Michael Taylor examines why the trading industry is so profitable for brokers, educators and promoters, yet consistently punishing for most participants. He explores the structural incentives, behavioural traps and discipline gaps that explain why so many traders fail despite lower costs and better access than ever.

The trading industry is extremely lucrative. But not for everyone.

Firstly, there are brokers, or spread bet/CFD providers.

Given the juicy commissions and hefty financing fees, these generate large profits for firms of this type. We can see this simply by looking at IG Markets, CMC Markets, and Plus500, who are all listed businesses.

Even brokers that don’t provide any leveraged products can generate large profits, such as Hargreaves Lansdown, which has now been taken private.

But spread bet and CFD providers can also profit further by B-booking losing traders.

This is allowing losing traders to trade unhedged on the platform.

If you’re a CFD provider and you know that 90% of traders will lose their deposit within six months, then logically if you don’t hedge and simply take the other side of the trade, then client losses flow straight into your pocket.

This does, of course, raise a concern that the brokers are incentivised to help you lose.

And we can see for sure that Plus500 uses this model because it has ‘client risk’.

When clients do well, Plus500 does worse.

IG claims it doesn’t do this, according to its own website.

But many brokers do, and they will pay large amounts to people who can recruit them.

This is why you see so many muppets pretending to be traders, standing in front of a rented Lamborghini, telling you that you can make £10k in 15 minutes just by following their trades.

SquaredFinancial has offered me $2,500 in order to sign someone up to their platform.

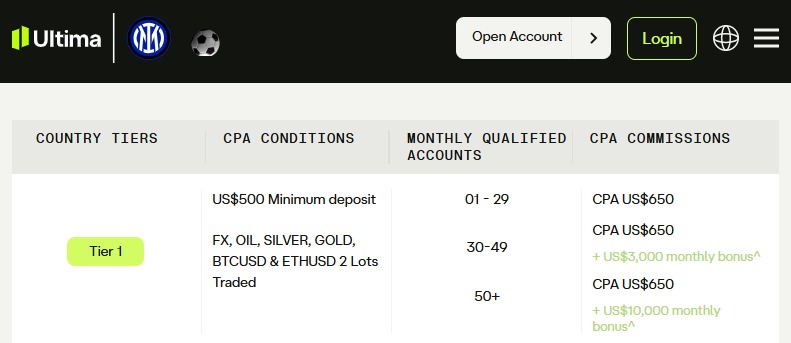

Inter Milan’s partner broker Ultima has offered me $42,500 a month to just sign up 50 people.

These are not small sums, and so it’s easy to see why some people abandon their morals in order to cash in at the expense of others.

I have detailed how this scam works in a parody video here.

But it’s not just CFD platforms.

Trading education can be a lucrative business, if you’re willing to employ the same methods.

Fake screenshots, fake brokers, market a flashy lifestyle with supercars, watches, exotic holidays, and you appeal to both the lazy and naïve. The market for this is huge.

If you tell people that trading is hard, most people will fail, and some people will lose everything they own and more… suddenly, people lose interest.

This has been my experience, and as a result only people who understand what they are getting into open a broker account and try enter the trading arena.

But why do most traders fail?

Commissions are cheaper than they’ve ever been.

Back when I started, I’d pay IG £8 a trade and so on a £1,000 position I was turning over 1.6% just to get in an out. On £500 it was 3.2%.

Now, it’s £0.

There were other charges and fees that have gradually come down or been removed.

Data is more accessible than it’s ever been.

In fact, it’s never been easier to trade and yet most are losing.

Trading gives people what they want

The simple answer is that trading is hard and it gives people what they want.

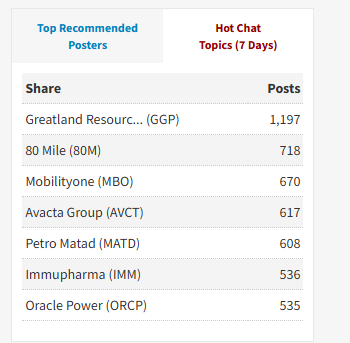

If we look at the bulletin boards, which are mostly filled with moronic rampers, there is a high concentration of activity on low quality stocks.

Here are the hot chat topics of the last 7 days.

From memory, I know most of these stocks are not profitable or even cash generative.

That means they are reliant on external funding and tapping shareholders in order to keep the lights on.

Unprofitable and non-cash generative stocks, over time, tend to deliver sub-standard and negative returns.

Yet these are the stocks that punters flock to: the long shots.

This is a gambler mentality, and a lot of activity in these stocks are from speculators and gamblers.

And the market gives them what they want: excitement and a cool-sounding story, that if it delivers, will be huge, but in reality, probably won’t.

I’m not saying you can’t have an edge in this part of the market. You absolutely can. But not everyone can, and most people don’t.

Most people treat the market as a hobby.

Hobbies cost you money, and they’re doing at leisure.

Winning traders treat the market as a business.

Businesses pay you money, and they’re done diligently.

When you turn up to win, your chances of success are vastly increased.

They lack the right knowledge either through ego or don’t know where to go

I remember one trader emailing me with a long essay. I responded to him and basically suggested that he didn’t sign up to my or any course and to not start trading as he wasn’t in the right place – he wanted to make money quickly and was pressured to do so.

He told me that he’d be fine once he’d picked a platform and could get started.

I never heard from him again, but I knew there was nothing I could do. People have to make their own mistakes, and unfortunately emotions and volatility are a deadly cocktail.

Traders don’t have the full picture

Some traders understand technical analysis.

But they don’t know how to exploit through position sizing.

Others know a little about something, or something about nothing.

They jump from system to system. They don’t log their trades.

Only with data can you actually get the full picture, whereas a new trader will take five losses in a row and conclude that this specific strategy isn’t working for them.

If you’re right 60% of the time, which is a good strike rate, then you can expect five losses in a row fairly often.

Traders lack emotional discipline

I once had an email for a trader who said he hadn’t made money in the last 10 years.

Out of curiosity, I asked for his trades and when I viewed them, I could see he actually made money, but he was giving it back by refusing to cut his losses.

There would be large losses and stocks held at losses for years, sucking his physical capital, draining his emotional capital, attached with a large opportunity cost for good measure.

Mark Minervini has said that those who trade without a stop loss, eventually stop trading.

He’s right.

Whether it’s physical or mental, you need a stop loss.

If you can’t control your risk, you can’t scale.

Michael Taylor

Get Michael’s trade ideas: https://newsletter.buythebullmarket.com/

Free educational content: @shiftingshares

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Agree with your submission, many traders are like those who bet on the horses, will always boast about the 20:1 winner, but not a mention of all their looses in the last month. Can’t deny I have had losses in the past, and would advise small traders to realise by the time you hear of a sure bet the big finance houses or the sharks have already made the money and are exiting. It always amazes me how a stock will always rise after one of the large financial houses tips a share it rises, TOO Late, In the 60’s, a financial tipster working for the News of the World, bought a share on the Friday, tipped it on the Sunday, and sold it after its rise on the Monday.