This month’s deep dive into all thing’s funds-related looks at turbulent Japan, why it’s time to become more nervous about gold prices, an under-the-radar UK-listed PE fund that could be a great play on the UK economy, and a fab model portfolio of alternative listed funds from a UK investment bank.

Japan – what’s going on out east!

Over in my column in the Daily Telegraph last week – see here – I picked up some dramatic recent developments in Japan, a stock market I’m still very enthusiastic about. General elections, rising bond yields, plummeting yen, central bank interventions, a massive debt mountain, and impending tax cuts – it’s all kicking off in Japan. So, to summarise, here’s the outline of a way to think about what’s happening out east:

1. The new government is keen to help worried Japanese consumers by boosting spending and tax cuts

2. That will increase the fiscal deficit and increase worries amongst bond investors, sending bond yields much higher and bond prices lower

3. That in turn could increase pressure on the Bank of Japan to increase short-term interest rates

4. Which will increase Japanese government spending on interest payments

5. Which will, in turn, worry international bond investors (Can Japan afford this extra interest spending?), weakening the Japanese yen again

6. A weaker Japanese yen is great news for Japanese exporters, and is usually seen as a positive for local equity markets

That last point, 6, which suggests a weaker yen, has an unfortunate complication: although a weak yen has been seen as a positive for the Japanese stock market, UK investors often see much lower returns than Japanese investors because the currency losses eat into their profits. This highlights a key risk of investing in Japanese funds in the UK – your gains from owning the underlying stocks might be wiped out by currency moves.

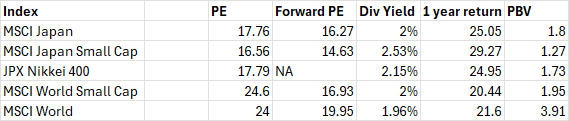

Turning to the local stock market, I’d highlight valuations that remain sensible even after the recent rally in equities. The table below shows the three main institutional Japanese equity benchmarks, the MSCI Japan index, its small-cap sibling and my favourite index, the JPX Nikkei 400 index.

As you can see from the data in this table (which was correct as of January 1st 2026), the Japanese market continues to trade at a meaningful discount to global equities, yields a higher dividend, and also boasts stronger asset backing (a lower price-to-book value, or PBV). Japanese equities could rise another 20% and still be only close to global benchmark levels in terms of valuations.

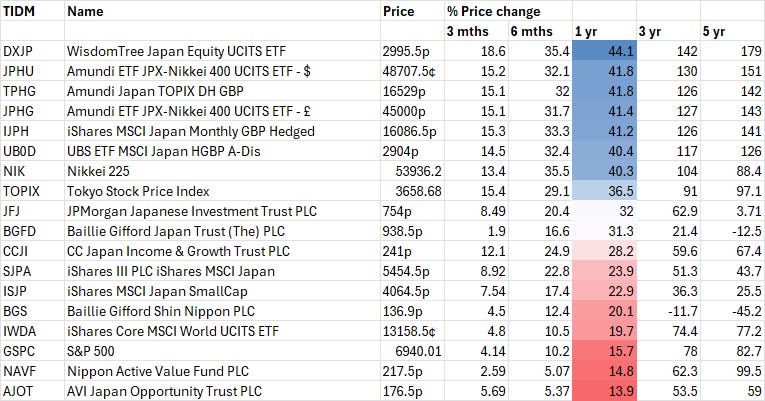

The table below shows returns for a wide range of UK funds investing in Japan, ETFs, and index benchmarks. I’ve colour-coded returns for the last 12 months.

Some general observations:

1. The top performer is an ETF from Wisdom Tree which tracks an index which is rules-based, fundamentally weighted and is comprised of the dividend-paying companies from Japan, selected based on global revenue exposure and risk-filtered using a composite risk score (”CRS”) screening, which is made up of two factors (quality and momentum) each carrying an equal weighting

2. The JPX Nikkei 400 index is also a strong performer. This is my favourite index for Japanese equities. The JPX-Nikkei 400 Index (often called the “Shame Index” or the “Quality Index”) was launched in 2014 by the Japanese government, working with local exchanges, with a specific goal: to move beyond measuring company size and instead reward those that are profitable and shareholder-friendly. Unlike traditional Japanese indices that track local stocks by market cap (TOPIX) or price (Nikkei 225), the JPX-Nikkei 400 uses a “smart” selection process designed to attract international investors. These metrics include Return on Equity (ROE) with a 40% weighting, Operating Profit with a 40% weighting, and Market Capitalisation with a 20% weighting.

3. The monthly hedged iShares Japan ETF has also performed very strongly and is my preferred way of investing in a broad swathe of the Japanese market. The MSCI Japan index is broader and more useful than the local Nikkei 225 and TOPIX indices, and currency hedging also removes the currency depreciation risk I’ve highlighted above.

4. ETFs have been consistently beating the actively managed funds in the last year, but that’s not always been the case, and I can see an argument for owning an actively managed investment trust. The only challenge is that I’d favour funds that invest in the much cheaper mid- to small-cap end of the market, which have significantly underperformed the main market over the last year. My favourite fund would be Nippon Active Value Fund. It’s a riskier option than ETFs, but I think there is a real long-term opportunity for activist small- to mid-cap active fund managers.

Gold: some thoughts

I’ve been a consistent gold bull for the last couple of years, and I remain, hesitantly, one. My base case is that in a populist world, where economic mismanagement is a real problem and inflationary pressures are looming, there are few safe havens left, except for gold (and certainly not bitcoin).

My hesitation, though, is the current almost-exponential increase in the price of gold and the sheer momentum-driven weight of money flowing into the precious metal (and even more so silver). Take European-domiciled gold ETFs, for instance, which have attracted over €2bn since the start of 2026, according to Morningstar data. According to Kenneth Lamont, Principal, Manager Research at Morningstar:

“Gold ETFs have attracted more than €2 billion in net inflows since the beginning of the year, helping to propel prices to fresh record highs.”

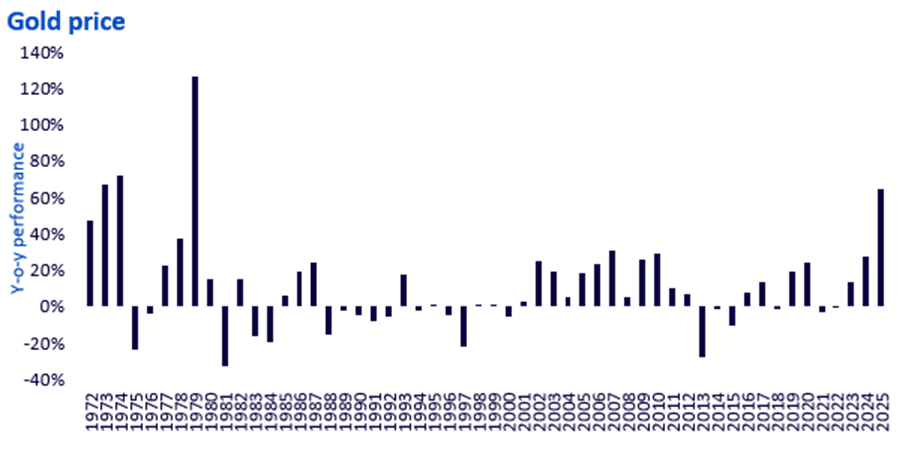

As a gold bull, I’m very nervous about this. I’m also nervous that the recent increases in the gold price are quite sizeable in historical terms. ETF issuer Wisdom Tree has done the sums recently. They note that gold rose 65% in 2025.

“marking its strongest annual performance since 1979, when prices surged by 126%. That earlier episode coincided with rampant inflation, the Iranian Revolution following the fall of the Shah, the Three Mile Island nuclear accident, and extraordinary volatility across commodity markets. Inflationary pressures were so severe that the Federal Reserve entered an existential phase, ultimately appointing Paul Volcker, widely regarded as the only figure willing to engineer a recession to restore the central bank’s credibility and ensure the long-term sustainability of the US economy. While surpassing the 1979 benchmark would always have been a tall order, achieving more than half of that performance is nonetheless remarkable.”

And slightly worrying my view. I still think gold could hit $6000 an ounce in the near term and maybe even $10,000 an ounce by the end of the decade – a confident prediction from market guru Ed Yardeni of Yardeni Research. But I also think the odds of a sharp short-term reversal are growing by the day!

Source: WisdomTree, Bloomberg. 1972-2025

A UK small cap listed PE trust worth investigating

The listed private equity fund Literacy Capital has a fairly unique strategy – it’s focused on UK small to mid-cap private buyouts where, typically, the family/owner wants some realisation event but doesn’t want a ‘typical’ large PE transaction with all that that entails i.e stripping out cost, lots of rolling businesses into each other, putting on leverage. Literacy Capital is very focused on the UK domestic economy, and its typical investment ticket price is between £2 and £10m. It also very carefully builds up the portfolio companies by bringing in expertise and investing in growth where necessary. In terms of peers, I suppose Oakley Capital does similar stuff but with much bigger tickets and across Europe.

Fund Facts: Literacy Capital

- Website – https://www.literacycapital.com/home/default.aspx

- Ticker BOOK

- Price c 400p

- Discount 22%

The story of Literacy Capital began in 2017 when it was founded by Paul Pindar and his son Richard. Paul is a heavyweight in the UK business world, having co-founded Capita and served as its CEO for decades, taking it from a small startup to a FTSE 100 powerhouse.

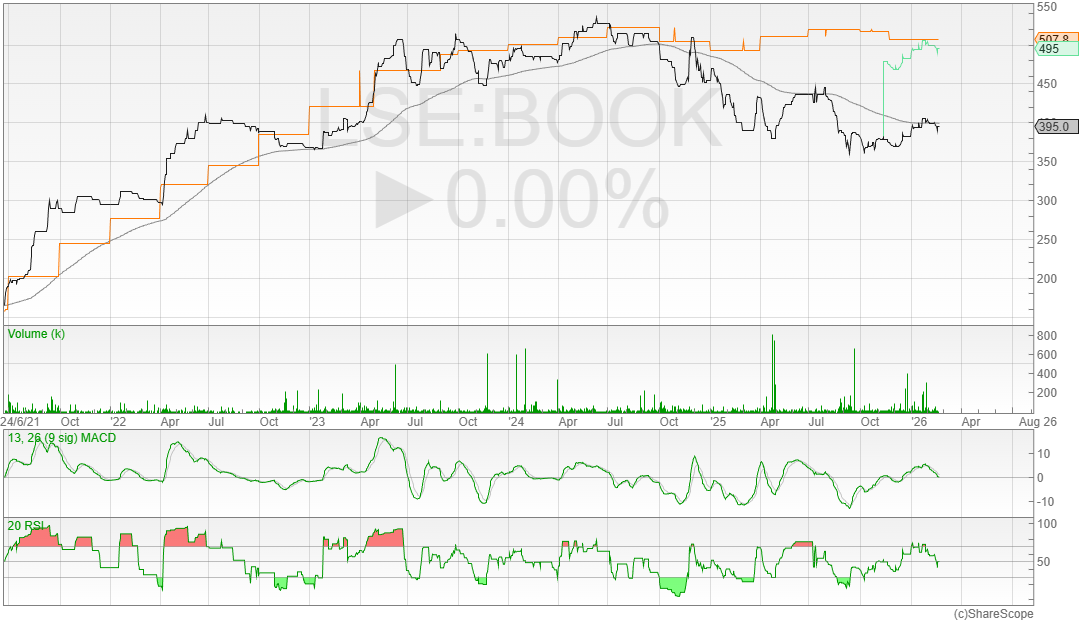

Like many private equity funds listed on the LSE, Literacy Capital gets under the hood of its portfolio companies to help them scale, professionalise, and eventually find the right exit. Since its IPO in June 2021, the company has delivered impressive results, with a NAV total return of 222% through September 2025, beating the FTSE All Share’s 45% return over the same period. If you look even further back to its inception in 2018, the total returns sit at 418%.

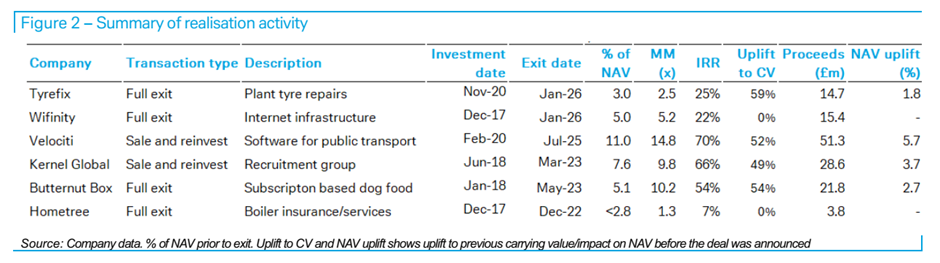

What really drives the engine here are the exits. Literacy Capital has a knack for selling businesses at values far higher than what they were carrying them for on the books. Their track record for realisations shows an average internal rate of return (IRR) of 41% and an average money multiple of 7.3x. – when they exit a business, the average uplift to its carrying value has been around 36%. If you strip out a couple of deals where they had already marked the value up right before the sale, that average jump at the time of exit actually climbs to 53%. Notable recent successes include the partial sale of Velociti in July 2025 and the full exit of Kernel Global in March 2023, both of which significantly boosted the overall NAV. More recently, they announced the exits of Wifinity and Tyrefix, which are expected to bring in substantial cash early in 2026.

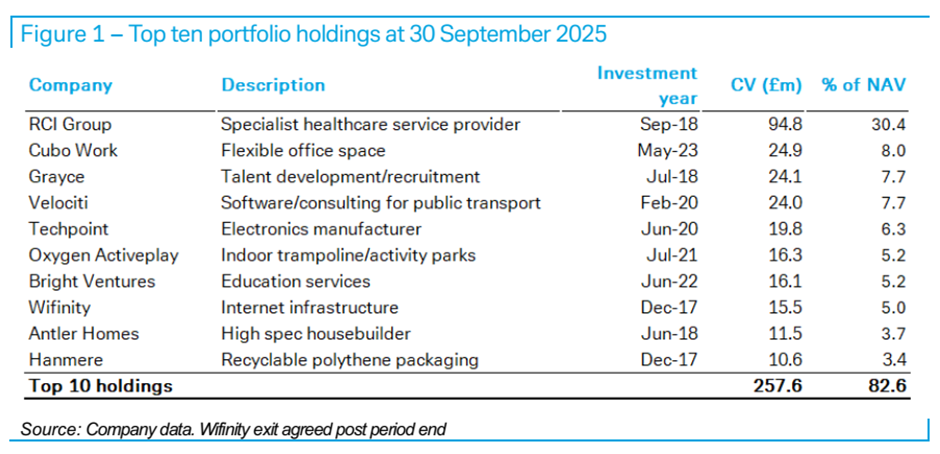

Looking at what they actually own, the portfolio is dominated by a few key names. Their largest holding by far is RCI Group, a specialist healthcare service provider that accounts for about 30.4% of the NAV. RCI has been a winner for Literacy, already returning over £23m in cash since the initial investment in 2018. Other big players include Cubo Work, which provides flexible office spaces and has grown from 5 to 16 locations since BOOK got involved, and Grayce, a talent development business that uses a “Hire-Train-Deploy” model. There’s also Techpoint, an electronics manufacturer that has had a bit of a bumpy ride lately but recently showed signs of life as the top contributor to NAV growth in the third quarter of 2025.

The funds share price has had a tough year or so, moving from a big premium to NAV (because liquidity was shallow and the shares tightly held) to a big discount which has slightly improved. That’s not been great for existing shareholders but I think there is now light at the end of the tunnel.

I’m being optimistic here, but my hunch is that the UK economy will likely prosper in the next 12 to 18 months, and opportunities for new deals will multiply for this fund. Its focus is on small to mid-sized private equity deals, mainly in the sub £20m to £10m category, where the competition for deal flow is much less intense. This gives the fund a favourable macro tailwind. In addition, I like the fund’s core USP – on smaller private businesses where founders are eventually looking to cash out (eventually) from attractive growth sectors. I also like the fund managers’ clear alignment with shareholders and the sensible fee structure. As the fund has become better known, my hope is that the discount might tighten a bit and more Nav accretive deals might come through.

A great list of alternative funds for further research

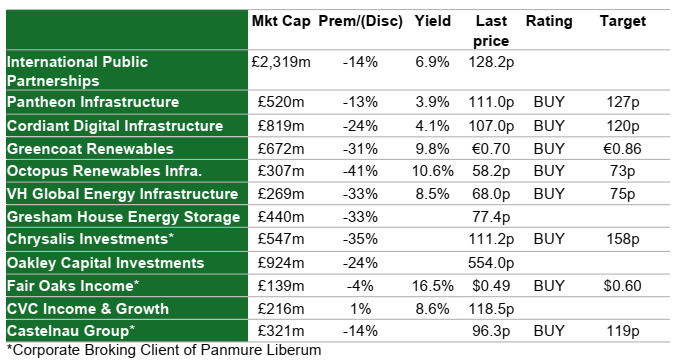

The funds part of London investment bank Panmure Liberum has built up a very strong record working with, and researching, alternative London-listed funds (investment trusts). Their research team is top-notch and has just released their 12-fund model portfolio for this year, which I think is a cracking starting point for anyone looking for a well-run, cheap alternative investment trust. According to Panmure Liberum:

“The portfolio combines income at attractive spreads to risk-free, enhanced by discounts, with vehicles where we have confidence in the capacity for capital growth. We prioritise strategies with the potential to deliver 10%+ NAV total returns over time, either through demonstrated delivery or a credible path to higher returns, with current discounts to NAV accelerating the route to those outcomes from a TSR perspective. “

Looking down the list, I’d make the following comments:

- International Public Private Partnerships is, in my view, the best bond proxy available on the London market for income-focused investors. Its shares are more volatile than gilts, but much of its income stream is government-linked (though not all), and the fund has a conservative reputation. I own a large amount of INPP and keep adding to it.

- Pantheon Infrastructure is a class act, though one of the newest funds on this list. In a few years, it’s built up a sterling reputation for NAV-accretive deals in private equity-backed infrastructure businesses. I own shares in the fund and have been adding to that holding in recent months. My only slight caution is that I think 3i Infrastructure has a better track record and a more mature portfolio.

- Cordiant Digital. I have waxed lyrically about this fund for years now. The digital infrastructure play has a maturing portfolio of digital assets ranging from mobile phone towers through digital broadcast to fibre and data centres. It’s building a great track record and is another of my core holdings

- Chrysalis has also featured many times in my notes on funds. This private equity fund invests in late-stage, mature, high-growth businesses such as Starling Bank. The fund has also been aggressively buying back shares and I have owned for many years now.

- Oakley Capital strikes me as the most interesting private equity firm with a direct portfolio of assets after Hg Capital (which trades at much higher valuations). Its European focus on mid-sized private businesses is impressive, as is its track record. I’ve owned this on and off for a few years. I recently switched from Oakley to Literacy Capital (see above)

- Fair Oaks Income is for the adventurous, but if you can understand the proposition and wrap your head around the risks, this is a great income play. It invests in CLO debt and equity, most of which is European. This market has been riding high but has its challenges but the Fair Oak time is first rate.

David Stevenson

Twitter: @advinvestor

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.