Bruce suggests that political leaders need a risk manager, to prevent them from increasing risk as a position moves against them. Companies covered MOON, and computer games companies FDEV and KWS.

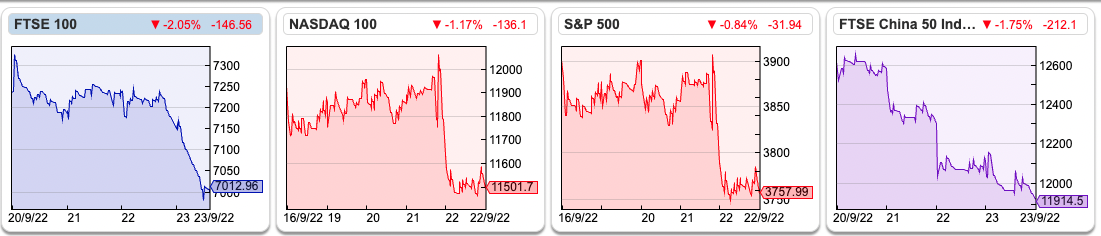

The FTSE 100 was down -3.1% last week to 7,012. US markets were also weak, with the Nasdaq 100 and S&P500 both down -3.0%. The Bank of England raised interest rates by 50bp to 2.25% and the Fed raised by 75bp to a target range of 3%-3.25%. Aside from the yield on the US 10Y Government bond, which jumped to 3.72%, the curve has become more inverted (10Y yielding less than the 2 year) with a 50bp spread, the widest in more than 40 years. That’s normally a recession indicator for the US economy.

The pound fell to 1.10 to the dollar, and the UK Govt bond yield rose to 3.79% in response to the UK government’s mini-budget. Somehow the Chancellor caused a coordinated sell-off in the pound, government bonds and the FTSE. Put another way, financial markets responded in an unequivocally negative fashion, despite the UK Government trying to suggest that the tax cuts are ‘pro-growth’.

I first came across the phrase ‘gambling for resurrection’ during the 2007-9 financial crisis. The concept had been borrowed from political science, as it refers to a weak leader with domestic problems who starts a foreign war to maintain office. An oft-cited example is Leopoldo Galtieri of Argentina. A hedge fund manager suggested to me in H1 2008 that bank management would take more risk to try to trade out of their subprime and credit derivative difficulties. As investors, we know that good risk management is to recognise losses early, rather than increase risk as a position moves against you. Political leaders do not have a risk manager though.

This interview with Sir Tony Brenton, former British Ambassador to Russia explains that the delay in Putin’s decision to mobilise the army was likely caused by an internal ‘cat fight’ (his words) among Russian elites. I saw Sir Tony give a very nuanced talk in London a decade ago at the EBRD, about the nature of Putin’s power and the Russian leader’s legal background in international trade. Putin and the siloviki fear successful democracies with an independent judiciary and free media on their border. Hence the 2014 EU trade deal that gave Ukraine preferential access was perceived as a threat by the Kremlin. Having visited Kyiv a couple of times over the years, my experience was things were gradually improving, foreign tourism brought optimism and new ideas. I even found craft beer bars and hipster cafes springing up, offering flat whites and smashed avocado on toast.

But last year GDP per capita in Ukraine was below $5K, still 4 times lower productivity than neighbouring Poland. In effect, Ukrainians are fighting, and dying, to improve their institutions, but also for visa-free travel and Ryanair flights to Europe. The value of institutions to prevent leaders from making a mess of things closer to home should not go unheeded, in my view.

After a well-deserved summer break, Mello returns with an event this evening (Monday 26th). David has got DSW Capital (a professional services firm), Plant Health Care (patented proteins such as Harpin αß that help produce healthy plants) and The Property Franchise Group (estate agency franchise).

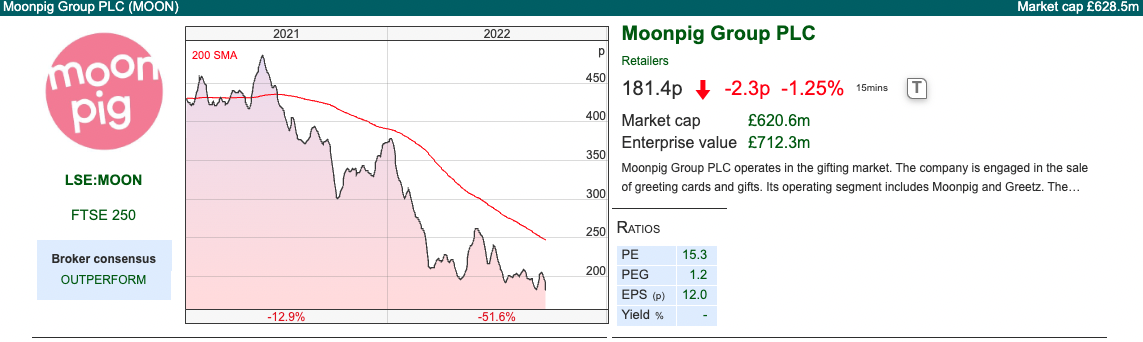

This week I look at Moonpig, an overpriced IPO which has fallen -52% YTD but is now starting to look interesting. Plus two computer games companies: Frontier Developments and Keywords Studios, which both reported results last week.

Moonpig AGM statement FY Apr

This online greeting cards business, which was IPO’ed by Private Equity (Exponent, Lexington Capital Partners plus a couple of others) at the beginning of last year put out an ‘inline’ trading update ahead of its AGM. The shares have halved in value from their IPO price. It could have been worse, Made.com also put out an RNS last week. It was floated by Level Equity and has now fallen to 4.5p versus an IPO price of 200p in June last year. I think a 98% decline in less than 18 months is a record, but if you can think of any worse IPOs let me know in the chat.

The MOON shares fell -10% on the morning of the RNS because investors tend to be sceptical of H2 weightings, as they can be a precursor to disappointment if the second-half performance fails to come through. The company has an April year end, is expecting 58-60% of revenues to be Nov-Apr (which includes Christmas obviously). Last year there wasn’t much of an H2 weighting with a revenue split 47/53 H1/H2, but pre-pandemic the revenue split was 38/62 in the FY to Apr 2020. That supports management’s assertion that the business is returning to pre-Covid seasonality, so I think the share price reaction was harsh. As an aside, the ability to easily check H1 v H2 results on Sharepad is really an excellent feature, because users can easily cross-check what management claim with the numbers that they’ve reported in the past.

History: Moonpig was founded in 2000, at the end of the first internet bubble, making personalised cards. They then expanded into gifts, such as flowers, chocolates, balloons and other personalised gifts. The Prospectus talks about a ‘gifting companion ecosystem’ – which simply means that customers can set reminders for special dates and events. I’m not sure that this is much of a competitive advantage versus other retailers, but management seems to believe it is. That said, they have a 60% market share in online cards in the UK and Netherlands and 12m active customers at the end of 2020. As well Moonpig, the company also operates Buyagift and Red Letter Days brands in the UK and the Greetz brand in the Netherlands.

Between FY Apr 2018 and FY Apr 2020 revenue doubled from £87m to £173m – then doubled again in the first year of the pandemic to £368m FY Apr 2021 just as the PE backers decided to sell to the market. They IPO’ed on the LSE in February 2021 at 350p, giving the company a market cap of £1.2bn on admission. They raised just £11m for the company and selling shareholders received £471m. The selling shareholders were Exponent, LCP, Strategic Partners and various other Private Equity vehicles. Abrdn invested pre-IPO and sold down its stake to 1% while BlackRock and Henderson were buyers. Given it was a PE-backed IPO, timed to take advantage of frothy market conditions during the vaccine rally, it’s perhaps unsurprising that the shares halved in value from the IPO price.

Shareholders: Having sold down their stake to 1% at the IPO, Abrdn have now bought back in and own 13.7%. They are now the largest shareholder. Exponent still own 12%, down from 41% pre-IPO and LCP own 5.5%, down from 19% pre-IPO. BlackRock own 9.8% and Liontrust 5.5%.

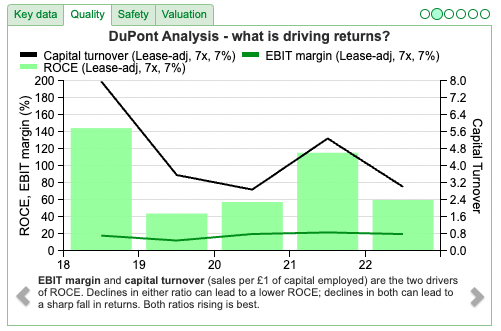

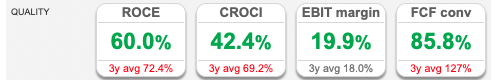

Financials: Forecasts for FY Apr 2023F (assuming the H2 weighting does indeed come through) are for £351m of revenue and £57m of PBT. Sharepad’s quality metrics, such as 60% RoCE and EBIT margin of 19.9% do reveal impressive profitability – so rather than anything fundamentally wrong with the company I think the IPO was just priced too richly. Hence, I’m flagging the company as now potentially interesting after the -50% share price decline.

Valuation: The shares are trading on a PER 12.2x Apr 2024F dropping to 10x Apr 2024F. The price/sales ratio is now below 2x, so given the high level of profitability, I think the current valuation is discounting another warning.

Opinion: Looks interesting given the recent performance. I think a good rule of thumb is to avoid IPOs where the selling shareholder is Private Equity, and I’m not sure why institutional fund managers support these deals. However, now that the share price has fallen -50% I think this is worth having a look at. The chart looks rather ugly though, so it may be worth waiting to see how they do over the next six months.

One other aspect worth pondering, is what happens to the majority of companies that PE doesn’t list on the stock exchange, but instead are re-sold to other Private Equity vehicles? This Danish pension funds says that 80% of the portfolio companies that it invested in were sold either to another buyout group or to a “continuation fund” (that is the same PE sponsor, but a different fund that it controls). Do only the worst PE deals get floated on the stock market?

Frontier Developments FY results to May

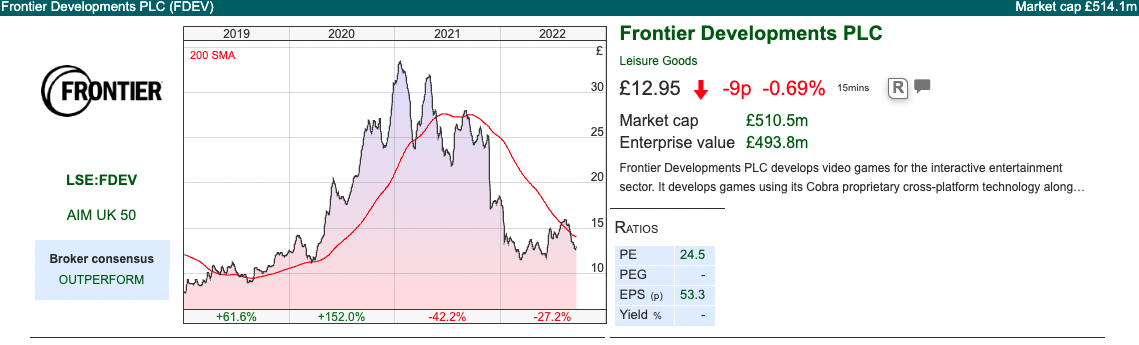

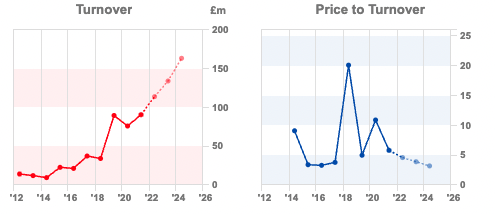

This computer games company announced FY results to May, with revenue +26% to £114m, but PBT down -95% to £1m. Both figures were in-line with a mid-June trading update from the company.

The gross profit margin was down to 65% (v 70% FY May 2021). That shouldn’t be concerning though, because FDEV has a mixed strategy, developing its own Intellectual Property for games but also licencing third-party IP, for instance paying Games Workshop royalties for Warhammer 40,000: Chaos Gate – Daemonhunters. Royalties are also paid for F1® Manager and Jurassic World. The fall in gross margin reflects the higher sales of licensed IP games, particularly Jurassic World Evolution 2 during the reporting period. FDEV also has recently set up a label (Foundry) to partner with independent developers and publish their titles, which they pay developers royalties for.

The real damage to profitability was done on the R&D (more than doubled to £46m) and sales & marketing (+69% to £12.3m) expense lines. In the June RNS, the company did warn that they would fully amortise expenses for Elite Dangerous: Odyssey, through the p&l because the sales of the game on PCs had been less popular than hoped. Management said there would be a £7m non-cash charge through the p&l and the group operating PBT would be £1m-£2m. Although the company said the fall in profits was caused by a large non-cash charge, the cash position also fell by £3.7m to £39m at 31 May 2022. That reduction in cash during FY22 reflected investment in games for release in future years, working capital movements, and the £5m of shares bought by the Employee Benefit Trust in April 2022.

Outlook: That said, last week’s FY results show cash balances at 31 August 2022 have now recovered to £53m. The statement also says the Board remains confident of delivering FY May 2023F. Looking at the past three years, around 57-58% of revenue has been in Nov-May H2, which obviously contains Christmas. Going back to before the pandemic, the company had weak Christmas seasons in 2018 and 2019, with H2 revenues being below the level of H1 – suggesting that before the pandemic the games didn’t tend to be gifted? Longer term the company has guided that they think they can grow at CAGR of 20%. That could be right, but there’s no analysis to support it.

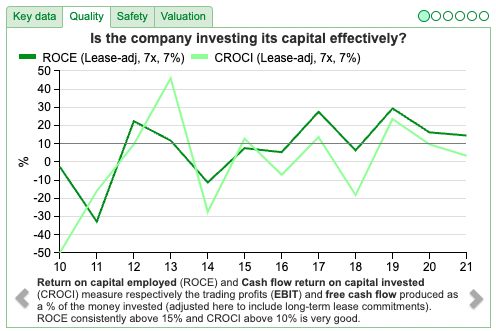

Valuation: The shares are trading on 19x May 2024F and 3.2x sales forecast in the same year. Historically RoCE has been lumpy, depending on the upfront cost spent to develop games versus the timing of their release cycle. Since 2018 Frontier’s RoCE has swung between 29% and 1% just reported, so profitability ought to improve in the coming years. They also mention in the commentary a trend of releasing paid-downloadable content (PDLC), effectively paid updates for games, which should mean that revenue becomes less lumpy in future. They don’t put any numbers on PDLC yet though.

Shareholders: David Braben, the founder has stood down as Chief Exec, but still owns 32.8% of the shares. He retains the role of Board President and Founder. There’s also a new Non-Exec Chairman, David Wilton who was previously the CFO of Sumo until it was bought by Tencent. Jonny Watts is the new Chief Exec, he’s worked with David Braben for 24 years and has been FDEV’s Chief Creative Officer for the last decade. He has two degrees, one in zoology and one in computer science.

The next largest shareholder of FDEV is Tencent the Chinese ‘superapp’ and games company run by Pony Ma, which owns 8.6%. Tencent has been buying up computer games companies like US-listed Epic Games and AIM-listed Sumo Group, but more recently the Chinese government seems to have taken a dim view of expanding internationally and also tried to limit playing time because it believed video games were distracting Chinese children from education.

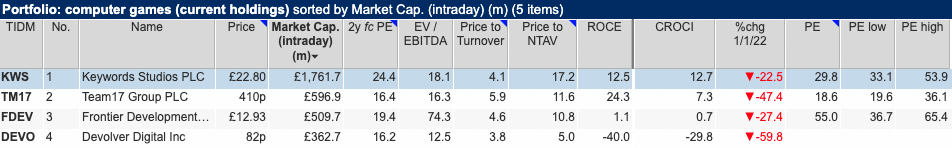

Opinion: I wrote up the whole sector for MoneyWeek in August. I was hoping to find some high conviction ‘buy’ ideas, but with household disposable incomes under pressure, I became nervous that the sector might struggle over the coming six months. I’ve used Shared to make a comparison table, showing that all of the companies are trading at or below their historic high-low PE range. If they have disappointing sales over Christmas, I think they could become cheaper though.

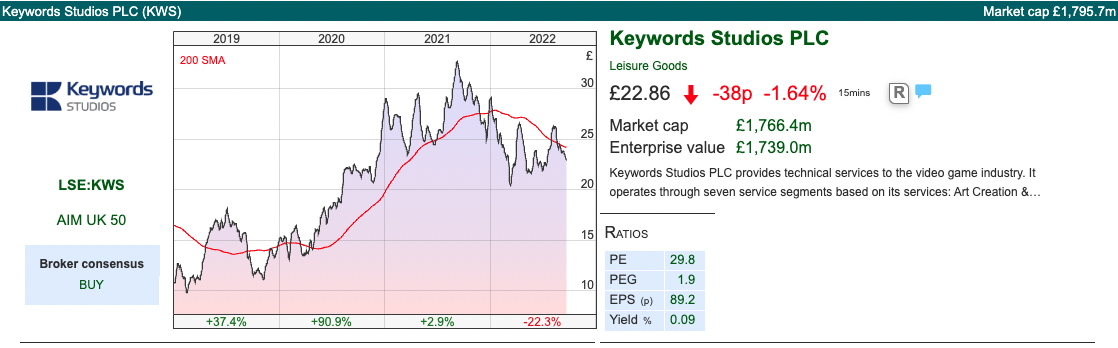

Keywords Studios H1 results June

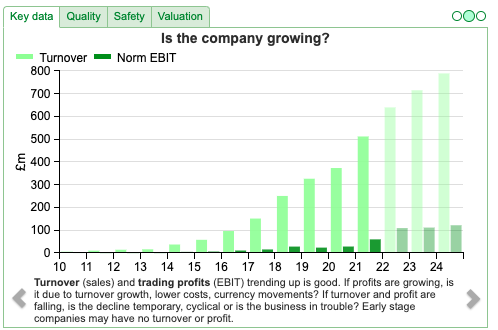

This acquisitive computer games support services company released H1 results with revenues up +34.5% to €321m for H1 to June. On an organic basis revenue growth was +22%. Statutory PBT was €39m, an increase of +78%. Net cash, ex-lease liabilities, was €121m and they have undrawn credit facilities of €150m.

They made three acquisitions in the first half for €67m total maximum consideration. The most recent was Smoking Gun for $40m Canadian dollars (£26m or €30m) announced last week, which creates real-time strategy games like Microsoft Solitaire and Microsoft Mahjong.

Keywords started out as offering translation services for computer games companies but has diversified into related services such as marketing, player support, art services, functionality quality assessment as well as localisation. They say that they are the clear market leader in what they do, 3x larger than the next biggest competitor, but still only have 5% market share. One thing to notice is the much lower gross margin 38.8% H1 to June than other computer game companies because they are providing support services rather than developing games with their own IP.

I’ve noticed that the story has changed, with management now acquiring independent developers (Smoking Gun being the most recent example), rather than just translation or other support services. That may be to improve the margin but does suggest that the risk profile of the group is changing.

Outlook: The company is comfortable with FY Dec 2022F revenue forecasts of €642m and €102m of adjusted PBT. That implies +25% growth in revenue and +19% growth in PBT this year. Historically Keywords organic revenue growth has averaged c. 15% per annum (low of 10% growth in 2018 and a high of 19% growth in 2021) from 2017 onwards.

That impressive organic growth has been helped by acquisitions, meaning that total revenue has compounded at +31% CAGR since 2017. Adjusted PBT has grown at +34% CAGR over the same time period. Their track record is hard to fault, KWS listed on AIM in mid-2013 at 123p valuing the company at just under £50m market cap. The share price is now 2286p and the market cap £1.8bn.

Valuation: The shares are trading on 24x Dec 2023F falling to 22x Dec 2024F, which is towards the lower end of the historic range. Management clearly believes there are plenty of opportunities to continue growing, but I also note that 3-year RoCE is below 10%, so I’d be reluctant to pay a high multiple for that growth.

Opinion: I’ve been nervous that so many international acquisitions would be hard to integrate and keep the company’s culture. But so far management have done very well. As a services company, KWS’s revenue ought to be more stable than FDEV, which is driven by their games release cycle and the hit/flop dynamics of titles. I regret selling my KWS shares after they quadrupled to £8, but I don’t feel much urgency to chase them above £22.

Bruce Packard

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Weekly Market Commentary 26/09/22 |MOON, FDEV, KWS| Gambling for Resurrection

Bruce suggests that political leaders need a risk manager, to prevent them from increasing risk as a position moves against them. Companies covered MOON, and computer games companies FDEV and KWS.

The FTSE 100 was down -3.1% last week to 7,012. US markets were also weak, with the Nasdaq 100 and S&P500 both down -3.0%. The Bank of England raised interest rates by 50bp to 2.25% and the Fed raised by 75bp to a target range of 3%-3.25%. Aside from the yield on the US 10Y Government bond, which jumped to 3.72%, the curve has become more inverted (10Y yielding less than the 2 year) with a 50bp spread, the widest in more than 40 years. That’s normally a recession indicator for the US economy.

The pound fell to 1.10 to the dollar, and the UK Govt bond yield rose to 3.79% in response to the UK government’s mini-budget. Somehow the Chancellor caused a coordinated sell-off in the pound, government bonds and the FTSE. Put another way, financial markets responded in an unequivocally negative fashion, despite the UK Government trying to suggest that the tax cuts are ‘pro-growth’.

I first came across the phrase ‘gambling for resurrection’ during the 2007-9 financial crisis. The concept had been borrowed from political science, as it refers to a weak leader with domestic problems who starts a foreign war to maintain office. An oft-cited example is Leopoldo Galtieri of Argentina. A hedge fund manager suggested to me in H1 2008 that bank management would take more risk to try to trade out of their subprime and credit derivative difficulties. As investors, we know that good risk management is to recognise losses early, rather than increase risk as a position moves against you. Political leaders do not have a risk manager though.

This interview with Sir Tony Brenton, former British Ambassador to Russia explains that the delay in Putin’s decision to mobilise the army was likely caused by an internal ‘cat fight’ (his words) among Russian elites. I saw Sir Tony give a very nuanced talk in London a decade ago at the EBRD, about the nature of Putin’s power and the Russian leader’s legal background in international trade. Putin and the siloviki fear successful democracies with an independent judiciary and free media on their border. Hence the 2014 EU trade deal that gave Ukraine preferential access was perceived as a threat by the Kremlin. Having visited Kyiv a couple of times over the years, my experience was things were gradually improving, foreign tourism brought optimism and new ideas. I even found craft beer bars and hipster cafes springing up, offering flat whites and smashed avocado on toast.

But last year GDP per capita in Ukraine was below $5K, still 4 times lower productivity than neighbouring Poland. In effect, Ukrainians are fighting, and dying, to improve their institutions, but also for visa-free travel and Ryanair flights to Europe. The value of institutions to prevent leaders from making a mess of things closer to home should not go unheeded, in my view.

After a well-deserved summer break, Mello returns with an event this evening (Monday 26th). David has got DSW Capital (a professional services firm), Plant Health Care (patented proteins such as Harpin αß that help produce healthy plants) and The Property Franchise Group (estate agency franchise).

This week I look at Moonpig, an overpriced IPO which has fallen -52% YTD but is now starting to look interesting. Plus two computer games companies: Frontier Developments and Keywords Studios, which both reported results last week.

Moonpig AGM statement FY Apr

This online greeting cards business, which was IPO’ed by Private Equity (Exponent, Lexington Capital Partners plus a couple of others) at the beginning of last year put out an ‘inline’ trading update ahead of its AGM. The shares have halved in value from their IPO price. It could have been worse, Made.com also put out an RNS last week. It was floated by Level Equity and has now fallen to 4.5p versus an IPO price of 200p in June last year. I think a 98% decline in less than 18 months is a record, but if you can think of any worse IPOs let me know in the chat.

The MOON shares fell -10% on the morning of the RNS because investors tend to be sceptical of H2 weightings, as they can be a precursor to disappointment if the second-half performance fails to come through. The company has an April year end, is expecting 58-60% of revenues to be Nov-Apr (which includes Christmas obviously). Last year there wasn’t much of an H2 weighting with a revenue split 47/53 H1/H2, but pre-pandemic the revenue split was 38/62 in the FY to Apr 2020. That supports management’s assertion that the business is returning to pre-Covid seasonality, so I think the share price reaction was harsh. As an aside, the ability to easily check H1 v H2 results on Sharepad is really an excellent feature, because users can easily cross-check what management claim with the numbers that they’ve reported in the past.

History: Moonpig was founded in 2000, at the end of the first internet bubble, making personalised cards. They then expanded into gifts, such as flowers, chocolates, balloons and other personalised gifts. The Prospectus talks about a ‘gifting companion ecosystem’ – which simply means that customers can set reminders for special dates and events. I’m not sure that this is much of a competitive advantage versus other retailers, but management seems to believe it is. That said, they have a 60% market share in online cards in the UK and Netherlands and 12m active customers at the end of 2020. As well Moonpig, the company also operates Buyagift and Red Letter Days brands in the UK and the Greetz brand in the Netherlands.

Between FY Apr 2018 and FY Apr 2020 revenue doubled from £87m to £173m – then doubled again in the first year of the pandemic to £368m FY Apr 2021 just as the PE backers decided to sell to the market. They IPO’ed on the LSE in February 2021 at 350p, giving the company a market cap of £1.2bn on admission. They raised just £11m for the company and selling shareholders received £471m. The selling shareholders were Exponent, LCP, Strategic Partners and various other Private Equity vehicles. Abrdn invested pre-IPO and sold down its stake to 1% while BlackRock and Henderson were buyers. Given it was a PE-backed IPO, timed to take advantage of frothy market conditions during the vaccine rally, it’s perhaps unsurprising that the shares halved in value from the IPO price.

Shareholders: Having sold down their stake to 1% at the IPO, Abrdn have now bought back in and own 13.7%. They are now the largest shareholder. Exponent still own 12%, down from 41% pre-IPO and LCP own 5.5%, down from 19% pre-IPO. BlackRock own 9.8% and Liontrust 5.5%.

Financials: Forecasts for FY Apr 2023F (assuming the H2 weighting does indeed come through) are for £351m of revenue and £57m of PBT. Sharepad’s quality metrics, such as 60% RoCE and EBIT margin of 19.9% do reveal impressive profitability – so rather than anything fundamentally wrong with the company I think the IPO was just priced too richly. Hence, I’m flagging the company as now potentially interesting after the -50% share price decline.

Valuation: The shares are trading on a PER 12.2x Apr 2024F dropping to 10x Apr 2024F. The price/sales ratio is now below 2x, so given the high level of profitability, I think the current valuation is discounting another warning.

Opinion: Looks interesting given the recent performance. I think a good rule of thumb is to avoid IPOs where the selling shareholder is Private Equity, and I’m not sure why institutional fund managers support these deals. However, now that the share price has fallen -50% I think this is worth having a look at. The chart looks rather ugly though, so it may be worth waiting to see how they do over the next six months.

One other aspect worth pondering, is what happens to the majority of companies that PE doesn’t list on the stock exchange, but instead are re-sold to other Private Equity vehicles? This Danish pension funds says that 80% of the portfolio companies that it invested in were sold either to another buyout group or to a “continuation fund” (that is the same PE sponsor, but a different fund that it controls). Do only the worst PE deals get floated on the stock market?

Frontier Developments FY results to May

This computer games company announced FY results to May, with revenue +26% to £114m, but PBT down -95% to £1m. Both figures were in-line with a mid-June trading update from the company.

The gross profit margin was down to 65% (v 70% FY May 2021). That shouldn’t be concerning though, because FDEV has a mixed strategy, developing its own Intellectual Property for games but also licencing third-party IP, for instance paying Games Workshop royalties for Warhammer 40,000: Chaos Gate – Daemonhunters. Royalties are also paid for F1® Manager and Jurassic World. The fall in gross margin reflects the higher sales of licensed IP games, particularly Jurassic World Evolution 2 during the reporting period. FDEV also has recently set up a label (Foundry) to partner with independent developers and publish their titles, which they pay developers royalties for.

The real damage to profitability was done on the R&D (more than doubled to £46m) and sales & marketing (+69% to £12.3m) expense lines. In the June RNS, the company did warn that they would fully amortise expenses for Elite Dangerous: Odyssey, through the p&l because the sales of the game on PCs had been less popular than hoped. Management said there would be a £7m non-cash charge through the p&l and the group operating PBT would be £1m-£2m. Although the company said the fall in profits was caused by a large non-cash charge, the cash position also fell by £3.7m to £39m at 31 May 2022. That reduction in cash during FY22 reflected investment in games for release in future years, working capital movements, and the £5m of shares bought by the Employee Benefit Trust in April 2022.

Outlook: That said, last week’s FY results show cash balances at 31 August 2022 have now recovered to £53m. The statement also says the Board remains confident of delivering FY May 2023F. Looking at the past three years, around 57-58% of revenue has been in Nov-May H2, which obviously contains Christmas. Going back to before the pandemic, the company had weak Christmas seasons in 2018 and 2019, with H2 revenues being below the level of H1 – suggesting that before the pandemic the games didn’t tend to be gifted? Longer term the company has guided that they think they can grow at CAGR of 20%. That could be right, but there’s no analysis to support it.

Valuation: The shares are trading on 19x May 2024F and 3.2x sales forecast in the same year. Historically RoCE has been lumpy, depending on the upfront cost spent to develop games versus the timing of their release cycle. Since 2018 Frontier’s RoCE has swung between 29% and 1% just reported, so profitability ought to improve in the coming years. They also mention in the commentary a trend of releasing paid-downloadable content (PDLC), effectively paid updates for games, which should mean that revenue becomes less lumpy in future. They don’t put any numbers on PDLC yet though.

Shareholders: David Braben, the founder has stood down as Chief Exec, but still owns 32.8% of the shares. He retains the role of Board President and Founder. There’s also a new Non-Exec Chairman, David Wilton who was previously the CFO of Sumo until it was bought by Tencent. Jonny Watts is the new Chief Exec, he’s worked with David Braben for 24 years and has been FDEV’s Chief Creative Officer for the last decade. He has two degrees, one in zoology and one in computer science.

The next largest shareholder of FDEV is Tencent the Chinese ‘superapp’ and games company run by Pony Ma, which owns 8.6%. Tencent has been buying up computer games companies like US-listed Epic Games and AIM-listed Sumo Group, but more recently the Chinese government seems to have taken a dim view of expanding internationally and also tried to limit playing time because it believed video games were distracting Chinese children from education.

Opinion: I wrote up the whole sector for MoneyWeek in August. I was hoping to find some high conviction ‘buy’ ideas, but with household disposable incomes under pressure, I became nervous that the sector might struggle over the coming six months. I’ve used Shared to make a comparison table, showing that all of the companies are trading at or below their historic high-low PE range. If they have disappointing sales over Christmas, I think they could become cheaper though.

Keywords Studios H1 results June

This acquisitive computer games support services company released H1 results with revenues up +34.5% to €321m for H1 to June. On an organic basis revenue growth was +22%. Statutory PBT was €39m, an increase of +78%. Net cash, ex-lease liabilities, was €121m and they have undrawn credit facilities of €150m.

They made three acquisitions in the first half for €67m total maximum consideration. The most recent was Smoking Gun for $40m Canadian dollars (£26m or €30m) announced last week, which creates real-time strategy games like Microsoft Solitaire and Microsoft Mahjong.

Keywords started out as offering translation services for computer games companies but has diversified into related services such as marketing, player support, art services, functionality quality assessment as well as localisation. They say that they are the clear market leader in what they do, 3x larger than the next biggest competitor, but still only have 5% market share. One thing to notice is the much lower gross margin 38.8% H1 to June than other computer game companies because they are providing support services rather than developing games with their own IP.

I’ve noticed that the story has changed, with management now acquiring independent developers (Smoking Gun being the most recent example), rather than just translation or other support services. That may be to improve the margin but does suggest that the risk profile of the group is changing.

Outlook: The company is comfortable with FY Dec 2022F revenue forecasts of €642m and €102m of adjusted PBT. That implies +25% growth in revenue and +19% growth in PBT this year. Historically Keywords organic revenue growth has averaged c. 15% per annum (low of 10% growth in 2018 and a high of 19% growth in 2021) from 2017 onwards.

That impressive organic growth has been helped by acquisitions, meaning that total revenue has compounded at +31% CAGR since 2017. Adjusted PBT has grown at +34% CAGR over the same time period. Their track record is hard to fault, KWS listed on AIM in mid-2013 at 123p valuing the company at just under £50m market cap. The share price is now 2286p and the market cap £1.8bn.

Valuation: The shares are trading on 24x Dec 2023F falling to 22x Dec 2024F, which is towards the lower end of the historic range. Management clearly believes there are plenty of opportunities to continue growing, but I also note that 3-year RoCE is below 10%, so I’d be reluctant to pay a high multiple for that growth.

Opinion: I’ve been nervous that so many international acquisitions would be hard to integrate and keep the company’s culture. But so far management have done very well. As a services company, KWS’s revenue ought to be more stable than FDEV, which is driven by their games release cycle and the hit/flop dynamics of titles. I regret selling my KWS shares after they quadrupled to £8, but I don’t feel much urgency to chase them above £22.

Bruce Packard

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.