A trend following signal for AIM is close to turning positive, so we could see confidence return in smaller UK stocks. Companies covered: ENSI, ADF and RMV.

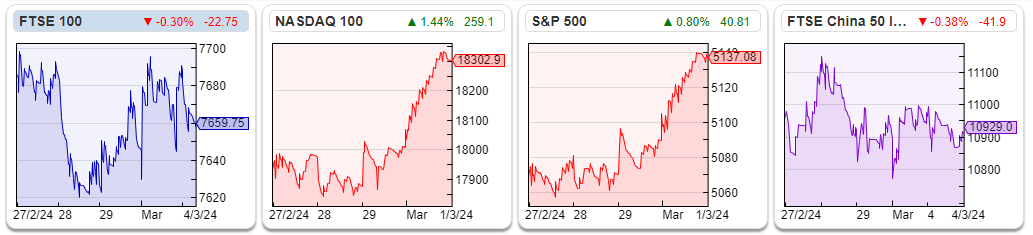

The FTSE 100 was down -0.4% to 7,659 last week. The Nasdaq100 and S&P500 were up +2.0 and +1.0% respectively. In the US the bull market continues, with Webull’s $7bn listing via the SPAC structure, while Reddit is targeting a value of $6.5bn, though that is down from a $10bn valuation in a private funding round in 2021. Reddit has cumulative losses of over $700m, including a net loss of $90.8mn in 2023, according to the FT. It warned in its prospectus that it “may never achieve profitability”.

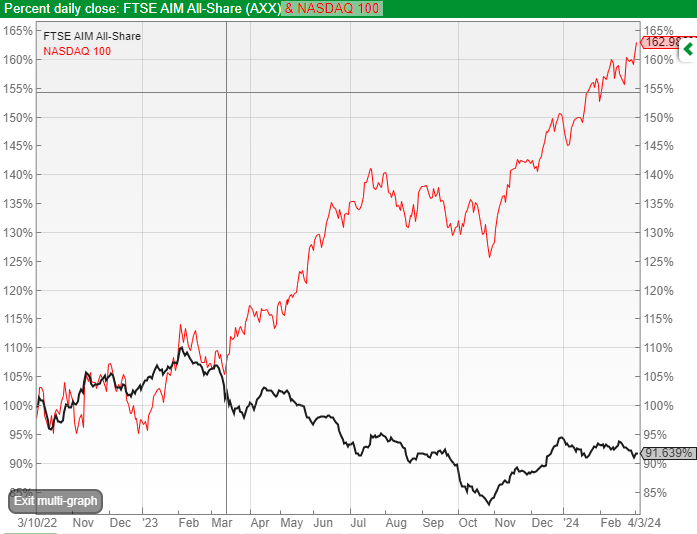

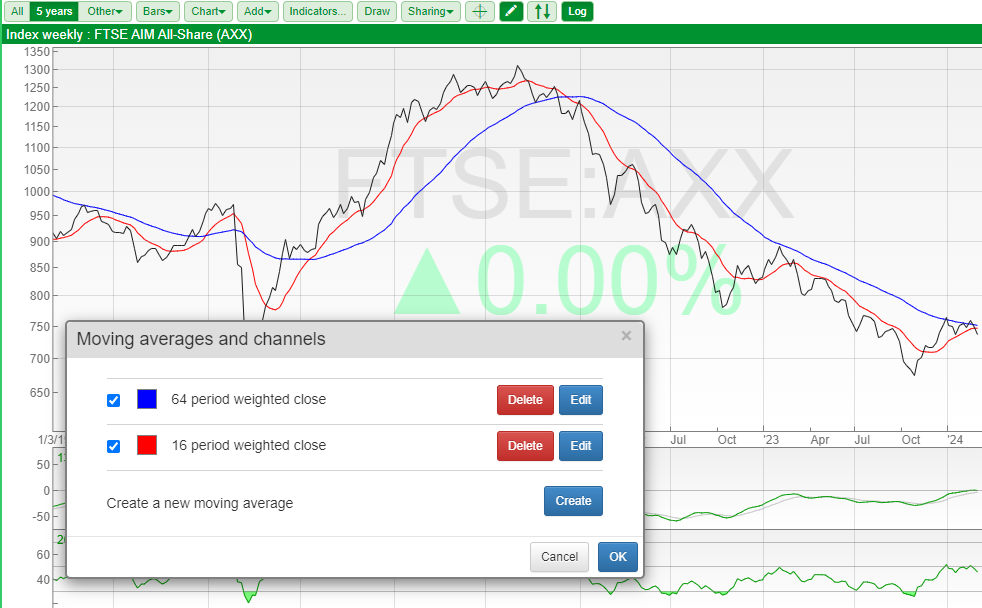

AIM has endured a much more difficult 18 months than Nasdaq, so we are certainly not in a bull market in the UK. However, the UK small cap index is within touching distance of its 64/16 day moving average cross-over.

I took that particular 64/16 signal from hedge fund manager Andreas Clenow, who has published a couple of books. The idea is that if we do see the moving average break through decisively, that should give readers confidence that the worst of the bear market in AIM shares is over. In further support, we tend to see in election years (both the US and UK) Central Banks let markets run a little hot, which should also be helpful.

Clenow suggests that all trend-following strategies attempt to do the same thing, and not to get hung up on the perfect entry and exit rules. If you don’t like the 64/16 day cross-over in Sharepad you just click on the “Add” tab and select your own time periods.

However, the most common amateur mistake is to spend all your time tweaking entry and exit rules and not enough concentrating on position sizing, he says. In addition, trend-following strategies work best when they are diversified across markets and asset classes. You can find his core trading rules here.

Last week we saw a bid for Direct Line and a bidding war emerge for Wincanton. Wincanton had already received a bid from CMA CGM, but the logistics firm received a rival offer from New York listed GXO. On Monday, we saw an approach to Renalytix AI, which is up 7x since the beginning of February. Management do warn in Monday’s RNS that they only have existing cash resources to last through April this year.

On the negative side, we saw profit warnings from Halfords, FD Technologies and St James’s Place. Following STJ’s warning there was an article in The Sunday Times, suggesting that as the wealth manager’s provision against customer complaints only goes back to 2018, we could see further bad news to come in future. Avacta announced a placing at a 34% discount to the previous closing share price. Saietta, which supplies drives to Indian Electric Vehicles (EVs) and only listed in July 2021, has called in the administrators and been suspended from AIM. The business has generated around £30m of losses since listing. I wonder if this is an effect of professional fund manager outflows, meaning that there is significantly less appetite to continue to fund loss-making ‘blue sky’ ventures. Here’s a link to Paul Hill of Vox Markets and fund manager Gervais Williams of Premier Miton discussing SED last June. Saietta’s failure is bad news for staff and shareholders, but if the riskier companies that can’t fund growth disappear from AIM that should support index performance too.

This week I look at microchip company Ensilica. Facilities by ADF which provide trailers and other facilities to the film and TV sector. Then a brief comment on Rightmove’s results, and the potential threat from OnTheMarket’s new US owner driving keener competition.

Ensilica H1 Nov Results

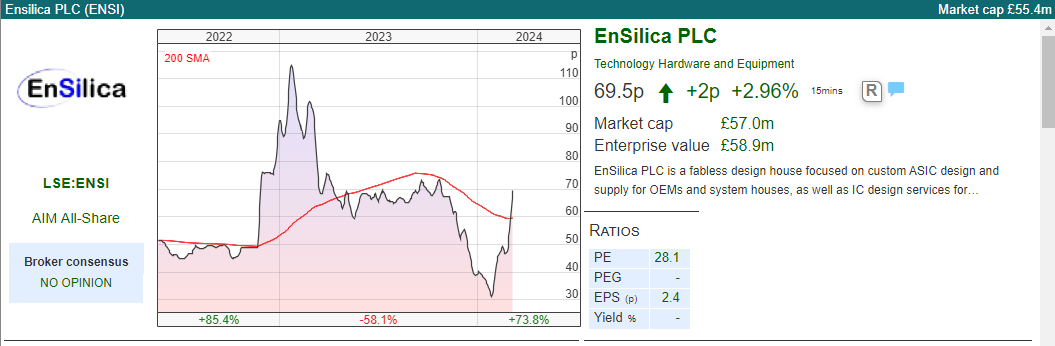

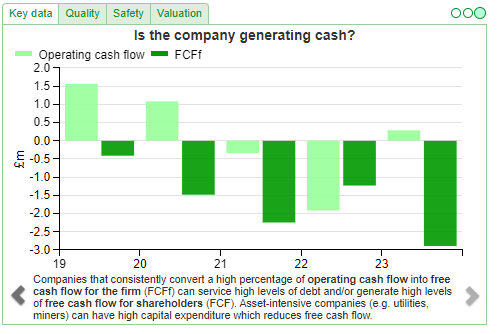

This microchip maker of mixed-signal ASICS (Application Specific Integrated Circuits) listed in May 2022. The advantage of ASICs is that they use less power than a general-purpose CPU. They announced a placing last week, as cashflow has been negative since listing and raised £1.1m at 50p per share. A second RNS disclosed a significant order worth $20m over calendar years 2025 and 2026. They had last raised money in December: £1.56m at 40p per share.

A third RNS announced their H1 Nov results which look reasonably positive with H1 revenue +12% to £9.6m and an LBT of £309K. They had £3.8m of net debt at the end of Nov, before H1 interest costs of £368K, they made a small profit (less than £100K). That interest cost implies they are paying almost 20% annualised financing costs. Management says in their bullet points on page one of the RNS that debt has reduced by 10%, however, if I skip to page 9 “Analysis of Net Debt” shows that net debt including lease liabilities actually increased by +15%. Possibly I’m being pedantic as the two placings occurred after November, which will mean net debt will fall, however, I think it is worth paying attention to the way management communicate with investors and their “voluntary disclosure”.

The RNS also flagged that short-term cashflow is dependent on the receipt of R&D tax credits (some of which was expected in December) and material customer payments, one of which is overdue and others are expected in March and April.

History: The company was founded in 2001, originally as a consultancy to the global semiconductor industry. Their IP technology focus was on radar signal processing and encryption accelerator hardware, which has been supplied to many major semiconductor suppliers. They opened an office in Bangalore, India in 2012. Then in 2016, they decided to shift from consultancy to a ‘design and supply’ model, which means they run an end-to-end process through to final chip delivery. The drawback of the model is that this requires upfront investment, but the benefit is a higher margin and longer-term income. Their radar technology is licensed to major Tier 1 automotive companies. Other customers include industrial enterprises, software companies and service providers developing proprietary hardware. ENSI is an approved supplier to Visteon Inc (NASDAQ: VC), Continental AG (ETR: CON), Vitesco Technologies (ETR: VTSC), Infineon Technologies (ETR:IFX), AST Mobile (NASDAQ: ASTS) and Square Inc (NYSE: SQ), amongst others.

They came to market in May 2022, raising £6m at 50p per share, valuing the market cap of the company on admission at £38m. The Admission Document says that the ASIC market size is projected to grow +8% CAGR and reach US$28 billion by 2026.

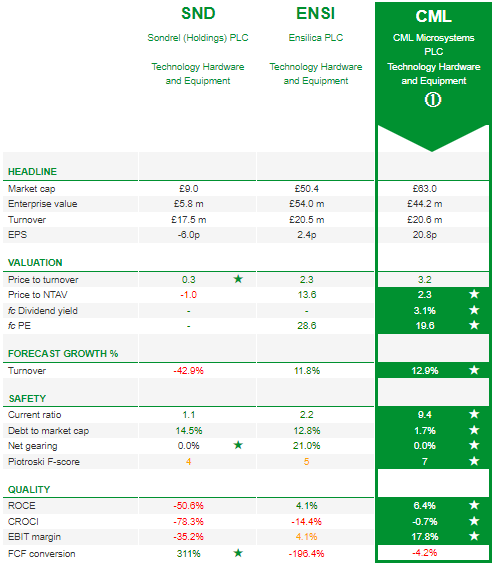

The gross margin is 44%, which I think is surprisingly low given that they design the microchips and they outsource manufacturing to third parties – the so-called “Fabless Model”. For comparison gross margin at CML Microsystems, which I own, is 75%. There’s an interview with Paul Jourdan of Amati (6% shareholder) halfway through last year, about 21 minutes in. He says it is a similar business to Sondrel, which also designs ASIC chips and fell -90% last year, but has more recently bounced strongly.

Comparison with Sondrel: Last week Sondrel also announced a chip design contract win worth $23m, to be used for video streaming. Initial contract value is $9m. SND management also said that they were in advanced discussions with a potential capital provider which would help their working capital needs, looking to raising money with a mandatory convertible at 10p per share. I would avoid investing in Sondrel until it becomes clear that they have a self-funding business model.

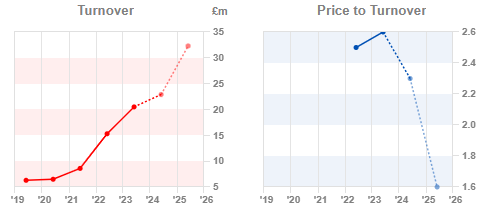

Valuation: Allenby published their forecasts the day before ENSI increased their share count by 2.23m and also before they announced the contract win. I have adjusted for the number of shares, but it’s hard to know how much of the contract win drops through to the bottom line. The broker has forecast revenue growth of +12% FY May 2024F, but an acceleration of +41% the following year to £32m. That suggests 5.5p of EPS FY May 2025, giving ENSI a PER of 13x. I’m assuming that EPS is understated though because of the contract win, so we ought to see upgrades. Also worth noting that turnover has shown good progress, while the price/turnover has de-rated presumably as investors worried about how the growth was funded.

Opinion: Looks potentially interesting. Not a sector that I know much about, but the economics of the Fabless model ought to be attractive if there is demand for ENSI’s chip designs. I’ve used Sharepad’s “Compare” tab, which also prefers CML to ENSI and SND. I’m hoping that there is a “read-across” to CML from these contract win announcements. If any readers follow this sector closely, please do post your thoughts in the chat.

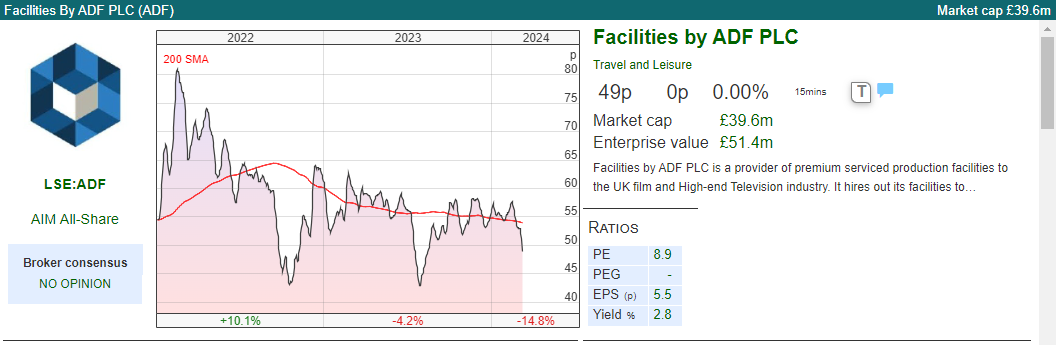

Facilities by ADF FY Dec Trading Update

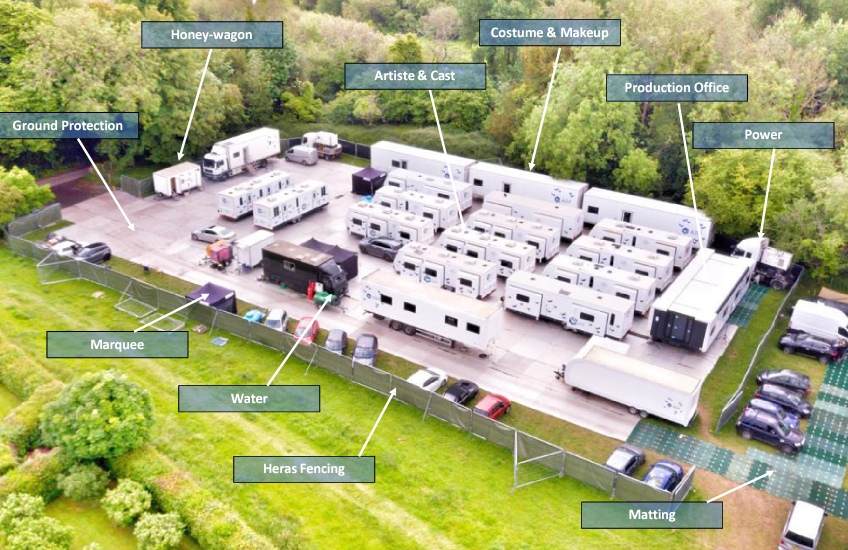

Sharepad user @Damianbcannon pitched this idea on the Mello B.A.S.H. at the start of last week. The company is a 2021 IPO vintage and provides “honeywagons” to the UK film and TV industry. Honeywagons are portable toilets used by the actors and crew and ADF also supplies specialised trailers for dressing rooms, wardrobe and make-up as well as other production facilities like generator units. They’ve been affected by the screenplay Writers Guild of America strike, similar to Zoo Digital (translation services). The studios and the writers reached an agreement a few months ago, so potentially we should see a recovery in both stocks as filming and production re-starts.

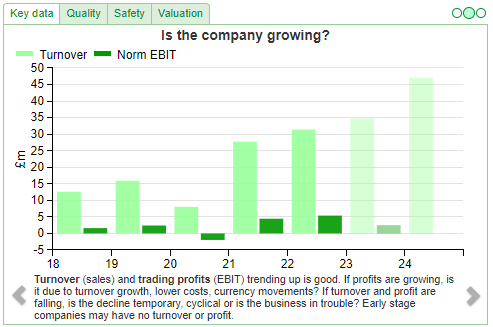

The company had a record H1 2023 with revenues of c.£22m, but H2 was disrupted by the lengthy strike so revenues dropped to around c.£13m. Management says that the impact on the film and TV industry has carried on into H1 Jun 2024 with film and TV producers having to reorganise schedules which is proving challenging at short notice. This has meant there will be a one-off reduction in ADF’s utilisation rate in the current half before returning to a full H2, more in line with pre-strike levels.

History: The company started life in 1992 as Andy Dixon Facilities, and won their first contracts with the BBC, ITV and S4C in 1997. By 2018 the fleet size had grown to 293 units, versus 700 intended by the end of last year at the time of the IPO.

They listed on AIM at 50p per share, with selling shareholders receiving £3m and the company receiving £15m of new capital (gross of fees). That valued the company at £38m on admission. At the time of the IPO, their largest customer was Netflix (24% of revenue), followed by Sky (19% of revenue) and the BBC (13% of revenue). Andrew Dixon, the founder sold down his stake from 26% at the time of the IPO to 12% currently. Marsden Proctor, the current CEO also sold down his stake and now owns 1.8% of the shares. The largest shareholder is the Business Growth Fund, backed by Barclays, with 19% which bought in at the time of the IPO. I note the Finance Director, Neil Evans was an officer in the Royal Marine Commandos before qualifying as an accountant at Deloitte.

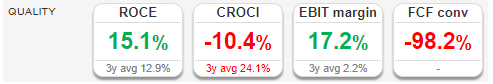

Valuation: Cavendish, their broker, cut FY Dec 2024F revenues by -19% to £47m and EPS by -34% to 5.0p. That puts them on just below 10x PER. Annoyingly management haven’t asked their broker to publish FY Dec 2025F, which ought to be a more normal year. I am tempted to take H1 results last year and multiply by 2x to suggest that 6.4p of EPS ought to be achievable. However, that might be undercooking it, if there is a catch-up similar to what happened when lockdowns ended. Cavendish’s original FY Dec 2024F numbers were £58m of revenue and EPS of 8.8p, so that might be achievable for FY Dec 2025F, which would put the shares on 6x PER. That could be very good value. I would however highlight the poor cashflow, as demonstrated by Sharepad’s -98% FCF conversion, which I am assuming is just a timing issue also related to the strikes, but is well worth keeping an eye on.

Opinion: This looks like a profitable niche, with a company that has hit a temporary setback. Before the pandemic, the company was generating an RoCE of around 30% and mid-teens EBIT margins. The company has an impressive track record of growth, growing revenues from below £13m FY 2018 to £47m forecast FY 2024F. I’m not sure about how large the fleet could grow to though, the Admission Document says management have “ambitions” to grow to £100m of revenue, which would be quite a few ‘honeywagons’ for the film and TV industry. So I agree with Damian, I like it.

Rightmove FY Dec Results

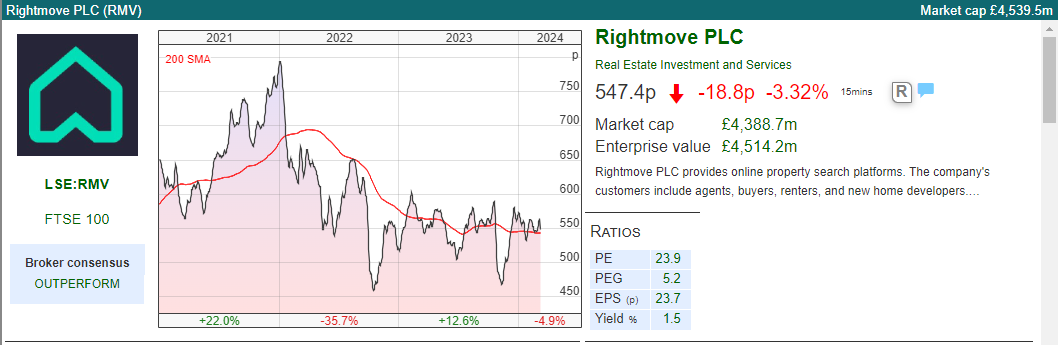

I was curious to see how this online estate agent advertising platform would fare, as competitor OnTheMarket was bought by Nasdaq-listed CoStar for 110p in cash last year. That was a 56% premium to the closing price, and the idea was that CoStar would invest in order to disrupt and challenge Rightmove’s hold on the market.

Rightmove’s market share remains at 86%. They don’t mention OnTheMarket or CoStar specifically and the outlook statement suggests 7-9% revenue growth, down slightly in 2023. Management says that the fall in revenue growth is likely to be estate agents (Rightmove’s customers) failing during the macro environment, rather than competition. Given the OnTheMarket deal was only completed in December last year, it is too early to see an impact from increased competition. I think the situation is worth following though.

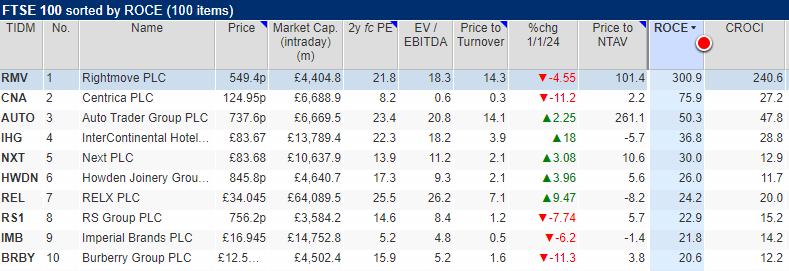

The results themselves were ‘steady as she goes’ Rightmove reported FY Dec revenue +10% to £364m and PBT up +8% to £260m – very healthy margin of 71%. They had £39m of cash on their balance sheet. Sharepad shows that RMV has the highest RoCE in the FTSE 100 by a country mile.

Valuation: The shares are trading on a PER of 22x FY Dec 2024F, dropping to 19x the following year. On a price to FY Dec 2024F forecast revenue, the shares are still trading above 12x, so if margins are hit then they could be vulnerable.

Opinion: This is a long-term multi-bagger, but is down by a third from its peak in late 2021. Phil Oakley wrote it up in November last year. Rightmove strikes me as an excellent company, but perhaps with growth slowing and competition increasing the investment case isn’t as clear cut as it was 15 years ago. I don’t think it is hard to find Quality at a Reasonable Price (QuaaRP) stocks at the moment. Hargreaves Lansdown and Fevertree show that when high growth / high margin stocks disappoint they can fall a long way.

Notes

Bruce owns shares in Hargreaves Lansdown and CML Microsystems

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Weekly Market Commentary | 05/03/2024 | ENSI, ADF, RMV | AIM cross-over approaching?

A trend following signal for AIM is close to turning positive, so we could see confidence return in smaller UK stocks. Companies covered: ENSI, ADF and RMV.

The FTSE 100 was down -0.4% to 7,659 last week. The Nasdaq100 and S&P500 were up +2.0 and +1.0% respectively. In the US the bull market continues, with Webull’s $7bn listing via the SPAC structure, while Reddit is targeting a value of $6.5bn, though that is down from a $10bn valuation in a private funding round in 2021. Reddit has cumulative losses of over $700m, including a net loss of $90.8mn in 2023, according to the FT. It warned in its prospectus that it “may never achieve profitability”.

AIM has endured a much more difficult 18 months than Nasdaq, so we are certainly not in a bull market in the UK. However, the UK small cap index is within touching distance of its 64/16 day moving average cross-over.

I took that particular 64/16 signal from hedge fund manager Andreas Clenow, who has published a couple of books. The idea is that if we do see the moving average break through decisively, that should give readers confidence that the worst of the bear market in AIM shares is over. In further support, we tend to see in election years (both the US and UK) Central Banks let markets run a little hot, which should also be helpful.

Clenow suggests that all trend-following strategies attempt to do the same thing, and not to get hung up on the perfect entry and exit rules. If you don’t like the 64/16 day cross-over in Sharepad you just click on the “Add” tab and select your own time periods.

However, the most common amateur mistake is to spend all your time tweaking entry and exit rules and not enough concentrating on position sizing, he says. In addition, trend-following strategies work best when they are diversified across markets and asset classes. You can find his core trading rules here.

Last week we saw a bid for Direct Line and a bidding war emerge for Wincanton. Wincanton had already received a bid from CMA CGM, but the logistics firm received a rival offer from New York listed GXO. On Monday, we saw an approach to Renalytix AI, which is up 7x since the beginning of February. Management do warn in Monday’s RNS that they only have existing cash resources to last through April this year.

On the negative side, we saw profit warnings from Halfords, FD Technologies and St James’s Place. Following STJ’s warning there was an article in The Sunday Times, suggesting that as the wealth manager’s provision against customer complaints only goes back to 2018, we could see further bad news to come in future. Avacta announced a placing at a 34% discount to the previous closing share price. Saietta, which supplies drives to Indian Electric Vehicles (EVs) and only listed in July 2021, has called in the administrators and been suspended from AIM. The business has generated around £30m of losses since listing. I wonder if this is an effect of professional fund manager outflows, meaning that there is significantly less appetite to continue to fund loss-making ‘blue sky’ ventures. Here’s a link to Paul Hill of Vox Markets and fund manager Gervais Williams of Premier Miton discussing SED last June. Saietta’s failure is bad news for staff and shareholders, but if the riskier companies that can’t fund growth disappear from AIM that should support index performance too.

This week I look at microchip company Ensilica. Facilities by ADF which provide trailers and other facilities to the film and TV sector. Then a brief comment on Rightmove’s results, and the potential threat from OnTheMarket’s new US owner driving keener competition.

Ensilica H1 Nov Results

This microchip maker of mixed-signal ASICS (Application Specific Integrated Circuits) listed in May 2022. The advantage of ASICs is that they use less power than a general-purpose CPU. They announced a placing last week, as cashflow has been negative since listing and raised £1.1m at 50p per share. A second RNS disclosed a significant order worth $20m over calendar years 2025 and 2026. They had last raised money in December: £1.56m at 40p per share.

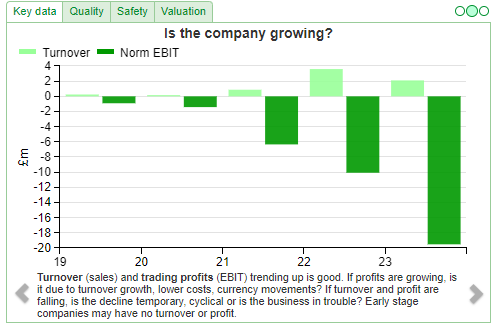

A third RNS announced their H1 Nov results which look reasonably positive with H1 revenue +12% to £9.6m and an LBT of £309K. They had £3.8m of net debt at the end of Nov, before H1 interest costs of £368K, they made a small profit (less than £100K). That interest cost implies they are paying almost 20% annualised financing costs. Management says in their bullet points on page one of the RNS that debt has reduced by 10%, however, if I skip to page 9 “Analysis of Net Debt” shows that net debt including lease liabilities actually increased by +15%. Possibly I’m being pedantic as the two placings occurred after November, which will mean net debt will fall, however, I think it is worth paying attention to the way management communicate with investors and their “voluntary disclosure”.

The RNS also flagged that short-term cashflow is dependent on the receipt of R&D tax credits (some of which was expected in December) and material customer payments, one of which is overdue and others are expected in March and April.

History: The company was founded in 2001, originally as a consultancy to the global semiconductor industry. Their IP technology focus was on radar signal processing and encryption accelerator hardware, which has been supplied to many major semiconductor suppliers. They opened an office in Bangalore, India in 2012. Then in 2016, they decided to shift from consultancy to a ‘design and supply’ model, which means they run an end-to-end process through to final chip delivery. The drawback of the model is that this requires upfront investment, but the benefit is a higher margin and longer-term income. Their radar technology is licensed to major Tier 1 automotive companies. Other customers include industrial enterprises, software companies and service providers developing proprietary hardware. ENSI is an approved supplier to Visteon Inc (NASDAQ: VC), Continental AG (ETR: CON), Vitesco Technologies (ETR: VTSC), Infineon Technologies (ETR:IFX), AST Mobile (NASDAQ: ASTS) and Square Inc (NYSE: SQ), amongst others.

They came to market in May 2022, raising £6m at 50p per share, valuing the market cap of the company on admission at £38m. The Admission Document says that the ASIC market size is projected to grow +8% CAGR and reach US$28 billion by 2026.

The gross margin is 44%, which I think is surprisingly low given that they design the microchips and they outsource manufacturing to third parties – the so-called “Fabless Model”. For comparison gross margin at CML Microsystems, which I own, is 75%. There’s an interview with Paul Jourdan of Amati (6% shareholder) halfway through last year, about 21 minutes in. He says it is a similar business to Sondrel, which also designs ASIC chips and fell -90% last year, but has more recently bounced strongly.

Comparison with Sondrel: Last week Sondrel also announced a chip design contract win worth $23m, to be used for video streaming. Initial contract value is $9m. SND management also said that they were in advanced discussions with a potential capital provider which would help their working capital needs, looking to raising money with a mandatory convertible at 10p per share. I would avoid investing in Sondrel until it becomes clear that they have a self-funding business model.

Valuation: Allenby published their forecasts the day before ENSI increased their share count by 2.23m and also before they announced the contract win. I have adjusted for the number of shares, but it’s hard to know how much of the contract win drops through to the bottom line. The broker has forecast revenue growth of +12% FY May 2024F, but an acceleration of +41% the following year to £32m. That suggests 5.5p of EPS FY May 2025, giving ENSI a PER of 13x. I’m assuming that EPS is understated though because of the contract win, so we ought to see upgrades. Also worth noting that turnover has shown good progress, while the price/turnover has de-rated presumably as investors worried about how the growth was funded.

Opinion: Looks potentially interesting. Not a sector that I know much about, but the economics of the Fabless model ought to be attractive if there is demand for ENSI’s chip designs. I’ve used Sharepad’s “Compare” tab, which also prefers CML to ENSI and SND. I’m hoping that there is a “read-across” to CML from these contract win announcements. If any readers follow this sector closely, please do post your thoughts in the chat.

Facilities by ADF FY Dec Trading Update

Sharepad user @Damianbcannon pitched this idea on the Mello B.A.S.H. at the start of last week. The company is a 2021 IPO vintage and provides “honeywagons” to the UK film and TV industry. Honeywagons are portable toilets used by the actors and crew and ADF also supplies specialised trailers for dressing rooms, wardrobe and make-up as well as other production facilities like generator units. They’ve been affected by the screenplay Writers Guild of America strike, similar to Zoo Digital (translation services). The studios and the writers reached an agreement a few months ago, so potentially we should see a recovery in both stocks as filming and production re-starts.

The company had a record H1 2023 with revenues of c.£22m, but H2 was disrupted by the lengthy strike so revenues dropped to around c.£13m. Management says that the impact on the film and TV industry has carried on into H1 Jun 2024 with film and TV producers having to reorganise schedules which is proving challenging at short notice. This has meant there will be a one-off reduction in ADF’s utilisation rate in the current half before returning to a full H2, more in line with pre-strike levels.

History: The company started life in 1992 as Andy Dixon Facilities, and won their first contracts with the BBC, ITV and S4C in 1997. By 2018 the fleet size had grown to 293 units, versus 700 intended by the end of last year at the time of the IPO.

They listed on AIM at 50p per share, with selling shareholders receiving £3m and the company receiving £15m of new capital (gross of fees). That valued the company at £38m on admission. At the time of the IPO, their largest customer was Netflix (24% of revenue), followed by Sky (19% of revenue) and the BBC (13% of revenue). Andrew Dixon, the founder sold down his stake from 26% at the time of the IPO to 12% currently. Marsden Proctor, the current CEO also sold down his stake and now owns 1.8% of the shares. The largest shareholder is the Business Growth Fund, backed by Barclays, with 19% which bought in at the time of the IPO. I note the Finance Director, Neil Evans was an officer in the Royal Marine Commandos before qualifying as an accountant at Deloitte.

Valuation: Cavendish, their broker, cut FY Dec 2024F revenues by -19% to £47m and EPS by -34% to 5.0p. That puts them on just below 10x PER. Annoyingly management haven’t asked their broker to publish FY Dec 2025F, which ought to be a more normal year. I am tempted to take H1 results last year and multiply by 2x to suggest that 6.4p of EPS ought to be achievable. However, that might be undercooking it, if there is a catch-up similar to what happened when lockdowns ended. Cavendish’s original FY Dec 2024F numbers were £58m of revenue and EPS of 8.8p, so that might be achievable for FY Dec 2025F, which would put the shares on 6x PER. That could be very good value. I would however highlight the poor cashflow, as demonstrated by Sharepad’s -98% FCF conversion, which I am assuming is just a timing issue also related to the strikes, but is well worth keeping an eye on.

Opinion: This looks like a profitable niche, with a company that has hit a temporary setback. Before the pandemic, the company was generating an RoCE of around 30% and mid-teens EBIT margins. The company has an impressive track record of growth, growing revenues from below £13m FY 2018 to £47m forecast FY 2024F. I’m not sure about how large the fleet could grow to though, the Admission Document says management have “ambitions” to grow to £100m of revenue, which would be quite a few ‘honeywagons’ for the film and TV industry. So I agree with Damian, I like it.

Rightmove FY Dec Results

I was curious to see how this online estate agent advertising platform would fare, as competitor OnTheMarket was bought by Nasdaq-listed CoStar for 110p in cash last year. That was a 56% premium to the closing price, and the idea was that CoStar would invest in order to disrupt and challenge Rightmove’s hold on the market.

Rightmove’s market share remains at 86%. They don’t mention OnTheMarket or CoStar specifically and the outlook statement suggests 7-9% revenue growth, down slightly in 2023. Management says that the fall in revenue growth is likely to be estate agents (Rightmove’s customers) failing during the macro environment, rather than competition. Given the OnTheMarket deal was only completed in December last year, it is too early to see an impact from increased competition. I think the situation is worth following though.

The results themselves were ‘steady as she goes’ Rightmove reported FY Dec revenue +10% to £364m and PBT up +8% to £260m – very healthy margin of 71%. They had £39m of cash on their balance sheet. Sharepad shows that RMV has the highest RoCE in the FTSE 100 by a country mile.

Valuation: The shares are trading on a PER of 22x FY Dec 2024F, dropping to 19x the following year. On a price to FY Dec 2024F forecast revenue, the shares are still trading above 12x, so if margins are hit then they could be vulnerable.

Opinion: This is a long-term multi-bagger, but is down by a third from its peak in late 2021. Phil Oakley wrote it up in November last year. Rightmove strikes me as an excellent company, but perhaps with growth slowing and competition increasing the investment case isn’t as clear cut as it was 15 years ago. I don’t think it is hard to find Quality at a Reasonable Price (QuaaRP) stocks at the moment. Hargreaves Lansdown and Fevertree show that when high growth / high margin stocks disappoint they can fall a long way.

Notes

Bruce owns shares in Hargreaves Lansdown and CML Microsystems

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.