Bruce looks at the BoE Financial Stability Report and ponders whether the rising cost of mortgages will cause forced selling in equity markets. Companies covered FCAP, GAW and ZTF

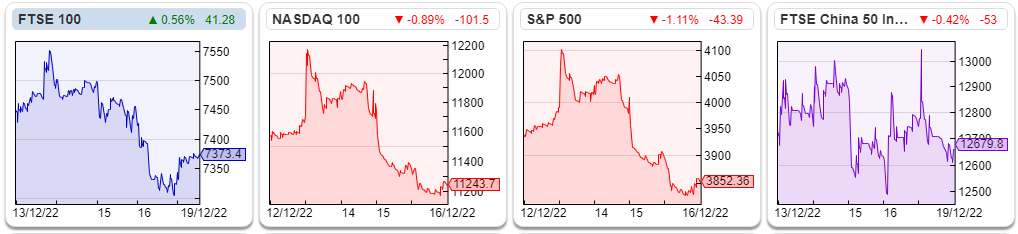

The FTSE 100 was down -1% in the last 5 days to 7,373, with the Nasdaq100 -2.8% and S&P500 -2.1%. The FTSE 100 was also flat for the year, the second-best performing major index behind the Bombay Stock Exchange (S&P BSE100), which was the only major index to end the year in positive territory. AIM was down -32% the worst-performing major index, while the Nasdaq100 and S&P500 were down -31% and -19% respectively. That suggests the sell-off was driven by a re-appraisal of risk appetite, rather than anything specific to UK markets. The UK 10Y government bond yield was 3.45%, down from a peak of 4.5% in early October. The US 10Y was 3.54%, down from a peak of 4.2% around the same time. Brent crude remains below $80 per barrel.

Financial Stability Report

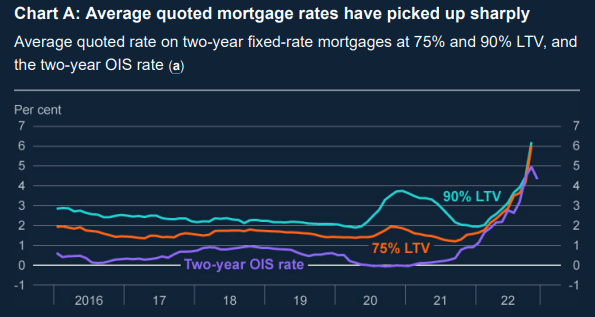

The BoE has published their twice-yearly Financial Stability Report, from where I’ve taken the chart below showing that the average 2-year fix on a 75% Loan To Value mortgage has already risen to 6%. Around a third (or 2.7m households) are on short-term rates and will face higher repayments by the end of 2023, plus a further 20% of owner-occupier mortgages (or 1.7m households) are on variable-rate mortgages.

Interestingly the spread between 90% LTV and 75% LTV mortgages has narrowed. This goes uncommented on by the Central Bank, except to say that currently, less than 10% of mortgages to owner-occupiers are above 75% LTV. That compares to a quarter of all mortgages which were >75% LTV in 2007 and 40% of new lending >90% LTV in 1991.

Sadly, that doesn’t make things easier for those unlucky 10% of households who overstretched themselves just at the wrong point in the economic cycle.

The other area to watch is the 2m Buy To Let (BTL) mortgages outstanding, which is around 8% of the housing stock. BTL borrowers are particularly vulnerable to rising interest rates, as around 85% of them are borrowing interest only from banks. Interest-only borrowers are more sensitive to tighter financial conditions.

As a general observation, the Financial Stability Report seems to contain less charts and data than before the financial crisis and the tone is more reassuring. I suppose that the Central Bank knows journalists will pick out the juiciest bits and amplify them in headlines. For instance, the section on what went wrong with Liability Driven Investments (LDI) at the back is titled ‘In focus – the resilience of LDI funds’. No one was saying LDI funds were resilient in October. Here’s a link to a fun article about a MP who has let slip that Lloyds Bank £50bn pension scheme was a forced seller in September. For context, the entire bank’s market cap is £30bn, versus £10bn loss mentioned in the article.

My feeling is that highly indebted borrowers don’t tend to have large equity holdings. Instead private investors tend to be either I) an older demographic who have been paying down their mortgage for decades and are close to debt free, or II) more recently, younger people who’ve given up on the idea of owning a house, who began investing when the pandemic hit. I could be wrong – I haven’t seen any data but it’s an impression I get from going to company presentations to amateur investors and talking to my friends with large mortgages. I imagine we’ll find out in 2023. If readers have seen any data on this, please do share on the chat.

I also wanted to highlight Michael Taylor’s piece in the FT, arguing that if you have borrowed at an attractive rate, thoughtlessly paying down your mortgage may not generate the highest expected return. Everyone’s financial circumstances are different, and neither this weekly nor his original article in the newspaper are intended as advice. However, I think it’s indisputable that there’s an opportunity cost to paying down your mortgage. Alternative uses for the money include a FTSE All World tracker +9.9% CAGR between 1994 to 2021 or smaller market cap shares which have grown +18% CAGR in the UK since the 1950’s. Past performance doesn’t represent a guarantee of future returns, but that is true of both UK house prices and equity markets.

This week I look at Zotefoams, the plastics business with an interesting story around recycled drinks cartons and Games Workshop’s partnership with Amazon. But I start with FinnCap, which looks to me an interesting way to play a recovery, albeit with uncertain timing.

FinnCap H1 to September

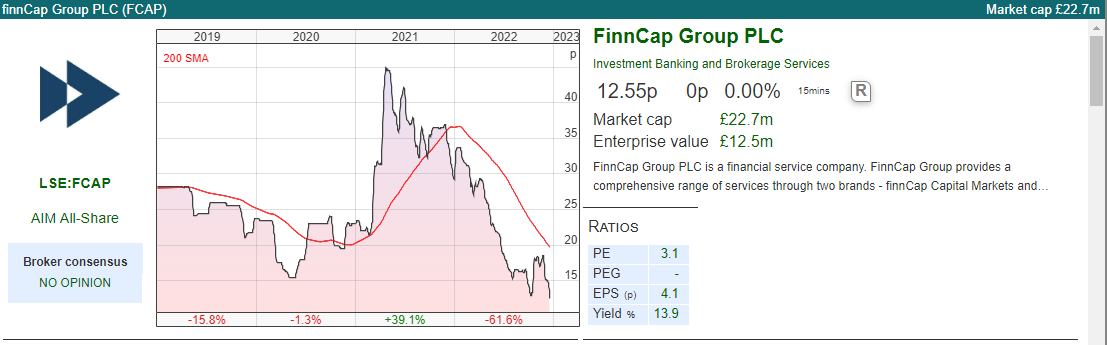

I’m flagging this broking firm which is down -62% YTD for contrarians. H1 revenue to Sept halved from £32m H1 last year to £16m H1 this year. They spent £1.4m on fees related to their aborted deal with Panmure Gordon. Despite slashing admin expenses by a third (reducing headcount by 15 across the group), that hasn’t been enough and PBT has swung from £6.3m positive last year to a loss of £2.6m this year.

They had £11m of cash remaining on their balance sheet at the end of Sept, down from £24m end of Mar year-end. I did also check that payables hadn’t increased, because sometimes brokers will flatter their cash balances with deferred consideration to employees in trade and other payables, but actually, that has decreased over the six months from £20m in Mar to £9m Sept. They’ve also scrapped the dividend, which is disappointing but understandable.

Current trading: Q3 trading remains in line with their FY March expectations, without saying what they are. Ironically for a broker, they don’t pay to have forecasts published on their own business. They released an AGM trading update in Sept, saying that they expect better group revenue performance in H2 than H1. That phrase appears to be missing from December’s RNS though, instead, they say that both Equity Capital Markets (ECM £9.3m revenues H1) and Merger and Acquisition (M&A £7.1m revenues H1) divisions should be inline or ahead of H1. That sounds like a slight reduction in expectations, from ‘better’ a couple of months ago to ‘ahead or inline’ last week.

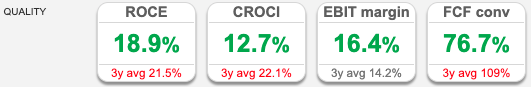

They do also say that they expect their fixed cost base to reduce to £28m for FY Mar 2024. The historic track record of RoCE and EBIT margin is impressive, so hopefully they’ll rebound in future years too.

Valuation: It looks like the business will remain loss-making for FY Mar 2023F. Putting a through-the-cycle post-tax margin of 11% on £32m of revenue FY 2023F implies £3.5m Through The Cycle earnings, so a multiple of 6x versus the current market cap. That does however ignore FinnCap’s revenue growth from £19m in Mar 2017 to £52m FY Mar last year. If you believe that the business can return to growth, and perhaps hit £80m of revenue in a few years’ time with an 11% post tax margin, that implies a multiple of (post tax earning £8.8m) under 3x. That’s without adjusting for £11m of cash, which currently represents 40% of the market cap.

Opinion: This is currently trading in “deep value” below ground levels. I can see that it’s likely that they’ll make a loss FY 2023F, and possibly 2024F too. However, they have enough cash to fund a couple of years of losses. The time to buy brokers is not when they are reporting record profits, but in the grimdark years when there is little hope. Even coal mining stocks have recently hit a rich black seam, so perhaps stockbrokers will one day? I’ll avoid for now, but it is on my watch list.

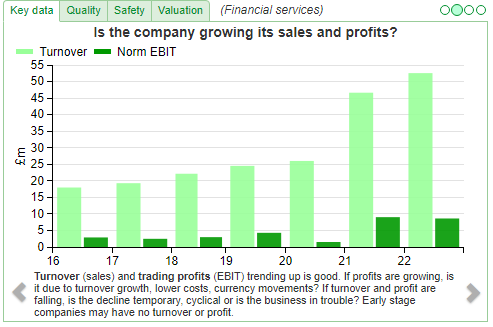

Zotefoams Trading Update FY Dec

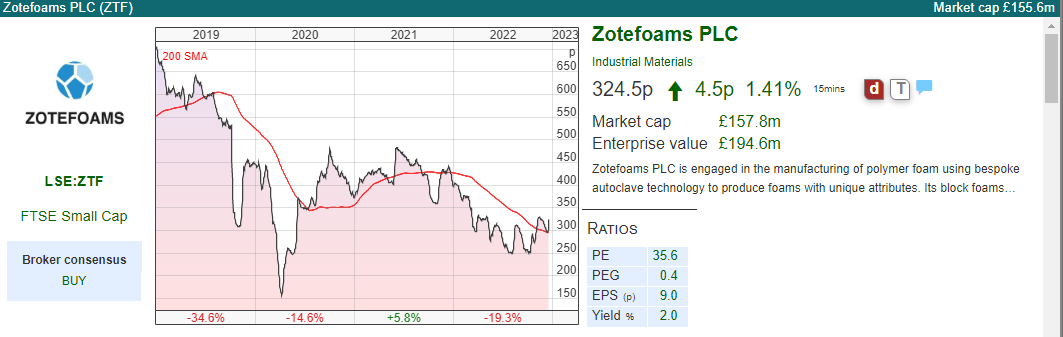

This plastics and cellular materials company was already having a good year, announced last week that October and November has remained strong, helped by weak sterling for most of 2022, the Board now expects Group FY22 adj PBT to be ahead of current market expectations (£10.7m according to the company’s RNS). There is still some uncertainty on whether customer shipments will fall this side of the year-end, so the extent of the outperformance will depend on timing of those orders. That’s understandable.

The company’s products AZOTE, ZOTEK and MuCell are used in space station pods, running shoes, life jackets, consumer packaging including food, aircraft and automotive seals, buoyancy aids and orthopaedic limbs. Just 10% of revenue comes from the UK, with Europe 28%, USA 22% and Rest of the World 40%.

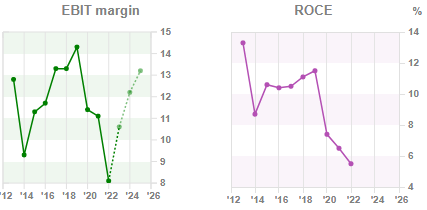

One thing I don’t like about the statement is that management describes Zotefoams as ‘world leading’, yet the 3-year average RoCE is 8.5%, and the EBIT margins are unimpressive. Both have been declining, though are forecast to rebound.

One thing I don’t like about the statement is that management describes Zotefoams as ‘world leading’, yet the 3-year average RoCE is 8.5%, and the EBIT margins are unimpressive. Both have been declining, though are forecast to rebound.

To be clear, this may be the best company in their sector, with proprietary IP, with profitability on the low side perhaps there are better areas to be world-leading? I might claim to be a world-leading shuffleboard player, however, I’m unlikely to make as good a living from the game as the world’s 100th-best football player.

The company is sensitive to higher energy costs and also their primary raw material is Low-Density Polyethylene Polymer (LDPP) which has also risen in price, but so far they have managed to pass on costs to customers and actually increased adj operating margins at the H1 stage to above 10%. That may be because they protected themselves from rising energy costs with hedges (which will become more expensive in 2023), though Sharepad’s forecast tab shows EBIT margins improving in 2023F and 2024F to 12.2% and 13.2% respectively. That implies something has changed versus the last few years and that they do now have pricing power.

History: The company was founded in 1921 as Onazote Limited and commercialised hard and soft rubber, one early application was as insulation for Wall’s ice cream vans. They’ve been headquartered in Croydon since the 1930’s, but more recent history starts with a management buyout in 1992 (revenues were £13m and PBT was £2.1m back then according to Sharepad) then in 1995 they floated on the LSE. The track record of growth since the financial crisis has been steady, although RoCE has been on the decline over the last decade.

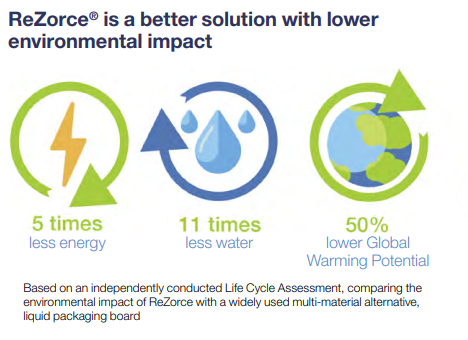

One interesting area is the ongoing development of ReZorce, a circular packaging technology with patent protection, that could offer a truly circular solution for the 300 billion unit per annum drinks carton market. At the moment although households sort drinks cartons into recycled waste, between 50%-75% actually end up in landfill or an incinerator, because the mixed material nature of cartons make them economically unattractive to recycle. Zotefoam’s solution on the other hand recycles cartons back into the same type of packaging. Their most recent comment on ReZorce was in October when they said:

“Good progress has been made on strategic initiatives, including the development of ReZorce, as well as the Group’s wider ESG focus on reducing Scope 1 and 2 carbon emissions and launching foams with recycled content.”

There’s a lot more information in their most recent Annual Report.

Valuation: The shares are trading on 16.5x and 13.5x Dec 2023F and Dec 2024F respectively. That seems about right to me, unless ReZorce really does move the dial.

Opinion: This strikes me as a good business on a reasonable valuation, but I feel like there are higher quality businesses available on similar multiples, or beaten-up stocks more geared into a recovery. I’d also like to understand how management are increasing margins at a time when their raw material and input costs are rising. That seems odd given the track record, so I’d be worried about the possibility that forecasts might be too optimistic.

Games Workshop partnership with Amazon

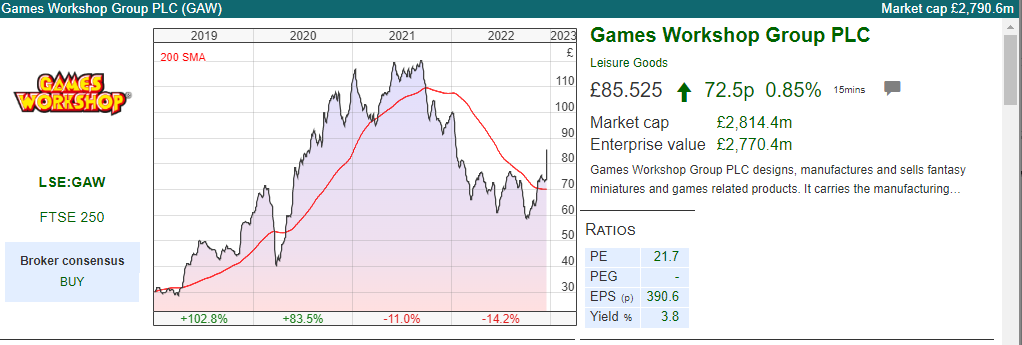

Games Workshop was up +16% last week, as on Friday it announced that it had reached an agreement in principle with Amazon to develop film and TV shows, and also to grant the online retailer associated merchandising rights. The actor Henry Cavill will be the Executive Producer, as well as bringing his sword arm to the starring role. Here’s a link to him talking about his Warhammer hobby on Graham Norton.

Games Workshop was up +16% last week, as on Friday it announced that it had reached an agreement in principle with Amazon to develop film and TV shows, and also to grant the online retailer associated merchandising rights. The actor Henry Cavill will be the Executive Producer, as well as bringing his sword arm to the starring role. Here’s a link to him talking about his Warhammer hobby on Graham Norton.

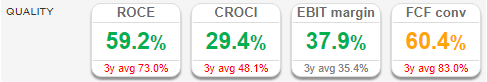

Valuation: There were no changes to forecasts to FY May 2023F, so the shares are on 21x May 2023F (there’s low single-digit EPS growth forecast for May 2024F and 2025F, so the multiple stays the same in future years). That could appear expensive for a low growth stock, however you’re also buying 73% RoCE 3 year average, operational gearing and an EBIT margin between 35% and 40%.

Opinion: As GAW is my largest holding, that announcement and the share price reaction has been an uplifting way to end the year. I intend to keep holding, as I think there’s still a lot of potential to grow the business.

Performance: More generally I’ve finished the year down -15% in the last 12 months, and at one point at the end of September was down more than -35% (it’s hard to be exact because I have been buying the dips through the year – so that calculation is just assuming my portfolio had remained unchanged from the start of 2022). My best performers were MS International up +126%, Bank of Georgia +46% and Air Partner which was bid for and was up +41% from January. My worst were 4D Pharma (small position size) which has been de-listed and is likely a zero, Creightons -66%, Smoove and Impax both down -53% since the 1st of January.

I hope readers haven’t been too discouraged about performance this year, I’m looking forward to shopping for more bargains in 2023.

Notes

The author holds shares in Games Workshop

kshop

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Weekly Market Commentary | 20/12/22 | FCAP, GAW, ZTF | Mortgages v equity investing

Bruce looks at the BoE Financial Stability Report and ponders whether the rising cost of mortgages will cause forced selling in equity markets. Companies covered FCAP, GAW and ZTF

The FTSE 100 was down -1% in the last 5 days to 7,373, with the Nasdaq100 -2.8% and S&P500 -2.1%. The FTSE 100 was also flat for the year, the second-best performing major index behind the Bombay Stock Exchange (S&P BSE100), which was the only major index to end the year in positive territory. AIM was down -32% the worst-performing major index, while the Nasdaq100 and S&P500 were down -31% and -19% respectively. That suggests the sell-off was driven by a re-appraisal of risk appetite, rather than anything specific to UK markets. The UK 10Y government bond yield was 3.45%, down from a peak of 4.5% in early October. The US 10Y was 3.54%, down from a peak of 4.2% around the same time. Brent crude remains below $80 per barrel.

Financial Stability Report

The BoE has published their twice-yearly Financial Stability Report, from where I’ve taken the chart below showing that the average 2-year fix on a 75% Loan To Value mortgage has already risen to 6%. Around a third (or 2.7m households) are on short-term rates and will face higher repayments by the end of 2023, plus a further 20% of owner-occupier mortgages (or 1.7m households) are on variable-rate mortgages.

Interestingly the spread between 90% LTV and 75% LTV mortgages has narrowed. This goes uncommented on by the Central Bank, except to say that currently, less than 10% of mortgages to owner-occupiers are above 75% LTV. That compares to a quarter of all mortgages which were >75% LTV in 2007 and 40% of new lending >90% LTV in 1991.

Sadly, that doesn’t make things easier for those unlucky 10% of households who overstretched themselves just at the wrong point in the economic cycle.

The other area to watch is the 2m Buy To Let (BTL) mortgages outstanding, which is around 8% of the housing stock. BTL borrowers are particularly vulnerable to rising interest rates, as around 85% of them are borrowing interest only from banks. Interest-only borrowers are more sensitive to tighter financial conditions.

As a general observation, the Financial Stability Report seems to contain less charts and data than before the financial crisis and the tone is more reassuring. I suppose that the Central Bank knows journalists will pick out the juiciest bits and amplify them in headlines. For instance, the section on what went wrong with Liability Driven Investments (LDI) at the back is titled ‘In focus – the resilience of LDI funds’. No one was saying LDI funds were resilient in October. Here’s a link to a fun article about a MP who has let slip that Lloyds Bank £50bn pension scheme was a forced seller in September. For context, the entire bank’s market cap is £30bn, versus £10bn loss mentioned in the article.

My feeling is that highly indebted borrowers don’t tend to have large equity holdings. Instead private investors tend to be either I) an older demographic who have been paying down their mortgage for decades and are close to debt free, or II) more recently, younger people who’ve given up on the idea of owning a house, who began investing when the pandemic hit. I could be wrong – I haven’t seen any data but it’s an impression I get from going to company presentations to amateur investors and talking to my friends with large mortgages. I imagine we’ll find out in 2023. If readers have seen any data on this, please do share on the chat.

I also wanted to highlight Michael Taylor’s piece in the FT, arguing that if you have borrowed at an attractive rate, thoughtlessly paying down your mortgage may not generate the highest expected return. Everyone’s financial circumstances are different, and neither this weekly nor his original article in the newspaper are intended as advice. However, I think it’s indisputable that there’s an opportunity cost to paying down your mortgage. Alternative uses for the money include a FTSE All World tracker +9.9% CAGR between 1994 to 2021 or smaller market cap shares which have grown +18% CAGR in the UK since the 1950’s. Past performance doesn’t represent a guarantee of future returns, but that is true of both UK house prices and equity markets.

This week I look at Zotefoams, the plastics business with an interesting story around recycled drinks cartons and Games Workshop’s partnership with Amazon. But I start with FinnCap, which looks to me an interesting way to play a recovery, albeit with uncertain timing.

FinnCap H1 to September

I’m flagging this broking firm which is down -62% YTD for contrarians. H1 revenue to Sept halved from £32m H1 last year to £16m H1 this year. They spent £1.4m on fees related to their aborted deal with Panmure Gordon. Despite slashing admin expenses by a third (reducing headcount by 15 across the group), that hasn’t been enough and PBT has swung from £6.3m positive last year to a loss of £2.6m this year.

They had £11m of cash remaining on their balance sheet at the end of Sept, down from £24m end of Mar year-end. I did also check that payables hadn’t increased, because sometimes brokers will flatter their cash balances with deferred consideration to employees in trade and other payables, but actually, that has decreased over the six months from £20m in Mar to £9m Sept. They’ve also scrapped the dividend, which is disappointing but understandable.

Current trading: Q3 trading remains in line with their FY March expectations, without saying what they are. Ironically for a broker, they don’t pay to have forecasts published on their own business. They released an AGM trading update in Sept, saying that they expect better group revenue performance in H2 than H1. That phrase appears to be missing from December’s RNS though, instead, they say that both Equity Capital Markets (ECM £9.3m revenues H1) and Merger and Acquisition (M&A £7.1m revenues H1) divisions should be inline or ahead of H1. That sounds like a slight reduction in expectations, from ‘better’ a couple of months ago to ‘ahead or inline’ last week.

They do also say that they expect their fixed cost base to reduce to £28m for FY Mar 2024. The historic track record of RoCE and EBIT margin is impressive, so hopefully they’ll rebound in future years too.

Valuation: It looks like the business will remain loss-making for FY Mar 2023F. Putting a through-the-cycle post-tax margin of 11% on £32m of revenue FY 2023F implies £3.5m Through The Cycle earnings, so a multiple of 6x versus the current market cap. That does however ignore FinnCap’s revenue growth from £19m in Mar 2017 to £52m FY Mar last year. If you believe that the business can return to growth, and perhaps hit £80m of revenue in a few years’ time with an 11% post tax margin, that implies a multiple of (post tax earning £8.8m) under 3x. That’s without adjusting for £11m of cash, which currently represents 40% of the market cap.

Opinion: This is currently trading in “deep value” below ground levels. I can see that it’s likely that they’ll make a loss FY 2023F, and possibly 2024F too. However, they have enough cash to fund a couple of years of losses. The time to buy brokers is not when they are reporting record profits, but in the grimdark years when there is little hope. Even coal mining stocks have recently hit a rich black seam, so perhaps stockbrokers will one day? I’ll avoid for now, but it is on my watch list.

Zotefoams Trading Update FY Dec

This plastics and cellular materials company was already having a good year, announced last week that October and November has remained strong, helped by weak sterling for most of 2022, the Board now expects Group FY22 adj PBT to be ahead of current market expectations (£10.7m according to the company’s RNS). There is still some uncertainty on whether customer shipments will fall this side of the year-end, so the extent of the outperformance will depend on timing of those orders. That’s understandable.

The company’s products AZOTE, ZOTEK and MuCell are used in space station pods, running shoes, life jackets, consumer packaging including food, aircraft and automotive seals, buoyancy aids and orthopaedic limbs. Just 10% of revenue comes from the UK, with Europe 28%, USA 22% and Rest of the World 40%.

To be clear, this may be the best company in their sector, with proprietary IP, with profitability on the low side perhaps there are better areas to be world-leading? I might claim to be a world-leading shuffleboard player, however, I’m unlikely to make as good a living from the game as the world’s 100th-best football player.

The company is sensitive to higher energy costs and also their primary raw material is Low-Density Polyethylene Polymer (LDPP) which has also risen in price, but so far they have managed to pass on costs to customers and actually increased adj operating margins at the H1 stage to above 10%. That may be because they protected themselves from rising energy costs with hedges (which will become more expensive in 2023), though Sharepad’s forecast tab shows EBIT margins improving in 2023F and 2024F to 12.2% and 13.2% respectively. That implies something has changed versus the last few years and that they do now have pricing power.

History: The company was founded in 1921 as Onazote Limited and commercialised hard and soft rubber, one early application was as insulation for Wall’s ice cream vans. They’ve been headquartered in Croydon since the 1930’s, but more recent history starts with a management buyout in 1992 (revenues were £13m and PBT was £2.1m back then according to Sharepad) then in 1995 they floated on the LSE. The track record of growth since the financial crisis has been steady, although RoCE has been on the decline over the last decade.

One interesting area is the ongoing development of ReZorce, a circular packaging technology with patent protection, that could offer a truly circular solution for the 300 billion unit per annum drinks carton market. At the moment although households sort drinks cartons into recycled waste, between 50%-75% actually end up in landfill or an incinerator, because the mixed material nature of cartons make them economically unattractive to recycle. Zotefoam’s solution on the other hand recycles cartons back into the same type of packaging. Their most recent comment on ReZorce was in October when they said:

“Good progress has been made on strategic initiatives, including the development of ReZorce, as well as the Group’s wider ESG focus on reducing Scope 1 and 2 carbon emissions and launching foams with recycled content.”

There’s a lot more information in their most recent Annual Report.

Valuation: The shares are trading on 16.5x and 13.5x Dec 2023F and Dec 2024F respectively. That seems about right to me, unless ReZorce really does move the dial.

Opinion: This strikes me as a good business on a reasonable valuation, but I feel like there are higher quality businesses available on similar multiples, or beaten-up stocks more geared into a recovery. I’d also like to understand how management are increasing margins at a time when their raw material and input costs are rising. That seems odd given the track record, so I’d be worried about the possibility that forecasts might be too optimistic.

Games Workshop partnership with Amazon

Valuation: There were no changes to forecasts to FY May 2023F, so the shares are on 21x May 2023F (there’s low single-digit EPS growth forecast for May 2024F and 2025F, so the multiple stays the same in future years). That could appear expensive for a low growth stock, however you’re also buying 73% RoCE 3 year average, operational gearing and an EBIT margin between 35% and 40%.

Opinion: As GAW is my largest holding, that announcement and the share price reaction has been an uplifting way to end the year. I intend to keep holding, as I think there’s still a lot of potential to grow the business.

Performance: More generally I’ve finished the year down -15% in the last 12 months, and at one point at the end of September was down more than -35% (it’s hard to be exact because I have been buying the dips through the year – so that calculation is just assuming my portfolio had remained unchanged from the start of 2022). My best performers were MS International up +126%, Bank of Georgia +46% and Air Partner which was bid for and was up +41% from January. My worst were 4D Pharma (small position size) which has been de-listed and is likely a zero, Creightons -66%, Smoove and Impax both down -53% since the 1st of January.

I hope readers haven’t been too discouraged about performance this year, I’m looking forward to shopping for more bargains in 2023.

Notes

The author holds shares in Games Workshop

kshop

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.