Bruce takes a look at the causes of volatility in the natural gas price, and what this might signal for equity markets. Companies covered CKN, EYE, CTG.

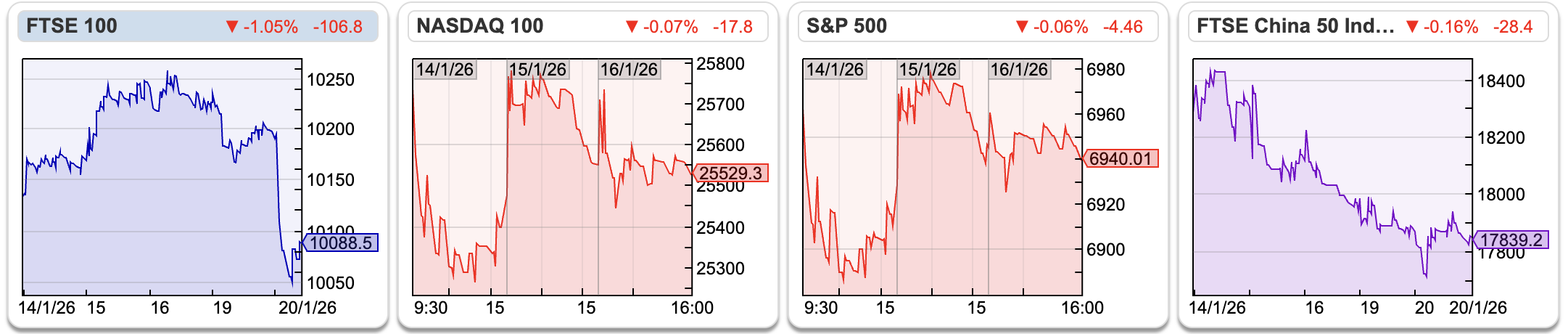

The FTSE 100 was down less than 0.5% over the last 5 trading days, but remains above the 10,000 level. Nasdaq was off less than -1%, while the FTSE China 50 was off -2.6%. AIM is one of the best performing major indices +4.3% YTD, beaten only by the Nikkei 225 +6.5% and the FTSE Techmark +9%.

The FTSE 100 was down less than 0.5% over the last 5 trading days, but remains above the 10,000 level. Nasdaq was off less than -1%, while the FTSE China 50 was off -2.6%. AIM is one of the best performing major indices +4.3% YTD, beaten only by the Nikkei 225 +6.5% and the FTSE Techmark +9%.

The recent cold snap has been great for those who booked holidays in the Alps. I’ve also been receiving photos from friends jumping around on frozen lakes in Berlin. Interestingly though Sharescope shows that the price of Natural Gas has been weak since the beginning of December.

The price was down -40% from the start of December, but has just bounced +16% at the start of this week. I messaged an energy markets contact, and she suggested that traders were already anticipating a cold winter in Northern Europe so this had driven the price spike in H2 last year; but they had failed to appreciate just how much Chinese industrial demand for gas has been falling which has driven the fall from December. China has also stopped buying electricity from Russia. China has hit its Communist Party +5% GDP growth target for the third year in a row, but quarter on quarter growth is slowing. Here’s an FT article about faltering domestic demand in China.

The price was down -40% from the start of December, but has just bounced +16% at the start of this week. I messaged an energy markets contact, and she suggested that traders were already anticipating a cold winter in Northern Europe so this had driven the price spike in H2 last year; but they had failed to appreciate just how much Chinese industrial demand for gas has been falling which has driven the fall from December. China has also stopped buying electricity from Russia. China has hit its Communist Party +5% GDP growth target for the third year in a row, but quarter on quarter growth is slowing. Here’s an FT article about faltering domestic demand in China.

Now, this week’s +16% jump in Natural Gas prices has been caused by a sudden recognition that if Europe buys half its Natural Gas from the US, we have replaced dependency on Russia with dependency on an increasingly “America First” US, with eyes on Greenland. While “there are other sources of gas in the world” beyond the U.S., the risk of Trump cutting off gas supplies to Europe in a dispute over Greenland “should be taken into account,” one senior EU diplomat told POLITICO. But “hopefully we’ll not get there,” the official told the website. So I intend to keep using Sharescope to track natural gas (NG1), as the first signs of trouble might emerge here.

This week I look at Clarkson, the shipbroker trying to build up its high margin data business, Eagle Eye the consumer insights and data business for retailers, that is announcing contract wins. I finish with Christie, the professional services firm that has seen two upgrades in the last month.

Clarkson FY Dec 2025F profit upgrade

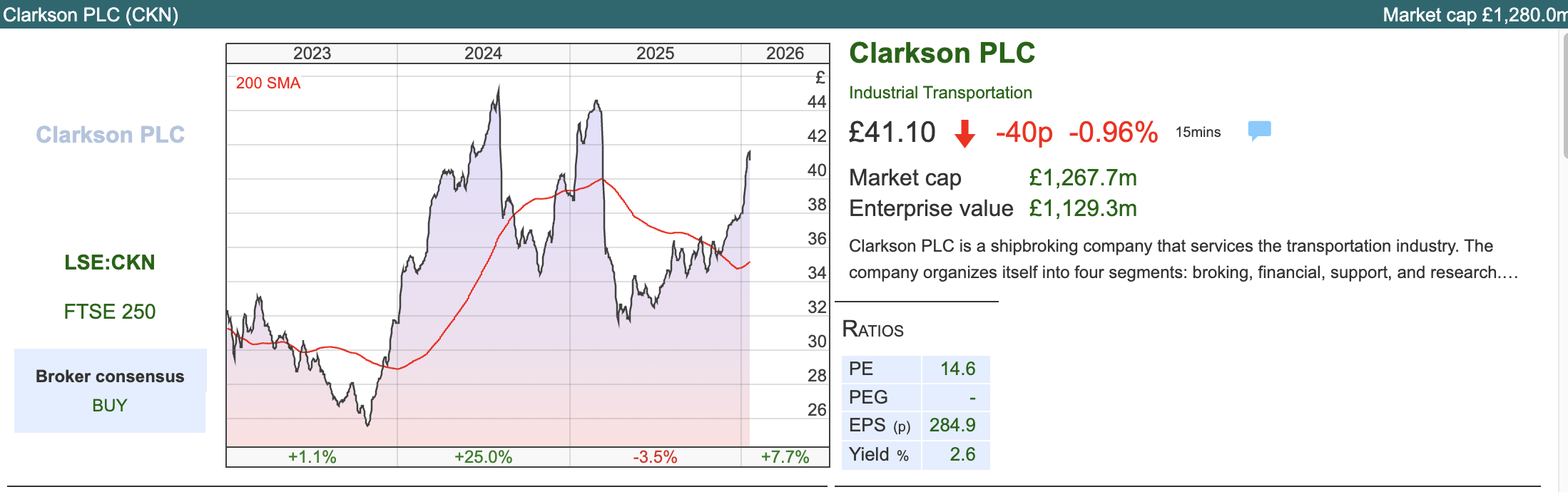

A positive start to the year for this shipbroking business, founded in 1852. The shares sold off last year, as investors anticipated that the group might struggle in the event of a global trade war. I would imagine that global trade is still a risk on investors’ minds, but at least that should be priced in by now?

A positive start to the year for this shipbroking business, founded in 1852. The shares sold off last year, as investors anticipated that the group might struggle in the event of a global trade war. I would imagine that global trade is still a risk on investors’ minds, but at least that should be priced in by now?

A week ago management put out an RNS saying that FY Dec 2025F underlying PBT is now expected to be “not less than £90m, reflecting stronger results in the second half of the year.” That’s still down -21% versus £115m reported FY Dec 2024, but the shares responded by rising +7%.

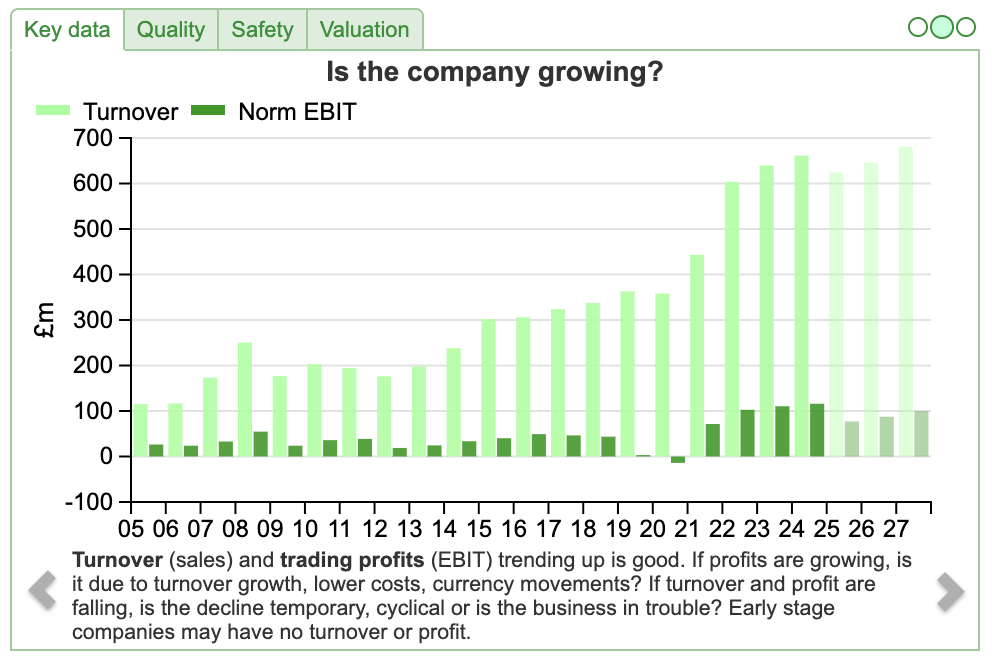

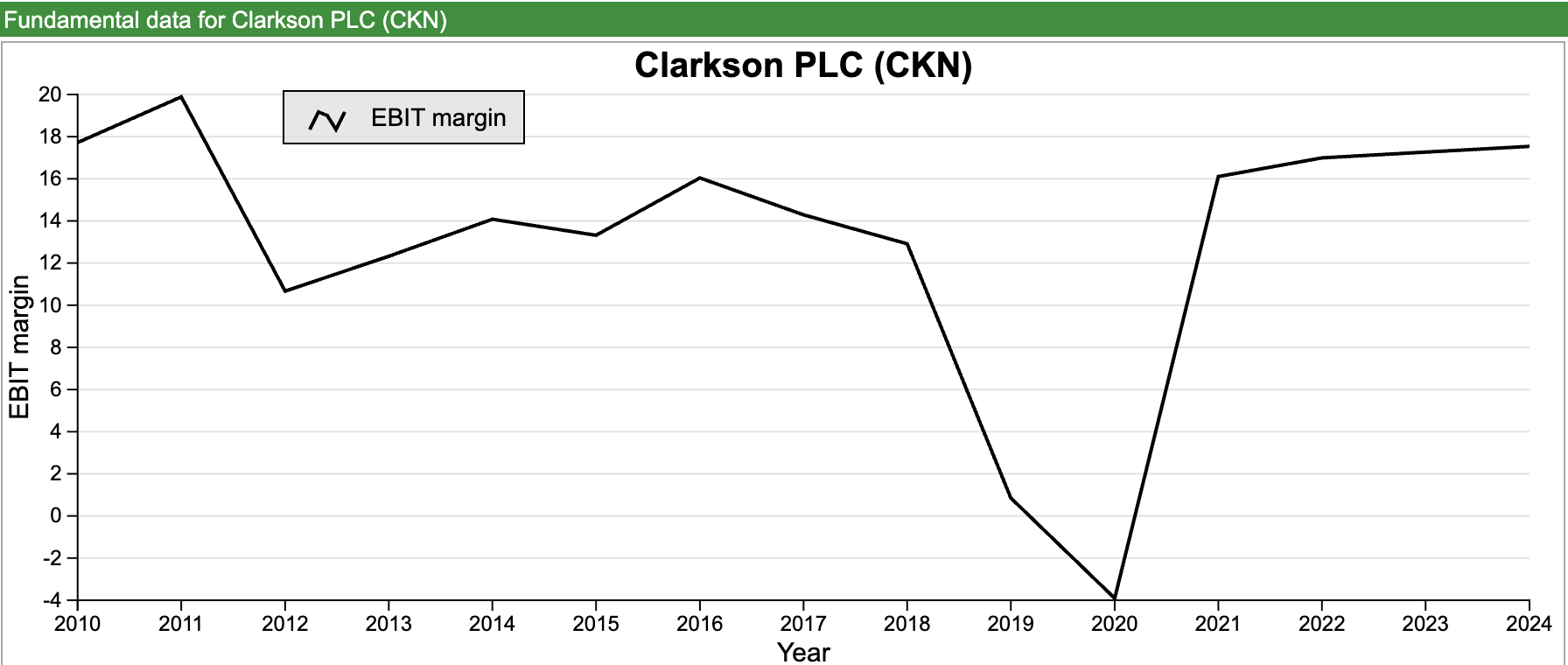

The CEO Andi Case, talks about transforming the group’s business model to become the “Bloomberg of Shipping.” A month ago I suggested, that if you scratch the surface of many businesses like WINE, you see a financial business model underneath. In the case of Clarkson’s Research division, which tracks over 150,000 ships and 2 million vessel positions daily, you could argue this is a financial data business. These can be very lucrative for shareholders with network effects and “lock-in”. Clarkson management are attempting to use their “incidental” data from their brokerage business for input into a high-margin, recurring revenue product called the Shipping Intelligence Network (SIN). I’ve used Sharescope to track the long term trend in group EBIT margin. In the chart below you can see that since the pandemic margins have been stable, but there’s not much evidence of margin expansion yet as SIN is not yet big enough to be expand the group margin.

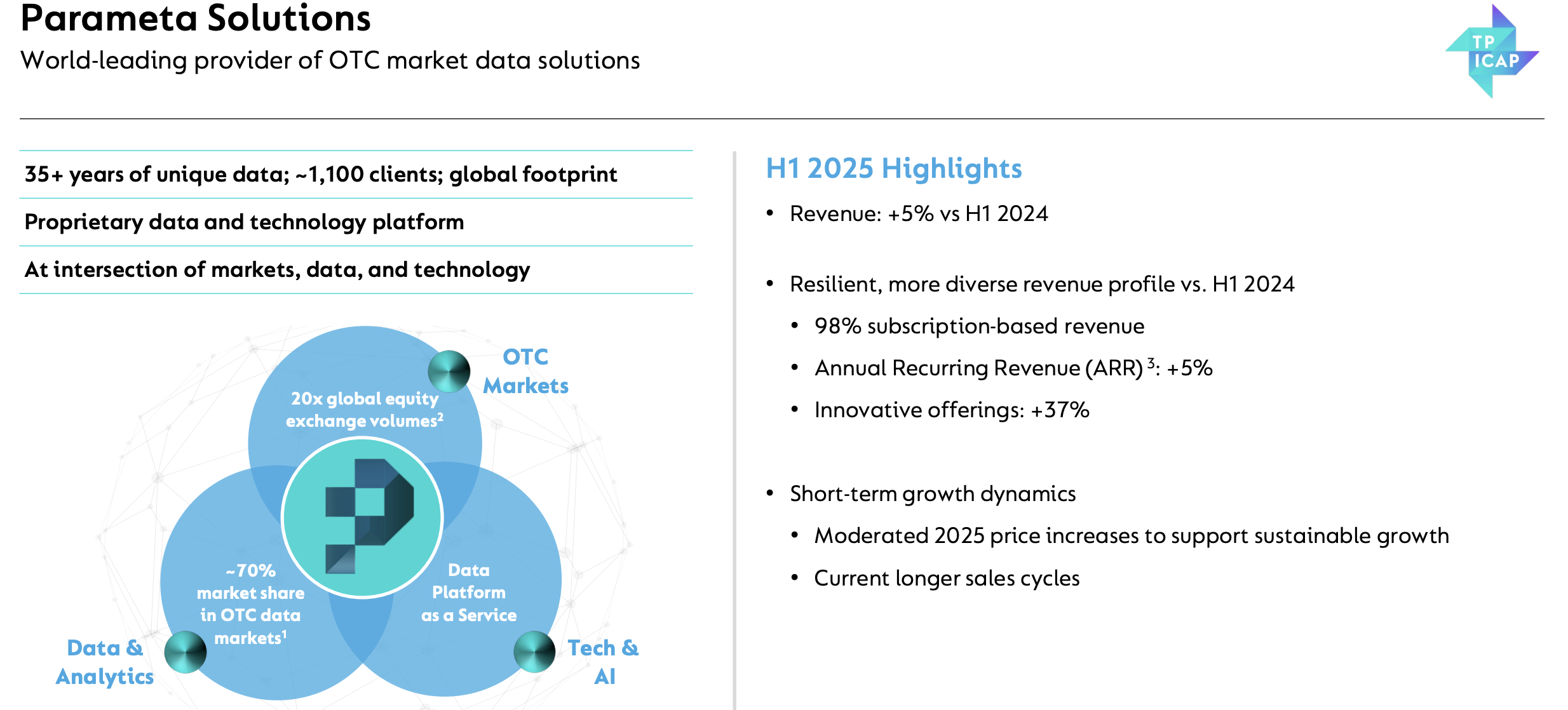

In H1, the Research Division was just 14% of PBT, but grew at +11% y-o-y while achieving a stable 39% margin. Rather than Bloomberg or LSE though, CKN reminds me of TCAP and their Parameta Solutions business, that uses the “exhaust pipe” of OTC market trades to create valuable data, which an activist investor (Justin Hughes) suggested could be spun-off to create value £1.5bn of value when the market cap of the entire group was just £1.3bn. Just as Parameta benefits (see slide below) from MiFID II and regulatory requirement to demonstrate “best execution” transparency in finance, Clarkson should benefit from EU Emissions tracking regulation.

Shipping companies have had a legal requirement to track carbon intensity since the start of 2025 and Clarkson is selling the “Carbon Calculator” inside their platform. They expect the regulations to tighten over time and so it’s no longer just “nice to have” data; it’s “comply or be fined” data, as far as I can tell. Unsurprisingly, investors tend to put a high multiple on high margin, growing recurring revenue streams that are mandated by regulators.

Shipping companies have had a legal requirement to track carbon intensity since the start of 2025 and Clarkson is selling the “Carbon Calculator” inside their platform. They expect the regulations to tighten over time and so it’s no longer just “nice to have” data; it’s “comply or be fined” data, as far as I can tell. Unsurprisingly, investors tend to put a high multiple on high margin, growing recurring revenue streams that are mandated by regulators.

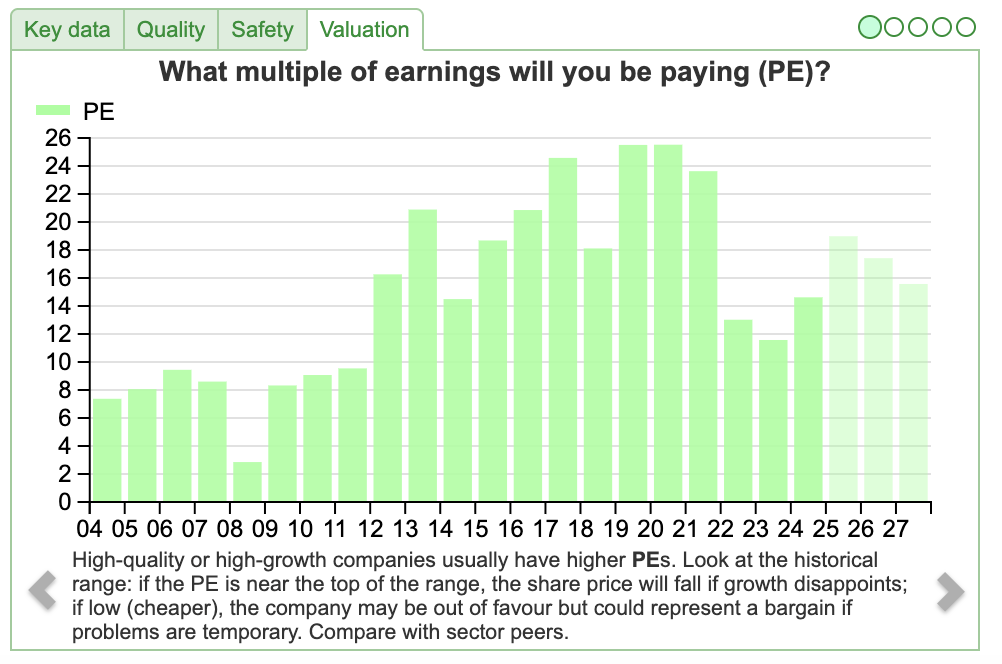

Valuation: Clarkson trades on a PER of 17x Dec 2026F and EV/EBITDA of 8x the same year. Before the pandemic, investors were prepared to pay a mid-20s PER for this stock, encouraged by the strong track record of profitable growth.

Opinion: I like this as an idea. Investors traditionally view shipbroking as cyclical and “lumpy”, not as bad as the likes of PEEl or TCAP, but a similar dynamic — if trade slows down, fee based commissions dry up. Management lack the flexibility to cut the cost base so even a small drop in revenue is magnified into a steep fall in PBT. For instance, CKN’s revenue fell -4% at H1 last year, resulting in a -25% decline in reported PBT.

By growing their Research and Technology segments (currently profit margins around 38–40%), Clarkson is building a recurring, high-margin revenue stream that should persist even when activity in the shipping markets is becalmed in the doldrums. I’ve bought a starter position – annoyed I didn’t spot this earlier.

Eagle Eye contract wins/Trading Update

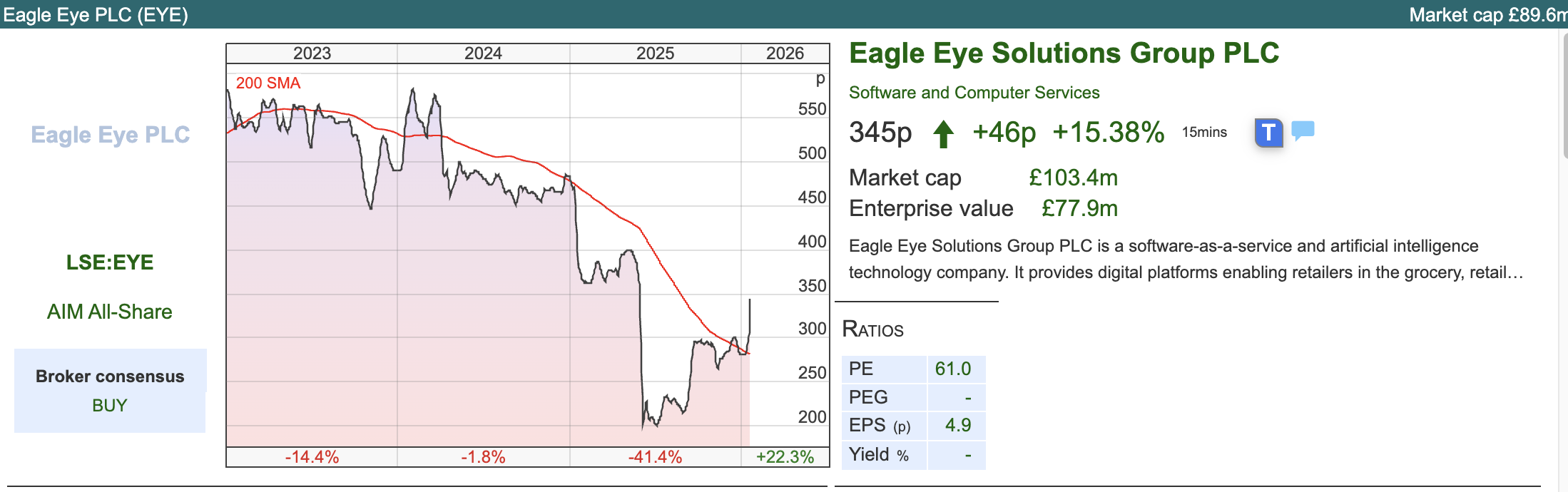

This customer loyalty technology group that helps retailers, pubs and restaurants with promotions has been reporting contract wins and is a Paul Hill favourite. I last wrote about it in August 2023, when I liked the concept but disliked the 40x PER multiple. There was a profit warning followed by a contract loss announcement which are the two lurches downwards in H1 2025 that you can see in the chart above.

This customer loyalty technology group that helps retailers, pubs and restaurants with promotions has been reporting contract wins and is a Paul Hill favourite. I last wrote about it in August 2023, when I liked the concept but disliked the 40x PER multiple. There was a profit warning followed by a contract loss announcement which are the two lurches downwards in H1 2025 that you can see in the chart above.

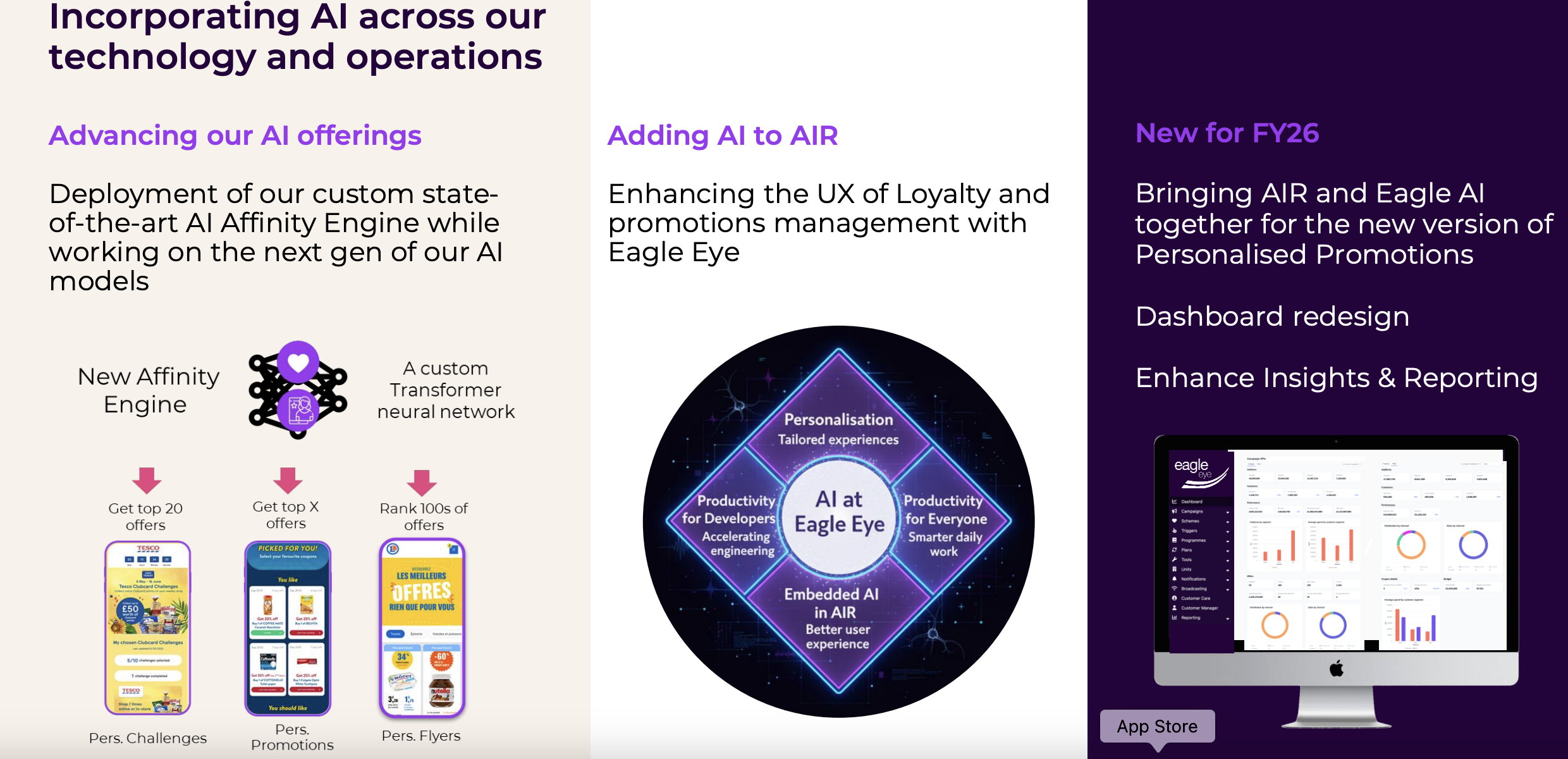

Last week they announced a “substantial and multi-year” contract with Wakefern Food Corp in the USA. This new customer marks Eagle Eye’s fourth North American win in FY Jun 2026F to date, following recent contract wins with a convenience store chain, a grocery supermarket chain and one of North America’s largest independent food retailers. Then they followed this up with an “ahead of consensus” trading update, with consensus for FY Jun 2026F given as £45.1m revenue, and £5.9m adjusted EBITDA. Shore Capital, their broker, have raised FY Jun 2026F adjusted EBITDA by +15%.

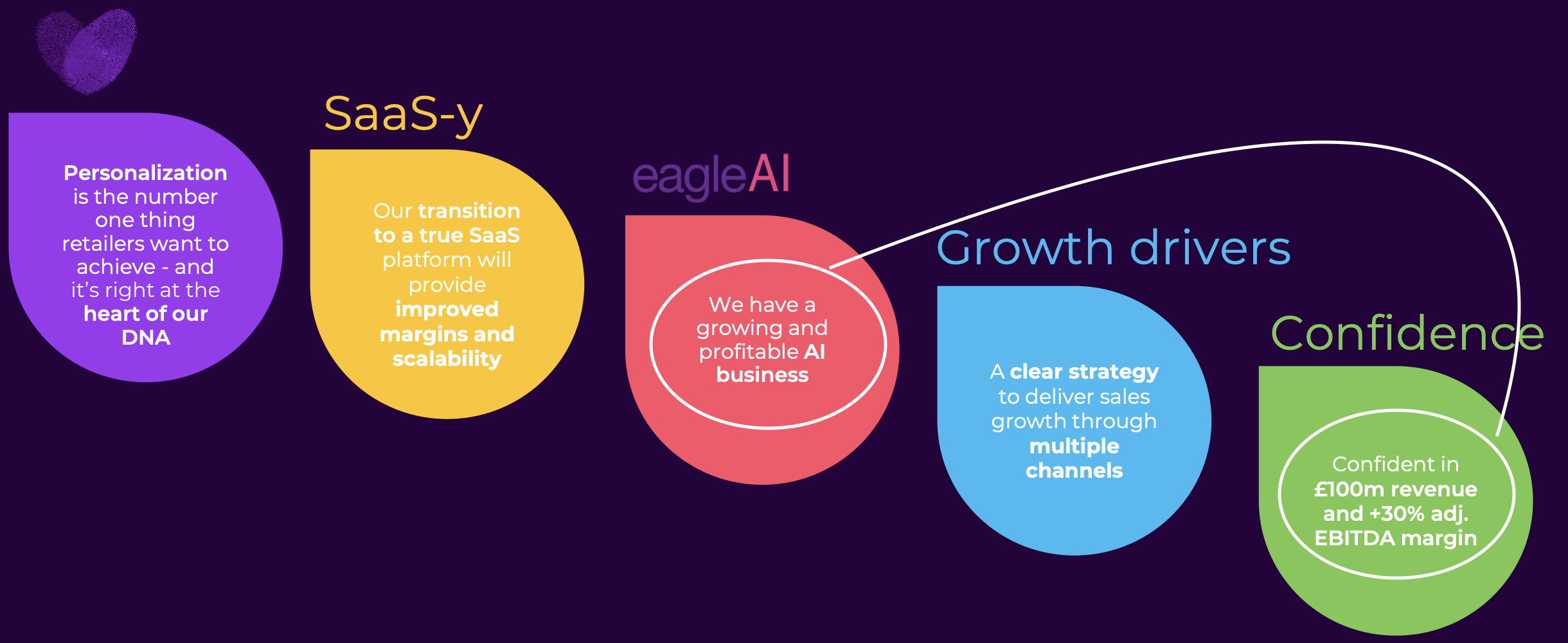

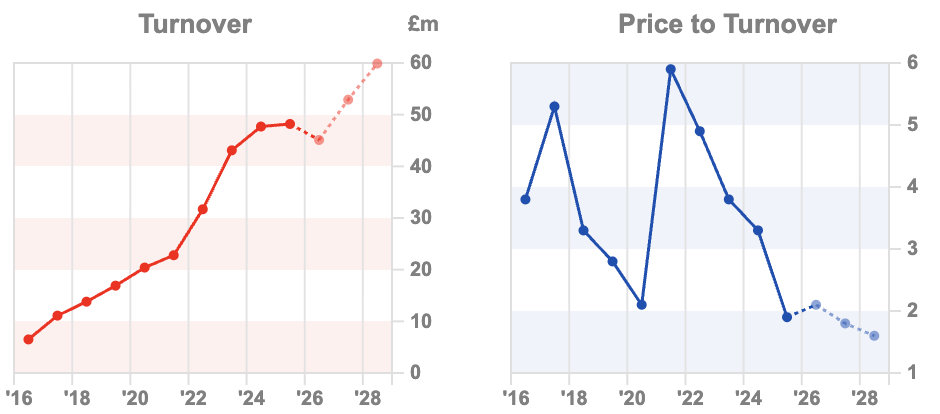

I’m currently on the look out for possible beneficiaries from AI. Active Ops, the “decision intelligence” group that has financial services clients seems to be an example and Eagle Eye management are suggesting £100m of revenue at a 30% EBITDA margin from AI execution at scale in their analyst presentations. That compares to EYE reporting £48m revenue reported FY Jun 2025 at a 25% EBITDA margin. Note though that 25% EBITDA margin reduces to a 6% EBIT margin, so the “DA” of EBITDA is significant, according to Sharescope.

Balance sheet: As of last June, they had £12m of cash on their balance sheet. There’s also £10m of retained losses in equity and £5m deferred tax asset, so we should see several years of low tax rate now the company has broken even after several years of historic losses. There’s also a £10m borrowing facility with HSBC, presumably there for flexibility and small acquisitions.

Balance sheet: As of last June, they had £12m of cash on their balance sheet. There’s also £10m of retained losses in equity and £5m deferred tax asset, so we should see several years of low tax rate now the company has broken even after several years of historic losses. There’s also a £10m borrowing facility with HSBC, presumably there for flexibility and small acquisitions.

Valuation: Shore Capital are now forecasting 11.6p of EPS Jun 2027F, which puts the shares on a PER of 30x. EV/EBITDA is 7x the same year. On a price/sales multiple 1.9x 2027F around half the level of AOM 3.8x sales multiple the same year.

Opinion: I own ActiveOps, which is a similar story but with a superior near term track record. Presumably the price to revenue multiple could re-rate back towards the >5x they were reporting a couple of years ago. No position yet, but I can see the attraction. Well done to Paul Hill for keeping faith in this halfway through last year.

Christie FY Dec 2025F profit upgrade

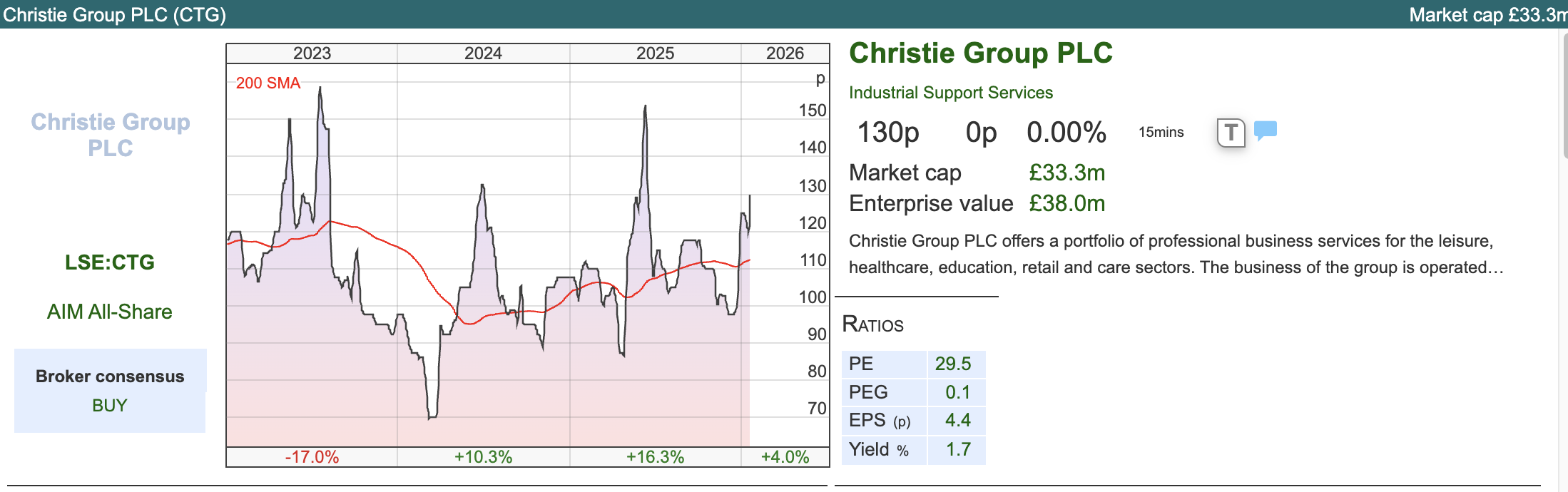

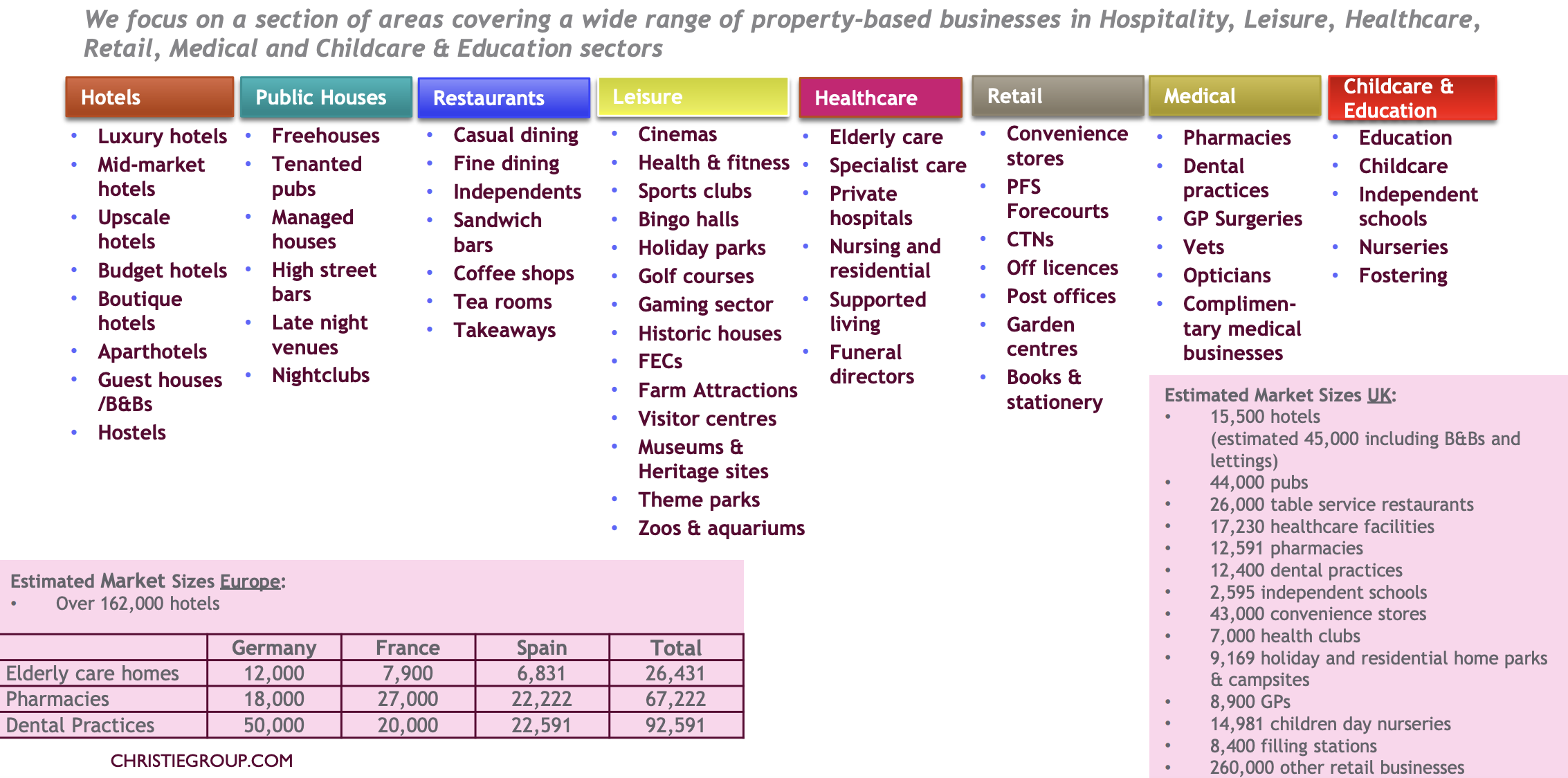

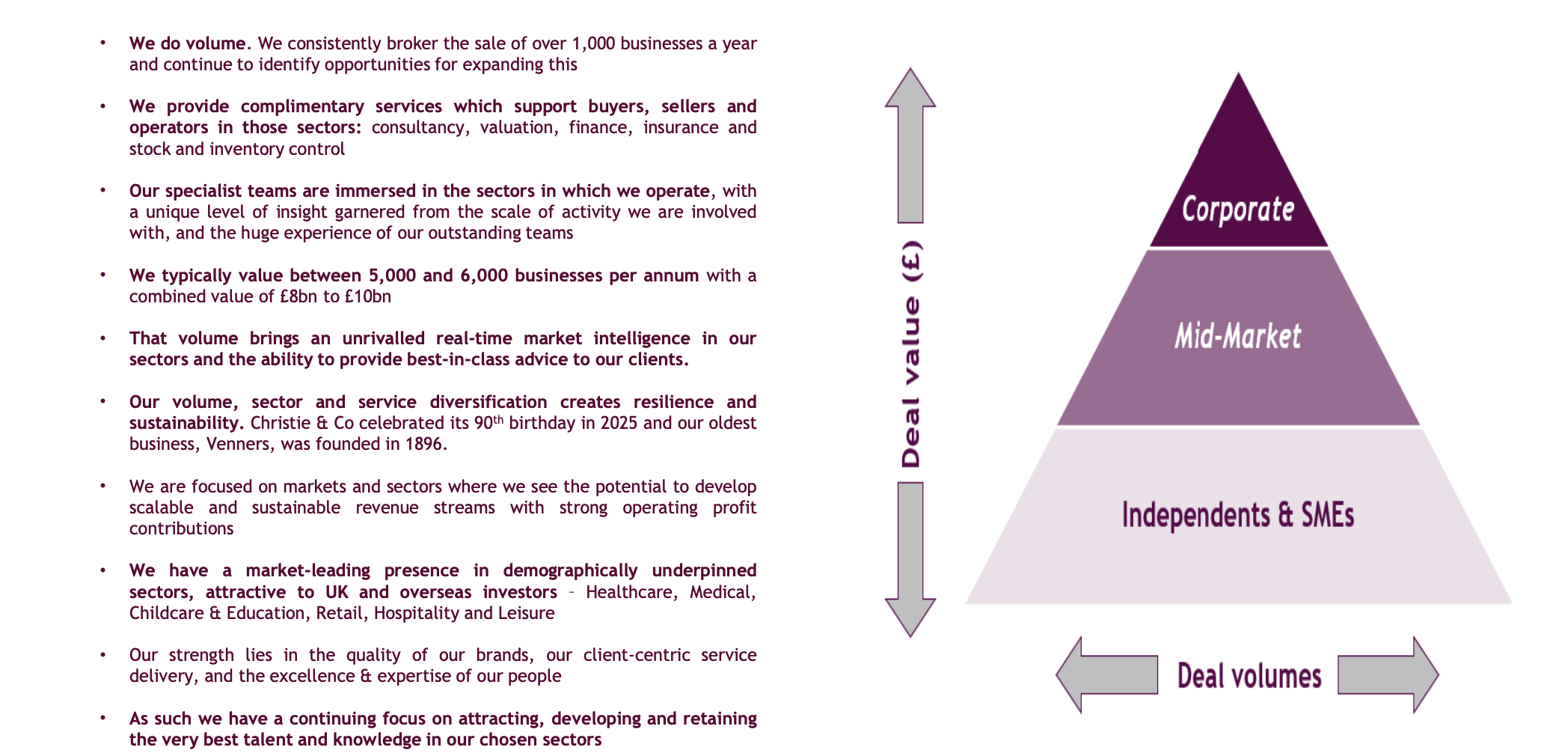

This 90 year old professional services firm announced FY Dec 20225 performance “considerably ahead of its previously upgraded expectations”. They specialise in pubs, restaurants, hotels, healthcare, retail, childcare and education sectors. Hospitality and retail sectors have been hit by the cost of living and disruption from Airbnb and Amazon, but perhaps that has encouraged entrepreneurs to sell their businesses, which has benefited Christie, as they earn fees from the transaction.

This 90 year old professional services firm announced FY Dec 20225 performance “considerably ahead of its previously upgraded expectations”. They specialise in pubs, restaurants, hotels, healthcare, retail, childcare and education sectors. Hospitality and retail sectors have been hit by the cost of living and disruption from Airbnb and Amazon, but perhaps that has encouraged entrepreneurs to sell their businesses, which has benefited Christie, as they earn fees from the transaction.

As a reminder, on the 23rd Dec management had guided that Q4 had been strong, saying that their Professional & Financial Services division had advised on the sale or purchase of over 1,000 businesses in the UK, which was the same level as previous year – but higher value deals are being done so they have seen a boost to transaction fees charged. December was unexpectedly strong level of invoicing after the 23 Dec RNS, up +40% versus the average of the previous 11 months. That’s less useful than a Dec v Dec 2024 comparison, but helps explain the two upgrades in less than a month.

As a reminder, on the 23rd Dec management had guided that Q4 had been strong, saying that their Professional & Financial Services division had advised on the sale or purchase of over 1,000 businesses in the UK, which was the same level as previous year – but higher value deals are being done so they have seen a boost to transaction fees charged. December was unexpectedly strong level of invoicing after the 23 Dec RNS, up +40% versus the average of the previous 11 months. That’s less useful than a Dec v Dec 2024 comparison, but helps explain the two upgrades in less than a month.

There weren’t any numbers in the first upgrade RNS, but they’re now expecting revenues > £70.0m (2024: £59.2m) with operating profit from continuing operations almost doubling to > £6.5m (2024: £3.5m). In December they also announced the disposal of loss making Vennersys inventory management division, so continuing operations excludes this – but that deal completed in Jan this year, presumably the losses on disposal will be recognised in H1 Jun 2026F.

Outlook: They talk about ongoing demand and strong pipeline. Their broker Shore Capital has removed future year forecasts though! Presumably that is at the request of management, but strikes me as unhelpful. Previous forecasts were for revenue £71.2m Dec 2026F, growing +8% to £76.8m in Dec 2027F. Adj EPS forecasts were 8.2p Dec 2026F, then growing +44% to 11.8p.

Valuation: Previous forecasts from Shore were for EPS of 8.2p FY Dec 2026F, rising to 11.8 Dec 2027F. That’s PER of 16x dropping to 11x the following year. Aside from the likely EPS upgrades though, there was over £9m of cash on the balance sheet. Shore point out that K3 Capital was bought by Sun Capital in Feb 2023 on an EV/EBITDA multiple of 13.1x. A 10x multiple for Christie would imply a c 250p share price.

Valuation: Previous forecasts from Shore were for EPS of 8.2p FY Dec 2026F, rising to 11.8 Dec 2027F. That’s PER of 16x dropping to 11x the following year. Aside from the likely EPS upgrades though, there was over £9m of cash on the balance sheet. Shore point out that K3 Capital was bought by Sun Capital in Feb 2023 on an EV/EBITDA multiple of 13.1x. A 10x multiple for Christie would imply a c 250p share price.

Ownership: Christie’s website says their largest shareholder is Philip Gwyn who joined the Board in 1974 owns 28%. However the 2024 Annual Report says he is recently deceased (perhaps the shares are in probate?) Hwfa Gwyn, presumably a younger relative, is a non Exec Director. Baron Lee of Trafford is the next largest shareholder with 6%. No institutional fund managers own a disclosable stake according to the investor relations website. Normally I’m wary of stocks no professional investors on the share register, but in this case I’m reassured by Lord Lee’s presence and the earnings upgrades, so we might see some large marginal buyers?

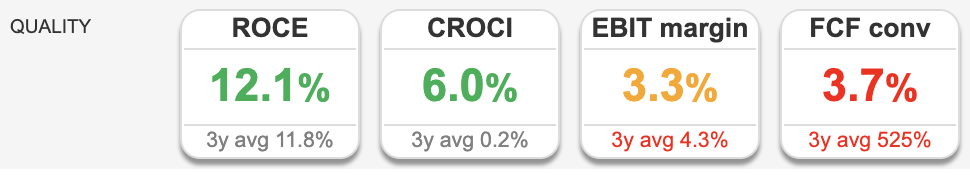

Opinion: This is a cyclical people business, currently enjoying a tailwind. Revenues fell in 2023 and the group made a loss, so ShareScope’s backward looking quality measures are less encouraging. For instance the 3 year average EBIT margin was just 4.3%, whereas Shore believe the business can achieve 10% operating margins and sales above £80m.

It’s also possible that Lord Lee has spotted something here and believes there’s a more favourable long term trend? For instance the H1 presentation says that “Healthcare, Medical and Hospitality provide opportunities to build a European business in markets of equivalent or larger size than UK”.

It’s also possible that Lord Lee has spotted something here and believes there’s a more favourable long term trend? For instance the H1 presentation says that “Healthcare, Medical and Hospitality provide opportunities to build a European business in markets of equivalent or larger size than UK”.

I followed him into MS International, the share price halved, before then doubling, doubling, doubling again, and doubling a fourth time to peak at over £16 last year. Lord Lee can be too early with his timing, but he seems to have a knack for spotting a long term winner – so I suggest that this merits further work.

Bruce Packard

Notes

Bruce owns shares in Clarkson

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Bi-Weekly Market Commentary | 21/01/2026 | CKN, EYE, CTG | Natural Gas snaps back

Bruce takes a look at the causes of volatility in the natural gas price, and what this might signal for equity markets. Companies covered CKN, EYE, CTG.

The recent cold snap has been great for those who booked holidays in the Alps. I’ve also been receiving photos from friends jumping around on frozen lakes in Berlin. Interestingly though Sharescope shows that the price of Natural Gas has been weak since the beginning of December.

Now, this week’s +16% jump in Natural Gas prices has been caused by a sudden recognition that if Europe buys half its Natural Gas from the US, we have replaced dependency on Russia with dependency on an increasingly “America First” US, with eyes on Greenland. While “there are other sources of gas in the world” beyond the U.S., the risk of Trump cutting off gas supplies to Europe in a dispute over Greenland “should be taken into account,” one senior EU diplomat told POLITICO. But “hopefully we’ll not get there,” the official told the website. So I intend to keep using Sharescope to track natural gas (NG1), as the first signs of trouble might emerge here.

This week I look at Clarkson, the shipbroker trying to build up its high margin data business, Eagle Eye the consumer insights and data business for retailers, that is announcing contract wins. I finish with Christie, the professional services firm that has seen two upgrades in the last month.

Clarkson FY Dec 2025F profit upgrade

A week ago management put out an RNS saying that FY Dec 2025F underlying PBT is now expected to be “not less than £90m, reflecting stronger results in the second half of the year.” That’s still down -21% versus £115m reported FY Dec 2024, but the shares responded by rising +7%.

The CEO Andi Case, talks about transforming the group’s business model to become the “Bloomberg of Shipping.” A month ago I suggested, that if you scratch the surface of many businesses like WINE, you see a financial business model underneath. In the case of Clarkson’s Research division, which tracks over 150,000 ships and 2 million vessel positions daily, you could argue this is a financial data business. These can be very lucrative for shareholders with network effects and “lock-in”. Clarkson management are attempting to use their “incidental” data from their brokerage business for input into a high-margin, recurring revenue product called the Shipping Intelligence Network (SIN). I’ve used Sharescope to track the long term trend in group EBIT margin. In the chart below you can see that since the pandemic margins have been stable, but there’s not much evidence of margin expansion yet as SIN is not yet big enough to be expand the group margin.

In H1, the Research Division was just 14% of PBT, but grew at +11% y-o-y while achieving a stable 39% margin. Rather than Bloomberg or LSE though, CKN reminds me of TCAP and their Parameta Solutions business, that uses the “exhaust pipe” of OTC market trades to create valuable data, which an activist investor (Justin Hughes) suggested could be spun-off to create value £1.5bn of value when the market cap of the entire group was just £1.3bn. Just as Parameta benefits (see slide below) from MiFID II and regulatory requirement to demonstrate “best execution” transparency in finance, Clarkson should benefit from EU Emissions tracking regulation.

Valuation: Clarkson trades on a PER of 17x Dec 2026F and EV/EBITDA of 8x the same year. Before the pandemic, investors were prepared to pay a mid-20s PER for this stock, encouraged by the strong track record of profitable growth.

Opinion: I like this as an idea. Investors traditionally view shipbroking as cyclical and “lumpy”, not as bad as the likes of PEEl or TCAP, but a similar dynamic — if trade slows down, fee based commissions dry up. Management lack the flexibility to cut the cost base so even a small drop in revenue is magnified into a steep fall in PBT. For instance, CKN’s revenue fell -4% at H1 last year, resulting in a -25% decline in reported PBT.

By growing their Research and Technology segments (currently profit margins around 38–40%), Clarkson is building a recurring, high-margin revenue stream that should persist even when activity in the shipping markets is becalmed in the doldrums. I’ve bought a starter position – annoyed I didn’t spot this earlier.

Eagle Eye contract wins/Trading Update

Last week they announced a “substantial and multi-year” contract with Wakefern Food Corp in the USA. This new customer marks Eagle Eye’s fourth North American win in FY Jun 2026F to date, following recent contract wins with a convenience store chain, a grocery supermarket chain and one of North America’s largest independent food retailers. Then they followed this up with an “ahead of consensus” trading update, with consensus for FY Jun 2026F given as £45.1m revenue, and £5.9m adjusted EBITDA. Shore Capital, their broker, have raised FY Jun 2026F adjusted EBITDA by +15%.

I’m currently on the look out for possible beneficiaries from AI. Active Ops, the “decision intelligence” group that has financial services clients seems to be an example and Eagle Eye management are suggesting £100m of revenue at a 30% EBITDA margin from AI execution at scale in their analyst presentations. That compares to EYE reporting £48m revenue reported FY Jun 2025 at a 25% EBITDA margin. Note though that 25% EBITDA margin reduces to a 6% EBIT margin, so the “DA” of EBITDA is significant, according to Sharescope.

Valuation: Shore Capital are now forecasting 11.6p of EPS Jun 2027F, which puts the shares on a PER of 30x. EV/EBITDA is 7x the same year. On a price/sales multiple 1.9x 2027F around half the level of AOM 3.8x sales multiple the same year.

Opinion: I own ActiveOps, which is a similar story but with a superior near term track record. Presumably the price to revenue multiple could re-rate back towards the >5x they were reporting a couple of years ago. No position yet, but I can see the attraction. Well done to Paul Hill for keeping faith in this halfway through last year.

Christie FY Dec 2025F profit upgrade

There weren’t any numbers in the first upgrade RNS, but they’re now expecting revenues > £70.0m (2024: £59.2m) with operating profit from continuing operations almost doubling to > £6.5m (2024: £3.5m). In December they also announced the disposal of loss making Vennersys inventory management division, so continuing operations excludes this – but that deal completed in Jan this year, presumably the losses on disposal will be recognised in H1 Jun 2026F.

Outlook: They talk about ongoing demand and strong pipeline. Their broker Shore Capital has removed future year forecasts though! Presumably that is at the request of management, but strikes me as unhelpful. Previous forecasts were for revenue £71.2m Dec 2026F, growing +8% to £76.8m in Dec 2027F. Adj EPS forecasts were 8.2p Dec 2026F, then growing +44% to 11.8p.

Ownership: Christie’s website says their largest shareholder is Philip Gwyn who joined the Board in 1974 owns 28%. However the 2024 Annual Report says he is recently deceased (perhaps the shares are in probate?) Hwfa Gwyn, presumably a younger relative, is a non Exec Director. Baron Lee of Trafford is the next largest shareholder with 6%. No institutional fund managers own a disclosable stake according to the investor relations website. Normally I’m wary of stocks no professional investors on the share register, but in this case I’m reassured by Lord Lee’s presence and the earnings upgrades, so we might see some large marginal buyers?

Opinion: This is a cyclical people business, currently enjoying a tailwind. Revenues fell in 2023 and the group made a loss, so ShareScope’s backward looking quality measures are less encouraging. For instance the 3 year average EBIT margin was just 4.3%, whereas Shore believe the business can achieve 10% operating margins and sales above £80m.

I followed him into MS International, the share price halved, before then doubling, doubling, doubling again, and doubling a fourth time to peak at over £16 last year. Lord Lee can be too early with his timing, but he seems to have a knack for spotting a long term winner – so I suggest that this merits further work.

Bruce Packard

Notes

Bruce owns shares in Clarkson

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.