share price has done so well when the LSE has shrunk to be the ninth largest stock market in the world by market capitalisation. That places London’s market cap only just ahead of Saudi Arabia in 10th place, according to the slide below from The Visual Capitalist mapping the market capitalisation of various stock markets around the world.

London has also seen a significant long-term decline. In 1899 the UK was the largest stock market in the world and two-thirds larger than the USA, according to an old Credit Suisse Global Returns Yearbook that I still have on my hard drive. That compares to the Nasdaq and the NYSE which are currently just under half the entire market cap of global equity markets ($110 trillion) up from 15% in 1899.

Although it’s nice to receive bids for shares we hold, I wonder if we will come to regret so many companies leaving the index at “fire sale valuations”. It seems to me a significant amount of the returns reported by Private Equity are achieved by low-ball bids for companies that have temporarily hit a sticky wicket, then as conditions improve selling the same companies back to public markets at a multiple of the price paid. This activity isn’t creating any value, it is merely a wealth transfer from shareholders in public companies and index trackers (you and me) to limited partners in Private Equity (wealthy individuals and institutions).

We should also lay some of the blame for the current situation at the feet of professional fund managers who have agreed to sell out of quality companies in the past and bought into duff IPO’s with the proceeds. I think this is one area where amateur investors have shown better judgment than the professionals. Still, things seem to be improving, as this fun analysis of WE Soda’s failed IPO suggests. I hope Raspberry Pi also signals an improving trend.

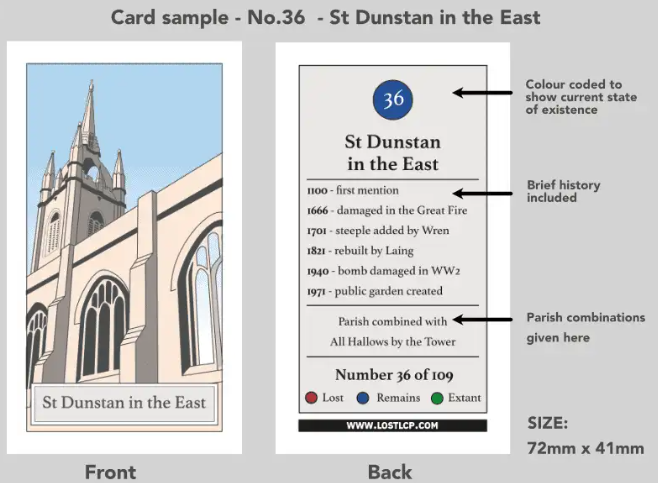

Something else that the City of London has lost is churches. In 1600 there were 110 churches in the square mile of the City of London, many were lost in the Great Fire of 1666 and others have been lost since (for instance during the Blitz). Today there are only 40 left. A friend of mine has taken to preserving their memory and he has published a series of collectable cards with illustrations, plus a book with maps of each parish. Below is a sample from St Dunstan in the East, the idea is that you hunt out the churches amongst all the newly built glass towers containing bankers, stockbrokers, PRs and lawyers and collect the cards.

I recommend checking out his lost churches website, and if you are in the City with time between meetings, this could be a good way to spend an hour or two.

This week I look at Bank of Georgia’s trading update and the political developments in the country. Plus pawnbroker and jewellery retailer, Ramsdens, and a follow-up comment on Argentex.

Bank of Georgia Q1 March Trading Update

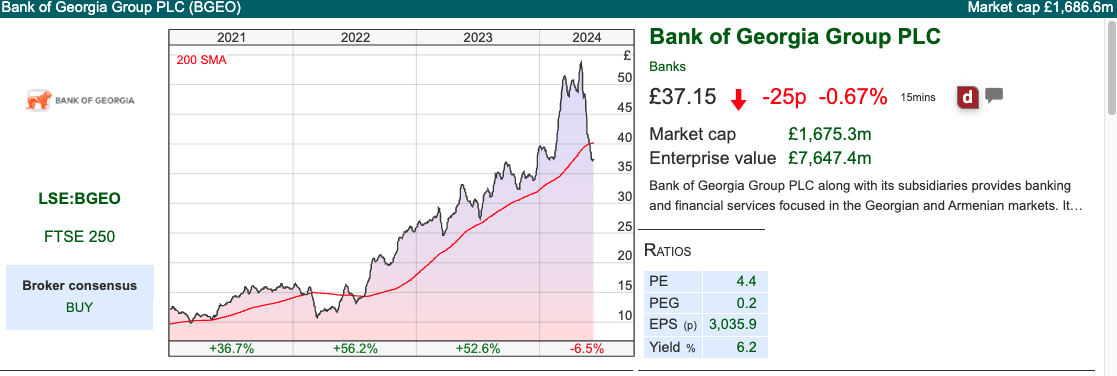

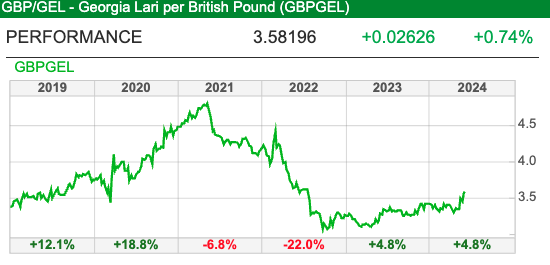

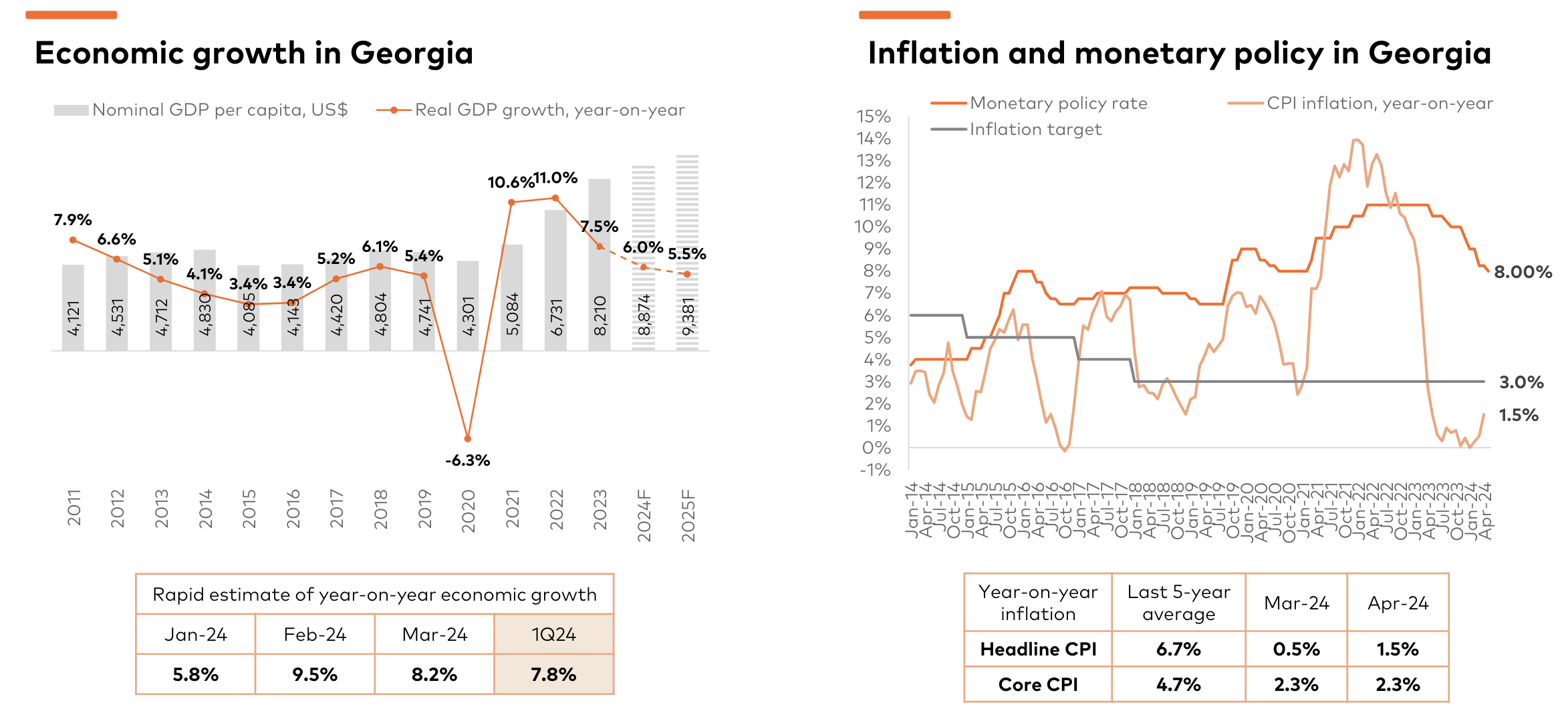

This Tbilisi headquartered bank reported strong results, with Q1 March revenue up +14% to GEL 644m (£186m) and PBT up +23% to GEL 433m (£125m). The Net Interest Margin improved slightly to 6.4% in the quarter as the helpful inflation outlook enabled the National Bank of Georgia (NBG) to cut its policy rate by a total of 1.5% to 8.0% since January 2024, which follows a 1.5% reduction in 2023. Sharepad shows that the Georgian Lari has declined (ie you receive more Laris for your pound) by around 5% since the start of the year.

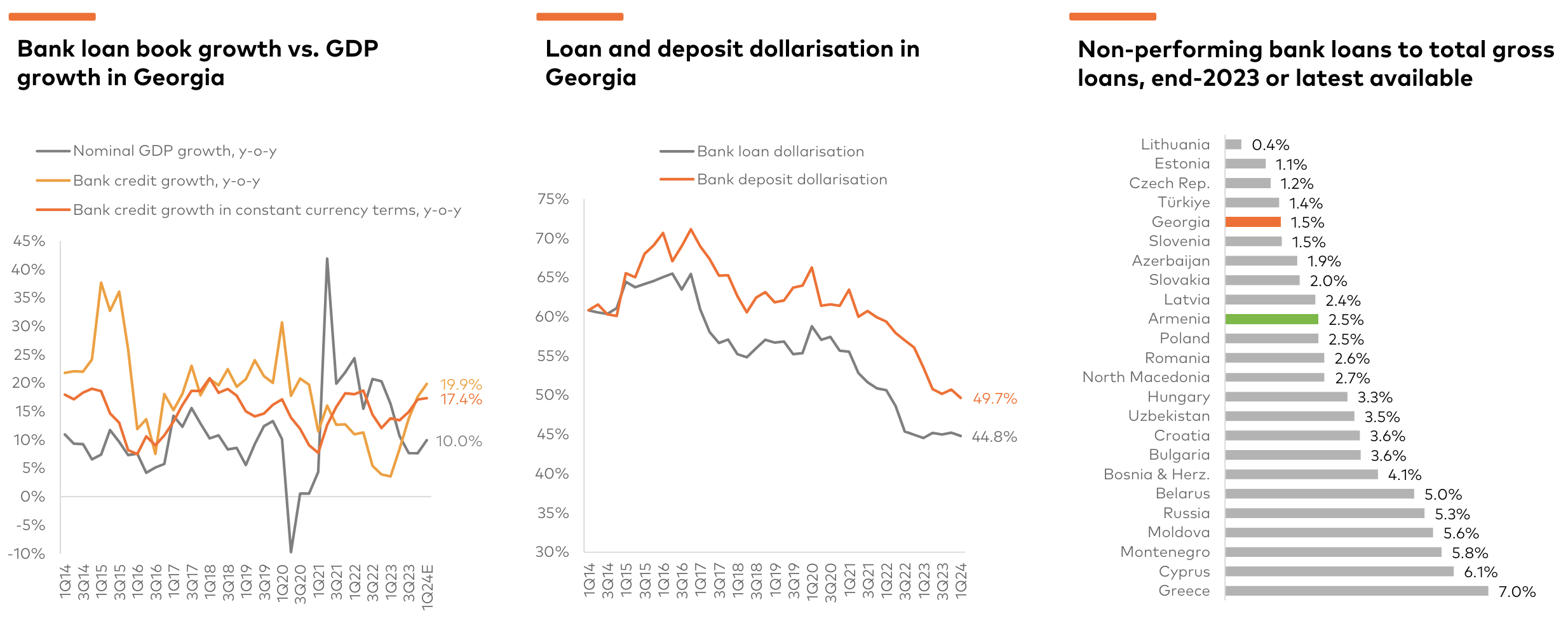

BGEO’s RoE was a remarkable 28%, as profitability and growth have been helped by a strong Georgian economy which has benefited from Russians fleeing their own country. The bank’s medium-term target is for RoE of 20%, loan book growth of +15% and dividend payout of between 30-50%.

In February, management announced that they were buying Ameribank, an Armenian bank with a top 3 market share. The cost of the deal: $306m in cash (equating to 0.65x price to book, or less than 3x PER) was paid for out of capital, without the Georgian bank having to issue new shares. As the bank was bought for a discount to book value, BGEO has recorded GEL 686m (£198m) of negative goodwill on the balance sheet.

In February, management announced that they were buying Ameribank, an Armenian bank with a top 3 market share. The cost of the deal: $306m in cash (equating to 0.65x price to book, or less than 3x PER) was paid for out of capital, without the Georgian bank having to issue new shares. As the bank was bought for a discount to book value, BGEO has recorded GEL 686m (£198m) of negative goodwill on the balance sheet.

So the bank’s results and the strategy seems to be going well, the share price though tells a different story. Since the 1st of May, the shares are down -30% and have fallen through its 200-day Simple Moving Average. That is likely caused by political noise around a Foreign Agents’ Bill, which the ruling Georgian Dream party has voted through parliament, despite street protests. There’s an in-depth summary in this FT article. The EU has told Georgia that if the law is passed, they have no hope of joining the EU and European officials joined in the protests outside parliament in Tbilisi. 80% of the Georgian population support joining the EU and I have heard from friends in Berlin that even young Russians fleeing Putin’s regime have the feeling that they are not welcome in the country. I’ve also spoken to others who believe that Bidzina Ivanishvili, head of the Georgian Dream party, is pro-Georgia, he just believes that the country should not antagonise its larger, violent neighbour to the North. There haven’t been any opinion polls published since the FAB was passed by the government, but it seems likely that the Georgian Dream party have lost support. On the conference call, management were asked about the possibility of sanctions from the US, UK and EU against some of the bank’s customers who have been obstructive to democracy. They believe this would have an impact, but would easily be absorbed given BGEO’s high profitability.

Valuation: The shares are trading on a PER of 3.2x FY Dec 2025F and less than 3x the following year’s forecast earnings. On a price/sales basis, they trade on 1.9x and Price/Tangible book 0.9x. Cavendish are forecasting a dividend of 8.4 Lari this year, and 9.2 Lari FY Dec 2025F, implying a current yield of 6.1% and 7.1% next year. In addition to the dividend, management are continuing to buyback shares; on the 24th May they had GEL 53m outstanding to be completed this year.

To put it simply, the BGEO valuation seems to be discounting some sort of Government expropriation or other instability. That said, in August 2008 Russian tanks rolled over the border, while the rest of the world was seeing the collapse of the global banking system and yet the bank traded its way through the crisis, without a taxpayer bail-out.

Opinion: BGEO is performing well, though I can understand some investors feeling nervous about the country shifting its alignment towards Russia and away from the EU. For instance, the economy may suffer if tourist visits decline from 2023 levels, in March the Ministry of Economy and Sustainable Development was predicting that there would be 6.8m international visitors spending $4.5bn USD in revenues from tourism in 2024.

The next political event is the elections in October, where protestors will have the opportunity to show their displeasure at the ballot box, assuming that fair elections are allowed to take place. My feeling is that the grassroots support for an open, progressive society with a well-functioning economy will be too strong for any Russian meddling to de-rail, so I continue to hold.

Ramsdens H1 March

I looked at H&T Group in March this year, mentioning that pawnbrokers may benefit from the rising gold price, +14% YTD. Ramsdens which also does pawnbroking loans, jewellery retailing and FX, makes an interesting contrast and underlines the importance of looking at divisional reporting trends.

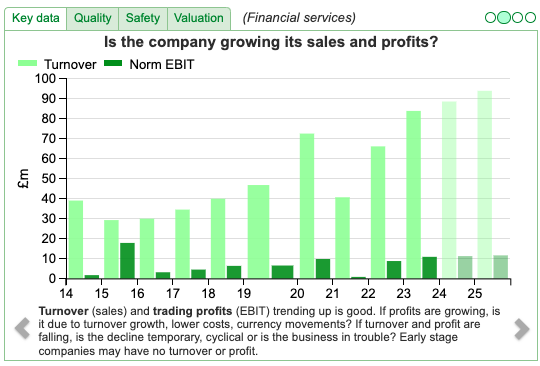

Ramsdens reported group revenue growth +12% to £44m H1 Mar 2024, and statutory PBT +8% to £4.0m. They reiterated FY expectations of profitable growth (Sharepad shows forecast revenues of +6% to £89m, but flat EPS of 24p).

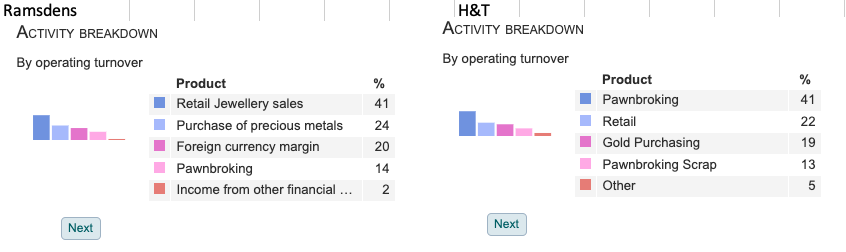

However, it’s worth comparing Sharepad’s ‘Activity Breakdown’ which shows that RFX’s pawnbroking is around half the size of HAT’s core pawnbroking division. Instead, Ramsden’s relies more on Jewellery sales (41% of turnover at the FY stage) which has been harmed by falling sales in premium watches.

Watches of Switzerland warned about this negative trend in January and saw its shares fall more than -30% on the day. RFX reported sales growth of just +1% in their Retail Jewellery division, with falling premium watch sales offset by increased sales in second-hand items.

The second largest division, Purchase of Precious Metals, buys “unwanted” valuables (more likely customers need to sell to raise cash in a hurry). This reported H1 revenue +35% to £14m and gross profit +25% to £5m, as the cost of living pressure on consumers has helped the business. As the price of gold has risen, they have smelted an increasing amount of their stock position.

Valuation: The shares are trading on a PER of 12x Mar 2024F and 11x Mar 2025F. At 5.4% Ramsden’s has a higher dividend yield and superior RoCE (17.4% v 13.3%) to HAT. The difference is that HAT has almost double-digit growth forecast in the future, twice the level that Ramsden’s is forecast to grow at.

Opinion: Regulators are keen that vulnerable customers are not exploited in this sector, so I’d suggest that at 17.4% RFX’s RoCE is near the top end of its range. The investment case looks solid, and their precious metals business seems to be benefiting from the rising price of gold, even as the premium jewellery sales are struggling. I question if they should bother selling new jewellery items at all. The rest of the group (pawnbroking, second-hand jewellery, purchasing precious metals) does seem to fit together well and has been showing good performance at a time when other consumer-focused stocks are under pressure. The valuation looks attractive, but could be signalling that cost of living pressures on households will lessen in the next 18 months, so customers may have less need for the services RFX offers.

Argentex Conference Call H1 March

I commented on AGFX a month ago that it was a pity that the new management have not scheduled any presentations to amateur investors. When a share price has fallen over -60% YTD, with little explanation from management about what has gone wrong, and what they can do to fix performance, it doesn’t give investors much confidence in the future strategy. Despite having net cash of £18m at the end of December, in May management announced that they would raise around £3m of capital at 45p per share in a placing, versus a current share price of 35p.

I’m happy to say that AGFX have now scheduled a call on InvestorMeetCompany on Tuesday the 18th of June, at 11am British Summer Time. You can register for the meeting here. I don’t want to be overly critical of the current management, because they have inherited a difficult situation. However, as an investor, I would like a clear explanation of why the previous investment case, particularly revenue growth, has disappointed.

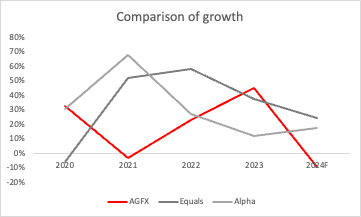

The chart shows that AGFX’s (in red) top-line growth has been around half the level of its larger competitors Equals and Alpha Group (in grey). From 2019 to 2024F growth has compounded at 15%, versus above 30% for the two larger FX trading businesses. That slower pace is despite management investing in new hires and starting from a lower base. One explanation is that previous management simply invested in the wrong areas, but I’m keen to hear what story new management have to tell.

Notes

Bruce owns shares in AGFX and BGEO

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Bi-Weekly Market Commentary | 11/06/2024 | BGEO, RFX, AGFX | Things we lost in the fire (sale)

A look at the decline of the London Stock Exchange, versus the remarkable performance of the LSEG share price. Companies covered: BGEO, RFX, AGFX

The FTSE 100 fell -0.8% in the last 5 days to 8,203. The Nasdaq100 was up +2.5% and the S&P500 +1.3%. The Nasdaq is the second-best performing major index +13 YTD, behind only Japan’s Nikkei +16%. The worst performing indices are Brazil’s Bovespa -8% YTD, followed by the Shanghai Composite +2.5% YTD. Copper (HG-MT) has fallen -11% from its peak in mid-May, but is still up +15% YTD.

One of the fun things I enjoy about using Sharepad is the flexibility of the ‘multi-graph’ feature. Adding shares and indices to the same portfolio means you compare how a company’s share has performed relative to an index. For instance, this remarkable graph (below) shows that since 2001 the FTSE 100 is up circa +50%, while the LSEG share price is up by almost 30x since it listed in July 2001.

It seems bizarre that the LSEG share price has done so well when the LSE has shrunk to be the ninth largest stock market in the world by market capitalisation. That places London’s market cap only just ahead of Saudi Arabia in 10th place, according to the slide below from The Visual Capitalist mapping the market capitalisation of various stock markets around the world.

London has also seen a significant long-term decline. In 1899 the UK was the largest stock market in the world and two-thirds larger than the USA, according to an old Credit Suisse Global Returns Yearbook that I still have on my hard drive. That compares to the Nasdaq and the NYSE which are currently just under half the entire market cap of global equity markets ($110 trillion) up from 15% in 1899.

Although it’s nice to receive bids for shares we hold, I wonder if we will come to regret so many companies leaving the index at “fire sale valuations”. It seems to me a significant amount of the returns reported by Private Equity are achieved by low-ball bids for companies that have temporarily hit a sticky wicket, then as conditions improve selling the same companies back to public markets at a multiple of the price paid. This activity isn’t creating any value, it is merely a wealth transfer from shareholders in public companies and index trackers (you and me) to limited partners in Private Equity (wealthy individuals and institutions).

We should also lay some of the blame for the current situation at the feet of professional fund managers who have agreed to sell out of quality companies in the past and bought into duff IPO’s with the proceeds. I think this is one area where amateur investors have shown better judgment than the professionals. Still, things seem to be improving, as this fun analysis of WE Soda’s failed IPO suggests. I hope Raspberry Pi also signals an improving trend.

Something else that the City of London has lost is churches. In 1600 there were 110 churches in the square mile of the City of London, many were lost in the Great Fire of 1666 and others have been lost since (for instance during the Blitz). Today there are only 40 left. A friend of mine has taken to preserving their memory and he has published a series of collectable cards with illustrations, plus a book with maps of each parish. Below is a sample from St Dunstan in the East, the idea is that you hunt out the churches amongst all the newly built glass towers containing bankers, stockbrokers, PRs and lawyers and collect the cards.

I recommend checking out his lost churches website, and if you are in the City with time between meetings, this could be a good way to spend an hour or two.

This week I look at Bank of Georgia’s trading update and the political developments in the country. Plus pawnbroker and jewellery retailer, Ramsdens, and a follow-up comment on Argentex.

Bank of Georgia Q1 March Trading Update

This Tbilisi headquartered bank reported strong results, with Q1 March revenue up +14% to GEL 644m (£186m) and PBT up +23% to GEL 433m (£125m). The Net Interest Margin improved slightly to 6.4% in the quarter as the helpful inflation outlook enabled the National Bank of Georgia (NBG) to cut its policy rate by a total of 1.5% to 8.0% since January 2024, which follows a 1.5% reduction in 2023. Sharepad shows that the Georgian Lari has declined (ie you receive more Laris for your pound) by around 5% since the start of the year.

BGEO’s RoE was a remarkable 28%, as profitability and growth have been helped by a strong Georgian economy which has benefited from Russians fleeing their own country. The bank’s medium-term target is for RoE of 20%, loan book growth of +15% and dividend payout of between 30-50%.

So the bank’s results and the strategy seems to be going well, the share price though tells a different story. Since the 1st of May, the shares are down -30% and have fallen through its 200-day Simple Moving Average. That is likely caused by political noise around a Foreign Agents’ Bill, which the ruling Georgian Dream party has voted through parliament, despite street protests. There’s an in-depth summary in this FT article. The EU has told Georgia that if the law is passed, they have no hope of joining the EU and European officials joined in the protests outside parliament in Tbilisi. 80% of the Georgian population support joining the EU and I have heard from friends in Berlin that even young Russians fleeing Putin’s regime have the feeling that they are not welcome in the country. I’ve also spoken to others who believe that Bidzina Ivanishvili, head of the Georgian Dream party, is pro-Georgia, he just believes that the country should not antagonise its larger, violent neighbour to the North. There haven’t been any opinion polls published since the FAB was passed by the government, but it seems likely that the Georgian Dream party have lost support. On the conference call, management were asked about the possibility of sanctions from the US, UK and EU against some of the bank’s customers who have been obstructive to democracy. They believe this would have an impact, but would easily be absorbed given BGEO’s high profitability.

Valuation: The shares are trading on a PER of 3.2x FY Dec 2025F and less than 3x the following year’s forecast earnings. On a price/sales basis, they trade on 1.9x and Price/Tangible book 0.9x. Cavendish are forecasting a dividend of 8.4 Lari this year, and 9.2 Lari FY Dec 2025F, implying a current yield of 6.1% and 7.1% next year. In addition to the dividend, management are continuing to buyback shares; on the 24th May they had GEL 53m outstanding to be completed this year.

To put it simply, the BGEO valuation seems to be discounting some sort of Government expropriation or other instability. That said, in August 2008 Russian tanks rolled over the border, while the rest of the world was seeing the collapse of the global banking system and yet the bank traded its way through the crisis, without a taxpayer bail-out.

Opinion: BGEO is performing well, though I can understand some investors feeling nervous about the country shifting its alignment towards Russia and away from the EU. For instance, the economy may suffer if tourist visits decline from 2023 levels, in March the Ministry of Economy and Sustainable Development was predicting that there would be 6.8m international visitors spending $4.5bn USD in revenues from tourism in 2024.

The next political event is the elections in October, where protestors will have the opportunity to show their displeasure at the ballot box, assuming that fair elections are allowed to take place. My feeling is that the grassroots support for an open, progressive society with a well-functioning economy will be too strong for any Russian meddling to de-rail, so I continue to hold.

Ramsdens H1 March

I looked at H&T Group in March this year, mentioning that pawnbrokers may benefit from the rising gold price, +14% YTD. Ramsdens which also does pawnbroking loans, jewellery retailing and FX, makes an interesting contrast and underlines the importance of looking at divisional reporting trends.

Ramsdens reported group revenue growth +12% to £44m H1 Mar 2024, and statutory PBT +8% to £4.0m. They reiterated FY expectations of profitable growth (Sharepad shows forecast revenues of +6% to £89m, but flat EPS of 24p).

However, it’s worth comparing Sharepad’s ‘Activity Breakdown’ which shows that RFX’s pawnbroking is around half the size of HAT’s core pawnbroking division. Instead, Ramsden’s relies more on Jewellery sales (41% of turnover at the FY stage) which has been harmed by falling sales in premium watches.

Watches of Switzerland warned about this negative trend in January and saw its shares fall more than -30% on the day. RFX reported sales growth of just +1% in their Retail Jewellery division, with falling premium watch sales offset by increased sales in second-hand items.

The second largest division, Purchase of Precious Metals, buys “unwanted” valuables (more likely customers need to sell to raise cash in a hurry). This reported H1 revenue +35% to £14m and gross profit +25% to £5m, as the cost of living pressure on consumers has helped the business. As the price of gold has risen, they have smelted an increasing amount of their stock position.

Valuation: The shares are trading on a PER of 12x Mar 2024F and 11x Mar 2025F. At 5.4% Ramsden’s has a higher dividend yield and superior RoCE (17.4% v 13.3%) to HAT. The difference is that HAT has almost double-digit growth forecast in the future, twice the level that Ramsden’s is forecast to grow at.

Opinion: Regulators are keen that vulnerable customers are not exploited in this sector, so I’d suggest that at 17.4% RFX’s RoCE is near the top end of its range. The investment case looks solid, and their precious metals business seems to be benefiting from the rising price of gold, even as the premium jewellery sales are struggling. I question if they should bother selling new jewellery items at all. The rest of the group (pawnbroking, second-hand jewellery, purchasing precious metals) does seem to fit together well and has been showing good performance at a time when other consumer-focused stocks are under pressure. The valuation looks attractive, but could be signalling that cost of living pressures on households will lessen in the next 18 months, so customers may have less need for the services RFX offers.

Argentex Conference Call H1 March

I commented on AGFX a month ago that it was a pity that the new management have not scheduled any presentations to amateur investors. When a share price has fallen over -60% YTD, with little explanation from management about what has gone wrong, and what they can do to fix performance, it doesn’t give investors much confidence in the future strategy. Despite having net cash of £18m at the end of December, in May management announced that they would raise around £3m of capital at 45p per share in a placing, versus a current share price of 35p.

I’m happy to say that AGFX have now scheduled a call on InvestorMeetCompany on Tuesday the 18th of June, at 11am British Summer Time. You can register for the meeting here. I don’t want to be overly critical of the current management, because they have inherited a difficult situation. However, as an investor, I would like a clear explanation of why the previous investment case, particularly revenue growth, has disappointed.

The chart shows that AGFX’s (in red) top-line growth has been around half the level of its larger competitors Equals and Alpha Group (in grey). From 2019 to 2024F growth has compounded at 15%, versus above 30% for the two larger FX trading businesses. That slower pace is despite management investing in new hires and starting from a lower base. One explanation is that previous management simply invested in the wrong areas, but I’m keen to hear what story new management have to tell.

Notes

Bruce owns shares in AGFX and BGEO

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.