Are we in an early-stage bull market for small caps? Michael Taylor shares his experience on trend trading and how now could be a good time to get on board some trends early, taking a look at two potential examples in BKS and IGP.

Intraday trading is fun. But it’s hard, most people fail, and there’s a lot of money chasing the alpha. In fact, trading itself is hard, and most people fail. But the longer the time zone, the easier it becomes.

This is why I’m a firm believer that trend trading, or swing trading, has the highest strike rate and the most profitable type of trade. I know this to be true for myself at least due to my own stats on Trade Smash that I’ve imported from IG.

If we are in an early-stage bull market for small caps, then getting on board trends early has the potential to deliver magnificent returns.

Technology can deliver high ROCE ratios which can then be reinvested into growing the asset-light business which powers the stock price. It’s no surprise that many multi-baggers come from this sector.

And whilst I don’t want to say these two stocks will be multibaggers, but certainly have the potential should the businesses continue to grow. That said, the historical stock price performance of these businesses has not exactly been stellar.

Let’s take a closer look.

Beeks Financial Cloud Group

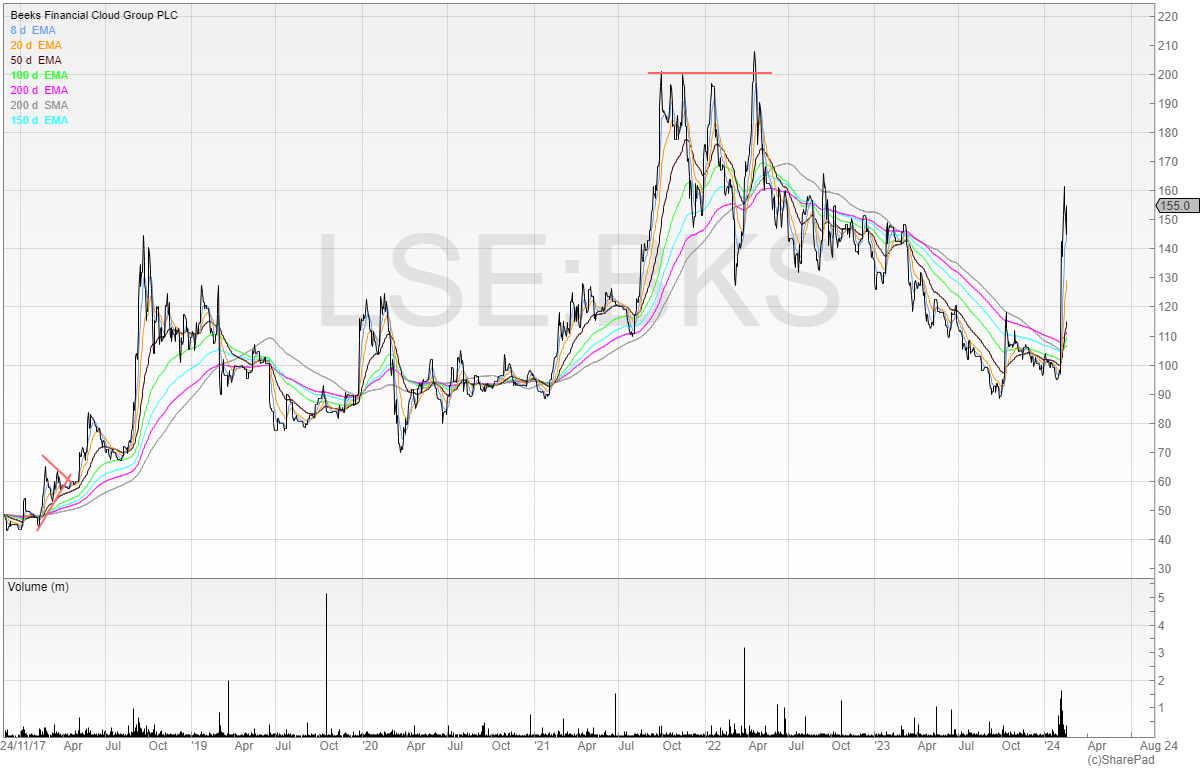

Since listing in 2017 Beeks has been on a rollercoaster. It’s almost halved and more than halved in its history, so any investors who lack the stomach for volatility will no doubt have been shaken out.

Beeks provides trading infrastructure for financial businesses. This is a high margin, recurring revenue business, and clients tend to be sticky. The reason for this is that 1) there are high switching costs – if it works then no reason to change and if anything goes wrong in a switch it can be hugely detrimental to the customer, and 2) the service is constantly needed and so it is recurring in nature.

Revenue growth has been slow, but finally the revenues are starting to accelerate and with that the expectation of profits.

FY24 was confirmed by the company to be in line, and it reported that FY25 was significantly ahead of market expectations.

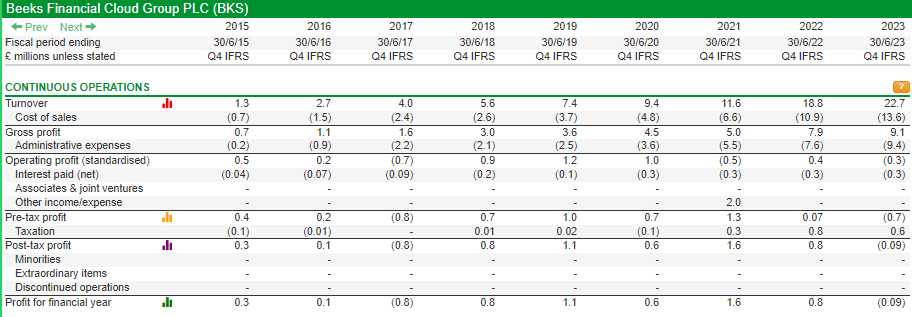

These are the current forecasts for BKS.

If profits are to continue to grow at more than 40%, then clearly a PE in the 20s would give the company a low PEG ratio. In my opinion, that rating would be more than justified.

If we were to take a conservative 7p for FY25 and give a PE of 20 we’d get a share price of 140p. At the current price of 155p then I’d say this seems priced in for now, unless the company continues to beat expectations.

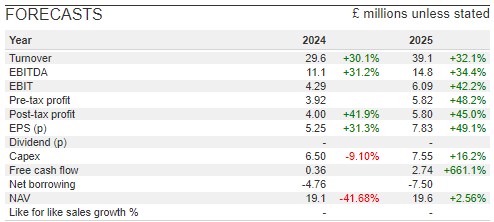

However, let’s take a look at the recent chart.

The 200p level seems to be significant resistance here.

Even though the company is performing ahead, I don’t see any entry here at the moment.

I could buy in now, and hope for more upgrades, but there’s no edge in that for me, and I prefer to only trade where I can do so with the odds in my favour.

Rather, I’d prefer to see some consolidation and a base form, or perhaps in the future an entry trigger on an ahead statement.

Nothing to do for now but worth keeping tabs on in the future. If profits continue to grow and accelerate, the future price of this share may be a lot higher.

Intercede Group (IGP)

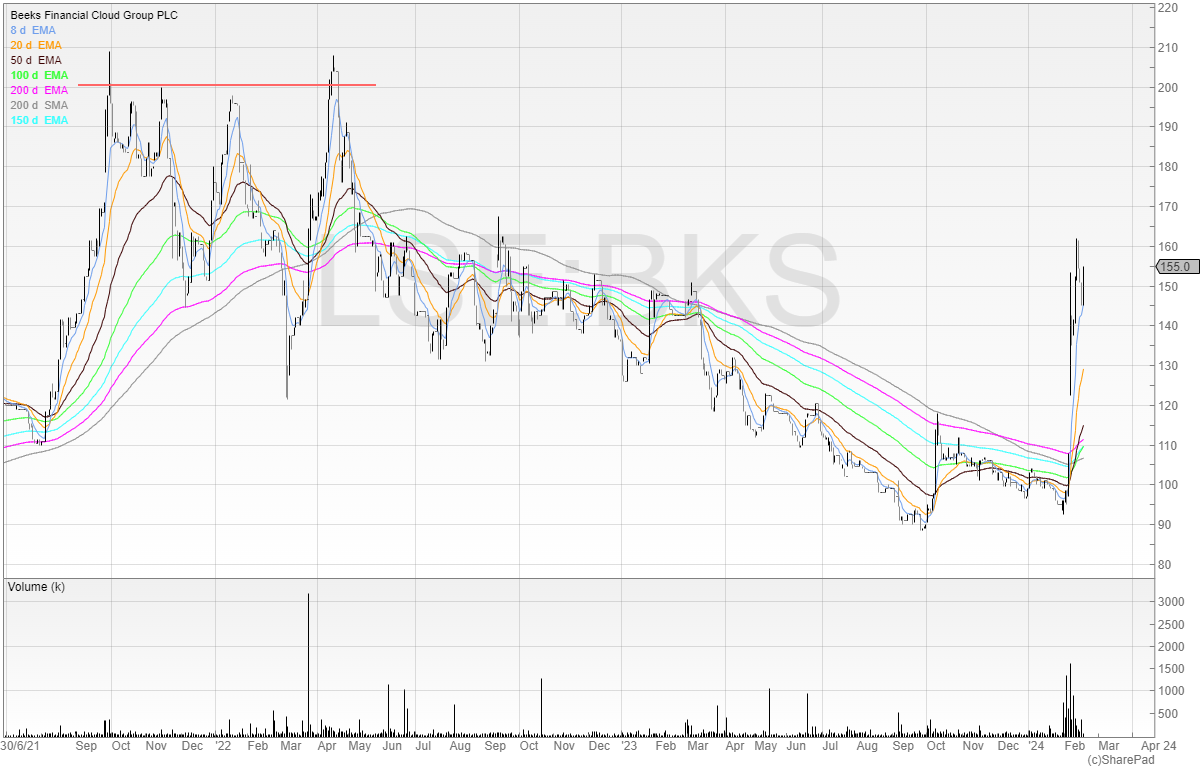

Intercede Group is another stock with a volatile history.

Since listing in 2001, the price is only a meagre 25% higher. But in that time, there have been plenty of swings.

The turnaround started with a new board in 2018 and despite reaching 117.5 in 2021 it came all the way back to trade below 40p in 2022.

The company provides a service called MyID which is an identity and credential management system.

As its software, the gross margins are high as we can see from the half-year report. £7 million of revenue translates into £6.9 million of gross profit.

That means additional revenue to the business trickles down significantly into the bottom line but the issue here has been that the company has struggled to grow revenue (and therefore profits).

That could be changing though.

The company beat its expectations in November and again in January. A slew of contract wins have been announced in the last few months.

At £56 million market cap, there is still plenty of room for growth if the company can scale up its revenues.

I see the 117.5p level as resistance, and so I’d like to see a gentle rise and consolidation before a breakout. Or perhaps there will be an entry trigger on a new upgrade? Either way, I believe it’s worth watching.

Michael Taylor

Get detailed analytics on all of your trades with Michael’s trading journal available free here: https://www.tradesmash.com/

Twitter: @shiftingshares

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.