Bruce Packard reviews a year where gold has outshone global equity markets, with a muted Santa Rally doing little to close the gap. He examines the forces behind the surge and assesses a mix of consumer, mining and leisure stocks. Companies covered WINE, JLP, BOWL, XPF.

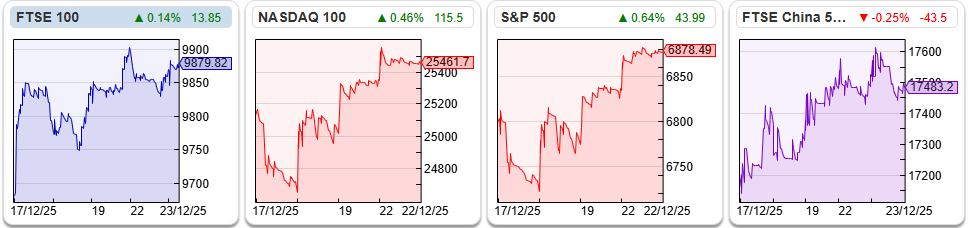

The FTSE 100 was up +2% to 9,879 with a muted “Santa Rally”. The Nasdaq100 and S&P500 were also up, but by less, +1.6% and +0.9% respectively. The best performing indices YTD were the FTSE All World Europe Ex UK and Brazil’s Bovespa both up by +32%. The Bovespa, Hang Sen, China 50, and Nikkei have all done better than the Nasdaq +21% and S&P500 +17%. The S&P 500 equal weight index is up less than 10% this year, whereas gold is up +71% YTD.

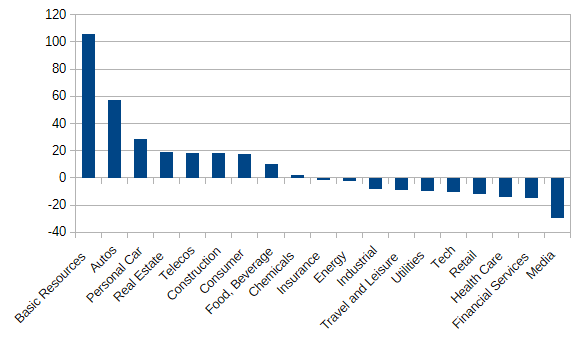

AIM was the worst performing major indices, but still in positive territory +6%. The AIM Basic Resources sector has been surprisingly strong, driven by the precious metals miners, which has more than doubled.

The trouble is that some of the larger AIM 50 stocks like RWS, Big Technologies, Global Data, Impax AM and YouGov are down by around -40%. I’m not able to detect a consistent theme, except perhaps that all of these businesses have done well historically but are now their “moats” are at risk of being disrupted by AI or lower cost technology. One buyer of gold has been stablecoins, which seems a curious source of demand, but Paolo Ardoini has been buying over 100 tonnes gold for his Tether stablecoin, suggesting “the world is going towards darkness.”

This week I look at Naked Wines, which has only just begun to recover from its post pandemic hangover. A special situation with Jubilees Metals, re-positioning itself by disposing of its South African chrome and PGM business, now focused on Zambian copper mines. Then a couple of leisure companies, Hollywood Bowl and escape rooms and shuffleboard group XP Factory.

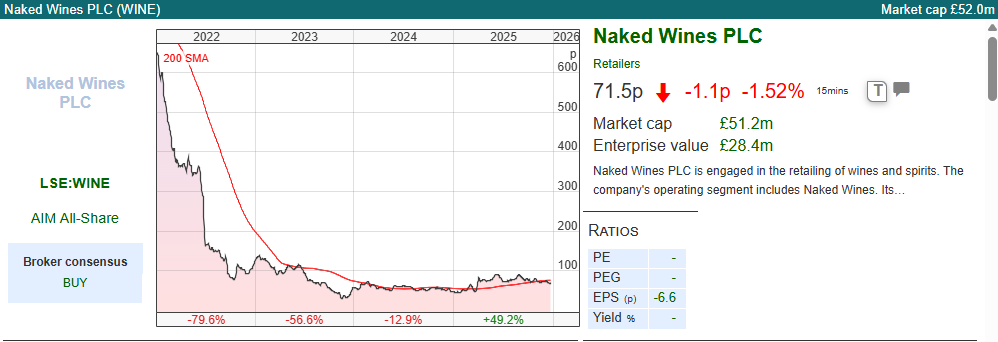

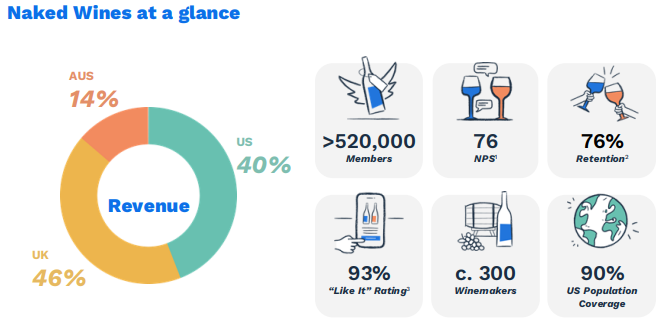

Naked Wine FY Mar trading statement

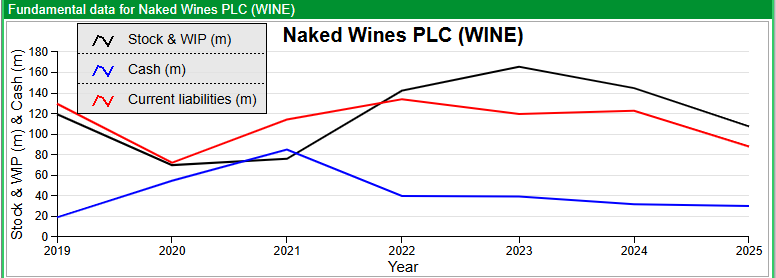

This Direct-to-Consumer (D2C) subscription wine business was a “pandemic winner” peaking at around £9 in 2021, before falling to 30p per share a couple of years later. Management extrapolated growth and bought too much inventory (Sharescope shows that inventory peaked at £165m v sales of £354m FY Mar 2023). Since then, sales have fallen 3 years in a row, and sales are forecast to keep falling. On the positive side, customers rate the site highly and are likely to recommend it with a Net Promoter Score of 76.

Revenues will be at the lower end of guidance, but the EBITDA is towards the top end of the range. Net cash ex lease liabilities up rose to £31m (prior H1 Sept £23m) and there’s even a small £2m buyback. Lease liabilities are roughly £5m, so not significant. Instead the risk is that customers send them money, but this sits on their balance sheet and can be returned to them at any time. So there’s a £70m of Angels’ Funds (they call subscribers “Angels” for some reason) current liability, but less than half that amount offsetting cash asset – the fear in 2023 was a “bank run” with management unable to liquidate their wine inventory fast enough to pay back customers. Marc Rubinstein, who is a customer but also a finance blogger, wrote about it here.

Inventory has fallen by c. £26m since Sept 24, so they’re progressing with their target to generate c. £40m cash from unwinding this excess inventory. If you don’t fancy being a shareholder, perhaps now is a good time to be a customer, on the other side of that inventory unwind?

Valuation: Looks expensive on a PER basis. But other ratios far more attractive, for instance: 0.3x sales and the EV/EBITDA is below 5x Mar 2027F. If you focus on the cash, then it’s trading on price/FCF 7x Mar 2027F.

Opinion: Wine inventory shouldn’t lose value in the same way as fashion or perishable goods. That hypothesis is confirmed by the analyst presentation, which says that they’re mainly overstocked in high quality US red wines, which have a shelf life of > 10 years. The Sharescope chart above shows the improving cash generation, even as sales continue to fall; meaning that their inventory is still valuable and can be sold. The chart looks as if it has bottomed with the shares up +49% this year. I don’t own any yet, but as a former banks’ analyst, I think I understand the risks. As Marc says: “Unzip companies across a range of industries and you will find financial companies lurking inside.”

Opinion: Wine inventory shouldn’t lose value in the same way as fashion or perishable goods. That hypothesis is confirmed by the analyst presentation, which says that they’re mainly overstocked in high quality US red wines, which have a shelf life of > 10 years. The Sharescope chart above shows the improving cash generation, even as sales continue to fall; meaning that their inventory is still valuable and can be sold. The chart looks as if it has bottomed with the shares up +49% this year. I don’t own any yet, but as a former banks’ analyst, I think I understand the risks. As Marc says: “Unzip companies across a range of industries and you will find financial companies lurking inside.”

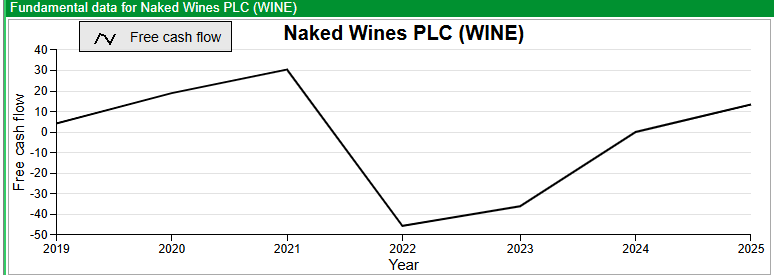

Jubilee Metals FY Jun 2025

This African miner that has only just managed to release FY Jun results comes with a health warning. Their joint broker, alongside Zeus is Shard Capital, who had an interesting relationship with Lars Windhorst before the pandemic. Still, there might be an interesting special situation here.

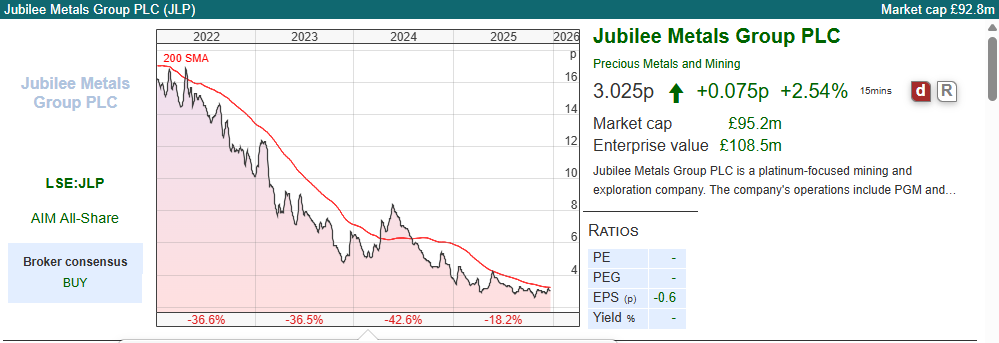

In June this year, they proposed selling their South African chrome and PGM operations announced, with an enterprise value of value of $147m dollars (debt of US$57m) resulting in a cash realisation of around $90m. That compares to a current market cap of £95m (just over $130m). The plan is to then use the cash to pursue “exciting growth plans” in Zambian copper mining. I did mention that it comes with a health warning!

Management say that copper unit production guidance for FY Jun 2026 is expected to be within the range of 4 500t to 5 100t depending on the extent of the current rainy season (FY Jun 2025 production: 2 211t). The press release says those figures are both copper cathode and copper sulphide in concentrate. Yet, there’s a difference between cathode (the finished product 99.99% pure, which trades at the LME copper price of $12,000 per metric tonne) and unrefined copper sulphide concentrate (35-25% pure). So, it’s not possible to take that production guidance and work out how it converts into revenue. I’m not a mining sector specialist, but this production guidance comes across to me as unhelpful.

Disposal of PGM and Chrome operations: The South African operations are being sold on a 6x EV/EBITDA multiple. Yet the PGM operations have just seen EBITDA more than double to $14m FY Jun 2025 – and the PGM basket price has continued to be strong since June. As the platinum price is up +118% YTD, it strikes me as rather a strange time to be selling a PGM business. There’s very little information on the private company buying.

In the 1990’s I invested in UK listed aluminium and steel mining operations in Central Asia, run by Alisher Usmanov and Farhad Moshiri. The duo took separated off the Central Asian operations and then took them private, leaving their investors with a “rump” business in the listed entity that went nowhere. A few years later, somehow Usmanov and Moshiri ended up billionaires owning Premier League football teams. I and the other London based investors pondered what had happened to the original investment case: which was to back these two characters who were determined to make money in Central Asian mining. No evidence of wrong doing: I share my stories about losing money as an entertaining learning experience.

Valuation: The JLP forecasts on Sharescope are stale, I think no broker has updated their forecast since the restructuring. So, presumably mining sector analysts have also found management’s guidance to interpret.

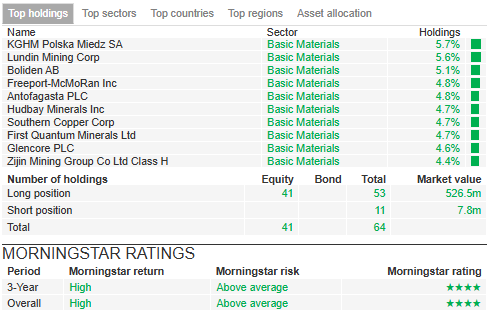

Instead, I’ve used Sharescope to look up the COPG, Global X Copper Miners ETF, with names like Glencore and Antofagasta in the top 10 holding, and has forecast PER of 15x and trades on 1.1x sales. That seems to me a safer way to play the rising price of copper, that trying to pick individual stocks. The COPG ETF is up +72% YTD.

Opinion: There are enough red flags here to put me off. I’d need to see a broker note from Zeus and also to be more familiar with the sector. I’m flagging it as a cash rich special situation and with the price of copper up +34% this year, there might be something here for risk tolerant investors prepared to do the work.

Hollywood Bowl FY Sept 2025

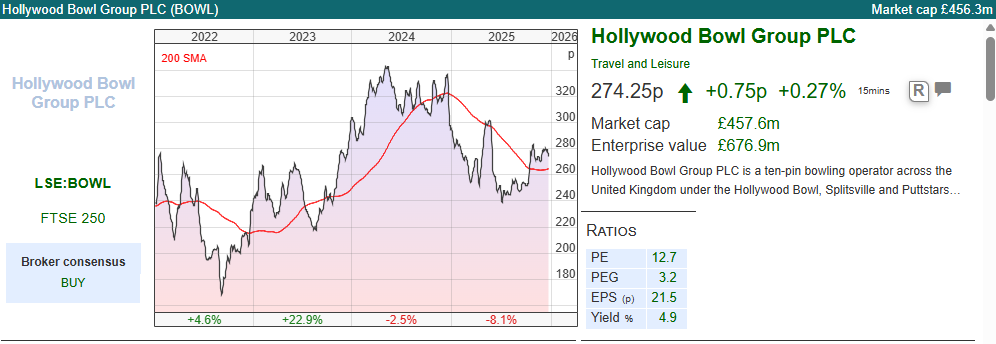

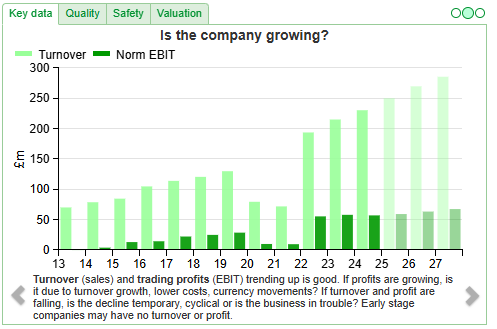

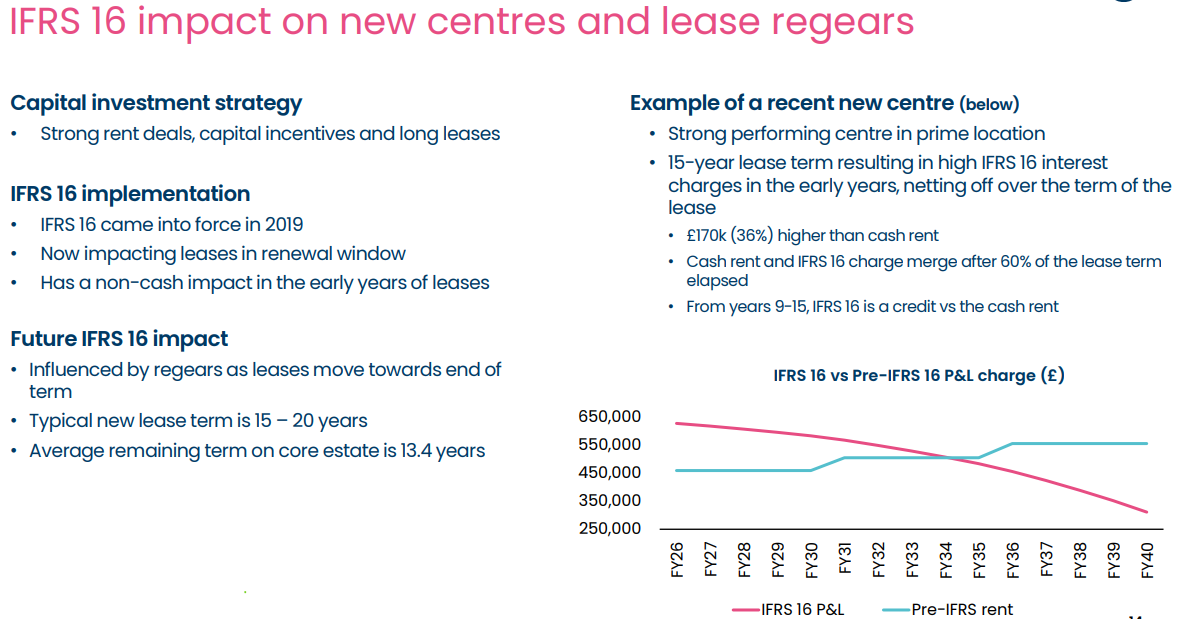

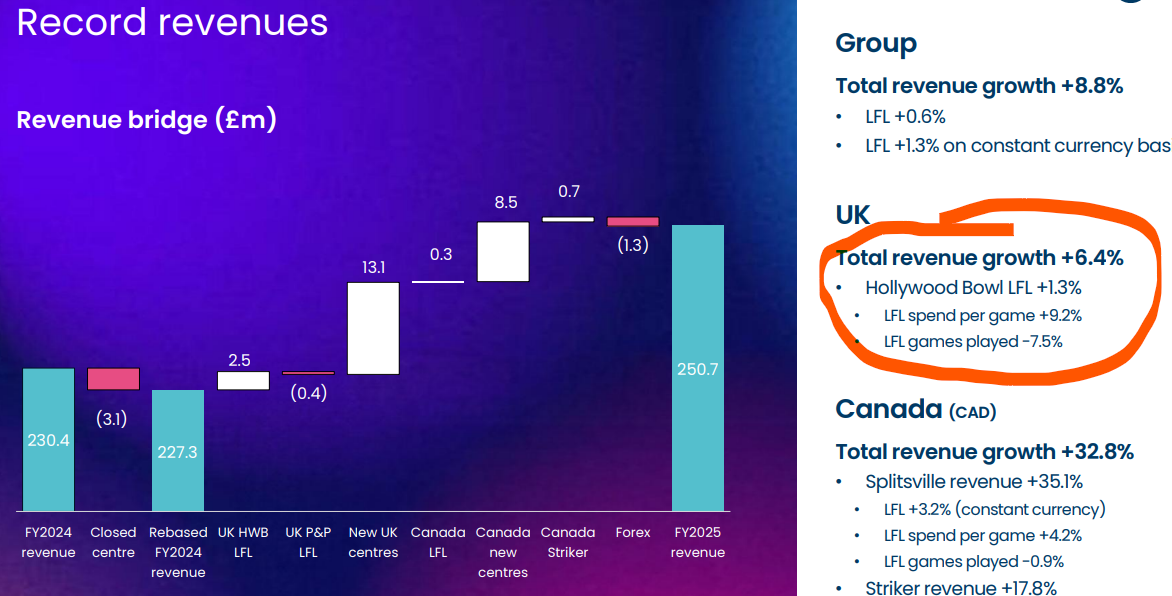

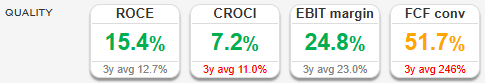

The UK and Canada’s largest ten pin bowling operator announced FY Sept 2025 revenue +9% to £251m and statutory PBT +4% to £44m. Adjusted PBT is down -9% though to £46m. “Group adjusted EBITDA under IFRS 16” falls from £91m FY Sept 2025 to Free Cash Flow of £21m and Net Cash Flow of -£13m after £36m of dividends and buybacks are deducted. So the adjustments are worth paying attention to.

Net cash stood at £15m, with an undrawn RCF of £25m, although those figures exclude lease liabilities. For most companies leases are not significant, but for retailers, pubs, restaurants and other leisure companies they can become a problem. That is, in a downturn it’s possible for a business to run into difficulties while still reporting cash on the last balance sheet date, Mothercare, Arcadia, Superdry and Jamie Oliver’s restaurants spring to mind. For BOWL the lease liabilities on the balance sheet add up to £235m, versus shareholders equity of £151m, deducting goodwill that drops to net tangible equity of £52m. That seems manageable, but worth thinking about how the business might perform in a downturn when consumer disposable income is under pressure. BOWL share price briefly collapsed below 70p at the start of the pandemic.

Outlook: Management reiterate that they are on track to reach 130 centres by 2035 (of which 95 in UK and 35 in Canada). Currently they have 92 centres (77 in the UK and 15 in Canada). Like-for-like revenue growth, which adjusts for openings, was only +1% in the UK because of a dry summer, when presumably customers prefer to go to sunbathe in the park. The revenue bridge shows that customers are spending were spending more per game, but games played were down -7.5%. They describe this +1% performance as “excellent”, which I think is a little self-indulgent.

They say that 70% of UK revenue is not subject to Cost-of-Goods-Sold inflation in the UK, labour represents 20% of UK revenue and energy costs are hedged through to FY Sept 2027. There’s no mention of next year’s expectations, but ShareScope suggests revenue is forecast to grow +8% this year and +6% FY Sept 2027F, with EPS +10% then +6%.

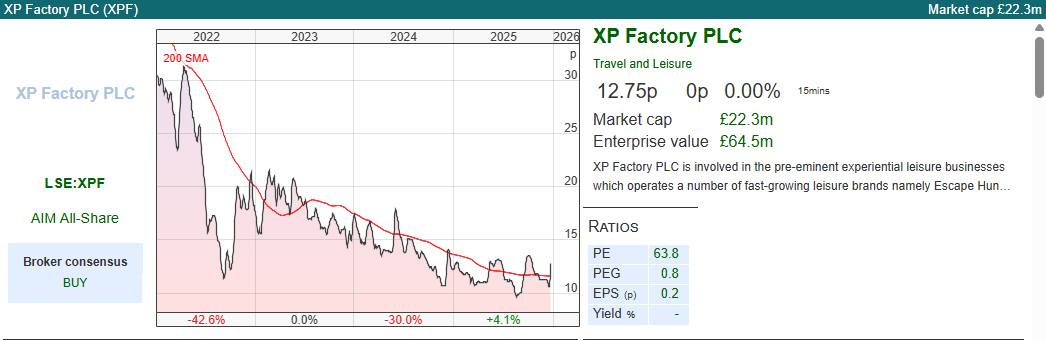

Comparison with XP Factory: XP Factory, which is also “experiential leisure” with Escape Hunt and Boom Battle Bars brands reported H1 Sept 2025 a week earlier. Revenue was up +13% to £28m while the group was loss making on a statutory basis. The quarterly progression suggests that Escape Rooms also experienced a difficult early summer, with a Q1 (ie Mar-Jun) Like-for-Like falling -3.5% then rebounding strongly to +6.8% in Q2 and LfL 9 weeks to 30 November further increasing +8.3%. Boom Battle Bars, which is Shuffleboard, Axe Throwing, Crazier Golf and Beer Pong saw LfL growth down -7%, with no real explanation other than the entire sector is struggling. In their outlook statement they suggest growth in the industry is slowing and, in some cases, capacity is coming out of the market. They say that the escape room concept experienced similar trends in the early 2020’s and Escape Hunt has emerged a clear industry leader, and so they’re optimistic that the other concepts will benefit from a similar trends and emerge as a leading player.

Comparison with XP Factory: XP Factory, which is also “experiential leisure” with Escape Hunt and Boom Battle Bars brands reported H1 Sept 2025 a week earlier. Revenue was up +13% to £28m while the group was loss making on a statutory basis. The quarterly progression suggests that Escape Rooms also experienced a difficult early summer, with a Q1 (ie Mar-Jun) Like-for-Like falling -3.5% then rebounding strongly to +6.8% in Q2 and LfL 9 weeks to 30 November further increasing +8.3%. Boom Battle Bars, which is Shuffleboard, Axe Throwing, Crazier Golf and Beer Pong saw LfL growth down -7%, with no real explanation other than the entire sector is struggling. In their outlook statement they suggest growth in the industry is slowing and, in some cases, capacity is coming out of the market. They say that the escape room concept experienced similar trends in the early 2020’s and Escape Hunt has emerged a clear industry leader, and so they’re optimistic that the other concepts will benefit from a similar trends and emerge as a leading player.

Valuation: XPF shares are trading on 35x PER Mar 2026F, but with EPS more than doubling the following year that PER drops to 12x Mar 2027F. That translated to 8x EV/EBITDA and 0.3x sales, both Mar 2027F.

Opinion: With two revenue streams: i) shuffleboard/bowling alleys/amusement machines, and also ii) selling food and drinks, theoretically this should be a good business for shareholders – except if everyone has the same insight, too much competition kills the economic returns! Related to competition, is that if you’re selling an intangible product (games of shuffleboard, beer pong, laser tag etc) there’s potential money laundering by unlisted smaller operators (see note below on hairdressing and nail salons). To be clear, large listed companies like BOWL or XPF are not facilitating money laundering, but their unlisted competition might be, which is worth bearing in mind given XPF’s comments about overcapacity in the industry.

I can see why some investors might like the investment case here, both XPF and BOWL could do really well if the “feel good factor” returns in 2026. Personally I would prefer to avoid for now and wait to see if the competition really is in retreat.

Bruce Packard

@bruce_packard

Notes

A drug dealer with a friendly relationship with a hairdresser or nail salon can simply put £100 of drug money into the till and record it as revenue from five extra haircuts/manicures that never happened. HMRC can’t prove how many haircuts were performed in a day, allowing criminals to overstate their revenue to match the cash they are trying to launder. When the £100 of drug money cash is deposited into the bank, it appears as legitimate business income, the criminal may even be operating two separate accounts with different banks.

I obviously wasn’t doing this with my shuffleboard bar and neither are BOWL nor XPF.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Bi-Weekly Market Commentary | 24/12/2025 | WINE, JLP, BOWL, XPF | Gold and silicon

The FTSE 100 was up +2% to 9,879 with a muted “Santa Rally”. The Nasdaq100 and S&P500 were also up, but by less, +1.6% and +0.9% respectively. The best performing indices YTD were the FTSE All World Europe Ex UK and Brazil’s Bovespa both up by +32%. The Bovespa, Hang Sen, China 50, and Nikkei have all done better than the Nasdaq +21% and S&P500 +17%. The S&P 500 equal weight index is up less than 10% this year, whereas gold is up +71% YTD.

AIM was the worst performing major indices, but still in positive territory +6%. The AIM Basic Resources sector has been surprisingly strong, driven by the precious metals miners, which has more than doubled.

The trouble is that some of the larger AIM 50 stocks like RWS, Big Technologies, Global Data, Impax AM and YouGov are down by around -40%. I’m not able to detect a consistent theme, except perhaps that all of these businesses have done well historically but are now their “moats” are at risk of being disrupted by AI or lower cost technology. One buyer of gold has been stablecoins, which seems a curious source of demand, but Paolo Ardoini has been buying over 100 tonnes gold for his Tether stablecoin, suggesting “the world is going towards darkness.”

This week I look at Naked Wines, which has only just begun to recover from its post pandemic hangover. A special situation with Jubilees Metals, re-positioning itself by disposing of its South African chrome and PGM business, now focused on Zambian copper mines. Then a couple of leisure companies, Hollywood Bowl and escape rooms and shuffleboard group XP Factory.

Naked Wine FY Mar trading statement

This Direct-to-Consumer (D2C) subscription wine business was a “pandemic winner” peaking at around £9 in 2021, before falling to 30p per share a couple of years later. Management extrapolated growth and bought too much inventory (Sharescope shows that inventory peaked at £165m v sales of £354m FY Mar 2023). Since then, sales have fallen 3 years in a row, and sales are forecast to keep falling. On the positive side, customers rate the site highly and are likely to recommend it with a Net Promoter Score of 76.

Revenues will be at the lower end of guidance, but the EBITDA is towards the top end of the range. Net cash ex lease liabilities up rose to £31m (prior H1 Sept £23m) and there’s even a small £2m buyback. Lease liabilities are roughly £5m, so not significant. Instead the risk is that customers send them money, but this sits on their balance sheet and can be returned to them at any time. So there’s a £70m of Angels’ Funds (they call subscribers “Angels” for some reason) current liability, but less than half that amount offsetting cash asset – the fear in 2023 was a “bank run” with management unable to liquidate their wine inventory fast enough to pay back customers. Marc Rubinstein, who is a customer but also a finance blogger, wrote about it here.

Inventory has fallen by c. £26m since Sept 24, so they’re progressing with their target to generate c. £40m cash from unwinding this excess inventory. If you don’t fancy being a shareholder, perhaps now is a good time to be a customer, on the other side of that inventory unwind?

Valuation: Looks expensive on a PER basis. But other ratios far more attractive, for instance: 0.3x sales and the EV/EBITDA is below 5x Mar 2027F. If you focus on the cash, then it’s trading on price/FCF 7x Mar 2027F.

Jubilee Metals FY Jun 2025

This African miner that has only just managed to release FY Jun results comes with a health warning. Their joint broker, alongside Zeus is Shard Capital, who had an interesting relationship with Lars Windhorst before the pandemic. Still, there might be an interesting special situation here.

In June this year, they proposed selling their South African chrome and PGM operations announced, with an enterprise value of value of $147m dollars (debt of US$57m) resulting in a cash realisation of around $90m. That compares to a current market cap of £95m (just over $130m). The plan is to then use the cash to pursue “exciting growth plans” in Zambian copper mining. I did mention that it comes with a health warning!

Management say that copper unit production guidance for FY Jun 2026 is expected to be within the range of 4 500t to 5 100t depending on the extent of the current rainy season (FY Jun 2025 production: 2 211t). The press release says those figures are both copper cathode and copper sulphide in concentrate. Yet, there’s a difference between cathode (the finished product 99.99% pure, which trades at the LME copper price of $12,000 per metric tonne) and unrefined copper sulphide concentrate (35-25% pure). So, it’s not possible to take that production guidance and work out how it converts into revenue. I’m not a mining sector specialist, but this production guidance comes across to me as unhelpful.

Disposal of PGM and Chrome operations: The South African operations are being sold on a 6x EV/EBITDA multiple. Yet the PGM operations have just seen EBITDA more than double to $14m FY Jun 2025 – and the PGM basket price has continued to be strong since June. As the platinum price is up +118% YTD, it strikes me as rather a strange time to be selling a PGM business. There’s very little information on the private company buying.

In the 1990’s I invested in UK listed aluminium and steel mining operations in Central Asia, run by Alisher Usmanov and Farhad Moshiri. The duo took separated off the Central Asian operations and then took them private, leaving their investors with a “rump” business in the listed entity that went nowhere. A few years later, somehow Usmanov and Moshiri ended up billionaires owning Premier League football teams. I and the other London based investors pondered what had happened to the original investment case: which was to back these two characters who were determined to make money in Central Asian mining. No evidence of wrong doing: I share my stories about losing money as an entertaining learning experience.

Valuation: The JLP forecasts on Sharescope are stale, I think no broker has updated their forecast since the restructuring. So, presumably mining sector analysts have also found management’s guidance to interpret.

Instead, I’ve used Sharescope to look up the COPG, Global X Copper Miners ETF, with names like Glencore and Antofagasta in the top 10 holding, and has forecast PER of 15x and trades on 1.1x sales. That seems to me a safer way to play the rising price of copper, that trying to pick individual stocks. The COPG ETF is up +72% YTD.

Opinion: There are enough red flags here to put me off. I’d need to see a broker note from Zeus and also to be more familiar with the sector. I’m flagging it as a cash rich special situation and with the price of copper up +34% this year, there might be something here for risk tolerant investors prepared to do the work.

Hollywood Bowl FY Sept 2025

The UK and Canada’s largest ten pin bowling operator announced FY Sept 2025 revenue +9% to £251m and statutory PBT +4% to £44m. Adjusted PBT is down -9% though to £46m. “Group adjusted EBITDA under IFRS 16” falls from £91m FY Sept 2025 to Free Cash Flow of £21m and Net Cash Flow of -£13m after £36m of dividends and buybacks are deducted. So the adjustments are worth paying attention to.

Net cash stood at £15m, with an undrawn RCF of £25m, although those figures exclude lease liabilities. For most companies leases are not significant, but for retailers, pubs, restaurants and other leisure companies they can become a problem. That is, in a downturn it’s possible for a business to run into difficulties while still reporting cash on the last balance sheet date, Mothercare, Arcadia, Superdry and Jamie Oliver’s restaurants spring to mind. For BOWL the lease liabilities on the balance sheet add up to £235m, versus shareholders equity of £151m, deducting goodwill that drops to net tangible equity of £52m. That seems manageable, but worth thinking about how the business might perform in a downturn when consumer disposable income is under pressure. BOWL share price briefly collapsed below 70p at the start of the pandemic.

Outlook: Management reiterate that they are on track to reach 130 centres by 2035 (of which 95 in UK and 35 in Canada). Currently they have 92 centres (77 in the UK and 15 in Canada). Like-for-like revenue growth, which adjusts for openings, was only +1% in the UK because of a dry summer, when presumably customers prefer to go to sunbathe in the park. The revenue bridge shows that customers are spending were spending more per game, but games played were down -7.5%. They describe this +1% performance as “excellent”, which I think is a little self-indulgent.

They say that 70% of UK revenue is not subject to Cost-of-Goods-Sold inflation in the UK, labour represents 20% of UK revenue and energy costs are hedged through to FY Sept 2027. There’s no mention of next year’s expectations, but ShareScope suggests revenue is forecast to grow +8% this year and +6% FY Sept 2027F, with EPS +10% then +6%.

Valuation: XPF shares are trading on 35x PER Mar 2026F, but with EPS more than doubling the following year that PER drops to 12x Mar 2027F. That translated to 8x EV/EBITDA and 0.3x sales, both Mar 2027F.

Opinion: With two revenue streams: i) shuffleboard/bowling alleys/amusement machines, and also ii) selling food and drinks, theoretically this should be a good business for shareholders – except if everyone has the same insight, too much competition kills the economic returns! Related to competition, is that if you’re selling an intangible product (games of shuffleboard, beer pong, laser tag etc) there’s potential money laundering by unlisted smaller operators (see note below on hairdressing and nail salons). To be clear, large listed companies like BOWL or XPF are not facilitating money laundering, but their unlisted competition might be, which is worth bearing in mind given XPF’s comments about overcapacity in the industry.

I can see why some investors might like the investment case here, both XPF and BOWL could do really well if the “feel good factor” returns in 2026. Personally I would prefer to avoid for now and wait to see if the competition really is in retreat.

Bruce Packard

@bruce_packard

Notes

A drug dealer with a friendly relationship with a hairdresser or nail salon can simply put £100 of drug money into the till and record it as revenue from five extra haircuts/manicures that never happened. HMRC can’t prove how many haircuts were performed in a day, allowing criminals to overstate their revenue to match the cash they are trying to launder. When the £100 of drug money cash is deposited into the bank, it appears as legitimate business income, the criminal may even be operating two separate accounts with different banks.

I obviously wasn’t doing this with my shuffleboard bar and neither are BOWL nor XPF.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.