Richard puts the last 10 shares to pass his minimum quality filter through 5 Strikes and finds two exotic companies. One is making less money in a roaring market. The other is making big profits in a declining one.

Today, I am collecting up stragglers, the last companies to publish annual reports in 2025 that passed my minimum quality filter.

The next stage of the process is to look for strikes (nasties) in their financial track records. The fewer strikes there are, the easier that record should be to analyse. Typically, I have focused my attention on shares that achieve less than three strikes.

In 2026, though, I am going to be a little more curious by also considering shares that achieve three or more strikes but seem to be improving. These may be 5 Strikes stars of the future and if we can be sufficiently confident, it may be worth investing in them now.

| Name | TIDM | Prev AR | Strikes | # Strikes |

|---|---|---|---|---|

| Jarvis Securities | JIM | 30/12/25 | – CROCI – Growth | 2 |

| NCC | NCC | 23/12/25 | – Holdings ? Acquisitions ? Growth – ROCE – Shares | 4 |

| Catalyst Media | CMX | 22/12/25 | – CROCI – Growth – ROCE | 3 |

| Oxford Metrics | OMG | 19/12/25 | – Holdings – CROCI – Growth – ROCE | 4 |

| Renew Holdings | RNWH | 19/12/25 | ? Holdings – Shares | 2 |

| Character Group | CCT | 17/12/25 | – CROCI – Growth | 2 |

| Compass | CPG | 17/12/25 | – Holdings – Debt ? Growth | 3 |

| Goldplat | GDP | 15/12/25 | – Growth ? ROCE | 2 |

| Future | FUTR | 12/12/25 | – Holdings ? Acquisitions – Growth – Shares | 4 |

| Imperial Brands | IMB | 11/12/25 | – Holdings – Debt – Growth | 3 |

| Click here for our 5 Strikes explainer | 06/01/2026 | |||

Goldplat [- Growth ? ROCE]

Goldplat seized my attention last year, because it achieved only one strike for inconsistent growth.

The company produces gold, but does not operate mines. Instead it processes waste from gold miners to extract gold. The business felt a bit “edgy” to me though, gold prices are cyclical, and Goldplat operates in remote markets, one of which is in long-term decline (South Africa).

If it felt edgy then, it feels more edgy now. Goldplat’s turnover fell by 22% in the year to June 2025, and it would have been worse if gold prices had not grown strongly.

The main reason for the decline was a change in Government policy in Ghana, where Goldplat’s biggest operation by revenue is located.

Like other West African countries, Ghana has prohibited the export of gold concentrate in an effort to reduce smuggling. Now Goldplat must process the gold it recovers into semi-pure “doré” bars locally before exporting it to international refiners.

Goldplat has invested in plant to make the bars, but the implications for the profitability of the business are unclear to me.

Smiths News [? Holdings ? Debt – Growth ? ROCE]

Smiths News is borderline 2/3 strikes. I am including it because in many ways its financials are improving. So too is confidence:

Over most of the last eight years Smiths News has been highly cash generative and highly profitable. This has allowed it to reduce debt.

Debt is still high in relation to capital employed (about 50%), but probably not dangerously so. The ratio is high because Smiths News requires little capital to operate, not because it is loaded with debt. Net debt at the end of 2025 (£24 million), was less than the free cash generated by the business during the year.

The company may be unique in including the following in its pitch to investors: “Slow and predictable long term revenue decline c3%-5% per year” from its core market.

Smiths News distributes newspapers and magazines to supermarkets, newsagents and other retailers in high streets and transport hubs. Its annual report is scattered with photos of industrious warehouse workers:

The market is declining because fewer of us are reading physical newspapers. Smiths News earns good money because it is the dominant distributor, with a 55% market share by sales volume and exclusive relationships with publishers.

The more than 10% revenue decline in 2020 was in part due to the pandemic, when people visited shops less, but the company’s DMD subsidiary also lost its biggest contract, which was with British Airways, towards the end of the previous financial year.

The contract loss, which the company put down to more competitive tenders, may reveal a vulnerability. Smiths News has other big customers. Its biggest, contributed just over £100m in turnover in 2025, which is 11% of total revenue.

The three next biggest customers contributed 13.1% collectively. The company’s biggest customers are the big supermarket chains, including the biggest (Tesco), and TG Jones, the high street retailer that was WH Smith.

In 2019, the decline in turnover was even greater due to troubles at parcel delivery subsidiary Tuffnells, and the loss of the BA contract. Connect, as Smiths News was called then, disposed of Tuffnells in 2020 so it is no longer a problem.

As well as getting rid of a loss-making business, the disposal of Tuffnells simplified Connect. Smiths News today, has only one operating segment. Its mission goes beyond newsprint:

Source: Smiths News

The consensus of two analysts forecasts 3% revenue declines for the next three years, which is at the lower end of the range mooted by Smiths News.

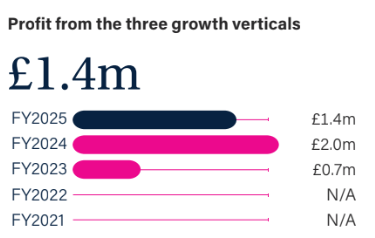

Perhaps that is because three new “growth verticals” are expected to dent the decline in the core business.

The verticals are based on Smiths News’ established early morning delivery and returns infrastructure:

- Instead of returning nearly empty, vans that have delivered the news are returning with dry mixed recycling, solving a problem for small and medium sized retailers.

- Smiths News is also moving into the distribution of related products like books, DVDs, greeting cards, gifts, and toys.

- And it is using its network to fulfill deliveries for business to business customers, delivering spare parts to field service engineers for example.

These profit streams are currently contributing little to total adjusted operating profit, which was £39.1 million in 2025.

Source: Key Performance Indicators, Smiths News annual report 2025

The directors’ performance related share option plan for 2026 anticipates growth. It includes targets for “Profit from Growth and Diversified Activities” of between £4.29 million in 2028 (minimum payout) and £6.9 million (maximum payout).

It is early days for these services, though, and I wonder if the growth verticals are promising enough to halt the company’s declining turnover. The targets for the 2025 plan, which vests in 2027, require slightly higher profit (£4.8 million to £7.5 million).

Of the other shares that passed or nearly passed 5 Strikes, I have written up Renew Holdings recently at interactive investor. I may circle back to Character Group.

Richard Beddard

Contact Richard Beddard by email: richard@beddard.net, web: beddard.net

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.