WANdisco has owned up to ‘significant accounting irregularities’ and the prospects for shareholders now look grim. Maynard Paton revisits the software developer to identify the warning signs

Small-Cap Spotlight Report Revisited: WANdisco (LSE: WAND)

You can become a better investor by occasionally visiting the stock-market graveyard.

One company that now seems destined for the cemetery is WANdisco, the software developer that last week suddenly warned of “significant, sophisticated and potentially fraudulent irregularities“.

The shares have been suspended while independent investigators work out what exactly has occurred. Remarks including “significant going concern issues” make for grim reading:

“The identification of these irregularities will significantly impact the Company’s cash position and lead to a material uncertainty regarding its overall financial position and significant going concern issues. The Board now expects that anticipated FY22 revenue could be as low as USD 9 million and not USD 24 million as previously reported. In addition, the Company has no confidence in its announced FY22 bookings expectations.“

I wrote about WANdisco for SharePad during May 2021 and the bombshell announcement must prompt a revisit. What can we learn to help us avoid the next great investment disaster?

Let’s take a closer look.

Raising $236 million to exploit a ‘$50 billion opportunity’

To recap, WANdisco — derived from Wide Area Network Distributed Computing — developed clever software that migrated data from in-house servers to cloud-service providers such as Microsoft and Amazon.

Customers apparently liked the software because of its ability to transfer huge volumes of data without any systems ‘downtime’. Unlike traditional data transfers, WANdisco’s service impressively allowed the ‘source’ data to be updated during the migration and yet always be transferred without inconsistencies.

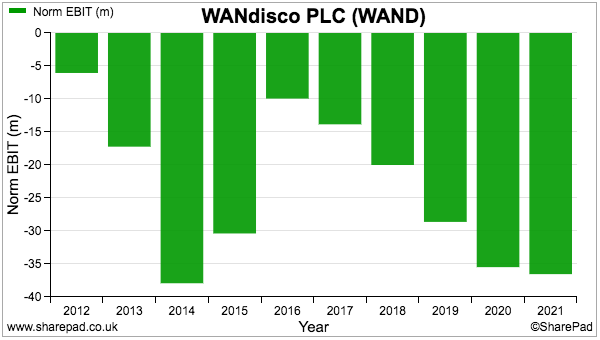

I say customers “apparently liked” the software, because customers did appear very elusive. WANdisco’s annual revenue had remained at less than $20 million following the group’s 2012 flotation…

…despite vast amounts spent developing the software that led to ongoing losses that approached $40 million:

The losses were funded by a remarkable run of share placings:

WANdisco raised some $236 million as a public company, and the share count had tripled since the float.

Investors were persuaded to keep funding WANdisco because of some ultra-bullish management talk. My original SharePad article referred to a “$50 billion market opportunity” and WANdisco believing its software could become the “de facto standard in data-replication technology” for the likes of Microsoft and Amazon.

The implication was WANdisco would then become a “multi-billion pound company”… which suggested substantial upside from the then £260 million market cap.

Sharedealings, meetings and the chairman’s 2016 warning

WANdisco’s persistent losses and regular fundraisings no doubt persuaded many investors to steer clear.

But those losses and fundraisings did not obviously point to “significant, sophisticated and potentially fraudulent irregularities” lurking in the books.

When I wrote my original article, WANdisco did not seem anything other than a persistent cash-burner funded by impressionable investors with a boss that told a good story about a costly IT solution.

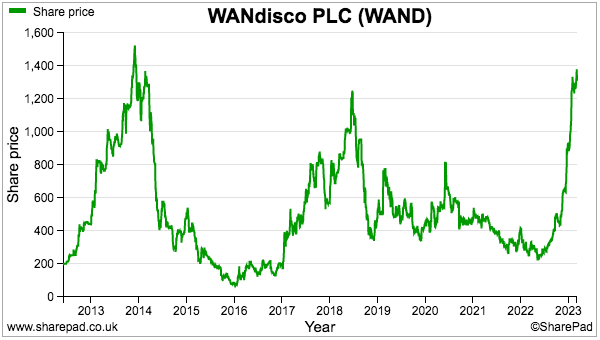

Mind you, last year the story did begin to look quite real. The shares soared to £13 to support an £880m market cap…

… as the company announced various larger and larger contracts, deals and arrangements:

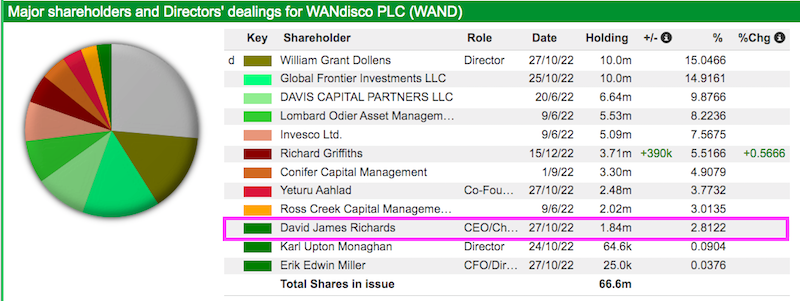

Beyond the limited revenue and hefty cash burn, my original SharePad article noted boss David Richards had not participated in any of the fundraisings:

“The actions of company directors often speak louder than their words… and co-founder Mr Richards has not really shown too much faith with his own shareholding…“

“After the flotation, Mr Richards owned 3.3 million shares representing 16% of the company. Today he owns 2.1 million shares representing 4% after selling chunks during 2013 (at 810p) and 2017 (at 550p)“

Mr Richards owned 1.84 million shares at the time of the bombshell announcement, meaning he had continued to trim his holding during the last year or two…

…which was not a good look when he was always asking other investors to buy more shares.

Not looking good either were WANdisco’s remuneration decisions. My original SharePad article noted Mr Richards almost always received a bonus despite all the losses:

“Sceptical WANdisco investors may have noticed the company’s remuneration report. Co-founder Mr Richards has almost always received a chunky bonus to accompany what is now a $501,000 salary“

Sure enough, the subsequent 2021 annual report disclosed another bonus for Mr Richards of £146k (approximately $200k):

I did write within my original SharePad article:

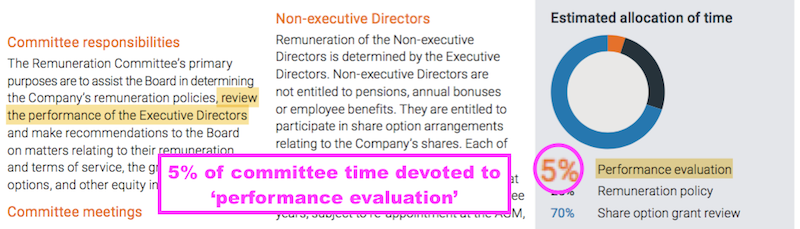

“Perhaps if the non-execs spent more time reviewing the performance of the executives rather than reviewing the company’s option plans… a greater drive towards profitability may have already occurred.“

The non-execs appeared to have a cosy relationship with Mr Richards, handing out bonuses despite the limited sales progress and little sign of an impending profit.

The 2021 annual report showed once again the remuneration committee spending a disconcertingly low 5% of its time reviewing the performance of the executives, with the other 95% of its time spent devising pay and option plans:

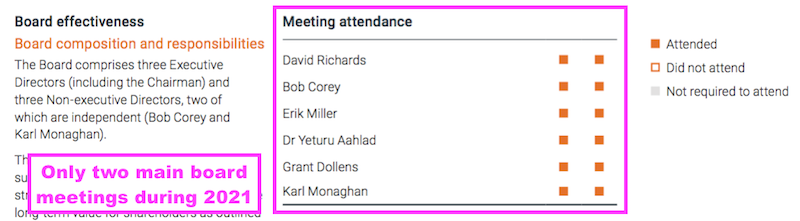

The 2021 annual report also revealed the directors convened only two main board meetings during the year:

Looking back, the non-execs seemed worryingly content not to have the executives provide formal board updates about the business.

The absence of a 2016 bonus for Mr Richards is interesting. That year Mr Richards was ousted as WANdisco’s boss… only for him to return just one week later.

WANdisco’s then-chairman, Paul Walker, was remarkably blunt by claiming Mr Richards was “not… the right person” to lead WANdisco:

“As independent non-executive directors, we had not considered David the right person to lead the Company going forwards. Since the announcement of 29 September 2016 regarding David Richards stepping down from the Board, we have been informed that approximately 58% of the Company’s shareholders support David’s reinstatement as CEO. Accordingly, we have decided to resign from the Board with immediate effect. “

Mr Walker was chief executive of Sage between 1994 and 2010 and before then its finance director between 1987 and 1994.

Mr Walker, therefore, knew how to run a software business…

…and when an industry heavyweight such as Mr Walker says Mr Richards was “not… the right person” to lead WANdisco, shareholders ought to have taken a lot more notice.

Back to the share dealings of Mr Richards, and WANdisco’s boss employed the services of Equities First Holdings during 2021. Mr Richards borrowed money using part of his shareholding as collateral:

“WANdisco, the LiveData company, announces that further to the announcement of 11 November… David Richards, Chairman and CEO of the Company, has today transferred the 350,000 ordinary shares to Equities First Holdings (the “Transferred Shares”)… for a consideration (” Transfer Amount”) which is based upon the average of the last sale price of the ordinary shares as reported on Bloomberg over the last three trading days being 320 pence per ordinary share.

Mr. Richards is required to repurchase the Transferred Shares in three years at the same Transfer Amount.”

Most likely a very awkward coincidence, but borrowing money through Equities First Holdings was also undertaken by Rob Terry, the boss of Quindell, whose leadership of the insurer led to an investigation by the Serious Fraud Office.

Auditor text, Jersey accounting and revenue forecast

WANdisco’s 2021 annual report did not contain obvious indicators of “significant, sophisticated and potentially fraudulent irregularities“.

The auditor was BDO, so not small, and its audit report did not carry any alarming warnings about weak financial controls or similar. And only minor text changes within the key audit matters occurred between 2020 and 2021.

Among the small alterations was the following text from 2020 that was absent from 2021:

“We tested the completeness of revenue by ensuring all projects won per the client management system tied back to the underlying accounting records.”

Did the absence of that text mean BDO stopped cross-checking all projects between the two systems during 2021? Or was the cross-checking still performed, but the text simply removed to make way for additional text such as this:

“We performed cut-off testing, testing a sample of revenue transactions either side of the period end to underlying support to confirm that revenue was appropriately recognised in the correct period.”

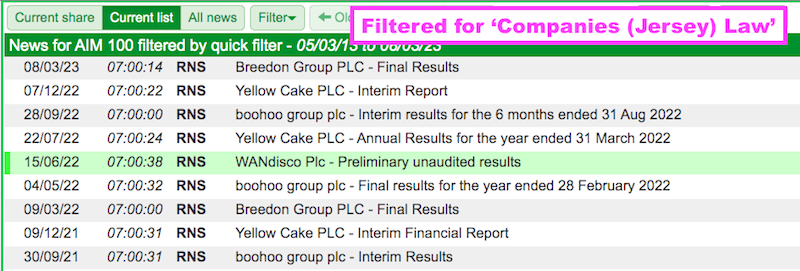

WANdisco’s accounts being compiled according to Jersey company law may be of interest:

“The Directors present their report and the audited financial statements for the year ended 31 December 2021 in accordance with the Companies (Jersey) Law 1991…

Legislation in Jersey governing the preparation and dissemination of financial statements may differ from legislation in other jurisdictions.“

SharePad indicates WANdisco was one of only four AIM 100 companies with Jersey accounting:

WANdisco’s Jersey affiliation was therefore uncommon and certain disclosures — such as employee numbers and a breakdown of the associated payments — were excluded from the group’s 2021 accounting notes.

A snippet of management over-optimism was tucked away within the impairment-test small-print:

“These calculations use cash flow projections based on Board approved budget and financial forecasts, which anticipate growth in the Group’s installed base along with new customer growth, resulting in an average revenue growth of 78% over the five-year period with a 7% increase in cost base over the five-year period, and appropriate long-term growth rates.”

Projecting five-year average revenue growth of 78% felt very ambitious for any part of WANdisco’s operations given the previous five years witnessed group revenue fall by 36%.

Trade receivables versus revenue

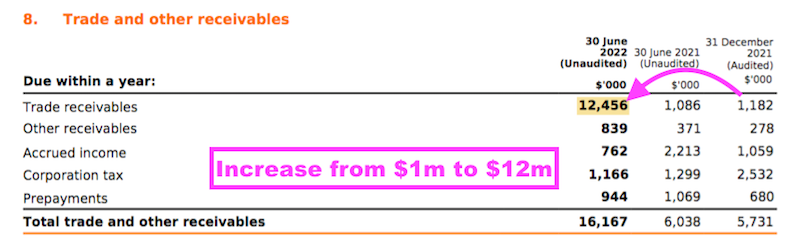

Potential signs of untoward accounting started to emerge within September’s interim figures.

Trade receivables surged from $1 million to $12 million during the six months:

Trade receivables typically represent invoiced revenue still owed by customers, and WANdisco’s explanation of how customers owed $12 million when trailing twelve-month revenue was $10 million was not clear:

“The significant increase in trade receivables reflects favourable business terms on contracts signed in the period, and the acceleration of sales bookings compared to the prior year.“

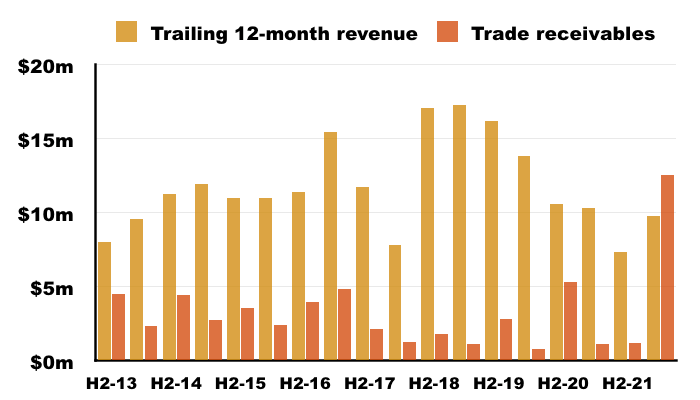

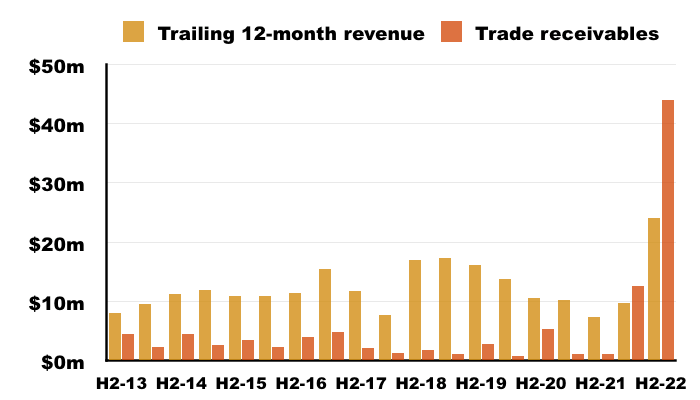

My chart below compares trailing twelve-month revenue to trade receivables for each half-year since December 2013:

Trade receivables suddenly surpassing revenue was certainly unusual.

A statement during January then indicated 2022 revenue was at least $24m and trade receivables were $44m:

“Trading in Q4 2022 finished strongly following significant contract momentum with both new and existing customers. As a result, the Company’s preliminary unaudited revenues are expected to be no less than $24m, growth of 229% year on year (FY21: $7.3m).

The Company ended the period with a strong balance sheet, with cash of approximately $19m and $44m in trade receivables as at 31 December 2022.“

Those 2022 figures emphasised the sudden ballooning of trade receivables versus revenue:

I must be completely frank here; I have no idea how WANDisco’s trade receivables could be so large versus its revenue.

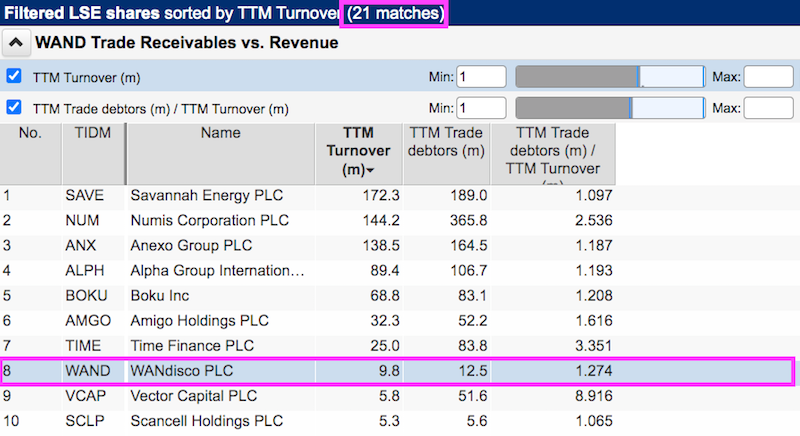

SharePad shows WANdisco among only 21 shares with trade receivables greater than revenue, which suggests the level of trade receivables was very unusual and further enquiries were very necessary:

Nobody will warn you about the next bombshell fraud

Could you have identified “significant, sophisticated and potentially fraudulent irregularities” in WANdisco’s accounts before the bombshell announcement?

The level of trade receivables suddenly surging during the first half and then surging further during the second was the only real sign of something very suspicious occurring within the books.

Everything else — the history of losses, the lack of revenue, the ultra-bullish management, that 2016 warning from Sage’s old boss, the few board meetings and the regular executive bonuses — may not have pointed to potential fraud…

…but did present a very clear picture that WANdisco was not managed for outside shareholders.

WANdisco claimed the irregularities were “represented by one senior sales employee“, which does not seem credible given the business employed 164 people and the “significant [and] sophisticated” irregularities inflated 2022 revenue by 166%.

Only time will tell how Mr Richards and his finance director could overlook what would now seem to be numerous fictitious purchase orders.

Despite beefed-up auditor reporting and greater City regulation generally, WANdisco’s likely journey to the graveyard is a sober reminder that the stock market will always be home to occasional dishonest accounting…

… and ordinary investors can only rely upon themselves to weed out the possible offenders. Nobody warned us that Patisserie Valerie was a fraud, nobody warned us that WANdisco could be a fraud… and nobody will warn us about the next bombshell fraud either.

Until next time, I wish you safe and healthy investing with SharePad.

Maynard Paton

Maynard writes about his portfolio at maynardpaton.com and co-hosts the Private Investor’s Podcast with Roland Head. He does not own shares in WANdisco.

Got some thoughts on this week’s article from Maynard? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for a specific share.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.