Richard’s filter strikes out, so he takes a closer look at Cerillion, the software company that achieved no strikes at all last time. The company has a perfect track record, but how much does that tell us about the future?

5 Strikes

Over the last few weeks, very few companies have published annual reports, only one has passed my minimum quality filter. A brief look at cut price shoe seller Shoe Zone’s financial track record revealed too many strikes to put it on my research list.

| Name | TIDM | Prev AR | Strikes | # Strikes |

|---|---|---|---|---|

| Shoe Zone | SHOE | 30/1/26 | – CROCI – Debt – Growth – ROCE | 4 |

| Click here for our 5 Strikes explainer | 05/02/2026 | |||

January and February generally do not produce many candidates for investment. Many companies close their financial year at the same time as the calendar year-end, and they are busy preparing their preliminary results and subsequent annual reports.

In spring, I will be much busier.

The winter lull gives me the opportunity to investigate the companies that have achieved a few strikes in a bit more detail. This time, I’ve chosen Cerillion, the software company that achieved no strikes at all.

What Cerillion does

The first question I ask when I look at a new company is how it makes money. It is often a tricky one to answer. On the surface, Cerillion is quite straightforward.

It makes software for telecommunications companies that connects customers to fixed-line, mobile and broadband networks. It enables them to introduce new telephone and internet products, tariffs, and packages, bill and charge customers, take orders and deal with billing queries for example.

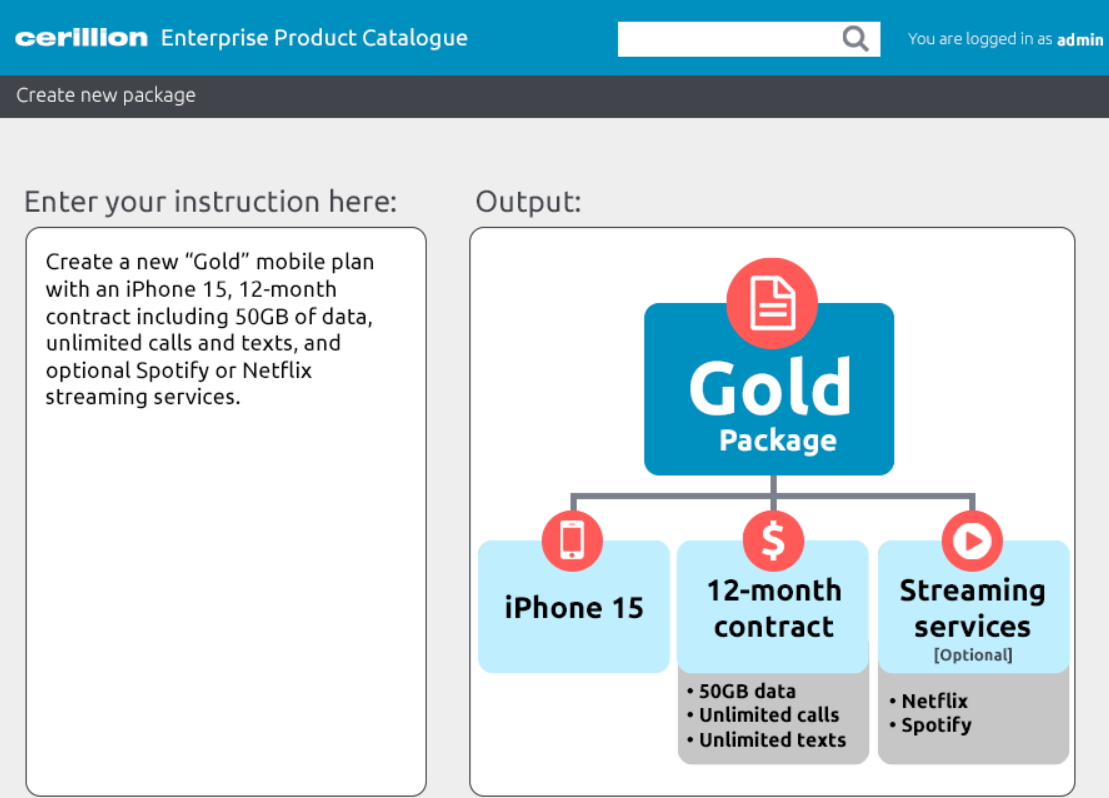

This blog post explains one of Cerillion’s newer features. Customers can use the Generative AI provider of their choice, like ChatGPT, Google Gemini and Claude, to create a new product within Cerrillion’s software by typing in a description or uploading a crudely drawn diagram:

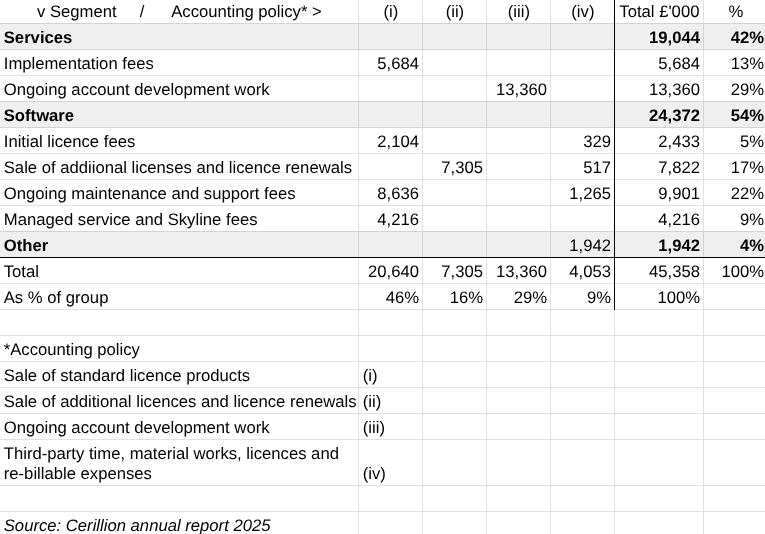

Cerillion’s segmental report, though, suggests that its offering is a lot more complicated than just writing code and selling it. In the table below showing the segmental breakdown, I have calculated the contribution of each segment as a percentage of the total.

In many industries, software has moved to a rental model known as SaaS, software as a service delivered over the internet.

The only SaaS product explicitly identified in the annual report for 2025 is Skyline, billing and charging software for Communications Service Providers (CSPs). Cerillion’s website promotes another SaaS product: Unify. This appears to be a SaaS version of the company’s longstanding product platform.

Skyline fees are lumped into a subsegment with managed services that contributed just 9% of revenue in 2025. Most of the software sales are licences (22% of revenue).

SaaS software is sold under time-limited licences, as opposed to old-school perpetual licences for locally installed and managed software, but Cerillion’s reporting doesn’t distinguish between the two types of contract. This makes it impossible to know for sure how much revenue is SaaS revenue.

The difference is significant. SaaS is a rental model. Perpetual licences confer ownership. SaaS agreements generate regular payments. Perpetual licences are paid all at once upfront.

SaaS products are delivered over the internet. Maintenance and upgrades are pushed automatically to customers, lowering costs, and customers can generally do more of the configuration themselves. When the software company is required to provide support, it can do it remotely.

These differences have implications for revenue and profit. In the short-term a transition to SaaS reduces revenue and profit growth as upfront licence payments are replaced with regular subscription fees.

Once a company has transitioned to SaaS, which can take many years, growth should reassert itself as each new customer adds to the recurring revenue from the installed base.

Rivals should also be developing SaaS capabilities so the transition creates an opportunity to do it quicker and better, and take market share at their expense. But it is also possible that it works the other way and rivals win Cerillion customers.

The impact on profitability depends on revenue and costs. One of the benefits to customers is that a SaaS solution should be cheaper. The challenge to the software company is to maintain or improve its profit margins, by holding on to some of the cost savings, especially while it is supporting two business models.

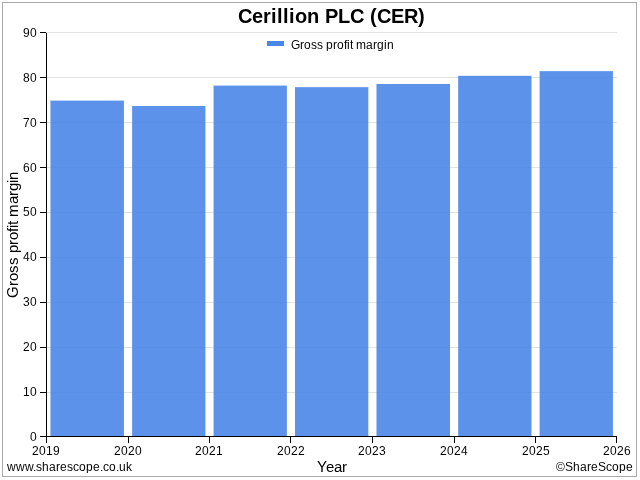

Cerillion appears to be getting more profitable. Between 2019 and 2025, gross profit margin has increased from 75% to nearly 82%.

Cerillion’s coyness about Saas revenue raises my hackles slightly. In the 2024 annual report, chief executive Louis Tancred Hall wrote:

“… market acceptance of SaaS-based product solutions continues to increase. Cerillion’s platform solution with a modular approach compares favourably to the more bespoke, services-heavy systems provided by the traditional vendors, our SaaS-based product offers telecom companies significant financial and operational benefits, lowering the total cost of ownership and providing them with the ability to launch new products with greater agility.”

The future is SaaS, but to me, the segmental report says the past and present are not.

I think high levels of service revenue are likely to be associated with perpetual licences, given Cerillion’s long-established user base. Before 2024, Cerillion disclosed SaaS revenue, defined as subscriptions for managed services and products sold on a “right to use” (rental) basis. In 2023, it was only 11% of total revenue.

In 2025, Cerillion earned 13% of revenue from implementing software (installing and configuring it), 22% from ongoing maintenance and support, and 29% from ongoing account development work (upgrades and enhancements). That adds up to 64% of total revenue. It is unlikely that a SaaS business would generate so much revenue from supporting activities.

Incidentally, the allocation of ongoing maintenance and support to the Software segment is confusing because it looks like a Service. The rationale may be that this is reliable, predictable income that follows the sale of a licence unlike the windfalls from implementation fees and account development. This is what brings Software revenue up from 31% to 54% and takes Service revenue down to 42% in the segmental report.

Another giveaway that Cerillion is not predominantly a SaaS business yet is that SaaS revenue is recurring. Investors often look to recurring revenue to tell them whether the core business is growing while a company is transitioning to a SaaS model. Cerillion’s recurring revenue was only 35% in 2025, and the measure includes items that may not be SaaS-like including third-party hardware costs.

The lowest quality revenue (least profitable) is probably from the sale of third party products and services. These include hardware and hosting. This amounted to 9% of revenue, which means 91% of revenue is derived from the sale or modification of Cerillion software, its own intellectual property. This is reassuring.

My first deep dive into Cerillion leaves me a bit conflicted. The company knows how to profit and grow, and believes it is ahead of rivals when it comes to SaaS.

But the transition to SaaS reduces the relevance of its track record when extrapolating future performance. I don’t think I should have had to work so hard to understand what Cerillion does. And I am not as confident as I should be that I do.

It has also reminded me that accounting at software companies is complex. Cerillion says as much in the notes to its accounts:

Source: Cerillion annual report 2025. Standard licensed product sales are “complex”.

Richard Beddard

Contact Richard Beddard by email: richard@beddard.net, web: beddard.net

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Penetrating analysis. Thanks Richard

Thanks John!

I don’t think the market knows what it wants from the software sector. I think the market is very confused.

The message used to be clear. Your clients are moving from on-site, to off-site and then to the cloud. Your future is on the cloud. And your future is recurring (SaaS) on the cloud.

Along come companies like Palantir who do have their own software but have field engineers working on-site with customers to engineer heavily customised solutions specific to that one customer engagement. Such consultancy heavy activities need very large customer accounts with deep pockets (~$30M per engagement). But companies like Cerillion are tiny and have tiny customer accounts. Not the sort of customers that can afford Palantir … or OpenAI.But strangely companies like Palantir don’t have very many customers. Whereas established software buinesses have very many customers.

And then the larger data / software companies who have moved to the cloud, and who have moved significantly towards SaaS announce that they need to invest a little more to take advantage of AI. Here I am thinking about: Experian, London Stock Exchange, Rightmove, Autotarder, Relx, Sage. And the market drives down their PE multiple to say “we dont think you are going to grown much”. All of the companies listed have very many customers and a great track record.

And right at the early stage, small companies you have Private Equity trusts such as HGT and Oakley – who focus on Softare / Services businesses – being hit by the market because the market think they are not going to thrive.

Well, “Mr Market” what do you want? You are suddenly skeptical about AI related Capex at the top end Hyperscalers. Skeptical about profitable, established SaaS large companies, skpetical about mid-sized SaaS companies still going through the transition, and skeptical about the tiny early stage companies of the future!

Meanwhile the market just keeps on bidding up the price of Semiconductors without asking what these semiconductors are doing to add value to customers.

… I think the market is just very, very confused.

Hi Neil, thanks for your comment, it made me laugh out loud. I fear I am adding to the confusion!