Michael looks at what the recent all-time high in the FTSE 100 means for traders and two trade ideas

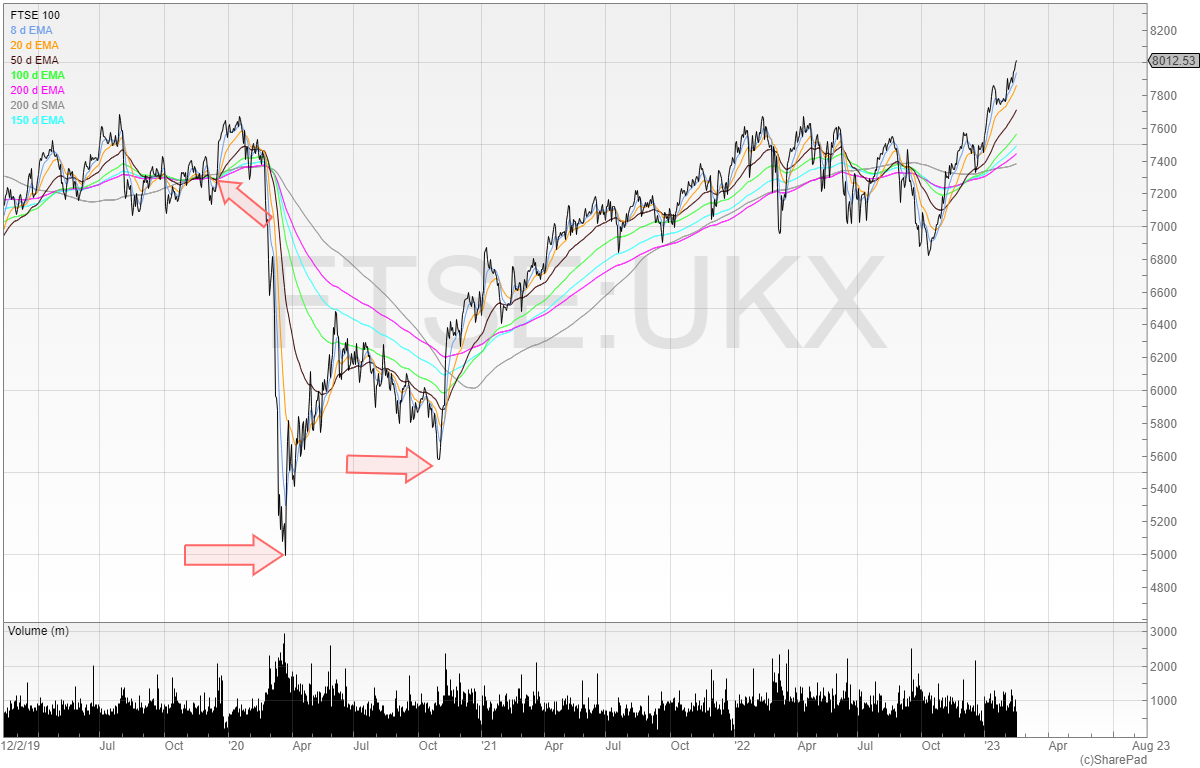

On Wednesday the FTSE 100 hit a high of 8,002. This is an all-time high and the holders of blue chips and dividend stalwarts alike will have been cheering.

All stocks have rallied in the last few months, but the FTSE 100 never showed any real sign of weakness.

(Top arrow marks the Boris Bounce – next two arrows show the bottom once lockdown was announced)

Since October 2022 the FTSE 100 has been in rally mode. This is great for those with pensions that are invested in equities as it’s almost certain that the FTSE 100 will make up some of that equity exposure.

And as the FTSE 100 has never been a fan favourite it’s also never had the overvaluations that are prevalent in the US.

But how can everyone be talking about the cost-of-living crisis and the market is at all-time highs?

We already know the stock market does not equal the economy. Is there a correlation? Of course, but saying the economy is doing badly and therefore stocks will do badly is too generic.

Generally, markets look 6-9 months forward and so this is why stocks can bottom well before the economy has started up upturn.

It’s also why stocks will start rallying despite bad news and by the time the narrative starts to turn positive the stock has already doubled in price.

But we also have to look at some of the constituents of the FTSE 100:

- BP

- HSBC

- Rio Tinto

- JD Sports

- AstraZeneca

- Anglo American

- Lloyds Banking Group

- British American Tobacco

- London Stock Exchange

- Reckitt Benckiser

- Rolls Royce

- Vodafone

- Unilever

- Diageo

- B&M

Not one of these companies is an exciting tech stock. OK, maybe you can argue London Stock Exchange because of the data… but really?

The majority of it is commodities and consumer goods. Old economy. Reliable, predictable.. and boring.

Whilst retailers have generally taken a beating, the FTSE 100 has the best-in-class Next and B&M. Commodity prices have also skyrocketed since Covid and so another reason for the FTSE 100’s performance.

But coming back to the question: what does this mean for traders?

The answer is: not much.

Unless you’re an active trader of FTSE 100 stocks then you probably don’t pay much attention to it.

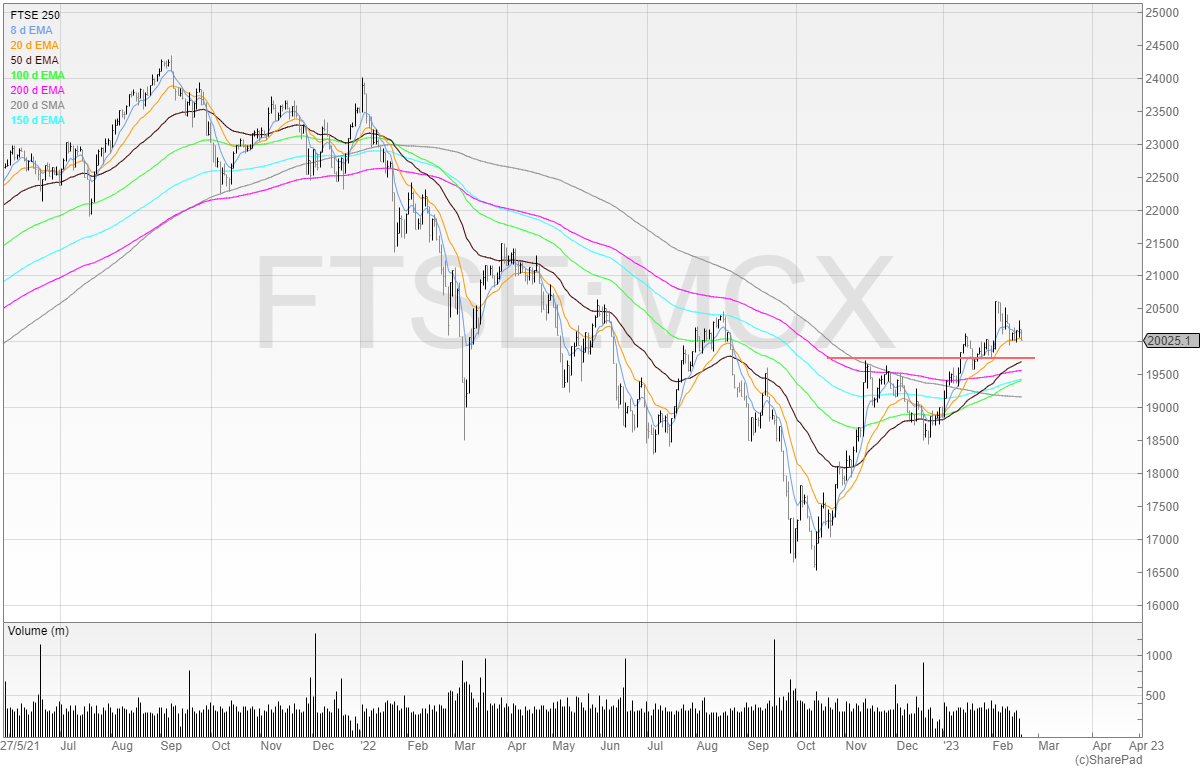

It’s more useful to pay attention to the FTSE 250.

We can see that the FTSE 250 has also been rallying since October. It has since broken out of the 200 EMA resistance and made a fresh high.

I consider this to be in an uptrend for now.

That means as a trader going long means you’re going with the trend – at least in the more domestic stocks. And then you should always be going with the trend in the individual stock.

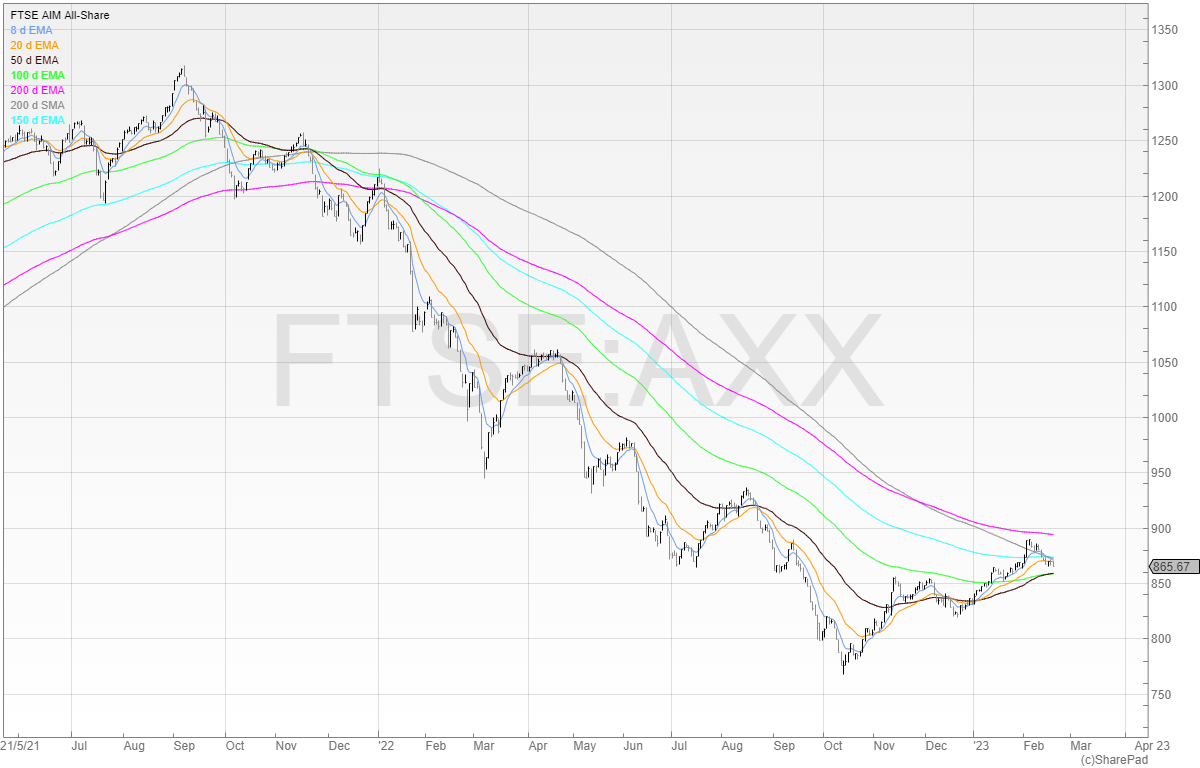

Let’s take a look at the AIM All-Share.

It’s still below the 200 moving averages.

And whilst it’s rallied from the lows it’s not exactly setting the world alight.

This suggests that the more speculative of stocks (AIM is full of trash stocks) are doing badly when you compare to the domestic FTSE 250 and the multinational FTSE 100.

That said, it’s very much a stockpicker’s market and there will always be a basket of stocks that heavily outperform the overall index. Especially in the AIM All-Share.

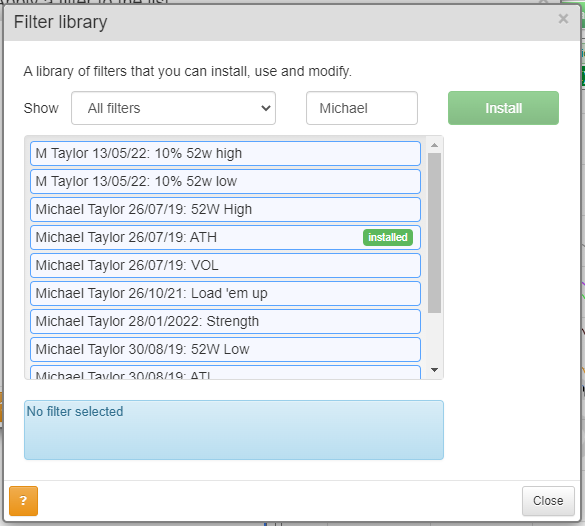

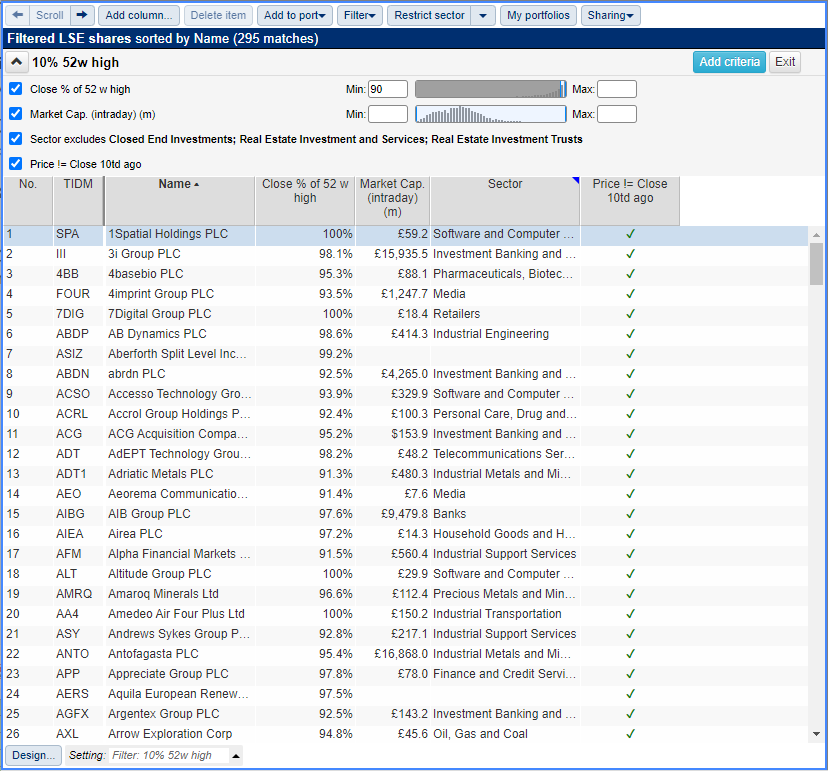

To take advantage of stocks that are breaking out I suggest using my 10% within 52-week highs filter.

Head to the filter library and search “Michael”.

This will bring up all of my filters.

From then on, install my 10% 52-week high filter and we can load up the results.

Running the filter on LSE shares brings up 295 results.

This is enough to go through over a weekend and then dig deeper into the chart.

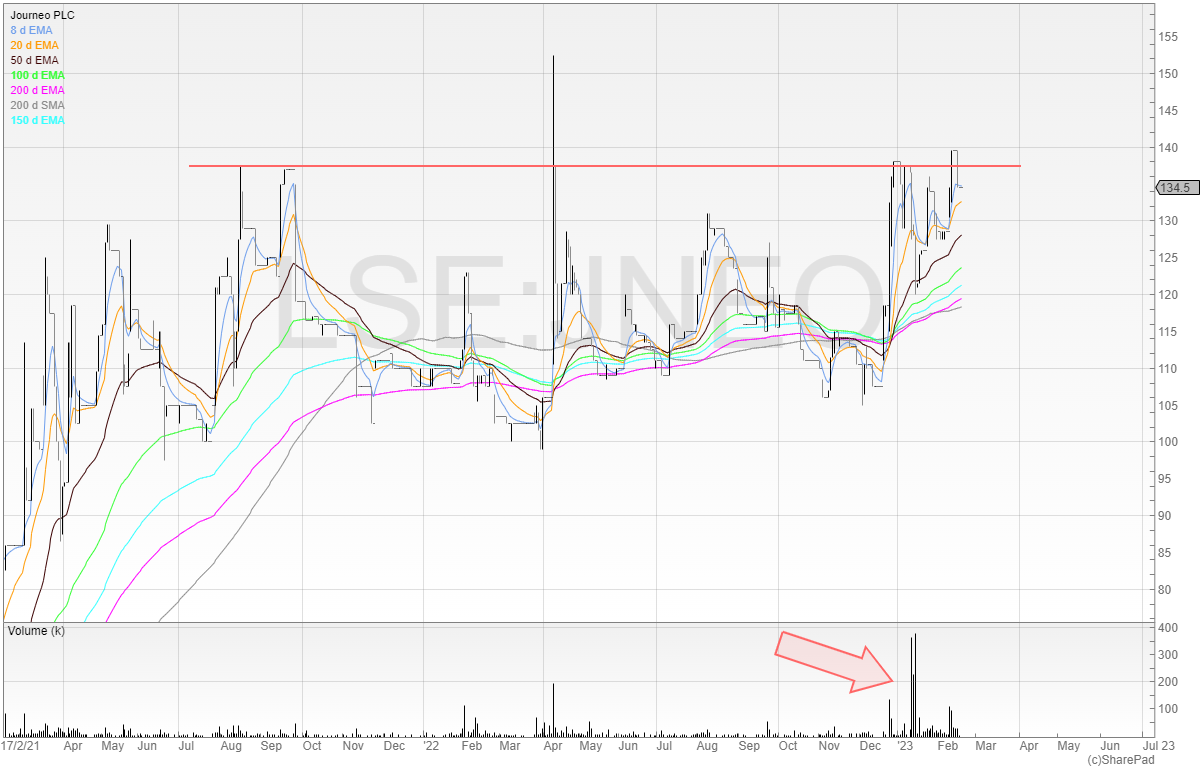

Here’s one on my watchlist: Journeo

I like the chart here as it’s been trending sideways in a range for nearly 18 months.

And the recent volume suggests something is up. A recent acquisition has grown the business.

Here’s another one: Capita

This looks to be like an extended stage one base. And a potential cup and handle forming.

However, at £480m market cap you’re unlikely to see any quick doubles here as the stock would need to find an extra £480 million of value attributed to it.

But the filter throws up some interesting ideas.

I’ve written some ideas in more detail in my premium newsletter below.

Michael Taylor

Buy the Bull Market premium newsletter available at: www.buythebullmarket.com

Twitter: @shiftingshares

Got some thoughts on this week’s article from Michael? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for a specific share or the “Traders chat”.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.